Market Overview:

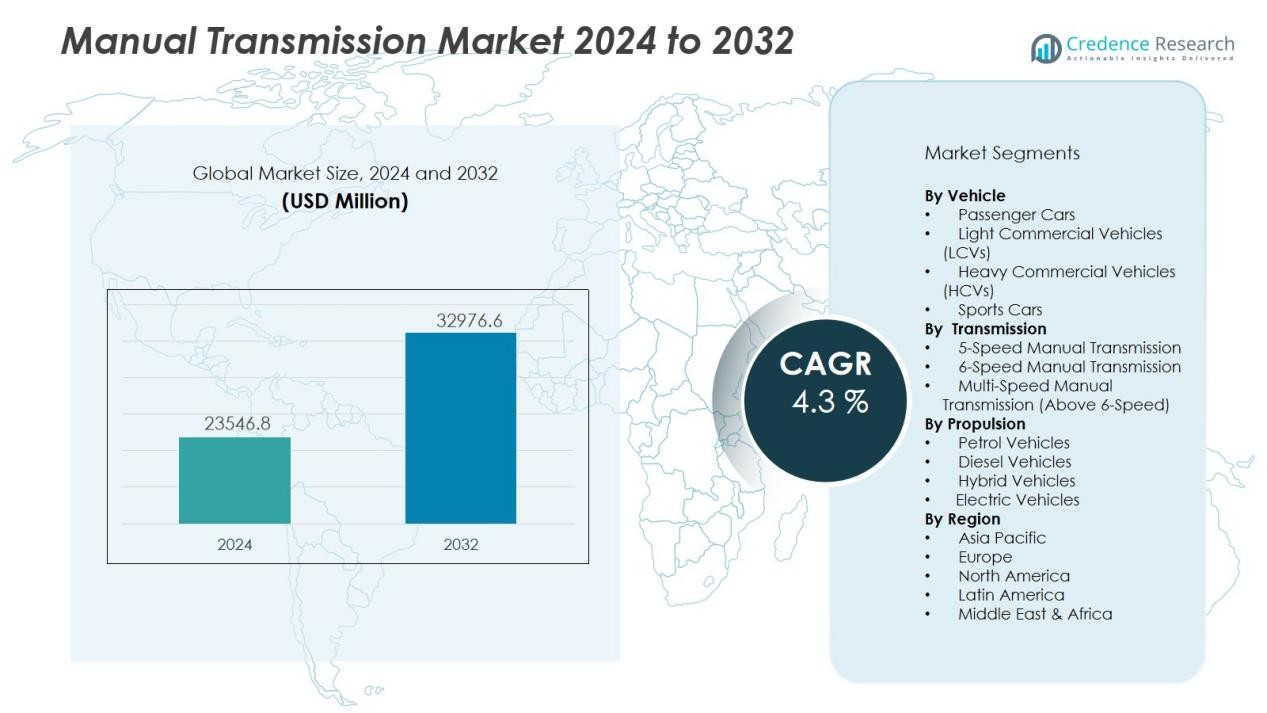

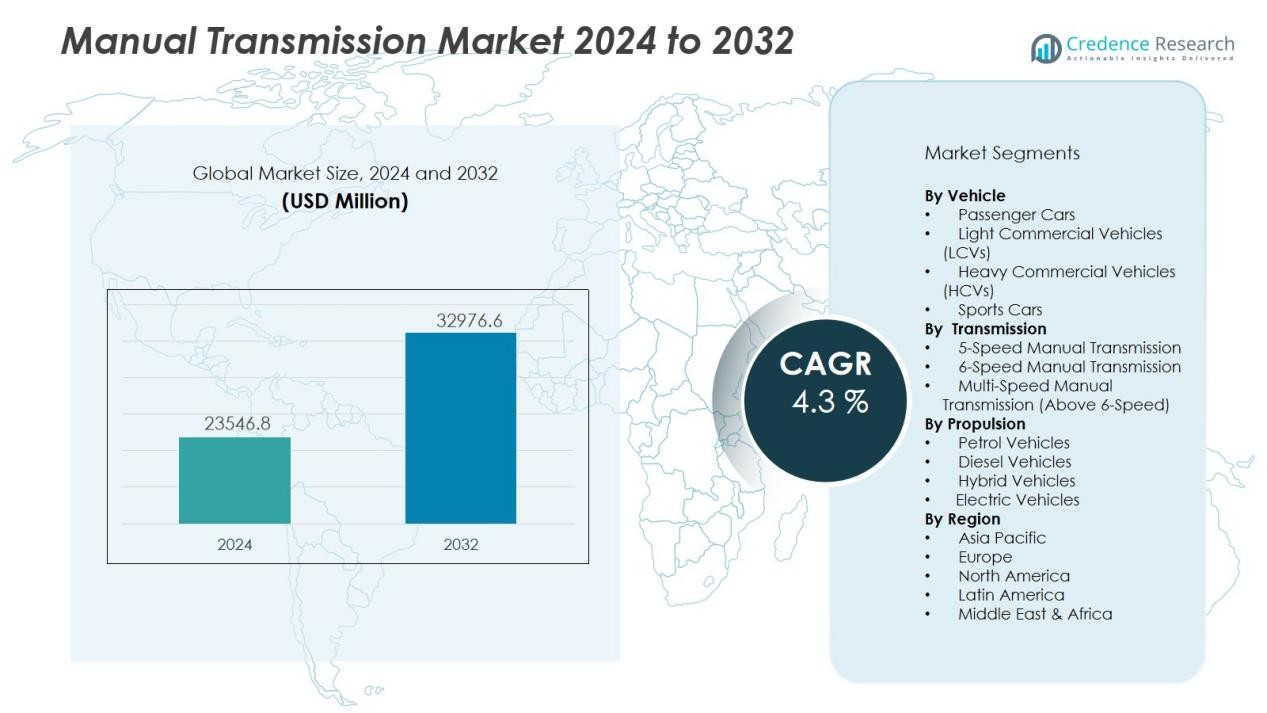

The manual transmission market size was valued at USD 23546.8 million in 2024 and is anticipated to reach USD 32976.6 million by 2032, at a CAGR of 4.3 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Manual Transmission Market Size 2024 |

USD 23546.8 Million |

| Manual Transmission Market, CAGR |

4.3 % |

| Manual Transmission Market Size 2032 |

USD 32976.6 Million |

Key drivers for the manual transmission market include rising vehicle ownership in emerging economies, strong adoption in light commercial vehicles, and increasing preference for robust powertrains in rural and off-road applications. It benefits from lower upfront costs compared to automatic alternatives, ease of repair, and higher fuel efficiency under skilled driving conditions. Furthermore, the growing demand for sports cars and enthusiast vehicles, where manual shifting remains integral to driving experience, supports sustained adoption.

Regionally, Asia-Pacific dominates the manual transmission market, driven by strong automotive production in countries such as China, India, and Japan, along with cost-conscious consumer bases. Europe follows, supported by a niche but stable demand for manual gearboxes in compact cars and sports models. North America shows declining adoption due to consumer preference for automatics, though it retains limited demand among driving enthusiasts. Latin America, the Middle East, and Africa continue to display healthy growth potential, led by rising demand for affordable and durable vehicles.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The manual transmission market was valued at USD 23,546.8 million in 2024 and is projected to reach USD 32,976.6 million by 2032, reflecting a CAGR of 3%.

- Cost-effectiveness drives adoption, with lower purchase prices, simpler maintenance, and reduced repair expenses appealing to cost-sensitive buyers.

- Durability and reliability in demanding rural, off-road, and heavy-load conditions strengthen demand among fleet operators and commercial vehicle users.

- Skilled driving enables fuel efficiency advantages, supporting adoption in regions with volatile fuel prices and strong focus on operating costs.

- Enthusiast and performance vehicle segments sustain niche demand, where manual gearboxes remain central to driving experience and brand identity.

- Asia-Pacific leads with 45% market share, followed by Europe with 25% and North America with 15%, reflecting diverse regional dynamics.

- Rising adoption of automatic and electric vehicles challenges growth, while declining manual driving skills among younger generations intensify long-term risks.

Market Drivers:

Cost-Effectiveness and Affordability:

The manual transmission market benefits significantly from its cost advantage over automatic alternatives. It offers lower upfront costs, reduced repair expenses, and simpler maintenance, making it highly attractive in cost-sensitive markets. Consumers in developing economies prioritize value-for-money, and manual systems align well with their preferences. This price advantage ensures sustained adoption across passenger and light commercial vehicles.

- For instance, Avalon Motors reports its manual transmission vehicles are on average £600–£1,000 less expensive than automatic models in 2025, giving budget-focused buyers a clear financial edge.

Durability and Reliability in Demanding Conditions:

Manual transmissions are recognized for their robustness and ability to withstand challenging terrains and heavy loads. The manual transmission market thrives in regions where vehicles are subjected to rural, off-road, and commercial applications. It provides greater control to drivers in steep or rugged environments, improving reliability. Fleet operators prefer manual systems for their longevity and resilience under demanding operating conditions.

- For instance, Eaton’s manual transmissions are trusted in commercial heavy-duty trucks, with field reports showing over 1.5 million Eaton HD transmissions in service worldwide, many operating successfully for over 10 years in extreme applications.

Fuel Efficiency Under Skilled Driving:

Despite growing competition from automatics, manual gearboxes remain fuel-efficient when driven skillfully. The manual transmission market benefits from consumer awareness of fuel economy in regions with volatile fuel prices. It allows precise gear selection, which supports better fuel optimization in urban and highway driving. This efficiency sustains demand among drivers who prioritize operating costs over convenience.

Niche Demand in Performance and Enthusiast Vehicles:

Sports cars and enthusiast vehicles continue to rely on manual transmissions to enhance the driving experience. The manual transmission market gains steady support from consumers who value direct control and engagement. It caters to niche segments where manual shifting defines performance appeal and brand identity. This specialized demand ensures ongoing relevance despite the broader industry shift toward automatics.

Market Trends:

Growing Preference for Affordable and Durable Mobility Solutions:

The manual transmission market is witnessing a steady trend toward affordability-driven adoption, particularly in emerging economies where budget-conscious consumers dominate vehicle sales. It continues to gain traction among light commercial vehicles and entry-level passenger cars because of lower purchase costs and simpler maintenance. Demand is also sustained in rural and semi-urban areas where vehicles face challenging terrains, requiring durable and easy-to-repair powertrains. Consumers view manual gearboxes as reliable solutions that reduce long-term ownership expenses. Automakers continue to position manual models strategically in price-sensitive markets to maintain competitiveness. This trend highlights the resilience of manual systems despite the global shift toward automatics.

- For instance, Ford’s Ranger pickup truck in South Africa sold 32 765 continued its dominance with more than 65% of the 2024 model year units sold equipped with manual gearboxes, catering to durability and ease of maintenance for rural fleets.

Sustained Demand in Enthusiast and Performance Vehicle Segments:

While mainstream adoption faces competition from automatic and electric drivetrains, the manual transmission market benefits from niche demand in sports and enthusiast vehicles. It offers drivers greater engagement and control, which remain essential to performance-focused brands. Leading automakers retain manual options in their lineups to appeal to enthusiasts who prioritize driving experience over convenience. There is also a growing cultural trend, especially among younger drivers, to view manual driving as a skill and passion, preserving its relevance. Certain markets, including Europe and North America, showcase loyal customer bases that prefer manual gearboxes in compact and performance vehicles. This trend reinforces the long-term positioning of manual transmissions within select consumer and regional segments.

- For instance, Mazda reported that 53% of U.S. buyers of the MX-5 Miata opted for the manual transmission variant in the 2024 model year, underscoring continued appeal among enthusiasts.

Market Challenges Analysis:

Rising Shift Toward Automatic and Electric Vehicles:

The manual transmission market faces a major challenge from the accelerating adoption of automatic and electric vehicles worldwide. Consumers in developed economies increasingly prefer convenience, smoother driving, and advanced driver-assistance features that align with automatics. It struggles to compete in regions where urbanization and traffic congestion make automatic gearboxes more practical. Electric vehicles, which eliminate the need for traditional gear systems, further reduce the scope of manual adoption. Automakers are gradually phasing out manual options in premium and mid-range segments, limiting their availability to specific entry-level or enthusiast models. This trend significantly narrows growth opportunities for manual transmissions in the long term.

Changing Consumer Preferences and Skill Gaps:

Another challenge arises from shifting consumer behavior and reduced interest in manual driving among younger generations. The manual transmission market is affected by the declining number of drivers trained to operate manual vehicles, particularly in North America and parts of Asia. It also faces regulatory pressures tied to stricter emissions and efficiency standards, which often favor advanced automatic technologies. Consumers view manual systems as less convenient for congested city traffic, creating a perception gap. Limited promotional focus from automakers further contributes to declining awareness of their benefits. These factors collectively hinder the ability of manual transmissions to retain broad consumer appeal.

Market Opportunities:

Expansion in Emerging and Cost-Sensitive Markets:

The manual transmission market holds strong opportunities in emerging economies where affordability and durability remain top priorities for vehicle buyers. It is well-positioned to serve large populations in Asia-Pacific, Latin America, and Africa that continue to prefer budget-friendly vehicles. Growing demand for light commercial vehicles in logistics, agriculture, and construction sectors further supports adoption. Manual gearboxes offer lower repair costs and longer lifespans, which are highly valued in these markets. Automakers can strengthen their presence by offering localized models tailored to rural and semi-urban needs. This creates sustained room for growth despite global industry shifts.

Niche Growth in Performance and Specialty Segments:

Enthusiast and performance-driven vehicles present another key opportunity for the manual transmission market. It continues to attract drivers who value control, engagement, and traditional driving experiences. Sports car manufacturers maintain manual variants to differentiate their offerings and retain brand loyalty among niche customer bases. Training schools and cultural promotion of manual driving as a skill also help preserve relevance. Limited-edition models with manual gearboxes are gaining popularity among collectors, adding to their long-term demand. These niche but profitable segments ensure that manual transmissions remain an integral part of the automotive landscape.

Market Segmentation Analysis:

By Vehicle:

The manual transmission market shows strong penetration in passenger cars and light commercial vehicles, where affordability and ease of repair remain critical. It dominates entry-level hatchbacks, sedans, and compact SUVs in emerging economies due to price-sensitive buyers. Light commercial vehicles, including vans and small trucks, prefer manual gearboxes for durability and control in heavy-load conditions. Heavy commercial vehicles use manual systems in regions where rugged terrains and cost efficiency outweigh automation. Sports cars also retain demand, as enthusiasts value manual gear shifting for engagement and driving experience.

By Transmission:

The manual transmission market includes 5-speed, 6-speed, and advanced multi-speed gearboxes. The 5-speed segment remains common in entry-level vehicles due to its cost-effectiveness and simplicity. The 6-speed segment is growing rapidly, offering better performance, fuel efficiency, and smoother gear ratios for modern vehicles. Multi-speed options above 6 gears cater to performance-focused cars, enhancing acceleration and driving control. It continues to evolve with improvements in gear design to meet stricter efficiency and emission requirements.

- For instance, Maruti Suzuki equips its Alto K10 with a 5-speed manual transmission, enabling the compact car to achieve a certified mileage of 24.39 km/l, making it a popular choice in the entry-level segment.

By Propulsion:

The manual transmission market is primarily driven by internal combustion engine (ICE) vehicles, where manual gearboxes remain cost-effective and widely adopted. Petrol and diesel vehicles across passenger and commercial categories sustain the highest demand. Hybrid adoption remains limited, as electrification aligns better with automatic systems. Electric vehicles reduce the scope for manual gearboxes, but niche opportunities persist in hybrid performance models. It maintains relevance in ICE-dominated markets, ensuring steady growth in developing regions while facing contraction in EV-driven economies.

- For instance, ZF Friedrichshafen launched its new 6-speed manual transmission in 2023 for BMW’s M2 model, enabling torque handling capacity of up to 550 Nm, reinforcing manual gear adoption in performance cars.

Segmentations:

By Vehicle:

- Passenger Cars

- Light Commercial Vehicles (LCVs)

- Heavy Commercial Vehicles (HCVs)

- Sports Cars

By Transmission:

- 5-Speed Manual Transmission

- 6-Speed Manual Transmission

- Multi-Speed Manual Transmission (Above 6-Speed)

By Propulsion:

- Petrol Vehicles

- Diesel Vehicles

- Hybrid Vehicles

- Electric Vehicles (Niche/Performance-Oriented)

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Asia-Pacific :

Asia-Pacific holds 45% market share of the manual transmission market, driven by strong vehicle production and high consumer preference for affordable models. Countries such as China, India, and Japan lead adoption due to large populations and cost-sensitive buyers. It benefits from rising sales of compact cars and light commercial vehicles used in logistics, agriculture, and rural transport. Local manufacturers continue to focus on manual variants to capture entry-level segments. Government initiatives promoting domestic vehicle production further strengthen regional growth. The region remains the most significant contributor to long-term demand despite the rise of automatic and electric vehicles.

Europe :

Europe holds 25% market share of the manual transmission market, supported by consistent demand for compact and enthusiast vehicles. It benefits from cultural acceptance of manual driving and niche adoption in performance cars. Countries such as Germany, France, and Italy maintain strong customer bases that value control and fuel efficiency. Regulatory measures encouraging sustainability push automakers to refine manual gearboxes for better efficiency. Sports car brands continue to include manual options to satisfy loyal drivers. The region sustains stable demand even as automatic transmissions expand in premium vehicle categories.

North America :

North America holds 15% market share of the manual transmission market, reflecting shifting consumer preferences toward convenience-focused vehicles. Automatic and electric drivetrains dominate sales in the United States and Canada, where urbanization and traffic congestion reduce demand for manual gearboxes. It faces challenges from limited driver training and cultural trends that favor automatics. Niche adoption persists in sports cars and select enthusiast models, keeping manual options alive in performance-focused segments. Pickup trucks and commercial vehicles retain limited demand where durability is valued. The region’s contribution is shrinking, but manual transmissions remain relevant to targeted consumer groups.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The manual transmission market is moderately competitive, with both global leaders and regional manufacturers shaping its dynamics. Key players include Aisin, BorgWarner, Allison, Divgi TorqTransfer Systems, Hyundai Transys, and Eaton, each contributing to product innovation and global supply. It is driven by the ability of these companies to deliver cost-effective, durable, and fuel-efficient solutions that meet the needs of diverse vehicle segments. Leading manufacturers focus on refining gear designs, improving shift quality, and enhancing efficiency to remain relevant against automatic and electric alternatives. Regional players strengthen competition by offering localized, affordable systems tailored for emerging economies. Strategic collaborations with automakers, continuous investment in research and development, and strong aftersales networks further define competitive positioning. It sustains a balance between established multinational corporations and niche regional suppliers, ensuring wide product availability and adaptability across global markets.

Recent Developments:

- In August 2025, Aisin supplied its eAxle system for the new Isuzu D-MAX EV, enhancing Isuzu’s electric powertrain capabilities with this integration released.

- In December 2023, BorgWarner completed its acquisition of the Electric Hybrid Systems business segment of Eldor Corporation, enhancing BorgWarner’s ePropulsion portfolio with high-voltage power electronics.

- In March 2025, Ricardo joined the Australian Hydrogen Council, deepening its role in the country’s hydrogen sector to drive collaboration and policy innovation for clean energy.

Market Concentration & Characteristics:

The manual transmission market is moderately concentrated, with a mix of global automakers and regional manufacturers shaping competition. It features established players who integrate manual gearboxes into entry-level and commercial vehicle segments, ensuring broad availability in cost-sensitive regions. The market is characterized by price-driven demand, long product life cycles, and strong reliance on aftersales and maintenance networks. Automakers differentiate by refining efficiency, durability, and driving experience, particularly in performance and enthusiast models. Regional players strengthen their presence by offering localized solutions that meet rural and semi-urban mobility needs. Despite increasing competition from automatic and electric drivetrains, it maintains relevance through affordability, reliability, and niche consumer loyalty.

Report Coverage:

The research report offers an in-depth analysis based on Vehicle, Transmission, Propulsion and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- The manual transmission market will continue to sustain demand in emerging economies where affordability and durability remain strong priorities.

- It will retain importance in light commercial vehicles due to lower maintenance costs and suitability for rugged operating conditions.

- Automakers will keep offering manual options in entry-level passenger cars to capture cost-sensitive consumers.

- The market will find niche growth in sports cars and enthusiast vehicles where driving engagement remains a core appeal.

- Technological refinements in gear design and efficiency will enhance competitiveness against advanced automatic systems.

- Training institutions and cultural trends that emphasize manual driving skills will help preserve relevance in select regions.

- Regulatory pressure on fuel efficiency will encourage manufacturers to optimize manual gearboxes for better performance.

- The market will experience gradual contraction in developed economies where automatics and EVs dominate adoption.

- Regional manufacturers in Asia-Pacific, Latin America, and Africa will play a vital role in sustaining growth.

- The overall outlook indicates resilience, with manual transmissions maintaining a defined role in cost-driven and performance-focused segments despite industry transformation.