Market Overview

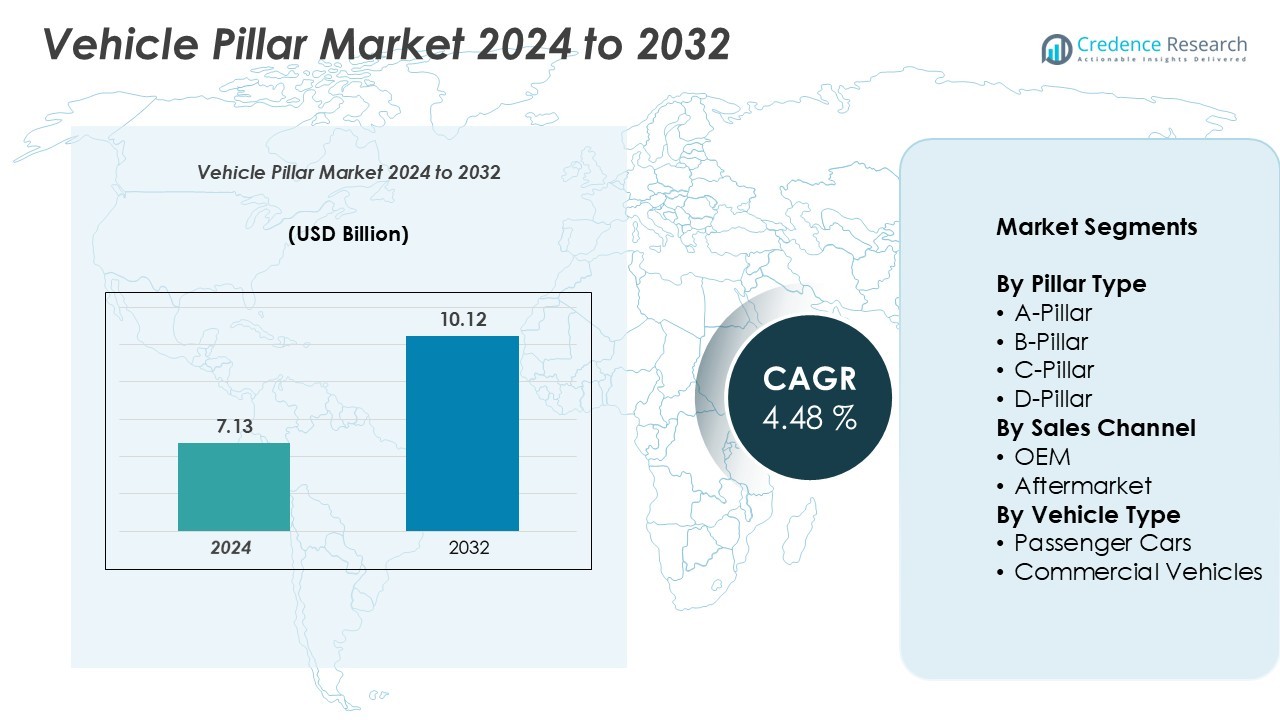

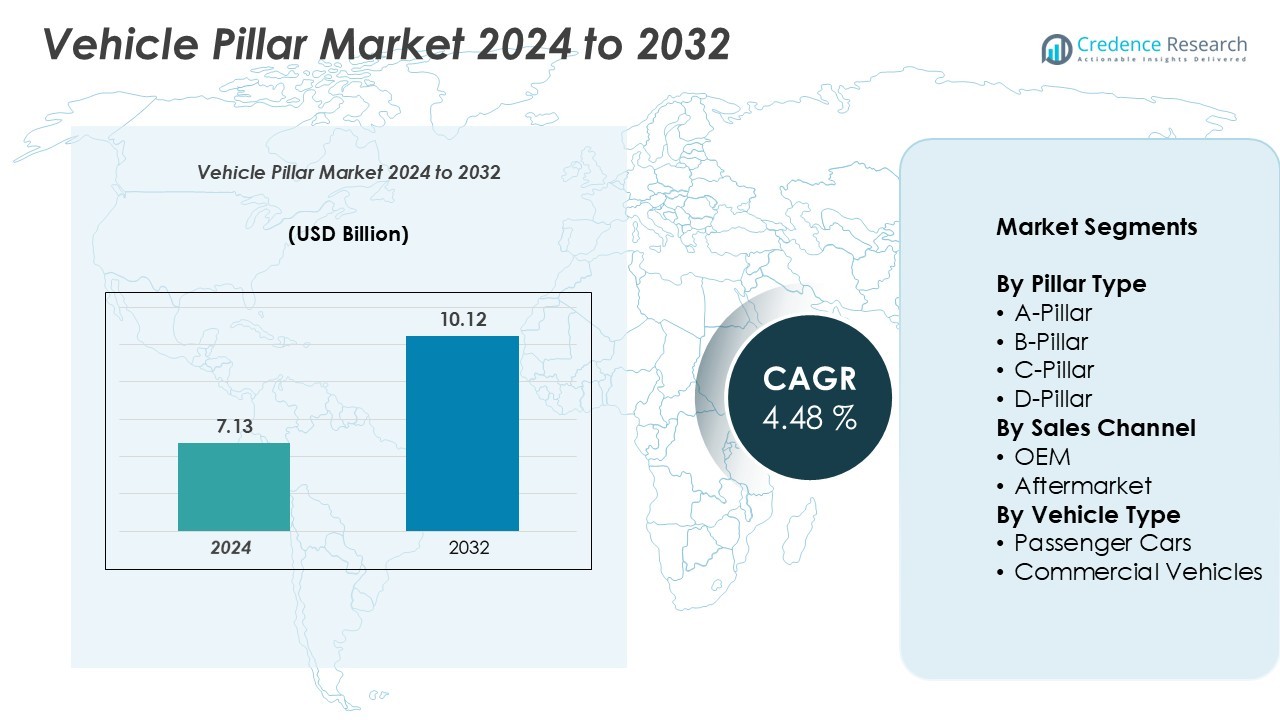

The Vehicle Pillar Market size was valued at USD 7.13 billion in 2024 and is anticipated to reach USD 10.12 billion by 2032, at a CAGR of 4.48% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Vehicle Pillar Market Size 2024 |

USD 7.13 Billion |

| Vehicle Pillar Market , CAGR |

4.48% |

| Vehicle Pillar Market Size 2032 |

USD 10.12 Billion |

The vehicle pillar market is led by major players including G-TEKT Corporation, Honda Motor Co., Ltd., AISIN Corporation, Volkswagen AG, AutoKiniton US Holdings, Inc., Toyota Motor Corporation, Ford Motor Company, Benteler International AG, and Hyundai Mobis Co., Ltd. These companies dominate through strong R&D investments, advanced lightweighting technologies, and strategic partnerships with OEMs. Asia Pacific is the leading region, holding 32% of the global market share, driven by large-scale vehicle production and rising EV adoption. North America follows with 28%, supported by strong regulatory frameworks and technology integration. Europe, with a 25% share, benefits from premium vehicle demand and stringent safety standards. This regional concentration aligns with robust manufacturing capabilities and innovation leadership.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The vehicle pillar market size was valued at USD 7.13 billion in 2024 and is projected to reach USD 10.12 billion by 2032, growing at a CAGR of 4.48%.

- Rising safety regulations and growing EV production are driving demand for advanced pillar designs with improved crash protection and lightweight construction.

- Key trends include increased use of high-strength steel and aluminum, integration of ADAS sensors, and development of smart, transparent A-pillars to enhance visibility.

- The market is dominated by major players such as G-TEKT Corporation, Toyota Motor Corporation, Ford Motor Company, and Volkswagen AG, focusing on innovation and global expansion.

- Asia Pacific leads with 32% of the market share, followed by North America at 28% and Europe at 25%. The B-pillar segment holds the largest share due to its critical role in vehicle structure and passenger safety.

Market Segmentation Analysis:

By Pillar Type

The B-Pillar segment dominates the vehicle pillar market with the largest share. B-pillars provide crucial structural support, enhancing occupant protection during side-impact collisions. Their strength and placement improve vehicle rigidity, making them essential in both passenger and commercial vehicles. OEMs prioritize B-pillars in modern safety designs to meet crash test regulations and lightweighting goals. Increasing use of advanced materials like high-strength steel and aluminum further boosts adoption. As automotive manufacturers focus on structural safety and improved cabin stability, the B-pillar remains the most widely used pillar type in new vehicle platforms.

- For instance, ArcelorMittal developed its advanced high-strength steel grade, Usibor® 2000, with a very high tensile strength of up to 2,000 MPa. The steel was designed to improve safety and reduce vehicle weight through its use in structural components that need to withstand high forces during a collision.

By Sales Channel

The OEM segment holds the dominant share in the vehicle pillar market. Original equipment manufacturers integrate pillars into vehicle structures during production, ensuring high precision and strength. The growing demand for lightweight, safe, and aerodynamically efficient vehicles drives OEM adoption. Automakers use advanced forming techniques and automated welding to enhance pillar durability and reduce vehicle weight. OEM channels also benefit from strict safety standards and regulatory compliance. With rising global vehicle production and the shift toward electric platforms, OEM sales continue to lead over aftermarket channels.

- For instance, Honda Motor Co. uses hot-stamped boron steel pillars produced with advanced welding techniques, such as laser welding, to create stronger and lighter body structures. This process improves both rigidity and energy absorption to enhance crashworthiness.

By Vehicle Type

The Passenger Cars segment leads the vehicle pillar market with the highest share. Passenger vehicles require multiple pillars for enhanced structural integrity, crash safety, and aerodynamic performance. Rising demand for SUVs and sedans, especially in urban markets, drives this dominance. Automakers use advanced pillar designs to balance strength and visibility while improving fuel efficiency. Lightweight materials like aluminum and composites further support this trend. Increasing adoption of electric vehicles and focus on passenger safety features ensure strong growth for pillar integration in passenger car manufacturing.

Key Growth Drivers

Rising Focus on Passenger Safety and Crash Protection

Stringent automotive safety regulations and growing consumer awareness are driving strong demand for robust vehicle pillar structures. B- and A-pillars play a key role in maintaining cabin integrity during frontal and side impacts, directly influencing crash ratings. Automakers increasingly use advanced high-strength steel and aluminum alloys to enhance rigidity without adding weight. The rise in global road accidents further accelerates safety feature integration, making pillars essential in modern vehicle designs. OEMs are also adopting reinforced pillars to meet Euro NCAP and IIHS safety standards. This regulatory and safety-driven approach significantly boosts the vehicle pillar market.

- For instance, in its Scalable Product Architecture (SPA) platform, first used in the 2016 XC90, Volvo significantly increased its use of hot-formed boron steel, which is the strongest type of steel used in car bodies. This was done to build an ultra-strong safety cage, including reinforced B-pillars, to enhance crash performance and improve occupant survival rates in side-impact tests. The amount of hot-formed steel in SPA-based vehicles like the XC90 was increased from 7% in the previous model to up to 40%.

Increasing Demand for Lightweight Vehicles

The automotive sector is shifting toward lightweight construction to improve fuel efficiency and reduce emissions. Vehicle pillars made from aluminum, magnesium, and composite materials are gaining traction due to their strength-to-weight ratio. This shift aligns with global CO₂ emission targets and supports electric vehicle range optimization. Lightweight pillars enhance structural performance without compromising passenger safety. Automakers are integrating laser welding and hydroforming technologies to reduce weight and improve production efficiency. The growing demand for lightweight vehicles globally is a major driver, especially in passenger car and EV manufacturing.

Expansion of Electric and Autonomous Vehicle Production

The rapid expansion of electric and autonomous vehicles creates new opportunities for innovative pillar design. EV manufacturers prioritize lightweight and aerodynamic structures to maximize battery efficiency. Pillars are increasingly integrated with sensors, cameras, and ADAS systems to support autonomous driving. A-pillars with embedded vision systems enhance driver visibility and safety, enabling advanced navigation features. Global EV production growth, supported by government incentives and infrastructure investments, fuels pillar demand. As OEMs focus on intelligent and connected vehicle architectures, pillars become crucial components for both safety and technology integration.

Key Trends & Opportunities

Adoption of Advanced Materials and Manufacturing Technologies

Automakers are increasingly adopting advanced materials like carbon fiber-reinforced plastics, high-strength steel, and aluminum to improve pillar performance. These materials offer better rigidity, corrosion resistance, and reduced weight. Additive manufacturing and hydroforming enable complex pillar geometries that enhance crash performance and aerodynamic efficiency. Integrating lightweight materials also aligns with regulatory mandates for emission reduction. This shift creates opportunities for suppliers specializing in high-performance structural components. Companies investing in material innovation and advanced production processes are well positioned to capitalize on this trend.

- For instance, BMW uses a multi-material “Carbon Core” construction in the B-pillars of the 7 Series to enhance structural rigidity and safety. This technology, which incorporates CFRP, ultra-high-tensile steels, and aluminum, was first used in the 7 Series starting with the 2016 model year. While CFRP is used to strategically reduce weight and increase strength, the total vehicle weight reduction on the 7 Series is typically cited as being up to 130 kg.

Integration of Smart Features and ADAS Systems

Pillars are evolving from passive structural components to active technology enablers. OEMs are integrating sensors, radar, LiDAR, and cameras into A- and B-pillars to support ADAS and autonomous functions. Transparent pillar technologies improve driver visibility and reduce blind spots, enhancing road safety. Smart pillars also house antennas and communication modules to support connected vehicle functions. The increasing adoption of Level 2 and Level 3 autonomous driving features presents a strong growth opportunity for smart pillar development, pushing suppliers to innovate integrated structural-electronic solutions.

- For instance, Jaguar Land Rover revealed a research concept called the “360 Virtual Urban Windscreen” to address blind spots caused by the car’s pillars. The technology used screens embedded in the interior pillars that would display a live video feed from cameras mounted on the exterior of the vehicle. The goal was to provide an uninterrupted 360-degree view around the car, making pedestrians, cyclists, and other vehicles more visible in urban environments.

Key Challenges

High Manufacturing Costs and Material Limitations

The use of advanced lightweight materials such as carbon fiber and aluminum significantly increases production costs. High-strength materials require specialized processing methods like hydroforming and laser welding, which involve expensive equipment and skilled labor. This cost burden affects smaller manufacturers and limits large-scale adoption. Additionally, maintaining structural strength while reducing weight poses design challenges. Balancing cost-effectiveness and safety standards remains a critical issue for OEMs. This challenge can slow market expansion, especially in price-sensitive segments like entry-level vehicles.

Design Complexity and Regulatory Compliance

Vehicle pillars must meet strict global safety regulations while supporting evolving design requirements. Integrating ADAS systems, wiring, and sensors into pillars adds complexity, increasing engineering and testing costs. Manufacturers must ensure crashworthiness, visibility, and lightweighting goals simultaneously. Regulatory variations across regions further complicate compliance, requiring tailored solutions for different markets. Any design failure can lead to production delays and high recall costs. Managing this complexity while maintaining cost and performance efficiency is a major challenge for industry players.

Regional Analysis

North America

North America holds 28% of the global vehicle pillar market share. The region benefits from strong automotive production, advanced safety regulations, and growing EV adoption. Automakers in the U.S. and Canada invest heavily in high-strength materials and lightweight structures to meet fuel efficiency and safety standards. B-pillars dominate regional demand due to their crucial role in crash protection. OEMs integrate smart pillar technologies with ADAS features to enhance driver visibility and passenger safety. Rising consumer preference for SUVs and electric vehicles further boosts pillar integration. Ongoing investments in advanced manufacturing strengthen North America’s market position.

Europe

Europe accounts for 25% of the vehicle pillar market share. The region is driven by stringent Euro NCAP safety standards and high demand for premium passenger cars. German and French automakers focus on lightweight pillar structures to meet emission targets and improve crash performance. The push for electric and autonomous vehicles accelerates the adoption of smart A- and B-pillars integrated with sensors and cameras. Strong R&D investment in advanced materials such as aluminum and composites supports innovation. Europe’s commitment to vehicle safety and sustainability ensures steady growth across OEM production networks.

Asia Pacific

Asia Pacific leads the vehicle pillar market with a 32% share. The region benefits from rapid urbanization, growing vehicle production, and rising consumer demand for passenger cars. China, Japan, and India drive pillar adoption through large-scale manufacturing and expanding EV infrastructure. OEMs prioritize cost-efficient yet strong pillar structures to meet safety standards. Lightweight material integration supports fuel efficiency and emission goals. B-pillar installations dominate due to their structural importance and high production volumes. The region’s competitive manufacturing base and supportive regulatory environment position it as the global growth hub.

Latin America

Latin America holds a 9% market share in the vehicle pillar industry. The region experiences steady demand growth supported by expanding automotive assembly facilities in Brazil and Mexico. OEMs are adopting stronger B-pillars to meet improving safety regulations and rising export demand. Increasing passenger car production and vehicle modernization programs also support market expansion. While lightweight materials adoption is still emerging, manufacturers are investing in cost-effective pillar solutions. Gradual EV adoption is expected to create future opportunities for advanced pillar integration, especially in urban centers with infrastructure development.

Middle East & Africa

The Middle East & Africa region represents 6% of the vehicle pillar market share. Growth is driven by rising vehicle imports, expanding assembly operations, and increasing demand for passenger vehicles. Safety regulations are tightening, pushing OEMs to adopt stronger pillar structures in new models. The market is shifting from basic structural pillars to lightweight and durable designs that enhance crash performance. Investments in regional manufacturing and EV mobility initiatives are also contributing to growth. Although the market is at an early stage, infrastructure development and localization of production support long-term potential.

Market Segmentations:

By Pillar Type

- A-Pillar

- B-Pillar

- C-Pillar

- D-Pillar

By Sales Channel

By Vehicle Type

- Passenger Cars

- Commercial Vehicles

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The vehicle pillar market features a moderately consolidated competitive landscape, with leading OEMs and tier-one suppliers focusing on product innovation, lightweighting, and advanced manufacturing. Key players include G-TEKT Corporation, Honda Motor Co., Ltd., AISIN Corporation, Volkswagen AG, AutoKiniton US Holdings, Inc., Toyota Motor Corporation, Ford Motor Company, Benteler International AG, and Hyundai Mobis Co., Ltd. These companies invest in high-strength steel, aluminum, and composite technologies to enhance crash performance and reduce vehicle weight. Many are integrating sensor-based and ADAS-ready pillar solutions to support autonomous and electric vehicle platforms. Strategic collaborations, capacity expansions, and technology upgrades are common competitive strategies. For instance, major automakers and component suppliers are aligning pillar designs with global safety standards and lightweight targets. Continuous R&D efforts and global manufacturing footprints enable these players to maintain strong market positions while addressing evolving regulatory and consumer demands across regions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In November 2024, AUDI launched the E Concept Sportback car in China, featuring a curved pillar-to-pillar 4K touch display and a glass rooftop, marking a significant step in innovative EV interiors and showcasing advanced in-cabin technology.

- In October 2024, ZEEKR introduced the MIX EV with distinctive double B-pillar doors, priced below USD 40K, highlighting the company’s focus on affordable yet innovative electric vehicle design and accessibility.In November 2023, Fisker showcased the production-intent version of the Fisker Pear at The Grove, during the Los Angeles Auto Show. The Pear featured a new see-through A-pillar with a surround-view camera for improved driver visibility. This innovative tech aimed to address visibility issues, especially during left-hand turns.

- In July 2023, Mercedes-Benz unveiled a concept at the IAA Mobility auto show in Munich, offering a preview of its entry segment vision. The teaser showcased a sleek sedan with side-view mirrors attached to the A-pillar and distinctive white accents emphasizing its styling lines. Notably absent were visible door handles, suggesting a departure from conventional design.

Report Coverage

The research report offers an in-depth analysis based on Pillar Type, Sales Channel, Vehicle Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Vehicle pillar designs will focus more on lightweight materials to meet emission targets.

- Demand for smart pillars with integrated sensors and ADAS features will increase.

- OEMs will invest in advanced forming and welding technologies to improve pillar strength.

- Electric and autonomous vehicle growth will create new design requirements for pillar integration.

- Safety regulations will continue to drive innovation in structural reinforcement.

- Asia Pacific will remain the leading region due to strong vehicle production.

- North America and Europe will adopt more advanced pillar technologies for EV platforms.

- Transparent and camera-integrated A-pillars will enhance visibility and safety.

- Strategic partnerships between OEMs and suppliers will strengthen global supply chains.

- The aftermarket segment will grow with rising vehicle customization and replacement needs.