Market Overview

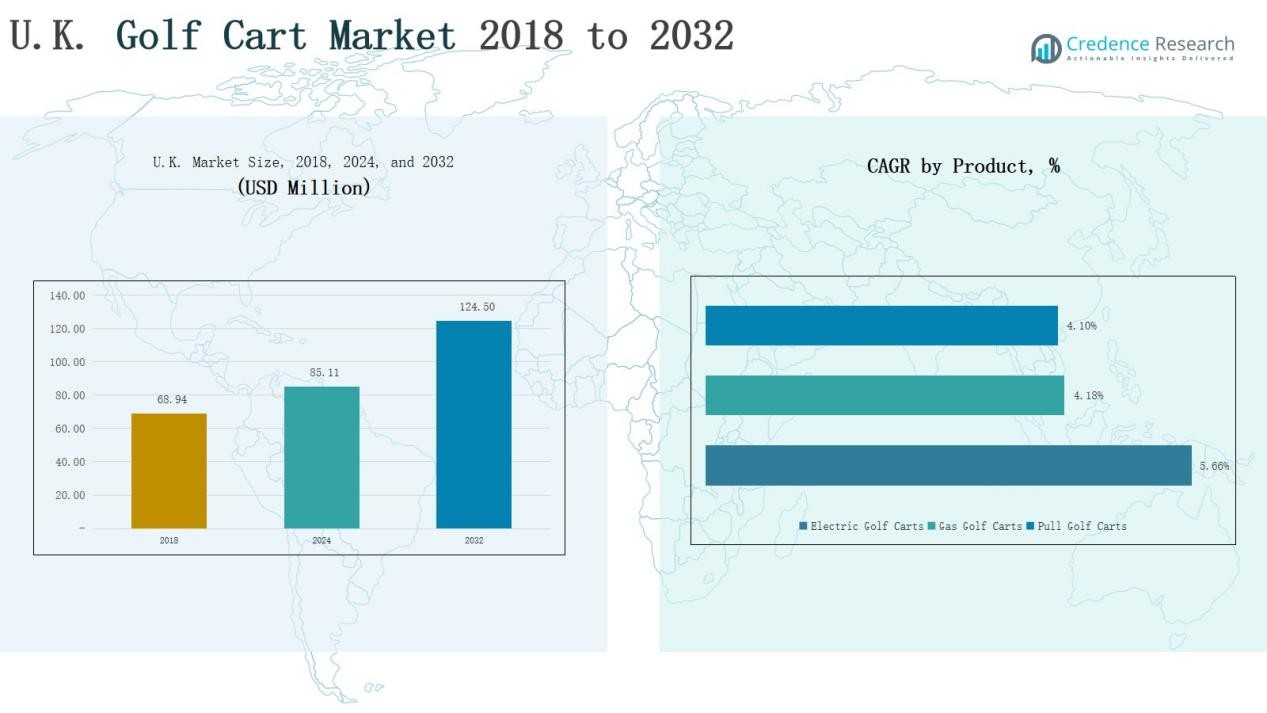

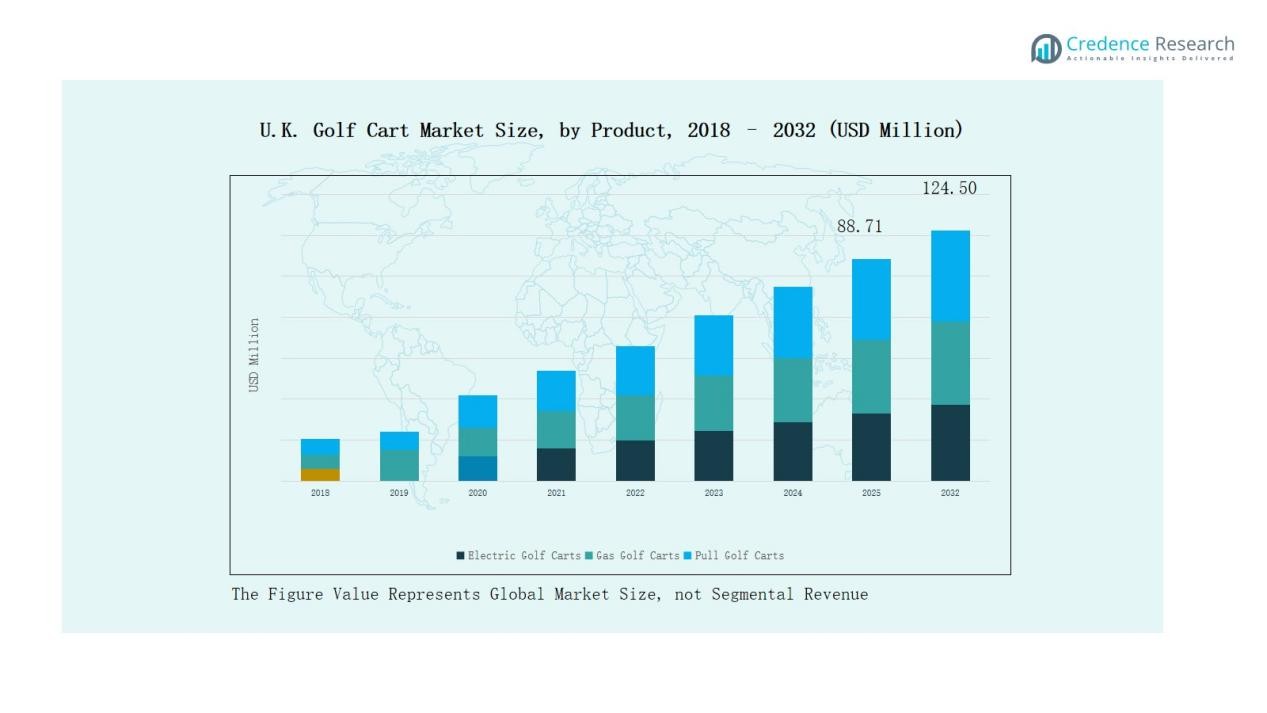

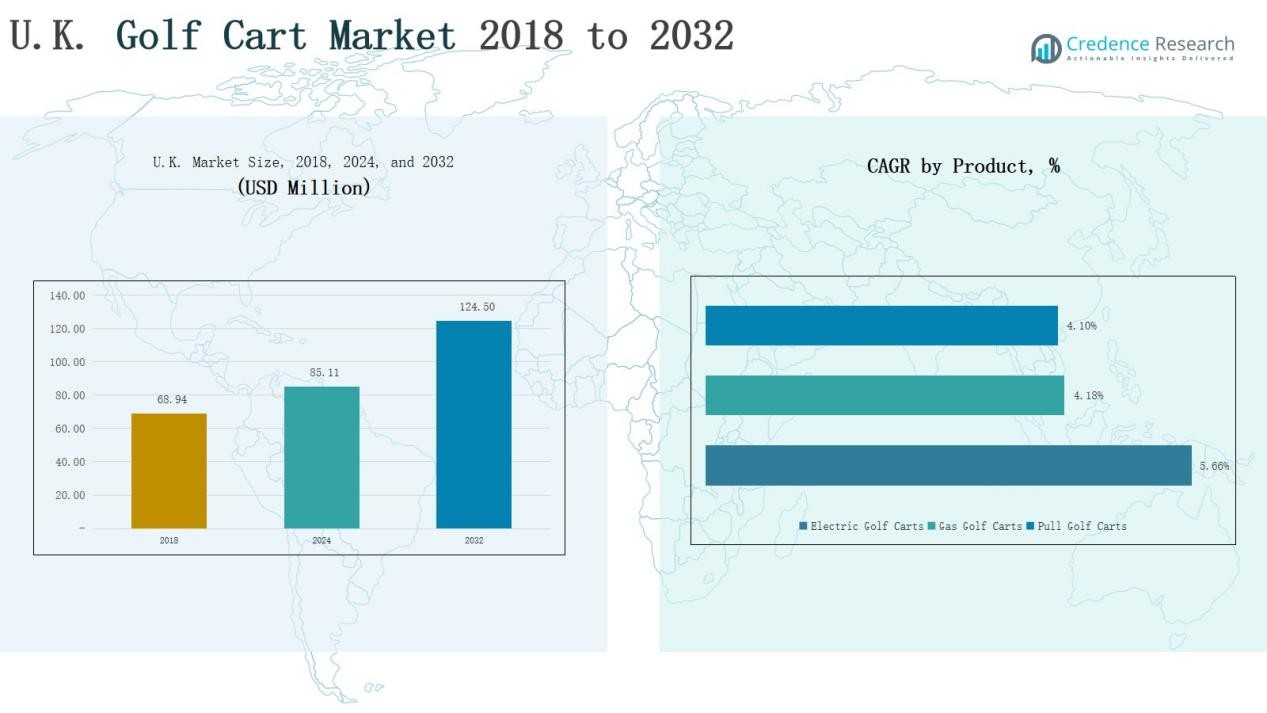

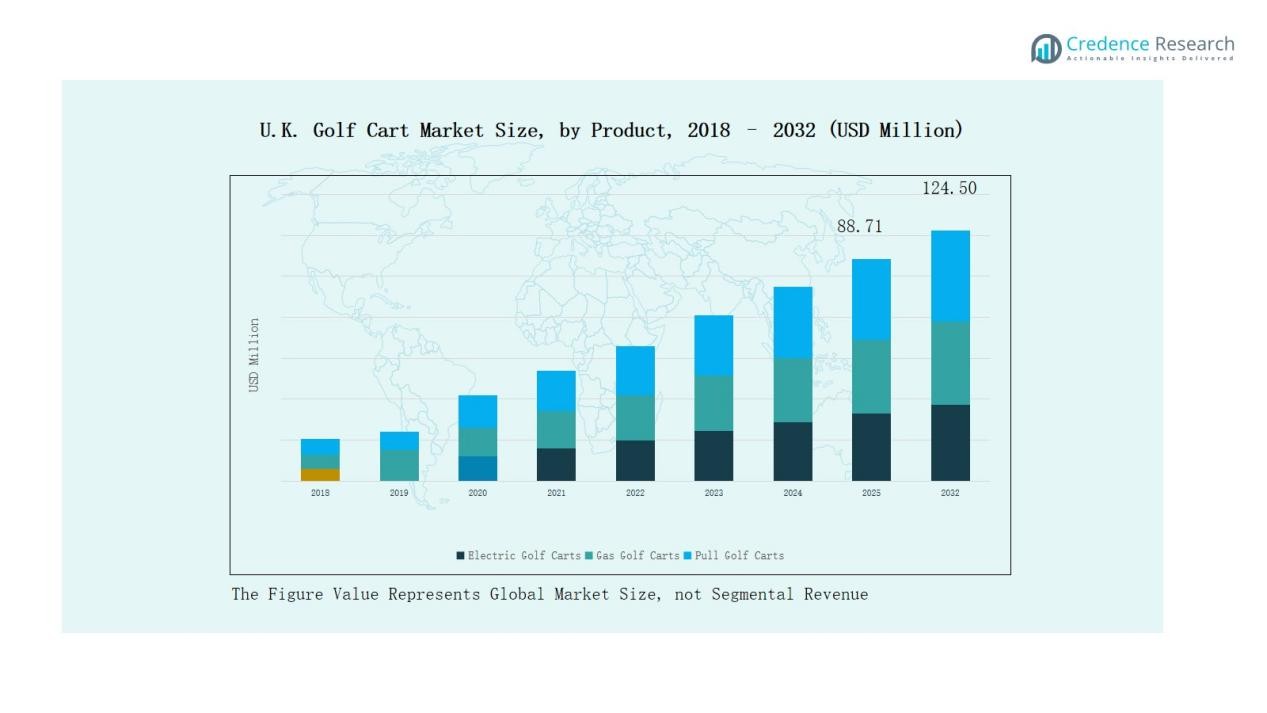

UK Golf Cart Market size was valued at USD 68.94 million in 2018 to USD 85.11 million in 2024 and is anticipated to reach USD 124.20 million by 2032, at a CAGR of 3.57% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| UK Golf Cart Market Size 2024 |

USD 85.11 Million |

| UK Golf Cart Market, CAGR |

3.57% |

| UK Golf Cart Market Size 2032 |

USD 124.20 Million |

The UK Golf Cart Market features a competitive landscape with prominent players such as Club Car, Yamaha, Motocaddy, PowaKaddy, Stewart Golf, Garia, E-Z-GO, Textron Specialized Vehicles Inc., Cruise Car, Inc., GDRIVE Golf Cart, and Melex. These companies compete through product innovation, advanced electric and hybrid models, and tailored solutions for both golfing and utility applications. England emerges as the leading regional market within the UK, commanding approximately 62% of the national market share, driven by a high concentration of golf courses, resort facilities, and expanding adoption in commercial and leisure sectors. This dominance is reinforced by strong brand presence, robust distribution networks, and growing demand for eco-friendly mobility solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The UK Golf Cart Market, valued at USD 85.11 million in 2024, is projected to reach USD 124.20 million by 2032, growing at a CAGR of 3.57%, driven by rising demand for electric models, technological innovation, and expansion into hospitality, tourism, and industrial applications.

- England leads the market with 62% share, supported by its extensive golf infrastructure, premium resorts, and adoption of eco-friendly transportation solutions.

- Manufacturers compete through product innovation, customization, and advanced features such as GPS integration, lithium-ion batteries, and fleet management systems.

- Challenges include high initial investment costs, limited charging infrastructure, and seasonal fluctuations impacting demand and revenue stability.

- Opportunities lie in luxury and customized models, broader non-golf applications, and continued investment in sustainable mobility solutions across the UK.

Market Segment Insights

By Product

In the UK Golf Cart Market, the Electric Golf Carts segment holds the leading position, driven by increasing demand for eco-friendly and low-emission mobility solutions. Their quiet operation, lower maintenance requirements, and compatibility with environmental regulations make them a preferred choice across golf courses, resorts, and private estates. Technological advancements in battery performance, including extended range and faster charging, continue to strengthen their adoption.

- For instance, Green Carts has successfully integrated electric-powered golf carts into UK leisure facilities, offering high-performance, zero-emission vehicles that help golf course operators improve efficiency while reducing environmental impact.

By Application

The Golfing segment leads the market, supported by the UK’s strong golfing tradition and a wide network of premium courses. Demand is fueled by the need for comfortable, reliable, and efficient on-course transportation, with modern fleets incorporating GPS navigation, weather-resistant designs, and advanced fleet management systems. Continuous investment in course infrastructure further enhances the adoption of golf carts in this segment.

- For instance, Trackhawk GPS provides golf courses with discreet real-time GPS tracking for enhanced security and optimized fleet management, allowing managers to monitor cart locations and pace of play efficiently.

By Seating Capacity

The 2 Seater segment dominates due to its practicality, maneuverability, and suitability for most golf course and private estate requirements. Its compact design, ease of handling, and cost efficiency make it an ideal choice for both recreational and professional use. Growing customization options, such as weather enclosures and additional storage, further expand its appeal across multiple user segments.

Key Growth Drivers

Rising Demand for Eco-Friendly Transportation

The UK Golf Cart Market is witnessing strong growth due to the increasing shift toward sustainable and low-emission mobility solutions. Electric golf carts are gaining preference as golf courses, resorts, and private estates adopt greener alternatives to meet environmental regulations and reduce operational costs. The push toward carbon neutrality and the availability of advanced battery technologies have enhanced performance, range, and charging efficiency, making electric models more attractive for both commercial and personal use.

- For instance, Tri County Golf Cars Ltd., an authorized UK dealer for E-Z-GO, brings 18 years of expertise offering quality golf carts and services. Their range supports commercial clients who prioritize reliable, electric-powered transportation on golf courses.

Expansion Beyond Golf Courses

While golf remains the core application, the market is expanding into sectors such as hospitality, tourism, real estate, and industrial facilities. Resorts, large estates, airports, and event venues are increasingly deploying golf carts for efficient on-site transportation. This diversification is supported by the carts’ versatility, low operating costs, and adaptability to varied terrains. Customizable designs, utility-focused models, and enhanced load capacities further drive adoption in non-golf applications, broadening the market’s potential.

- For instance, Yamaha Motor Co., Ltd., based in Japan, has integrated advanced lithium iron phosphate battery technology into their electric golf carts, which are increasingly deployed in gated communities, resorts, and tourism venues for quiet and sustainable mobility solutions.

Technological Advancements in Product Design

Innovations in golf cart design and technology are fueling market expansion. Features such as GPS integration, digital dashboards, advanced safety systems, and weatherproofing enhance the user experience and operational efficiency. Lithium-ion batteries, regenerative braking, and energy-efficient drivetrains improve performance while reducing maintenance needs. Additionally, manufacturers are focusing on ergonomic seating, improved suspension systems, and customizable features to cater to diverse consumer requirements, thereby boosting overall market demand.

Key Trends & Opportunities

Adoption of Lithium-Ion Battery Technology

A growing trend in the UK Golf Cart Market is the transition from lead-acid to lithium-ion batteries. Lithium-ion technology offers extended lifespan, reduced charging times, lighter weight, and improved energy efficiency. This shift aligns with sustainability goals while lowering long-term operational costs. The trend is opening opportunities for manufacturers to introduce premium electric models that appeal to eco-conscious consumers and high-end golf course operators seeking advanced, low-maintenance fleet solutions.

- For instance, Eco Tree’s LiFePO4 lithium batteries provide up to 12 times longer lifespan and charge up to 10 times faster compared to traditional lead-acid options, significantly enhancing golf cart performance on courses.

Growth in Luxury and Customized Models

An emerging opportunity lies in the rising demand for luxury golf carts featuring high-end finishes, advanced infotainment systems, and personalized aesthetics. Premium resorts, exclusive golf clubs, and private owners are increasingly seeking bespoke models that reflect their brand identity or personal style. This segment also benefits from enhanced comfort features, such as plush seating, climate control, and extended range, positioning luxury carts as a status symbol and lifestyle product beyond their traditional utility.

- For instance, Danish company Garia offers road-legal luxury golf carts priced above $20,000, equipped with refined finishes and advanced infotainment options.

Key Challenges

High Initial Investment Costs

The relatively high upfront cost of golf carts, particularly electric and luxury models, poses a barrier to adoption for smaller clubs, private buyers, and certain commercial establishments. While operational savings are realized over time, the initial expenditure can deter potential customers. This challenge is more pronounced in the premium segment, where advanced features and customization significantly increase purchase prices.

Limited Charging Infrastructure

The adoption of electric golf carts faces limitations due to insufficient charging infrastructure in some regions and facilities. Golf courses or venues without dedicated charging stations may face operational disruptions, particularly when managing large fleets. The need for grid upgrades and investment in fast-charging solutions can slow down widespread adoption, especially in rural or less-developed areas.

Seasonal and Weather-Dependent Demand

The UK’s seasonal climate impacts golf cart usage, with peak demand concentrated in warmer months. Adverse weather conditions, such as heavy rain or snow, limit outdoor activities and reduce operational hours for golf courses and resorts. This seasonality creates fluctuations in sales and rental demand, affecting revenue stability for manufacturers, dealers, and rental operators.

Regional Analysis

England

England holds the largest share of the UK Golf Cart Market at 62% due to its extensive network of golf courses, luxury resorts, and high-end leisure facilities. It benefits from a strong golfing culture supported by well-maintained courses and consistent investment in sports infrastructure. The region shows rising adoption of electric golf carts driven by environmental regulations and sustainability initiatives. Premium resorts and estates contribute significantly to demand through luxury and customized models. It continues to witness growth from non-golf applications, including hospitality and private estate use. Strong distribution networks and the presence of key market players reinforce its leadership position.

Scotland

Scotland accounts for 18% of the UK Golf Cart Market, supported by its status as the historic home of golf and host to world-class tournaments. The market benefits from steady demand from prestigious golf courses and tourism-oriented resorts. Electric models are gaining traction as operators focus on environmental sustainability and cost efficiency. It experiences consistent demand from seasonal tourism, particularly during major sporting events. Local authorities and private clubs are investing in upgrading fleets with advanced, low-emission models. The region maintains its growth momentum through heritage-driven tourism and international golfing events.

Wales

Wales represents 12% of the UK Golf Cart Market, with demand driven by a growing number of golf resorts and increasing tourism. The market benefits from the integration of golf carts in leisure and hospitality facilities. It is witnessing a shift toward electric and utility-focused models for both golfing and resort operations. Seasonal tourism peaks influence purchase patterns, with higher demand during summer months. Manufacturers are targeting the region with cost-effective, durable models suited to diverse terrains. Growing interest in outdoor leisure activities supports the expansion of the market.

Northern Ireland

Northern Ireland holds 8% of the UK Golf Cart Market, supported by its vibrant golfing scene and strong tourism sector. The region’s golf courses and resorts adopt modern fleets to enhance customer experience and operational efficiency. Electric golf carts are increasingly replacing older gas-powered models, aligning with sustainability goals. It sees opportunities from hosting international tournaments and expanding luxury hospitality projects. Investment in infrastructure and high-profile sporting events boosts demand across the market. Strong ties between tourism and golf continue to drive steady growth.

Market Segmentations:

By Product

- Electric Golf Carts

- Gas Golf Carts

- Pull Golf Carts

By Application

- Golfing

- Utility Work

- Recreation

By Seating Capacity

- 2 Seater

- 4 Seater

- 6 Seater and Above

By Region

- England

- Scotland

- Wales

- Northern Ireland

Competitive Landscape

The competitive landscape of the UK Golf Cart Market is characterized by the presence of established global manufacturers and specialized regional players competing across product innovation, customization, and service quality. Key companies such as Club Car, Yamaha, Motocaddy, PowaKaddy, Stewart Golf, Garia, E-Z-GO, Textron Specialized Vehicles Inc., Cruise Car, Inc., GDRIVE Golf Cart, and Melex dominate through diverse product portfolios that cater to both golfing and non-golf applications. Competition focuses on expanding electric and luxury segments, integrating advanced technologies such as GPS navigation, lithium-ion batteries, and fleet management systems. Manufacturers strengthen their positions through dealer partnerships, aftersales services, and targeted marketing to premium resorts and golf clubs. The market also sees rising interest in bespoke designs and eco-friendly solutions, encouraging continuous R&D investment. Strategic initiatives, including product launches, collaborations, and regional expansion, are central to maintaining market share in this highly competitive and evolving sector.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Club Car, LLC

- Yamaha

- Motocaddy

- PowaKaddy

- Stewart Golf

- Garia

- E-Z-GO

- Textron Specialized Vehicles Inc

- Cruise Car, Inc.

- GDRIVE Golf Cart

- Melex

- Other Key Players

Recent Developments

- On May 9, 2024, Stewart Golflaunched its Q Follow Carbon Range, available in Red Carbon, Blue Carbon, and Raw Carbon finishes. The range features Cerakote® ceramic coating, offering enhanced durability and a premium aesthetic.

- In April 2025, Motocaddy introduced the ME Remote, an affordable entry-level remote-controlled electric golf cart designed for convenient hands-free operation and strong handling capability

- In June 2025, PowaKaddyunveiled a redesigned cart bag range, including the FLEX, EDGE, and updated Dri-Tech models, all equipped with Mag-Lok® magnetic attachment technology for more secure and convenient cart-to-bag connection.

Market Concentration & Characteristics

The UK Golf Cart Market demonstrates a moderately concentrated structure, with a few leading manufacturers holding significant market share while regional and niche players cater to specialized needs. It is characterized by strong competition in the electric segment, driven by sustainability priorities and technological advancements. Product differentiation is achieved through performance enhancements, ergonomic designs, and customization options tailored to golfing, hospitality, and utility applications. The market benefits from established distribution channels, brand loyalty among premium golf clubs, and consistent demand from both recreational and commercial sectors. Seasonal fluctuations influence sales patterns, with peak demand aligning with tourism and sporting events. Continuous investment in battery technology, fleet management systems, and luxury model upgrades sustains competitiveness. The industry’s growth potential is reinforced by expanding non-golf applications and increasing adoption in eco-conscious infrastructure projects across the country.

Report Coverage

The research report offers an in-depth analysis based on Product, Application, Seating Capacity and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for electric golf carts will continue to grow due to environmental regulations and sustainability goals.

- Luxury and customized models will see rising adoption among premium resorts and private buyers.

- Non-golf applications such as hospitality, tourism, and industrial transport will expand market opportunities.

- Technological advancements in battery performance and charging speed will enhance operational efficiency.

- Integration of GPS navigation and fleet management systems will become standard in commercial fleets.

- Manufacturers will focus on lightweight materials and improved ergonomics for better user comfort.

- Replacement of older gas-powered carts with eco-friendly alternatives will accelerate across the country.

- Seasonal tourism peaks will drive higher sales during warmer months and major sporting events.

- Distribution networks will strengthen through partnerships with dealers and service providers.

- Increased investment in infrastructure will support greater adoption across golf courses and leisure facilities.