| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Life Science Instrumentation Market Size 2024 |

USD 75,205.45 million |

| Life Science Instrumentation Market, CAGR |

6.52% |

| Life Science Instrumentation Market Size 2032 |

USD 124,331.70 million |

Market Overview:

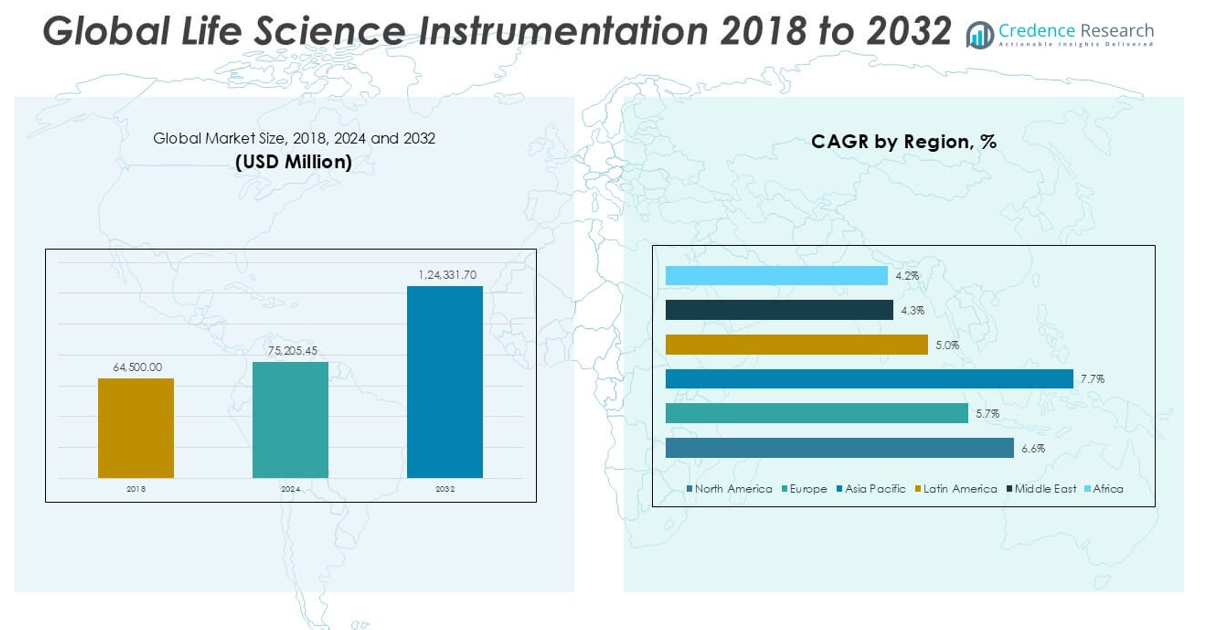

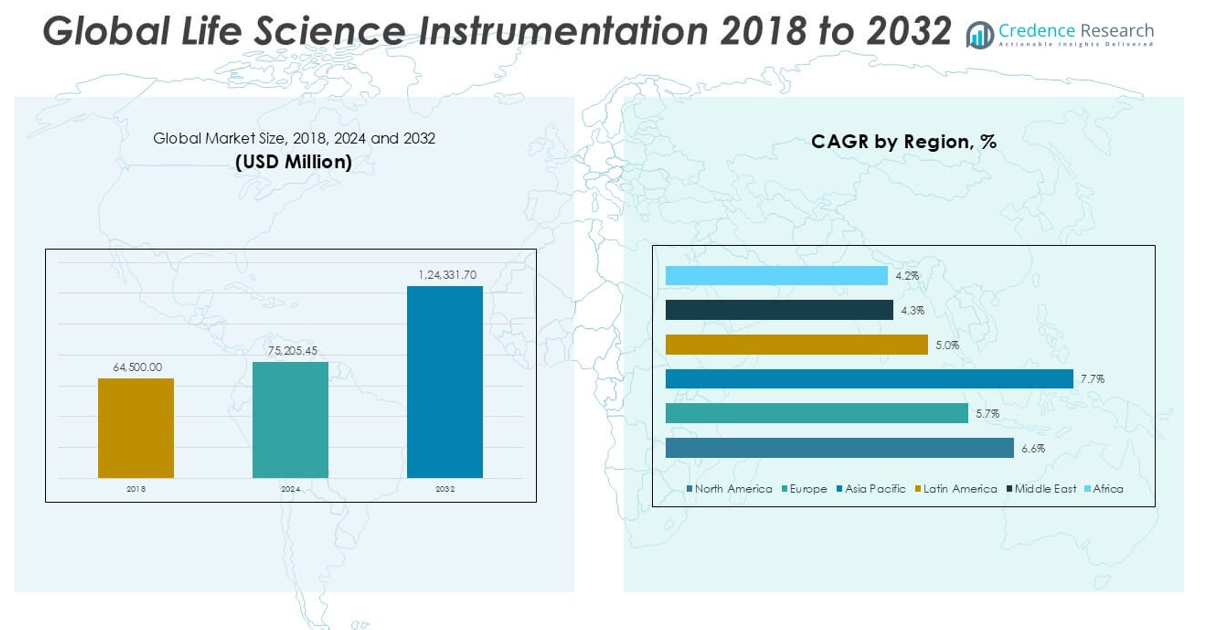

The Life Science Instrumentation market size was valued at USD 64,500.00 million in 2018, reached USD 75,205.45 million in 2024, and is anticipated to reach USD 124,331.70 million by 2032, at a CAGR of 6.52% during the forecast period.

The Life Science Instrumentation market is led by key players such as Thermo Fisher Scientific, Danaher Corporation, Agilent Technologies, Illumina, PerkinElmer, Bio-Rad Laboratories, Bruker Corporation, and Merck KGaA. These companies maintain their competitive edge through technological advancements, broad product portfolios, and strong global distribution networks. North America dominates the market, holding a 39.7% share in 2024, driven by advanced healthcare infrastructure and high adoption of innovative diagnostic technologies. Europe follows with a 27.3% market share, supported by strong research initiatives and growing clinical applications. Asia Pacific, capturing 25.6% of the market, is the fastest-growing region, fueled by expanding pharmaceutical industries and increasing healthcare investments.

Market Insights

- The Life Science Instrumentation market was valued at USD 64,500.00 million in 2018, reached USD 75,205.45 million in 2024, and is expected to reach USD 124,331.70 million by 2032, growing at a CAGR of 6.52% during the forecast period.

- The market is driven by rising pharmaceutical research, increasing clinical diagnostic needs, and technological advancements in analytical tools supporting drug discovery and precision medicine.

- Growing trends include the integration of artificial intelligence, automation, and increasing demand for portable and point-of-care instruments improving efficiency and accessibility across healthcare and research settings.

- The competitive landscape is led by companies such as Thermo Fisher Scientific, Danaher Corporation, Agilent Technologies, and Illumina, focusing on product innovation, strategic partnerships, and expansion into emerging markets.

- North America holds the largest regional share at 39.7% in 2024, followed by Europe at 27.3% and Asia Pacific at 25.6%, while spectroscopy leads the technology segment with significant adoption across key applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

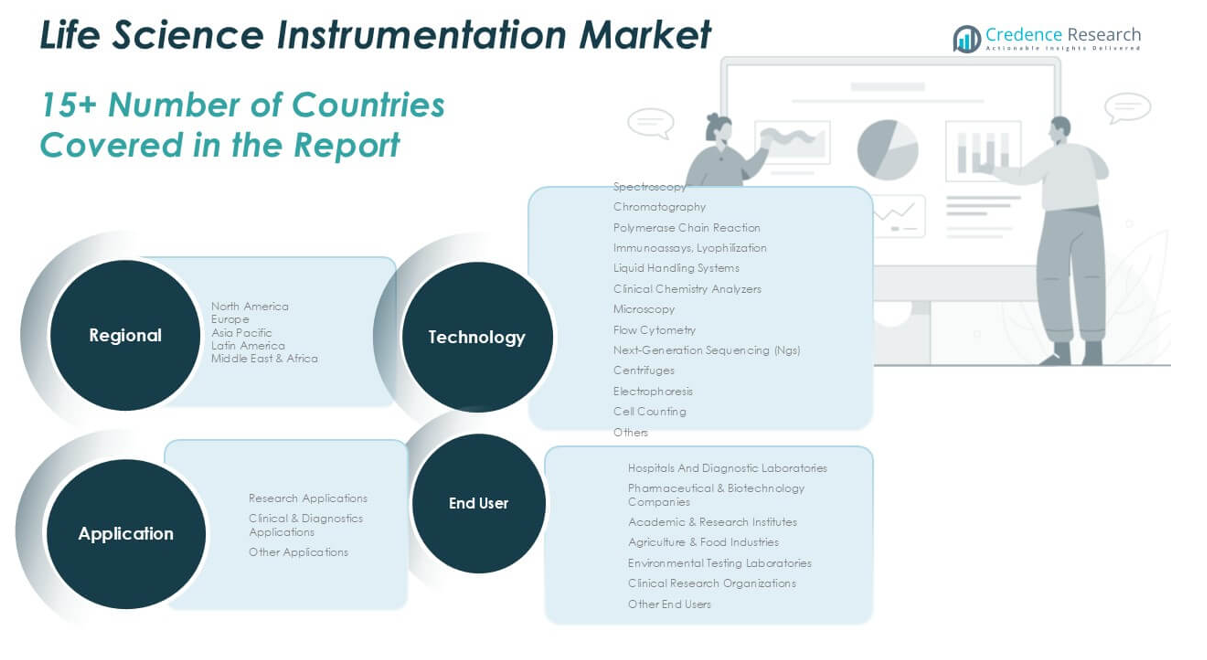

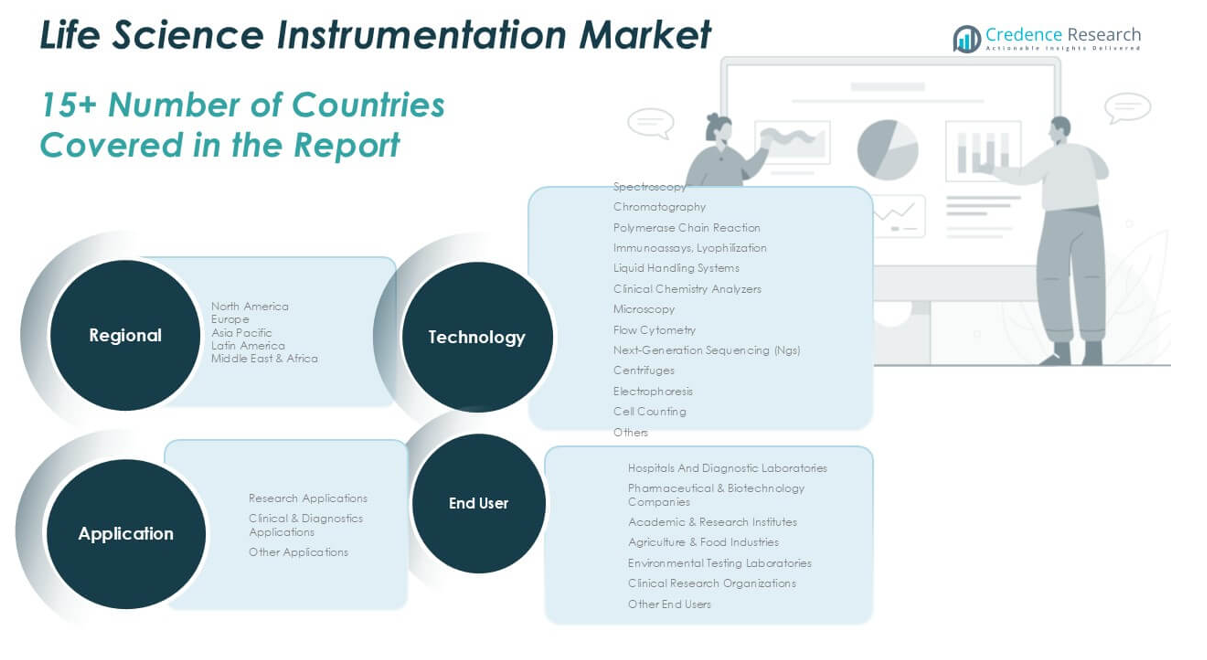

By Technology:

Within the Life Science Instrumentation market, spectroscopy holds the largest market share among the technology segments. Its dominance is driven by widespread adoption in pharmaceutical, environmental, and clinical research due to its accuracy and reliability in molecular analysis. The increasing demand for advanced spectroscopic techniques in drug development and quality control processes further supports its leading position. Additionally, the growth of chromatography and polymerase chain reaction (PCR) technologies significantly contributes to the market, propelled by their essential roles in genetic research, diagnostics, and the rising focus on personalized medicine.

- For instance, Agilent Technologies launched the Cary 3500 UV-Vis spectrophotometer, capable of performing up to four temperature experiments simultaneously, significantly increasing throughput in pharmaceutical labs.

By End User

Pharmaceutical and biotechnology companies represent the dominant end-user segment in the Life Science Instrumentation market, capturing the highest market share. This leadership is fueled by the rising investments in drug discovery, clinical trials, and biotechnological advancements. The extensive use of life science instruments in quality assurance, molecular research, and biologics production supports the segment’s growth. Hospitals and diagnostic laboratories also hold a substantial share, driven by increasing diagnostic procedures and demand for accurate clinical testing. Academic and research institutes contribute steadily, supported by government-funded research and technological innovation in life sciences.

- For instance, the University of Oxford utilizes Bruker’s Avance NEO NMR spectrometer capable of operating at 1.2 GHz for molecular structure analysis in academic research.

By Application

In the Life Science Instrumentation market, clinical and diagnostic applications account for the largest market share, primarily driven by the rising incidence of chronic and infectious diseases. The growing emphasis on early diagnosis, coupled with technological advancements in molecular diagnostics and clinical testing, supports the growth of this application segment. Increasing demand for reliable and rapid diagnostic solutions in hospitals and laboratories further strengthens this position. Research applications also significantly contribute to the market, as they are essential for drug development, genetic studies, and the advancement of precision medicine in both academic and commercial research settings.

Market Overview

Expanding Pharmaceutical and Biotechnology Research

The rapid expansion of pharmaceutical and biotechnology research significantly drives the Life Science Instrumentation market. Growing investments in drug discovery, genomics, proteomics, and biologics production are increasing the demand for advanced instrumentation. Pharmaceutical companies are accelerating clinical trials and adopting high-throughput technologies to improve efficiency and precision. The increasing global disease burden and the need for innovative therapies further fuel the requirement for life science instruments to support complex research processes and ensure regulatory compliance.

- For instance, PerkinElmer’s Opera Phenix Plus high-content screening system can image up to 250,000 wells per day, facilitating large-scale drug screening projects.

Rising Demand for Clinical Diagnostics

The growing need for accurate and early disease diagnosis strongly supports market growth. With increasing incidences of chronic and infectious diseases, including cancer and genetic disorders, healthcare systems are prioritizing advanced clinical diagnostic tools. Life science instruments enable high-sensitivity testing, which is essential for timely and targeted treatment. The integration of molecular diagnostics and automation in laboratories further enhances testing capabilities, driving the demand for innovative instruments across hospitals, diagnostic centers, and clinical laboratories worldwide.

- For instance, Roche’s cobas 6800 system can deliver 96 test results in approximately 3.5 hours, improving diagnostic turnaround times in high-volume clinical settings.

Technological Advancements in Analytical Tools

Continuous technological advancements in analytical tools and life science equipment drive market expansion. Innovations such as next-generation sequencing (NGS), high-resolution microscopy, and advanced chromatography systems are enhancing research accuracy and throughput. The development of user-friendly, automated, and multifunctional instruments reduces manual intervention and improves operational efficiency. These technological improvements are attracting pharmaceutical companies, academic institutions, and clinical laboratories to adopt the latest life science instrumentation for better analytical performance and faster results.

Key Trends and Opportunities

Integration of Artificial Intelligence and Automation

The integration of artificial intelligence (AI) and automation in life science instrumentation presents significant opportunities for market growth. Automated systems and AI-driven data analysis enhance precision, reduce human error, and speed up complex procedures. These advancements are transforming laboratory workflows, enabling high-throughput screening and real-time diagnostics. The growing preference for intelligent instruments that streamline operations and deliver rapid results is creating new growth avenues, particularly in clinical diagnostics and pharmaceutical research applications.

- For instance, Danaher’s Cytiva Amersham ImageQuant 800 uses AI-based imaging software that enables real-time gel and blot analysis within minutes, reducing manual processing time.

Rising Adoption of Portable and Point-of-Care Instruments

The increasing adoption of portable and point-of-care life science instruments is shaping market trends. Compact, easy-to-use devices enable faster diagnostics and on-site testing, especially in resource-limited settings. This shift supports the decentralization of laboratory services and improves patient care by facilitating immediate clinical decisions. Manufacturers are focusing on developing lightweight, efficient, and cost-effective instruments that address the growing demand for mobility and accessibility in diagnostic and research environments.

- For instance, Cepheid’s GeneXpert Omni system, weighing less than 2.2 kg, provides rapid PCR-based diagnostic results in remote and decentralized locations.

Key Challenges

High Cost of Advanced Instruments

The high cost associated with life science instrumentation poses a significant challenge to market growth. Sophisticated equipment, such as high-end spectroscopy and sequencing systems, require substantial capital investment, limiting adoption among small and mid-sized laboratories. Additionally, the maintenance and operational costs of these instruments further restrict accessibility, particularly in developing regions. Budget constraints in academic and healthcare institutions may slow market penetration despite increasing demand for advanced diagnostic and research tools.

Stringent Regulatory Requirements

Compliance with stringent regulatory frameworks represents a major challenge in the Life Science Instrumentation market. Instruments used in clinical diagnostics and pharmaceutical applications must meet rigorous quality and safety standards imposed by regulatory authorities. Obtaining necessary approvals involves time-consuming processes and extensive validation, which can delay product launches. Continuous updates in regulatory guidelines also demand ongoing adjustments from manufacturers, increasing the complexity and cost of product development and commercialization.

Technical Complexity and Skilled Workforce Shortage

The technical complexity of modern life science instruments requires specialized expertise for proper operation and data interpretation. Many laboratories face challenges in recruiting and retaining skilled personnel trained to handle sophisticated equipment and advanced analytical methods. The shortage of qualified professionals limits the efficient utilization of available technologies and may result in suboptimal outcomes. This skills gap, particularly in emerging markets, constrains the broader adoption of advanced life science instrumentation.

Regional Analysis

North America

North America dominates the Life Science Instrumentation market, holding the largest market share of approximately 39.7% in 2024. The market was valued at USD 25,877.40 million in 2018 and reached USD 29,888.53 million in 2024. It is projected to grow to USD 49,640.05 million by 2032 at a CAGR of 6.6%. This growth is supported by advanced healthcare infrastructure, increasing investments in pharmaceutical research, and the rapid adoption of cutting-edge diagnostic technologies. The region’s focus on precision medicine and strong regulatory frameworks further contribute to its leading position in the global market.

Europe

Europe holds a significant share in the Life Science Instrumentation market, accounting for 27.3% of the global market in 2024. The regional market was valued at USD 18,318.00 million in 2018 and reached USD 20,589.20 million in 2024, with an expected growth to USD 32,049.31 million by 2032, registering a CAGR of 5.7%. The presence of leading research institutions, favorable government initiatives, and growing demand for clinical diagnostics are key growth drivers. Increasing focus on biotechnology and genomics research further supports Europe’s steady market expansion across pharmaceutical and academic sectors.

Asia Pacific

The Asia Pacific region is the fastest-growing market for Life Science Instrumentation, with a CAGR of 7.7% and a market share of 25.6% in 2024. The regional market was valued at USD 15,802.50 million in 2018, rising to USD 19,241.00 million in 2024, and is anticipated to reach USD 34,830.63 million by 2032. Rapid expansion in pharmaceutical manufacturing, increasing investments in healthcare infrastructure, and the growing demand for advanced diagnostic solutions are driving market growth. The rising prevalence of chronic diseases and supportive government policies further contribute to the region’s dynamic development.

Latin America

Latin America represents a developing market in the Life Science Instrumentation sector, holding a 3.5% market share in 2024. The market was valued at USD 2,296.20 million in 2018 and reached USD 2,631.44 million in 2024, with projections to grow to USD 3,850.55 million by 2032 at a CAGR of 5.0%. Increasing healthcare investments, growing awareness of early diagnostics, and expanding pharmaceutical sectors contribute to steady growth. Countries like Brazil and Mexico are witnessing rising adoption of clinical diagnostic tools, although market penetration remains moderate compared to more developed regions.

Middle East

The Middle East holds a modest position in the Life Science Instrumentation market, accounting for 1.9% of the global market in 2024. The market was valued at USD 1,367.40 million in 2018 and increased to USD 1,413.37 million in 2024, with expectations to reach USD 1,963.63 million by 2032, growing at a CAGR of 4.3%. Growth in the region is supported by improving healthcare systems, rising investments in laboratory infrastructure, and an increasing focus on clinical research. However, high equipment costs and limited technical expertise continue to challenge broader market adoption.

Africa

Africa’s Life Science Instrumentation market remains the smallest, with a 2.0% market share in 2024. Valued at USD 838.50 million in 2018, the market grew to USD 1,441.92 million in 2024 and is projected to reach USD 1,997.52 million by 2032, registering a CAGR of 4.2%. Market growth is driven by the gradual development of healthcare infrastructure, increasing focus on infectious disease diagnostics, and international support for healthcare advancements. Despite progress, limited access to advanced technologies and skilled professionals restrains the region’s market expansion, particularly in rural and underserved areas.

Market Segmentations:

By Technology

- Spectroscopy

- Chromatography

- Polymerase Chain Reaction

- Immunoassays, Lyophilization

- Liquid Handling Systems

- Clinical Chemistry Analyzers

- Microscopy

- Flow Cytometry

- Next-Generation Sequencing (NGS)

- Centrifuges

- Electrophoresis

- Cell Counting

- Others

By End User

- Hospitals and Diagnostic Laboratories

- Pharmaceutical & Biotechnology Companies

- Academic & Research Institutes

- Agriculture & Food Industries

- Environmental Testing Laboratories

- Clinical Research Organizations

- Other End Users

By Application

- Research Applications

- Clinical & Diagnostics Applications

- Other Applications

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Life Science Instrumentation market is highly competitive, with several leading global players actively shaping the industry through continuous innovation, strategic collaborations, and product development. Major companies such as Thermo Fisher Scientific, Danaher Corporation, Agilent Technologies, Illumina, and PerkinElmer dominate the market with extensive product portfolios and strong distribution networks. These firms focus on technological advancements, including automation, artificial intelligence integration, and next-generation sequencing, to strengthen their market position. Companies like Shimadzu Corporation, Bruker Corporation, and Bio-Rad Laboratories are enhancing their offerings through precision instruments and expanding their presence across emerging markets. The market is characterized by a steady influx of advanced, user-friendly instruments that address evolving research and clinical demands, while price competitiveness and regulatory compliance remain key factors influencing market dynamics.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Thermo Fisher Scientific

- Danaher Corporation (USA)

- Agilent Technologies (USA)

- Illumina (USA)

- PerkinElmer (USA)

- Bio-Rad Laboratories (USA)

- Bruker Corporation (USA)

- Merck KGaA (Germany)

- BD (Becton, Dickinson and Company) (USA)

- Waters Corporation (USA)

- Shimadzu Corporation (Japan)

- Hitachi High-Technologies Corporation (Japan)

- Oxford Instruments (UK)

- Horiba, Ltd. (Japan)

- JASCO Corporation (Japan)

- Analytik Jena AG (Germany)

- Teledyne Technologies Incorporated (USA)

- LEICA Microsystems (Germany)

- Retsch GmbH (Germany)

- Sartorius AG (Germany)

Recent Developments

- In May 2025, Revvity, Inc, announced the launch of its new IDS i20 analytical random access platform from EUROIMMUN, enabling full automation of chemiluminescence immunoassays (ChLIA). The IDS i20 platform is a CE marked and FDA listed device that allows laboratories to consolidate multiple specialty tests on a unique single instrument with greater reagent capacity and higher test throughput compared to existing offerings.

- In February 2024, To support a wider range of ion chromatography analysis with one instrument, Thermo Fisher Scientific Inc., launched the Thermo Scientific™ Dionex™ Inuvion™ Ion Chromatography (IC) system, helping to make ion analysis simpler and more intuitive for labs of all sizes. The new analytical instrument is designed to be easily reconfigurable, providing those who require determination of ionic and small polar compounds with a one stop shop for consistent, reliable ion analysis.

- In September 2024, UC San Diego, along with partners Thermo Fisher Scientific and Nikon Instruments, took a critical step forward in that direction with the opening of one of the world’s most pioneering centers for technology across the biological, physical and health sciences.

- In November 2024, If ASHG attendees can count on one thing, it’s PacBio creating a buzz. The company has developed a reputation for launching its products with flair, typically accompanied by a concert with a band that is not too old like Maroon 5 and Flo Rida. This year was no exception. When PacBio launched their latest instrument, Vega, on Wednesday night, One Republic was on site to help them do it.

- In December 2024, The Human Proteome Organization (HUPO) 2024 event in Dresden, Germany, offered a vibrant backdrop for Agilent Technologies’ latest product launch the Agilent Infinity III LC Series. This new series has been engineered to meet the evolving needs of researchers, incorporating the InfinityLab Assist Technology, which is designed to enhance the user experience through automating instrument routines, simplifying sample preparation, assisting with maintenance and troubleshooting, and providing context-sensitive help content and solvent management guidance.

- In 2023, Thermo Fisher Scientific introduced a new trace elemental analyzer. The Thermo Scientific iCAP RQplus ICP-MS Analyzer can be used in the pharmaceutical, food, and environmental sectors. It can be used for different sample types and trace elements at low concentrations.

Market Concentration & Characteristics

The Life Science Instrumentation Market demonstrates a moderately concentrated structure with a few large global players holding substantial market shares. It is characterized by rapid technological advancements, continuous product innovations, and high capital investment requirements. Leading companies such as Thermo Fisher Scientific, Danaher Corporation, Agilent Technologies, and Illumina dominate with strong brand recognition and broad product portfolios. It reflects a high degree of product differentiation, driven by the demand for precision, automation, and advanced analytical capabilities. The market exhibits strong entry barriers due to complex regulatory standards, high development costs, and the need for specialized expertise. Intense competition encourages companies to focus on research and development to introduce user-friendly, high-performance instruments. It shows significant dependence on end-user segments like pharmaceutical companies, clinical laboratories, and academic research institutes. The market benefits from stable demand across healthcare, biotechnology, and environmental sectors while facing price sensitivity in emerging regions and challenges in securing skilled operators for advanced equipment.

Report Coverage

The research report offers an in-depth analysis based on Technology, End User, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Life Science Instrumentation market will continue to grow steadily driven by advancements in pharmaceutical and biotechnology research.

- Demand for clinical diagnostics instruments will rise due to increasing focus on early and accurate disease detection.

- The integration of artificial intelligence and automation will significantly improve laboratory efficiency and analytical precision.

- Portable and point-of-care instruments will gain popularity for faster diagnostics and broader accessibility in remote areas.

- Companies will invest more in developing multifunctional, user-friendly, and high-throughput instruments to meet evolving research needs.

- North America will maintain its market leadership while Asia Pacific will experience the fastest growth due to expanding healthcare infrastructure.

- Strict regulatory requirements and complex approval processes will remain key challenges for new product launches.

- The shortage of skilled professionals will continue to limit optimal instrument utilization, particularly in emerging markets.

- Strategic partnerships, mergers, and acquisitions will shape competitive strategies among major industry players.

- Growing demand for precision medicine and genomics research will create new opportunities for market expansion.