Market Overview:

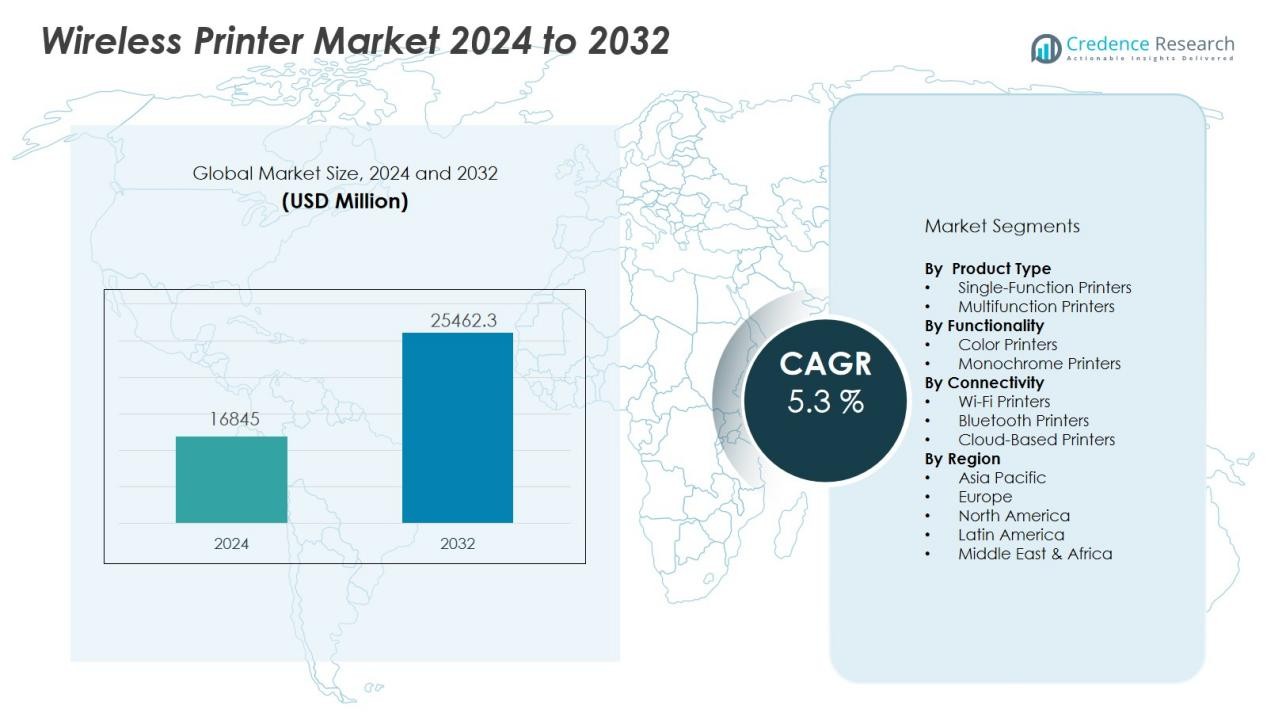

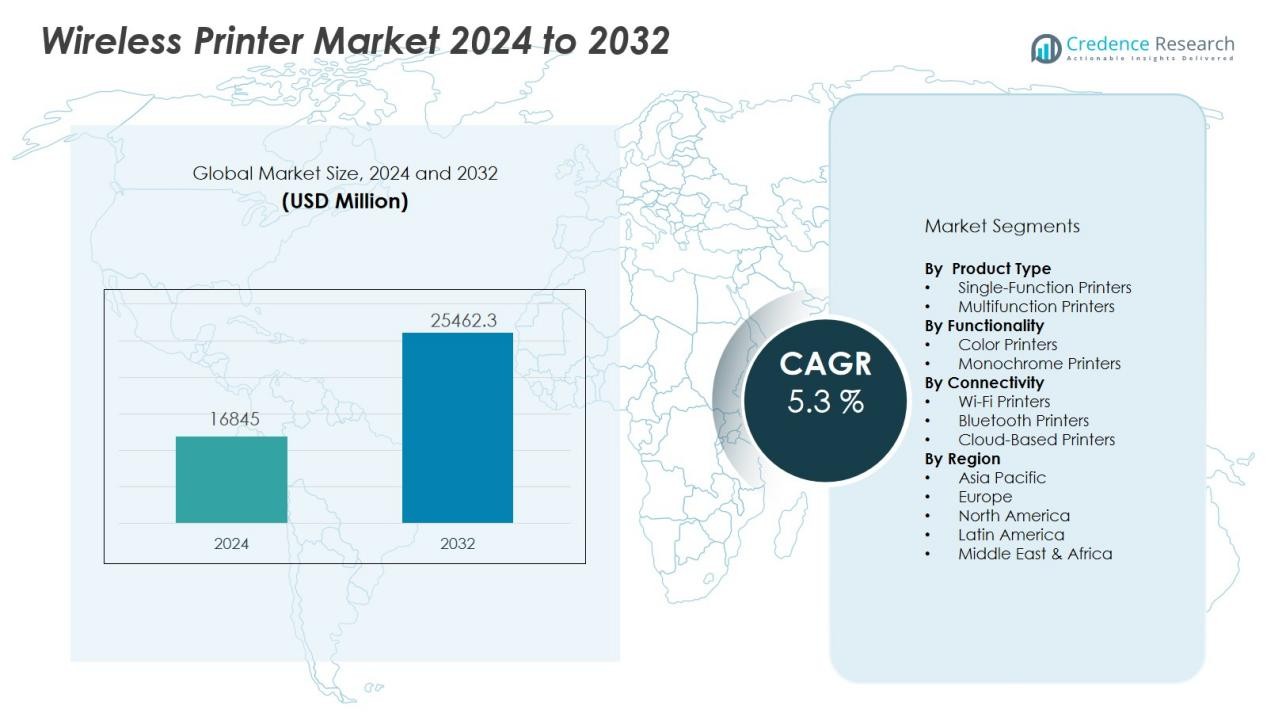

The wireless printer market size was valued at USD 16845 million in 2024 and is anticipated to reach USD 25462.3 million by 2032, at a CAGR of 5.3 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Wireless printer market Size 2024 |

USD 16845 Million |

| Wireless printer market, CAGR |

5.3 % |

| Wireless printer market Size 2032 |

USD 25462.3 Million |

Key market drivers include the rising prevalence of remote and hybrid work environments, which amplify the need for wireless, portable, and easy-to-integrate printing solutions. Enhanced connectivity features such as Wi-Fi Direct, Bluetooth, and mobile app compatibility have improved user experience and reduced dependency on traditional wired infrastructure. The demand for multifunctional devices that offer printing, scanning, and copying in a compact form further accelerates adoption among small and medium-sized businesses, home offices, and educational institutions.

Regionally, North America holds the largest share of the wireless printer market, driven by early technology adoption and a mature enterprise ecosystem. Europe and Asia-Pacific follow closely, fueled by rapid digitalization, expanding small business sectors, and increasing consumer spending on smart home devices. Emerging markets in Latin America and the Middle East & Africa are also witnessing notable growth due to rising internet penetration and digital transformation initiatives.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The wireless printer market was valued at USD 16,845 million in 2024 and is projected to reach USD 25,462.3 million by 2032, reflecting a CAGR of 5.3% during the forecast period.

- Demand rises sharply due to remote and hybrid work models, which require secure, flexible, and portable printing solutions across both home and corporate settings.

- Integration of cloud and mobile printing with advanced connectivity options like Wi-Fi Direct and Bluetooth supports seamless printing from smartphones, tablets, and cloud storage platforms.

- Multifunctional devices offering printing, scanning, and copying in compact formats see high adoption among small businesses, home offices, and educational institutions seeking efficient solutions.

- Cybersecurity risks and data privacy concerns remain significant challenges, prompting organizations to invest in advanced security protocols and regular firmware updates.

- High operational costs and maintenance complexities limit widespread adoption, especially for small businesses and home users managing consumables and technical issues.

- North America leads the market with a 36% share, followed by Europe at 28% and Asia-Pacific at 23%, with growth in all regions fueled by digitalization, smart device adoption, and rising internet penetration.

Market Drivers:

Proliferation of Remote and Hybrid Work Models Fuels Demand:

The expansion of remote and hybrid work arrangements has redefined the requirements for modern printing solutions. Employees increasingly require secure, flexible access to printing from various locations, prompting businesses to invest in wireless technologies. Companies now prioritize devices that support seamless connectivity to multiple platforms and devices. This shift has accelerated the adoption of wireless printers in both home and corporate settings, driving steady market expansion.

- For instance, HP’s LaserJet Pro M404dw delivers its first page in as fast as 6.3 seconds over dual-band Wi-Fi, enabling distributed teams to print critical documents without delay.

Integration of Cloud and Mobile Printing Enhances Flexibility:

Organizations prioritize solutions that support mobile and cloud-based workflows. Wireless printers offer integration with smartphones, tablets, and cloud storage platforms, allowing users to print from anywhere within a network. It empowers businesses to improve efficiency by reducing time and effort spent on document handling. Compatibility with multiple operating systems and remote management capabilities also contribute to the growing appeal of these devices.

- For instance, HP’s Color LaserJet Pro MFP M479fdw offers HP ePrint and Google Cloud Print integration, enabling users to send print jobs from mobile devices over the cloud at up to 28 ppm.

Advances in Connectivity Standards and Security Bolster Adoption:

Continuous advances in wireless connectivity standards such as Wi-Fi Direct and Bluetooth have eliminated many technical barriers in printer deployment. Enhanced security protocols ensure safe data transmission, which is essential in today’s data-sensitive environments. Businesses value printers that can be easily integrated into existing networks without compromising security. The wireless printer market benefits from these technological improvements, reinforcing buyer confidence and increasing adoption rates.

Rising Demand for Multifunctional and Space-Saving Devices:

Small businesses, home offices, and educational institutions seek multifunctional printers that combine printing, scanning, and copying in compact designs. Wireless models meet this demand by offering flexibility and ease of installation without extensive cabling. The convenience of managing multiple document tasks from a single device saves both time and space. These practical advantages have established wireless printers as preferred choices for diverse user segments seeking cost-effective and adaptable solutions.

Market Trends:

Expansion of Mobile Printing and Smart Device Integration Drives Innovation:

Mobile printing capabilities and smart device integration have become core features in the wireless printer market, shaping the future of personal and business printing. Consumers now expect printers to offer seamless compatibility with smartphones, tablets, and laptops, using technologies like AirPrint, Google Cloud Print, and dedicated mobile apps. Manufacturers have responded by developing devices with intuitive interfaces and app-based controls, allowing users to manage print jobs and monitor supplies remotely. The rise of the Bring Your Own Device (BYOD) culture in workplaces further accelerates this shift, pushing enterprises to adopt flexible, universally compatible wireless printers. It enables a frictionless printing experience across platforms and locations. Voice assistant integration, such as compatibility with Amazon Alexa or Google Assistant, is also emerging as a differentiator for new models.

- For instance, the Epson EcoTank L14150—featuring Wi-Fi Direct, Epson iPrint and Remote Print Driver—yields an ultra-high 6,000 colour pages per refill, minimizing interruptions during heavy mobile printing tasks.

Sustainability, Cost Efficiency, and Subscription Models Shape Buyer Preferences:

Sustainability and cost efficiency have moved to the forefront of purchasing criteria in the wireless printer market. Manufacturers focus on designing energy-efficient devices, supporting eco-friendly ink cartridges, and implementing automatic duplex printing to reduce paper usage. Subscription-based ink and maintenance services gain traction, allowing users to manage printing costs more effectively and ensure continuous device performance. It supports both businesses and consumers in optimizing total cost of ownership and minimizing downtime. Efforts to reduce electronic waste through recycling initiatives and longer product life cycles further align with the growing demand for sustainable office technology. The market continues to evolve with these trends, reflecting buyer preference for environmentally responsible and cost-effective solutions.

- For instance, the HP LaserJet Pro MFP 4102fdn features automatic duplex printing and boasts a low Typical Electricity Consumption of just 0.40 kWh/week, helping organizations significantly reduce both energy and paper consumption.

Market Challenges Analysis:

Cybersecurity Risks and Data Privacy Concerns Limit Adoption:

Cybersecurity risks and data privacy concerns present significant challenges for the wireless printer market. Printers connected to corporate or home networks can become entry points for cyber threats if not properly secured. It creates vulnerabilities that hackers may exploit to access sensitive documents or compromise larger IT infrastructures. Organizations must invest in robust security protocols and regular firmware updates to mitigate these risks. The need for comprehensive training and ongoing vigilance also adds complexity to deployment and management. Data breaches or unauthorized access incidents can undermine confidence in wireless printing solutions.

High Operational Costs and Maintenance Complexities Impede Market Growth:

High operational costs and maintenance complexities affect the widespread adoption of wireless printers, especially for small businesses and home users. Consumables such as ink, toner, and specialty paper contribute to ongoing expenses. Technical issues related to wireless connectivity, software compatibility, or device malfunctions can require expert intervention and increase downtime. It places a strain on resources for organizations with limited IT support. Frequent updates and troubleshooting may disrupt workflows and lead to user frustration, hindering long-term loyalty in a competitive market.

Market Opportunities:

Emerging Demand from Home Offices and Education Expands Addressable Market:

Rising adoption of remote work and online education creates substantial opportunities for the wireless printer market. Home offices, students, and educators require reliable, user-friendly printing solutions that fit compact spaces. It presents manufacturers with the chance to develop affordable, multifunctional devices tailored for individual users and small teams. Features such as mobile printing, cloud integration, and intuitive setup will drive preference for wireless models in these growing segments. The expanding e-learning ecosystem and flexible work arrangements will support long-term demand. Companies that cater to these needs with scalable and efficient products can achieve significant market share.

Smart Technology Integration and Industry-Specific Solutions Unlock New Growth Areas:

Integration of smart technologies into wireless printers opens up avenues for value-added services and industry-specific solutions. Voice assistant compatibility, IoT integration, and predictive maintenance features can differentiate new product lines and enhance user experience. The wireless printer market benefits when manufacturers offer devices that streamline workflow automation and secure document management for sectors such as healthcare, legal, and logistics. It allows vendors to move beyond basic printing to deliver holistic digital document solutions. Partnerships with software providers and service platforms will create new revenue streams and foster ecosystem growth.

Market Segmentation Analysis:

By Product Type:

The wireless printer market encompasses single-function and multifunction printers. Single-function printers appeal to users focused on basic printing needs and streamlined operations. Multifunction printers, equipped with scanning, copying, and sometimes fax capabilities, attract both businesses and home offices seeking space-saving, all-in-one solutions. Multifunction models dominate the market due to their versatility and efficiency in managing diverse document workflows.

By Functionality:

The market divides into color and monochrome printers. Color printers support vibrant, high-quality outputs for presentations, marketing materials, and educational content. Monochrome printers target environments where fast, cost-effective black-and-white printing is the priority, such as legal, administrative, or logistics applications. The choice of functionality depends on end-user requirements for document quality and operational costs.

- For instance, Canon’s PIXMA TS series uses a six-color hybrid-ink system and precision FINE print heads with approximately 6,000 nozzles on a 20 mm x 16 mm chip, enabling smooth color gradation and high-resolution photo prints.

By Connectivity:

The market includes Wi-Fi, Bluetooth, and cloud-based printing options. Wi-Fi-enabled printers lead due to their compatibility with multiple devices and ease of integration into home or business networks. Bluetooth connectivity offers simple, direct device pairing, ideal for personal or small office setups. Cloud printing allows remote access and document management, supporting modern workstyles and digital collaboration. The wireless printer market reflects these evolving preferences across user segments.

- For instance, Canon’s uniFLOW Online cloud solution processes and converts over 40 file types directly in the cloud, ensuring seamless access and printing from any supported device.

Segmentations:

By Product Type:

- Single-Function Printers

- Multifunction Printers

By Functionality:

- Color Printers

- Monochrome Printers

By Connectivity:

- Wi-Fi Printers

- Bluetooth Printers

- Cloud-Based Printers

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America :

North America holds a 36% market share in the wireless printer market, supported by advanced IT infrastructure and early adoption of digital solutions. The region benefits from widespread integration of wireless devices in both business and home environments. Enterprises invest in secure, high-performance printers to support remote and hybrid workforces. Strong consumer awareness and established e-commerce channels drive sales of smart, connected devices. The presence of leading technology companies and ongoing innovation sustain market momentum. It positions North America as a core growth engine with steady demand from both corporate and residential users.

Europe :

Europe accounts for 28% of the global wireless printer market, driven by rapid digital transformation and strict environmental regulations. The region’s enterprises embrace eco-friendly technologies and value energy-efficient, low-emission devices. High digital literacy rates and investments in smart office solutions contribute to sustained growth. Government initiatives to promote sustainable practices in public and private sectors accelerate the replacement of traditional printing with wireless alternatives. The expanding small and medium-sized business sector also boosts demand for compact, multifunctional printers. It enables Europe to maintain a robust position with a growing focus on sustainability and digital efficiency.

Asia-Pacific :

Asia-Pacific commands a 23% share of the wireless printer market, underpinned by rapid urbanization, rising disposable incomes, and expanding internet access. Strong demand from small businesses, educational institutions, and tech-savvy households fuels ongoing growth. Countries such as China, Japan, and India invest heavily in digital infrastructure, creating opportunities for market penetration. Local manufacturers introduce affordable, innovative devices tailored for diverse user needs. The increasing shift toward remote learning and work supports higher adoption rates across urban and semi-urban areas. It establishes Asia-Pacific as a dynamic, fast-evolving market with significant long-term potential.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Canon

- Dell

- HP

- Konica Minolta

- Epson

- Fujifilm

- Ricoh

- Roland

- Kyocera

- Lexmark

- Oki

Competitive Analysis:

The wireless printer market features strong competition among global leaders and established regional players. Canon, Dell, HP, Konica Minolta, Epson, Fujifilm, and Ricoh all compete for market share by prioritizing innovation, product reliability, and integration with evolving digital environments. It requires continuous investment in R&D to deliver faster, more efficient, and secure printing solutions. Major companies differentiate their offerings through advanced connectivity, energy efficiency, and tailored features for diverse user segments. Pricing strategies, after-sales service, and distribution reach further influence competitive positioning. New entrants face high entry barriers due to technological complexity and strong brand loyalty among end users. The wireless printer market remains dynamic, with leading brands expanding portfolios and forming strategic alliances to maintain their edge in a rapidly changing landscape.

Recent Developments:

- In June 2025, Canon U.S.A. completed the fourth edition of its career-building program Skilled Professionals at Rising Canon, emphasizing talent development in the U.S..

- In July 2025, Konica Minolta signed a joint development agreement with Toyota Motor Corporation on July 3, 2025, to develop a manned pressurized space rover and dust removal technology as part of space/ground collaboration.

- In April 2025, Roland celebrated 404 Day marking the 20th anniversary of its SP-404 sampling workstation, with global events and software updates.

Market Concentration & Characteristics:

The wireless printer market exhibits moderate to high concentration, with a few global players such as HP, Canon, Epson, and Brother holding significant shares. It features intense competition driven by rapid technological advancements, continuous product innovation, and strong brand recognition. Companies differentiate themselves through proprietary software, energy-efficient features, and seamless connectivity options. The market demonstrates high entry barriers due to the need for advanced R&D capabilities and established distribution networks. Pricing strategies, after-sales service, and integration with smart ecosystems also shape competitive dynamics. The wireless printer market reflects a balance between established multinationals and emerging regional manufacturers introducing niche products and cost-effective solutions.

Report Coverage:

The research report offers an in-depth analysis based on Product Type, Functionality, Connectivity and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- Demand for wireless printers will continue to grow across home, small business, and enterprise segments due to increasing digitalization and flexible work models.

- Manufacturers will invest in enhancing mobile printing capabilities and seamless integration with smart devices and cloud platforms.

- Security features and data protection protocols will become central to new product development as cybersecurity concerns rise.

- Voice assistant compatibility and IoT-enabled functionalities will gain traction, offering users a more intuitive printing experience.

- Energy-efficient designs and eco-friendly consumables will attract environmentally conscious buyers and align with global sustainability initiatives.

- Subscription-based ink and maintenance services will expand, supporting predictable operating costs and reducing device downtime.

- Compact, multifunctional devices will become standard for home offices, educational institutions, and small businesses prioritizing space and efficiency.

- Partnerships between hardware manufacturers and software providers will drive innovation in workflow automation and document management.

- Regional manufacturers will introduce cost-effective, feature-rich models to serve emerging markets and value-focused buyers.

- The wireless printer market will adapt to evolving user expectations, creating new opportunities for growth through continuous technology upgrades and tailored solutions.