Market Overview:

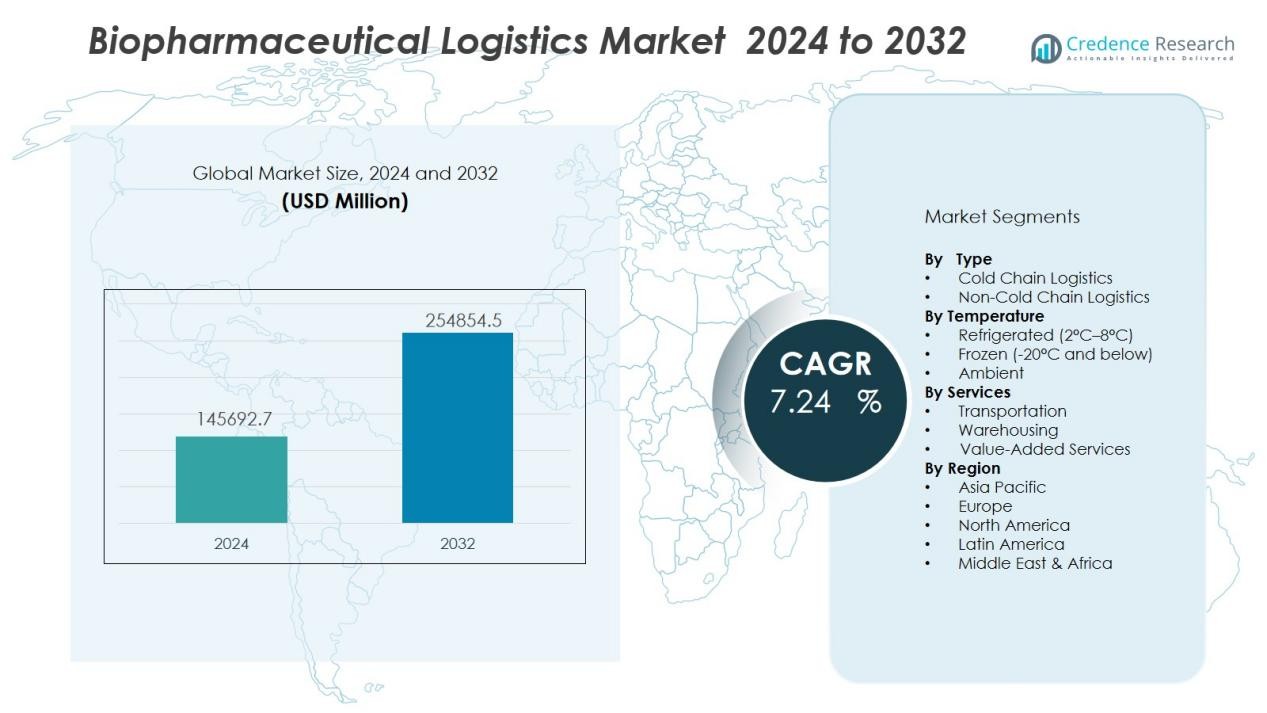

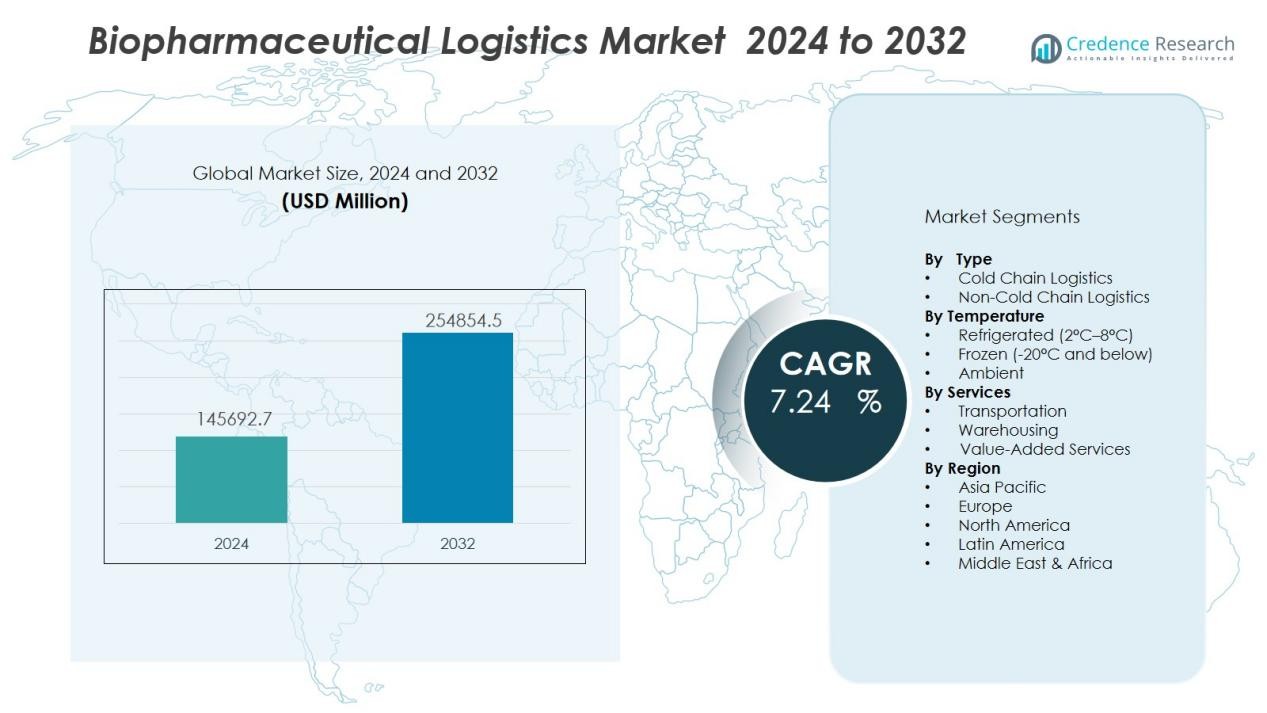

The biopharmaceutical logistics market size was valued at USD 145692.7 million in 2024 and is anticipated to reach USD 254854.5 million by 2032, at a CAGR of 7.24 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Biopharmaceutical Logistics Market Size 2024 |

USD 145692.7 Million |

| Biopharmaceutical Logistics Market, CAGR |

7.24 % |

| Biopharmaceutical Logistics Market Size 2032 |

USD 254854.5 Million |

Market growth is driven by the expanding global demand for biologics, vaccines, and advanced therapies, coupled with increasing pharmaceutical trade across borders. Rising prevalence of chronic and infectious diseases, advancements in cold chain technologies, and heightened regulatory emphasis on product integrity are accelerating the need for specialized logistics solutions. The surge in clinical trials and biopharma manufacturing, particularly in emerging economies, is further supporting market expansion.

Regionally, North America holds a dominant share of the biopharmaceutical logistics market due to its well-established healthcare infrastructure, high R&D investments, and advanced cold chain capabilities. Europe follows closely, supported by strict quality regulations and a strong network of logistics providers. Asia-Pacific is expected to witness the fastest growth, driven by rising healthcare spending, increasing pharmaceutical exports, and rapid infrastructure development in countries like China and India.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The biopharmaceutical logistics market was valued at USD 145,692.7 million in 2024 and is projected to reach USD 254,854.5 million by 2032, growing at a CAGR of 7.24% during 2024–2032.

- Rising demand for biologics, vaccines, cell and gene therapies is driving the need for specialized temperature-controlled logistics solutions.

- Expanding global pharmaceutical trade and stricter cross-border regulations are increasing investments in compliant and technology-driven logistics networks.

- Technological advancements in cold chain infrastructure, including IoT-enabled monitoring, GPS tracking, and automated warehouses, are improving reliability and visibility

- Growth in clinical trials and biopharma manufacturing in emerging markets is creating strong demand for regional cold chain expansion and specialized handling.

- High operational costs and infrastructure gaps in certain emerging economies present challenges for cost-efficient and compliant delivery.

- North America holds 38% market share, Europe accounts for 31%, and Asia-Pacific holds 24%, with Asia-Pacific expected to register the fastest growth due to infrastructure investments and rising pharmaceutical exports.

Market Drivers:

Rising Demand for Biologics, Vaccines, and Specialty Drugs:

The growing adoption of biologics, cell and gene therapies, and vaccines is a major driver for the biopharmaceutical logistics market. These products often require stringent temperature control, specialized packaging, and rapid transit to maintain efficacy. It benefits from the increasing global immunization programs and expanding patient access to advanced treatments. The demand for time-sensitive and temperature-sensitive logistics solutions continues to expand with the rising prevalence of chronic and infectious diseases.

- For instance, Moderna’s COVID-19 vaccine demonstrated superior temperature stability, maintaining potency at standard refrigerator temperatures (2-8°C) for up to 30 days, eliminating the need for specialized ultra-cold storage infrastructure and enabling distribution through existing cold chain networks.

Expansion of Global Pharmaceutical Trade and Cross-Border Regulations:

International trade in pharmaceuticals is increasing, driving the need for efficient, compliant logistics networks. The biopharmaceutical logistics market is supported by growing exports and imports of high-value biopharma products between developed and emerging economies. Stringent cross-border regulations require advanced tracking, validated storage conditions, and adherence to Good Distribution Practices (GDP). These regulatory demands encourage investments in technology-enabled logistics solutions to ensure compliance and product integrity.

- For instance, Air India became the first Indian carrier to achieve GDP certification for pharmaceutical cargo, successfully transporting over 4,000 tonnes of pharmaceuticals globally in FY 2024-25.

Advancements in Cold Chain Infrastructure and Technology Integration:

Innovations in temperature-controlled storage, data loggers, GPS tracking, and IoT-enabled monitoring systems are transforming biopharmaceutical supply chains. The biopharmaceutical logistics market leverages these advancements to reduce spoilage, prevent deviations, and ensure real-time visibility. Investments in automated warehouses, specialized transport fleets, and risk mitigation strategies are enhancing service reliability. Cold chain expansion into remote and underserved markets further strengthens global distribution capabilities.

Growth in Clinical Trials and Biopharma Manufacturing in Emerging Markets:

The rising number of clinical trials for biologics and vaccines across Asia-Pacific, Latin America, and Eastern Europe is creating new logistics demands. The biopharmaceutical logistics market benefits from increasing outsourcing of manufacturing and distribution to these regions. It supports the timely delivery of investigational products, samples, and trial materials under strict handling requirements. Expanding production hubs in countries like China and India are also boosting regional cold chain and distribution infrastructure.

Market Trends:

Integration of Advanced Digital Technologies in Cold Chain Management:

The adoption of IoT-enabled sensors, real-time tracking systems, and blockchain-based documentation is transforming operational efficiency in the biopharmaceutical logistics market. Companies are investing in predictive analytics and AI-driven platforms to monitor shipment conditions, detect risks, and prevent product losses. It enables end-to-end visibility across the supply chain, ensuring compliance with strict regulatory standards. The trend toward paperless documentation and automated temperature alerts improves operational speed and reduces human error. Demand for smart packaging solutions with embedded data loggers is also rising, providing granular insights into temperature excursions and handling conditions. These innovations are strengthening customer confidence and enhancing the reliability of high-value biopharmaceutical shipments.

- For instance, UPS Healthcare operates more than 200 facilities with 17 million square feet of cGMP and GDP-compliant healthcare distribution space, achieving 99.9% on-time delivery performance for over 1.1 million COVID-19 vaccine shipments.

Expansion of Sustainable and Decentralized Distribution Models:

Sustainability is emerging as a key focus area, with logistics providers in the biopharmaceutical logistics market adopting energy-efficient refrigeration systems, reusable packaging, and optimized routing to lower carbon footprints. The rise of decentralized distribution hubs closer to treatment centers and patients is shortening delivery timelines and reducing transit risks. It supports the growing demand for personalized medicines, which require smaller batch shipments with faster turnaround times. Partnerships between logistics providers, healthcare facilities, and technology companies are creating agile supply chain ecosystems. The expansion of same-day and last-mile delivery services for temperature-sensitive products is improving accessibility in urban and remote regions. These developments are redefining service models to align with environmental goals and evolving healthcare delivery needs.

- For instance, Thermo Fisher Scientific opened a new 5,000-square-meters ultra-cold facility in the Netherlands in 2024 that operates 15% on solar power with 160 solar panels installed on the roof, achieving gas-free operations while providing temperature ranges from ambient to cryogenic storage.

Market Challenges Analysis:

Stringent Regulatory Compliance and Risk of Product Loss:

Compliance with diverse global regulations and Good Distribution Practices (GDP) remains a critical challenge in the biopharmaceutical logistics market. Each region enforces unique standards for storage, handling, and documentation, creating operational complexity. It requires significant investment in training, auditing, and technology to meet these requirements. Temperature excursions, mishandling, and delays can lead to costly product losses, especially for high-value biologics and vaccines. Maintaining consistent quality control across multiple carriers and jurisdictions increases operational risk. These factors demand robust quality management systems and continuous monitoring.

High Operational Costs and Infrastructure Limitations in Emerging Markets:

Specialized cold chain infrastructure, advanced monitoring devices, and secure transport add substantial costs to biopharmaceutical logistics operations. The biopharmaceutical logistics market faces higher expenses in regions lacking established storage facilities, skilled personnel, or reliable transport networks. It becomes challenging to maintain product integrity during long-distance shipments in such markets. Limited last-mile cold chain capabilities in rural and remote areas hinder timely delivery. Currency fluctuations and geopolitical instability further strain profitability. Companies must balance cost-efficiency with uncompromising quality to sustain competitiveness in these regions.

Market Opportunities:

Rising Demand for Advanced Therapies and Personalized Medicine:

The growing adoption of cell and gene therapies, precision medicine, and specialty biologics presents significant opportunities for the biopharmaceutical logistics market. These treatments require highly specialized handling, small-batch deliveries, and rapid turnaround times. It benefits from the increasing number of healthcare facilities offering personalized treatments that depend on secure and efficient supply chains. Demand for customized cold chain solutions, including ultra-low temperature storage, is expanding. Collaborations between logistics providers and biotech firms are enabling tailored distribution models. This shift is creating long-term growth potential for service providers with advanced capabilities.

Expansion into Emerging Markets with Infrastructure Development:

Rapid healthcare advancements and increasing pharmaceutical production in emerging economies are opening new growth avenues for the biopharmaceutical logistics market. Governments and private investors are building modern cold chain facilities and improving transport connectivity. It allows logistics providers to tap into high-growth markets in Asia-Pacific, Latin America, and the Middle East. Rising healthcare spending and expanding access to advanced therapies are boosting demand for reliable logistics solutions. Strategic partnerships with local players can help global providers strengthen market presence. These developments position the sector for accelerated expansion in underpenetrated regions.

Market Segmentation Analysis:

By Type:

The biopharmaceutical logistics market is segmented into cold chain logistics and non-cold chain logistics. Cold chain logistics dominates due to the high volume of temperature-sensitive biologics, vaccines, and specialty drugs requiring strict environmental control. It benefits from advancements in refrigeration technology, real-time monitoring, and specialized packaging solutions. Non-cold chain logistics supports the transport of stable pharmaceuticals, medical devices, and consumables, with demand driven by expanding pharmaceutical manufacturing and global trade.

- For instance, Henry Schein demonstrates substantial non-cold chain capabilities through its centralized distribution network handling over 300,000 branded products with $12.7 billion in sales serving more than 1 million customers globally in 33 countries.

By Temperature:

Temperature segments include refrigerated (2°C–8°C), frozen (-20°C and below), and ambient. Refrigerated transport holds the largest share, driven by vaccines, monoclonal antibodies, and other biologics with narrow temperature tolerance. Frozen logistics is growing with the rise of cell and gene therapies requiring ultra-low storage conditions. Ambient segment demand comes from stable drugs and APIs transported under controlled room temperatures.

- For instance, UPS Healthcare utilizes continuous end-to-end IoT temperature monitoring to ensure vaccines remain between 2°C and 8°C during transit, achieving compliance across thousands of vaccine shipments with less than 1% deviation in 2021.

By Services:

Service categories cover transportation, warehousing, and value-added services such as packaging, labeling, and customs clearance. Transportation accounts for the largest share, supported by road, air, and sea freight networks tailored for pharmaceutical distribution. Warehousing is evolving with GDP-compliant facilities offering real-time inventory control and cold storage zones. Value-added services enhance product safety and regulatory compliance, strengthening end-to-end supply chain efficiency.

Segmentations:

By Type:

- Cold Chain Logistics

- Non-Cold Chain Logistics

By Temperature:

- Refrigerated (2°C–8°C)

- Frozen (-20°C and below)

- Ambient

By Services:

- Transportation

- Warehousing

- Value-Added Services (Packaging, Labeling, Customs Clearance)

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America :

North America holds 38% market share in the biopharmaceutical logistics market, supported by advanced cold chain infrastructure and high per capita healthcare expenditure. The region benefits from a strong network of specialized logistics providers, regulatory enforcement, and robust R&D activity. It is driven by the high demand for biologics, vaccines, and clinical trial supplies. The U.S. leads in adopting advanced tracking and monitoring technologies, ensuring compliance and product safety. Canada’s expanding pharmaceutical manufacturing and export capabilities contribute to regional growth. Strategic collaborations between logistics firms and pharmaceutical companies are further strengthening market capabilities.

Europe:

Europe accounts for 31% market share in the biopharmaceutical logistics market, driven by strict quality regulations and well-developed transport networks. The region has a dense network of GDP-compliant storage facilities and specialized distribution channels. It benefits from strong cross-border pharmaceutical trade within the EU and to global markets. Germany, the UK, and Switzerland are key hubs due to their advanced manufacturing and research facilities. Adoption of sustainable and reusable packaging solutions is gaining traction. Expansion of clinical trials and biotechnology investments is boosting regional logistics demand.

Asia-Pacific :

Asia-Pacific holds 24% market share in the biopharmaceutical logistics market, driven by rapid healthcare infrastructure development and increasing pharmaceutical exports. The region is witnessing significant investment in cold chain facilities and last-mile delivery solutions. It benefits from rising demand for vaccines, specialty drugs, and personalized therapies in countries like China, India, and Japan. Government support for pharmaceutical manufacturing and R&D is strengthening supply chain capabilities. Regional logistics providers are forming partnerships with global players to meet quality and compliance standards. The shift toward advanced therapies is creating new growth avenues across the region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- UPS

- DB Schenker

- Marken

- World Courier

- BDP

- Catalent

- CEVA

- Agility

- Panalpina

- Thermo Fisher Scientific

- Biocair

- FedEx

Competitive Analysis:

The biopharmaceutical logistics market is highly competitive, with global and regional players offering specialized cold chain and value-added services. Leading companies such as UPS, DB Schenker, Marken, World Courier, and BDP leverage extensive distribution networks, advanced tracking systems, and GDP-compliant operations to ensure product integrity. It also includes strong competition from Catalent, CEVA, Agility, and Panalpina, which focus on expanding service portfolios and enhancing temperature-controlled capabilities. Players invest in IoT-enabled monitoring, automated warehousing, and strategic partnerships with pharmaceutical manufacturers to strengthen market position. Service differentiation is achieved through reliable last-mile delivery, regulatory compliance expertise, and tailored solutions for biologics and advanced therapies. The market’s competitive landscape is shaped by the need for innovation, cost efficiency, and the ability to operate seamlessly across global supply chains.

Recent Developments:

- In February 2025, featured the integration announcement of Marken, MNX, and Polar Speed under the global brand Marken, UPS Healthcare Precision Logistics, expanding precision healthcare logistics capabilities.

- In August 2024 saw Marken join United Airlines’ Eco-Skies Alliance, helping accelerate decarbonization efforts in global healthcare logistics.

- In June 2024, World Courier appointed ROAST as its global full-service digital agency to enhance digital marketing and demand generation.

Market Concentration & Characteristics:

The biopharmaceutical logistics market is moderately concentrated, with a mix of global leaders and specialized regional providers competing for market share. It is characterized by high entry barriers due to stringent regulatory requirements, significant infrastructure investments, and the need for advanced cold chain capabilities. Leading companies differentiate through technology integration, GDP-compliant operations, and global distribution networks. The market emphasizes reliability, temperature control precision, and real-time visibility to ensure product integrity. Strategic partnerships between logistics firms, pharmaceutical manufacturers, and technology providers are common to expand service reach and enhance compliance. Growing demand for specialized handling of biologics and advanced therapies continues to shape competitive dynamics.

Report Coverage:

The research report offers an in-depth analysis based on Type, Temperature, Services and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- Demand for specialized cold chain solutions will rise with the growth of biologics, cell and gene therapies, and personalized medicine.

- Digital transformation through IoT, AI, and blockchain integration will enhance shipment visibility, risk management, and compliance.

- Sustainability initiatives will drive adoption of reusable packaging, energy-efficient refrigeration, and optimized routing to reduce environmental impact.

- Expansion of decentralized distribution models will shorten delivery times and improve patient access to advanced treatments.

- Strategic collaborations between logistics providers, pharmaceutical companies, and technology firms will strengthen supply chain resilience.

- Emerging markets in Asia-Pacific, Latin America, and the Middle East will see significant infrastructure investment, improving cold chain capabilities.

- Last-mile delivery innovations, including same-day services for temperature-sensitive products, will become more prevalent in urban and rural areas.

- Regulatory compliance will remain a central focus, encouraging investment in training, audits, and validated equipment.

- Growth in global pharmaceutical trade will increase cross-border logistics complexity, requiring advanced documentation and quality control systems.

- Continued investment in clinical trial logistics will create opportunities for providers with specialized handling and rapid turnaround capabilities.