Market Overview:

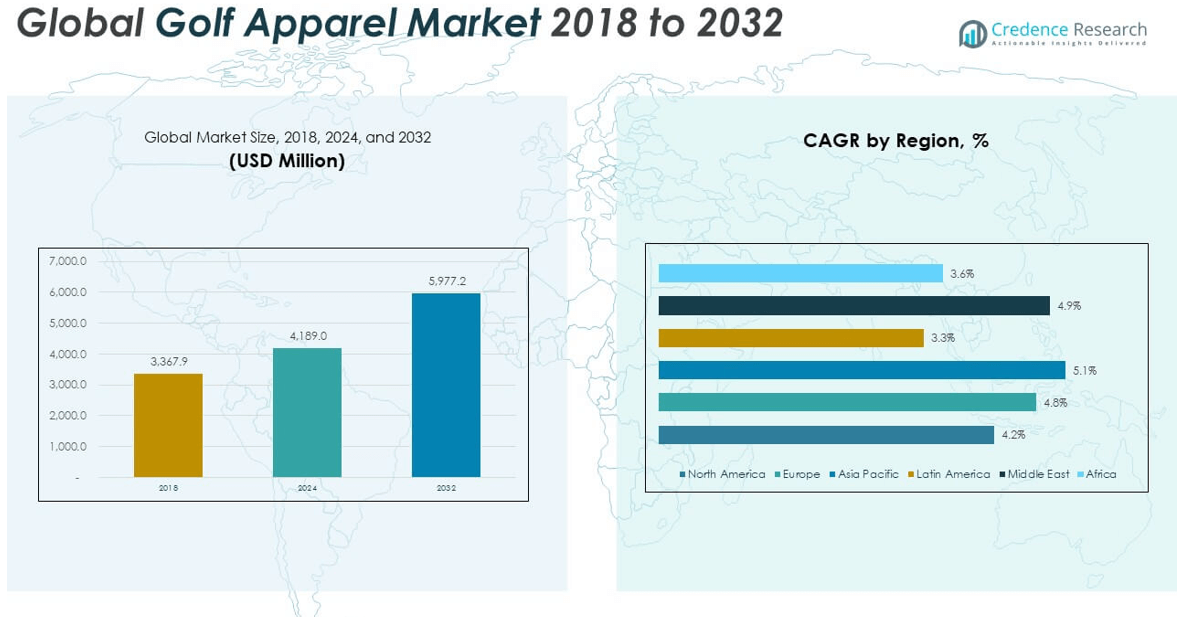

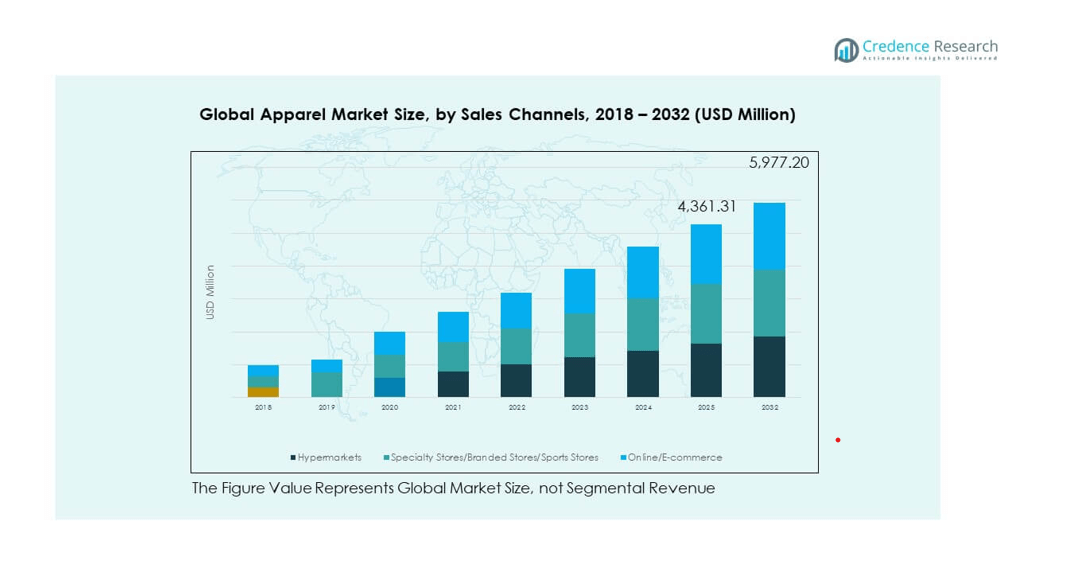

The Golf Apparel Market size was valued at USD 3,367.9 million in 2018 to USD 4,189.0 million in 2024 and is anticipated to reach USD 5,977.2 million by 2032, at a CAGR of 4.61% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Golf Apparel Market Size 2024 |

USD 4,189.0 million |

| Golf Apparel Market, CAGR |

4.61% |

| Golf Apparel Market Size 2032 |

USD 5,977.2 million |

The market growth is driven by rising participation in golf as a leisure and competitive sport, coupled with the increasing popularity of premium and performance-based apparel. Technological advancements in fabrics, such as moisture-wicking, UV protection, and stretch materials, are enhancing comfort and functionality. Additionally, growing influence from sports celebrities, expanding golf tourism, and the shift toward fashionable athletic wear are boosting consumer demand across diverse age groups.

North America leads the market due to its established golf culture, high disposable incomes, and a strong presence of leading brands. Europe follows closely, supported by prestigious tournaments and a growing community of recreational players. Emerging markets in Asia-Pacific, particularly Japan, South Korea, and China, are experiencing rapid adoption due to rising interest in golf and expanding retail infrastructure. The Middle East is also gaining momentum, driven by golf tourism and investments in sports facilities.

Market Insights:

- The Golf Apparel Market was valued at USD 4,189.0 million in 2024 and is projected to reach USD 5,977.2 million by 2032, growing at a CAGR of 4.61%.

- Rising global participation in golf and growth in sports tourism are driving demand for high-quality, performance-oriented apparel.

- Advancements in fabric technology, including moisture-wicking, UV protection, and stretch materials, are enhancing product appeal.

- Seasonal demand fluctuations and dependency on golf course activity remain key restraints in sustaining year-round sales.

- North America benefits from a mature golfing culture and high disposable incomes, while Europe sees strong demand for weather-adapted apparel.

- Asia Pacific leads the market share, driven by increasing golf events, growing middle-class income, and expanding retail infrastructure.

- The Middle East and Latin America show growth potential through luxury tourism and development of golf resorts, creating opportunities for premium apparel sales.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Golf Participation and Influence of Sports Tourism

Growing interest in golf as both a competitive sport and leisure activity is a key force behind market expansion. It benefits from increasing memberships in golf clubs and participation in local and international tournaments. Sports tourism significantly fuels demand, with golf destinations attracting visitors who purchase high-quality apparel. Consumers prioritize clothing that blends style with performance features, enhancing their on-course experience. The market gains momentum from celebrity endorsements and visibility in global sports events. Corporate sponsorships create additional demand for branded attire. Investments in golf course infrastructure also encourage apparel sales. Luxury lifestyle branding further strengthens its appeal among premium buyers. The development of golf academies for amateurs has also expanded the base of potential apparel customers. Social media exposure of golfing events continues to amplify the aspirational value of owning premium golf attire.

Technological Advancements in Performance Fabrics

Innovations in fabric technology are transforming the product landscape. It gains from widespread adoption of moisture-wicking, UV-protective, and temperature-regulating materials. These advancements improve comfort and functionality during play in varied weather conditions. Stretch fabrics enhance mobility, catering to performance-focused consumers. Apparel brands invest heavily in research to integrate new textile engineering techniques. Sustainability trends push manufacturers toward eco-friendly fabrics without compromising performance. High durability and easy maintenance boost consumer satisfaction. Competitive differentiation is increasingly achieved through fabric innovation, driving both loyalty and repeat purchases. Brands also experiment with anti-odor and antimicrobial treatments to further enhance usability. This focus on innovation positions manufacturers to meet evolving consumer expectations with value-driven features.

Premiumization and Lifestyle Integration of Golf Apparel

The blending of sportswear and lifestyle fashion elevates the product category. It appeals to consumers seeking apparel suitable for both the golf course and casual settings. Premium collections featuring exclusive designs and limited editions enhance brand prestige. Consumers show a willingness to invest in higher-priced products that reflect status and style. Global fashion trends influence color palettes, patterns, and fits in golf apparel lines. Collaborations between sportswear brands and fashion designers expand reach. Retailers leverage this integration to capture crossover buyers from other apparel categories. Lifestyle positioning strengthens year-round sales beyond active golfing seasons. Celebrity collaborations also boost desirability among younger buyers. Growing interest in “athleisure” ensures the market remains relevant even outside active play.

- For instance, Adidas has elevated its golf line by merging performance-driven fabrics with fashion-forward silhouettes via collaborations, such as the 2025 partnership with JAY3LLE, which introduced bold designs like pleated skorts and bomber jackets for women.

Sustainability-Driven Product Development

Eco-conscious consumers influence product design and sourcing. It gains from brands incorporating recycled polyester, organic cotton, and biodegradable materials. Sustainable packaging further reinforces eco-friendly positioning. Manufacturing processes adopt water-efficient and low-impact dyeing techniques. Transparency in supply chains builds trust with environmentally aware buyers. Certifications such as Global Organic Textile Standard (GOTS) enhance credibility. Collaborations with sustainability-focused organizations improve brand reputation. This trend aligns with the broader shift toward responsible consumerism in sportswear. Consumer demand for traceable production also drives innovation in material sourcing. Brands prioritizing sustainability often command stronger long-term loyalty from this growing segment.

- For example, Nike introduced Dri-FIT technology in 1991 as part of its FIT performance line, designed to wick sweat away from the skin to the fabric’s surface for faster evaporation and dryness. Many current Nike golf shirts, such as the Dri-FIT Victory Polo, are made from 100% recycled polyester and feature this moisture-management technology for comfort during play.

Market Trends:

Integration of Smart and Sensor-Embedded Golf Apparel

The market witnesses growing adoption of technology-enabled apparel. It includes garments with embedded sensors to monitor swing metrics, posture, and movement patterns. These innovations cater to performance-driven golfers seeking real-time feedback. Smart fabrics that adapt to temperature and moisture changes enhance comfort. Wearable technology integration strengthens the premium product segment. Partnerships between sportswear brands and tech companies accelerate this trend. Training-oriented apparel expands the role of clothing beyond aesthetics. This integration aligns with broader consumer interest in connected sports gear. Data analytics generated from these garments also helps brands refine product design. Such features create an ecosystem where apparel supports ongoing skill improvement.

- For instance, Under Armour has led advancements in smart wearable integration by embedding high-fidelity sensors in the midsole of its UA HOVR™ shoes, which connect via Bluetooth to deliver stride analysis, cadence, and real-time gait coaching through the MapMyRun™ app.

Customization and Personalization for Consumer Engagement

Consumers increasingly seek products that reflect individual style preferences. It benefits from advancements in digital printing and made-to-order manufacturing. Personalization extends to monogramming, logo placement, and color selection. Golf clubs and corporate events drive demand for customized team apparel. Digital tools allow shoppers to preview and modify designs before purchase. Brands use customization to deepen customer engagement and loyalty. Limited-edition releases with personalized elements create exclusivity. This trend strengthens the connection between consumers and premium golf apparel brands. Loyalty programs offering exclusive customization options further encourage repeat purchases. Social media sharing of personalized apparel boosts brand visibility organically.

- For example, Titleist, through its parent Acushnet, enhanced customization capabilities by operating a new 500,000 sq ft distribution and embroidery center in Lakeville, MA, increasing throughput and reducing lead times for custom-embroidered FootJoy apparel and personalized Titleist gear.

Cross-Category Collaborations in Sports and Fashion

Collaborations between golf apparel brands and high-fashion designers create unique market offerings. It attracts consumers from both sports and fashion markets. Limited collections boost media attention and social media engagement. These partnerships introduce unconventional designs, appealing to younger demographics. Retailers use collaborative launches to drive store traffic. Influencer marketing amplifies the reach of such products. Brand value increases through association with luxury or high-profile partners. Cross-category collaborations help refresh brand identity and expand market visibility. These partnerships often lead to experimental materials and patterns. Seasonal capsule collections further enhance exclusivity and demand.

Expansion of Retail and E-Commerce Distribution Channels

Rapid growth in retail infrastructure supports broader market access. It benefits from increased availability of branded products in specialty sports stores and high-end retail outlets. E-commerce platforms enable brands to target global customers with tailored marketing strategies. Direct-to-consumer channels strengthen brand control and margins. Digital product visualization and customization tools enhance the shopping experience. Partnerships with major online marketplaces expand visibility. Urbanization in emerging economies opens new consumer bases for golf apparel. Distribution diversification ensures consistent sales across geographies and seasons. Pop-up retail events tied to major tournaments are also driving brand exposure. Social commerce integrations make purchasing faster and more engaging for online audiences.

Market Challenges Analysis:

Seasonal Dependency and Limited Year-Round Demand

Seasonality remains a critical challenge, particularly in regions with limited golf-friendly weather. It often faces fluctuations in sales, with peaks during specific seasons and declines in off-seasons. Dependence on golf course activity makes demand vulnerable to climatic changes. Retailers struggle to maintain consistent inventory turnover throughout the year. Seasonal patterns also influence marketing and promotional strategies. Inconsistent cash flow during low-demand periods impacts smaller brands more severely. Global expansion efforts must adapt to varied seasonal cycles in different regions. Addressing this challenge requires diversification of product usage beyond the golf course. The inclusion of transitional wear that suits multiple climates may ease seasonal volatility. Partnerships with indoor golf facilities can also help stabilize off-season sales.

Price Sensitivity and Competitive Pressures

High-quality golf apparel often carries premium pricing, limiting accessibility for price-sensitive consumers. It competes with both established sportswear brands and emerging niche players. Aggressive discounting by competitors erodes margins. Brand loyalty can be influenced by pricing over product differentiation in certain markets. Counterfeit products present risks to brand reputation and revenue. Balancing innovation costs with competitive pricing remains complex. E-commerce intensifies price competition through transparent comparisons. Brands must adopt value-driven strategies to maintain profitability without compromising quality. Exploring tiered product lines may capture wider demographics. Exclusive in-store experiences can help justify premium pricing to core buyers.

Market Opportunities:

Expansion into Untapped Emerging Markets

Untapped markets in Asia-Pacific, the Middle East, and parts of Latin America offer significant growth potential. It can benefit from rising disposable incomes, growing interest in golf, and investments in sports infrastructure. Targeted marketing campaigns can create awareness among first-time buyers. Partnerships with local distributors strengthen entry strategies. Hosting international tournaments in these regions can stimulate demand. Product adaptations to local climate and cultural preferences improve acceptance. These markets offer long-term potential for sustained revenue growth. Aligning with national sports initiatives in these regions can enhance market presence. Early mover advantage in such markets often delivers strong brand positioning.

Development of Multi-Functional and Lifestyle-Oriented Apparel

Multi-functional apparel designed for both golf and casual wear opens new consumer segments. It caters to individuals who value versatility, comfort, and style. Integration of performance fabrics into everyday clothing increases utility. Expanding lifestyle positioning enables brands to sustain sales year-round. Retailers can promote such products through both sports and fashion channels. Collaborations with lifestyle brands expand market appeal. This opportunity supports both brand differentiation and higher consumer engagement. Offering modular designs that adapt to varying weather conditions adds to functionality. Marketing such apparel through digital influencers can also capture non-golf audiences.

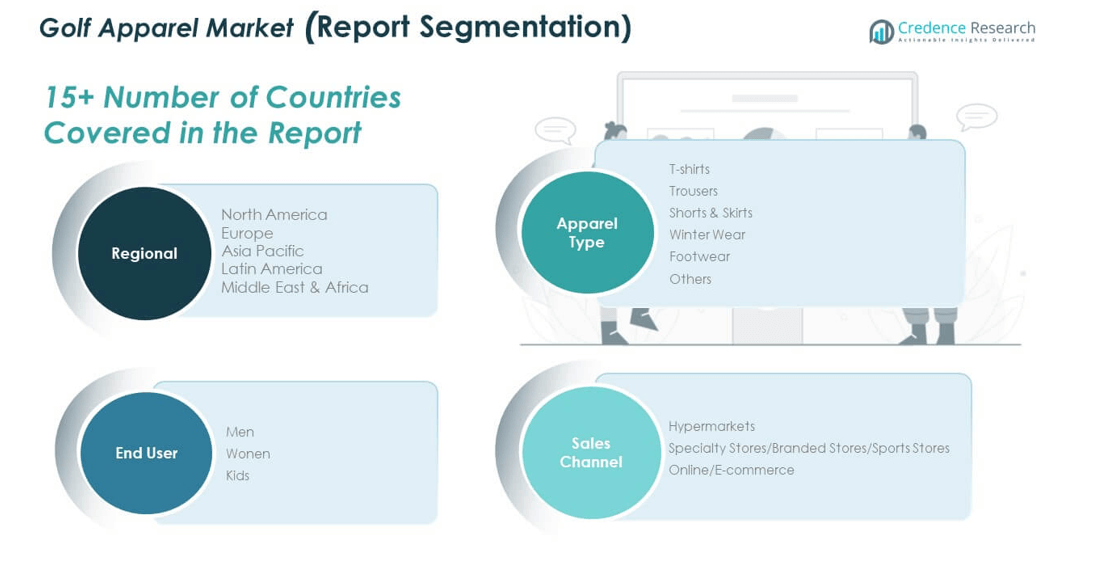

Market Segmentation Analysis:

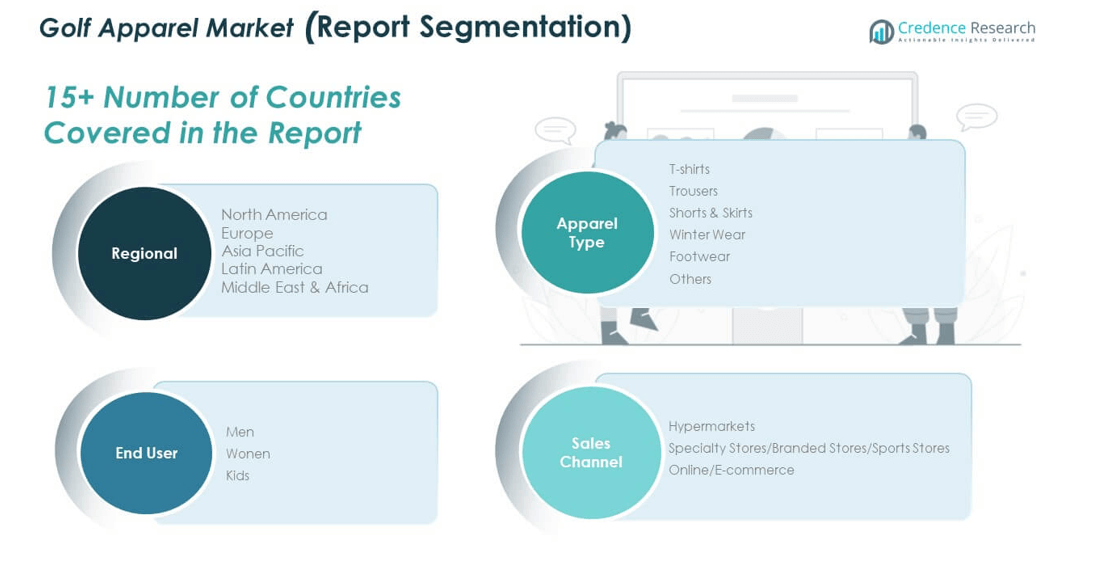

The Golf Apparel Market is segmented

By apparel type into T-shirts, trousers, shorts and skirts, winter wear, footwear, and others. T-shirts lead the segment due to their versatility, comfort, and suitability for various weather conditions, while trousers and shorts remain core items for both professional and casual play. Winter wear shows steady growth in colder regions, supported by demand for thermal and weather-resistant fabrics. Footwear holds a strong share, driven by innovation in grip, comfort, and performance-enhancing designs. The “others” category, including caps, gloves, and accessories, supports incremental sales through add-on purchases.

- For instance, Galvin Green’s INTERFACE-1 outerwear range is designed as a hybrid solution for golfers, offering windproof and water-repellent polyester with breathable, stretchy construction. Pieces like the Leonard jacket incorporate Thermore® padding for added warmth while maintaining flexibility and comfort in cold, blustery conditions.

By end user, the market caters to men, women, and kids, with men accounting for the largest share owing to higher participation rates and brand penetration. The women’s segment is expanding quickly, supported by fashion-oriented designs and rising female engagement in golf. The kids’ category benefits from golf academies and junior training programs encouraging early adoption of the sport.

- For example, Garb Inc., founded in 1996 as the original junior golf apparel brand, is a leading supplier of children’s golf clothing. The company has been the primary kids’ apparel provider for major events such as the U.S. Open, PGA Championship, and Ryder Cup since 2001, reinforcing its strong presence in youth golf.

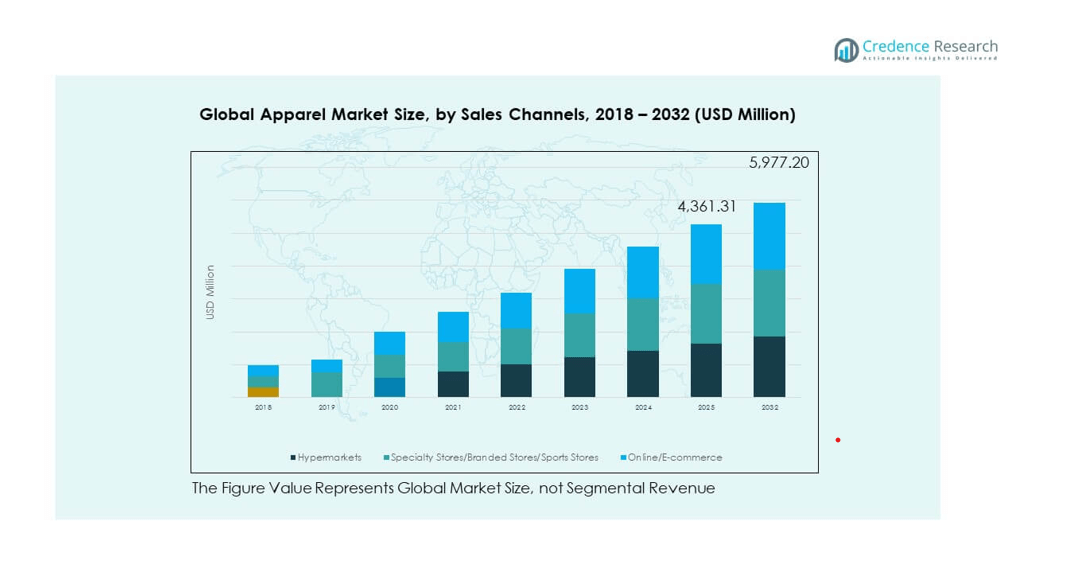

By sales channel, hypermarkets offer broad accessibility and competitive pricing, while specialty stores and branded sports outlets attract buyers seeking premium collections and personalized service. Online and e-commerce platforms are expanding rapidly, offering global reach, product customization, and convenience, making them a key growth driver across all regions.

Segmentation:

By Apparel Type

- T-shirts

- Trousers

- Shorts & Skirts

- Winter Wear

- Footwear

- Others

By End User

By Sales Channel

- Hypermarkets

- Specialty Stores / Branded Stores / Sports Stores

- Online / E-commerce

By Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis:

North America

The North America Golf Apparel Market size was valued at USD 778.32 million in 2018 to USD 948.15 million in 2024 and is anticipated to reach USD 1,314.98 million by 2032, at a CAGR of 4.2% during the forecast period. North America accounts for 22.64% of the global market in 2024, driven by its strong golfing culture, high disposable income levels, and well-established golf infrastructure. The region hosts numerous PGA tournaments, which influence consumer interest in premium apparel. It benefits from a mature retail environment and the presence of leading global brands offering advanced performance wear. Golf tourism in destinations such as Florida, California, and Arizona fuels steady sales. The growing adoption of e-commerce channels strengthens accessibility for rural and suburban consumers. Seasonal collections aligned with major tournaments sustain market engagement. Celebrity endorsements and influencer campaigns continue to drive consumer preference for high-end golf apparel.

Europe

The Europe Golf Apparel Market size was valued at USD 905.63 million in 2018 to USD 1,136.48 million in 2024 and is anticipated to reach USD 1,640.74 million by 2032, at a CAGR of 4.8% during the forecast period. Europe holds a 27.13% market share in 2024, supported by a rich golfing tradition and a wide network of prestigious courses. The UK, Germany, and France are leading contributors due to active participation in both amateur and professional golf. It benefits from seasonal golfing events, which stimulate apparel sales. The market sees strong demand for weather-resistant clothing given varied climatic conditions. Sustainability initiatives in apparel manufacturing appeal to eco-conscious consumers in the region. Golf apparel is positioned as both sportswear and casual wear, expanding its usage occasions. Retailers leverage fashion trends to refresh collections, attracting younger demographics. Sponsorship deals with European Tour events also enhance brand visibility and sales.

Asia Pacific

The Asia Pacific Golf Apparel Market size was valued at USD 1,059.20 million in 2018 to USD 1,358.91 million in 2024 and is anticipated to reach USD 2,017.90 million by 2032, at a CAGR of 5.1% during the forecast period. Asia Pacific commands a 32.44% market share in 2024, driven by growing middle-class income levels and rising golf participation in countries such as Japan, South Korea, and China. Expanding golf tourism and international tournaments boost apparel sales. It benefits from strong retail growth and increased brand penetration in urban markets. Local manufacturers are introducing competitively priced products to cater to new golfers. Premium brands focus on fashion-forward designs tailored for the region’s younger consumers. Government initiatives to promote sports tourism in Southeast Asia also contribute to demand. The integration of online sales channels widens access for remote buyers. This region shows strong potential for sustained long-term growth due to untapped consumer segments.

Latin America

The Latin America Golf Apparel Market size was valued at USD 343.86 million in 2018 to USD 400.05 million in 2024 and is anticipated to reach USD 518.22 million by 2032, at a CAGR of 3.3% during the forecast period. Latin America represents 9.55% of the global market in 2024, with growth supported by golf’s gradual expansion in Brazil, Mexico, and Argentina. The development of new courses in resort destinations stimulates apparel demand. It benefits from golf tourism linked to coastal and luxury resorts. Seasonal variations influence sales patterns, with peaks during cooler months. Retailers focus on expanding sports specialty stores in urban centers. Premium golf apparel remains a niche but growing segment among affluent consumers. Sponsorships for local tournaments help increase brand awareness. Increasing interest among younger players is expected to expand the customer base over time.

Middle East

The Middle East Golf Apparel Market size was valued at USD 160.99 million in 2018 to USD 204.18 million in 2024 and is anticipated to reach USD 298.86 million by 2032, at a CAGR of 4.9% during the forecast period. The Middle East holds a 4.87% share of the global market in 2024, with demand concentrated in countries like the UAE, Saudi Arabia, and Qatar. The region benefits from luxury-driven consumer preferences and a focus on high-end apparel. Year-round golf-friendly weather supports steady sales volumes. Golf tourism linked to exclusive resorts in Dubai and Abu Dhabi fuels apparel purchases. Leading brands partner with local distributors to strengthen market access. International tournaments hosted in the region boost visibility for premium collections. Customization and limited-edition releases appeal to the luxury segment. The growing expatriate community also supports consistent demand for branded golf apparel.

Africa

The Africa Golf Apparel Market size was valued at USD 119.90 million in 2018 to USD 141.23 million in 2024 and is anticipated to reach USD 186.49 million by 2032, at a CAGR of 3.6% during the forecast period. Africa accounts for a 3.37% market share in 2024, with South Africa leading due to its established golf culture and course infrastructure. The market remains in an early growth phase, with opportunities emerging in Nigeria, Kenya, and Morocco. It benefits from hosting international tournaments, which stimulate apparel sales during event seasons. Distribution remains limited, with growth focused on urban retail hubs. Affluent consumers in major cities drive demand for premium imports. Local manufacturing is slowly developing to address affordability issues. The market outlook remains positive as sports tourism expands in coastal and safari destinations. Partnerships between golf clubs and retailers are expected to boost brand exposure in coming years.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Amer Sports

- Roger Cleveland Golf Company Inc.

- Golfsmith International Holdings Inc.

- Dixon Golf Inc.

- Perry Ellis

- Fila

- Ralph Lauren

- Oxford Golf

- Sunice

- EP NY

- Other Key Players

Competitive Analysis:

The Golf Apparel Market features a mix of global sportswear leaders, premium fashion brands, and specialized golf-focused manufacturers competing for market share. It is shaped by strong brand loyalty, with established players leveraging advanced fabric technologies, innovative designs, and endorsements from professional golfers to maintain a competitive edge. Strategic collaborations with fashion labels and sponsorship of major tournaments enhance brand visibility. E-commerce growth has intensified competition, enabling smaller brands to enter and target niche audiences. Product differentiation is achieved through sustainability initiatives, customization options, and multi-functional designs. Leading companies invest in R&D to integrate performance-driven features into stylish collections. Regional players compete by offering competitively priced apparel tailored to local preferences. Marketing strategies increasingly focus on social media engagement and influencer partnerships to attract younger consumers.

Recent Developments:

- In July 2025, Dixon Golf took a significant sustainability step by inaugurating its new eco-friendly corporate headquarters in Chandler, Arizona. The facility features energy-efficient systems and desert landscaping and is designed for future expansion, reinforcing the company’s leadership in sustainable golf products like its eco-friendly golf balls.

- In April 2025, Roger Cleveland made headlines by returning to Cleveland Golf, the company he originally founded in 1979. After three decades designing for Callaway, Cleveland has assumed the influential role of “Founder and Advisor” at Cleveland Golf. His expertise will bolster the company’s product development, working closely with both R&D and PGA Tour professionals to continue the brand’s legacy of innovation in golf equipment and apparel.

- In March 2025, EMERGE Commerce announced the signing of a definitive agreement to acquire Tee 2 Green, a Canadian golf apparel and equipment business. Tee 2 Green has a 38-year track record and operates various retail stores and a private label brand, NORTHERN SPIRIT. This acquisition is expected to enhance EMERGE’s presence in golf apparel and bring its operations to positive cash flow.

Market Concentration & Characteristics:

The Golf Apparel Market is moderately concentrated, with a few dominant players holding significant shares alongside a diverse range of regional and niche brands. It is characterized by strong brand recognition, premium pricing strategies, and high product differentiation based on fabric performance, design aesthetics, and brand heritage. The market shows consistent demand from both professional and recreational golfers, with seasonal sales peaks linked to tournaments and favorable weather. Innovation cycles are frequent, driven by advancements in textile technology and evolving consumer preferences. Sustainability and lifestyle integration are becoming central to brand positioning. Retail channels are diverse, spanning specialty stores, luxury outlets, and e-commerce platforms. Competitive dynamics are influenced by global tournament sponsorships and strategic distribution partnerships.

Report Coverage:

The research report offers an in-depth analysis based on Apparel Type, End User and Sales Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Emerging markets are expected to play a significant role in expanding the consumer base, supported by rising golf participation and improved retail networks.

- Continuous advancements in performance fabrics will shape product development, delivering enhanced comfort, durability, and functionality.

- Sustainable materials and eco-friendly manufacturing practices will appeal to environmentally conscious buyers, influencing brand preference.

- The blending of sportswear and casual fashion will enable brands to reach audiences beyond traditional golfers.

- Digital commerce growth will strengthen market access, offering personalized marketing and seamless purchasing experiences.

- Customization and personalization options will deepen consumer loyalty, offering exclusivity in product ownership.

- Collaborations between golf apparel companies and global fashion houses will help capture younger, style-focused demographics.

- Smart apparel featuring integrated technology will cater to players seeking performance analytics and real-time feedback.

- Sponsorship of regional and global tournaments will boost brand visibility and generate seasonal demand peaks.

- Partnerships with resorts, golf clubs, and sports tourism operators will create new sales avenues and strengthen brand-consumer connections.