Market Overview:

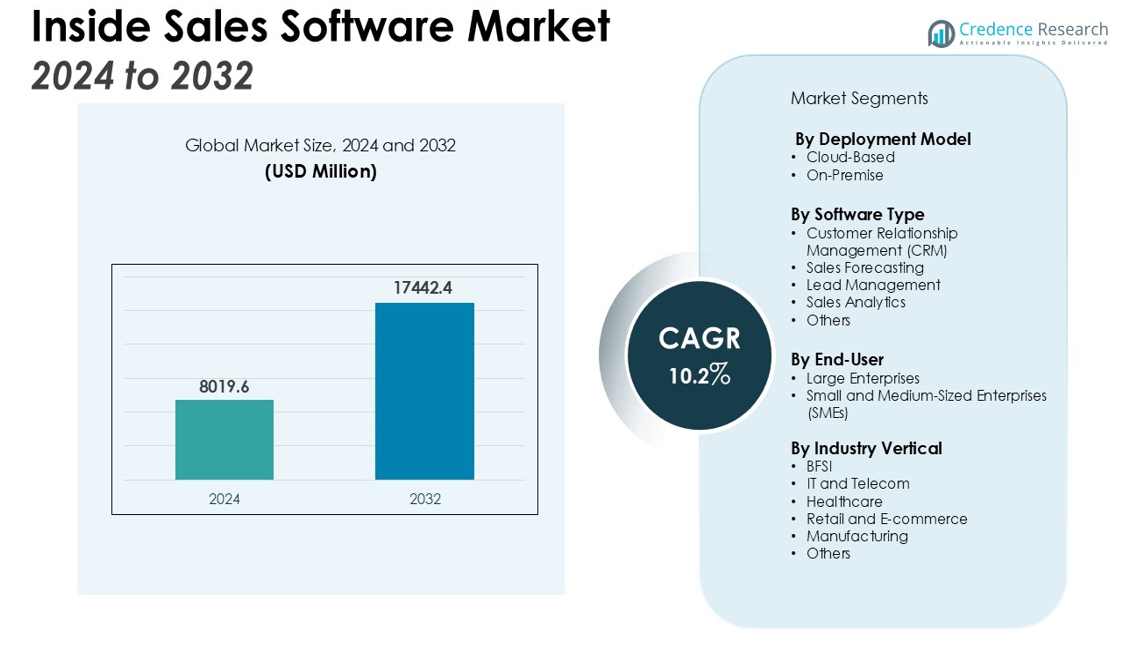

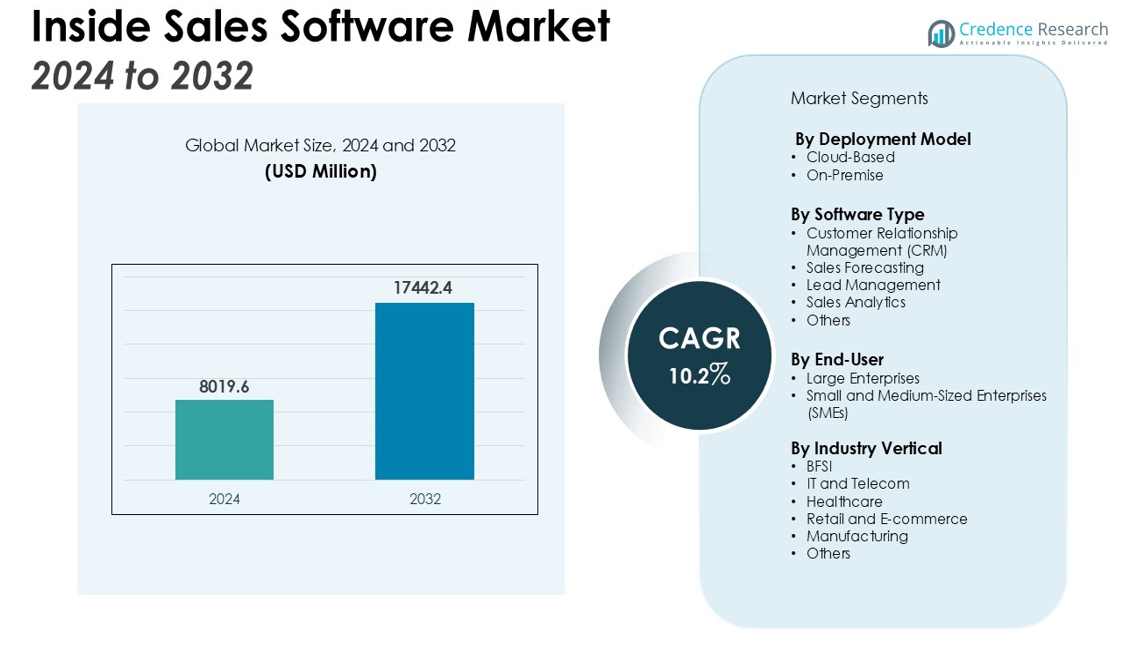

The Inside Sales Software Market size was valued at USD 8019.6 million in 2024 and is anticipated to reach USD 17442.4 million by 2032, at a CAGR of 10.2% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Inside Sales Software Market Size 2024 |

USD 8019.6 million |

| Inside Sales Software Market, CAGR |

10.2% |

| Inside Sales Software Market Size 2032 |

USD 17442.4 million |

Market expansion is driven by the rapid shift toward remote and virtual selling, along with the integration of AI-powered analytics and automation in sales processes. Businesses are investing in cloud-based solutions for their scalability, cost-effectiveness, and ability to integrate seamlessly with CRM platforms. The adoption of mobile-accessible, data-driven systems is enabling sales teams to improve productivity, optimize customer engagement, and shorten sales cycles.

North America holds the largest share of the market, supported by high technological adoption rates and the presence of leading software vendors. Europe follows with strong demand for automation and digital sales tools. The Asia-Pacific region is experiencing the fastest growth, driven by rapid digitalization and emerging economies embracing cloud solutions. South America and the Middle East & Africa are also witnessing steady adoption as sales infrastructure modernizes. Continuous innovation in AI-driven sales enablement platforms is expected to further enhance competitive differentiation and market penetration globally.

Market Insights:

- The Inside Sales Software Market was valued at USD 8019.6 million and is projected to reach USD 17442.4 million by 2032, registering a CAGR of 10.2% during the forecast period.

- Growth is fueled by the shift toward remote and virtual selling, with businesses adopting AI-powered analytics and automation to improve sales efficiency.

- Cloud-based deployments are in high demand for their scalability, cost-effectiveness, and seamless CRM integration, attracting both large enterprises and SMEs.

- Mobile-accessible, data-driven platforms are enhancing productivity by enabling sales teams to access real-time information and improve customer engagement.

- Key challenges include addressing strict data privacy regulations, ensuring security, and overcoming integration complexities with existing business systems.

- North America holds 41% of the market share, driven by advanced digital infrastructure and strong adoption of AI-enabled sales tools, while Europe holds 28% with a focus on automation and compliance.

- Asia-Pacific, with 22% market share, is the fastest-growing region due to rapid digital transformation, rising cloud adoption, and expanding e-commerce activity.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Accelerated Shift Toward Remote and Virtual Selling Models

The Inside Sales Software Market is benefitting from a widespread transition toward remote and virtual selling strategies across industries. Organizations are restructuring sales operations to minimize physical meetings and leverage digital engagement channels. It enables sales teams to conduct effective outreach, manage pipelines, and close deals without location constraints. This shift is reinforced by growing customer acceptance of virtual interactions and the cost efficiencies gained from reduced travel. Businesses are prioritizing tools that provide real-time communication, collaboration, and analytics capabilities.

- For instance, after hiring over 1,600 new inside sales representatives, Microsoft launched its Digital Inside Sales Hub.

Integration of AI-Powered Analytics and Automation Tools

It is gaining momentum through the adoption of AI-driven analytics that enhance lead scoring, sales forecasting, and customer segmentation. Automation features streamline repetitive tasks such as data entry, follow-ups, and reporting, allowing sales professionals to focus on high-value activities. The integration of predictive analytics empowers decision-making by identifying patterns and optimizing sales strategies. This technological advancement ensures better accuracy, faster response times, and improved conversion rates. The trend is encouraging vendors to enhance product capabilities with machine learning algorithms.

- For instance, vendors are enhancing their platforms to offer more granular control, such as HubSpot, which provides the capability to create up to 25 different scoring systems to precisely tailor lead prioritization to various business segments.

Growing Demand for Cloud-Based and Scalable Solutions

The Inside Sales Software Market is expanding with the rising preference for cloud-based deployments that offer scalability, flexibility, and remote accessibility. Cloud infrastructure supports seamless integration with CRM systems, enabling unified data management and workflow automation. It reduces infrastructure costs while ensuring rapid deployment and continuous updates. Organizations benefit from secure, customizable solutions that adapt to evolving sales requirements. This model is especially attractive for small and medium enterprises seeking enterprise-grade capabilities without heavy capital expenditure.

Enhanced Mobility and Real-Time Data Accessibility

It is witnessing increased adoption due to the need for mobile-accessible platforms that empower sales teams in the field. Mobile integration enables instant access to customer information, performance metrics, and sales materials from any location. Real-time data ensures timely decision-making and improved customer engagement. Businesses are equipping teams with tools that synchronize seamlessly across devices to maintain operational continuity. This mobility-focused approach is driving higher productivity and responsiveness in competitive sales environments.

Market Trends:

Adoption of AI-Driven Personalization and Predictive Capabilities

The Inside Sales Software Market is experiencing a surge in the adoption of AI-powered personalization features that enhance customer engagement and conversion rates. It enables sales representatives to tailor communications, offers, and follow-up strategies based on behavioral data and buying patterns. Predictive capabilities are helping organizations anticipate customer needs, prioritize high-value leads, and optimize sales pipelines. Vendors are incorporating advanced machine learning algorithms to improve accuracy and adaptability over time. This shift is transforming inside sales from reactive outreach to proactive, insight-driven engagement. Integration with business intelligence tools is further strengthening decision-making across sales teams.

- For instance, Salesforce launched Einstein GPT and announced it as the world’s first generative AI technology specifically for CRM, enabling the creation of AI-generated content for every sales, service, and marketing interaction.

Expansion of Omnichannel and Integrated Sales Ecosystems

It is evolving toward omnichannel sales models that unify interactions across email, social media, voice, video, and messaging platforms. This approach ensures consistent customer experiences and maximizes touchpoint effectiveness. Seamless integration with CRM, marketing automation, and customer service platforms is becoming a standard requirement. The trend is fostering the development of centralized dashboards that offer real-time visibility into customer journeys and sales performance. Cloud-based ecosystems are enabling scalable, collaborative environments for distributed teams. Growing demand for cohesive, data-driven sales ecosystems is pushing vendors to expand interoperability and enhance cross-platform functionality.

- For instance, integrating QuoteCloud with Zendesk Sell allows sales teams to collaborate on documents directly within the platform, and the integration can be set up through Zapier in just 3 steps.

Market Challenges Analysis:

Data Privacy, Security, and Compliance Concerns

The Inside Sales Software Market faces significant challenges related to data privacy, security, and regulatory compliance. It must address stringent laws such as GDPR, CCPA, and other regional data protection frameworks. Organizations handling sensitive customer information require robust encryption, access controls, and audit trails to mitigate risks. Breaches or non-compliance can lead to financial penalties and reputational damage. Vendors are under pressure to deliver secure platforms without compromising usability or performance. Balancing data accessibility with privacy safeguards remains a critical priority for industry players.

Integration Complexities and User Adoption Barriers

It is also hindered by integration complexities when connecting with existing CRM, ERP, and marketing automation systems. Disparate data formats, legacy infrastructure, and customization needs can extend deployment timelines and increase costs. Some sales teams resist adopting new technologies due to unfamiliarity or concerns about workflow disruption. Effective training, change management, and intuitive interfaces are essential to improve user adoption rates. Vendors that fail to address these challenges risk reduced customer satisfaction and retention. Ensuring seamless interoperability across diverse business environments is a decisive factor in achieving sustained market growth.

Market Opportunities:

Rising Demand for AI-Enhanced Sales Enablement Solutions

The Inside Sales Software Market holds strong opportunities through the expansion of AI-driven sales enablement tools. It can leverage advanced analytics, natural language processing, and predictive modeling to deliver deeper customer insights and targeted recommendations. Businesses are seeking platforms that not only manage sales processes but also guide representatives with data-backed strategies. AI integration offers the potential to increase win rates, reduce sales cycles, and improve customer retention. Vendors that develop intelligent, adaptive solutions stand to gain significant competitive advantages. Growing enterprise interest in automation and personalization is expected to accelerate this adoption trend.

Expansion into Emerging Markets and SMB Segments

It can capitalize on the rapid digital transformation in emerging economies, where businesses are increasingly adopting cloud-based solutions to modernize sales operations. Small and medium-sized businesses represent a high-growth segment due to their need for affordable, scalable, and easy-to-deploy platforms. Vendors offering flexible pricing models, multilingual support, and simplified integration will be well-positioned to capture this demand. Increasing internet penetration and mobile device usage in these markets enhances accessibility to inside sales software. Strategic partnerships with regional distributors and telecom providers can further expand market reach. This expansion potential creates significant long-term growth opportunities for industry participants.

Market Segmentation Analysis:

By Deployment Model

The Inside Sales Software Market is divided into cloud-based and on-premise solutions. Cloud-based deployment leads the market due to its scalability, lower upfront costs, and ease of integration with CRM and other business systems. It enables remote accessibility, faster updates, and seamless collaboration for distributed sales teams. On-premise solutions maintain demand in organizations requiring full control over data security and customization.

- For instance, Salesforce provides its cloud-based CRM platform to over 150,000 companies globally, including major enterprises like Walmart and Toyota, enabling vast scalability for their sales operations.

By Software Type

The market is segmented into customer relationship management, sales forecasting, lead management, sales analytics, and others. Customer relationship management holds a dominant share as businesses prioritize centralized platforms for managing client interactions and improving retention. Sales analytics is expanding rapidly with the integration of AI and predictive insights that optimize sales strategies. Lead management tools remain critical for pipeline visibility and conversion tracking.

By End-User

It serves industries such as BFSI, IT and telecom, healthcare, retail and e-commerce, manufacturing, and others. BFSI invests heavily in inside sales platforms to support high-volume client engagement and compliance needs. IT and telecom sectors leverage these solutions to manage complex sales cycles and global client bases. Retail and e-commerce companies adopt the software to enhance customer targeting, improve campaign effectiveness, and drive revenue growth.

- For instance, a major telecommunications provider, by implementing an integration platform from TCI to unify more than 50 disparate systems, achieved an annual cost saving of $2 million.

Segmentations:

By Deployment Model

By Software Type

- Customer Relationship Management (CRM)

- Sales Forecasting

- Lead Management

- Sales Analytics

- Others

By End-User

- Large Enterprises

- Small and Medium-Sized Enterprises (SMEs)

By Industry Vertical

- BFSI

- IT and Telecom

- Healthcare

- Retail and E-commerce

- Manufacturing

- Others

By Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis:

North America’s Market Leadership Driven by Technological Maturity

North America accounted for 41% of the Inside Sales Software Market, holding the largest regional share. The region’s dominance is supported by advanced digital infrastructure, high adoption of cloud technologies, and strong presence of leading vendors. It benefits from enterprises prioritizing AI-enabled analytics, automation, and integrated sales ecosystems to improve conversion rates. Regulatory compliance frameworks are well-established, encouraging the deployment of secure, scalable platforms. The competitive business environment drives continuous innovation in product offerings, while high investment in sales enablement tools sustains market leadership.

Europe’s Growth Supported by Automation and Compliance Standards

Europe captured 28% of the Inside Sales Software Market, maintaining a strong position in the global landscape. It is witnessing steady expansion driven by demand for sales automation tools and adherence to stringent data protection laws such as GDPR. Enterprises are investing in integrated solutions that streamline lead management and enhance cross-channel communication. Cloud adoption is accelerating as organizations seek flexible, cost-efficient platforms that can scale with market demands. Localized product offerings and multilingual support are key to addressing diverse markets, while technology providers and enterprises collaborate to deliver regulation-compliant solutions.

Asia-Pacific’s Rapid Expansion Fueled by Digital Transformation

Asia-Pacific held 22% of the Inside Sales Software Market, making it the fastest-growing regional segment. It is gaining momentum through rising internet penetration, mobile adoption, and rapid digital transformation across industries. Small and medium-sized enterprises are increasingly adopting affordable, cloud-based platforms with minimal deployment barriers. Emerging economies such as India, China, and Indonesia are investing heavily in digital sales infrastructure to capture growing consumer demand. Regional vendors and global players are competing with localization strategies and competitive pricing, while expanding e-commerce and cross-border trade further boost adoption.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Outreach

- Canvas

- HubSpot

- LeadSquared

- Zoho

- RingCentral

- Salesforce

- Zendesk

- Microsoft

- SalesLoft

- Pipedrive

Competitive Analysis:

The Inside Sales Software Market is highly competitive, with global and regional players focusing on innovation, product differentiation, and strategic partnerships. It is characterized by continuous investment in AI-driven analytics, automation features, and cloud-based capabilities to meet evolving sales needs. Leading companies are expanding their portfolios with advanced CRM integration, predictive sales tools, and omnichannel communication platforms. Vendors compete on scalability, ease of deployment, and data security compliance to attract enterprise clients and SMEs. Strategic mergers, acquisitions, and collaborations are enhancing market presence and technological expertise. Regional players are leveraging localized offerings and competitive pricing to capture emerging markets. Continuous R&D efforts aim to deliver personalized, insight-driven solutions that strengthen customer engagement and improve sales performance across industries.

Recent Developments:

- In March 2025, Zendesk unveiled several product innovations at its Relate 2025 conference, such as AI-powered Zendesk Agents and an improved Knowledge Graph for unifying help center information.

- In May 2025, SalesLoft introduced its Spring 2025 release, which featured 15 additional autonomous AI agents created to automate sales-related tasks and increase workflow efficiency.

Market Concentration & Characteristics:

The Inside Sales Software Market exhibits moderate to high concentration, with a mix of established global vendors and competitive regional players. It is dominated by companies offering comprehensive, cloud-based platforms with integrated CRM, analytics, and automation capabilities. The market is characterized by rapid technological innovation, high adoption rates in developed economies, and growing penetration in emerging regions. Competitive advantage is driven by product scalability, user-friendly interfaces, and compliance with data protection regulations. Vendors are focusing on AI-driven personalization, omnichannel integration, and mobile accessibility to meet evolving sales requirements. The presence of niche providers targeting specific industry verticals adds diversity while intensifying competition.

Report Coverage:

The research report offers an in-depth analysis based on Deployment Model, Software Type, End-User, Industry Vertical and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- AI-driven personalization will become a core feature, enabling sales teams to deliver highly targeted and context-aware customer interactions.

- Predictive analytics adoption will expand, improving lead prioritization, sales forecasting accuracy, and conversion rates.

- Cloud-based deployments will dominate, offering scalability, rapid implementation, and cost efficiency for enterprises and SMEs.

- Mobile-first platforms will gain traction, supporting on-the-go sales operations with real-time data accessibility.

- Integration with advanced CRM, marketing automation, and customer service platforms will strengthen omnichannel sales ecosystems.

- Data privacy and compliance capabilities will remain critical, with vendors investing in advanced security and encryption technologies.

- Emerging markets will drive significant adoption, fueled by digital transformation initiatives and growing internet penetration.

- Industry-specific solutions will increase, providing tailored features for sectors such as BFSI, healthcare, and retail.

- Strategic partnerships between software providers and technology firms will enhance innovation and market penetration.

- Continuous product innovation will focus on improving user experience, workflow automation, and cross-device synchronization to boost sales team productivity.