Market Overview:

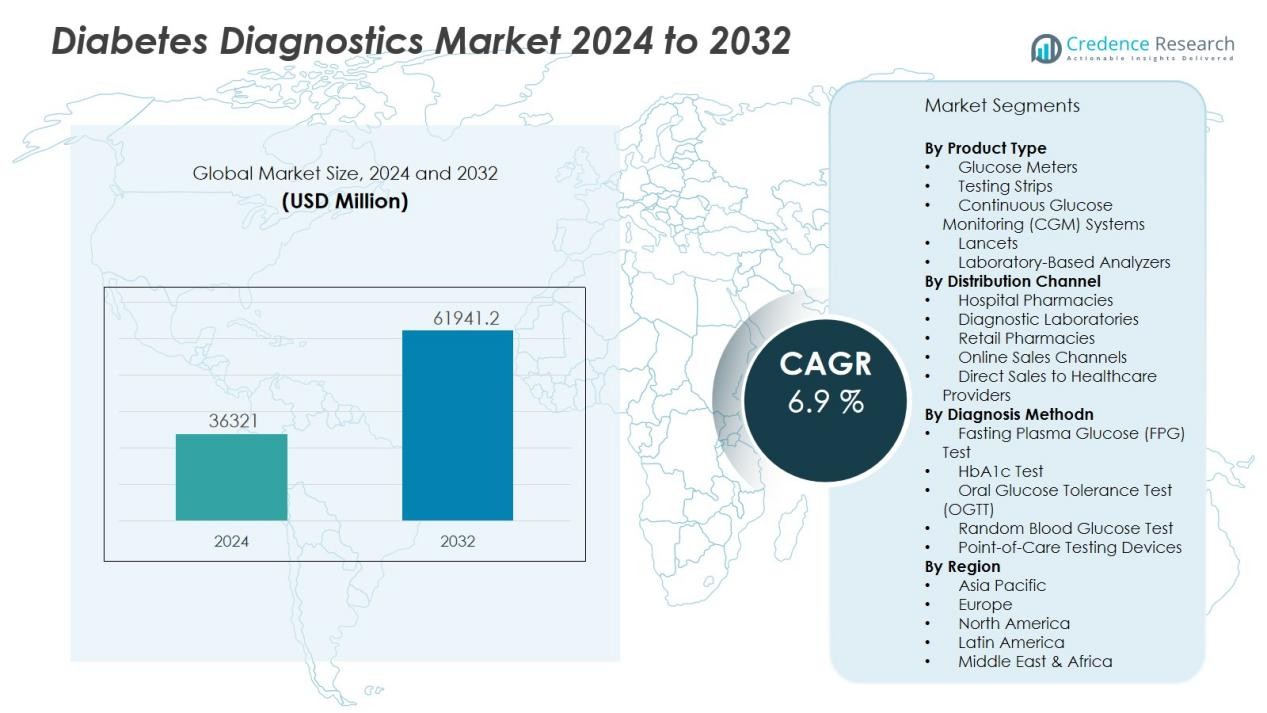

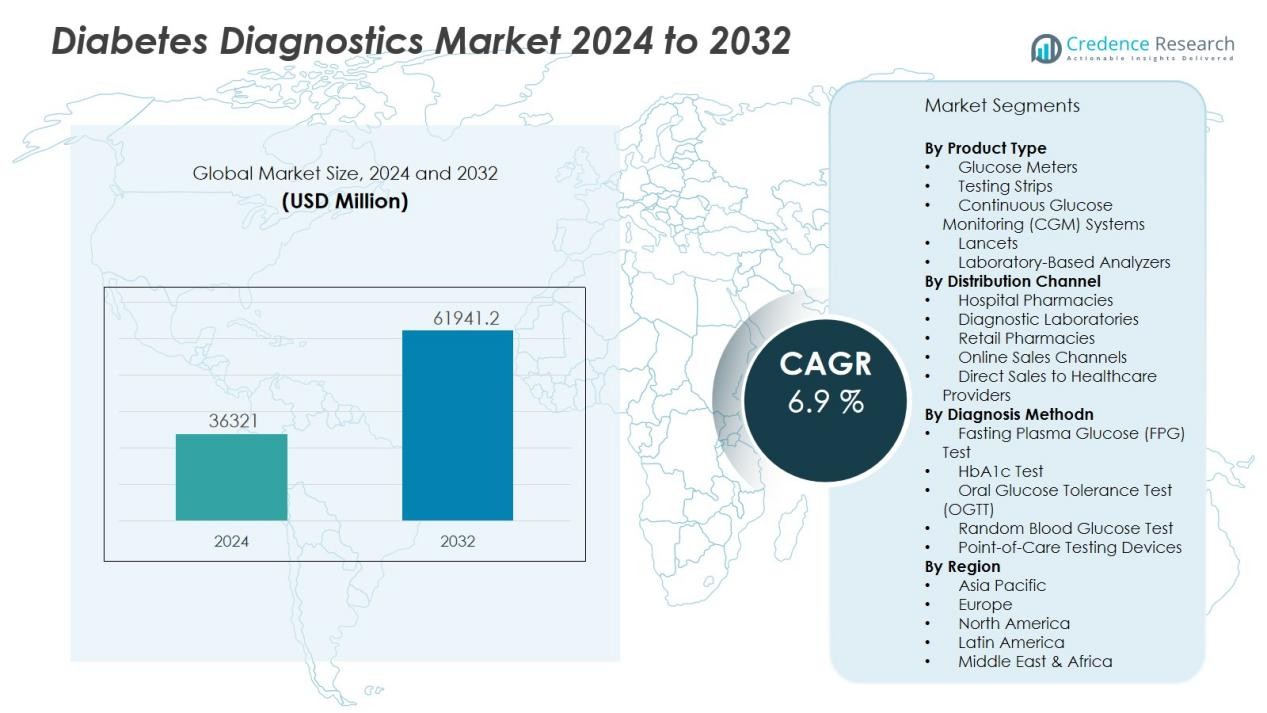

The diabetes diagnostics market size was valued at USD 36321 million in 2024 and is anticipated to reach USD 61941.2 million by 2032, at a CAGR of 6.9 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Diabetes Diagnostics Market Size 2024 |

USD 36321 Million |

| Diabetes Diagnostics Market, CAGR |

6.9 % |

| Diabetes Diagnostics Market Size 2032 |

USD 61941.2 Million |

Growth is driven by factors such as the rising incidence of type 1 and type 2 diabetes, driven by sedentary lifestyles, unhealthy dietary patterns, and aging populations. The adoption of minimally invasive and continuous glucose monitoring technologies is gaining momentum due to their real-time tracking capabilities and improved patient compliance. Additionally, supportive government initiatives, growing healthcare expenditure, and the expansion of home-based diagnostic solutions are fostering broader market penetration. The integration of AI and IoT-enabled platforms for predictive analysis is also creating new opportunities for personalized diabetes management.

Regionally, North America holds the largest share of the market, supported by high healthcare spending, advanced diagnostic infrastructure, and strong patient awareness programs. Europe follows closely, with well-established screening protocols and government-backed preventive healthcare initiatives. The Asia-Pacific region is expected to register the fastest growth due to rapid urbanization, increasing healthcare access, and a growing patient pool in countries such as China and India. Latin America and the Middle East & Africa present emerging opportunities, driven by improving healthcare systems and expanding diagnostic networks.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The diabetes diagnostics market was valued at USD 36,321 million in 2024 and is projected to reach USD 61,941.2 million by 2032, growing at a CAGR of 6.9% during 2024–2032.

- Rising incidence of type 1 and type 2 diabetes, fueled by sedentary lifestyles, poor dietary habits, and aging populations, is creating strong demand for early detection tools.

- Advancements in continuous glucose monitoring, non-invasive devices, and AI-powered analytics are enhancing diagnostic precision and patient convenience.

- Government initiatives, public-private partnerships, and increased healthcare funding are improving access to diagnostic services, particularly in underserved regions.

- High device costs, limited insurance coverage, and infrastructure gaps remain key challenges in expanding adoption in developing economies.

- North America leads with a 38% market share, followed by Europe at 29%, while Asia-Pacific holds 24% and is projected to grow the fastest.

- Expanding adoption of home-based testing kits, wearable biosensors, and telehealth integration is reshaping market dynamics and driving patient engagement.

Market Drivers:

Rising Global Diabetes Prevalence Driving Diagnostic Demand:

The growing incidence of type 1 and type 2 diabetes is a primary driver for the diabetes diagnostics market. Sedentary lifestyles, unhealthy dietary habits, and rising obesity rates are contributing to higher diagnosis rates worldwide. It is fueling the need for early detection tools that can prevent complications and reduce long-term healthcare costs. Healthcare systems are prioritizing screening programs to identify prediabetic and undiagnosed diabetic populations at an earlier stage. This trend is creating sustained demand for both laboratory-based and point-of-care diagnostic solutions.

- For instance, Abbott Laboratories reported over 5 million users worldwide for its FreeStyle Libre continuous glucose monitoring system in 2024, demonstrating significant adoption of advanced diagnostic technology for diabetes management.

Technological Advancements Enhancing Accuracy and Efficiency:

Innovations in diagnostic technology are transforming diabetes detection and monitoring. Continuous glucose monitoring systems, non-invasive devices, and AI-powered analytics are improving diagnostic precision and patient convenience. The diabetes diagnostics market is benefiting from automated laboratory platforms that enable faster turnaround times and higher testing volumes. Integration with mobile health applications allows real-time data sharing between patients and healthcare providers. These advancements are strengthening patient engagement and long-term disease management.

- For instance, Dexcom’s G6 CGM system offers instantaneous glucose updates and alert features, recording glucose levels every 5minutes for high-frequency management.

Government Initiatives and Healthcare Policy Support:

National health authorities are implementing programs to address the growing diabetes burden through awareness campaigns and subsidized testing. Public-private partnerships are improving access to diagnostics in underserved regions. It is enabling early intervention strategies that align with broader preventive healthcare goals. Funding for research and innovation is further supporting the development of advanced, cost-effective testing methods. These policies are shaping a favorable regulatory environment for market growth.

Shift Toward Home-Based and Remote Diagnostic Solutions:

Rising demand for home-based diagnostics is reshaping the competitive landscape. Compact, user-friendly devices are allowing patients to self-monitor with minimal clinical supervision. The trend is being reinforced by telemedicine adoption, enabling healthcare providers to remotely review and adjust treatment plans. It is reducing the need for frequent hospital visits while maintaining continuous care. This shift supports broader adoption in both developed and emerging markets.

Market Trends:

Integration of Digital Health and Artificial Intelligence in Diagnostics:

The diabetes diagnostics market is experiencing a rapid integration of digital health platforms and AI-driven tools. Advanced algorithms are enabling predictive analysis, early risk identification, and personalized treatment recommendations. Continuous glucose monitoring devices linked to smartphone applications are providing real-time data for patients and healthcare providers. It is improving disease management by facilitating timely interventions and lifestyle adjustments. AI-powered diagnostic platforms are also enhancing accuracy by analyzing large datasets from multiple sources. Cloud-based solutions are allowing secure data storage and seamless sharing across healthcare networks. This digital shift is driving both patient engagement and operational efficiency in clinical settings.

- For instance, Roche Diagnostics integrated its Accu-Chek Guide with the mySugr app, allowing users to automatically sync their blood glucose readings; mySugr reported a 36% improvement in patient adherence to glucose monitoring routines among its over 3 million registered users in 2024.

Growing Adoption of Non-Invasive and Wearable Diagnostic Technologies:

Demand for non-invasive and wearable diagnostic solutions is shaping the future of diabetes monitoring. Manufacturers are focusing on developing needle-free glucose measurement devices that enhance comfort and reduce infection risks. The diabetes diagnostics market is seeing increased investment in smart wearables that integrate biosensors for continuous monitoring. It is expanding adoption among patients seeking discreet and convenient diagnostic options. Wearable technologies are also supporting remote patient monitoring programs, enabling healthcare providers to track patient progress without frequent clinic visits. Enhanced interoperability with telemedicine platforms is streamlining virtual consultations and treatment adjustments. This trend is creating new opportunities for both established players and emerging innovators.

- For instance, Senseonics implanted its first 1,000 Eversense E3 sensors in U.S. patients in 2022, delivering an average of 41,584 real-time glucose readings per user over the 180-day wear period.

Market Challenges Analysis:

High Costs and Limited Accessibility in Developing Regions:

The diabetes diagnostics market faces significant barriers in regions with limited healthcare infrastructure and economic constraints. High device and testing costs restrict adoption among low-income populations, particularly in rural areas. It is further impacted by insufficient insurance coverage and lack of government-funded screening programs. Distribution challenges, coupled with inadequate trained personnel, limit the availability of advanced diagnostic tools. Patients in underserved areas often rely on outdated or less accurate methods, delaying timely intervention. Overcoming these cost and accessibility issues remains critical for equitable market expansion.

Regulatory Complexities and Data Privacy Concerns:

Stringent regulatory approval processes can slow the introduction of innovative diagnostic technologies. The diabetes diagnostics market must navigate varying compliance requirements across regions, which increases time-to-market and development costs. It is also challenged by data privacy regulations, especially with the rise of connected devices and digital health platforms. Protecting patient health data while enabling seamless sharing for clinical use is a persistent concern. Cybersecurity risks further complicate adoption of AI-powered and cloud-based solutions. Addressing these regulatory and security challenges is essential for building trust and ensuring sustainable growth.

Market Opportunities:

Expansion in Emerging Markets with Growing Healthcare Investments:

The diabetes diagnostics market holds significant potential in emerging economies where healthcare infrastructure is rapidly developing. Rising disposable incomes, urbanization, and increasing awareness of preventive healthcare are driving demand for modern diagnostic solutions. It is further supported by government initiatives aimed at improving access to diabetes screening and management. Partnerships between international manufacturers and local distributors can accelerate product penetration. Investments in mobile clinics and community-based screening programs are extending reach to rural and underserved populations. These factors create strong growth prospects in Asia-Pacific, Latin America, and parts of the Middle East and Africa.

Innovation in Non-Invasive and AI-Driven Diagnostic Solutions:

Advancements in non-invasive technologies present lucrative opportunities for market expansion. The diabetes diagnostics market is seeing rising interest in wearable sensors, smart patches, and AI-enabled platforms that enhance patient comfort and monitoring accuracy. It is benefiting from increasing adoption of home-based testing kits integrated with telemedicine services. AI-driven predictive analytics can improve early detection rates and personalized care strategies. Companies investing in R&D for compact, cost-effective devices can capture a broader customer base. The combination of convenience, accuracy, and digital integration positions these innovations as key drivers for future market growth.

Market Segmentation Analysis:

By Product Type:

The diabetes diagnostics market comprises glucose meters, testing strips, continuous glucose monitoring (CGM) systems, lancets, and laboratory-based analyzers. CGM systems are witnessing rapid adoption due to their real-time tracking capabilities and ability to reduce finger-prick testing. Glucose meters and strips maintain significant demand owing to affordability and widespread availability. Laboratory analyzers remain essential for comprehensive clinical assessments and confirmatory testing. Product innovation is focused on enhancing accuracy, portability, and connectivity with digital health platforms.

- For instance, the Nova Primary Glucose Analyzer, FDA-cleared in October 2022, provides precision equivalent to the legacy YSI 2300 reference system for measuring blood glucose in lithium heparinized whole blood or plasma, allowing clinical laboratories to process 100s of samples per day with advanced sensor technology and automated reporting.

By Distribution Channel:

Hospital pharmacies and diagnostic laboratories dominate distribution, supported by consistent patient flow and institutional purchasing power. Retail pharmacies play a critical role in ensuring product accessibility for self-monitoring patients. The diabetes diagnostics market is expanding through online sales, driven by growing e-commerce penetration and the convenience of home delivery. It is also seeing increased adoption of subscription-based models for consumables like testing strips. Direct sales to healthcare providers are enabling faster product availability in specialized care facilities.

- For instance, CVS Health dispensed more than 4 million glucose monitoring prescriptions in 2023 through its retail pharmacy network, enhancing convenient patient access to diabetes diagnostics.

By Diagnosis Method:

Diagnosis methods include fasting plasma glucose (FPG) tests, HbA1c tests, oral glucose tolerance tests (OGTT), and random blood glucose tests. HbA1c testing is gaining preference due to its ability to reflect long-term blood sugar control. FPG and OGTT remain widely used for initial diagnosis and prediabetes screening. Point-of-care testing devices are enabling faster turnaround times in clinics and home settings. It is fostering timely interventions and improved patient compliance.

Segmentations:

By Product Type:

- Glucose Meters

- Testing Strips

- Continuous Glucose Monitoring (CGM) Systems

- Lancets

- Laboratory-Based Analyzers

By Distribution Channel:

- Hospital Pharmacies

- Diagnostic Laboratories

- Retail Pharmacies

- Online Sales Channels

- Direct Sales to Healthcare Providers

By Diagnosis Method:

- Fasting Plasma Glucose (FPG) Test

- HbA1c Test

- Oral Glucose Tolerance Test (OGTT)

- Random Blood Glucose Test

- Point-of-Care Testing Devices

By Region:

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Regional Analysis:

North America :

North America holds a market share of 38% in the global diabetes diagnostics market, supported by advanced healthcare infrastructure and high adoption of innovative diagnostic technologies. The region benefits from extensive screening programs, strong reimbursement policies, and a well-established network of healthcare providers. It is further driven by high awareness levels among patients and healthcare professionals, encouraging early detection and disease management. Continuous glucose monitoring systems, AI-enabled diagnostic platforms, and home-based testing kits are widely integrated into patient care. The presence of leading market players accelerates the pace of technological innovation. Favorable regulatory frameworks and research funding continue to reinforce the region’s dominant position.

Europe :

Europe accounts for a market share of 29% in the diabetes diagnostics market, driven by stringent healthcare regulations and widespread adoption of preventive care strategies. Government-backed awareness campaigns and subsidized screening programs are increasing early diagnosis rates. It is supported by strong public healthcare systems and investments in advanced laboratory infrastructure. The region shows strong uptake of continuous glucose monitoring and telehealth-integrated diagnostic services. Collaborations between healthcare providers and technology companies are enhancing patient engagement and remote monitoring capabilities. A focus on reducing diabetes-related complications through timely interventions sustains steady market demand.

Asia-Pacific :

Asia-Pacific holds a market share of 24% and is expected to witness the fastest growth rate in the diabetes diagnostics market during the forecast period. Rapid urbanization, rising healthcare expenditure, and expanding access to diagnostic services are driving market expansion. It is further supported by large patient populations in countries such as China and India, where diabetes prevalence is rising sharply. Government health initiatives and public-private partnerships are improving diagnostic reach in both urban and rural areas. Increasing adoption of affordable home-based testing devices is encouraging regular monitoring. Growing investments in healthcare technology and manufacturing capacity are positioning the region as a key growth hub.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Medtronic plc

- F.Hoffmann-La-Ltd.

- Abbott Laboratories

- Bayer AG

- Valeritas Holding Inc.

- B Braun Melsungen AG

- Lifescan, Inc.

- Lifescan, Inc.

- Insulet Corporation

- Ypsomed Holdings

- Companion Medical

- Dexcom Inc.

- Sanofi

Competitive Analysis:

The diabetes diagnostics market is highly competitive, with global leaders focusing on innovation, product portfolio expansion, and strategic collaborations to strengthen market presence. Key players include Medtronic plc, F. Hoffmann-La Roche Ltd., Abbott Laboratories, Bayer AG, Valeritas Holding Inc., B. Braun Melsungen AG, and Lifescan, Inc. It is driven by advancements in continuous glucose monitoring systems, non-invasive diagnostic solutions, and AI-enabled platforms that enhance accuracy and patient convenience. Companies are investing in research and development to improve device connectivity, usability, and integration with telehealth services. Competitive strategies also involve expanding distribution networks, entering emerging markets, and forming partnerships with healthcare providers. Regulatory compliance, cost competitiveness, and brand reputation play critical roles in sustaining leadership. The market dynamic favors companies that can deliver high-performance, affordable solutions while addressing unmet needs in both developed and developing regions.

Recent Developments:

- In August 2024: Abbott Laboratories announced a global partnership with Medtronic to integrate Abbott’s latest FreeStyle Libre continuous glucose monitoring technology with Medtronic’s automated insulin delivery and smart insulin pen systems, enhancing diabetes care options for patients.

- In July 2024, F. Hoffmann-La Roche Ltd. completed the acquisition of LumiraDx’s Point of Care technology, expanding Roche’s diagnostic portfolio and enabling wider access to advanced immunoassay and future molecular testing at the primary care level.

- In April 2025, Medtronic plc received FDA approval for its Simplera Sync™ sensor, designed for use with the MiniMed™ 780G insulin pump system, thereby extending its range of continuous glucose monitoring solutions in the United States.

Market Concentration & Characteristics:

The diabetes diagnostics market is moderately concentrated, with a mix of global leaders and regional players competing through innovation, product diversification, and strategic partnerships. It is characterized by continuous advancements in continuous glucose monitoring systems, point-of-care testing devices, and AI-integrated platforms. Leading companies invest heavily in research and development to enhance accuracy, ease of use, and connectivity of diagnostic solutions. The market demonstrates high entry barriers due to stringent regulatory requirements, strong intellectual property protections, and the need for significant technological expertise. Competition is also shaped by pricing strategies, distribution networks, and after-sales service capabilities. Growing demand for home-based and non-invasive diagnostic devices is encouraging both established and emerging companies to expand their portfolios.

Report Coverage:

The research report offers an in-depth analysis based on Product Type, Distribution Channel, Diagnosis Method and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- Increasing integration of AI and machine learning will enhance diagnostic accuracy and enable predictive risk assessment for better disease management.

- Expansion of telemedicine and remote monitoring will drive demand for connected glucose monitoring devices and home-based testing kits.

- Rising healthcare investments in emerging economies will improve accessibility to advanced diagnostic technologies.

- Development of non-invasive and needle-free glucose monitoring solutions will boost patient adoption and compliance.

- Strategic collaborations between technology firms and healthcare providers will accelerate innovation and market penetration.

- Regulatory support for preventive healthcare initiatives will strengthen early detection programs.

- Growing adoption of wearable biosensors will enable continuous, real-time glucose tracking in daily life.

- Increasing focus on personalized medicine will lead to tailored diagnostic solutions based on individual risk profiles.

- Advancements in cloud-based health data platforms will enhance patient–provider connectivity and care coordination.

- Emphasis on cost-effective diagnostic devices will open opportunities in price-sensitive markets, fostering broader adoption.