Market Overview

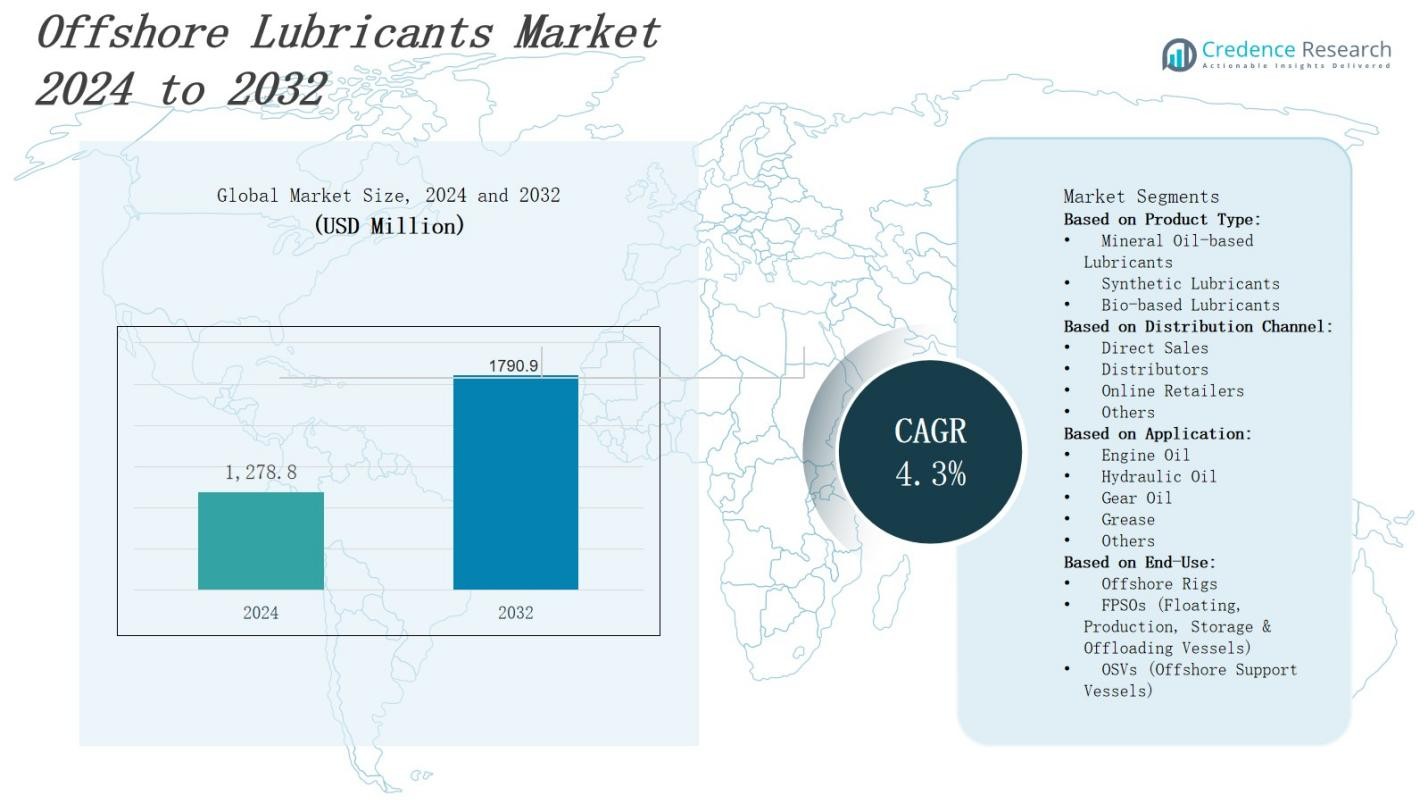

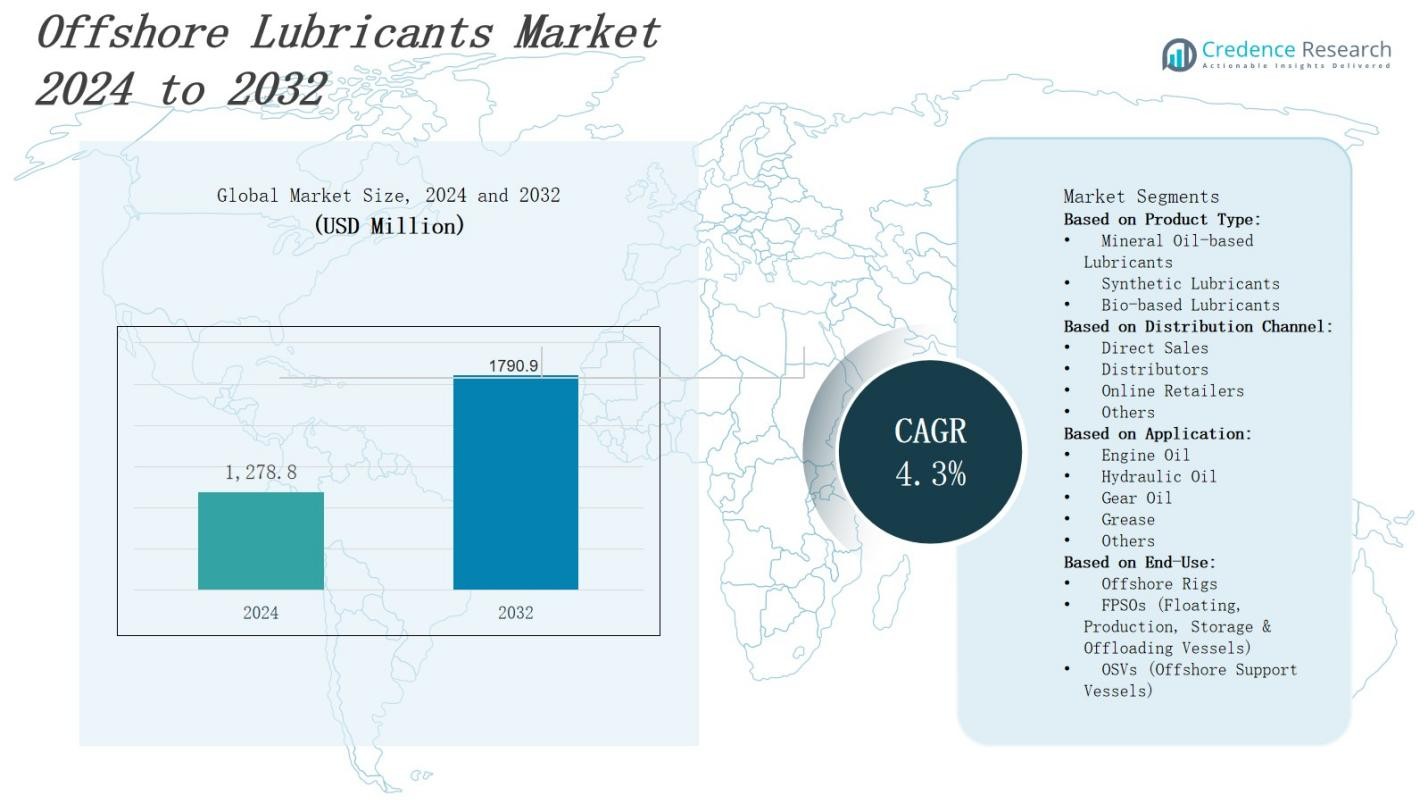

The offshore lubricants market is projected to grow from USD 1,278.8 million in 2024 to USD 1,790.9 million by 2032, registering a CAGR of 4.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Offshore Lubricants Market Size 2024 |

USD 1,278.8 Million |

| Offshore Lubricants Market, CAGR |

4.3% |

| Offshore Lubricants Market Size 2032 |

USD 1,790.9 Million |

Market growth in the offshore lubricants market is driven by rising offshore oil and gas exploration activities, increasing demand for high-performance lubricants to withstand extreme marine conditions, and advancements in lubricant formulations that enhance equipment efficiency and lifespan. Growing investments in offshore wind energy projects further boost consumption, while stringent environmental regulations are accelerating the adoption of eco-friendly and biodegradable lubricants. Trends include the integration of condition monitoring technologies for predictive maintenance, a shift toward synthetic and bio-based products, and increased R&D efforts to develop formulations tailored for deepwater and harsh-environment applications, ensuring reliability and sustainability in offshore operations.

The offshore lubricants market spans North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, with Asia-Pacific holding the largest share, followed by North America and Europe, while Latin America and the Middle East & Africa show steady growth. Key players include Shell, Exxon Mobil Corporation, Chevron, BP p.l.c., TotalEnergies, Eni, Repsol, MOL Group, Idemitsu Kosan, Castrol, Fuchs Petrolub, Quaker Chemical Corporation, and Lubrizol. These companies focus on advanced formulations, regulatory compliance, and strategic partnerships to meet diverse offshore operational needs across oil, gas, and renewable energy sectors.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The offshore lubricants market is projected to grow from USD 1,278.8 million in 2024 to USD 1,790.9 million by 2032, registering a CAGR of 4.3% during the forecast period.

- Rising offshore oil and gas exploration in deepwater and ultra-deepwater locations is boosting demand for high-performance lubricants capable of withstanding extreme marine conditions.

- Expanding offshore wind energy projects in Europe, Asia-Pacific, and North America are creating significant opportunities for specialized turbine lubricants.

- Advancements in synthetic and bio-based lubricant formulations are enhancing corrosion resistance, thermal stability, and equipment lifespan in harsh environments.

- Stringent environmental regulations are driving the adoption of Environmentally Acceptable Lubricants (EALs) that meet global marine pollution standards.

- Asia-Pacific holds 32% market share, followed by North America at 28%, Europe at 26%, Latin America at 8%, and the Middle East & Africa at 6%.

- Key players include Shell, Exxon Mobil Corporation, Chevron, BP p.l.c., TotalEnergies, Eni, Repsol, MOL Group, Idemitsu Kosan, Castrol, Fuchs Petrolub, Quaker Chemical Corporation, and Lubrizol.

Market Drivers

Rising Offshore Oil and Gas Exploration Activities Driving Lubricant Demand

The offshore lubricants market benefits significantly from expanding oil and gas exploration projects in deepwater and ultra-deepwater locations. It requires advanced lubricants to maintain equipment performance in extreme pressure, temperature, and corrosive marine conditions. Growing global energy demand is encouraging investments in offshore drilling platforms and rigs. The need for reliable machinery operation is increasing lubricant consumption. Operators prioritize high-quality formulations to reduce maintenance downtime. Technological advances in drilling equipment further enhance lubricant demand.

- For instance, Chevron Corporation provides its Chevron Marine Lubricants and Chevron RPM Marine oils specifically formulated for offshore drilling rigs and support vessels, addressing high load and thermal stress conditions in harsh marine environments.

Growing Offshore Wind Energy Installations Expanding Application Scope

The offshore lubricants market gains traction from rapid growth in offshore wind farms, particularly in Europe, Asia-Pacific, and North America. Turbines operating in marine environments demand specialized lubricants to ensure smooth gear, bearing, and hydraulic system performance. Rising renewable energy targets encourage governments and private investors to fund large-scale offshore wind projects. It supports higher lubricant adoption. The expansion of maintenance and service activities further boosts consumption. Sustainable lubricants are becoming preferred choices for wind energy applications.

- For instance, Shell has developed specialized synthetic lubricants that improve the durability and performance of gears and bearings in harsh marine environments, extending maintenance intervals for offshore turbines.

Advancements in Lubricant Formulations Enhancing Equipment Reliability

Continuous research and development in lubricant technology are creating high-performance products capable of withstanding harsh offshore conditions. The offshore lubricants market sees demand for synthetic and bio-based lubricants with superior corrosion resistance and thermal stability. It allows longer equipment life and reduced operational risks. Enhanced water resistance properties improve system performance. Custom formulations meet specific equipment needs, supporting efficiency. Industry partnerships between lubricant manufacturers and equipment OEMs are fostering innovative product development.

Stringent Environmental Regulations Promoting Eco-Friendly Lubricants

The offshore lubricants market faces increasing pressure to comply with global and regional environmental protection standards. Regulatory bodies mandate the use of environmentally acceptable lubricants (EALs) in sensitive marine ecosystems. It drives investment in biodegradable and non-toxic formulations. Companies adopt eco-friendly alternatives without compromising performance. Compliance requirements influence procurement strategies for offshore operators. Growing environmental awareness among stakeholders accelerates the transition toward sustainable lubricants. These factors create long-term growth opportunities for market players.

Market Trends

Increasing Shift Toward Synthetic and Bio-Based Lubricants

The offshore lubricants market is witnessing a steady transition from conventional mineral-based products to synthetic and bio-based alternatives. This shift is driven by the superior thermal stability, oxidation resistance, and extended service life of advanced formulations. It enables reduced maintenance frequency and lower operational downtime. Bio-based lubricants are gaining adoption due to environmental compliance requirements. Offshore operators prioritize high-performance lubricants to optimize efficiency. Growing research efforts aim to create customized eco-friendly solutions for harsh marine environments.

- For instance, Shell has developed synthetic lubricants specifically designed to withstand extreme offshore conditions, providing enhanced equipment reliability in harsh marine environments.

Integration of Predictive Maintenance and Condition Monitoring Systems

A key trend in the offshore lubricants market is the adoption of predictive maintenance technologies to improve equipment reliability. Operators use advanced sensors and analytics to assess lubricant condition in real time. It allows timely interventions, reducing unplanned outages. Data-driven insights enhance lubricant utilization and prevent premature component failures. The growing availability of IoT-enabled monitoring solutions is supporting this shift. Maintenance cost savings and extended machinery life make condition monitoring a strategic priority for offshore operations.

- For instance, offshore drilling rigs use vibration and temperature sensors to detect wear in rotating machinery, enabling timely repairs that prevent costly breakdowns.

Rising Demand from Expanding Offshore Wind Sector

The rapid growth of offshore wind projects is influencing product demand in the offshore lubricants market. Wind turbines deployed in marine environments require gear oils, greases, and hydraulic fluids capable of withstanding saltwater exposure and high load conditions. It is increasing demand for specialty lubricants tailored to renewable energy applications. The expansion of wind capacity in Europe, China, and the United States supports market growth. Lubricant suppliers are developing turbine-specific formulations to meet evolving performance and durability needs.

Focus on Environmentally Acceptable Lubricants for Regulatory Compliance

Environmental concerns are shaping purchasing decisions in the offshore lubricants market, with operators seeking lubricants that meet international marine pollution standards. The push for Environmentally Acceptable Lubricants (EALs) is strong in regions with strict regulatory oversight. It promotes the use of biodegradable, non-toxic products without sacrificing performance. Manufacturers are expanding product lines to address compliance needs. The trend aligns with global sustainability goals and enhances the environmental profile of offshore energy projects. Demand for EALs is expected to strengthen further.

Market Challenges Analysis

High Operational Costs and Supply Chain Constraints

The offshore lubricants market faces significant pressure from the high costs associated with offshore operations and complex supply chain logistics. Transporting lubricants to remote offshore rigs or wind farms requires specialized vessels and storage facilities, which increases expenses. It is further challenged by unpredictable weather conditions that disrupt timely deliveries. Global shipping delays and fluctuating fuel prices add to supply uncertainties. Limited on-site storage capacity forces operators to manage inventories carefully. These factors can hinder consistent lubricant availability, impacting maintenance schedules and operational efficiency.

Stringent Regulatory Compliance and Technical Performance Demands

Meeting strict environmental and performance regulations remains a major challenge for the offshore lubricants market. It must comply with global marine pollution standards while delivering high-performance characteristics in extreme operating conditions. Developing lubricants that are both eco-friendly and durable under high loads and saltwater exposure is technologically demanding. Regulatory changes require constant product reformulation, increasing R&D costs. Operators also face the risk of penalties for non-compliance, which heightens the need for certified products. This balancing act between sustainability, performance, and compliance continues to challenge market participants.

Market Opportunities

Expansion of Offshore Renewable Energy Projects Creating New Demand

The offshore lubricants market is positioned to benefit from the rapid global expansion of offshore renewable energy projects, particularly wind farms. Turbines operating in harsh marine environments require specialized lubricants to ensure long-term performance and reduce maintenance frequency. It opens opportunities for suppliers to develop products tailored for high-load gear systems, hydraulic components, and bearings. Government-backed renewable energy targets in Europe, Asia-Pacific, and North America are driving large-scale installations. The growth of maintenance service contracts for these assets further strengthens lubricant demand.

Technological Innovation in Eco-Friendly and High-Performance Lubricants

Ongoing advancements in lubricant formulations present a significant growth avenue for the offshore lubricants market. It can leverage innovations in synthetic and bio-based technologies to meet both performance and environmental standards. Rising demand for Environmentally Acceptable Lubricants (EALs) offers opportunities for product differentiation. Manufacturers investing in R&D can create solutions with superior corrosion resistance, thermal stability, and extended service life. Partnerships with equipment OEMs enhance product compatibility and adoption. The trend toward sustainability positions innovative suppliers for long-term competitive advantage.

Market Segmentation Analysis:

By Product Type

The offshore lubricants market is segmented into mineral oil-based, synthetic, and bio-based lubricants. Mineral oil-based variants remain widely used due to cost efficiency and established supply chains. Synthetic lubricants are gaining share for their superior thermal stability, corrosion resistance, and extended service life in extreme marine conditions. It is also witnessing growing adoption of bio-based lubricants, driven by environmental regulations and the need for biodegradable solutions. The demand balance is shifting toward high-performance and eco-friendly formulations.

- For instance, ExxonMobil’s synthetic offshore lubricants are formulated to withstand extreme temperatures and saline conditions, ensuring reliable performance on offshore rigs.

By Distribution Channel

Distribution channels include direct sales, distributors, online retailers, and others. Direct sales dominate in large-scale offshore operations where bulk supply and technical support are essential. Distributors play a key role in serving smaller operators and remote installations. Online retail is emerging as a convenient channel for procuring specialized lubricants, particularly in maintenance and aftermarket needs. It is encouraging suppliers to enhance digital platforms. Diverse channels ensure accessibility across varied offshore sectors.

- For instance, FUCHS Lubricants offers a specialized range of offshore lubricants and bespoke support packages primarily through direct sales, ensuring availability of OEM-approved products and tailored technical assistance for large-scale offshore oil and gas operations.

By Application

Key applications include engine oil, hydraulic oil, gear oil, grease, and others. Engine oils hold a significant share, ensuring reliable performance of marine engines under heavy loads. Hydraulic oils are critical for subsea and deck equipment operations, while gear oils serve high-load transmission systems in rigs and turbines. Greases provide essential protection for bearings and exposed components. It supports operational efficiency across offshore drilling, production, and renewable energy installations, driving steady demand across all lubricant categories.

Segments:

Based on Product Type:

- Mineral Oil-based Lubricants

- Synthetic Lubricants

- Bio-based Lubricants

Based on Distribution Channel:

- Direct Sales

- Distributors

- Online Retailers

- Others

Based on Application:

- Engine Oil

- Hydraulic Oil

- Gear Oil

- Grease

- Others

Based on End-Use:

- Offshore Rigs

- FPSOs (Floating, Production, Storage & Offloading Vessels)

- OSVs (Offshore Support Vessels)

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America holds 28% share of the offshore lubricants market, driven by extensive offshore oil and gas activities in the Gulf of Mexico and growing offshore wind projects along the U.S. East Coast. The region benefits from advanced marine engineering capabilities and strong regulatory frameworks supporting equipment efficiency and environmental compliance. It has high adoption of synthetic and Environmentally Acceptable Lubricants (EALs) due to strict environmental standards. Investments in deepwater drilling technologies sustain product demand. The U.S. remains the largest market, supported by energy security initiatives and modernization of offshore assets.

Europe

Europe accounts for 26% share of the offshore lubricants market, supported by well-established offshore wind infrastructure in the North Sea and active oil production in the North Atlantic. The region leads in environmental compliance, driving significant adoption of bio-based and low-toxicity lubricants. It benefits from large-scale maintenance activities and service contracts for offshore energy assets. Demand is reinforced by technological partnerships between lubricant manufacturers and equipment OEMs. The United Kingdom, Norway, and Germany are key markets, with strong focus on sustainable energy expansion.

Asia-Pacific

Asia-Pacific captures 32% share of the offshore lubricants market, fueled by offshore oil and gas exploration in China, Malaysia, and India, alongside rapid growth in offshore wind capacity. The region’s large coastline and expanding renewable energy investments boost long-term consumption. It experiences rising demand for high-performance synthetic lubricants to operate in tropical and typhoon-prone waters. Government-led initiatives for energy diversification strengthen offshore energy development. Local production capabilities are expanding to meet increasing operational requirements.

Latin America

Latin America represents 8% share of the offshore lubricants market, driven primarily by Brazil’s deepwater and pre-salt oil projects. The region benefits from increasing exploration investments in Argentina and Mexico. It requires durable lubricants to withstand high-pressure, high-temperature conditions in deepwater basins. National oil companies are modernizing offshore fleets, creating demand for advanced formulations. It also sees gradual adoption of environmentally acceptable lubricants to meet global shipping and offshore standards.

Middle East & Africa

The Middle East & Africa holds 6% share of the offshore lubricants market, supported by offshore oil and gas projects in the Persian Gulf and West Africa. The region’s demand is concentrated in high-capacity rigs and production vessels. It relies on premium lubricants to ensure operational reliability under extreme temperatures and corrosive seawater conditions. Offshore expansion in Angola, Nigeria, and the UAE sustains market growth. It is also adopting more synthetic products for extended operational life cycles.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Quaker Chemical Corporation

- MOL Group

- Castrol

- Eni

- Shell

- TotalEnergies

- Chevron

- Idemitsu Kosan

- Repsol

- BP p.l.c.

- Lubrizol

- Exxon Mobil Corporation

- Fuchs Petrolub

Competitive Analysis

The offshore lubricants market is competitive, with major players such as Shell, Exxon Mobil Corporation, Chevron, BP p.l.c., and TotalEnergies leveraging global supply networks and technical expertise to secure strong market positions. It also includes Eni, Repsol, MOL Group, and Idemitsu Kosan, which focus on delivering specialized marine lubricant solutions for offshore oil, gas, and renewable energy operations. Castrol, Fuchs Petrolub, Quaker Chemical Corporation, and Lubrizol emphasize innovation through R&D, developing synthetic and bio-based lubricants with enhanced corrosion resistance, thermal stability, and longer service life to meet extreme marine conditions. Companies are aligning with environmental regulations by expanding their portfolios of Environmentally Acceptable Lubricants (EALs) and forming partnerships with equipment OEMs to ensure compatibility and performance. Growing adoption of condition monitoring and predictive maintenance tools supports operational efficiency and strengthens customer loyalty. Competitive strategies focus on sustainability, technology integration, and tailored solutions, enabling market leaders and emerging players to maintain relevance in a sector shaped by regulatory, operational, and performance demands.

Recent Developments

- In May 2025, Lubrication Engineers, Inc. completed the acquisition of RSC Bio Solutions, securing biodegradable, high-performance marine and industrial lubricants, including FUTERRA® and EnviroLogic® brands, to expand its sustainable product range.

- In July 2025, Shell completed the full acquisition of Raj Petro Specialities, a Mumbai-based lubricant manufacturer, aiming to strengthen its lubricant portfolio and expand its customer base in India through Raj Petro’s manufacturing capabilities and diverse product range.

- In May 2024, Gulf Marine Services (GMS) expanded its Singapore-based fleet with the addition of two marine barges and a supply vessel to meet rising regional demand for marine support services, marking the first stage of a broader global expansion.

- In June 2023, ExxonMobil launched a new range of advanced offshore lubricants engineered to improve fuel efficiency and reduce environmental impact for offshore operations, with a focus on markets in the North Sea and Gulf of Mexico.

- In January 2024, Shell U.K. Limited acquired MIDEL and MIVOLT, enhancing its global lubricants portfolio with specialized transformer oils to serve customers in power distribution, offshore wind parks, utility companies, and traction power systems.

Market Concentration & Characteristics

The offshore lubricants market is moderately concentrated, with a mix of multinational corporations and regional suppliers competing on product performance, environmental compliance, and service quality. It is dominated by established players such as Shell, Exxon Mobil Corporation, Chevron, BP p.l.c., and TotalEnergies, which benefit from integrated operations, global distribution networks, and strong brand recognition. Mid-tier companies like Eni, Repsol, MOL Group, and Idemitsu Kosan focus on niche marine and offshore applications, while specialty lubricant producers such as Castrol, Fuchs Petrolub, Quaker Chemical Corporation, and Lubrizol emphasize innovation in synthetic and bio-based formulations. The market is characterized by high entry barriers due to technical requirements, certification standards, and capital-intensive R&D. Demand is shaped by offshore oil and gas activity, renewable energy expansion, and environmental regulations, leading suppliers to invest in tailored solutions that ensure operational reliability, extended equipment life, and compliance in extreme marine environments.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Distribution Channel, Application, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will grow with continued expansion of offshore oil and gas exploration in deepwater and ultra-deepwater regions.

- Adoption of synthetic and bio-based lubricants will increase to meet performance and environmental requirements.

- Offshore wind energy growth will drive the need for specialized turbine lubricants in harsh marine conditions.

- Investments in R&D will focus on developing formulations with superior corrosion resistance and extended service life.

- Condition monitoring technologies will be integrated to optimize lubricant usage and reduce maintenance costs.

- Environmentally Acceptable Lubricants (EALs) will gain wider adoption under stricter regulatory frameworks.

- Regional manufacturing capabilities will expand to ensure faster supply to offshore installations.

- Strategic partnerships between lubricant manufacturers and equipment OEMs will strengthen product compatibility.

- Supply chain resilience will improve through advanced logistics and storage solutions for remote offshore sites.

- Digital platforms will support direct sales and technical support for offshore operators.