Market Overview

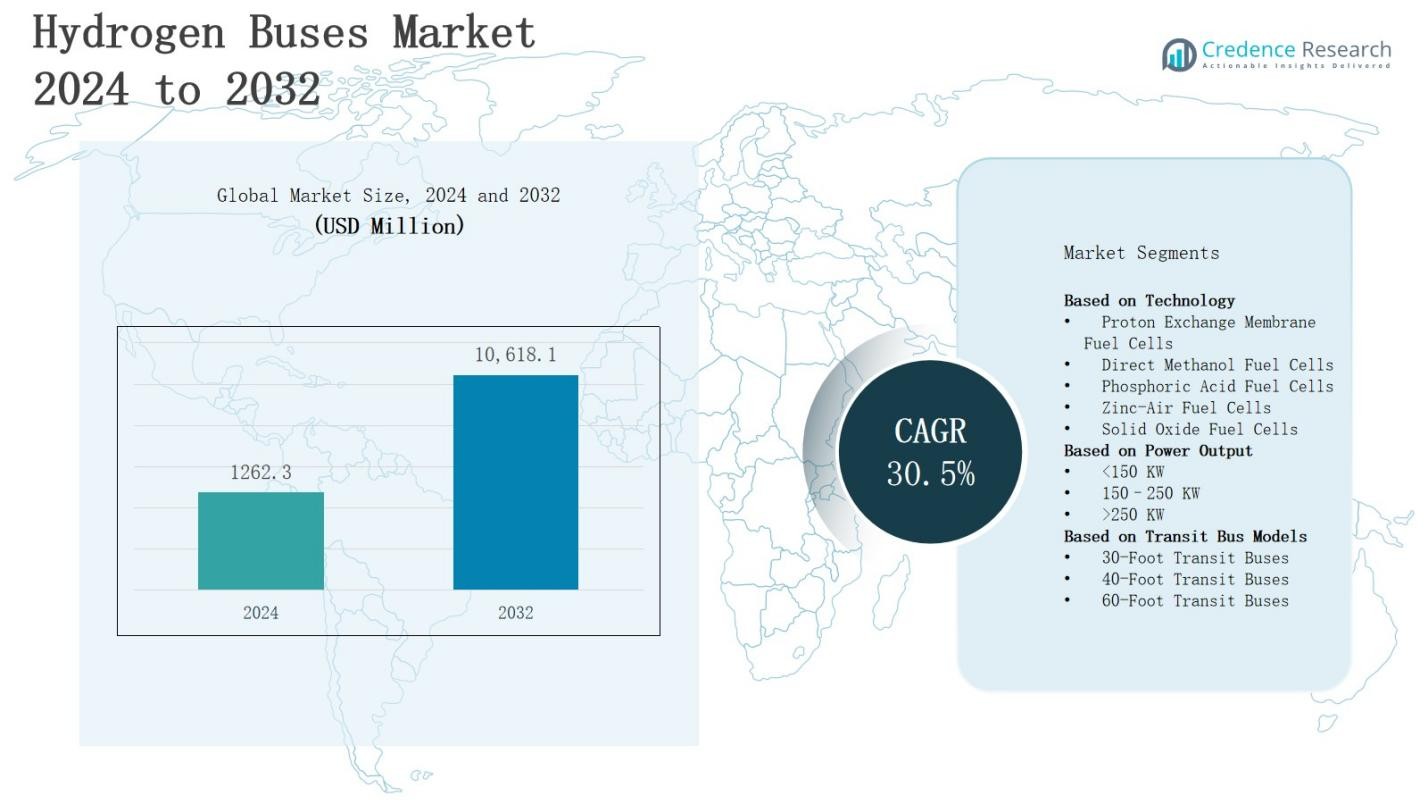

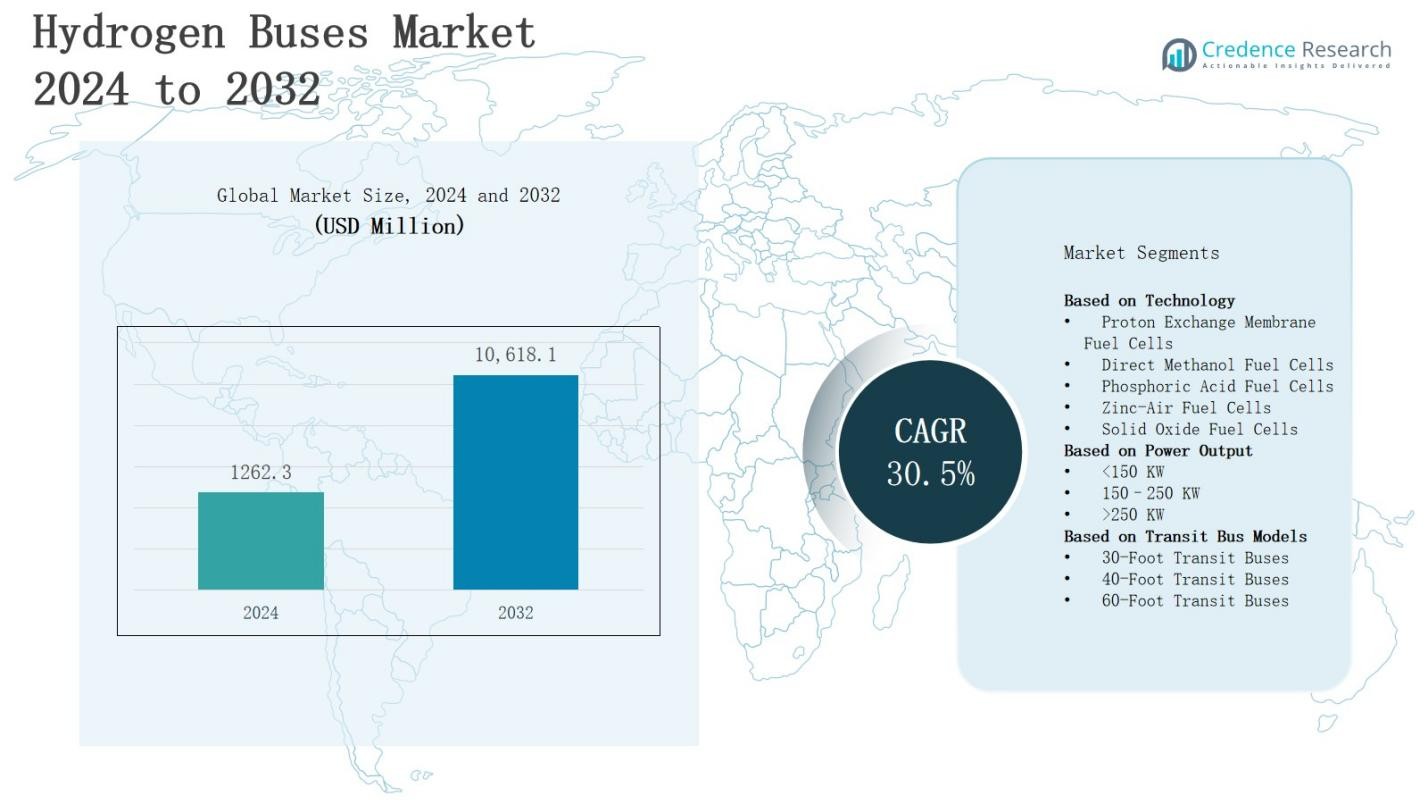

The hydrogen buses market is projected to grow from USD 1,262.3 million in 2024 to USD 10,618.1 million by 2032, registering a robust CAGR of 30.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Hydrogen Buses Market Size 2024 |

USD 1,262.3 Million |

| Hydrogen Buses Market, CAGR |

30.5% |

| Hydrogen Buses Market Size 2032 |

USD 10,618.1 Million |

Market growth in the hydrogen buses sector is driven by rising demand for zero-emission public transportation, stringent government regulations on vehicle emissions, and increasing investments in hydrogen infrastructure. Advancements in fuel cell technology are improving efficiency, reducing costs, and enhancing vehicle range, making hydrogen buses more viable for urban and long-distance routes. Growing adoption by transit agencies, supported by subsidies and public–private partnerships, is accelerating deployment. Trends include the expansion of green hydrogen production, integration of smart fleet management systems, and collaborative projects between bus manufacturers and energy providers to scale production and ensure sustainable fuel supply.

The hydrogen buses market spans North America, Europe, Asia-Pacific, and the Rest of the World, with Asia-Pacific leading adoption, followed by Europe and North America, while emerging deployments occur in Latin America and the Middle East. It benefits from strong policy support, infrastructure investments, and clean transport initiatives across regions. Key players include Tata Motors Limited, Hyundai, Hino Motors Ltd., NovaBus Corporation, EvoBus, Thor Industries, Ballard Power Systems, New Flyer Industries Ltd, New Flyer, and SunLine Transit Agency, all focusing on technology innovation, fleet expansion, and strategic collaborations.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The hydrogen buses market is projected to grow from USD 1,262.3 million in 2024 to USD 10,618.1 million by 2032, registering a CAGR of 30.5%, driven by strong policy support and rising demand for zero-emission transit solutions.

- Government subsidies, tax incentives, and public–private partnerships are accelerating adoption, while infrastructure investments are expanding refueling station networks in key urban corridors.

- Advancements in fuel cell technology are improving efficiency, reducing costs, and extending vehicle range, making hydrogen buses more competitive for both urban and intercity routes.

- High capital costs, limited refueling infrastructure, and fuel cell maintenance expenses remain key challenges, restricting adoption for smaller transit operators.

- Asia-Pacific leads with 37% market share, followed by Europe at 31%, North America at 24%, and the Rest of the World at 8%, reflecting varied policy commitments and infrastructure readiness.

- Expansion of green hydrogen production and large-scale electrolyzer projects is enhancing fuel availability, lowering costs, and strengthening the environmental profile of hydrogen buses.

- Key players such as Tata Motors Limited, Hyundai, Hino Motors Ltd., NovaBus Corporation, EvoBus, Thor Industries, Ballard Power Systems, New Flyer Industries Ltd, New Flyer, and SunLine Transit Agency are focusing on technology innovation, fleet expansion, and strategic collaborations.

Market Drivers

Rising Global Demand for Zero-Emission Public Transport

The hydrogen buses market is gaining momentum due to the growing urgency to reduce greenhouse gas emissions in the transportation sector. Governments are enforcing stricter emission norms, pushing transit authorities to adopt clean energy alternatives. Hydrogen buses offer long range, quick refueling, and operational efficiency, making them suitable for both urban and intercity travel. The shift toward decarbonized mobility is encouraging large-scale fleet conversions. Public acceptance is increasing with improved reliability and performance.

- For instance, Toyota Motor Corporation has deployed hydrogen fuel cell buses in various cities, highlighting their capability of long-range travel and quick refueling, which address operational efficiency for urban and intercity routes.

Government Policies and Funding Support

Strong policy frameworks and financial incentives are accelerating hydrogen bus adoption. Many countries are offering subsidies, tax benefits, and grants for fuel cell vehicle purchases and hydrogen infrastructure development. Public–private partnerships are expanding refueling networks, making operations more feasible. It benefits cities aiming to achieve net-zero emission targets within set timelines. International collaborations are facilitating technology transfer and cost reductions. Long-term government commitment is improving investor confidence and industry growth prospects.

- For instance, the Indian government has allocated ₹208 crore (approximately $25 million) for pilot projects involving 37 hydrogen fuel cell buses and nine refueling stations, with major companies like Tata Motors and Ashok Leyland participating.

Technological Advancements in Fuel Cell System

Continuous improvements in fuel cell efficiency, durability, and cost structure are strengthening the market. Modern hydrogen buses feature extended driving ranges and faster refueling compared to earlier models. It is enhancing operational competitiveness against battery electric alternatives, especially for long-haul and high-frequency routes. Integration with lightweight materials and advanced energy management systems further boosts performance. Innovation in onboard hydrogen storage solutions is improving safety and space utilization. These advancements are attracting both public and private fleet operators.

Expansion of Hydrogen Production and Supply Infrastructure

The growth of renewable-based hydrogen production is reinforcing the sector’s sustainability appeal. Green hydrogen projects are being deployed globally to supply transport-grade fuel with minimal carbon footprint. It ensures long-term fuel availability and price stability for bus operators. Large-scale electrolyzer installations are reducing per-unit hydrogen costs. Strategic refueling station deployment is improving route planning flexibility. Collaboration between energy companies and transportation agencies is ensuring smooth fuel supply chains. This synergy is driving market adoption rates.

Market Trends

Integration of Advanced Digital and Fleet Management Technologies

The hydrogen buses market is witnessing a shift toward smart operational management through the integration of telematics, IoT, and predictive maintenance systems. Real-time data tracking enables operators to optimize routes, monitor fuel consumption, and reduce downtime. It is improving service reliability and operational cost efficiency for transit agencies. Enhanced connectivity supports better coordination between refueling infrastructure and vehicle scheduling. Adoption of AI-driven diagnostics is extending vehicle life cycles. Digitalization is becoming a standard expectation for competitive fleet operations.

- For instance, Tata Motors delivered hydrogen fuel cell buses to Indian Oil Corporation featuring digital telematics for efficient vehicle maintenance and tracking, along with an intelligent transport system to boost operational efficiency and user safety.

Collaborative Partnerships to Accelerate Commercial Deployment

Strategic collaborations between bus manufacturers, hydrogen producers, and transit authorities are driving faster commercialization. The hydrogen buses market is benefiting from joint ventures that reduce costs and expand infrastructure. It is creating synergies that enable large-scale procurement and coordinated refueling station rollouts. Cross-industry alliances are improving supply chain resilience. Pilot projects funded by governments and private investors are scaling into permanent fleets. Collaborative frameworks are also enabling knowledge sharing and regional standardization in design and technology.

- For instance, Australian bus manufacturer Volgren partnered with Wrightbus to integrate advanced hydrogen fuel cell technology into locally made buses, significantly advancing zero-emission public transport in Australia.

Shift Toward Green Hydrogen and Sustainable Fuel Supply

Growing emphasis on environmental responsibility is increasing the use of green hydrogen in public transportation fleets. The hydrogen buses market is transitioning from fossil-based hydrogen to renewable-powered production methods, reducing lifecycle emissions. It is supporting government climate goals and improving public perception of hydrogen as a clean fuel. Expansion of wind and solar-powered electrolysis plants is boosting supply security. Fuel purity standards are advancing to ensure optimal bus performance. Sustainability credentials are becoming a key purchasing factor for transit agencies.

Expansion into Emerging and High-Density Urban Markets

Deployment is expanding beyond early-adopter countries into emerging economies and densely populated urban areas. The hydrogen buses market is seeing increased demand in Asia-Pacific, Latin America, and parts of Eastern Europe due to urban air quality concerns. It is prompting governments to integrate hydrogen buses into long-term public transport plans. Infrastructure investments are being concentrated in high-traffic corridors. Operators in megacities are prioritizing hydrogen buses for their fast refueling and long-range capabilities. Market penetration is expected to rise significantly in these regions.

Market Challenges Analysis

High Capital Costs and Limited Infrastructure Development

The hydrogen buses market faces significant challenges due to the high upfront costs of vehicles and supporting infrastructure. Fuel cell buses remain more expensive than diesel or battery-electric alternatives, creating budget constraints for transit agencies. It requires substantial investment in hydrogen production, storage, and refueling facilities to achieve operational viability. Limited refueling station availability restricts route flexibility and large-scale deployment. High maintenance costs for fuel cell systems further impact adoption. Financial risk discourages smaller operators from early participation in the market.

Technological Maturity and Supply Chain Constraints

The market is still navigating technical challenges related to fuel cell durability, hydrogen storage efficiency, and component standardization. The hydrogen buses market depends on specialized parts and advanced materials, leading to supply chain vulnerabilities and longer lead times. It also faces a shortage of skilled technicians for maintenance and repair. Variations in regional safety standards complicate cross-border adoption. Hydrogen production capacity remains limited in several key markets, slowing scaling efforts. These factors collectively hinder the pace of global market expansion.

Market Opportunities

Government Commitments to Clean Transportation Initiatives

The hydrogen buses market is well-positioned to benefit from global policy shifts toward zero-emission mobility. Governments are allocating substantial budgets to subsidize clean public transport and expand hydrogen infrastructure. It is driving demand through regulatory mandates and incentives that lower operational costs for fleet operators. Urban air quality improvement targets are reinforcing adoption priorities. Public–private partnerships are enabling quicker deployment in metropolitan regions. National hydrogen strategies are creating long-term market stability and investment opportunities for manufacturers and suppliers.

Advancements in Green Hydrogen and Large-Scale Fleet Integration

Growing renewable energy capacity is boosting green hydrogen production, enhancing the environmental value proposition of hydrogen buses. The hydrogen buses market can leverage this trend to attract cities committed to sustainable energy transitions. It offers a competitive edge for long-distance, high-frequency routes where battery-electric solutions face limitations. Integration into large municipal and intercity fleets is expanding procurement volumes. Cross-border transport corridors are opening opportunities for standardized hydrogen bus deployment. Continuous technological improvements will further strengthen commercial viability and long-term adoption rates.

Market Segmentation Analysis:

By Technology

The hydrogen buses market features multiple fuel cell technologies, with Proton Exchange Membrane Fuel Cells (PEMFC) holding a dominant share due to high efficiency, quick start-up, and suitability for varying load conditions. Direct Methanol Fuel Cells (DMFC) are gaining traction in niche applications for their simplified fuel storage, while Phosphoric Acid Fuel Cells (PAFC) offer durability for continuous operation. Zinc-Air Fuel Cells present lightweight advantages, and Solid Oxide Fuel Cells (SOFC) deliver high efficiency at elevated temperatures, catering to long-haul transit needs.

- For instance, PEMFCs used by manufacturers like Ballard Power Systems convert hydrogen to electricity with efficiencies exceeding 50% and enable refueling times of around 10 minutes, ideal for urban transit buses.

By Power Output

Power output segmentation addresses diverse operational requirements. Models under 150 KW cater to small urban routes and short-distance operations, offering cost and energy efficiency. The 150–250 KW category serves as the mainstream choice for standard city buses, balancing power with range. Systems exceeding 250 KW target heavy-duty applications and intercity transit, delivering higher performance under demanding conditions. The hydrogen buses market leverages these ranges to meet the operational demands of varied fleet sizes and service intensities.

- For instance, Tata Motors delivered hydrogen fuel cell buses to Indian Oil Corporation, featuring PEM fuel cells with power outputs around 150–200 kW, ideal for inter- and intra-city commutes balancing power and range efficiently.

By Transit Bus Models

Transit bus models in this sector vary to align with route density and passenger capacity needs. The 30-foot models suit narrow urban routes and lower ridership areas, offering maneuverability and efficiency. The 40-foot models dominate as the standard choice for metropolitan transit networks due to their balanced capacity and operational flexibility. The 60-foot articulated buses are designed for high-demand corridors, providing maximum passenger capacity and optimal performance for mass transit systems in congested urban environments.

Segments:

Based on Technology

- Proton Exchange Membrane Fuel Cells

- Direct Methanol Fuel Cells

- Phosphoric Acid Fuel Cells

- Zinc-Air Fuel Cells

- Solid Oxide Fuel Cells

Based on Power Output

- <150 KW

- 150–250 KW

- >250 KW

Based on Transit Bus Models

- 30-Foot Transit Buses

- 40-Foot Transit Buses

- 60-Foot Transit Buses

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America holds 24% of the hydrogen buses market, driven by strong federal and state-level initiatives promoting zero-emission public transport. The U.S. is leading deployment through funding programs, tax credits, and hydrogen infrastructure investments. Canada is following with strategic plans to integrate hydrogen buses into municipal fleets. It benefits from advanced manufacturing capabilities and established partnerships between bus makers and energy providers. Transit agencies in major cities are adopting fuel cell buses for long-range and heavy-duty applications. Growth is supported by collaborative projects aimed at expanding refueling networks across key transit corridors.

Europe

Europe accounts for 31% of the hydrogen buses market, supported by strict emission regulations and the European Union’s hydrogen strategy. Countries such as Germany, France, and the UK are leading large-scale trials and fleet integration programs. It gains momentum from investments in green hydrogen production and widespread refueling infrastructure. Public–private partnerships are facilitating technology standardization and cost reductions. The region’s commitment to climate neutrality by 2050 is driving sustained adoption. Urban transit authorities are replacing diesel fleets with hydrogen-powered models to meet sustainability goals.

Asia-Pacific

Asia-Pacific holds 37% of the hydrogen buses market, led by China, Japan, and South Korea. China is deploying thousands of hydrogen buses as part of its national clean transportation policy. Japan is integrating them into smart city projects, while South Korea is focusing on building a nationwide hydrogen economy. It benefits from strong government backing and high-volume manufacturing capabilities. Investments in hydrogen refueling stations are accelerating regional adoption. Growing urbanization and air quality concerns further strengthen the market outlook in this region.

Rest of the World

The Rest of the World represents 8% of the hydrogen buses market, with Latin America and the Middle East showing early adoption signs. Brazil and Chile are piloting hydrogen bus programs to diversify clean transport options. Gulf countries are exploring hydrogen as part of energy diversification strategies. It faces slower adoption due to high infrastructure costs but gains interest from international funding agencies. Expansion of renewable energy projects in these regions supports the feasibility of green hydrogen production. Urban transport modernization plans are expected to create new growth opportunities.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- NovaBus Corporation

- Ballard Power Systems

- SunLine Transit Agency

- Hino Motors Ltd.

- Tata Motors Limited

- New Flyer Industries Ltd

- Hyundai

- Thor Industries

- EvoBus

- New Flyer

Competitive Analysis

The hydrogen buses market is characterized by intense competition among established automotive manufacturers, fuel cell technology providers, and specialized transit solution companies. It is witnessing strategic collaborations, product innovations, and infrastructure partnerships to secure market share. Key players such as Tata Motors Limited, Hyundai, Hino Motors Ltd., NovaBus Corporation, EvoBus, and Thor Industries are expanding their hydrogen bus portfolios to meet growing demand for zero-emission transit. Ballard Power Systems plays a pivotal role by supplying advanced fuel cell systems to multiple bus manufacturers. New Flyer Industries Ltd and New Flyer are leading North American deployment efforts, supported by long-standing transit agency relationships. SunLine Transit Agency is demonstrating leadership in fleet integration and operational optimization of hydrogen buses. Companies are focusing on improving vehicle range, reducing lifecycle costs, and strengthening hydrogen supply chains. Government-backed pilot programs and large-scale orders are driving adoption, encouraging manufacturers to scale production and align with evolving sustainability regulations across global markets.

Recent Developments

- In April 2025, Wrightbus announced an enhanced hydrogen long-distance coach development plan, investing £5 million in R&D for a model capable of 1,000 km on a single refuel.

- In April 2025, Wrightbus announced an enhanced hydrogen long-distance coach development plan, investing £5 million in R&D for a model capable of 1,000 km on a single refuel.

- In July 2025, New Flyer introduced an extended-range hydrogen module with a four-tank system adding 17.5 kg of onboard fuel to enhance operational flexibility.

- In July 2025, Kansai Airports launched Japan’s first hydrogen-powered tourist minibus to support eco-tourism for KIX tours and Expo 2025.

- In June 2025, NTPC launched India’s first fleet of hydrogen fuel cell buses in Leh, Ladakh, marking the world’s highest-altitude green mobility project. The buses run on green hydrogen produced on-site using a solar power plant.

Market Concentration & Characteristics

The hydrogen buses market displays a moderate to high level of concentration, with a limited number of global and regional players dominating production and technology supply. It is characterized by the presence of established automotive manufacturers, specialized fuel cell technology providers, and transit solution companies collaborating to accelerate adoption. The market features strong barriers to entry due to high capital requirements, complex hydrogen infrastructure needs, and advanced technological expertise. Leading players are focusing on long-range capabilities, fast refueling, and cost optimization to improve competitiveness. Strategic partnerships between bus manufacturers, hydrogen producers, and transit authorities are shaping procurement models and infrastructure expansion. The sector is marked by high reliance on government subsidies, public–private investments, and regulatory mandates to drive deployment. Innovation in fuel cell systems, green hydrogen sourcing, and digital fleet management is influencing product differentiation and market positioning among top industry participants.

Report Coverage

The research report offers an in-depth analysis based on Technology, Power Output, Transit Bus Models and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption will expand as more cities commit to zero-emission public transport targets.

- Green hydrogen production will become a primary fuel source for bus fleets.

- Fuel cell technology will achieve higher efficiency and longer operational lifespans.

- Refueling infrastructure will grow along major transit and intercity corridors.

- Large-scale procurement programs will reduce per-unit costs for operators.

- Digital fleet management systems will enhance operational reliability and maintenance efficiency.

- Public–private partnerships will play a larger role in scaling deployment.

- Regional standardization of safety and performance requirements will improve interoperability.

- Emerging economies will integrate hydrogen buses into urban modernization projects.

- Cross-industry collaborations will accelerate innovation in vehicle design and hydrogen supply chains.