Market Overview:

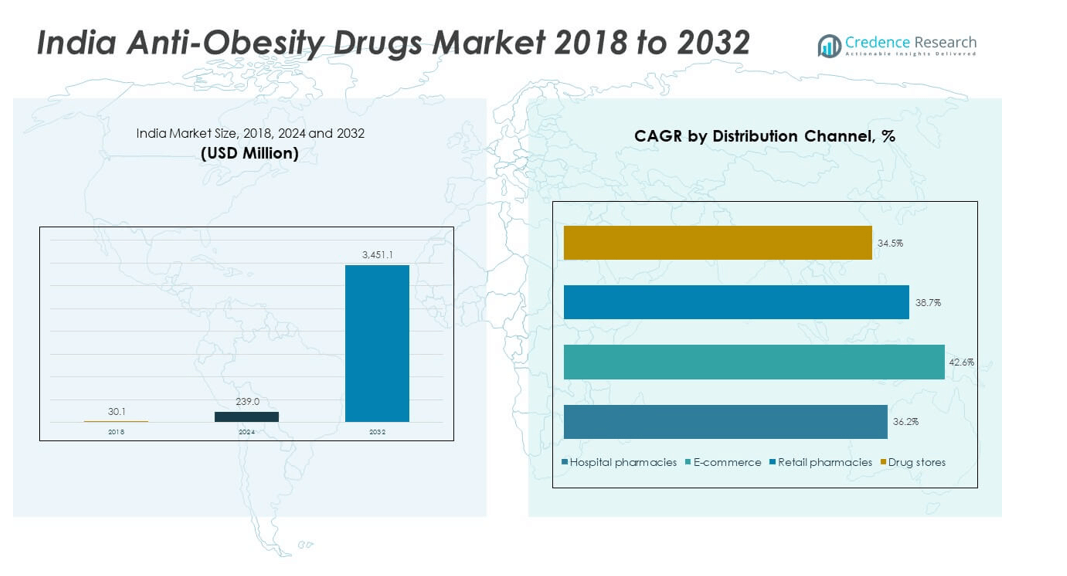

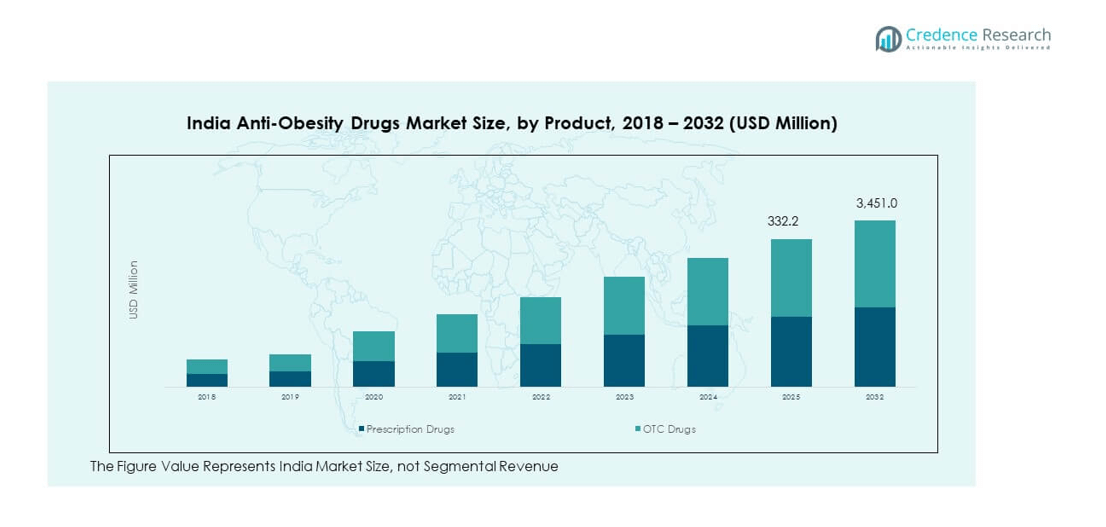

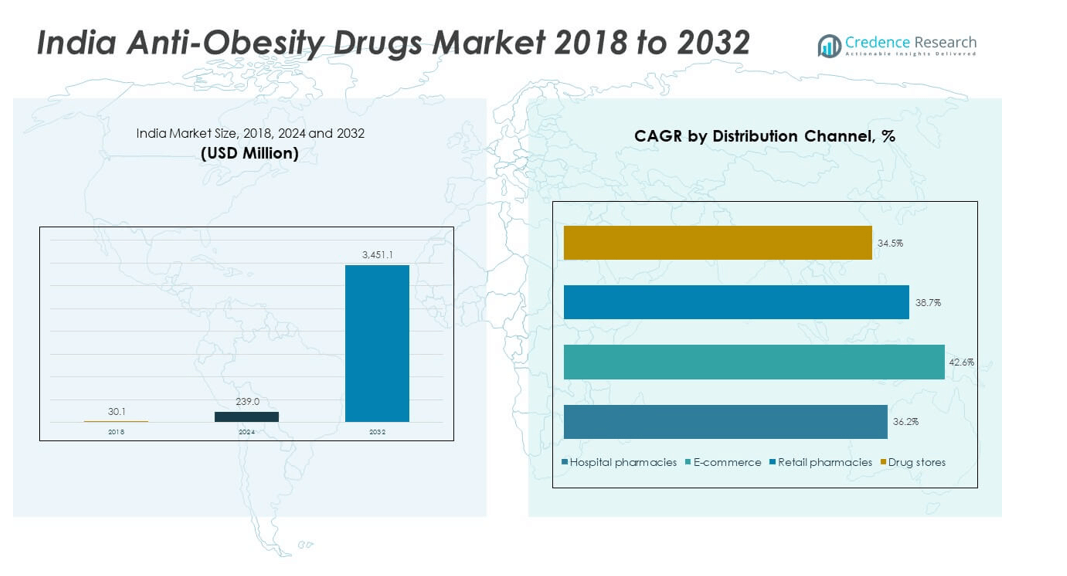

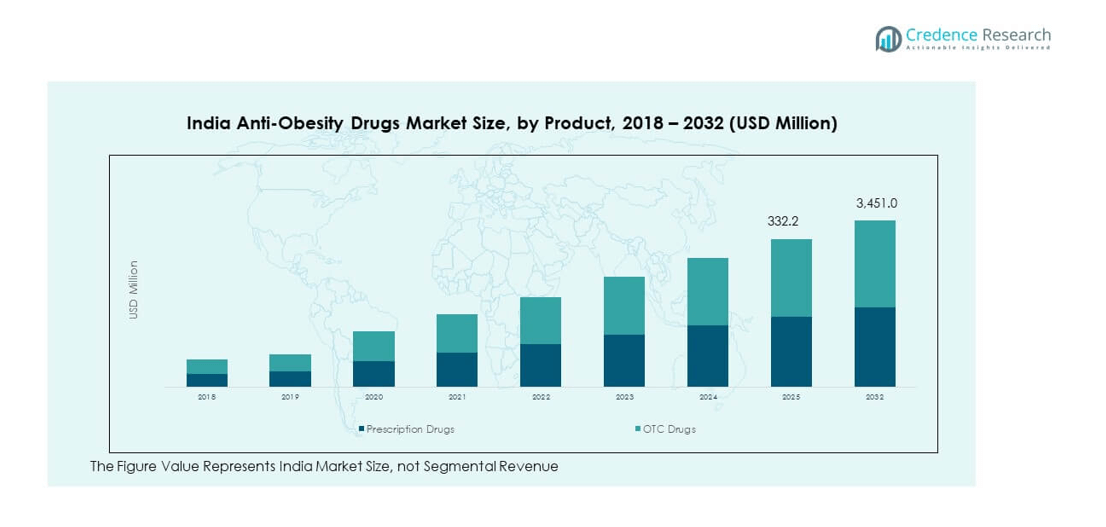

The India Anti-Obesity Drugs Market size was valued at USD 30.1 million in 2018 to USD 239.0 million in 2024 and is anticipated to reach USD 3,451.1 million by 2032, at a CAGR of 39.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| India Anti-Obesity Drugs Market Size 2024 |

USD 239.0 million |

| India Anti-Obesity Drugs Market, CAGR |

39.7% |

| India Anti-Obesity Drugs Market Size 2032 |

USD 3,451.1 million |

The market growth is fueled by rising obesity prevalence linked to sedentary lifestyles, poor dietary habits, and urbanization, which significantly increase demand for effective weight management solutions. Pharmaceutical companies are actively investing in novel drug formulations, particularly GLP-1 receptor agonists and peripherally acting therapies, to address unmet medical needs. Growing awareness about obesity-related health risks, such as cardiovascular disease and diabetes, also drives patient uptake. Moreover, government-led health programs, coupled with expanding telemedicine and e-pharmacy channels, are making anti-obesity drugs more accessible, thereby boosting adoption across both urban and semi-urban regions.

Regionally, the market demonstrates strong momentum across metropolitan cities such as Delhi, Mumbai, Bengaluru, and Hyderabad, where lifestyle disorders and rising disposable incomes drive demand for innovative drug therapies. Emerging opportunities are visible in tier-2 and tier-3 cities, supported by expanding healthcare infrastructure and digital healthcare adoption. International players are increasingly entering India, supported by a favorable regulatory environment and growing patient pools. While urban centers currently dominate market consumption, rural regions are gradually evolving, aided by awareness campaigns and improved distribution networks that strengthen nationwide market penetration.

Market Insights:

- The India Anti-Obesity Drugs Market was valued at USD 239.0 million in 2024 and is projected to reach USD 3,451.1 million by 2032, registering a CAGR of 39.7%.

- Rising prevalence of obesity driven by sedentary lifestyles and unhealthy diets is a major growth driver, creating strong demand for drug-based interventions.

- Innovation in GLP-1 receptor agonists and peripherally acting drugs is boosting physician adoption and expanding treatment options for patients.

- High treatment costs and limited insurance coverage remain key restraints, restricting affordability for a large segment of the population.

- North India led the market with 38% share in 2024, supported by urban lifestyle disorders and advanced healthcare infrastructure.

- South India accounted for 27% share, benefiting from strong hospital networks and pharmaceutical manufacturing clusters.

- West and East India together represented 35% of the market, with West India contributing 20% and East India 15%, showing strong potential for future growth.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Obesity Prevalence and Lifestyle Shifts

The India Anti-Obesity Drugs Market is expanding rapidly due to rising obesity cases linked to sedentary work culture, poor dietary patterns, and rapid urbanization. Increasing consumption of processed foods and reduced physical activity have accelerated the demand for pharmaceutical solutions. Healthcare professionals are prescribing drugs to manage risks of diabetes, hypertension, and cardiovascular disorders connected to excess weight. Patients are showing higher acceptance of drug-based interventions as awareness of obesity complications grows. Pharmaceutical firms are developing innovative molecules targeting obesity through multiple mechanisms. Government health campaigns highlight the risks of excess weight and promote treatment options. Urban populations with higher disposable incomes are emerging as the largest consumers of advanced therapies. It is creating a favorable environment for strong growth in drug sales across the nation.

Expanding Healthcare Infrastructure and Access Channels

The expansion of hospitals, specialty clinics, and diagnostic centers has strengthened distribution for anti-obesity therapies across India. Physicians in both urban and semi-urban regions are increasingly integrating prescription drugs into treatment regimes. Telemedicine platforms provide patients in remote areas with easier access to consultations and weight management therapies. E-pharmacies are expanding availability and delivering medications with discretion, building consumer confidence. The India Anti-Obesity Drugs Market benefits from government-backed digital health initiatives supporting online prescriptions and monitoring. Insurers are including obesity-related treatments under select health coverage, encouraging patient uptake. Patients are gaining faster access to newer therapies supported by strong supply networks. It is enabling wider adoption across diverse demographic groups in India.

Innovation in Drug Development and Rising Clinical Approvals

Pharmaceutical research is intensifying with novel therapies targeting appetite suppression, fat absorption, and metabolic regulation. GLP-1 receptor agonists are gaining popularity for their proven efficacy in weight loss and safety profile. The India Anti-Obesity Drugs Market is benefitting from accelerated clinical trials and faster regulatory clearances. Companies are investing in peripherally acting drugs with minimal side effects, ensuring long-term compliance. Multinational players are introducing global innovations into the Indian market through partnerships. Domestic manufacturers are also scaling production to deliver affordable solutions tailored for local needs. Clinical adoption is supported by strong physician trust in newer drug classes. It is reinforcing market momentum through advanced therapeutic options for patients.

- For instance, Eli Lilly’s tirzepatide (Mounjaro), launched in India in early 2025, is a dual GIP and GLP-1 receptor agonist that achieved average weight loss of 15–21% in global clinical trials, positioning it among the most effective drug-based obesity therapies worldwide.

Rising Awareness of Obesity-Linked Health Risks

Growing public knowledge about the risks of obesity-related conditions has significantly boosted demand for drug-based solutions. Cardiovascular disease, type 2 diabetes, and respiratory disorders are widely associated with weight gain. Healthcare campaigns emphasize preventive care, and this has increased consultations for obesity management. The India Anti-Obesity Drugs Market benefits from rising patient readiness to invest in treatments. Urban populations are more inclined to adopt medical therapies compared to traditional weight control methods. Physicians advocate for pharmaceutical support alongside lifestyle changes, increasing drug prescriptions. Obesity is no longer seen only as a lifestyle issue but a critical medical condition requiring intervention. It is strengthening the overall acceptance of drug-based obesity therapies across diverse age groups.

- For instance, the Indian Council of Medical Research (ICMR)–INDIAB study published in 2023 reported that approximately 101 million people in India are living with diabetes, highlighting a critical risk multiplier for obesity-related conditions.

Market Trends:

Adoption of Digital Health Tools for Obesity Management

Technology integration is reshaping patient engagement and obesity management practices in India. Mobile health apps support weight tracking, diet monitoring, and doctor consultations. Telehealth services provide patients with personalized care plans and easy access to medications. The India Anti-Obesity Drugs Market is gaining from collaborations between digital platforms and pharmaceutical companies. Wearable devices are being linked to therapy adherence monitoring, improving patient outcomes. Urban consumers increasingly prefer hybrid models combining medical drugs and digital coaching. Pharmacies integrate teleconsultation features to drive prescription-based sales. It is driving a technology-led ecosystem that supports sustained obesity treatment adoption.

- For instance, Apollo HealthCo, which integrates Apollo Pharmacy and Apollo 24|7’s digital services, expanded telehealth and remote consultation capabilities nationwide.

Growing Penetration of Combination Therapies and Multi-Target Drugs

Combination therapies are gaining traction due to their superior efficacy in weight reduction and metabolic control. Physicians are increasingly recommending drugs that combine appetite suppressants with fat absorption blockers. The India Anti-Obesity Drugs Market is witnessing more clinical trials validating multi-target formulations. Global companies are focusing on India as a key testbed for innovative drugs. Patients with severe obesity or comorbidities prefer these advanced options for quicker outcomes. Medical research supports their long-term effectiveness and reduced relapse rates. Specialist clinics are building structured programs around such therapies. It is fueling a stronger clinical and commercial preference for multi-target drugs.

Rising Influence of Preventive Healthcare and Lifestyle Integration

Preventive healthcare is gaining strong acceptance, and patients are integrating drugs into broader wellness strategies. Nutritional guidance, exercise programs, and counseling services are increasingly paired with pharmaceutical support. The India Anti-Obesity Drugs Market reflects this integration through multi-disciplinary weight management clinics. Consumers demand holistic care combining medication and behavioral therapies. Healthcare professionals are training patients to use drugs responsibly in parallel with lifestyle changes. Insurers are promoting preventive models by covering obesity management programs. The cultural shift toward wellness is pushing drug adoption into mainstream healthcare. It is strengthening the position of anti-obesity therapies as an integral part of preventive health.

Entry of Global Players and Strategic Collaborations

Global pharmaceutical companies are entering India with advanced therapies through licensing agreements and partnerships. Collaborations with domestic firms are enabling faster product rollouts and stronger supply chains. The India Anti-Obesity Drugs Market benefits from international expertise in clinical research and product development. Mergers and acquisitions strengthen market positioning and accelerate innovation delivery. Regulatory support for expedited drug approvals further encourages global investments. Strategic alliances between e-pharmacies and drug makers improve patient outreach. The expanding base of multinational players elevates competition and diversifies therapy options. It is shaping a highly competitive landscape that enhances patient choice and market maturity.

- For example, in 2025, Tata 1mg partnered with Unicommerce to deploy SaaS-driven order and warehouse management solutions, enhancing inventory accuracy and enabling faster, error-free delivery across over 1,000 Indian cities.

Market Challenges Analysis:

Regulatory Complexity and High Costs

The India Anti-Obesity Drugs Market faces regulatory challenges that delay drug approvals and restrict faster market entry. Strict clinical requirements increase the time and cost of product development. Patients often find newer therapies expensive, limiting accessibility beyond urban elites. Affordability gaps remain a key concern despite rising awareness and demand. Physicians sometimes hesitate to prescribe high-cost drugs due to limited insurance coverage. Domestic manufacturers face difficulties competing with global innovations at scale. The lack of standardized guidelines for obesity treatment creates inconsistencies in clinical practices. It is creating barriers that slow down broader adoption across India.

Limited Awareness in Semi-Urban and Rural Regions

Awareness about obesity as a medical condition remains low outside major cities. Many patients continue to view weight management as a lifestyle choice rather than a health priority. The India Anti-Obesity Drugs Market struggles with misconceptions that reduce drug adoption. Rural populations depend more on traditional remedies and lifestyle changes instead of medical treatment. Limited healthcare infrastructure restricts timely access to qualified physicians. Distribution networks in remote areas are underdeveloped, delaying access to advanced therapies. Public health campaigns are still concentrated in urban centers, leaving gaps in rural outreach. It is restricting the potential for nationwide market penetration despite strong growth in metros.

Market Opportunities:

Rising Demand for Advanced Therapies in Urban Populations

Urban India is showing growing demand for advanced obesity therapies supported by higher disposable incomes and lifestyle-related disorders. Patients are seeking safe, effective, and long-term solutions beyond traditional diet and exercise. The India Anti-Obesity Drugs Market has an opportunity to leverage this urban consumer shift. Specialty clinics and wellness centers are driving structured adoption of pharmaceutical interventions. Patients are motivated by concerns about diabetes, cardiovascular risks, and aesthetic appeal. Physicians in metro regions are increasingly prescribing modern therapies backed by clinical evidence. It is creating strong momentum for companies introducing next-generation anti-obesity drugs.

Expansion into Tier-2 Cities and E-Pharmacy Growth

Tier-2 cities are becoming important growth zones with rising healthcare infrastructure and consumer awareness. E-pharmacy platforms are strengthening drug availability with nationwide delivery systems. The India Anti-Obesity Drugs Market stands to benefit from digital penetration and wider adoption outside metros. Insurance players are starting to extend partial coverage for obesity treatments, reducing affordability gaps. Domestic firms can capitalize by offering cost-effective alternatives aligned with local demand. Strong government backing for digital healthcare strengthens these opportunities further. It is enabling the industry to tap new consumer bases beyond large metropolitan markets.

Market Segmentation Analysis:

The India Anti-Obesity Drugs Market is segmented

By product into prescription drugs and OTC drugs. Prescription drugs hold a dominant position due to their clinical efficacy and physician-driven adoption for patients with severe obesity and comorbidities. OTC drugs are gaining momentum among health-conscious consumers seeking convenient and cost-effective solutions. Growing awareness of obesity-linked risks has strengthened the demand for both categories, with prescription drugs expected to remain the primary growth driver. It benefits from strong regulatory backing and ongoing innovation in advanced formulations.

- For instance, in March 2025, Eli Lilly introduced Mounjaro (tirzepatide) in India an injectable, dual GIP and GLP‑1 receptor agonist following approval from the Central Drugs Standard Control Organization (CDSCO), reinforcing the dominance of prescription drugs in clinical obesity and diabetes care in the country.

By action pathway, the market is divided into peripherally acting drugs and centrally acting drugs. Peripherally acting drugs are widely adopted for their targeted mechanism and minimal systemic side effects, making them suitable for long-term use. Centrally acting drugs retain significance for patients requiring appetite control and central nervous system-based interventions. Physicians are increasingly balancing prescriptions across both categories depending on patient profiles. It creates a diversified demand landscape where multiple therapeutic approaches coexist.

- For example, orlistat (marketed as Xenical) operates as a peripherally acting lipase inhibitor that blocks fat absorption in the gastrointestinal tract and remains a cornerstone of long-term obesity management, capturing roughly 85% of the lipase inhibitors segment’s revenue in India in 2024.

By distribution channel segmentation highlights hospital pharmacies, e-commerce, retail pharmacies, and drug stores. Hospital pharmacies dominate due to their integration with specialist consultations and immediate prescription fulfillment. E-commerce platforms are rapidly expanding reach by offering discreet delivery and wider access to urban and semi-urban populations. Retail pharmacies remain vital due to their broad accessibility and trusted presence in local markets, while drug stores serve as an essential channel in rural and tier-2 regions. It is strengthening nationwide access, making distribution a critical enabler of market growth.

Segmentation:

By Product

- Prescription Drugs

- OTC Drugs

By Action Pathway

- Peripherally Acting Drugs

- Centrally Acting Drugs

By Distribution Channel

- Hospital Pharmacies

- E-commerce

- Retail Pharmacies

- Drug Stores

Regional Analysis:

North India holds the largest share of the India Anti-Obesity Drugs Market with 38% of total revenue in 2024, supported by high obesity prevalence across urban centers such as Delhi, Chandigarh, and Lucknow. Rising disposable incomes and lifestyle-related disorders in metropolitan areas are driving drug adoption. Hospitals and specialty clinics across this region are expanding patient access through advanced treatment programs. Strong government-led health awareness initiatives also support demand. Patients in North India show a high preference for prescription drugs over OTC products. It reflects a growing trust in clinically validated therapies that ensure long-term weight management.

South India accounts for 27% of the market share, anchored by advanced healthcare infrastructure in cities like Bengaluru, Chennai, and Hyderabad. The region demonstrates a strong uptake of prescription-based therapies due to the presence of leading hospitals and specialty centers. Rising adoption of digital health platforms supports patient engagement and wider availability of drugs through e-pharmacies. Urban populations with higher health awareness are early adopters of novel therapies such as GLP-1 receptor agonists. The India Anti-Obesity Drugs Market benefits from pharmaceutical manufacturing clusters located in South India, strengthening supply chains. It is creating a favorable ecosystem where innovation and accessibility align.

West and East India collectively represent 35% of the market, with West India contributing 20% and East India holding 15%. West India shows strong demand in cities like Mumbai, Pune, and Ahmedabad, where lifestyle disorders are common and healthcare access is well-developed. East India demonstrates slower adoption due to limited infrastructure but shows growing potential in states such as West Bengal and Odisha. Retail pharmacies and drug stores remain the primary distribution channels in these regions. The market is gradually expanding as healthcare investment rises and awareness campaigns penetrate semi-urban and rural areas. It underscores the potential for balanced growth beyond traditional metropolitan hubs.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Novo Nordisk

- Eli Lilly

- Sun Pharmaceutical Industries Ltd.

- Reddy’s Laboratories

- Cipla Ltd.

- Biocon Ltd.

- Lupin Ltd.

- Natco Pharma Ltd.

- Aurobindo Pharma Ltd.

- Torrent Pharmaceuticals Ltd.

- Zydus Lifesciences

Competitive Analysis:

The India Anti-Obesity Drugs Market is characterized by a mix of multinational corporations and domestic pharmaceutical leaders competing for share through innovation, affordability, and distribution strength. Global players such as Novo Nordisk and Eli Lilly dominate the prescription drug category with advanced GLP-1 receptor agonists that demonstrate superior efficacy in weight reduction. Domestic companies including Sun Pharmaceutical, Dr. Reddy’s Laboratories, Cipla, and Zydus Lifesciences compete aggressively by offering cost-effective alternatives and building strong retail networks. Biocon, Lupin, and Aurobindo Pharma are focusing on research-driven strategies and partnerships to expand their portfolios. Natco Pharma and Torrent Pharmaceuticals are enhancing their presence through generics and therapeutic diversification. Competition extends beyond innovation to distribution channels, with e-pharmacies emerging as strong allies for market expansion. The India Anti-Obesity Drugs Market benefits from collaborations, mergers, and regional expansions that ensure wider drug penetration across both urban and semi-urban populations. It is fostering an environment where pricing strategies, clinical credibility, and supply chain efficiency define competitive positioning.

Recent Developments:

- In July 2025, Dr. Reddy’s Laboratories announced plans to launch a generic, lower-cost version of Novo Nordisk’s Wegovy for the Indian market and 87 other countries in the coming year. This initiative represents a significant development for affordable access and signals the rising role of Indian pharmaceutical manufacturers in the global anti-obesity drugs landscape.

- In June 2025, Novo Nordisk launched its highly anticipated weight-loss drug Wegovy in India. The company introduced Wegovy just three months after Eli Lilly debuted its rival drug Mounjaro, reflecting intensifying competition in the fast-growing Indian anti-obesity drugs market.

- In March 2025, Eli Lilly launched its anti-obesity drug Mounjaro (Tirzepatide) in India, becoming the first major global company to introduce a GLP-1-based weight-loss medication in the country. Mounjaro is delivered in a single-dose vial, with monthly treatment costs between ₹14,000–17,500 depending on dosage.

Market Concentration & Characteristics:

The India Anti-Obesity Drugs Market demonstrates moderate concentration with a few global leaders holding significant shares, while domestic companies capture growth through competitive pricing and regional distribution. It reflects a dual structure where advanced prescription drugs from multinational corporations dominate premium segments, and generics or OTC drugs from Indian manufacturers cater to cost-sensitive consumers. Competitive intensity is rising due to digital health platforms that expand access and create new avenues for patient engagement. Market characteristics include rapid product innovation, shifting consumer preferences toward clinically proven therapies, and strong reliance on urban centers for initial adoption. It is evolving into a highly dynamic market where innovation, affordability, and accessibility determine leadership.

Report Coverage:

The research report offers an in-depth analysis based on Product, Action Pathway and Distribution Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The India Anti-Obesity Drugs Market will expand with increasing prevalence of obesity and lifestyle-related disorders across urban and semi-urban populations.

- Rising preference for clinically validated therapies will strengthen adoption of prescription drugs in high-risk patient groups.

- Growth of e-pharmacies and digital health platforms will improve accessibility and discreet delivery of obesity treatments.

- Advancements in GLP-1 receptor agonists and multi-target formulations will drive clinical adoption and reinforce physician trust.

- Domestic manufacturers will focus on affordable generics and biosimilars to compete with multinational companies and address cost-sensitive consumers.

- Tier-2 and tier-3 cities will emerge as significant growth zones supported by expanding healthcare infrastructure and awareness campaigns.

- Strategic partnerships between global and local firms will enhance supply chain strength and speed up product availability nationwide.

- Regulatory support for accelerated approvals will encourage innovation while maintaining safety and efficacy standards.

- Preventive healthcare models integrating lifestyle modification with drug therapies will gain traction among urban populations.

- Competitive intensity will increase with global firms introducing advanced products and Indian companies scaling regional distribution.