Market Overview

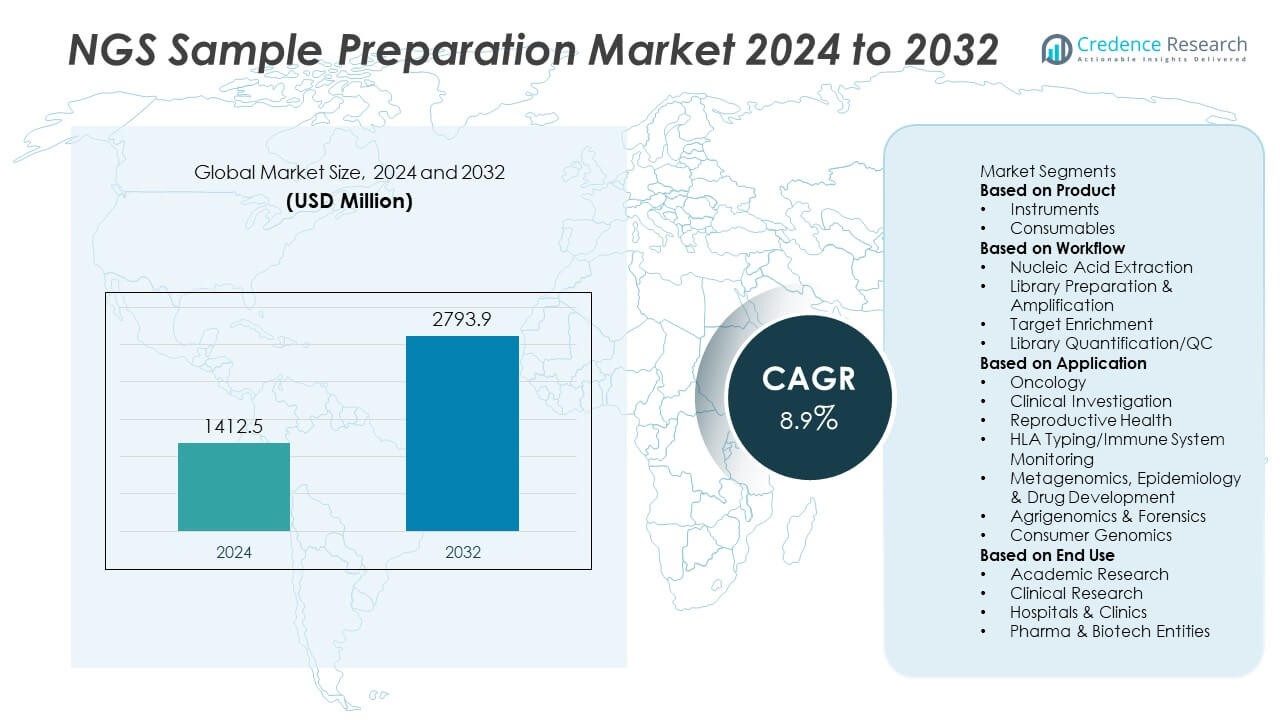

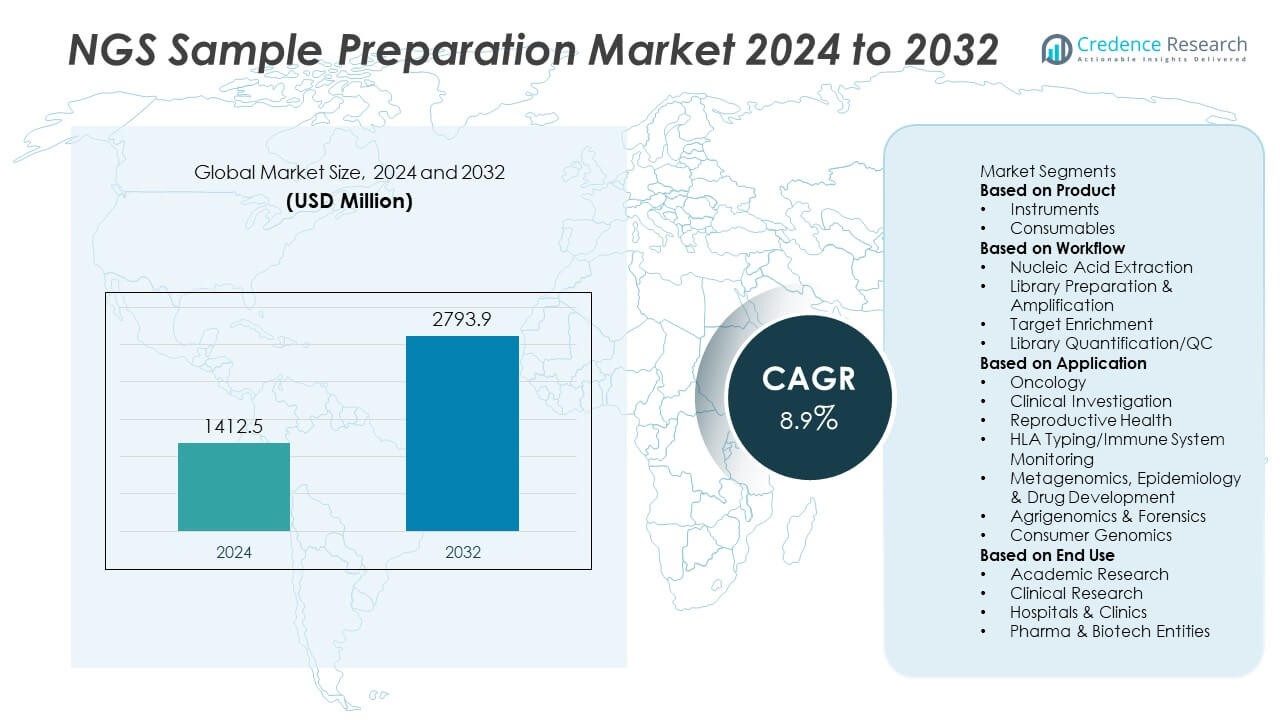

The NGS (Next-Generation Sequencing) Sample Preparation Market was valued at USD 1,412.5 million in 2024 and is projected to reach USD 2,793.9 million by 2032, expanding at a CAGR of 8.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| NGS Sample Preparation Market Size 2024 |

USD 1,412.5 Million |

| NGS Sample Preparation Market, CAGR |

8.9% |

| NGS Sample Preparation Market Size 2032 |

USD 2,793.9 Million |

The NGS Sample Preparation Market advances due to rising adoption of next-generation sequencing in clinical diagnostics, oncology, and population genomics. Demand increases for automation-compatible kits, single-cell processing, and standardized workflows that support high-throughput applications. Precision medicine initiatives and regulatory approvals for NGS-based testing drive consistent investment across healthcare and research institutions.

The NGS Sample Preparation Market demonstrates strong geographical diversity, with North America leading in technological innovation and clinical adoption, driven by robust research funding and advanced healthcare infrastructure. Europe follows with a focus on regulatory-compliant diagnostics and national genomic programs across countries such as Germany, the UK, and France. Asia-Pacific is expanding rapidly due to increasing investment in genomic research, population health initiatives, and growing demand for localized sequencing solutions in China, Japan, and India. Latin America and the Middle East & Africa show emerging potential through public health genomics and academic collaborations. Key players in this market include Illumina, Inc., which offers a comprehensive suite of sample prep solutions for clinical and research applications; Thermo Fisher Scientific Inc., known for its scalable automation-ready platforms; and QIAGEN, which provides customizable library prep.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The NGS Sample Preparation Market was valued at USD 1,412.5 million in 2024 and is projected to reach USD 2,793.9 million by 2032, growing at a CAGR of 8.9% during the forecast period.

- Rising adoption of next-generation sequencing in clinical diagnostics, oncology, and infectious disease monitoring continues to drive demand for reliable, high-throughput sample preparation workflows.

- The market shows a strong shift toward automation-compatible, pre-validated kits that minimize hands-on time, improve reproducibility, and support high-volume sequencing labs.

- Leading companies such as Illumina, Thermo Fisher Scientific, QIAGEN, and Agilent Technologies actively expand their product portfolios and invest in integration with robotic platforms and cloud-based digital tools.

- High cost of reagents, instruments, and workflow complexity remains a barrier to adoption among smaller labs and institutions with limited technical capacity or budget constraints.

- North America leads the market with strong infrastructure and research funding, followed by Europe with regulatory-backed adoption; Asia-Pacific is emerging rapidly with government-supported genomic programs.

- Increasing demand for cartridge-based systems, single-cell sample prep kits, and AI-supported workflow tracking solutions reflects a growing focus on scalability, accuracy, and lab efficiency.

Market Drivers

Increasing Adoption of NGS in Clinical Diagnostics and Precision Medicine

The NGS Sample Preparation Market is gaining momentum due to the expanding role of next-generation sequencing in clinical settings. Hospitals and diagnostic labs integrate NGS for applications such as inherited disease screening, oncology profiling, and infectious disease detection. The demand for reliable, high-throughput sample preparation protocols is growing with the adoption of precision medicine. Regulatory approvals for companion diagnostics further drive clinical utility, pushing laboratories to standardize workflows. Sample preparation kits tailored for specific applications streamline testing and reduce turnaround time. It supports the shift toward patient-specific treatment strategies and evidence-based clinical decisions.

- For instance, Illumina and Ovation are launching an integrated dataset of phenotypic, genomic, and proteomic data from patients treated with GLP-1 therapies, including therapy-responsive and nonresponsive populations.

Expanding Applications in Oncology, Agrigenomics, and Infectious Disease Research

The NGS Sample Preparation Market benefits from diverse application areas beyond human genomics. Researchers apply NGS in crop improvement, livestock breeding, and pathogen surveillance. Cancer research relies heavily on tumor profiling and liquid biopsy techniques, both requiring robust sample preparation methods. Public health agencies use metagenomic sequencing to monitor outbreaks and track antimicrobial resistance. Demand for uniform nucleic acid extraction and library construction kits continues to grow across research domains. It enables consistent, reproducible outcomes across a variety of sample types and organisms.

Automation and Workflow Standardization Support Scalability in Laboratories

Automation drives operational efficiency and consistency across sequencing workflows, increasing adoption of NGS platforms in high-throughput labs. The NGS Sample Preparation Market responds with pre-validated, automation-compatible kits that minimize user error and hands-on time. Vendors invest in robotic integration and platform-agnostic sample prep solutions. Standardized protocols help laboratories meet quality assurance requirements and accreditation standards. These innovations reduce turnaround time and operating costs. It facilitates scalable sequencing operations without compromising data quality.

- For instance, Agilent’s Bravo NGS Workstation with ODTC reduces touchpoints by up to 67% and automates runs of up to 96 samples.

Growth in Global Genomic Initiatives and Biobanking Infrastructure

National genome programs and international collaborations fuel demand for reliable sample preparation across regions. The NGS Sample Preparation Market plays a foundational role in enabling population-scale sequencing projects. Governments allocate funding for genome mapping, personalized medicine, and disease gene discovery. Biobanks require standardized sample preparation to support long-term storage and downstream sequencing. Industrial-scale sequencing partners depend on consistency and batch-to-batch reproducibility. It underpins the global shift toward genomic data-driven healthcare and biomedical discovery.

Market Trends

Shift Toward Automation-Compatible and Pre-Validated Sample Prep Kits

Laboratories increasingly adopt automation-ready solutions to meet the demand for high-throughput sequencing. The NGS Sample Preparation Market responds with kits designed for robotic platforms, reducing manual intervention and improving reproducibility. These products offer pre-validated protocols, minimizing the need for method development. Vendors focus on integration with liquid handling systems and thermal cyclers to support seamless workflows. Automation reduces variability and supports clinical-grade sequencing environments. It accelerates processing time and enables labs to manage growing sample volumes efficiently.

- For instance, Leiden University Medical Center implemented the Illumina DNA Prep kit on the flowbot ONE liquid handler and compared 16 bacterial library preparations processed both manually and automatically. The automated workflow reduced hands-on time from 125 minutes to 25 minutes, maintained comparable DNA yields (median 1.5‑fold difference), and achieved 100 percent concordance in multilocus sequence typing across samples.

Integration of Single-Cell and Low-Input Sample Preparation Technologies

Researchers seek advanced tools to prepare low-input and single-cell samples without compromising data integrity. The NGS Sample Preparation Market supports this trend with kits optimized for limited DNA or RNA quantities. Single-cell genomics is expanding in oncology, immunology, and neuroscience, requiring highly sensitive workflows. New chemistries and reagent formulations allow accurate profiling from minimal starting material. These innovations improve detection of rare variants and enhance transcriptomic resolution. It enables researchers to explore cell heterogeneity at unprecedented scale.

- For instance, the NEBNext Single Cell/Low Input RNA Library Prep Kit for Illumina enables library generation from as little as 2 pg of total RNA up to 200 ng, with high yields, uniform coverage, and enhanced detection of low-abundance transcripts.

Emphasis on Customization and Target Enrichment Strategies

Targeted sequencing gains popularity for its cost efficiency and clinical relevance in gene panel testing. The NGS Sample Preparation Market adapts by offering customizable enrichment kits and modular designs. Customers select panels based on disease-specific or research-specific genes of interest. Hybrid capture and amplicon-based enrichment methods evolve to improve coverage uniformity and sensitivity. Protocol flexibility supports a wide range of applications from somatic variant detection to rare mutation analysis. It empowers users to tailor sample prep strategies to meet precise analytical goals.

Growth in Cloud-Connected Sample Prep Platforms and Digital Workflow Solutions

Digital solutions gain traction to simplify sample tracking, reduce documentation errors, and support regulatory compliance. The NGS Sample Preparation Market incorporates cloud-based interfaces and LIMS-compatible systems. These tools monitor reagent usage, automate batch records, and provide real-time quality metrics. Integration with sequencing data pipelines enhances traceability and audit readiness. Software-linked platforms offer end-to-end visibility into the sample lifecycle. It improves transparency and standardization in both research and clinical environments.

Market Challenges Analysis

High Cost of Reagents, Kits, and Instruments Limits Accessibility for Smaller Labs

The NGS Sample Preparation Market faces pricing pressures that limit its accessibility in resource-constrained settings. Reagent and consumable costs remain high, especially for advanced kits with automation compatibility or specialized chemistries. Smaller laboratories and academic institutions often struggle to maintain consistent sequencing workflows due to budget limitations. The requirement for precision instruments, cold storage, and controlled environments adds to operational expenses. These constraints affect the scalability of projects and slow down adoption in emerging markets. It restricts the broader implementation of NGS in decentralized healthcare or low-throughput research environments.

Technical Complexity and Risk of Sample Loss Hinder Workflow Efficiency

Despite advancements, many NGS sample preparation protocols remain complex and require specialized training. The NGS Sample Preparation Market contends with challenges related to manual errors, cross-contamination, and inconsistent nucleic acid quality. Multi-step workflows increase the risk of degradation, especially in low-input or degraded samples. Inconsistent handling may compromise downstream sequencing accuracy, affecting overall data integrity. The need for precise thermal cycling, enzymatic reactions, and clean environments adds procedural rigidity. It reduces flexibility in sample types and limits throughput in high-volume settings.

Market Opportunities

Expansion of NGS-Based Testing in Emerging Markets Unlocks Commercial Potential

Rapid healthcare infrastructure development and increased research funding create strong demand for genomic technologies across emerging economies. The NGS Sample Preparation Market has the opportunity to grow by addressing unmet needs in countries investing in precision medicine, population genomics, and infectious disease surveillance. Localized production of sample prep reagents and distribution partnerships can reduce costs and improve availability. Public-private initiatives to establish national biobanks and genome mapping programs support market penetration. Technology transfer and training programs further enhance laboratory capabilities in underserved regions. It enables companies to build long-term presence in high-growth geographies.

Development of AI-Driven and Cartridge-Based Sample Prep Systems Enhances Usability

The rising demand for simplified, point-of-care-compatible sequencing solutions opens new avenues for innovation. The NGS Sample Preparation Market can capitalize on miniaturized, cartridge-based systems that integrate all steps into a closed, automated platform. These formats reduce error rates, improve biosafety, and minimize hands-on time for clinical and decentralized labs. AI-driven protocols can guide operators through quality checks, reagent tracking, and real-time error correction. Integration with cloud-based sequencing platforms enhances ease of use in diagnostics and field applications. It positions the market to support broader adoption across non-specialist settings.

Market Segmentation Analysis:

By Product:

The NGS Sample Preparation Market includes products such as reagents and consumables, instruments, and accessories. Reagents and consumables dominate the segment due to their recurring use in every sequencing run. High-throughput laboratories depend on high-quality reagents for nucleic acid extraction, quantification, fragmentation, and library preparation. Instrument sales grow steadily with the expansion of automation-compatible platforms and liquid handling systems. Demand for reliable accessories such as purification columns, pipette tips, and magnetic beads supports consistent workflow execution. It emphasizes the importance of performance consistency and scalability in sequencing environments.

- For instance, Illumina’s DNA PCR‑Free Prep kit completes a whole-genome sequencing library in roughly 90 minutes, with input DNA ranging from 25 ng to 300 ng, and supports up to 384-plex with unique dual indexes.

By Workflow:

Key workflows in the market include library preparation, target enrichment, fragmentation and end-repair, adapter ligation, and quality control. Library preparation remains the most critical and resource-intensive stage, requiring precise handling of enzymes, buffers, and clean-up reagents. Target enrichment techniques such as hybrid capture and amplicon-based methods continue to evolve, offering enhanced specificity for disease-focused applications. Fragmentation and end-repair protocols adapt to various input qualities, supporting both fresh and degraded samples. Adapter ligation and indexing drive multiplex sequencing, reducing per-sample costs and increasing efficiency. It enables high-throughput labs to meet clinical and research requirements without sacrificing accuracy.

By End-User:

End-users in the NGS Sample Preparation Market include academic and research institutes, hospitals and clinical laboratories, pharmaceutical and biotechnology companies, and contract research organizations (CROs). Academic institutions lead in early-stage innovation and protocol development, driving demand for flexible and customizable kits. Clinical labs require automation-ready, regulatory-compliant workflows to ensure reproducibility and traceability. Pharmaceutical firms utilize sample preparation in biomarker discovery, companion diagnostics, and clinical trial genomics. CROs support outsourcing of sequencing services and depend on scalable, standardized sample prep solutions. It serves a broad spectrum of user needs, from exploratory research to regulated diagnostics.

- For instance, Covaris introduced the truCOVER WGS PCR-free Library Prep Kit, which merges precise acoustic DNA shearing (via AFA® technology) with library prep in a single tube—enhancing accuracy, workflow efficiency, and reducing variability in whole-genome sequencing prep.

Segments:

Based on Product

Based on Workflow

- Nucleic Acid Extraction

- Library Preparation & Amplification

- Target Enrichment

- Library Quantification/QC

Based on Application

- Oncology

- Clinical Investigation

- Reproductive Health

- HLA Typing/Immune System Monitoring

- Metagenomics, Epidemiology & Drug Development

- Agrigenomics & Forensics

- Consumer Genomics

Based on End Use

- Academic Research

- Clinical Research

- Hospitals & Clinics

- Pharma & Biotech Entities

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America leads the NGS Sample Preparation Market, accounting for 38.4% of global revenue in 2024. The region benefits from a mature genomic infrastructure, strong research funding, and high adoption of NGS-based diagnostics in oncology and rare disease testing. Major sequencing companies such as Illumina, Thermo Fisher Scientific, and Agilent Technologies operate extensive manufacturing and distribution networks across the U.S. and Canada. Clinical laboratories and academic centers utilize NGS for personalized treatment plans, especially in cancer care and inherited disease profiling. Public initiatives like the NIH All of Us Research Program and Canada’s Genomics Enterprise continue to drive sequencing volume. It supports sustained demand for high-quality, regulatory-compliant sample preparation kits and automation-compatible platforms. Strong collaborations between research institutes and biotech firms further strengthen the region’s technological leadership.

Europe

Europe represents 27.1% of the global NGS Sample Preparation Market and maintains a strong position through academic research and government-backed healthcare genomics programs. Countries such as Germany, the United Kingdom, France, and the Netherlands invest in precision medicine initiatives and national genome sequencing efforts. The European Union’s Horizon Europe framework allocates substantial funding for research in genomics, rare disease, and cancer diagnostics. Clinical labs across the region adopt CE-IVD marked NGS kits for diagnostic testing under evolving IVDR compliance requirements. Biobanking programs across Sweden and Finland demand standardized sample processing protocols for long-term genomic studies. It drives the uptake of automated, high-throughput sample prep solutions, particularly in hospital-affiliated labs and centralized research facilities.

Asia-Pacific

Asia-Pacific holds 22.6% of the market and represents the fastest-growing region, supported by strong investments in national genomics infrastructure, increasing healthcare digitization, and growing awareness of precision medicine. China, Japan, South Korea, and Australia lead adoption across both research and clinical environments. China’s 100K Genome Project and Japan’s Genome Medical Project accelerate the need for large-scale sample preparation tools that meet international quality standards. Local manufacturers expand partnerships with global NGS leaders to support regional distribution of kits and reagents. Expanding cancer diagnostics and infectious disease surveillance programs across India and Southeast Asia contribute to rising demand. It creates opportunities for cost-efficient, scalable sample prep platforms tailored to local needs.

Latin America

Latin America captures 6.3% of the global NGS Sample Preparation Market, with Brazil and Mexico as leading contributors. The region shows steady progress in adopting NGS technologies in oncology diagnostics, academic research, and public health programs. Regional laboratories explore partnerships with international genomic service providers to increase access to sequencing tools. Government-supported precision medicine programs and oncology-focused genome mapping projects are gaining traction. Resource limitations pose challenges, but growing demand for decentralized testing drives interest in simplified, portable sample prep workflows. It enables broader implementation in both public and private healthcare systems across Latin America.

Middle East & Africa

The Middle East & Africa region accounts for 5.6% of the market, supported by emerging investments in healthcare innovation and genomic research. Countries such as the United Arab Emirates, Saudi Arabia, and South Africa lead in sequencing adoption through national health transformation plans. Genomic initiatives like the UAE Genomics Council aim to integrate whole genome sequencing into routine care, fueling demand for standardized sample preparation kits. Academic centers in Egypt and Kenya explore NGS applications in disease surveillance and genetic disease research. It remains a developing market, with potential for significant growth through international collaborations and government-backed healthcare modernization efforts.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The NGS Sample Preparation Market remains highly competitive, driven by innovation, product diversification, and global expansion strategies. Leading players include Illumina, Inc., Thermo Fisher Scientific Inc., QIAGEN, Agilent Technologies, Inc., Bio-Rad Laboratories, Inc., PerkinElmer Inc., F. Hoffmann-La Roche Ltd, BGI Genomics, Danaher Corporation (Beckman Coulter), and Eurofins Scientific. These companies focus on automation-ready, platform-agnostic kits designed to enhance workflow efficiency and reduce turnaround time. Illumina maintains a strong position with integrated sample-to-sequencer solutions and proprietary library prep technologies. Thermo Fisher Scientific leverages its extensive instrumentation and consumables portfolio to offer end-to-end workflow coverage. QIAGEN emphasizes customizable nucleic acid extraction and target enrichment kits tailored for clinical and research applications. Agilent Technologies invests in high-throughput, robotics-compatible solutions and quality control tools to serve both academic and diagnostic markets. Bio-Rad Laboratories and PerkinElmer strengthen their presence through targeted acquisitions and automation-friendly reagent platforms. Roche and Danaher (Beckman Coulter) focus on expanding molecular diagnostics capabilities with scalable, regulatory-compliant sample prep offerings. BGI Genomics and Eurofins Scientific support large-scale population studies and sequencing services, emphasizing global reach and cost-effective solutions. Competitive advantage is defined by innovation, regulatory approvals, automation integration, and strategic partnerships across clinical, pharmaceutical, and research sectors.

Recent Developments

- In May 2025, Illumina partnered with Ovation.io to create a large clinical multiomic dataset from 25,000 patients treated with GLP‑1 therapies.

- In April 2025, Agilent Technologies showcased its advanced cancer research tools at the American Association for Cancer Research (AACR) Annual Meeting, including the expanded Avida DNA Cancer Panels. These panels enable simultaneous DNA and methylation profiling from a single sample, allowing for deeper multiomic insights into cancer.

- In June 2024, Illumina incorporated its newest chemistry called XLEAP-SBS™ for all reagents, including those for the NextSeq 1000 and NextSeq 2000 NGS instruments.

Market Concentration & Characteristics

The NGS Sample Preparation Market exhibits moderate to high market concentration, with a few multinational players dominating product innovation, distribution, and strategic collaborations. It is characterized by a strong focus on workflow automation, platform compatibility, and protocol standardization to meet clinical, research, and regulatory demands. Key companies such as Illumina, Thermo Fisher Scientific, QIAGEN, and Agilent Technologies maintain competitive advantage through proprietary technologies, integrated platforms, and recurring consumable sales. The market favors companies with robust R&D pipelines, global manufacturing capacity, and established relationships with clinical labs and research institutions. High entry barriers exist due to technical complexity, regulatory compliance requirements, and the need for precision-engineered instrumentation. It supports sustained innovation in target enrichment, low-input DNA/RNA handling, and high-throughput processing. Product differentiation depends on ease of use, automation readiness, sample compatibility, and validated performance across sequencing platforms. The market evolves rapidly with rising demand for scalable, digital, and point-of-care–oriented solutions that streamline genomic workflows.

Report Coverage

The research report offers an in-depth analysis based on Product, Workflow, Application, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for automated, hands‑off sample preparation workflows will rise sharply across clinical and high‑throughput laboratories.

- Single‑cell and low‑input preparation kits will gain traction in research fields like oncology, immunology, and neuroscience.

- Cartridge‑based or closed‑system solutions will expand into decentralized and point‑of‑care settings.

- Integration of AI‑driven QC and workflow guidance will enhance reproducibility and reduce human error.

- Modular, customizable enrichment panels will serve specialized disease panels and targeted sequencing needs.

- Partnerships between kit providers and LIMS or cloud platforms will improve traceability and audit capabilities.

- Biobanks and national genomic initiatives will increase demand for standardized, batch‑consistent sample prep solutions.

- Emerging economies will adopt cost‑effective, compact sample prep platforms tailored for local clinical and research use.

- Innovations will focus on compatibility with long‑read and third‑generation sequencing technologies.

- Sustainability considerations will drive development of low‑waste, recyclable consumables and reduced‑volume workflows.