Market Overview:

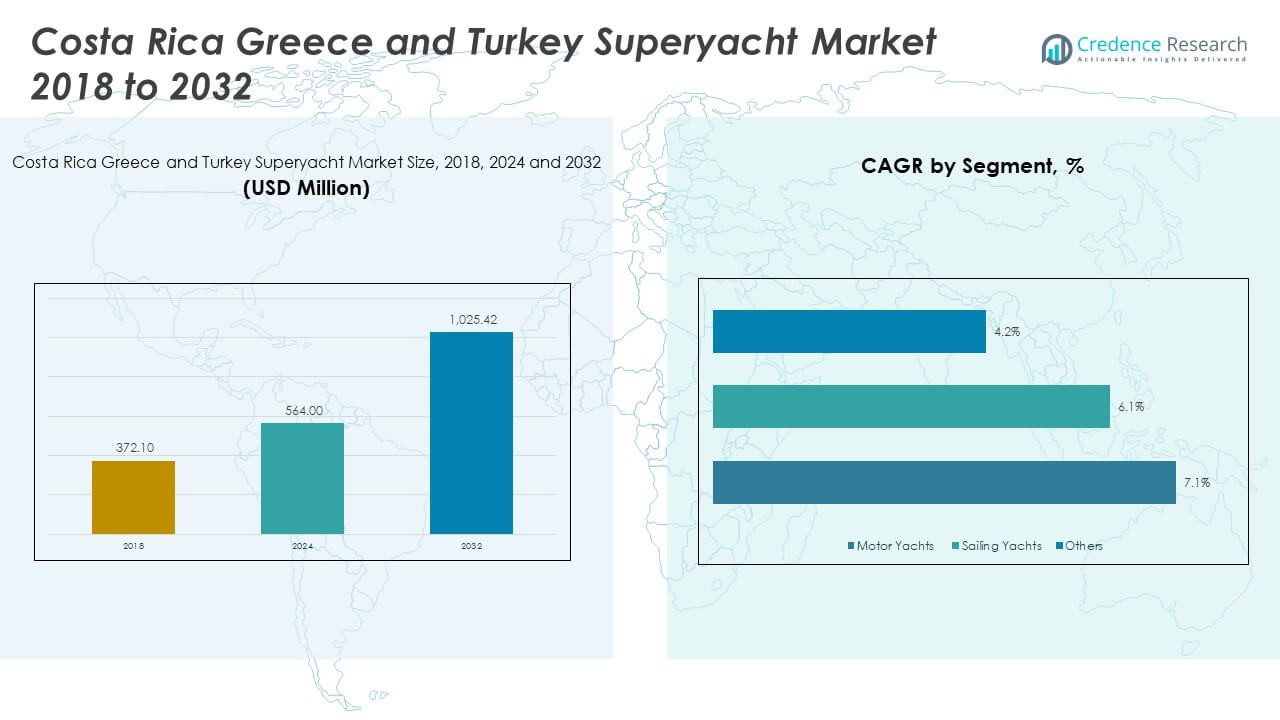

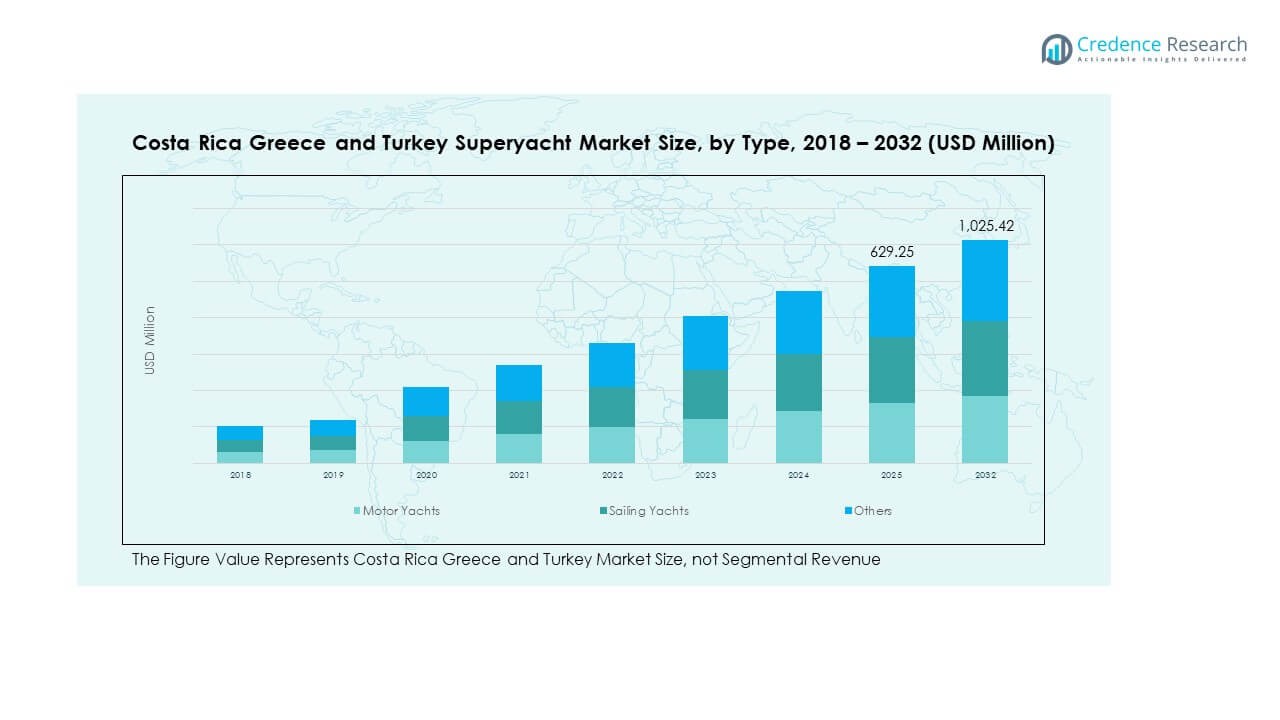

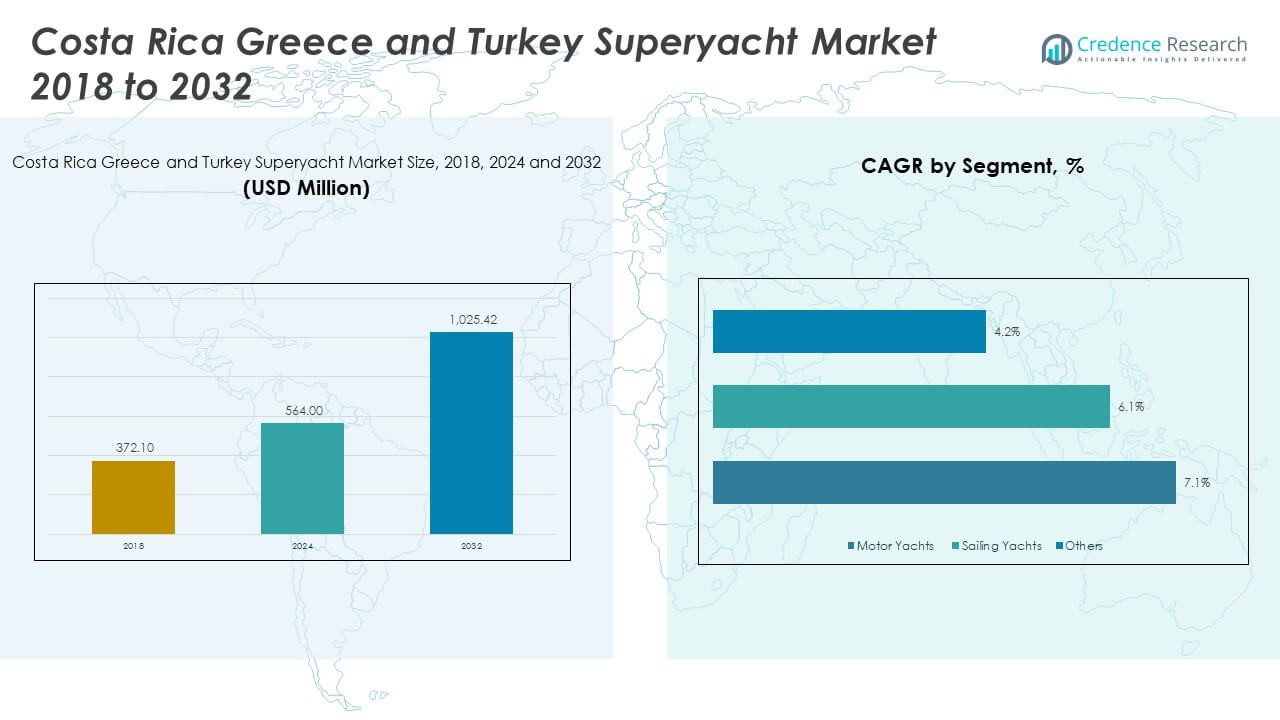

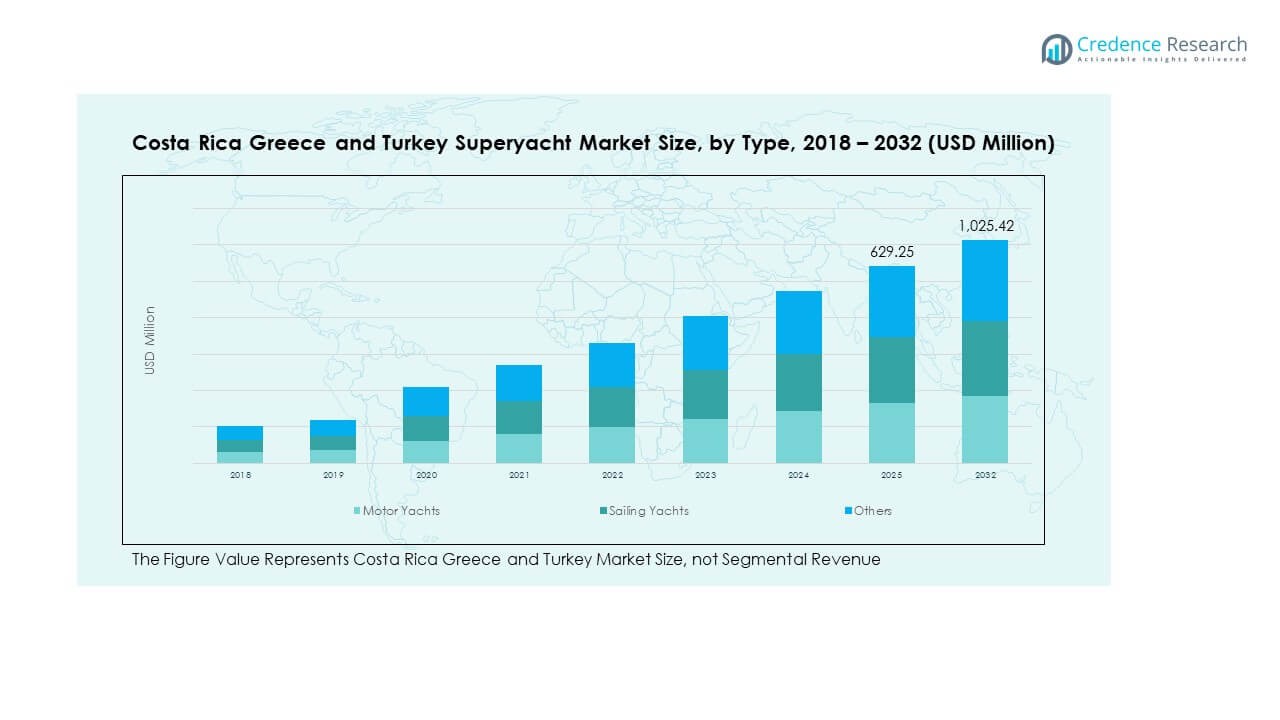

The Costa Rica, Greece and Turkey Superyacht Market size was valued at USD 372.10 million in 2018 to USD 564.00 million in 2024 and is anticipated to reach USD 1,025.42 million by 2032, at a CAGR of 7.23% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Costa Rica, Greece and Turkey Superyacht Market Size 2024 |

USD 564.00 Million |

| Costa Rica, Greece and Turkey Superyacht Market, CAGR |

7.23% |

| Costa Rica, Greece and Turkey Superyacht Market Size 2032 |

USD 1,025.42 Million |

The market growth is being driven by the rising demand for luxury marine tourism, increasing high-net-worth individuals, and a strong preference for exclusive travel experiences. Charter operators are expanding fleets with technologically advanced and environmentally sustainable yachts to meet changing consumer expectations. Investment in marina infrastructure and supportive government policies are also contributing to increased adoption. In addition, the integration of hybrid propulsion systems and luxury onboard amenities is enhancing customer appeal, fueling higher adoption of superyachts across premium leisure markets.

Regionally, Greece and Turkey are leading the superyacht market in this cluster, supported by their well-developed coastline tourism, historic sailing culture, and extensive marinas attracting international visitors. Greece, with its island-rich geography, draws significant yacht traffic, while Turkey benefits from a blend of modern marinas and emerging demand in luxury tourism. Costa Rica, though smaller in scale, is an emerging destination due to its eco-tourism focus and increasing appeal among wealthy travelers seeking exotic marine experiences. Together, these regions represent a balanced mix of mature and developing markets within the superyacht segment.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Costa Rica Greece and Turkey Superyacht Market was valued at USD 372.10 million in 2018, reached USD 564.00 million in 2024, and is projected to hit USD 1,025.42 million by 2032, growing at a CAGR of 7.23%.

- Greece leads with 46% of the regional share due to extensive marinas, island-rich geography, and a strong maritime tradition, while Turkey holds 38%, supported by competitive shipbuilding and luxury tourism.

- Costa Rica holds 16%, and though smaller, it is the fastest-growing region driven by eco-tourism demand, premium yachting experiences, and rising global attention to sustainable travel.

- By type, motor yachts account for nearly 65% of the market, reflecting high demand for speed, comfort, and luxury features among private owners and charter operators.

- Sailing yachts represent close to 25%, while others contribute the remainder, supported by niche demand for traditional experiences and custom expedition-style yachts.

Market Drivers

Rising demand for luxury tourism and lifestyle experiences is shaping sustained growth

The Costa Rica Greece and Turkey Superyacht Market is driven by a growing appetite for high-end marine leisure and luxury lifestyle experiences. Wealthy travelers are showing preference for personalized itineraries that combine exclusivity with premium comfort. Demand for superyacht charters is increasing in line with rising disposable incomes and a broader global luxury tourism wave. It is benefitting from the desire of affluent consumers to explore coastal destinations with privacy and convenience. Expansion in marina infrastructure and service quality is reinforcing this trend. Government initiatives supporting marine tourism create favorable business conditions. Continuous innovation in onboard entertainment, technology, and interiors is enhancing appeal. Together, these factors generate strong demand for superyachts across these coastal economies.

- For instance, Oceanco delivered the 117-meter superyacht Infinity, one of the largest yachts ever constructed in the Netherlands. Infinity features expansive leisure areas and a wellness-focused deck, underscoring the industry’s shift toward lifestyle amenities that strengthen its exclusive charter appeal.

Growing fleet modernization and adoption of advanced marine technologies supports expansion

Operators in the Costa Rica Greece and Turkey Superyacht Market are investing in fleet renewal with vessels that feature modern navigation, propulsion, and sustainability-focused designs. Shipyards are incorporating hybrid systems, advanced materials, and digital integration to appeal to a younger and environmentally aware clientele. It is boosting adoption of energy-efficient models that align with stricter environmental regulations. Charter companies are diversifying their offerings to meet demand for both long-haul luxury cruises and short-term leisure charters. Expansion of aftersales and maintenance services enhances operational efficiency. Rising collaborations between designers, technology providers, and operators are accelerating innovation cycles. The integration of automation technologies is improving safety and performance standards. Stronger technology adoption ensures long-term competitiveness and wider market penetration.

Expanding presence of high-net-worth individuals and regional tourism accelerates demand

The Costa Rica Greece and Turkey Superyacht Market benefits from the rising number of high-net-worth individuals seeking luxury travel experiences in pristine marine destinations. It is attracting strong attention from international investors due to favorable tax regimes and lucrative charter revenues. Regional tourism growth is complementing superyacht demand, particularly in Greece and Turkey, which attract millions of visitors annually. Superyachts offer a premium alternative to traditional tourism infrastructure, reinforcing regional economic value. Local economies benefit from employment generation, marine services, and allied tourism sectors. Expansion of international flights and tourism connectivity supports accessibility of yacht destinations. Affluent clients from Europe, North America, and Asia drive demand for personalized charter services. Together, these developments strengthen market visibility and long-term growth.

- For example, Lürssenrecently launched the 122‑meter yacht Kismet, which accommodates 24 guests and 40 crew, illustrating how large-capacity vessels are tailored to serve elite clients seeking extended voyages across the Mediterranean

Supportive regulatory frameworks and marina infrastructure investment enhance industry outlook

The Costa Rica Greece and Turkey Superyacht Market is gaining momentum due to favorable government policies and strong infrastructure expansion. Authorities in Greece and Turkey are supporting marina development projects to accommodate larger fleets and attract global tourism. It is helping local economies by creating sustainable business opportunities in coastal areas. Investment in port facilities ensures smoother logistics, fueling more arrivals of international yachts. Governments are introducing regulations that balance marine ecosystem preservation with luxury tourism growth. Incentives for sustainable yacht construction and operation encourage market adoption. Public-private partnerships are unlocking additional investment channels. Strategic infrastructure planning supports regional leadership in global yacht tourism.

Market Trends

Integration of eco-friendly propulsion systems and green yacht technologies is redefining design

The Costa Rica Greece and Turkey Superyacht Market is witnessing a strong shift toward eco-conscious yacht design with hybrid propulsion systems, alternative fuels, and recyclable materials. Builders are integrating solar panels, battery storage, and lightweight composites to lower emissions and enhance efficiency. It is creating stronger appeal among environmentally aware owners and charter customers. Eco-certifications are influencing purchase decisions and boosting brand value for shipyards. Designers are exploring new hull shapes that minimize fuel use and improve navigation performance. The shift toward eco-friendly practices also enhances global competitiveness of regional yards. Sustainability-focused innovation has become a central trend in yacht procurement.

- For example, the 56-meter superyacht BLUE II by Turquoise Yachts is equipped with a diesel-electric hybrid propulsion system that supports reduced emissions, improved fuel efficiency, and quieter operations. Multiple yacht industry sources, including Burgess and Yachts International, confirm that BLUE II incorporates diesel-electric technology compliant with IMO Tier III standards, aligning with sustainability and efficiency goals.

Growing popularity of charter management platforms and digital booking services is transforming access

The Costa Rica Greece and Turkey Superyacht Market is being reshaped by digital platforms that simplify yacht booking, management, and operational tracking. Technology-driven charter services allow travelers to compare yachts, customize itineraries, and make reservations seamlessly. It is enabling greater transparency and widening accessibility for first-time users. Operators are leveraging data-driven platforms to improve fleet utilization and revenue optimization. Integration of customer-centric apps with real-time service features elevates customer satisfaction. Online presence of yacht operators enhances visibility across international markets. Increased adoption of digital booking platforms is modernizing traditional charter processes. This transformation drives higher customer engagement and consistent fleet activity.

- For example, in 2024, Privat 3 Money launched its “P3 Marine” platform, introduced at the Monaco Yacht Show, designed to support the financial needs of the superyacht industry. The platform provides multi-currency accounts, dedicated debit and prepaid cards, real-time transaction reporting, and streamlined expense and payment management tools for yacht owners, managers, charter brokers, and crew.

Rising influence of experiential tourism and personalized charter experiences expands demand

The Costa Rica Greece and Turkey Superyacht Market is adapting to changing consumer expectations centered on exclusive experiences and personalized services. Affluent travelers seek itineraries tailored around cultural, culinary, and wellness-driven activities. It is prompting operators to design bespoke journeys that include private events, curated dining, and destination-focused excursions. Charter companies are expanding luxury concierge services to differentiate offerings. Enhanced interior customization reflects the growing importance of unique onboard experiences. Rising awareness of wellness tourism is supporting demand for health-oriented yacht features. Experiential travel is now a defining factor in yacht selection. This trend solidifies the market’s position as a luxury lifestyle hub.

Increased focus on smart yacht technologies and advanced onboard connectivity enhances competitiveness

The Costa Rica Greece and Turkey Superyacht Market is embracing smart technologies such as AI-powered navigation, IoT-based monitoring, and immersive entertainment systems. It is enabling owners and guests to experience seamless digital integration on board. Enhanced communication systems allow continuous connectivity across international waters. Smart automation improves safety, fuel management, and predictive maintenance. Advanced entertainment features, including AR and VR solutions, elevate onboard engagement. Shipyards are promoting digital integration as a core design feature to attract younger, tech-savvy buyers. The fusion of luxury with technology increases yacht desirability. This shift places digital innovation at the center of competitive strategies.

Market Challenges Analysis

Rising operational costs and stringent environmental compliance impact profitability levels

The Costa Rica Greece and Turkey Superyacht Market faces challenges from increasing operational costs, driven by fuel, crew salaries, and maintenance expenses. It is further impacted by tightening international maritime regulations focused on emissions, safety, and sustainability standards. Compliance requires costly retrofits and continuous investment in technology. Smaller operators may face difficulties sustaining profitability under these conditions. Insurance and port charges are adding financial pressure to charter businesses. Rising competition also places downward pressure on charter rates. Limited availability of skilled marine workforce adds another layer of operational complexity. Addressing these challenges demands consistent innovation and financial resilience.

Geopolitical risks and regional economic volatility influence long-term stability

The Costa Rica Greece and Turkey Superyacht Market is exposed to risks arising from geopolitical tensions, fluctuating currency values, and uncertain tourism flows. It is vulnerable to disruptions in international travel regulations and global economic slowdowns. Political instability in certain regions can reduce investor confidence and visitor numbers. Economic downturns limit discretionary spending on luxury travel, affecting charter demand. Port congestion and limited docking slots can create operational inefficiencies. Extreme weather conditions related to climate change pose further uncertainty. These challenges create unpredictability in growth trajectories and force stakeholders to adopt adaptive strategies.

Market Opportunities

Expansion of sustainable tourism initiatives and eco-luxury demand creates long-term potential

The Costa Rica Greece and Turkey Superyacht Market is positioned to benefit from global momentum in sustainable tourism and eco-luxury experiences. It is attracting investors who recognize the value of aligning yacht services with responsible tourism practices. Opportunities exist for builders to introduce hybrid and alternative-fuel yachts that appeal to new-age customers. Regions can strengthen their competitiveness by promoting eco-certified marinas and services. Growth in environmental awareness is fueling long-term demand for sustainable yachting experiences. Investors can leverage these trends to unlock higher brand credibility and customer loyalty.

Rising appeal of emerging destinations and diversified charter services boosts industry outlook

The Costa Rica Greece and Turkey Superyacht Market holds opportunities in tapping underexplored destinations and diversifying charter service offerings. It is benefiting from demand for unique itineraries that go beyond traditional hubs, enhancing regional tourism appeal. Operators can expand service portfolios with adventure, wellness, and event-focused charters. Investment in high-quality crew training programs will improve customer service standards. Digital marketing channels provide scope to reach affluent customers globally. Partnerships between regional tourism boards and operators can elevate destination visibility. These opportunities allow stakeholders to expand customer bases and strengthen competitive differentiation.

Market Segmentation Analysis:

The Costa Rica Greece and Turkey Superyacht Market

By type is divided into motor yachts, sailing yachts, and others. Motor yachts dominate demand due to their speed, range, and luxury features, appealing to high-net-worth individuals who prioritize comfort and performance. Sailing yachts maintain relevance for buyers seeking a traditional marine experience, supported by eco-friendly appeal and lower operational costs. The others category, which includes custom and expedition-style yachts, is gaining interest from niche customers who prefer specialized designs tailored to unique travel experiences.

- For example, Oceanco delivered the 90-meter motor yacht DreAMBoat, designed by Espen Øino with interiors by Terence Disdale. The yacht features a steel hull with an aluminum superstructure and is built to combine luxury, comfort, and long-range cruising performance.

By technology, the market is segmented into conventional propulsion and hybrid/eco-friendly propulsion. Conventional propulsion continues to hold a major share due to established infrastructure and operational familiarity. However, hybrid and eco-friendly propulsion is expanding at a faster pace due to rising environmental awareness and stricter maritime regulations. It reflects growing interest in sustainable yachting, with shipyards investing in advanced propulsion systems to reduce emissions and fuel consumption. This transition positions the region to align with global sustainability goals.

- For example, Heesen’s 50-meter hybrid superyacht ORION is powered by twin MTU 12V 2000 M61 IMO Tier III engines combined with a hybrid propulsion system and a Fast Displacement Hull Form (FDHF). It achieves a transatlantic range of 3,750 nautical miles at 12 knots, with fuel consumption reported at 98 liters per hour.

By application is divided into private ownership and charter services. Private ownership represents a significant portion, driven by wealthy individuals investing in superyachts for personal use and prestige. Charter services are expanding strongly due to increasing tourism in Costa Rica, Greece, and Turkey, where travelers demand luxury experiences without full ownership commitments. It creates a dynamic balance between personal use and commercial operations, reinforcing the versatility of the regional superyacht market across diverse customer segments.

Segmentation:

By Type

- Motor Yachts

- Sailing Yachts

- Others

By Technology

- Conventional Propulsion

- Hybrid/Eco-Friendly Propulsion

By Application

- Private Ownership

- Charter Services

By Region

Regional Analysis:

The Costa Rica Greece and Turkey Superyacht Market shows distinct regional dynamics shaped by geography, tourism, and investment patterns. Greece holds the largest market share at 46%, supported by its extensive coastline, numerous islands, and mature marina infrastructure that attracts both private owners and charter operators. The region benefits from a long-standing maritime tradition, strong yacht-building capabilities, and an influx of international travelers seeking premium marine tourism. It remains a leading hub for superyacht activity in the Mediterranean and continues to attract foreign investments in marina expansions and fleet modernization.

Turkey accounts for 38% of the regional market, supported by rising luxury tourism, expanding marina networks, and competitive shipbuilding expertise. It has emerged as a key destination for yacht charters, offering a mix of cultural heritage, scenic coastlines, and cost advantages compared to other European hubs. Turkish shipyards are gaining international recognition for building custom and technologically advanced superyachts, reinforcing the country’s competitive position. It benefits from growing domestic demand and increasing attention from Middle Eastern and European clients. Strategic location between Europe and Asia enhances Turkey’s role as a central player in yacht tourism and construction.

Costa Rica holds 16% of the market share, positioning itself as a growing but emerging destination. It appeals to eco-conscious travelers with a focus on sustainable tourism and unspoiled marine biodiversity. The region is strengthening its infrastructure to attract high-net-worth visitors who prefer exclusive and environmentally responsible yachting experiences. It benefits from its status as a global eco-tourism hub, where superyacht charters are integrated into broader luxury travel offerings. While its scale is smaller compared to Greece and Turkey, Costa Rica represents strong long-term growth potential in the regional market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Aegean Yacht

- Su Marine Yachts

- Turquoise Yachts

- Bilgin Yachts

- RMK Marine

- Motomarine S.A.

- Elefsis Shipyards

- Skaramangas Shipyards

- Ferretti Group

- Benetti Yachts

- Sanlorenzo Yachts

- Perini Navi

Competitive Analysis:

The Costa Rica Greece and Turkey Superyacht Market is characterized by a blend of established European shipyards and emerging regional players focused on luxury design, advanced technology, and sustainable solutions. Leading companies such as Turquoise Yachts, Bilgin Yachts, and RMK Marine strengthen Turkey’s position as a global builder of high-value custom yachts, supported by competitive costs and modern facilities. Greek players including Motomarine S.A., Elefsis Shipyards, and Skaramangas Shipyards highlight the nation’s maritime heritage and contribute to fleet expansion through refits and specialized builds. It benefits from international groups such as Ferretti, Benetti, Sanlorenzo, and Perini Navi, which expand charter fleets and deliver advanced models across these destinations. The competitive landscape is shaped by innovation in hybrid propulsion, digital integration, and experiential designs that appeal to a younger, eco-conscious clientele. Companies are pursuing regional expansions, acquisitions, and product launches to strengthen portfolios and capture a wider customer base. The market reflects a dynamic balance between tradition and modernization, with local yards enhancing global recognition through craftsmanship and international brands securing presence in premium marinas.

Recent Developments:

- In Costa Rica, on July 23, 2025, a key development in the superyacht market was the acquisition of Los Sueños Marina by Safe Harbor Marinas. The deal expanded Safe Harbor’s international portfolio and placed the renowned Los Sueños facility under its management. Los Sueños Marina features 200 wet slips and 166 dry slips, with capacity for vessels up to 180 feet and a range of hospitality services. This acquisition highlights Costa Rica’s rising appeal as a yachting destination and reinforces Safe Harbor’s presence in premier boating markets.

- In Turkey, the superyacht market marked a major milestone with the inaugural Superyacht Show Türkiye, held from May 8 to May 12, 2025. The event positioned the country as a central hub for luxury yachting, featuring new product launches from leading shipyards including Turquoise Yachts, Bilgin Yachts, and RMK Marine. Industry engagement was extensive, with shipyard tours and summit participation by global players such as Denison Yachting.

- In March 2025, Aegean Yacht delivered the 37.3-metre explorer yacht Carmen from its Bodrum site in Turkey. Carmen stands out with a militaristic aesthetic and flexible layouts, including convertible cabins and leisure-focused spaces such as a sundeck American bar, beach club, and a bow Jacuzzi. The yacht accommodates 10 guests across five cabins and is now available for charter in regions like Greece.

- In February 2025, Turquoise Yachts delivered its largest build yet, the 79-metre superyacht Nympheas, and confirmed imminent delivery for the ultra-large Project Vento. These launches emphasize Turquoise’s expansion in hybrid propulsion and eco-friendly technology for superyachts in Turkey and Greece.

Market Concentration & Characteristics:

The Costa Rica Greece and Turkey Superyacht Market displays moderate concentration, with regional players competing alongside established international manufacturers. It demonstrates characteristics of a growing yet competitive industry where innovation, design customization, and sustainability drive differentiation. Leading companies dominate the luxury segment, while smaller yards cater to niche demands and refit services. The market is influenced by tourism growth, high-net-worth customer expansion, and investment in marina infrastructure. Competitive intensity is reinforced by new entrants seeking to capitalize on eco-luxury demand and experiential tourism. The presence of both heritage shipyards and modern technology adopters highlights a dual focus on tradition and forward-looking innovation.

Report Coverage:

The research report offers an in-depth analysis based on Type, Technology and Application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for larger and more technologically advanced yachts will increase as affluent buyers prioritize comfort, efficiency, and luxury.

- Hybrid and eco-friendly propulsion systems will gain stronger traction, aligning with global sustainability targets and customer preferences.

- Charter services will expand further, supported by tourism growth and rising interest in personalized marine experiences.

- Greece will continue to lead the regional market, driven by mature marina infrastructure and sustained international yacht arrivals.

- Turkey will strengthen its shipbuilding role by offering competitive pricing, modern facilities, and globally recognized craftsmanship.

- Costa Rica will emerge as a premium eco-yachting destination, attracting travelers seeking environmentally responsible luxury tourism.

- Digital booking platforms and smart yacht management systems will redefine customer engagement and fleet efficiency.

- Investment in marina infrastructure and coastal facilities will support higher capacity and enhance destination attractiveness.

- Collaborations between international shipyards and regional operators will foster technology transfer and design innovation.

- Evolving customer expectations around wellness, privacy, and cultural immersion will shape the design and service models of next-generation superyachts.