Market Overview

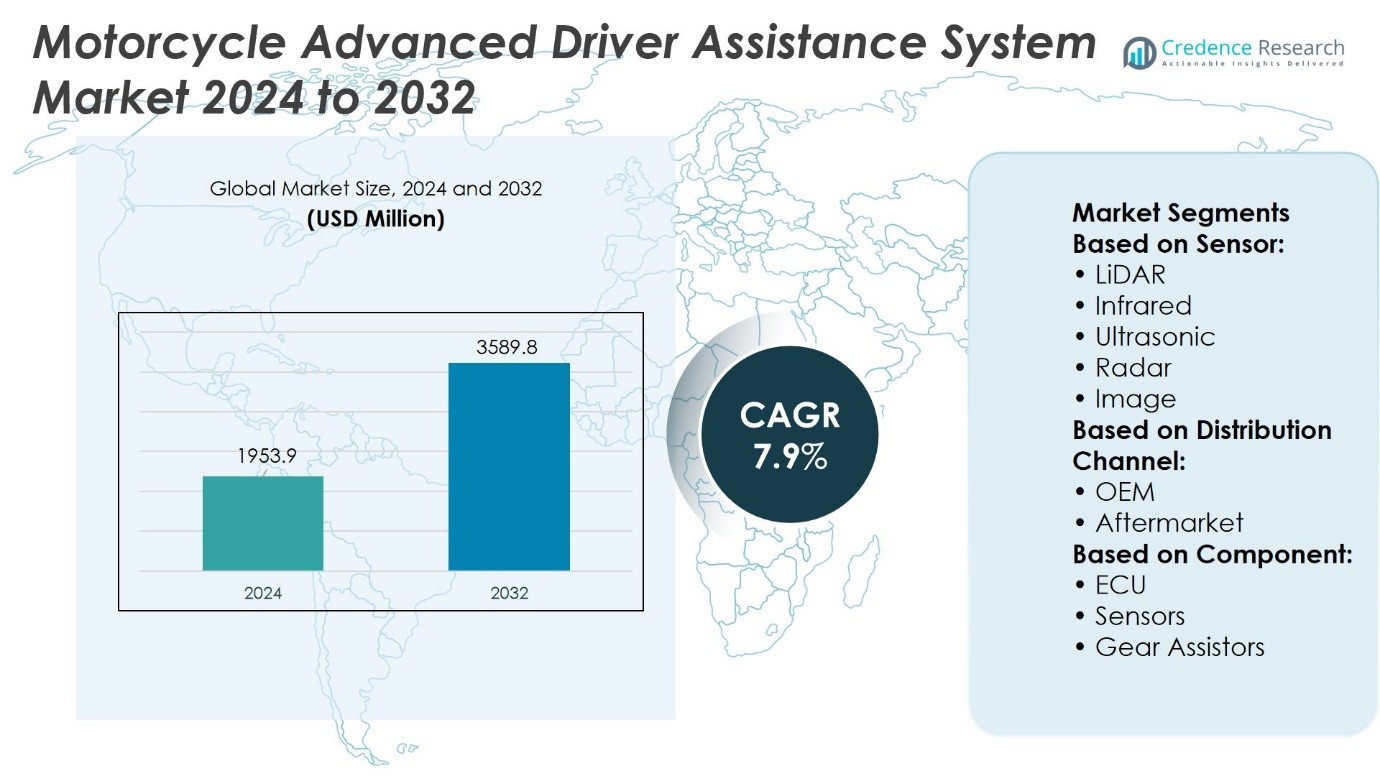

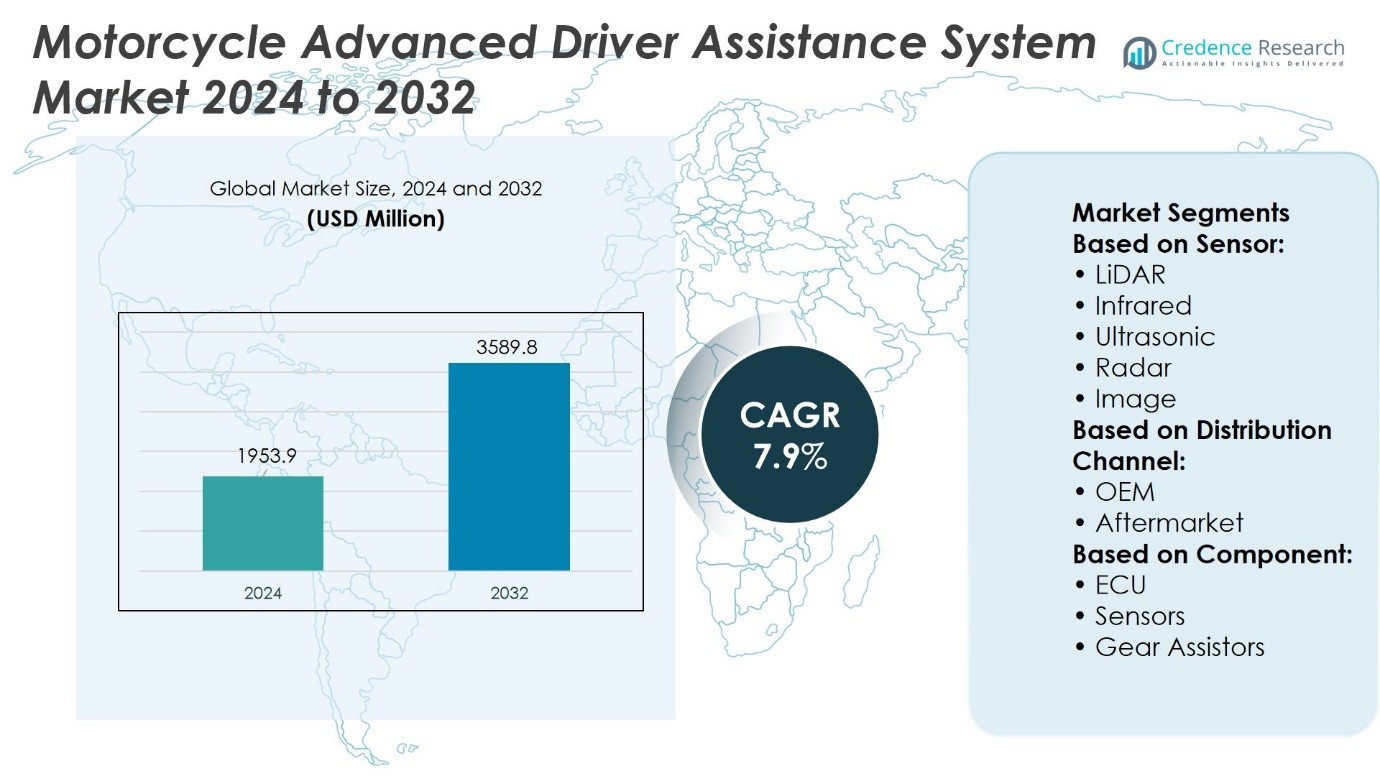

Motorcycle Advanced Driver Assistance System Market size was valued at USD 1953.9 million in 2024 and is anticipated to reach USD 3589.8 million by 2032, at a CAGR of 7.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Motorcycle Advanced Driver Assistance System Market Size 2024 |

USD 1953.9 Million |

| Motorcycle Advanced Driver Assistance System Market, CAGR |

7.9% |

| Motorcycle Advanced Driver Assistance System Market Size 2032 |

USD 3589.8 Million |

The Motorcycle Advanced Driver Assistance System Market grows on rising demand for rider safety, stricter regulatory standards, and increasing adoption of premium motorcycles equipped with advanced features. It advances through innovations in radar, camera, and sensor fusion that enable adaptive cruise control, collision warning, and blind spot detection. AI and machine learning strengthen real-time decision-making, while connectivity solutions integrate motorcycles with cloud platforms and mobile applications. The market benefits from strong consumer interest in touring and adventure segments where stability and control systems are critical. It reflects a clear shift toward technology-driven safety and rider confidence.

The Motorcycle Advanced Driver Assistance System Market shows strong geographical adoption led by Europe with strict safety regulations and premium OEM presence, followed by North America with advanced technology integration and Asia-Pacific driven by rising premium motorcycle demand. Latin America and the Middle East & Africa demonstrate gradual uptake supported by adventure and touring segments. Key players include BMW Group, Honda Motor Co. Ltd., Ducati, KTM AG, Husqvarna, TVS Motor Co., Continental AG, Robert Bosch GmbH, ZF Friedrichshafen, and Garmin Ltd.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Motorcycle Advanced Driver Assistance System Market size was valued at USD 1953.9 million in 2024 and is expected to reach USD 3589.8 million by 2032, at a CAGR of 7.9%.

- Rising demand for rider safety and strict regulatory standards drive adoption of advanced assistance systems in motorcycles.

- Innovations in radar, camera, and sensor fusion enable adaptive cruise control, collision warning, and blind spot detection.

- Competitive landscape features strong presence of global OEMs and technology suppliers focusing on ADAS integration.

- High system cost and technical complexity in diverse riding conditions remain key restraints.

- Europe leads market share with strict regulations and premium OEM presence, followed by North America and Asia-Pacific.

- Latin America and Middle East & Africa show gradual adoption, while adventure and touring segments strengthen demand globally.

Market Drivers

Rising Focus on Rider Safety and Accident Reduction

The Motorcycle Advanced Driver Assistance System Market grows with increasing emphasis on reducing road accidents and enhancing rider protection. Governments strengthen regulations around two-wheeler safety, encouraging adoption of advanced systems. OEMs integrate adaptive cruise control, blind spot detection, and collision warning features to improve real-time rider awareness. It addresses high accident rates linked to motorcycles compared with passenger cars. Consumers demand safer models that combine performance with advanced protection. This shift strengthens confidence in riding across diverse road conditions.

- For instance, Ducati conducted field trials of a radar‑based blind‑spot detection system and reported that the radar sensor alerted riders to vehicles in adjacent lanes up to 45 meters away providing riders with a clear warning window before potential side‑impact scenarios occurred.

Integration of Radar, Camera, and Sensor Technologies in Motorcycles

The market expands through rapid adoption of radar and camera-based technologies to support advanced assistance features. Manufacturers deploy compact sensors that fit seamlessly within motorcycle designs without compromising aesthetics. It enables precise monitoring of traffic surroundings and supports automated alerts for collision avoidance. Tier-1 suppliers collaborate with OEMs to accelerate deployment of ADAS functions in mid-range and premium motorcycles. The Motorcycle Advanced Driver Assistance System Market benefits from a clear move toward smarter connectivity in two-wheelers. High demand for real-time data processing drives investments in advanced ECU and sensor fusion platforms.

- For instance, Bosch’s millimeter-wave radar sensor shipments reaching 100 million units globally signifies a major milestone in the widespread adoption and standardization of this technology, particularly in the two-wheeler sector, according to industry news.

Growing Consumer Interest in Connected and Premium Motorcycles

Consumer preference for connected motorcycles accelerates adoption of ADAS features across segments. Premium motorcycles attract strong demand from riders seeking convenience, safety, and long-distance touring capabilities. It reflects a lifestyle trend where motorcycles serve both recreational and daily commuting roles. Enhanced display clusters, smartphone connectivity, and integrated safety systems create a more engaging riding experience. Manufacturers emphasize differentiation through safety innovations to attract competitive buyers. The Motorcycle Advanced Driver Assistance System Market aligns with a broader shift toward digitalization in personal mobility.

Expansion of Adventure and Touring Segments with Advanced Safety Features

Adventure motorcycle wheels Market aligns with strong demand for long-distance riding experiences where advanced safety plays a crucial role. OEMs equip adventure and touring bikes with adaptive headlights, cornering ABS, and lane change assist to support challenging terrains. It highlights the role of ADAS in improving stability, especially in unpredictable road conditions. Riders seek confidence in handling diverse landscapes with better braking and traction systems. Demand grows strongly in markets with established touring culture and rising disposable incomes. Integration of advanced systems positions motorcycles as safer and more versatile mobility solutions.

Market Trends

Increasing Adoption of Radar-Based Assistance Systems in Motorcycles

The Motorcycle Advanced Driver Assistance System Market reflects a clear trend toward radar-enabled technologies for safer riding. OEMs deploy compact millimeter-wave radars to support adaptive cruise control and collision warning. It allows precise detection of vehicles in blind spots and enhances rider confidence in dense traffic. Manufacturers integrate radar with onboard cameras to achieve accurate environmental mapping. Rising demand for premium motorcycles drives wider integration of these advanced modules. This trend reshapes product portfolios across both established and emerging brands.

- For instance, in June 2023, Bosch supplied over 50,000 units of its 77 GHz mid-range radar sensors to motorcycle OEMs including Ducati and KTM, enabling adaptive cruise control systems on models like the Ducati Multistrada V4, which features two front and one rear radar unit with a detection range of up to 160 meters.

Growing Use of Artificial Intelligence for Real-Time Decision Support

AI integration emerges as a key trend shaping next-generation safety features in motorcycles. The Motorcycle Advanced Driver Assistance System Market incorporates machine learning algorithms to improve rider alerts and predictive analytics. It enables systems to differentiate between critical hazards and normal riding conditions. Developers enhance software platforms that process large volumes of sensor data with low latency. This capability supports functions such as lane departure warnings and object classification. Increasing reliance on AI expands the role of software in motorcycle safety innovation.

- For instance, Israeli company Ride Vision has produced and deployed AI-powered collision-alert systems in over 10 million kilometers of real-world motorcycle riding, enabling true real-time threat detection and rider warning capabilities.

Rising Consumer Preference for Connected Safety Ecosystems

Connectivity trends influence the evolution of advanced driver assistance in motorcycles. The Motorcycle Advanced Driver Assistance System Market advances toward cloud-based platforms that share real-time safety data. It integrates mobile applications, GPS, and vehicle-to-vehicle communication for a cohesive safety ecosystem. Riders demand digital features that complement safety technologies with convenience and entertainment functions. OEMs respond by offering subscription services linked to connected safety solutions. This direction fosters new revenue streams while elevating consumer trust in advanced motorcycle platforms.

Expansion of Adventure and Touring Motorcycles with Advanced ADAS Features

Adventure and touring segments continue to adopt advanced safety technologies at a faster pace. The Motorcycle Advanced Driver Assistance System Market aligns with demand for systems that enhance rider control in variable conditions. It emphasizes features such as cornering ABS, traction management, and adaptive headlights tailored for long-distance travel. OEMs highlight advanced ADAS integration as a differentiator in the competitive premium touring category. Consumers value improved stability in off-road and highway environments. This trend underlines how safety technologies strengthen brand identity and rider loyalty in higher-end motorcycle segments.

Market Challenges Analysis

High Cost of Integration and Limited Penetration in Entry-Level Motorcycles

The Motorcycle Advanced Driver Assistance System Market faces challenges linked to the high cost of integrating advanced sensors, radars, and electronic control units. Premium motorcycles can accommodate these technologies, but entry-level and mid-range models struggle with affordability. It creates a gap where advanced safety remains limited to a smaller consumer base. Manufacturers encounter difficulties balancing cost efficiency with the demand for sophisticated features. Smaller OEMs lack resources to scale production while maintaining competitive pricing. This barrier slows broader market penetration and restricts safety innovation to select segments.

Technical Complexity and Reliability Concerns in Real-World Conditions

Complexity in designing ADAS systems for motorcycles presents a significant challenge. The Motorcycle Advanced Driver Assistance System Market requires precise calibration of radars, cameras, and software to function under varying road and weather conditions. It highlights concerns around false alerts, sensor malfunctions, and rider distraction. Harsh environments such as heavy rain, dust, or glare strain the reliability of assistance systems. OEMs must invest heavily in rigorous testing protocols to ensure performance consistency. Technical limitations and concerns around rider adaptation reduce consumer trust in adopting these advanced features.

Market Opportunities

Rising Scope for Integration of Advanced Safety Features in Emerging Markets

The Motorcycle Advanced Driver Assistance System Market holds strong opportunity in regions where motorcycle ownership outpaces passenger cars. Rapid urbanization and growing traffic density elevate demand for advanced safety systems. It creates prospects for OEMs to integrate ADAS functions into commuter and mid-range motorcycles. Governments encourage road safety adoption through regulatory initiatives, opening new segments for technology providers. Affordable sensor platforms and modular ADAS solutions enable cost-effective scaling. Expanding demand from emerging economies positions safety integration as a central growth avenue.

Expanding Role of Connectivity and Collaboration with Technology Providers

Partnerships between motorcycle manufacturers and technology companies create a robust pipeline of innovation. The Motorcycle Advanced Driver Assistance System Market benefits from collaborations that integrate radar, camera, AI, and cloud connectivity into two-wheelers. It offers opportunities for suppliers to deliver specialized modules tailored to motorcycles rather than adapted from cars. The growth of connected ecosystems allows OEMs to explore subscription-based safety features as a revenue stream. Integration with 5G networks enhances real-time responsiveness and predictive safety alerts. Strong collaboration across industries transforms safety systems into strategic differentiators in global markets.

Market Segmentation Analysis:

By Sensor

The Motorcycle Advanced Driver Assistance System Market segments by sensor into LiDAR, infrared, ultrasonic, radar, and image-based technologies. Radar dominates current deployments due to its ability to detect vehicles at varying distances with accuracy, even under poor weather. It improves functions such as adaptive cruise control and blind spot monitoring. LiDAR gains interest for its capacity to generate detailed 3D mapping, though cost and size remain barriers. Infrared sensors enhance night vision systems by detecting heat signatures of pedestrians and animals. Ultrasonic sensors are widely adopted for low-speed maneuvering support, while image sensors complement radar in lane detection and object recognition. The diversity of sensor integration highlights the growing complexity of motorcycle safety systems.

- For instance, Bosch’s radar system deployed on the Ducati Multistrada V4 uses both front and rear 77 GHz sensors, each with a detection range of 160 meters, enabling adaptive cruise and blind spot detection.

By Distribution Channel

Distribution channels divide into OEM and aftermarket solutions. OEM installations lead adoption as manufacturers embed ADAS features directly into new motorcycles. It creates a competitive advantage in premium and mid-range segments where buyers prioritize advanced safety. OEMs integrate systems with factory-calibrated precision, offering higher trust levels for consumers. Aftermarket channels expand gradually, targeting riders who seek to upgrade existing motorcycles with modular ADAS kits. These solutions focus on affordability and accessibility while providing essential safety functions. The combination of OEM strength and aftermarket expansion ensures wider market reach across diverse customer bases.

- For instance, Berg Insight forecasts that the number of active OEM-embedded telematics systems in two-wheelers will reach 59.7 million units by 2029, up from 16.7 million in 2024—highlighting the scale of OEM adoption in the connected ADAS ecosystem.

By Component

Segmentation by component includes ECU, sensors, and gear assistors. The ECU plays a central role by processing sensor data and enabling real-time decision-making for safety interventions. It integrates complex algorithms that support features like collision warning and traction control. Sensors represent the largest functional layer, with radar, cameras, and ultrasonic units forming the backbone of detection systems. Gear assistors gain momentum as they enable smoother shifts and enhance rider control in demanding environments. It emphasizes rider comfort and contributes to stability in long-distance touring. The strong interplay of these components underlines the technical depth of the Motorcycle Advanced Driver Assistance System Market and supports continuous innovation across all segments.

Segments:

Based on Sensor:

- LiDAR

- Infrared

- Ultrasonic

- Radar

- Image

Based on Distribution Channel:

Based on Component:

- ECU

- Sensors

- Gear Assistors

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America accounts for 28% of the Motorcycle Advanced Driver Assistance System Market, driven by the strong presence of premium motorcycle manufacturers and advanced technology providers. The region benefits from early adoption of adaptive cruise control, collision warning, and blind spot monitoring in high-end touring and cruiser motorcycles. It reflects consumer preference for premium safety features supported by strong disposable incomes. Regulatory bodies emphasize road safety standards, which further encourage OEMs to adopt ADAS solutions. The U.S. leads in deployment, supported by Harley-Davidson and international brands targeting safety-focused buyers. Canada shows steady uptake, with urban riders increasingly valuing connectivity and ADAS features for commuter motorcycles. North America strengthens its role as a technology innovator through strategic partnerships between OEMs and global sensor suppliers.

Europe

Europe holds the largest share at 31% of the Motorcycle Advanced Driver Assistance System Market, supported by a strong culture of motorcycle touring and strict safety regulations. The region benefits from the dominance of premium OEMs such as BMW Motorrad, Ducati, KTM, and Triumph, all of which integrate advanced ADAS features into their motorcycles. The European Union enforces strict road safety policies that accelerate the adoption of radar, camera, and sensor-based systems. Germany and Italy remain key hubs due to their leadership in high-performance motorcycle production. The region’s infrastructure for connected mobility further strengthens adoption, with advanced road networks that support V2X and sensor-based communication. Europe positions ADAS-equipped motorcycles as a standard for premium buyers, reinforcing its technological leadership in this sector.

Asia-Pacific

Asia-Pacific captures 27% of the Motorcycle Advanced Driver Assistance System Market, reflecting the region’s massive two-wheeler population and growing demand for safety technologies. Countries such as Japan, China, and India drive adoption, supported by leading OEMs like Honda, Yamaha, Kawasaki, and Hero MotoCorp. It reflects a gradual shift from cost-driven buying behavior toward feature-rich motorcycles with higher safety standards. Japan leads technological integration, while India shows growing demand in urban premium motorcycle segments. Rising accident rates in densely populated cities highlight the need for ADAS systems such as ABS, traction control, and lane monitoring. Asia-Pacific demonstrates the strongest long-term growth outlook, supported by rapid urbanization, expanding premium motorcycle sales, and the presence of global as well as local technology suppliers.

Latin America

Latin America holds 7% of the Motorcycle Advanced Driver Assistance System Market, where adoption is in early stages but growing steadily. Brazil and Mexico are the largest contributors, driven by rising sales of mid- to high-end motorcycles. It highlights demand for ABS, traction control, and smartphone-based connectivity in urban and semi-urban regions. Local distributors and aftermarket suppliers introduce modular ADAS kits to make safety features more accessible. Road safety initiatives by governments create awareness, but affordability challenges remain a constraint. Despite this, the growing interest in touring and adventure motorcycles supports stronger adoption of advanced assistance features. Latin America shows potential as premium motorcycle imports increase alongside infrastructure development.

Middle East & Africa

The Middle East & Africa region accounts for 7% of the Motorcycle Advanced Driver Assistance System Market, driven by expanding demand for premium touring and adventure motorcycles. Gulf countries such as the UAE and Saudi Arabia lead the region with rising interest in luxury motorcycles equipped with ADAS technologies. It emphasizes features like adaptive headlights, stability control, and connected dashboards for long-distance travel across highways and desert terrains. Africa, led by South Africa, shows early but growing interest as safety awareness increases. Limited affordability and infrastructure challenges restrict mass adoption, but premium motorcycle imports sustain demand in niche markets. The region leverages its adventure tourism culture to expand opportunities for ADAS-equipped motorcycles, particularly in off-road and desert touring segments.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- TVS Motor Co.

- Ducati Motor Holding S.P.A.

- ZF Friedrichshafen

- Husqvarna

- Continental AG

- Garmin Ltd.

- BMW Group

- Honda Motor Co. Ltd.

- KTM AG

- Robert Bosch GmbH

Competitive Analysis

The Motorcycle Advanced Driver Assistance System Market features leading players such as TVS Motor Co., Ducati Motor Holding S.P.A., ZF Friedrichshafen, Husqvarna, Continental AG, Garmin Ltd., BMW Group, Honda Motor Co. Ltd., KTM AG, and Robert Bosch GmbH.The Motorcycle Advanced Driver Assistance System Market demonstrates intense competition driven by advancements in radar, sensor fusion, and electronic control units. Leading manufacturers emphasize the integration of adaptive cruise control, blind spot detection, and collision avoidance systems to strengthen product portfolios. Technology suppliers focus on delivering compact and cost-effective modules that meet the unique design and performance needs of motorcycles. Premium motorcycle brands highlight ADAS features as differentiators in touring and adventure categories, while mid-range producers explore modular solutions for broader accessibility. Navigation and connectivity providers contribute by linking GPS and communication functions with rider safety platforms. The competitive environment increasingly revolves around strategic partnerships, software-driven innovation, and the ability to scale adoption across both developed and emerging markets.

Recent Developments

- In January 2025, ZF announced the launch of its next-generation sensor fusion technology, which enhances vehicle perception capabilities.

- In February 2025, Denso introduced its latest radar systems designed for improved object detection and collision avoidance in urban environments.

- In January 2024, Bosch and Magna announced a strategic collaboration to develop next-generation ADAS technologies, combining Bosch’s software expertise with Magna’s hardware capabilities (Bosch press release).

- In January 2024, Garmin announced a partnership with Yamaha Motor to provide advanced infotainment systems for select Yamaha motorcycles and smart scooters.

Market Concentration & Characteristics

The Motorcycle Advanced Driver Assistance System Market shows moderate concentration, with a mix of global technology suppliers and established motorcycle manufacturers shaping competition. It is characterized by strong reliance on sensor integration, radar modules, and electronic control units that enable adaptive cruise control, collision alerts, and traction management. Premium motorcycle brands lead adoption, while mid-range models gradually integrate modular solutions to expand accessibility. Technology partnerships between OEMs and electronics providers play a central role in advancing product capabilities and scaling adoption across diverse markets. It reflects a balance between innovation in high-end motorcycles and affordability strategies in emerging economies. Market dynamics are defined by high research intensity, regulatory influence, and increasing demand for connectivity-driven safety features.

Report Coverage

The research report offers an in-depth analysis based on Sensor, Distribution Channel, Component and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for radar-based assistance systems will expand across premium and mid-range motorcycles.

- AI and machine learning integration will strengthen real-time decision support in rider safety.

- Connectivity solutions will link motorcycles with cloud platforms and mobile applications.

- Regulatory initiatives will push wider adoption of advanced safety technologies in two-wheelers.

- Compact and cost-effective sensor platforms will enable broader use in emerging markets.

- Adventure and touring motorcycles will continue to integrate advanced stability and control systems.

- Strategic partnerships between OEMs and technology suppliers will drive faster innovation cycles.

- Aftermarket adoption will grow through modular ADAS kits for existing motorcycles.

- Integration with 5G networks will improve responsiveness and predictive safety alerts.

- Rider acceptance of advanced safety systems will rise with improved reliability and affordability.