Market Overview:

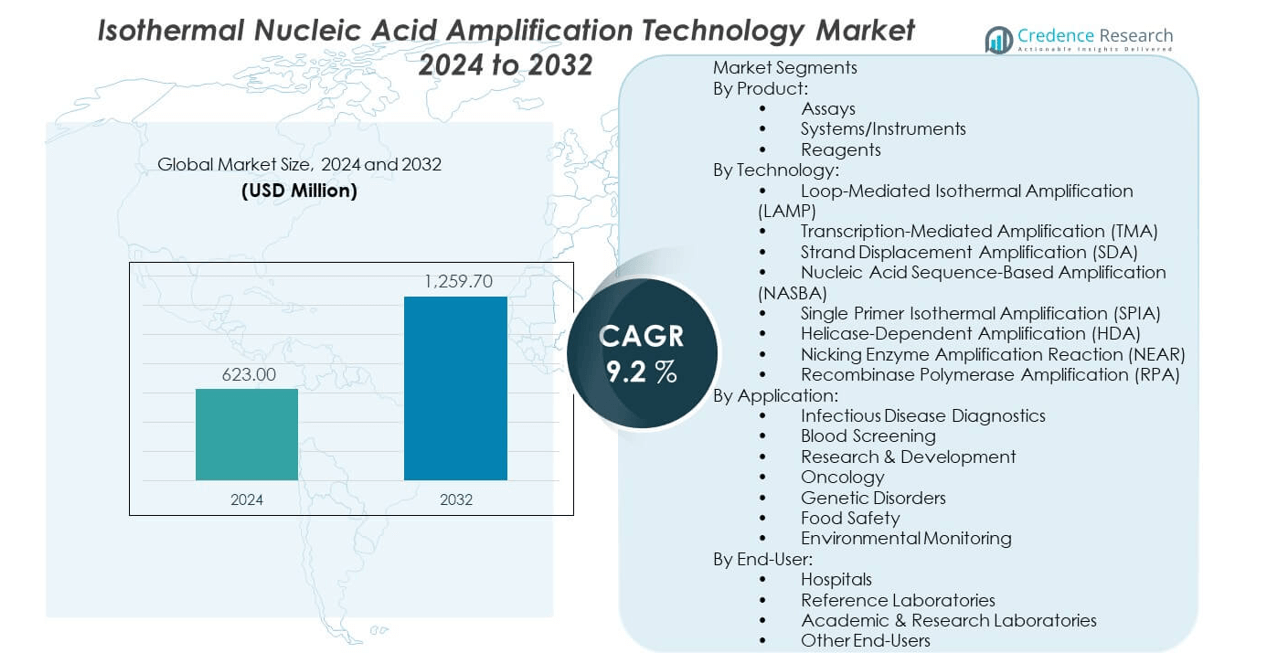

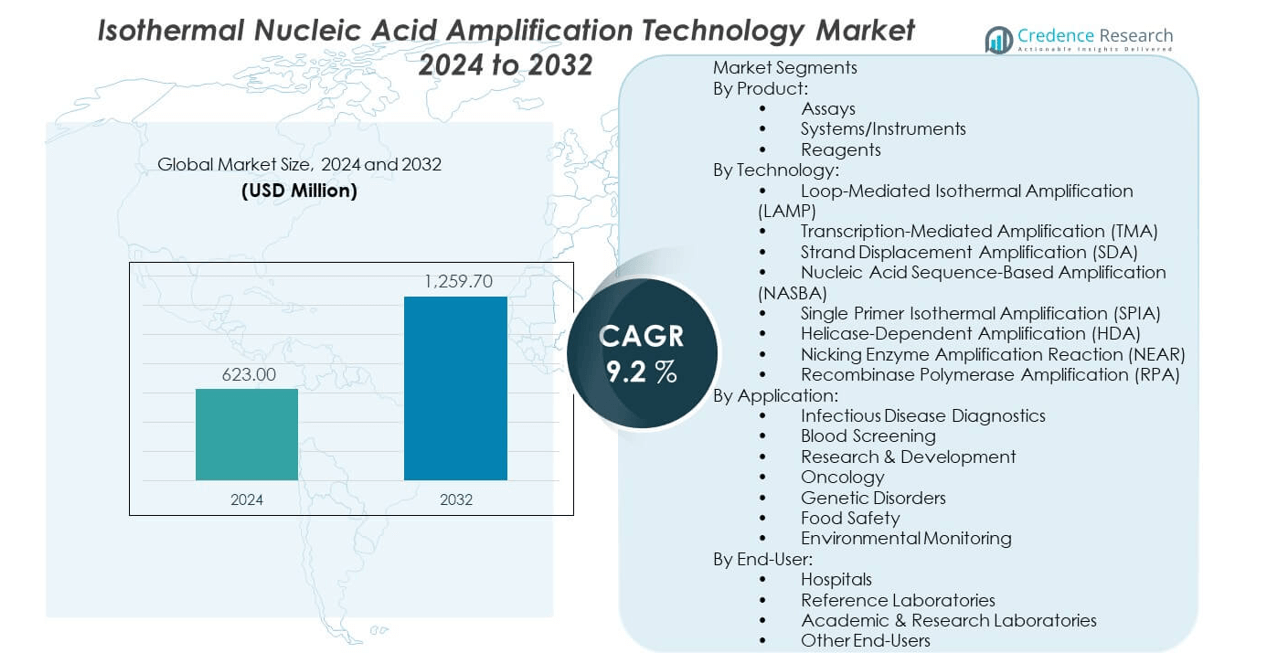

The Isothermal nucleic acid amplification technology market is projected to grow from USD 623 million in 2024 to an estimated USD 1,259.7 million by 2032, with a compound annual growth rate (CAGR) of 9.2% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Isothermal Nucleic Acid Amplification Technology Market Size 2024 |

USD 623 million |

| Isothermal Nucleic Acid Amplification Technology Market, CAGR |

9.2% |

| Isothermal Nucleic Acid Amplification Technology Market Size 2032 |

USD 1,259.7 million |

The market is primarily driven by the growing demand for rapid, cost-effective, and equipment-free molecular diagnostics. Healthcare settings increasingly prefer isothermal amplification over traditional PCR due to its faster turnaround, simplified protocols, and minimal infrastructure requirements. Its application is expanding across infectious disease diagnostics, food safety testing, and environmental monitoring. Continuous innovation in assay development and the growing adoption of point-of-care testing, especially in resource-limited settings, are fueling market expansion. The technology’s compatibility with portable devices supports its integration into decentralized healthcare systems.

North America leads the isothermal nucleic acid amplification technology market due to strong investments in molecular diagnostics and the presence of major biotech firms. Europe follows closely, supported by robust public health initiatives and early adoption of innovative diagnostic tools. Meanwhile, the Asia-Pacific region is witnessing rapid growth, driven by expanding healthcare infrastructure, increasing awareness, and rising demand for affordable diagnostics in populous countries like China and India. Latin America and parts of Africa are emerging markets, benefiting from global health programs and investments in disease surveillance technologies.

Market Insights:

- The isothermal nucleic acid amplification technology market is projected to expand from USD 623 million in 2024 to USD 1,259.7 million by 2032, growing at a CAGR of 9.2%, driven by its affordability, speed, and minimal equipment needs across diagnostic settings.

- Rising demand for rapid, low-resource molecular diagnostics in decentralized and point-of-care environments is a major growth driver, especially for infectious disease testing and outbreak response.

- The market faces restraints such as limited standardization across platforms and risk of false positives in field use, impacting diagnostic consistency and regulatory clearance.

- North America leads the market due to advanced molecular diagnostic infrastructure and strong biotech investment, while Europe maintains steady growth with institutional support and innovation adoption.

- Asia-Pacific is the fastest-growing region, supported by rising diagnostic needs, healthcare infrastructure upgrades, and government focus on affordable, accessible medical technologies.

- Latin America and Africa are emerging markets benefiting from international disease surveillance programs and NGO-driven deployment of portable diagnostic technologies in underserved regions.

- The technology’s strong alignment with portable, digital diagnostic platforms and favorable regulatory backing continues to accelerate its adoption, although technical challenges remain for low-abundance target detection in complex biological samples.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Growing demand for rapid diagnostic tools in decentralized and point-of-care healthcare settings:

The Isothermal nucleic acid amplification technology market benefits from a rising need for quick, reliable, and equipment-light molecular diagnostic tools. Healthcare providers seek methods that enable detection without complex thermocyclers, reducing setup time and cost. The simplicity of isothermal amplification supports its adoption in community clinics, field labs, and emergency settings. Public health agencies favor it for widespread infectious disease surveillance and outbreak response. It allows faster decision-making in clinical workflows, improving patient management. With fewer steps and user-friendly formats, it suits varied operator expertise levels. Governments and NGOs deploy it in low-resource environments for timely disease detection. This widespread applicability enhances its role in global health strategies.

- For instance, Abbott’s ID NOW™ platform utilizes isothermal amplification to deliver results in 13 minutes or less for influenza and SARS-CoV-2 at the point of care, serving over 25,000 installed instruments globally as of 2023.

Expanding applications in infectious disease diagnosis across multiple sectors:

The Isothermal nucleic acid amplification technology market gains traction from its application across human health, veterinary diagnostics, and agriculture. Infectious disease testing represents a large and growing share of the global diagnostics market. The technology’s capability to detect pathogens in under an hour appeals to labs managing high sample volumes. It supports early detection of tuberculosis, HIV, malaria, and respiratory viruses. In veterinary diagnostics, it helps monitor zoonotic diseases with minimal lab infrastructure. Food safety labs use it to detect bacterial contamination like Salmonella and Listeria. Water quality testing benefits from fast turnaround and portability. This wide applicability increases demand across industrial, clinical, and public sectors.

- For instance, Eiken Chemical Co., Ltd. developed the Loopamp™ LAMP kits, which are WHO-prequalified for tuberculosis detection and demonstrate sensitivity above 95% for pulmonary samples in multi-country field trials.

Strong alignment with the shift toward portable and digital diagnostic platforms:

The Isothermal nucleic acid amplification technology market aligns well with global moves toward compact, connected diagnostic solutions. It integrates easily with handheld devices and microfluidic systems, enabling testing outside of central labs. Technology developers package it into disposable cartridges and portable analyzers, reducing the burden on trained personnel. Digital integration allows data transmission to healthcare networks and cloud platforms. This facilitates real-time reporting, remote patient monitoring, and public health alerts. Wearable diagnostic innovations and smartphone-based readers further support its utility. Its compatibility with battery-powered and solar-driven systems makes it viable in off-grid locations. These factors reinforce its position in modern diagnostics.

Favorable regulatory pathways and funding for infectious disease technologies:

The Isothermal nucleic acid amplification technology market benefits from streamlined regulatory approvals and active government support. Agencies like the FDA and WHO have included several isothermal platforms in emergency and essential diagnostic lists. Funding bodies prioritize technologies that offer scalability, affordability, and rapid implementation. Pandemic response programs and global health grants channel investment into isothermal diagnostics. It qualifies for fast-track development and deployment in epidemic zones. International collaborations encourage local manufacturing and distribution in underserved regions. Private sector partnerships increase the pace of R&D and commercialization. Supportive frameworks lower entry barriers for innovators and startups in molecular diagnostics.

Market Trends:

Integration of isothermal amplification with CRISPR-based detection systems:

The Isothermal nucleic acid amplification technology market sees a trend toward combining amplification with CRISPR-Cas detection methods. This fusion enhances both sensitivity and specificity, allowing precise identification of single-nucleotide polymorphisms. It enables multiplex detection of multiple pathogens in one assay. Researchers and companies develop CRISPR-integrated point-of-care kits with visual readouts. The compatibility of isothermal methods with these systems supports instrument-free testing. This trend drives interest from biotechnology startups and academic labs. Funding agencies back projects integrating CRISPR with isothermal systems for real-time diagnostics. These innovations support rapid and decentralized testing in both urban and rural settings.

- For instance, Sherlock Biosciences commercialized their CRISPR-based SHERLOCK™ platform, leveraging RPA isothermal amplification to achieve attomolar detection limits and FDA Emergency Use Authorization for COVID-19 testing in under an hour.

Rise of paper-based and lateral flow isothermal amplification platforms:

The Isothermal nucleic acid amplification technology market shifts toward low-cost, disposable diagnostic formats like paper-based strips. These platforms incorporate colorimetric or fluorescent indicators for visual results. Companies target resource-limited regions with lateral flow assays based on isothermal amplification. Developers aim for room temperature storage and minimal user steps. Such devices are ideal for at-home and field testing applications. Their scalability supports mass production and distribution. Public health campaigns favor these platforms for large-scale disease screening. Integration with smartphone apps adds connectivity and ease of use.

- For instance, QuidelOrtho lateral flow QuickVue test, based on isothermal amplification, can detect influenza A and B and COVID-19 antigens from nasal swabs, boasting CLIA-waived status and facilitating millions of rapid tests annually in decentralized locations.

Growth in environmental and agricultural pathogen surveillance applications:

The Isothermal nucleic acid amplification technology market extends beyond human diagnostics into environmental and agricultural sectors. Testing water sources for microbial contamination becomes faster and field-deployable with isothermal tools. Farmers use these systems to detect plant pathogens, reducing crop losses. Aquaculture industries apply the technology for real-time pathogen detection in fisheries. Portable devices allow on-site diagnostics without relying on distant labs. Governments support environmental surveillance to mitigate biosecurity threats. These non-clinical applications diversify the market and draw new investments. Partnerships with agriculture tech companies expand market scope.

Advances in automation and miniaturization of isothermal diagnostic platforms:

The Isothermal nucleic acid amplification technology market experiences a shift toward automated and miniaturized platforms. Engineers design compact devices with built-in sample prep, amplification, and detection modules. Such systems reduce user intervention and error. Automated platforms increase throughput in labs and improve test consistency. Integration with lab-on-chip and microfluidic designs reduces reagent consumption. Manufacturers target both developed and emerging markets with scalable configurations. Miniaturized systems support diagnostics in mobile labs and emergency units. These advancements align with global goals for accessible and robust diagnostics.

Market Challenges Analysis:

Limited standardization and risk of false-positive results in non-lab settings:

The Isothermal nucleic acid amplification technology market faces challenges due to limited standardization across platforms and assay formats. Variability in primer design and enzyme selection affects test performance. Unlike PCR, it lacks a universally accepted validation protocol. This leads to inconsistent sensitivity and specificity in some applications. In field conditions, environmental factors can interfere with accuracy. False-positive results due to nonspecific amplification remain a concern, especially in resource-limited settings. The lack of internal controls in basic assay designs adds complexity to data interpretation. Regulatory agencies require more clinical validation, delaying approvals for some products. These issues hinder market adoption in some regions.

Technical limitations in detecting low-abundance targets in complex samples:

The Isothermal nucleic acid amplification technology market encounters technical constraints when applied to samples with low pathogen loads or complex matrices. Some amplification enzymes have limited tolerance to inhibitors present in biological or environmental samples. Pre-treatment steps are often necessary, increasing assay time and cost. In multiplex formats, cross-reactivity may reduce assay performance. Device manufacturers struggle to balance sensitivity, speed, and portability. High-fidelity enzymes and advanced probe designs are under development but remain expensive. These technical limitations restrict the market’s reach into certain critical use cases, such as early cancer diagnostics or low-level viral load detection.

Market Opportunities:

Expansion of home diagnostics and consumer health testing solutions:

The Isothermal nucleic acid amplification technology market holds opportunity in the fast-growing home diagnostics segment. Consumer interest in self-testing for infections, fertility, and wellness drives demand for easy-to-use kits. Developers design isothermal assays for integration into compact devices with visual readouts or smartphone interfaces. Retail and e-commerce channels support wide distribution. This trend supports market expansion beyond traditional clinical settings.

Increased investments in regional manufacturing and local diagnostics capacity:

The Isothermal nucleic acid amplification technology market can grow through investment in local production hubs and diagnostics infrastructure. Governments and global health bodies promote regional capacity building to ensure test availability during health emergencies. Public-private partnerships enable technology transfer, while local firms customize platforms for regional disease profiles. This localization strategy increases affordability and market penetration.

Market Segmentation Analysis:

By Product

The isothermal nucleic acid amplification technology market sees strong demand for assays, which hold the largest share due to their diagnostic utility and adaptability to various pathogens. Reagents follow, supported by continuous consumption in testing procedures. Systems and instruments show stable growth as manufacturers introduce compact, automated platforms for point-of-care and decentralized settings.

- For instance, Hologic launched Panther Trax in December 2021, delivering fully automated high-volume TMA-based diagnostic testing on its popular Panther system, with commercial rollouts in the US, Europe, and additional global regions.

By Technology

Loop-Mediated Isothermal Amplification (LAMP) leads due to its robust performance, ease of use, and suitability for rapid diagnostics. Transcription-Mediated Amplification (TMA) and Recombinase Polymerase Amplification (RPA) gain adoption in both centralized and portable testing systems. Strand Displacement Amplification (SDA), NASBA, NEAR, SPIA, and HDA cater to niche applications in clinical and research domains, offering options based on sensitivity, speed, and sample type.

- For instance, Eiken Chemical Co., Ltd. actively develops and markets LAMP-based Loopamp kits worldwide, which are used for a range of infectious diseases and routinely cited in global public health initiatives.

By Application

Infectious disease diagnostics dominate the market, fueled by rising demand for rapid and accurate testing in both developed and emerging healthcare systems. Oncology and genetic disorder testing are expanding as isothermal technologies enable non-invasive, early-stage detection. Blood screening, food safety, and environmental monitoring remain vital across healthcare, agriculture, and public health sectors.

By End-User

Hospitals represent the primary end users, benefiting from fast turnaround and bedside applicability. Reference laboratories rely on it for efficient, high-throughput testing. Academic and research laboratories contribute to technology development and validation. Other end-users, including NGOs and remote healthcare providers, apply it in underserved regions lacking advanced diagnostic infrastructure.

Segmentation:

By Product:

- Assays

- Systems/Instruments

- Reagents

By Technology:

- Loop-Mediated Isothermal Amplification (LAMP)

- Transcription-Mediated Amplification (TMA)

- Strand Displacement Amplification (SDA)

- Nucleic Acid Sequence-Based Amplification (NASBA)

- Single Primer Isothermal Amplification (SPIA)

- Helicase-Dependent Amplification (HDA)

- Nicking Enzyme Amplification Reaction (NEAR)

- Recombinase Polymerase Amplification (RPA)

By Application:

- Infectious Disease Diagnostics

- Blood Screening

- Research & Development

- Oncology

- Genetic Disorders

- Food Safety

- Environmental Monitoring

By End-User:

- Hospitals

- Reference Laboratories

- Academic & Research Laboratories

- Other End-Users

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America and Europe

North America dominates the isothermal nucleic acid amplification technology market, accounting for approximately 38.4% of the global share in 2024. The region benefits from strong investment in molecular diagnostics, a well-established healthcare infrastructure, and the presence of major biotechnology companies. The United States leads in both adoption and innovation, supported by favorable regulatory frameworks and government funding for infectious disease control. Canada contributes with growing interest in decentralized diagnostic systems and public health initiatives. Europe follows with a market share of around 26.7%, driven by early adoption of novel diagnostic tools and expanding applications across clinical and research sectors. Countries like Germany, the UK, and France support growth through advanced healthcare systems and active R&D in molecular diagnostics.

Asia-Pacific

The Asia-Pacific region holds a market share of approximately 22.5% and shows the fastest growth rate globally. Rising demand for affordable diagnostic tools, expanding healthcare access, and government efforts to modernize infrastructure support rapid market expansion. China and India lead the region with high disease burden, growing awareness, and increased investment in domestic diagnostic capabilities. Japan and South Korea contribute through technological advancement and innovation in portable diagnostic devices. The region sees growing public-private partnerships to enhance diagnostic coverage in rural and semi-urban areas. It presents strong opportunities for manufacturers targeting volume-driven markets with scalable and cost-effective platforms.

Latin America and Middle East & Africa

Latin America and the Middle East & Africa collectively account for the remaining 12.4% of the global isothermal nucleic acid amplification technology market. These regions are emerging markets, supported by global health initiatives, non-governmental programs, and increasing demand for decentralized diagnostic solutions. Brazil and Mexico drive Latin American adoption through national disease surveillance programs and expanding healthcare infrastructure. In the Middle East & Africa, countries such as South Africa, Saudi Arabia, and the UAE lead market activity through public sector initiatives and diagnostic imports. Limited local manufacturing and variable reimbursement environments pose challenges, but international funding and targeted deployment in epidemic-prone areas support moderate growth. These regions provide long-term potential as access to affordable, rapid diagnostics improves.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Abbott Laboratories

- Hologic Inc.

- Grifols S.A.

- Becton, Dickinson and Company (BD)

- bioMérieux SA

- Eiken Chemical Co. Ltd.

- Meridian Bioscience Inc.

- QIAGEN N.V.

- QuidelOrtho Corporation

- Thermo Fisher Scientific Inc.

- Tecan Trading AG

- New England Biolabs

- DiaSorin S.p.A.

- OptiGene Limited

- Ustar Biotechnologies Ltd.

- LGC Limited

- TwistDx Limited

- Roche

- Genomtec

Competitive Analysis:

The isothermal nucleic acid amplification technology market features a mix of established diagnostics companies and innovative biotech firms competing to advance rapid molecular testing. Abbott Laboratories, Hologic Inc., and Thermo Fisher Scientific maintain strong positions through integrated platforms and global distribution. QIAGEN and bioMérieux leverage their assay development capabilities to address infectious disease diagnostics. Eiken Chemical and Meridian Bioscience specialize in LAMP-based technologies, catering to decentralized testing needs. Startups like Genomtec and OptiGene contribute agility and specialized device innovation. The market remains competitive as companies invest in faster workflows, portable formats, and digital integration. It favors firms with strong assay portfolios and the ability to meet regulatory requirements across diverse geographies.

Recent Developments:

- In June 2025, bioMérieux SA released a new automated nucleic acid amplification assay for mycoplasma detection, expanding its cell and gene therapy product testing lineup with an automated, high-throughput method based on isothermal technology.

- In May 2025, QIAGEN N.V. completed the acquisition of Genoox, a genomics software provider, for $70 million; the acquisition is set to expand QIAGEN’s clinical genomics and molecular diagnostics portfolio, complementing its isothermal assay offerings.

- In April 2025, Meridian Bioscience Inc. introduced new enzyme stabilization services specifically for isothermal assays, aimed at enhancing reagent stability and reducing costs for molecular diagnostics developers.

- In February 2025, Abbott Laboratories announced that its ID NOW platform surpassed 100 million rapid point-of-care isothermal nucleic acid amplification tests performed in 2023 alone, highlighting continuing investment in rapid diagnostic product deployment using isothermal technology.

Market Concentration & Characteristics:

The isothermal nucleic acid amplification technology market shows moderate concentration, with key players controlling a significant portion of global revenue. It supports innovation and market entry through relatively low infrastructure requirements compared to PCR technologies. The market favors companies with assay development capabilities, rapid regulatory clearance, and decentralized deployment strategies. It demonstrates high growth potential due to widespread demand for rapid diagnostics and expanding applications across healthcare, veterinary, food safety, and environmental sectors. Companies with scalable, portable, and user-friendly solutions hold a competitive edge.

Report Coverage:

The research report offers an in-depth analysis based on product, technology, application, end-user, and region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for rapid molecular diagnostics will remain strong across healthcare, veterinary, and food safety applications.

- Adoption in point-of-care and decentralized settings will increase as healthcare systems prioritize portability and simplicity.

- Innovations in lyophilized reagents and disposable cartridges will enhance field usability and shelf stability.

- Multiplex testing formats will expand to support syndromic panels and reduce diagnostic turnaround.

- Integration with digital platforms will enable real-time data reporting, remote monitoring, and public health alerts.

- Low- and middle-income countries will emerge as high-potential markets due to growing health infrastructure and global aid programs.

- Regulatory pathways will continue to streamline for emergency use and essential diagnostics, supporting faster commercialization.

- Strategic collaborations between biotech startups and diagnostics giants will drive innovation and global distribution.

- Advances in enzyme design and probe chemistry will improve sensitivity and specificity for low-abundance targets.

- Competitive pricing and manufacturing scalability will remain key factors in driving market penetration globally.