Market overview

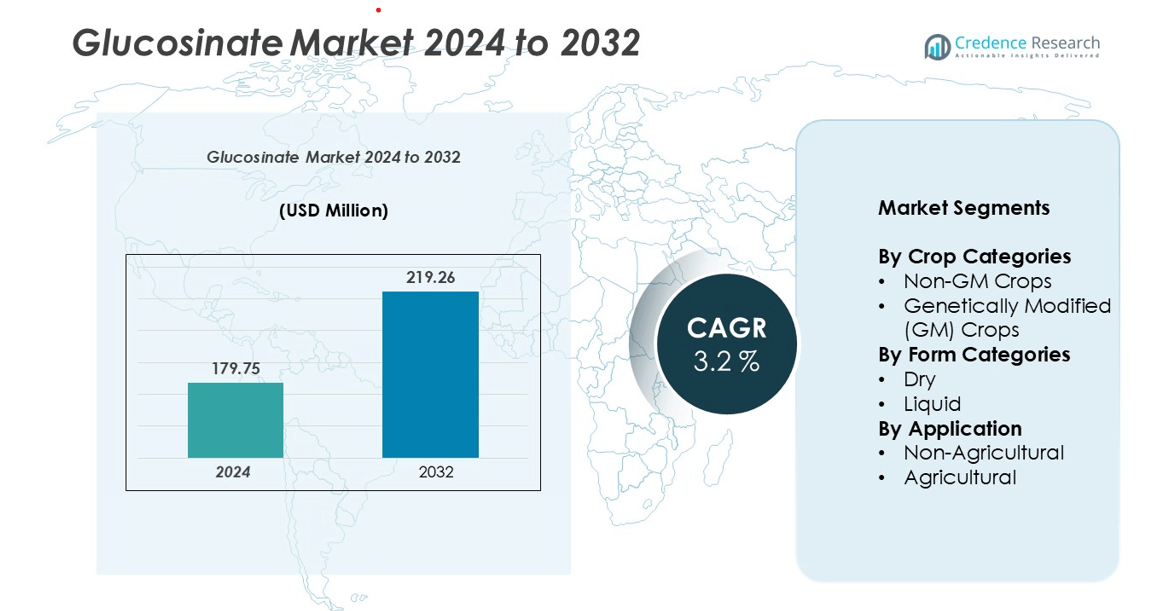

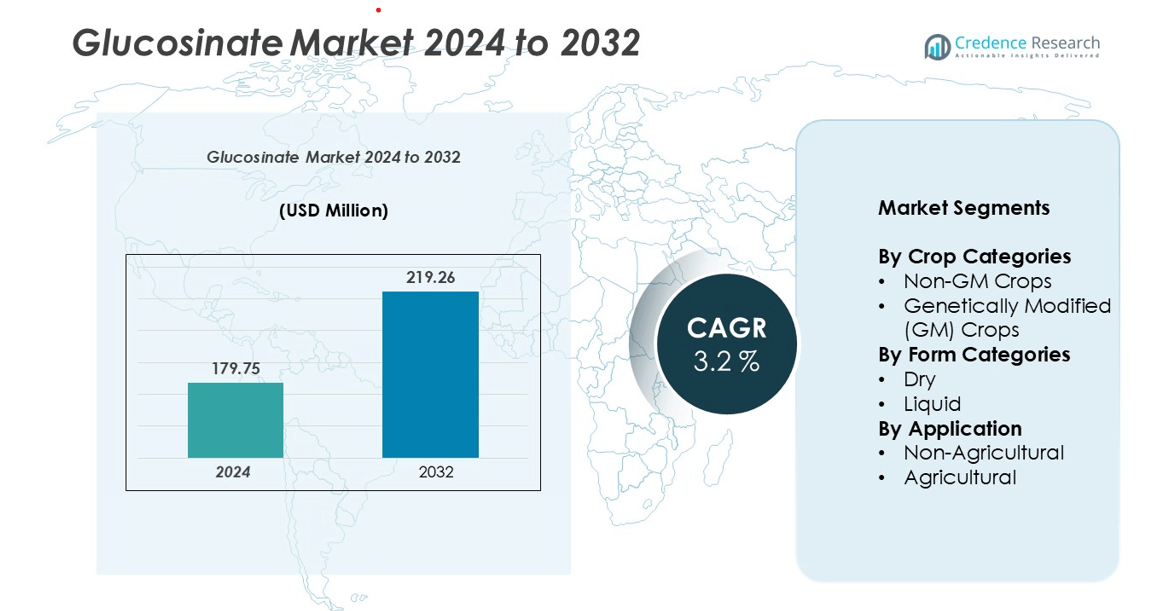

Glufosinate market size was valued at USD 179.75 million in 2024 and is anticipated to reach USD 219.26 million by 2032, at a CAGR of 3.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Glufosinate Market Size 2024 |

USD 179.75 million |

| Glufosinate Market, CAGR |

3.2% |

| Glufosinate Market Size 2032 |

USD 219.26 million |

The Glufosinate market is led by prominent companies such as BASF SE, Bayer AG, Syngenta, Dow AgroSciences, Aventis, Certis, Fargro, Hoechst, Lier Chemical, and Jiangsu Huangma. These players dominate through strong R&D investments, innovative formulations, and robust distribution networks, enabling them to address both large-scale and niche agricultural requirements. North America emerges as the leading region, accounting for approximately 35% of the global market share, driven by high adoption of non-GM crops and advanced farming practices. Europe follows with around 28%, supported by stringent regulatory compliance and sustainable agriculture initiatives. Asia-Pacific holds close to 22%, benefiting from rising food demand, expanding commercial farming, and increasing mechanization. The combined influence of these key players across strategic regions ensures sustained market growth and reinforces their competitive positioning globally.

Market Insights

- The Glufosinate market was valued at USD 179.75 million in 2024 and is projected to reach USD 219.26 million by 2032, growing at a CAGR of 3.2%.

- Market growth is driven by rising adoption of non-GM crops, demand for sustainable agriculture, and increasing use of Glufosinate-based herbicides for cereals, vegetables, and oilseeds.

- Key trends include the integration of Glufosinate into eco-friendly and organic farming solutions, precision agriculture adoption, and innovation in dry and liquid formulations for improved efficacy.

- The competitive landscape is dominated by companies such as BASF SE, Bayer AG, Syngenta, Dow AgroSciences, Aventis, and Certis, which leverage R&D, strategic partnerships, and distribution networks to maintain market share. Smaller regional players contribute through niche offerings and competitive pricing.

- Regionally, North America leads with a 35% share, Europe holds 28%, Asia-Pacific 22%, Latin America 9%, and MEA 6%, while Non-GM crops and dry formulations are the dominant sub-segments globally.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Crop Categories:

The Glufosinate market is segmented into Non-GM Crops and Genetically Modified (GM) Crops, with Non-GM Crops dominating the segment, capturing a significant market share of approximately 62%. This dominance is driven by increasing consumer preference for organic and non-GMO products, stricter regulatory standards on genetically modified crops, and growing awareness of sustainable farming practices. Manufacturers are leveraging Glufosinate-based solutions to enhance crop protection in conventional farming, particularly for cereals, vegetables, and oilseeds, which further fuels adoption in non-GM crop cultivation.

- For instance, BASF’s Liberty® ULTRA herbicide, a glufosinate-based solution, has demonstrated superior efficacy in weed control.

ByForm Categories:

The market is categorized into Dry and Liquid forms, with Dry formulations holding the leading market share of around 57%. Dry Glufosinate products are favored due to their longer shelf life, ease of storage and transportation, and precise dosage application. The increasing mechanization of agriculture and demand for ready-to-use granular products in large-scale farming operations are key growth drivers. Additionally, dry forms provide consistent efficacy in various soil and climatic conditions, making them a preferred choice among manufacturers and farmers seeking reliable and cost-effective crop protection solutions.

- For instance, BASF’s Liberty® ULTRA herbicide, a liquid formulation powered by Glu-L™ technology, has been shown in BASF lab and growth chamber studies to drive nearly three times more herbicide into pigweed compared to generic glufosinate products.

By Application:

Glufosinate is applied in Agricultural and Non-Agricultural sectors, with Agricultural applications dominating the market with a share of approximately 70%. The growth is primarily driven by the rising need for efficient herbicides, weed management solutions, and crop protection products to enhance yield and quality. Agricultural adoption is further supported by government initiatives promoting sustainable and eco-friendly farming practices. In contrast, non-agricultural applications, including industrial and landscaping uses, are growing steadily but contribute a smaller share, reflecting the stronger reliance on Glufosinate in commercial farming operations.

Key Growth Drivers

Rising Demand for Sustainable Agriculture

The growing global emphasis on sustainable and eco-friendly farming practices is a major driver for the Glufosinate market. Farmers and agribusinesses are increasingly adopting Glufosinate-based herbicides and crop protection products to reduce chemical residues while maintaining high yields. Regulatory frameworks favoring reduced synthetic pesticide use and incentives for organic farming further stimulate adoption. For instance, Glufosinate solutions provide targeted weed control with minimal environmental impact, enhancing soil health and crop quality. The rising focus on precision agriculture and integrated pest management also encourages the use of safe, biodegradable compounds like Glufosinate, strengthening its market penetration across cereal, vegetable, and oilseed crops.

- For instance, BASF’s Liberty® ULTRA herbicide, powered by Glu-L™ Technology, has demonstrated up to 20% superior weed control and won nine out of ten head-to-head comparisons against generic glufosinate products in BASF research trials conducted nationwide in 2022-2023.

Expansion in Non-GM Crop Cultivation

Non-GM crop cultivation is experiencing steady growth due to rising consumer preference for organic and non-GMO foods. Glufosinate products are widely applied in these crops for effective weed management and yield enhancement. Their compatibility with non-GM crops positions them as a preferred choice among farmers aiming to meet global food safety standards. Additionally, stringent regulations on genetically modified crops in several regions encourage farmers to invest in conventional and sustainable alternatives. This shift directly contributes to the increasing demand for Glufosinate formulations, particularly in regions like Europe and North America, where non-GM adoption is prioritized, driving consistent market growth.

- For instance, BASF announced a long-term partnership with Seedworks Philippines to bring its non-genetically modified (non-GM) Provisia herbicide-tolerant rice trait into the country’s hybrid rice market. This initiative is part of a broader network involving ten seed partnerships across five Asian countries—India, Malaysia, Thailand, the Philippines, and China—to introduce the Clearfield and Provisia herbicide-tolerant traits for rice. The aim of this initiative is to address herbicide resistance and labor costs.

Technological Advancements in Formulations

Innovation in Glufosinate formulations, such as dry granules and liquid concentrates, has significantly boosted market adoption. Advanced delivery systems enhance efficacy, ease of application, and shelf life, making Glufosinate products more attractive to large-scale and precision farming operations. These technological improvements allow for better solubility, reduced dosage requirements, and minimized crop damage, increasing efficiency and cost-effectiveness. Manufacturers continue to invest in R&D to optimize formulations for diverse soil types and climatic conditions. Such innovations not only strengthen market competitiveness but also expand the application scope, supporting higher adoption across agricultural sectors globally.

Key Trends & Opportunities

Integration into Organic and Eco-Friendly Products

A significant trend is the incorporation of Glufosinate into organic and environmentally friendly farming solutions. Producers are formulating products that align with sustainable agriculture and clean-label requirements, catering to a growing base of eco-conscious consumers. This trend is further fueled by global initiatives promoting reduced chemical input in crop production. Glufosinate’s biodegradable nature and efficacy in weed control provide a compelling opportunity for manufacturers to develop eco-certified crop protection solutions. The increasing preference for non-toxic, residue-free agricultural products presents a strategic avenue for market expansion, particularly in North America and Europe, where sustainability is a critical purchasing criterion.

- For instance, BASF’s Provisia® Rice System, introduced in the Philippines through a partnership with Seedworks Philippines, enables rice acres lost to weedy rice to return to production at least two years sooner than traditional management practices.

Growing Adoption of Precision Agriculture

Precision agriculture offers significant opportunities for Glufosinate market growth. With the integration of GPS-based systems, drones, and automated spraying equipment, farmers can apply herbicides more accurately, improving efficiency and reducing wastage. Glufosinate products are particularly suitable for precision applications due to their targeted action and flexibility in formulation. The trend toward data-driven farming practices enhances product utilization and effectiveness while supporting environmental sustainability. Companies investing in precision-compatible Glufosinate solutions can leverage this opportunity to strengthen market share and foster long-term partnerships with technologically advanced farming operations globally.

- For instance, Bayer’s Liberty® 280 SL herbicide, containing glufosinate-ammonium as the active ingredient, is applied foliarly to emerged weeds, with optimal performance achieved on small weeds using 15-20 gallons per acre (GPA) of water.

Increasing Awareness of Health and Food Safety

Rising consumer awareness about food safety and chemical residues is influencing market trends. Glufosinate’s selective herbicidal properties and minimal residual impact make it a favorable alternative to conventional chemical herbicides. This creates opportunities for product positioning in health-conscious markets, particularly for fruits, vegetables, and cereal crops. Educational initiatives by agritech companies highlighting the benefits of safer herbicide options further promote adoption. As global demand for safe, high-quality produce rises, Glufosinate’s role as a sustainable crop protection solution continues to expand, offering substantial growth potential in both developed and emerging markets.

Key Challenges

Regulatory Constraints and Compliance

The Glufosinate market faces challenges due to strict regulatory frameworks governing herbicides and crop protection chemicals. Approvals, registration, and compliance with environmental and safety standards can delay product launches and increase operational costs. Variations in regulations across regions complicate global marketing strategies, requiring localized testing and documentation. Manufacturers must navigate these regulatory hurdles while ensuring product efficacy and safety, which may slow market expansion. Ongoing policy updates and stricter residue limits further challenge producers, necessitating continual investment in compliance, testing, and innovation to meet regulatory requirements and maintain market credibility.

Intense Competition and Pricing Pressure

The Glufosinate market is highly competitive, with numerous established chemical companies and emerging regional players. Price sensitivity among farmers and distributors exerts downward pressure on margins, making differentiation and brand loyalty crucial. Manufacturers must balance product quality, technological innovation, and cost-effectiveness to remain competitive. Additionally, alternatives such as glyphosate-based herbicides and integrated pest management solutions pose competition, potentially limiting Glufosinate adoption in certain regions. Sustaining profitability while investing in R&D and marketing requires strategic planning, highlighting the challenge of maintaining market share amid intense competition and fluctuating agricultural input costs.

Regional Analysis

North America:

North America dominates the Glufosinate market, accounting for approximately 35% of the global share. The region’s growth is driven by high adoption of non-GM crops, advanced agricultural technologies, and stringent regulations promoting sustainable farming practices. Farmers increasingly use Glufosinate-based herbicides to enhance crop yields while meeting strict residue limits and environmental standards. Strong government support for precision agriculture and organic farming, along with growing awareness of food safety, further accelerates adoption. Major markets include the U.S. and Canada, where large-scale cereal, vegetable, and oilseed cultivation ensures consistent demand for effective and eco-friendly crop protection solutions.

Europe:

Europe holds around 28% of the global Glufosinate market, with growth fueled by strict regulatory compliance for chemical herbicides and increasing demand for sustainable agricultural practices. Countries like Germany, France, and the U.K. lead in non-GM crop cultivation, creating a favorable environment for Glufosinate-based products. The market benefits from initiatives promoting organic farming, environmental safety, and integrated pest management. High consumer awareness regarding food safety and residue-free produce drives adoption. Additionally, innovation in dry and liquid formulations that comply with EU agricultural standards further strengthens market penetration, positioning Europe as a key region for Glufosinate growth.

Asia-Pacific:

The Asia-Pacific region accounts for approximately 22% of the global Glufosinate market, driven by rising population, increasing food demand, and the expansion of commercial farming. Countries such as China, India, and Japan are rapidly adopting Glufosinate products to enhance crop protection and productivity in cereals, fruits, and vegetables. Growing awareness of sustainable practices and government incentives for eco-friendly farming bolster adoption. The region also benefits from emerging manufacturing capabilities and R&D investments in formulation technologies. Expanding non-GM cultivation and increased mechanization create significant opportunities for market growth, making Asia-Pacific a strategic focus for Glufosinate manufacturers.

Latin America:

Latin America contributes around 9% to the global Glufosinate market, with Brazil and Argentina being the major consumers due to extensive agricultural activity. The region’s growth is driven by high demand for non-GM crops, increasing investment in modern farming techniques, and initiatives to improve crop yields sustainably. Glufosinate herbicides are widely used in soybean, maize, and wheat cultivation to ensure efficient weed control and enhance productivity. While regulatory frameworks are evolving, increasing adoption of precision agriculture and eco-friendly farming practices presents growth potential. Market expansion is also supported by rising awareness of food quality and safety standards among both producers and consumers.

Middle East & Africa (MEA):

The MEA region holds approximately 6% of the global Glufosinate market. Growth is fueled by expanding commercial agriculture in countries like South Africa, Egypt, and Saudi Arabia, coupled with rising awareness of sustainable farming practices. Adoption is primarily driven by the need for effective weed control in cereals, fruits, and vegetables under arid and semi-arid conditions. Market growth faces challenges from limited infrastructure and regulatory inconsistencies, but opportunities exist through increasing government support, agricultural mechanization, and partnerships with global manufacturers. Glufosinate’s efficacy and eco-friendly profile make it a preferred choice for farmers seeking higher yields with minimal environmental impact.

Market Segmentations:

By Crop Categories

- Non-GM Crops

- Genetically Modified (GM) Crops

By Form Categories

By Application

- Non-Agricultural

- Agricultural

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Glufosinate market is highly competitive, characterized by the presence of leading global agrochemical companies alongside emerging regional players. Key participants, including BASF SE, Bayer AG, Syngenta, Dow AgroSciences, and Aventis, dominate through strong R&D capabilities, innovative product portfolios, and extensive distribution networks. Companies focus on developing advanced dry and liquid formulations, improving efficacy, and ensuring compliance with stringent regulatory standards. Strategic initiatives such as mergers, acquisitions, and partnerships strengthen market presence and expand regional reach. For instance, collaboration with local distributors enables rapid market penetration in Asia-Pacific and Latin America. Additionally, smaller players like Certis, Fargro, Jiangsu Huangma, and Lier Chemical differentiate through niche solutions and competitive pricing. The competitive dynamics are further shaped by rising demand for eco-friendly and non-GM compatible products, encouraging continuous innovation and technological advancements to maintain market share and meet evolving farmer requirements.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- BASF SE

- Bayer AG

- Certis

- Dow AgroSciences

- Fargro

- Hoechst

- Jiangsu Huangma

- Lier Chemical

- Syngenta

- Aventis

Recent Developments

- In July 2024, BASF plans to halt the production of the active ingredient glufosinate-ammonium (GA) at the Knapsack and Frankfurt sites in Germany by the end of 2024 citing economic reasons.

- In January 2024, The U.S. EPA has approved label expansions for glufosinate-ammonium, allowing effective weed control for specialty crops such as avocados, figs, melons, hops, squashes, tomatoes, tropical fruits, and grasses grown for seed in the Pacific Northwest.

Report Coverage

The research report offers an in-depth analysis based on Crop Categories, Form Categories, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for Glufosinate is expected to rise with the growing focus on sustainable and eco-friendly agriculture.

- Non-GM crop cultivation will continue to drive market growth globally.

- Innovations in dry and liquid formulations will improve application efficiency and adoption.

- Precision agriculture technologies will enhance targeted Glufosinate use and reduce wastage.

- Expansion in emerging regions, particularly Asia-Pacific and Latin America, will provide new growth opportunities.

- Increasing regulatory support for low-residue and biodegradable herbicides will favor Glufosinate adoption.

- Rising awareness of food safety and residue-free produce will encourage use in fruits, vegetables, and cereals.

- Strategic partnerships and collaborations among key players will strengthen market reach and distribution.

- Research and development in eco-compatible solutions will drive product differentiation and competitiveness.

- Integration into organic and sustainable farming practices will boost long-term demand.