Market Overview

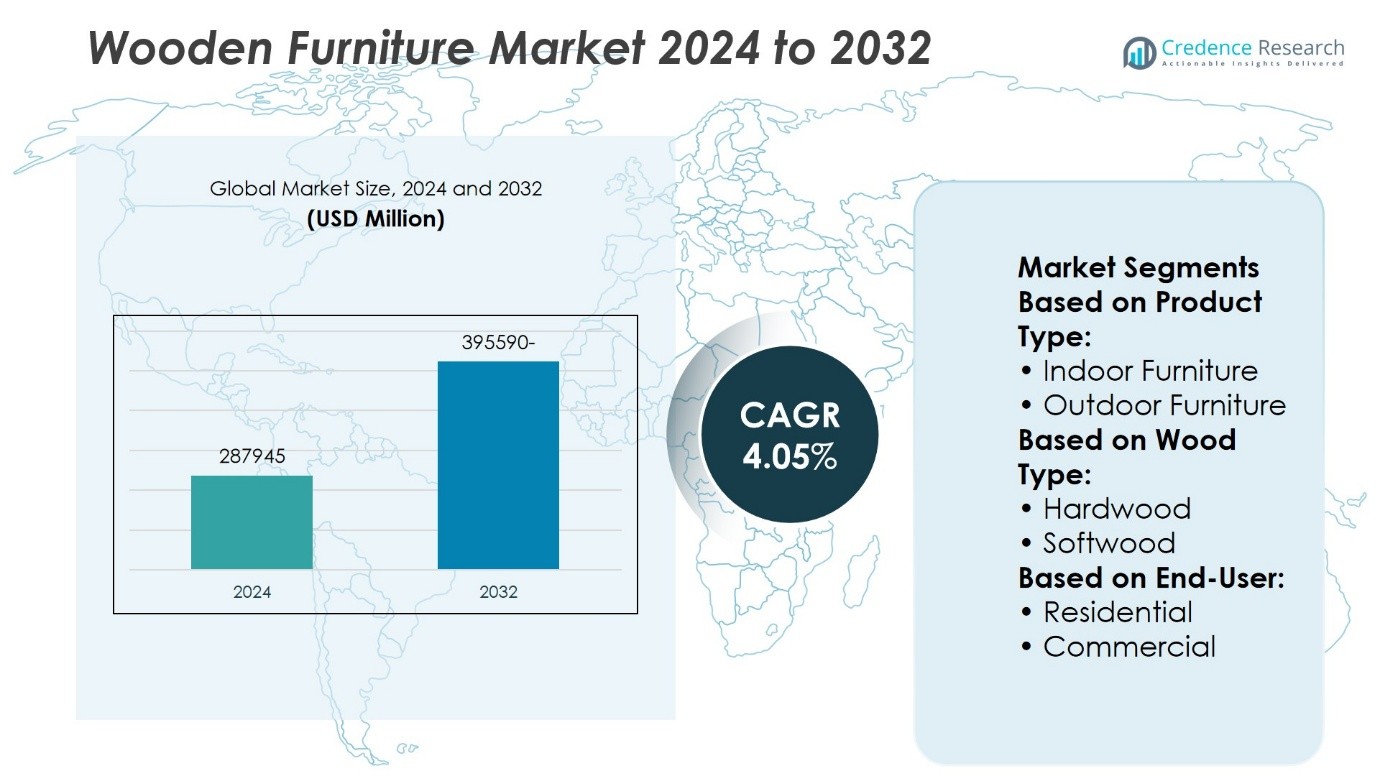

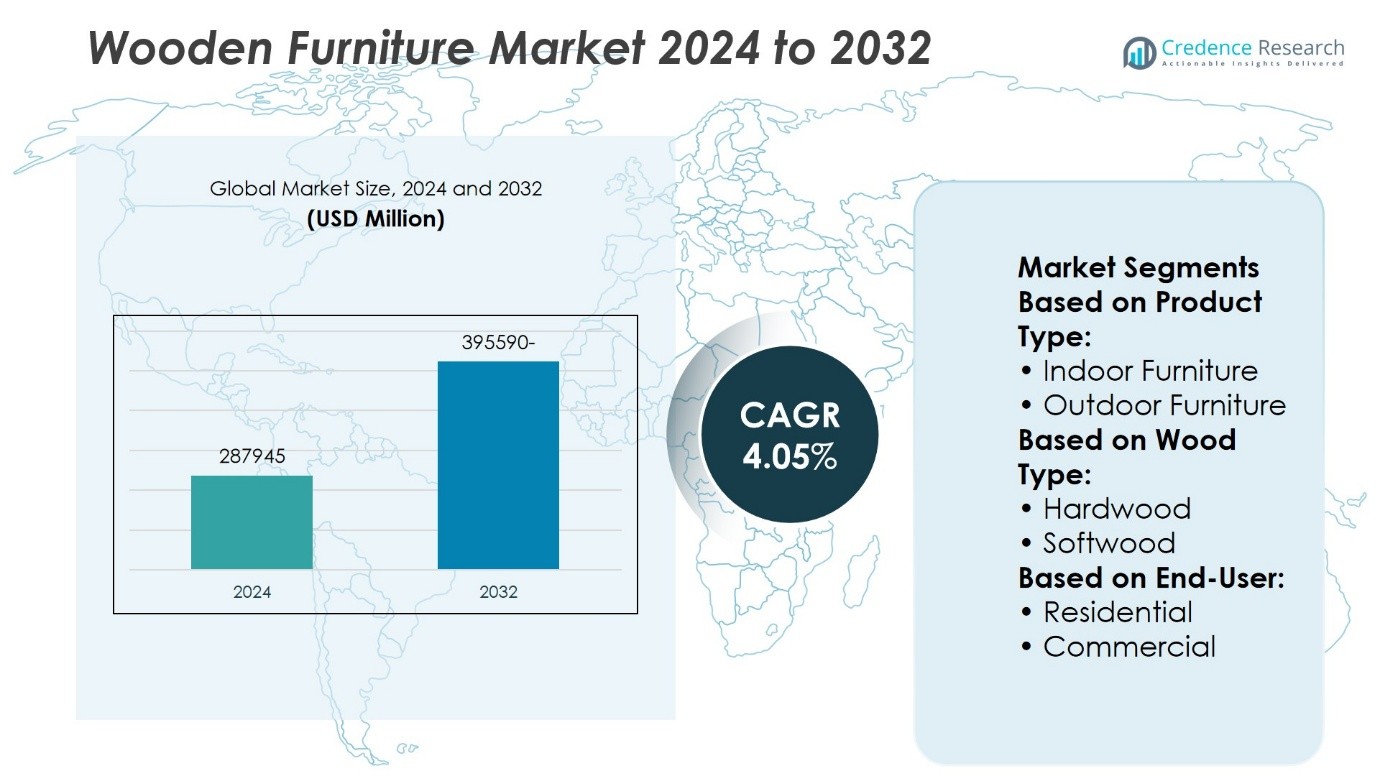

The Wooden Furniture Market was valued at 28,7945 million in 2024 and is projected to reach USD 39,5590 million by 2032, growing at a CAGR of 4.05% during the forecast period (2024–2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Wooden Furniture Market Size 2024 |

USD 28,7945 Million |

| Wooden Furniture Market, CAGR |

4.05% |

| Wooden Furniture Market Size 2032 |

USD 39,5590 Million |

The wooden furniture market is driven by increasing demand for sustainable and eco-friendly products, rising urbanization, and growing consumer preference for aesthetically appealing, functional furniture. Rapid expansion of e-commerce and shifting lifestyles have boosted sales of modular and space-saving designs. Consumers are increasingly seeking customizable and tech-integrated furniture that fits modern living environments. Trends such as minimalist interiors, premium wooden finishes, and hybrid home-office furniture continue to shape product innovation. Manufacturers are responding with design flexibility, sustainable sourcing, and digital tools to meet evolving expectations, positioning themselves to capture emerging opportunities across both developed and developing markets.

The wooden furniture market shows strong regional performance, with Asia-Pacific leading due to high production capacity and rising consumer demand. North America and Europe follow, driven by premium product adoption and sustainability trends. Latin America and the Middle East show steady growth from urbanization and expanding retail sectors. Key players include La-Z-Boy, Hooker Furniture, Natuzzi, Yihua Lifestyle Technology, Durian, FABRYKI MEBLI FORTE SA, HNI Corp, Haworth, Hulsta, and Global Furniture Group, each competing through design, quality, and regional strategies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The wooden furniture market was valued at over USD 28,7945 million in 2024 and is expected to grow at a CAGR of 4.05% from 2024 to 2032.

- Rising demand for eco-friendly, sustainable furniture is a major growth driver globally.

- Consumers are shifting toward modular, space-saving, and customizable wooden furniture solutions.

- The market is moderately fragmented with key players competing through design, pricing, and regional expansion.

- High raw material costs and supply chain disruptions remain key challenges for manufacturers.

- Asia-Pacific holds the largest market share, followed by North America and Europe with steady demand for premium wooden furniture.

- Growth in e-commerce and digital tools like AR for product visualization is transforming furniture retail channels.

Market Drivers

Increasing Consumer Preference for Sustainable and Eco-friendly Products

The growing global focus on sustainability has driven a shift in consumer preferences towards eco-friendly wooden furniture. People are more conscious of environmental impacts, opting for responsibly sourced wood and materials that contribute to a reduced carbon footprint. The use of sustainable practices in manufacturing wooden furniture not only supports environmental goals but also appeals to environmentally aware consumers. This demand for sustainable products is expected to continue growing, further strengthening the market.

- For instance, IKEA disclosed that its suppliers processed 13,400,000 cubic meters of round wood equivalent during FY24 operations, of which 2,140,000 cubic meters was recycled wood.

Rising Demand for Customization and Unique Designs

Consumers are increasingly looking for customized wooden furniture that aligns with their specific tastes and requirements. Furniture manufacturers are responding by offering tailored options, including various wood types, finishes, and dimensions. This demand for bespoke furniture is further supported by the rise of online platforms that allow customers to design their pieces, making customization more accessible and affordable. Such developments are expected to continue driving market growth.

- For instance, according to the U.S. Department of Commerce, custom furniture exporters shipped 870,000 units of customized furniture in 2023

Growth in Urbanization and Middle-Class Population

Urbanization plays a significant role in the expansion of the wooden furniture market. As more people move into cities and modern housing projects continue to rise, the demand for both functional and aesthetically pleasing furniture increases. This is especially noticeable in emerging economies where a growing middle class demands better living standards and higher-quality furnishings. The market is seeing a surge in demand for wooden furniture that offers both practicality and luxury, catering to diverse urban populations. Manufacturers are positioning themselves to meet these evolving needs.

Technological Advancements in Furniture Production

The adoption of new technologies in furniture production is also contributing to market expansion. Innovations such as CNC machines and 3D printing have revolutionized the way wooden furniture is designed and manufactured, allowing for greater precision and reduced waste. These advancements are making production more efficient and cost-effective, which is beneficial for both manufacturers and consumers. Companies are embracing these technologies to remain competitive in a market that increasingly values quality, craftsmanship, and sustainability. The integration of these technological solutions is enhancing the overall appeal of wooden furniture.

Market Trends

Growth of Smart and Multifunctional Wooden Furniture

The market for smart and multifunctional wooden furniture is rapidly expanding. Smart furniture, such as desks with built-in charging stations or sofas with storage compartments, meets these evolving needs. Manufacturers are adapting to this shift by integrating wireless charging, built-in speakers, and even lighting features into wooden pieces.

- For instance, IKEA had sold 140 million units of its BILLY bookcase line, with over 8.5 million of those units featuring modular components.

Demand for Minimalist and Modern Designs

Minimalist and modern furniture styles are becoming increasingly popular, especially in urban areas. These design preferences emphasize simplicity, clean lines, and functionality over ornate details. Consumers are moving away from traditional, heavy designs toward sleek, lightweight wooden furniture that complements contemporary home aesthetics.

Expansion of E-commerce and Online Furniture Shopping

E-commerce continues to shape the growth of the wooden furniture market. The convenience of online shopping, combined with the ability to compare prices and view detailed product information, appeals to an increasingly tech-savvy customer base. Companies are adapting by investing in their online presence and offering virtual tools to enhance the shopping experience.

- For instance, Pepperfry reported that 73% of its total furniture orders in 2023 were placed through its mobile and web platforms, and it deployed over 6,500 virtual reality previews daily through its “Studio Pepperfry” tool to allow customers to visualize wooden furniture in real-time room settings.

Emergence of Hybrid and Cross-Industry Collaborations

The wooden furniture market is witnessing an influx of hybrid and cross-industry collaborations. Companies are partnering with tech firms, designers, and even industries like the adventure motorcycle wheels market to create new, innovative products. These collaborations often combine the natural aesthetics of wood with other materials and technologies, resulting in unique offerings.

Market Challenges Analysis

Supply Chain Disruptions and Raw Material Costs

The wooden furniture market faces significant challenges related to supply chain disruptions and fluctuating raw material costs. The increasing demand for high-quality wood, coupled with supply chain bottlenecks, has led to rising costs for manufacturers. These challenges are compounded by the global need for sustainable sourcing, which can further limit material availability. Companies must navigate these hurdles to maintain competitive pricing while ensuring product quality. Manufacturers are exploring alternative materials and new sourcing strategies, but these efforts require time and investment.

Labor Shortages and Skilled Craftsmanship Constraints

The wooden furniture market also contends with labor shortages and a decline in skilled craftsmanship. Many manufacturers struggle to find skilled workers proficient in traditional woodcraft techniques and modern production methods. This shortage is affecting both production efficiency and the ability to meet growing demand. The adventure motorcycle wheels market, for instance, faces similar labor challenges, with both industries relying on skilled labor to ensure product quality and precision

Market Opportunities

Rising Demand in Emerging Markets and Urban Housing

The wooden furniture market holds strong growth potential in emerging economies driven by urbanization and rising disposable income. Rapid development in countries across Asia-Pacific, Latin America, and Africa is increasing the need for residential and commercial furniture. Young urban populations prefer modern, space-efficient, and affordable wooden furniture, creating steady demand. Governments in these regions are also investing in housing infrastructure, which supports long-term market expansion.

Integration of Technology and Customization in Design

The shift toward smart homes and connected living spaces presents new opportunities for innovation in wooden furniture. Consumers are increasingly interested in products that blend traditional craftsmanship with modern technology, such as built-in lighting, charging ports, or storage sensors. Furniture brands that invest in digital customization tools, augmented reality visualization, and modular construction methods can meet this demand effectively. These innovations position companies to engage tech-savvy buyers and expand their premium offerings.

Market Segmentation Analysis:

By Product Type:

Chairs and tables continue to lead in demand due to their widespread use across residential, office, and hospitality settings. Their functionality and frequent replacement cycle drive consistent sales. Beds and sofas also account for a substantial share, supported by increased spending on comfort and home décor. Cabinets, including wardrobes and kitchen units, are growing rapidly in urban areas where storage optimization is critical. Consumers increasingly favor modular, multifunctional designs to maximize small living spaces. The wooden furniture market reflects this demand by expanding product portfolios to include compact, high-utility designs that fit modern interiors.

- For instance, IKEA disclosed that its BILLY bookcase line achieved a production run exceeding 60,000,000 units since launch

By Wood Type:

Mass-produced furniture dominates due to its affordability, fast availability, and wide distribution through online and offline retail channels. It appeals to middle-income consumers and rental property owners looking for cost-effective furnishing options. In contrast, custom-made furniture is gaining traction among premium buyers seeking tailored designs and high-end materials. It offers value through personalization, craftsmanship, and aesthetic exclusivity. The wooden furniture market sees custom furniture as a key area for margin growth, with many manufacturers investing in digital tools to support design customization and consumer engagement.

By End User:

The residential segment contributes the largest revenue share, driven by rising homeownership, lifestyle upgrades, and interest in interior design. Consumers are furnishing living rooms, bedrooms, dining areas, and increasingly, home offices, following hybrid work models. The commercial segment is steadily expanding, particularly in hospitality, retail, and corporate spaces. Businesses prefer wooden furniture for its durability, aesthetic warmth, and branding potential. The wooden furniture market adapts to this demand by offering product lines tailored to hotels, restaurants, and co-working environments, ensuring functionality meets visual appeal.

Segments:

Based on Product Type:

- Indoor Furniture

- Outdoor Furniture

Based on Wood Type:

Based on End-User:

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America contributes around 24.1% of the global wooden furniture market share. The United States leads the regional market, driven by high consumer spending on home furnishings, lifestyle-focused consumption, and a steady housing market. American consumers show a strong preference for eco-friendly and locally sourced wood products, encouraging brands to focus on sustainable forestry practices and certifications like FSC (Forest Stewardship Council). Canada follows a similar trajectory, with growing interest in modern wooden furniture that emphasizes both form and function. The region’s mature retail environment and widespread adoption of digital tools have further boosted online sales channels.

Europe

Europe holds a significant 21.3% share in the wooden furniture market, with Germany, France, Italy, and the UK being the top contributors. European consumers are highly selective and often favor brands that offer durable, ethically produced furniture with contemporary aesthetics. The demand for Scandinavian-style wooden furniture remains strong, particularly in Northern and Western Europe. Regulations around timber sourcing and environmental impact are strict, pushing manufacturers toward greener practices. It supports a mature and premium-oriented market environment, where heritage brands and boutique manufacturers perform well.

Asia-Pacific

Asia-Pacific holds the largest share in the global wooden furniture market, accounting for approximately 39.5% of the total revenue in 2024. This dominance is driven by rising urbanization, expanding middle-class populations, and increasing homeownership across major economies such as China, India, Japan, and Southeast Asian nations. The region benefits from cost-effective labor and expanding e-commerce infrastructure, which allows both local and international brands to penetrate tier-2 and tier-3 cities. Consumers increasingly value furniture that combines craftsmanship with affordability, pushing brands to innovate in modular and space-saving designs suitable for smaller urban homes.

Latin America

Latin America accounts for 7.6% of the global wooden furniture market, with Brazil and Mexico leading the regional growth. The market here is driven by rising residential construction, increasing disposable income, and a growing young population entering homeownership. Local manufacturers often cater to both domestic demand and export markets, producing handcrafted wooden furniture using indigenous woods. Brazil, with its rich forest resources, has positioned itself as a key supplier, although environmental concerns around deforestation remain a challenge. Demand for locally made, rustic, and regionally inspired designs continues to grow among middle-class buyers.

Middle East & Africa (MEA)

The Middle East and Africa (MEA) represent 4.2% of the global market. The region shows steady growth due to urban development, rising income levels, and expanding hospitality infrastructure. Gulf countries such as the UAE and Saudi Arabia invest heavily in high-end wooden furniture for luxury hotels, retail, and residential projects. African nations like South Africa and Nigeria are seeing increased demand for affordable, durable furniture that suits diverse climates and lifestyles. Import reliance remains high, but local artisans and workshops are slowly gaining visibility with region-specific designs.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The wooden furniture market is highly competitive, with leading players Hooker Furniture Corporation, La-Z-Boy Incorporated, Natuzzi S.p.A., Hulsta, Yihua Lifestyle Technology Co., Ltd., Durian, FABRYKI MEBLI FORTE SA. The wooden furniture market is highly competitive, with leading players focusing on design innovation, product quality, and sustainable manufacturing practices. These companies compete by offering differentiated product lines tailored to a wide range of consumer preferences in both residential and commercial segments. Asian manufacturers like Yihua Lifestyle Technology leverage cost-efficient production, robust supply chains, and strong export capabilities to capture international demand. Their strategic focus includes automated manufacturing, direct-to-consumer channels, and diversification into emerging markets. Strong branding and consistent design updates allow them to cater to evolving consumer preferences in residential and commercial sectors. As demand for sustainable and multifunctional furniture rises, leading companies leverage eco-certified materials and ergonomic designs to stay ahead. The wooden furniture market remains moderately fragmented, with these key players setting benchmarks in quality, scalability, and customer engagement.

Recent Developments

- In July 2025, La-Z-Boy unveiled its first major brand refresh in over 20 years, focusing on a holistic wooden furniture experience rooted in “quiet luxury,” modern wood finishes, and tailored comfort. This brand transformation includes new design language, company-wide store expansion, and enhanced wood product lines tailored for small spaces and modern lifestyles

- In April 2025, Ethan Allen Interiors Inc., a leading designer and manufacturer of home furnishings, completed the acquisition of Hooker Furniture Corporation, a major furniture manufacturer, for approximately USD168 million (Ethan Allen Interiors Inc. SEC Filing). This acquisition significantly increased Ethan Allen’s market share and product offerings.

- In 2024, Natuzzi launched its first branded residential real estate project, the Natuzzi Harmony Residences, and also announced a major retail expansion with 43 new galleries and 25 new stores planned to open by the end of the year

Market Concentration & Characteristics

The wooden furniture market is moderately fragmented, with a mix of global, regional, and local players competing across multiple price points and product categories. It features a balance between large-scale manufacturers such as La-Z-Boy, Hooker Furniture, and Yihua Lifestyle Technology Co., Ltd., and smaller, design-focused firms catering to niche or regional demands. The market is characterized by high product differentiation, long replacement cycles, and strong consumer preference for aesthetic and durable solutions. It relies heavily on raw material availability, craftsmanship, and design innovation, making supply chain efficiency and sustainable sourcing critical success factors. Consumer demand varies widely across regions, with mature markets favoring minimalist and eco-conscious designs, while emerging economies focus on affordability and space-saving solutions. It is also increasingly influenced by digital trends, with e-commerce and augmented reality tools transforming how consumers browse and purchase furniture.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Wood Type, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for sustainable and eco-friendly wooden furniture will continue to grow across global markets.

- Customization and modular furniture designs will attract more consumers seeking personalized solutions.

- Urbanization and smaller living spaces will drive demand for multifunctional and compact wooden furniture.

- E-commerce platforms will play a larger role in product discovery, selection, and delivery.

- Technological integration in furniture, such as smart features, will gain more traction.

- Manufacturers will invest more in automation and digital tools to improve production efficiency.

- Emerging markets will offer significant growth opportunities due to rising disposable income.

- Premium furniture demand will rise in mature markets with a focus on aesthetics and quality.

- Brands focusing on circular economy models and recyclable materials will strengthen market presence.

- Strategic partnerships and regional expansions will remain key approaches for competitive growth.