Market Overview

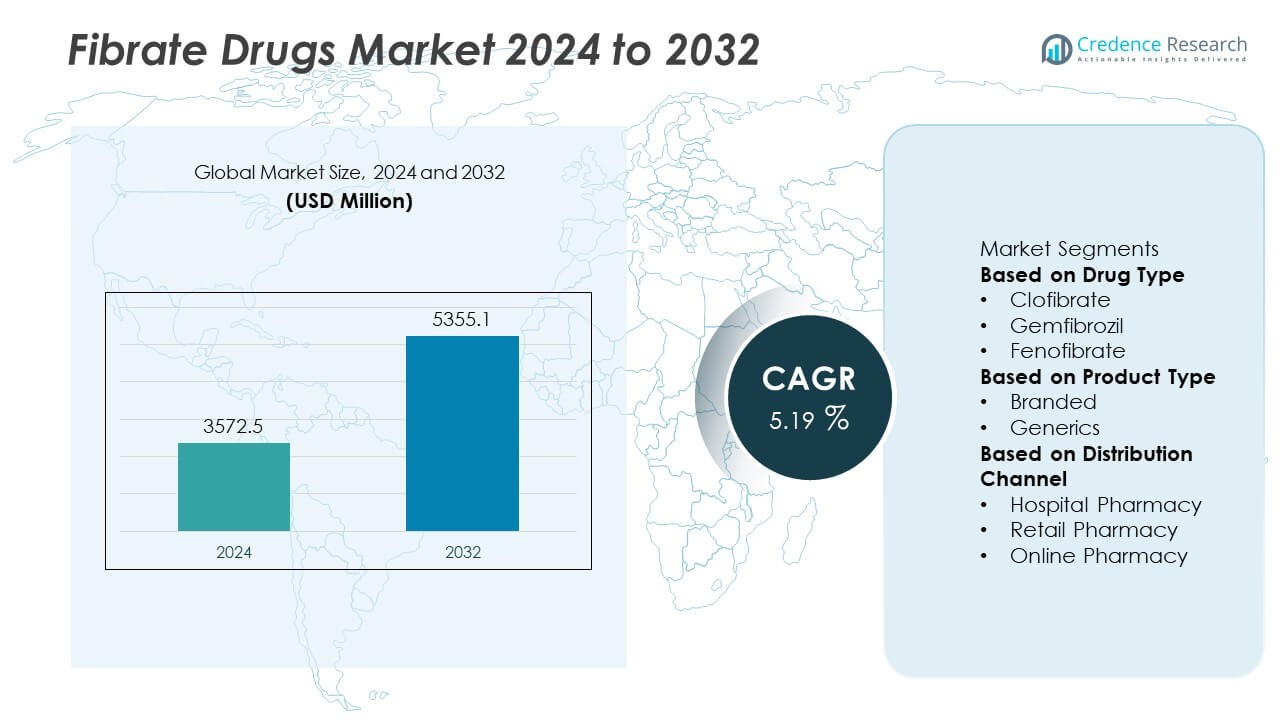

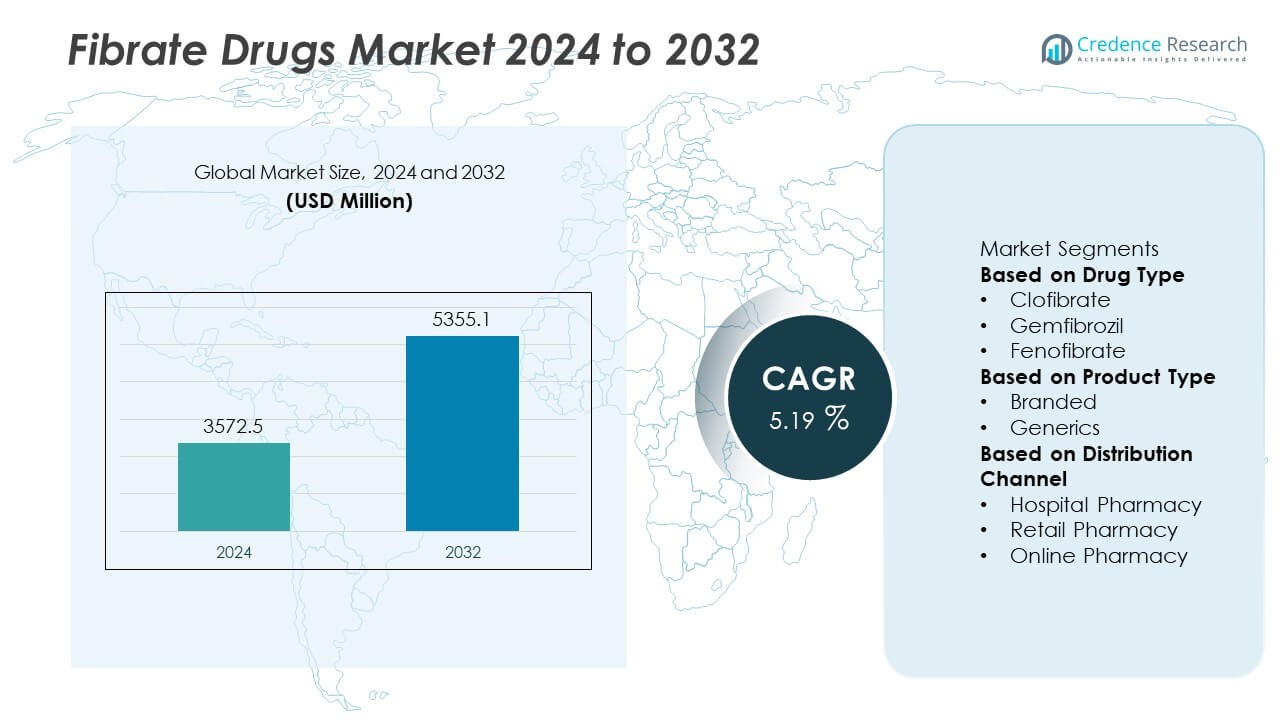

Fibrate Drugs Market size stood at USD 3,572.5 million in 2024 and is projected to reach USD 5,355.1 million by 2032, registering a CAGR of 5.19% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Fibrate Drugs Market Size 2024 |

USD 3,572.5 Million |

| Fibrate Drugs Market, CAGR |

5.19% |

| Fibrate Drugs Market Size 2032 |

USD 5,355.1 Million |

The Fibrate Drugs Market grows through rising prevalence of hyperlipidemia and cardiovascular diseases, driven by sedentary lifestyles, poor dietary habits, and aging populations. Strong clinical efficacy in reducing triglycerides and improving cholesterol balance sustains demand, while advancements in formulations enhance safety, bioavailability, and patient adherence. Preventive cardiovascular care initiatives and expanding healthcare access in emerging economies further support market growth.

The Fibrate Drugs Market spans North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa, with each region showing distinct growth dynamics. North America leads in adoption due to advanced healthcare infrastructure, high disease prevalence, and strong physician awareness. Europe demonstrates steady demand supported by robust reimbursement systems and established cardiovascular care protocols. Asia Pacific emerges as the fastest-growing region, driven by rising urbanization, lifestyle-related disorders, and improving healthcare access. Latin America and the Middle East & Africa witness gradual uptake, aided by expanding pharmacy networks and preventive healthcare initiatives. Key players shaping the competitive landscape include Pfizer Inc., Sun Pharmaceutical Industries Inc., Abbott, and Teva Pharmaceutical Industries, each leveraging product innovation, strategic partnerships, and global distribution to strengthen their market positions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Fibrate Drugs Market was valued at USD 3,572.5 million in 2024 and is projected to reach USD 5,355.1 million by 2032, growing at a CAGR of 5.19% during the forecast period.

- It expands due to the rising prevalence of hyperlipidemia and cardiovascular diseases, with increasing physician preference for fibrates in managing high triglycerides and improving cholesterol profiles.

- Emerging trends include the growing use of combination therapies with statins, development of next-generation fibrates with enhanced safety profiles, and integration of digital health platforms for patient monitoring and adherence.

- The competitive landscape features global and regional pharmaceutical companies such as Pfizer Inc., Sun Pharmaceutical Industries Inc., Abbott, and Teva Pharmaceutical Industries, each focusing on innovation, cost-effective generics, and market penetration strategies.

- The market faces restraints from intense competition with alternative lipid-lowering therapies like statins and omega-3 formulations, alongside stringent regulatory requirements for new product approvals.

- North America leads in adoption due to advanced healthcare infrastructure, Europe maintains strong demand supported by established care protocols, and Asia Pacific records the fastest growth driven by urbanization and lifestyle-related disorders.

- Latin America and the Middle East & Africa register steady growth through expanding pharmacy networks, improving healthcare access, and government-led preventive healthcare initiatives.

Market Drivers

Rising Prevalence of Hyperlipidemia and Cardiovascular Disorders Driving Demand

The growing global burden of hyperlipidemia and cardiovascular diseases significantly propels the Fibrate Drugs Market. Increasing sedentary lifestyles, poor dietary habits, and higher obesity rates contribute to elevated lipid profiles in large patient populations. Fibrate drugs play a critical role in lowering triglyceride levels and improving cholesterol balance, making them a preferred choice in treatment protocols. Healthcare providers recognize their value in reducing cardiovascular risk, which strengthens prescription volumes. Rising public health campaigns focused on early detection of dyslipidemia boost awareness and patient compliance. It benefits from this growing disease prevalence, ensuring sustained market demand.

- For instance, Pfizer reported that its fenofibrate-based therapy reduced patients’ serum triglyceride levels by approximately 68 mg/dL over a 12-week Phase III study.

Advancements in Drug Formulations and Therapeutic Efficacy Enhancing Adoption

Continuous innovation in fibrate drug formulations improves their bioavailability, patient tolerance, and therapeutic outcomes. Pharmaceutical companies invest in research to develop next-generation fibrates with reduced side effects and enhanced lipid-lowering properties. Sustained-release and combination formulations offer convenience and improved adherence, making these drugs more competitive in treatment regimens. Regulatory approvals for new formulations expand clinical options for physicians and patients. Improved efficacy in managing both triglycerides and HDL cholesterol elevates their clinical relevance. It positions itself as a viable solution for both monotherapy and combination therapy settings.

- For instance, Kowa Pharmaceuticals’ pemafibrate (K-877) was evaluated in a Phase III trial involving 2.49 million patient-days of treatment exposure, demonstrating significant triglyceride reduction with fewer renal adverse events compared to conventional fibrates.

Growing Geriatric Population with Higher Risk of Dyslipidemia Supporting Market Growth

An expanding elderly population faces an increased risk of lipid abnormalities, making fibrates a vital part of chronic disease management. Older adults often require long-term lipid-lowering therapies, and fibrates address specific lipid profile imbalances that statins may not fully control. Rising life expectancy and better access to healthcare drive higher diagnosis rates among this demographic. Physicians often prescribe fibrates to manage mixed dyslipidemia in elderly patients with comorbidities. It benefits from strong clinical evidence supporting its safety and effectiveness in older populations. The demographic shift ensures a consistent demand base for the market.

Expansion of Healthcare Access and Growing Prescription Rates in Emerging Markets

Rapid improvements in healthcare infrastructure across emerging economies drive greater accessibility to lipid-lowering therapies. Government programs promoting preventive healthcare lead to earlier detection and intervention for lipid disorders. Rising middle-class populations with increased healthcare spending power contribute to higher prescription volumes. Multinational pharmaceutical companies expand their presence in these regions through strategic partnerships and distribution networks. It gains from broader availability in retail and hospital pharmacies, increasing patient reach. Enhanced awareness among both physicians and patients accelerates the adoption of fibrate therapies in these high-growth markets.

Market Trends

Integration of Combination Therapies to Improve Lipid Management Outcomes

The Fibrate Drugs Market is witnessing a growing trend toward combination therapies that address multiple lipid parameters simultaneously. Physicians increasingly prescribe fibrates alongside statins to manage both high triglycerides and elevated LDL cholesterol. This approach enhances cardiovascular risk reduction in high-risk patients. Pharmaceutical companies are developing fixed-dose combinations that improve adherence and simplify treatment regimens. Regulatory support for combination approvals strengthens their commercial potential. It gains from the broader therapeutic scope offered by these integrated treatment strategies.

- For instance, the ACCORD-Lipid trial conducted by the National Heart, Lung, and Blood Institute enrolled 5.5 million patient-days of exposure to fenofibrate plus simvastatin, showing significant triglyceride reduction and improved HDL levels in diabetic patients.

Development of Next-Generation Fibrates with Enhanced Safety Profiles

Innovation focuses on creating fibrate molecules with improved tolerability and reduced adverse effects, particularly concerning liver function and muscle toxicity. Next-generation drugs aim to offer superior lipid-lowering capabilities while minimizing the risk of drug interactions. Advances in molecular design enable better targeting of peroxisome proliferator-activated receptors (PPARs), enhancing therapeutic precision. Clinical trials highlight promising efficacy with fewer side effects, encouraging wider physician acceptance. It positions itself as a safer long-term therapy option for chronic lipid disorders. The shift toward patient-centric formulations reflects a broader industry movement toward personalized medicine.

- For instance, Kowa Company’s selective PPARα modulator pemafibrate was evaluated in the PROMINENT trial with 10,497 patients who had baseline triglyceride levels between 200 and 499 mg/dL and type 2 diabetes.

Expansion of Preventive Cardiovascular Care Driving Early Intervention

Healthcare systems place greater emphasis on preventive care, with lipid profiling becoming a standard component of routine health check-ups. Earlier identification of dyslipidemia supports the timely initiation of fibrate therapy to avert severe cardiovascular events. Governments and insurers increasingly support preventive medication coverage, reducing financial barriers for patients. The market benefits from public awareness campaigns highlighting the risks of unmanaged triglyceride levels. It capitalizes on this preventive approach to secure long-term treatment adherence. The trend fosters higher prescription rates across both primary and specialty care settings.

Adoption of Digital Health Platforms for Patient Monitoring and Compliance

Pharmaceutical companies and healthcare providers integrate digital health solutions to track lipid levels and medication adherence in real time. Mobile apps, wearable devices, and telemedicine platforms enable remote consultations and proactive therapy adjustments. These technologies improve patient engagement and reduce therapy discontinuation rates. Data analytics tools assist physicians in customizing treatment plans for optimal results. It leverages these advancements to strengthen patient outcomes and reinforce trust in fibrate therapies. The digital shift aligns with the broader transformation of chronic disease management in healthcare systems worldwide.

Market Challenges Analysis

Stringent Regulatory Requirements and Prolonged Approval Timelines Restricting Innovation

The Fibrate Drugs Market faces challenges from complex regulatory frameworks that demand extensive clinical evidence before new formulations gain approval. Meeting stringent safety and efficacy criteria often requires long and costly trial phases, delaying market entry for innovative products. Smaller pharmaceutical firms struggle to allocate resources for such lengthy development cycles. Regulatory variations across regions create additional hurdles for companies seeking global commercialization. It experiences slower product diversification when approval processes extend beyond expected timelines. These barriers can limit patient access to improved therapeutic options.

Intense Competition from Alternative Lipid-Lowering Therapies Reducing Market Share

Fibrates compete directly with statins, omega-3 fatty acid formulations, and emerging biologics that target lipid disorders through novel mechanisms. Many physicians prefer statins for their well-established cardiovascular benefits, relegating fibrates to niche indications. The growing availability of cost-effective generic alternatives further pressures pricing and profitability. Patient adherence can decline when multiple therapy options create uncertainty about optimal treatment paths. It must differentiate itself through superior clinical outcomes or targeted use cases to maintain relevance. Competitive pressures challenge both market expansion and long-term growth potential.

Market Opportunities

Rising Focus on Personalized Lipid Management Creating New Growth Avenues

The Fibrate Drugs Market can expand by aligning with the healthcare industry’s shift toward personalized treatment strategies. Advances in genetic testing and lipid profiling allow physicians to tailor therapies based on individual patient risk factors. This precision-driven approach increases the relevance of fibrates in managing specific lipid abnormalities that other drugs may not address effectively. Pharmaceutical companies can leverage biomarker research to develop targeted fibrate formulations with improved efficacy. It benefits from integrating into precision medicine protocols, enhancing clinical outcomes and patient satisfaction. The trend creates space for innovation and niche market leadership.

Untapped Potential in Emerging Economies Driving Expansion Prospects

Rapid economic growth and improving healthcare infrastructure in emerging markets offer significant opportunities for fibrate manufacturers. Increasing public health awareness and government-led preventive care initiatives raise the detection rates of dyslipidemia. Expanding middle-class populations with greater access to prescription medications provide a growing consumer base. Strategic collaborations with local distributors and healthcare providers can accelerate market penetration. It can strengthen its position by offering cost-effective formulations that meet regional affordability standards. These markets present long-term growth potential supported by rising healthcare investments and evolving treatment protocols.

Market Segmentation Analysis:

By Drug Type

The Fibrate Drugs Market segments into fenofibrate, gemfibrozil, ciprofibrate, bezafibrate, and others. Fenofibrate holds a dominant share due to its proven efficacy in reducing triglyceride levels and improving HDL cholesterol, making it a preferred choice among physicians. Gemfibrozil remains relevant for patients requiring targeted triglyceride reduction with specific metabolic profiles. Ciprofibrate and bezafibrate offer therapeutic diversity in regions where they are clinically favored, supported by distinct pharmacological benefits. Emerging fibrate derivatives with improved safety profiles are expanding treatment options for patients intolerant to older formulations. It benefits from a diversified drug portfolio that caters to various patient needs and regional prescribing trends.

- For instance, Kowa’s pemafibrate program (PROMINENT) randomized 10,497 patients and had a median follow-up of 3.4 years, providing a large contemporary data set for a selective PPARα modulator in patients with diabetes and hypertriglyceridemia

By Product Type

The market categorizes products into branded and generic formulations. Branded fibrates continue to secure strong demand in developed markets, where brand loyalty and perceived quality influence prescribing decisions. Generic fibrates dominate in cost-sensitive regions, offering affordable access to essential lipid-lowering therapies. The growing shift toward generic adoption in developed economies, supported by healthcare cost-containment policies, impacts pricing dynamics. Pharmaceutical companies focus on value-added generics with improved delivery mechanisms to differentiate from standard options. It adapts to this dual structure by balancing innovation in branded drugs with competitive pricing in generics.

- For instance, Cipla distributed more than 11 million fibrate tablets annually across Africa and Southeast Asia by 2022, while also expanding into differentiated formulations for Europe.

By Distribution Channel

The distribution landscape includes hospital pharmacies, retail pharmacies, and online pharmacies. Hospital pharmacies account for a significant share, driven by prescriptions initiated during cardiovascular and metabolic disease management in clinical settings. Retail pharmacies provide wide accessibility for chronic therapy refills, supporting steady patient adherence. Online pharmacies are emerging as a fast-growing channel, fueled by increasing digital healthcare adoption and convenience-driven consumer behavior. Regulatory frameworks governing e-pharmacy operations vary, influencing adoption rates across regions. It gains from a multi-channel approach that ensures broad patient reach and aligns with evolving purchasing preferences.

Segments:

Based on Drug Type

- Clofibrate

- Gemfibrozil

- Fenofibrate

Based on Product Type

Based on Distribution Channel

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America accounts for the largest share of the Fibrate Drugs Market, representing approximately 37% of the global market in 2024. Strong clinical adoption of fibrates in lipid management protocols supports this dominance, particularly in the United States, where hyperlipidemia and cardiovascular disease prevalence remain high. Advanced healthcare infrastructure, extensive insurance coverage, and a large base of specialized healthcare providers drive high prescription rates. The presence of leading pharmaceutical companies and consistent regulatory approvals for newer formulations enhance market competitiveness. Canada contributes steadily, supported by public health initiatives promoting early detection of lipid disorders. It maintains growth momentum in this region through a balanced focus on branded and generic product availability. Strategic partnerships between pharmaceutical firms and healthcare networks strengthen distribution efficiency and patient access across urban and rural areas.

Europe

Europe holds around 29% of the global market share and demonstrates consistent demand for fibrate-based therapies. Countries such as Germany, France, Italy, and the United Kingdom are leading markets due to well-established cardiovascular care protocols and robust reimbursement systems. The region benefits from a strong presence of generic fibrates, making treatments more affordable and widely accessible. Ongoing clinical research in European healthcare institutions explores combination therapies, enhancing the role of fibrates in comprehensive lipid management. Eastern Europe shows increasing adoption rates as healthcare modernization programs expand diagnostic and treatment capabilities. It capitalizes on this region’s growing emphasis on preventive care and lifestyle-related disease management. Harmonized regulatory standards across the EU simplify multi-country product launches, benefiting multinational pharmaceutical companies targeting this market.

Asia Pacific

Asia Pacific represents approximately 23% of the global market and is the fastest-growing regional segment. Rising urbanization, dietary changes, and increased sedentary lifestyles contribute to higher incidences of dyslipidemia, particularly in China, India, and Japan. Expanding healthcare access, government-led screening programs, and a growing middle-class population with greater spending capacity support market expansion. Local pharmaceutical manufacturers contribute to cost-effective generic supply, boosting patient access in price-sensitive markets. Japan and South Korea focus on advanced therapeutic options, including newer-generation fibrates with improved safety profiles. It benefits from strategic collaborations with regional distributors, allowing deeper penetration into both metropolitan and rural healthcare markets. The region’s large patient pool ensures sustained demand growth over the forecast period.

Latin America

Latin America accounts for about 6% of the global market share and demonstrates steady adoption of fibrate therapies. Brazil and Mexico lead the region due to higher healthcare investments and increasing cardiovascular disease burden. Public health initiatives aimed at reducing lipid-related conditions support greater diagnostic coverage. Local production capabilities and the availability of affordable generics enhance treatment accessibility. Private healthcare expansion and growing pharmacy networks improve distribution reach. It maintains market presence in this region by aligning product offerings with regional affordability and regulatory frameworks. Challenges such as uneven healthcare infrastructure in smaller countries present opportunities for targeted expansion strategies.

Middle East & Africa

The Middle East & Africa region holds roughly 5% of the global market and is characterized by gradual adoption of fibrates in clinical practice. Gulf Cooperation Council (GCC) countries, led by Saudi Arabia and the UAE, drive demand through advanced healthcare systems and high rates of lifestyle-related lipid disorders. In Africa, South Africa serves as the primary market due to its developed healthcare sector and improving access to prescription medicines. Limited healthcare resources in parts of Sub-Saharan Africa slow adoption, but international health programs are helping to improve access. It benefits from the growing presence of private healthcare providers and the establishment of retail pharmacy chains. Expansion strategies in this region often focus on urban centers, where patient awareness and purchasing power are higher.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Sun Pharmaceutical Industries Inc.

- Pfizer Inc.

- Abbott

- Mylan N.V.

- Teva Pharmaceutical Industries

- Macleods Pharmaceuticals Limited

- Sanofi SA

- Novartis AG

- Aurobindo Pharma

- GlaxoSmithKline plc

Competitive Analysis

The competitive landscape of the Fibrate Drugs Market is characterized by the presence of prominent global and regional pharmaceutical companies competing through product innovation, cost efficiency, and strategic market expansion. Key players include Pfizer Inc., Sun Pharmaceutical Industries Inc., Abbott, Teva Pharmaceutical Industries, Novartis AG, Sanofi SA, GlaxoSmithKline plc, Mylan N.V., Macleods Pharmaceuticals Limited, and Aurobindo Pharma. These companies leverage extensive R&D capabilities to develop improved fibrate formulations with enhanced bioavailability, better safety profiles, and convenient dosing. Generic manufacturers such as Macleods Pharmaceuticals Limited, Aurobindo Pharma, and Mylan N.V. focus on affordability and large-scale production to capture price-sensitive markets, particularly in Asia Pacific and Latin America. Multinational giants like Pfizer Inc., Sanofi SA, and Novartis AG strengthen their market positions through robust distribution networks, regulatory approvals, and brand recognition. Sun Pharmaceutical Industries Inc. and Abbott maintain strong footprints in both branded and generic segments, supported by diversified product portfolios. Competitive strategies involve partnerships with healthcare providers, expansion into emerging economies, and adaptation to regional regulatory frameworks to ensure sustainable growth and market presence.

Recent Developments

- In July 2025, Novartis’s Leqvio (inclisiran) received FDA approval as a first-line LDL-C reduction therapy. It is not a fibrate but a small interfering RNA (siRNA) treatment designed to lower LDL cholesterol by targeting PCSK9 protein production.

- In December 2023, Mylan received FDA clearance for generic fenofibrate extended-release tablets—expanding affordable access for U.S. patients with high cholesterol and triglycerides.

- In January 2023, Glenmark Pharmaceuticals Ltd. (Glenmark), a research-led, global pharmaceutical company, launched a biosimilar of the popular 10,11 anti-diabetic drug, Liraglutide, for the first time in India. The drug is being marketed under the brand name Lirafit™ following the approval from the Drug Controller General of India (DCGI).

Market Concentration & Characteristics

The Fibrate Drugs Market exhibits moderate concentration, with a mix of global pharmaceutical leaders and strong regional manufacturers competing across branded and generic segments. It features well-established players with extensive distribution networks, robust research capabilities, and regulatory expertise that enable sustained market presence. The market is characterized by steady demand from chronic lipid disorder management, supported by its proven efficacy in lowering triglycerides and improving HDL cholesterol. Generic competition is intense, particularly in cost-sensitive regions, where affordability drives prescribing decisions. Innovation focuses on improved formulations, combination therapies, and enhanced safety profiles to differentiate products in a crowded therapeutic space. It operates in a regulated environment with high entry barriers due to stringent approval requirements and complex clinical trial demands. Demand remains stable across both developed and emerging markets, with growth opportunities tied to preventive cardiovascular care initiatives and the rising global burden of dyslipidemia.

Report Coverage

The research report offers an in-depth analysis based on Drug Type, Product Type, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with rising global prevalence of hyperlipidemia and cardiovascular diseases.

- Demand will increase through wider adoption of fibrates in combination therapy with statins.

- Next-generation fibrates with improved safety profiles will strengthen clinical acceptance.

- Preventive healthcare initiatives will drive earlier diagnosis and treatment adoption.

- Growth in emerging economies will accelerate due to improved healthcare access.

- Digital health tools will enhance patient monitoring and therapy adherence.

- Generic fibrates will dominate in price-sensitive regions, supporting wider accessibility.

- Strategic collaborations will improve distribution efficiency and market penetration.

- Regulatory approvals for innovative formulations will create new commercial opportunities.

- Rising geriatric populations will sustain long-term demand for chronic lipid management.