Market overview

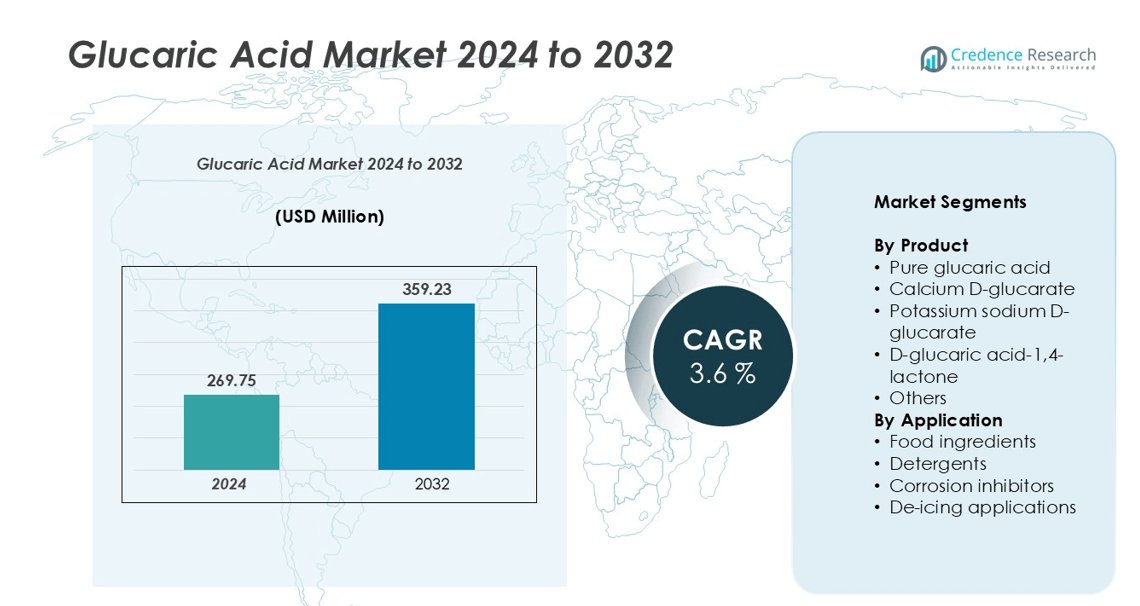

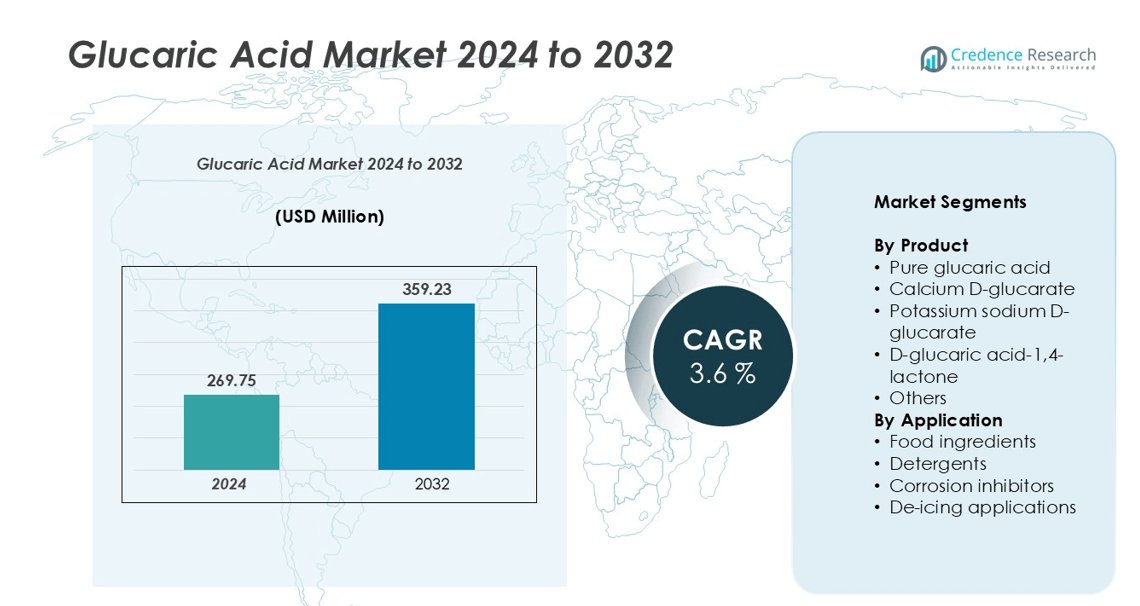

The glucaric acid market size was valued at USD 269.75 million in 2024 and is anticipated to reach USD 359.23 million by 2032, at a CAGR of 3.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Glucaric Acid Market Size 2024 |

USD 269.75 million |

| Glucaric Acid Market, CAGR |

3.6% |

| Glucaric Acid Market Size 2032 |

USD 359.23 million |

The glucaric acid market is dominated by key players such as Merck Millipore, Evonik, Jungbunzlauer, Toronto Research Chemicals, Fuso Chemical Co., Ltd., R-Biopharm Ag, TCI Chemicals, PMP Fermentation Products, Inc., Alfa Chemistry, and Prathista. These companies leverage product innovation, high-purity derivatives, and strategic partnerships to maintain competitive advantage. North America leads the global market with a 35% share, driven by high adoption in functional foods, dietary supplements, and eco-friendly industrial applications. Europe follows with a 30% share, supported by stringent environmental regulations and growing consumer awareness of sustainable products. Asia-Pacific, with a 20% share, is expanding rapidly due to increasing industrialization and rising demand for bio-based additives. Together, these regions form the core markets, while emerging regions such as Latin America and MEA present growth opportunities.

Market Insights

- The global glucaric acid market was valued at USD 269.75 million in 2024 and is projected to reach USD 359.23 million by 2032, growing at a CAGR of 3.6%.

- Market growth is driven by rising demand for functional foods, dietary supplements, and eco-friendly industrial applications, supported by increasing consumer awareness of health and sustainability.

- Key trends include adoption of bio-based and biodegradable chemicals, integration into hybrid industrial solutions, and technological advancements in fermentation and synthesis processes that enhance purity and reduce costs.

- The competitive landscape features major players such as Merck Millipore, Evonik, Jungbunzlauer, and Toronto Research Chemicals, focusing on product innovation, strategic partnerships, and expansion into emerging markets to strengthen market position.

- North America holds 35% market share, Europe 30%, Asia-Pacific 20%, Latin America 8%, and MEA 7%, with calcium D-glucarate leading the product segment and food ingredients dominating applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

The glucaric acid market is segmented into pure glucaric acid, calcium D-glucarate, potassium sodium D-glucarate, D-glucaric acid-1,4-lactone, and others. Among these, calcium D-glucarate dominates the segment, capturing the largest market share due to its extensive use in dietary supplements and functional foods. Its popularity is driven by increasing consumer awareness of health benefits, including detoxification and liver support. The growing trend toward natural and bio-based products further fuels demand, while ongoing research and product innovations continue to expand its applications across pharmaceutical and nutraceutical industries.

- For instance, Kalion Inc. and its glucaric acid production capacity would say that the company has completed large-scale fermentation runs, but no specific production tonnages like 75,000 or 12,000 metric tons per year are publicly confirmed.

By Application

In terms of application, the market is categorized into food ingredients, detergents, corrosion inhibitors, and de-icing applications. The food ingredients sub-segment holds the dominant share, propelled by rising incorporation of glucaric acid in functional foods, beverages, and dietary supplements. Demand is fueled by consumer preference for natural additives that support health and wellness. Additionally, regulatory approvals for food-grade glucaric acid and increasing health-consciousness in emerging markets continue to drive growth, making food ingredients the primary contributor to overall market expansion.

- For instance, Kalion, Inc., a U.S.-based industrial biotech company, completed its first full-scale production of glucaric acid in collaboration with Evonik in Europe. The production was described as a “custom manufacturing” campaign.

Key Growth Drivers

Rising Demand for Functional Foods and Dietary Supplements

The increasing consumer focus on health and wellness is a major driver for the glucaric acid market. Glucaric acid and its derivatives, such as calcium D-glucarate, are widely used in functional foods and dietary supplements for liver support and detoxification. Growing awareness about natural bioactive compounds and preventive healthcare has pushed manufacturers to incorporate glucaric acid in beverages, snacks, and nutraceutical formulations. Additionally, the shift from synthetic additives to bio-based ingredients reinforces its adoption. Companies are investing in research and development to create innovative formulations that meet consumer demand, further propelling market growth across developed and emerging regions.

- For instance, Kalion Inc. achieved a significant milestone by producing several tons of high-purity glucaric acid through its first full-scale fermentation process, conducted in collaboration with Evonik Industries.

Expansion of Eco-Friendly Industrial Applications

Glucaric acid’s biodegradable and non-toxic properties make it a preferred choice in detergents, corrosion inhibitors, and de-icing solutions. Industrial sectors are increasingly replacing conventional chemicals with sustainable alternatives to meet regulatory standards and reduce environmental impact. Its effectiveness as a chelating and corrosion-inhibiting agent attracts industries seeking performance without ecological compromise. Rising adoption in industrial cleaning and surface treatment applications, coupled with growing government incentives for eco-friendly products, strengthens market growth prospects. Manufacturers are also focusing on scaling up production to meet the growing industrial demand efficiently.

- For instance, Kalion Inc.’s high-purity glucaric acid has been utilized in applications such as improving the quality of recycled cotton, replacing phosphate corrosion inhibitors, and enhancing pharmaceutical excipients.

Government Support and Regulatory Approvals for Bio-Based Products

Government initiatives promoting bio-based and environmentally safe chemicals have significantly contributed to glucaric acid market expansion. Regulatory approvals for its use in food, supplements, and industrial applications enhance market confidence and encourage adoption. Policies incentivizing sustainable manufacturing processes, along with funding for research in bio-based acids, further drive development. This favorable regulatory environment reduces barriers to entry and accelerates commercialization across regions. As consumers increasingly prefer certified natural ingredients, regulatory backing ensures wider market penetration and encourages investments in production and application innovations.

Key Trends & Opportunities

Integration in Hybrid Industrial Solutions

A notable trend in the glucaric acid market is its integration into hybrid solutions, such as combining with other bio-based acids in detergents or corrosion inhibitors to improve performance and sustainability. This approach enhances product efficiency while addressing environmental regulations. Companies are exploring novel formulations that deliver multifunctional benefits, providing an opportunity for differentiation. The convergence of industrial performance with eco-friendly characteristics presents a lucrative avenue for manufacturers to capture niche segments and expand globally, particularly in regions with stringent environmental standards.

- For instance, Kalion Inc. has developed a high-purity glucaric acid product, KSPG40, which functions as an effective corrosion inhibitor for water treatment, and the company also markets a high-purity calcium glucarate for the pharmaceutical industry.

Rising Consumer Awareness and Health-Conscious Lifestyles

Growing awareness about natural health supplements and preventive care is creating significant opportunities for glucaric acid adoption in functional foods and nutraceuticals. Consumers increasingly seek bio-based compounds with scientifically proven health benefits, which drives product innovation and market expansion. This trend encourages manufacturers to develop fortified beverages, snacks, and dietary supplements featuring glucaric acid, targeting both aging populations and health-conscious younger demographics. The increasing media focus on detoxification, liver health, and wellness further strengthens market prospects.

- For instance, Kalion, Inc. collaborated with researchers at the Massachusetts Institute of Technology (MIT) to develop a microbial fermentation process for glucaric acid. In November 2021, the company announced its first full-scale production run, conducted with Evonik, which successfully yielded multi-ton volumes of high-purity glucaric acid.

Technological Advancements in Production

Advances in fermentation and chemical synthesis techniques are creating opportunities to produce glucaric acid more efficiently and cost-effectively. Process optimization reduces production costs while maintaining product purity, enabling manufacturers to scale operations and cater to both industrial and food-grade applications. Continuous improvements in production technology also open avenues for creating high-purity derivatives like calcium D-glucarate, enhancing market penetration. Companies investing in R&D to optimize yields and reduce environmental impact are well-positioned to capitalize on emerging market opportunities.

Key Challenges

High Production Costs

Despite growing demand, the production of glucaric acid remains relatively expensive due to the complexity of fermentation processes and chemical conversions. High raw material costs and energy-intensive manufacturing contribute to elevated product prices, limiting adoption in cost-sensitive regions. Smaller manufacturers may face difficulties in achieving economies of scale, while price-sensitive end-users may prefer cheaper synthetic alternatives. Addressing production efficiency and scaling up cost-effective technologies is critical for sustaining growth and maintaining competitive positioning in the global market.

Limited Awareness in Emerging Markets

While glucaric acid is gaining traction in developed regions, its adoption in emerging markets is restrained by limited awareness of its benefits and applications. Consumers and industries may lack knowledge regarding its health advantages or eco-friendly properties, restricting market penetration. Additionally, regulatory frameworks in some regions may be less supportive, further slowing adoption. Market players must invest in educational campaigns, collaborations with distributors, and targeted marketing strategies to overcome awareness barriers and unlock growth potential in these underdeveloped regions.

Regional Analysis

North America

North America holds a significant share of the glucaric acid market, accounting for approximately 35% of global demand. The region benefits from high adoption in functional foods, dietary supplements, and eco-friendly industrial applications. Rising consumer health awareness, coupled with stringent environmental regulations, drives demand for bio-based and sustainable chemicals. The United States dominates regional consumption, supported by strong research and development infrastructure and regulatory approvals for food-grade glucaric acid. Market growth is further fueled by collaborations between manufacturers and nutraceutical companies to develop innovative products that align with health and sustainability trends.

Europe

Europe commands around 30% of the global glucaric acid market, driven by regulatory support for bio-based products and growing consumer focus on health and sustainability. Germany, France, and the UK are key markets, benefiting from high adoption in functional foods, detergents, and industrial applications. Strict environmental norms encourage the replacement of synthetic chemicals with biodegradable alternatives, supporting industrial demand. Additionally, the expanding nutraceutical sector and increasing awareness of liver health and detoxification products boost adoption. Continuous innovation and product diversification by European manufacturers help maintain market dominance and drive steady growth in the region.

Asia-Pacific

The Asia-Pacific region accounts for roughly 20% of the global glucaric acid market, with demand primarily fueled by emerging economies such as China, India, and Japan. Rapid industrialization and growing awareness of natural additives in food and nutraceuticals are key drivers. The expanding detergent and corrosion inhibitor industries, alongside increasing investment in eco-friendly chemicals, provide additional growth opportunities. Rising disposable incomes and health-conscious lifestyles support consumption of glucaric acid-based dietary supplements. Market players are focusing on local manufacturing and partnerships to improve availability and reduce costs, positioning the region as a promising growth market.

Latin America

Latin America represents approximately 8% of the global glucaric acid market. The market growth is supported by increasing adoption in food ingredients, industrial applications, and eco-friendly chemicals, particularly in Brazil and Mexico. Rising awareness of health supplements and functional foods among urban populations drives consumption. Additionally, government initiatives promoting sustainable industrial practices encourage the replacement of conventional chemicals with biodegradable alternatives. Despite slower adoption compared to North America and Europe, ongoing investments in production infrastructure and marketing of glucaric acid derivatives are expected to strengthen regional market presence over the forecast period.

Middle East & Africa (MEA)

The MEA region holds about 7% of the global glucaric acid market, with demand primarily concentrated in industrial applications such as detergents, corrosion inhibitors, and de-icing solutions. Countries like Saudi Arabia, UAE, and South Africa are emerging markets due to growing awareness of sustainable chemicals and environmentally friendly industrial practices. Limited awareness in food and nutraceutical applications restrains market share. However, increasing investments in industrial infrastructure and rising interest in bio-based chemicals present growth potential. Market players are actively targeting MEA with educational initiatives and collaborations to expand adoption of glucaric acid across both industrial and functional applications.

Market Segmentations:

By Product

- Pure glucaric acid

- Calcium D-glucarate

- Potassium sodium D-glucarate

- D-glucaric acid-1,4-lactone

- Others

By Application

- Food ingredients

- Detergents

- Corrosion inhibitors

- De-icing applications

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The glucaric acid market is highly competitive, characterized by the presence of global chemical manufacturers, specialty ingredient producers, and emerging biotech firms. Leading players such as Merck Millipore, Evonik, Jungbunzlauer, and Toronto Research Chemicals dominate through strategic initiatives including product innovation, capacity expansion, and mergers or partnerships. Companies are focusing on developing high-purity derivatives, such as calcium D-glucarate, and expanding applications in functional foods, detergents, and industrial chemicals to strengthen their market positions. Technological advancements in fermentation and bio-based synthesis processes provide a competitive edge by reducing production costs and enhancing sustainability. Regional expansion strategies and collaborations with nutraceutical and industrial companies are also key to capturing emerging markets. The competitive dynamics are further intensified by R&D investments aimed at improving product performance, ensuring regulatory compliance, and meeting growing consumer demand for eco-friendly and health-oriented solutions

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In March 2024, Corbion announced to develop gluconic acid production to assist with the burgeoning appeal in consumers, specifically in food, and beverage industries. This expansion will catalyze the growth of the gluconic acid industry.

- In May 2023, Skinceuticals developed a potent cream called glycolic 10 renew overnight, which improves skin glow by 36% while maintaining tolerability. This will steer interest towards gluconic acid as an alternative ingredient to similar dosage forms

Report Coverage

The research report offers an in-depth analysis based on Product, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for glucaric acid is expected to grow steadily due to rising health-conscious consumer trends.

- Functional foods and dietary supplements will remain the largest application segment driving market growth.

- Industrial adoption in detergents, corrosion inhibitors, and de-icing applications will expand with increasing environmental regulations.

- Technological advancements in bio-based production processes will improve efficiency and product purity.

- Companies will invest in R&D to develop innovative glucaric acid derivatives for diversified applications.

- Emerging markets in Asia-Pacific, Latin America, and MEA are likely to witness significant growth.

- Sustainable and biodegradable properties will strengthen glucaric acid’s adoption in eco-friendly industrial solutions.

- Strategic collaborations and partnerships among key players will enhance global market reach.

- Consumer awareness campaigns will drive higher adoption in nutraceutical and health-focused products.

- Market competition will intensify, encouraging continuous innovation and product differentiation.