Market Overview:

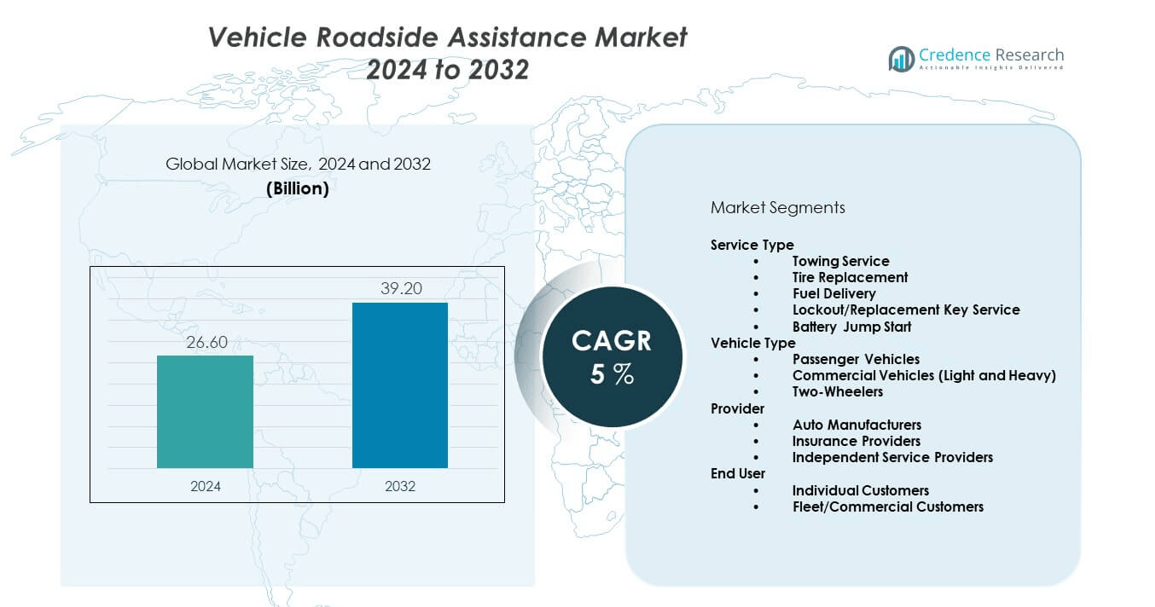

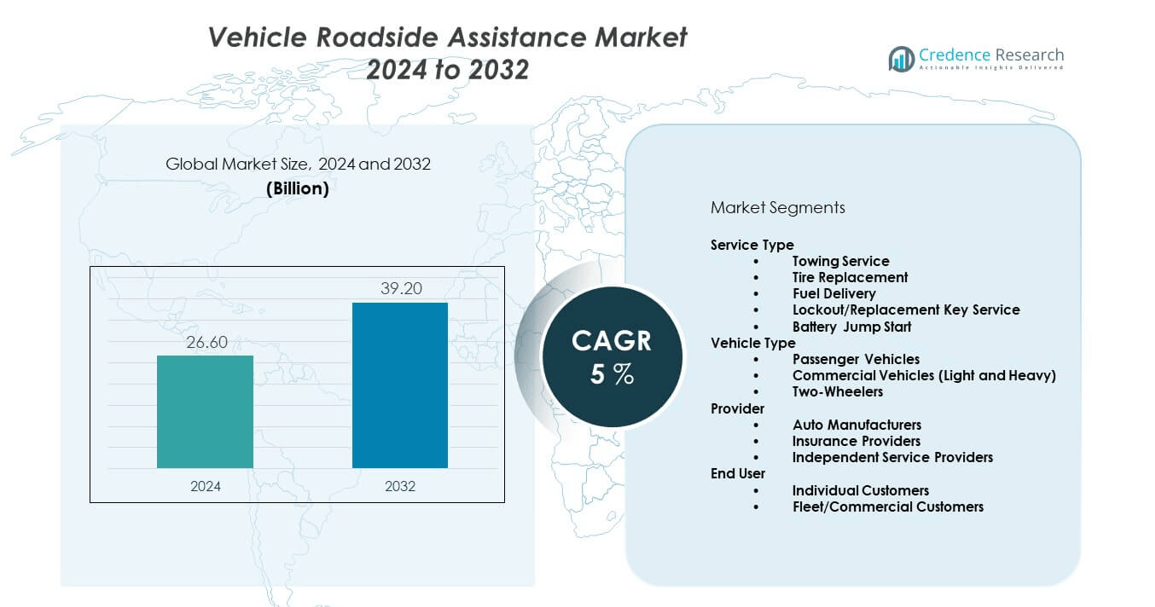

The vehicle roadside assistance market is projected to grow from USD 26.6 billion in 2024 to an estimated USD 39.2 billion by 2032, with a compound annual growth rate (CAGR) of 5% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Vehicle Roadside Assistance Market Size 2024 |

USD 26.6 billion |

| Vehicle Roadside Assistance Market, CAGR |

5% |

| Vehicle Roadside Assistance Market Size 2032 |

USD 39.2 billion |

The vehicle roadside assistance market is driven by a combination of rising vehicle ownership, urban congestion, and longer average vehicle lifespans that increase the likelihood of breakdowns. Customers expect immediate solutions, which fuels demand for professional towing, battery jump-starts, tire replacement, and fuel delivery services. The growth of connected cars, telematics integration, and mobile app-based assistance further strengthen service adoption, as providers can respond faster and more effectively. Partnerships between insurers, automakers, and service providers also widen coverage and accessibility.

Regionally, North America leads the vehicle roadside assistance market due to its advanced service infrastructure, widespread automobile ownership, and established insurance partnerships. Europe follows closely, supported by strong regulatory frameworks and mature automotive markets. The Asia-Pacific region is emerging as a high-growth hub, driven by rapid motorization, rising middle-class income levels, and increasing vehicle reliability concerns in countries like China and India. Latin America and the Middle East are witnessing steady growth as urbanization expands and car ownership rises, while Africa remains at an early stage but shows potential with growing automotive penetration.

Market Insights:

- The vehicle roadside assistance market is projected to grow from USD 26.6 billion in 2024 to USD 39.2 billion by 2032, registering a CAGR of 5% during the forecast period.

- Rising global vehicle ownership and aging fleets increase breakdown risks, driving steady demand for roadside services.

- Technological integration through telematics, GPS, and mobile platforms enhances efficiency and improves customer experience.

- High operational costs and intense price competition restrain profitability and challenge smaller service providers.

- Service fragmentation and inconsistent quality across independent operators limit trust and create adoption barriers.

- North America leads the market with advanced infrastructure and strong insurance-OEM partnerships.

- Asia-Pacific emerges as a high-growth region, fueled by rapid urbanization, rising incomes, and expanding vehicle ownership.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Vehicle Ownership and Aging Fleet Expansion Driving Assistance Demand:

The vehicle roadside assistance market is expanding due to the increasing number of vehicles on the road and the aging fleet that requires frequent support. Global urbanization and higher commuting distances intensify the likelihood of breakdowns, which drives demand for reliable services. Consumers seek quick recovery solutions for unexpected incidents, and providers respond with comprehensive offerings such as towing, tire change, and fuel delivery. Insurance companies also integrate roadside support into motor policies, enhancing accessibility and awareness. Automakers promote bundled plans to attract buyers and strengthen loyalty. It benefits from the surge in vehicle ownership across emerging and developed economies. Customers’ rising concern for safety and convenience ensures recurring reliance on assistance services. These factors create a strong foundation for sustainable industry growth.

- For instance, in 2024, Verizon Connect reported managing and connected vehicles globally, reflecting rising telematics usage aligned with aging fleet management, demonstrating expanding roadside service integration.

Technological Integration Enhancing Service Efficiency and Accessibility:

Technology adoption plays a critical role in improving efficiency in the vehicle roadside assistance market. Telematics, GPS, and mobile applications allow seamless communication between customers and service providers. Real-time tracking reduces delays, strengthens customer trust, and enhances response time accuracy. Mobile platforms simplify service booking and payment, making roadside support more accessible. It also benefits from predictive maintenance tools that detect potential issues before failures occur. Artificial intelligence and machine learning improve resource allocation and dispatch planning. Automakers and service providers collaborate on advanced digital solutions for their customers. The integration of technology transforms the sector into a more efficient and responsive service ecosystem.

- For example, Blink Roadside reports over 1.2 million completed service requests via its mobile platform in the US in 2024, with an average response time improvement from 45 minutes to 30 minutes compared to previous years, illustrating the efficiency gains from technology integration.

Expansion of Insurance and OEM Partnerships Strengthening Service Networks:

Partnerships between insurers and original equipment manufacturers (OEMs) are reinforcing the vehicle roadside assistance market. Insurance providers increasingly include emergency support as part of vehicle coverage to enhance customer satisfaction. OEMs offer free or discounted roadside assistance with new vehicles to create value and attract customers. It creates an extensive network that boosts customer awareness and adoption. These alliances ensure standardized and reliable service delivery across regions. Insurers and automakers use such services as tools to differentiate themselves in competitive markets. Growing insurance penetration in emerging markets further accelerates coverage expansion. The alignment of stakeholders strengthens service infrastructure and increases trust in roadside assistance.

Growing Focus on Safety and Reliability Driving Customer Preference:

The vehicle roadside assistance market is shaped by customer demand for safer and more reliable driving experiences. Unexpected breakdowns create safety risks, leading to rising adoption of emergency services. Providers offer around-the-clock assistance with solutions like towing, jump-starts, and lockout services. It aligns with customer priorities for reliable and secure travel. Governments also emphasize road safety awareness, indirectly supporting industry demand. Urban congestion and long-distance travel amplify the risks that make assistance indispensable. Companies emphasize service quality and fast response to enhance reputation. Growing focus on safety ensures strong and sustainable demand across both developed and emerging economies.

Market Trends:

Integration of Digital Platforms Driving User-Centric Experiences:

Digital-first platforms are reshaping the vehicle roadside assistance market by enabling faster and more convenient service. Mobile apps provide customers with one-click access to booking, tracking, and payment. It creates a transparent and user-friendly process that builds loyalty. Providers invest heavily in app ecosystems with live updates and customer feedback channels. Digital platforms also reduce reliance on call centers, streamlining operations. Data from these platforms allows providers to personalize services and predict demand. Subscription-based app models are particularly appealing to younger drivers. This digital shift enhances competitiveness while redefining customer engagement.

- For instance, booking and integrated payment gateways. YourMechanic’s app user retention rate increased by 25% year-over-year, attributed to enhanced live tracking and customer feedback features.

Adoption of Predictive and Preventive Service Models:

The vehicle roadside assistance market is witnessing a transition toward predictive and preventive service frameworks. Telematics and IoT systems track real-time vehicle performance, reducing sudden breakdowns. It helps service providers identify issues like low battery health before failures occur. Predictive analytics allows optimized resource allocation and proactive planning. Customers benefit from fewer disruptions and higher satisfaction. Providers use preventive support as part of premium membership plans to build loyalty. Such models reduce operating costs by minimizing emergency dispatch frequency. The shift from reactive to proactive assistance highlights the industry’s technological maturity.

- For instance, Insurance company AXA offers proactive roadside support plans with preventive diagnostics integrated into over 2 million policies in Europe, reducing roadside assistance calls by 18%, reflecting operational cost savings and improved customer satisfaction.

Rise of On-Demand and Subscription-Based Service Models:

Flexible service models are gaining momentum in the vehicle roadside assistance market. On-demand solutions allow drivers to access services without committing to long-term memberships. It has created opportunities for app-based aggregators that link customers with local operators. Subscription-based models with tiered benefits like priority response are also expanding. Providers gain recurring revenue streams while consumers enjoy customizable options. These models cater to millennials and young drivers who favor convenience and flexibility. Service innovation through pay-as-you-go formats improves market penetration. The rise of flexible models is redefining traditional approaches to service delivery.

Increasing Role of Electric and Hybrid Vehicles in Service Demand:

The electrification of transport is creating new service dynamics in the vehicle roadside assistance market. EV and hybrid drivers require specialized services like charging, towing, or battery diagnostics. It pushes service providers to upgrade capabilities and train technicians. Automakers align assistance packages with EV adoption, ensuring smooth ownership experiences. Providers deploy mobile charging units to meet emerging requirements. Investments in EV infrastructure complement roadside support services. Companies adapt offerings to align with the global shift to sustainable mobility. The growing EV fleet ensures continued evolution of service portfolios.

Market Challenges Analysis:

Rising Operational Costs and Competitive Pricing Pressure:

The vehicle roadside assistance market encounters persistent challenges from high operational expenses and pricing competition. Maintaining round-the-clock networks with skilled staff significantly raises costs. Providers struggle to balance affordability with service quality, particularly in competitive regions. It creates a difficult environment for smaller players that lack economies of scale. Fluctuating fuel prices and insurance-related costs add financial burdens. Expanding into rural regions also demands investments that pressure profit margins. Fierce competition often results in price undercutting that reduces sustainability. Providers face the dual challenge of controlling costs while maintaining customer trust in service reliability.

Fragmented Service Networks and Customer Expectation Gaps:

The vehicle roadside assistance market faces fragmentation, leading to inconsistent service delivery. Independent operators often lack standardized procedures, resulting in varied customer experiences. It undermines loyalty and creates trust gaps in a highly competitive market. Growing consumer expectations for rapid response times are hard to meet in remote locations. Limited infrastructure and logistical inefficiencies worsen the situation. Partnerships between insurers, automakers, and providers mitigate some fragmentation issues, but challenges persist. Addressing diverse urban and rural needs requires advanced infrastructure and coordination. Without uniform standards and integration, service fragmentation remains a major growth restraint.

Market Opportunities:

Expansion into Emerging Markets with Growing Vehicle Ownership:

Emerging regions provide strong growth opportunities for the vehicle roadside assistance market. Rising disposable income, urbanization, and increased car ownership expand the customer base. It allows providers to introduce bundled assistance packages and app-based service solutions. Insurance penetration is improving, which aligns with roadside support offerings. Global players are entering underserved regions to establish networks and capture market share. Urban traffic congestion and poor road infrastructure amplify the need for professional roadside assistance. Local partnerships help tailor services for affordability and scalability. Companies that invest early in these regions’ secure competitive advantages and revenue growth.

Leveraging Technology to Deliver EV and Smart Vehicle Assistance:

The rise of electric and connected vehicles opens new avenues for the vehicle roadside assistance market. EV users require specialized services such as mobile charging and diagnostic support. It compels providers to invest in advanced tools and trained staff. Connected car technology enhances real-time communication and predictive diagnostics for faster service delivery. Providers collaborate with automakers to integrate EV roadside support into ownership plans. Mobile platforms strengthen accessibility and improve customer satisfaction levels. By adapting to new mobility trends, companies future-proof their operations. The evolution toward EV and smart vehicle assistance creates high-value growth potential.

Market Segmentation Analysis:

Service Type

Towing services dominate the vehicle roadside assistance market, supported by high demand for recovery after breakdowns or accidents. Tire replacement is another major segment, driven by frequent punctures and wear during urban and highway travel. Fuel delivery services address unexpected depletions, particularly in regions with limited fueling infrastructure. Lockout and replacement key services are expanding due to growing incidences of misplaced or damaged keys. Battery jump-start services remain essential for older vehicles and regions with extreme weather conditions. Together, these services form a comprehensive backbone for emergency roadside support.

- For instance, Tire replacement services are significant; for example, YourMechanic conducted 150,000 on-site tire repairs and replacements in 2024.

Vehicle Type

Passenger vehicles hold the largest market share, reflecting their widespread use in commuting and leisure activities. Commercial vehicles, including both light and heavy categories, contribute significantly given their role in logistics and goods transportation where downtime is costly. Two-wheelers represent a smaller share but are rising rapidly in Asia-Pacific, where motorcycles and scooters dominate daily mobility. Each segment reflects different service priorities and contributes to a diverse demand profile.

Provider

Auto manufacturers lead with bundled roadside packages offered at the point of sale, strengthening customer loyalty. Insurance providers enhance their competitiveness by embedding assistance services into vehicle policies. Independent service providers occupy a flexible space, offering on-demand services and catering to diverse regional needs. The mix of providers ensures a balanced and competitive landscape.

End User

Individual customers dominate the market, accounting for the largest share due to increasing personal vehicle ownership and safety concerns. Fleet and commercial customers also represent a strong segment, as businesses require consistent support to minimize downtime and ensure operational efficiency. Both user groups drive the continued expansion of service networks globally.

Segmentation:

By Service Type

- Towing Service

- Tire Replacement

- Fuel Delivery

- Lockout/Replacement Key Service

- Battery Jump Start

By Vehicle Type

- Passenger Vehicles

- Commercial Vehicles (Light and Heavy)

- Two-Wheelers

By Provider

- Auto Manufacturers

- Insurance Providers

- Independent Service Providers

By End User

- Individual Customers

- Fleet/Commercial Customers

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America and Europe Leading the Market

North America holds the largest share of the vehicle roadside assistance market at 34%, supported by high vehicle ownership, advanced insurance penetration, and strong service networks. It benefits from established providers such as AAA, GEICO, and Allstate that deliver comprehensive coverage with technology-driven platforms. Europe follows closely with 28% market share, shaped by mature automotive markets and widespread adoption of bundled roadside packages by insurers and OEMs. Regulatory emphasis on road safety further enhances demand in European countries. Both regions are characterized by high consumer expectations for rapid response times and premium service offerings. Strong infrastructure and technology integration make these markets highly competitive and service-driven.

Asia-Pacific Emerging as High-Growth Region

Asia-Pacific accounts for 22% of the global vehicle roadside assistance market, with rapid growth driven by expanding vehicle ownership, rising disposable incomes, and urbanization. It benefits from large-scale two-wheeler and passenger car usage in countries like China and India. Service providers are expanding coverage to meet rising demand for towing, battery support, and tire replacement. Insurance penetration is increasing in the region, which creates opportunities for bundled assistance services. It also gains momentum from mobile app-based platforms targeting tech-savvy younger consumers. The region demonstrates strong potential as local providers collaborate with insurers and OEMs to extend cost-effective and scalable services.

Latin America, Middle East, and Africa Showing Steady Growth

Latin America contributes 9% market share to the vehicle roadside assistance market, where growing vehicle sales and increasing insurance adoption support steady demand. The Middle East represents 4%, benefiting from expanding passenger vehicle ownership and rising adoption of insurance-linked assistance packages. Africa accounts for 3%, reflecting its early-stage development but growing opportunities with rising car ownership and urban expansion. It faces challenges of fragmented networks and infrastructure gaps, yet international providers are beginning to enter these markets with scalable models. Demand in these regions is being shaped by rising safety awareness and the need for reliable vehicle recovery services. Together, Latin America, the Middle East, and Africa offer incremental growth opportunities for global and regional players.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The vehicle roadside assistance market is highly competitive with a mix of global insurance providers, automotive manufacturers, and independent service firms. Major players such as Allianz Global Assistance, AAA, Allstate, GEICO, and Agero dominate through established networks and technology-driven solutions. It benefits from strong integration with insurers and OEMs, where bundled service packages create customer loyalty and recurring revenue streams. Companies are differentiating through mobile app platforms, real-time tracking, and AI-powered dispatch systems. Independent providers focus on flexible, on-demand services to target niche markets. Strategic partnerships with automakers and insurers remain a defining competitive factor, while expansion into emerging economies offers growth opportunities for both global and regional players.

Recent Developments:

- In December 2024, Allianz Partners extended its partnership with Mazda Motor Europe, consolidating and expanding their European roadside assistance program to new markets including Poland, the Netherlands, and Portugal. This partnership provides brand-specific premium roadside assistance services, integrated with digital features on the MyMazda app for easier customer incident reporting and service tracking.

- In May 2025, GEICO highlighted its Emergency Roadside Service, which covers towing, battery boosts, tire changes, lockout services, fuel delivery, and winching. Their service is accessible via a mobile app that enables users to request and track roadside assistance efficiently.

- Allstate Insurance, as of April 2025, continues to offer three types of roadside assistance memberships with a range of services such as towing, jumpstarts, fuel delivery, lockout services, and tire changes. They provide flexible options including a pay-per-use service and insurance policy add-ons, with real-time service tracking through their platform.

- In July 2025, Agero strengthened its position in electric vehicle assistance by enabling Polestar to deliver leading roadside assistance to EV owners across the US, utilizing Agero’s advanced technology platform tailored for EV service.

Market Concentration & Characteristics:

The vehicle roadside assistance market is moderately consolidated, with leading companies such as Allianz, AAA, and Agero holding significant shares due to scale, brand presence, and extensive service networks. It is characterized by a combination of large global providers and smaller regional players that compete on pricing and coverage flexibility. Strong partnerships with insurance firms and automakers intensify competition while also creating market entry barriers for new participants. The industry shows high service dependency, recurring demand, and increasing reliance on digital platforms for efficient delivery.

Report Coverage:

The research report offers an in-depth analysis based on service type, vehicle type, provider, and end user. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Digital platforms will dominate service delivery with real-time tracking and app-based requests.

- Predictive maintenance and telematics will reduce breakdown risks and strengthen preventive assistance.

- Partnerships between insurers and automakers will expand bundled coverage offerings.

- On-demand and subscription-based roadside services will gain strong customer adoption.

- Electric vehicle adoption will drive demand for mobile charging and specialized support.

- Regional players will scale operations through alliances with global providers.

- Individual customers will continue leading demand while fleet operators gain share.

- Artificial intelligence will optimize dispatch and improve customer experience.

- Emerging markets will become key growth hubs with rising urbanization and vehicle ownership.

- Market competition will intensify as new digital entrants challenge established providers.