Market Overview:

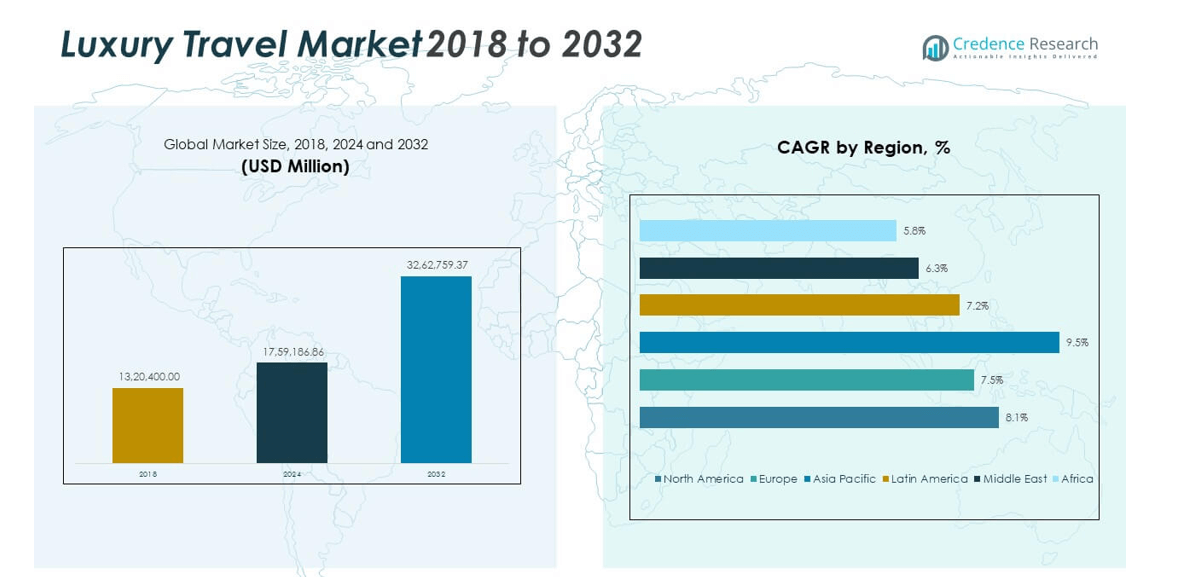

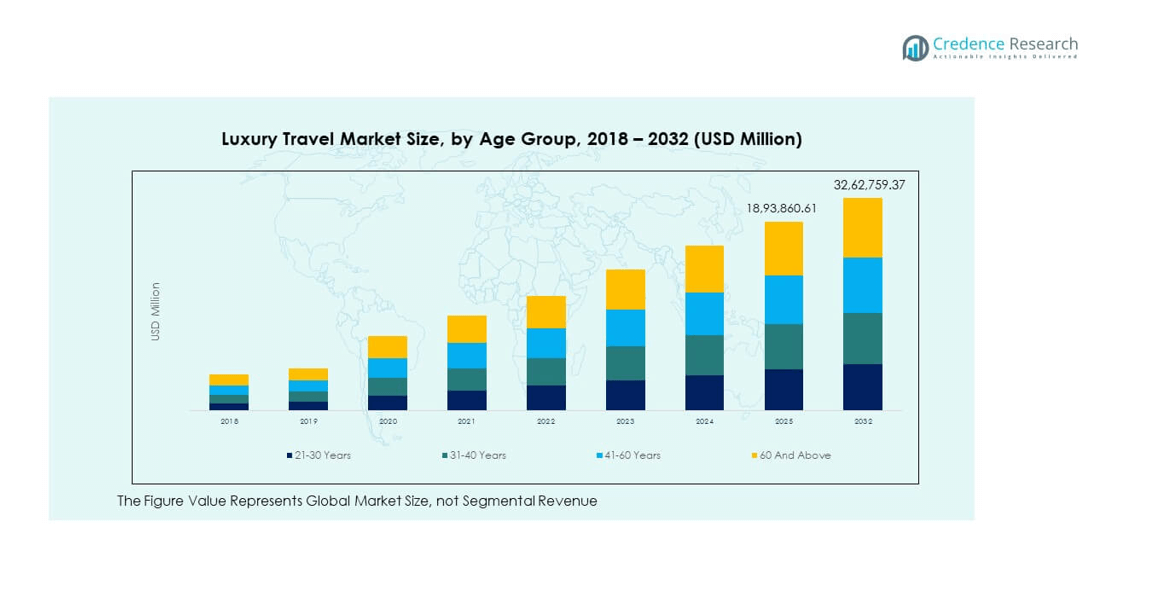

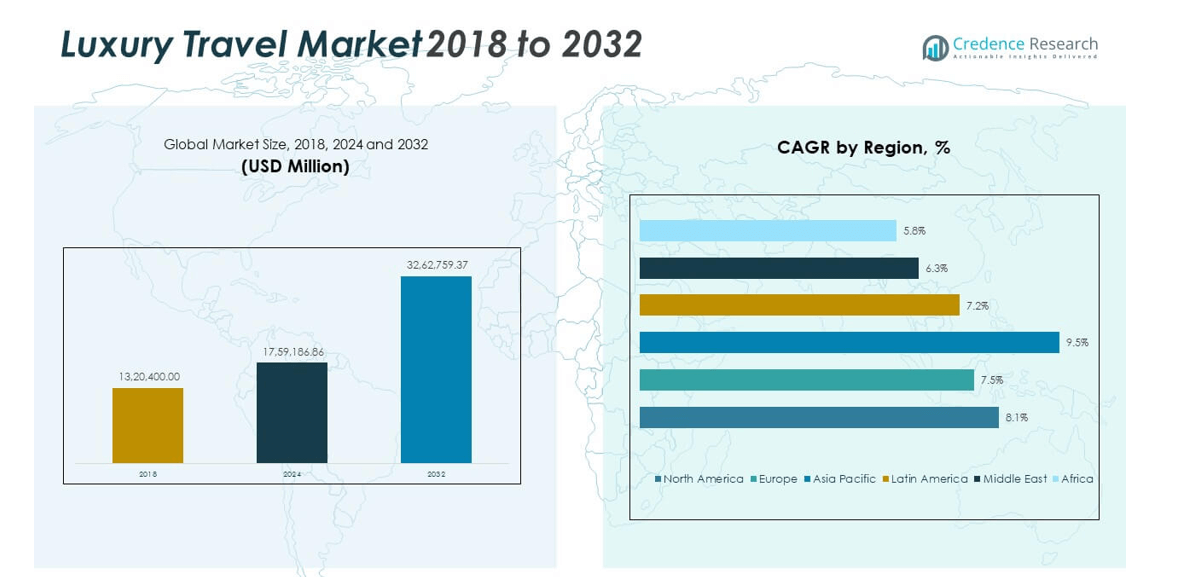

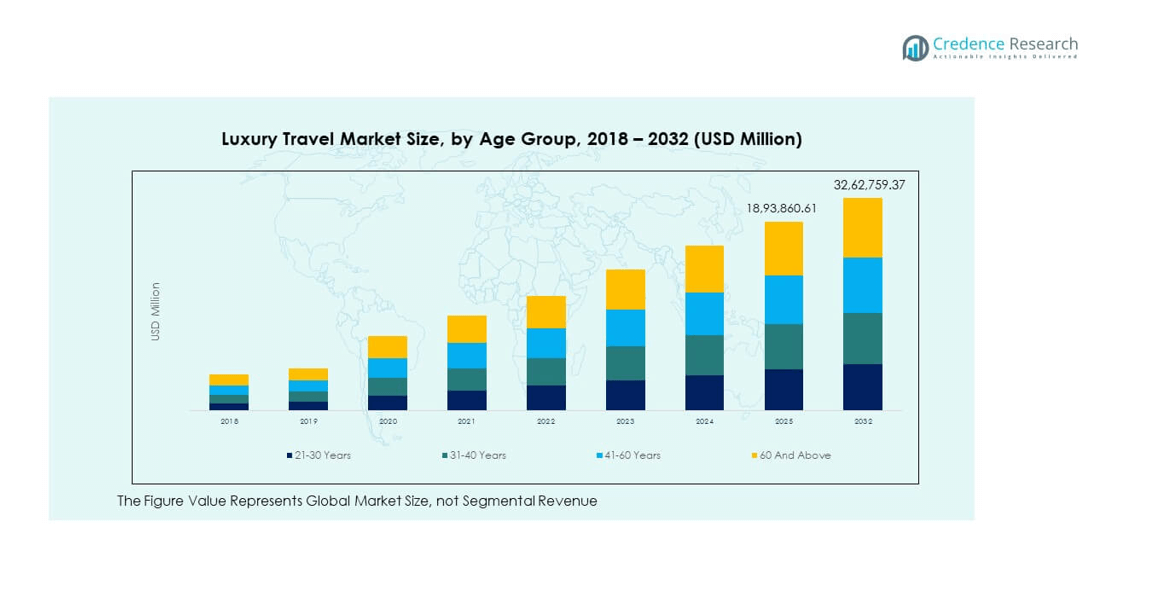

The Global Luxury Travel Market size was valued at USD 1,320,400.00 million in 2018 to USD 1,759,186.60 million in 2024 and is anticipated to reach USD 3,262,759.37 million by 2032, at a CAGR of 8.08% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Luxury Travel Market Size 2024 |

USD 1,759,186.60 million |

| Luxury Travel Market, CAGR |

8.08% |

| Luxury Travel Market Size 2032 |

USD 3,262,759.37 million |

The market is driven by the rising disposable incomes and growing preference for personalized, experience-based travel. High-net-worth individuals increasingly seek exclusive destinations, private accommodations, and curated itineraries. The influence of social media and digital storytelling enhances demand for luxury adventure, wellness, and sustainable travel options. Strong growth in premium hospitality and customized tour services also fuels market expansion.

North America and Europe lead the Global Luxury Travel Market due to mature tourism infrastructure and strong spending power. Asia-Pacific is emerging rapidly, supported by expanding wealth in China, India, and Southeast Asia. The Middle East attracts affluent travelers through luxury resorts and desert experiences, while Africa’s exotic safaris continue to gain appeal among high-end tourists.

Market Insights:

- The Global Luxury Travel Market was valued at USD 1,320,400.00 million in 2018, reached USD 1,759,186.60 million in 2024, and is expected to attain USD 3,262,759.37 million by 2032, expanding at a CAGR of 8.08% during the forecast period.

- Europe (33.4%), North America (27.9%), and Asia Pacific (27.2%) dominate the market due to mature tourism infrastructure, high-income travelers, and rising demand for premium cultural and adventure experiences.

- Asia Pacific, the fastest-growing region with a 5% CAGR, benefits from expanding middle-class wealth, digital travel adoption, and growing interest in experiential luxury tourism.

- The 41–60 years age group leads the market with 4% share, reflecting strong financial capacity and preference for comfort-oriented premium travel.

- The 31–40 years segment accounts for 5%, driven by rising participation in adventure, wellness, and customized international trips among younger affluent consumers.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Growing Preference for Personalized and Experiential Travel

High-net-worth travelers are increasingly favoring experiences over possessions. The Global Luxury Travel Market benefits from this shift, as affluent consumers seek unique journeys that reflect personal tastes. Customized itineraries, private villas, and exclusive excursions are in high demand. It drives operators to design bespoke packages that merge comfort with adventure. Luxury travelers expect seamless service across flights, stays, and local experiences. They value authenticity and privacy, influencing how brands market premium offerings. It strengthens partnerships between travel agents and hospitality brands. Personalized experiences now define the premium travel landscape.

- For instance, Abercrombie & Kent unveiled a brand overhaul in February 2025, emphasizing advanced journey design and exclusive, personalized experiences in over 60 countries. The company’s new global website and branding highlight a vast collection of curated adventures, including customizable “Tailormade Journeys,” designed by its team of global experts. A&K has not publicly announced a specific AI-powered platform for itinerary personalization; its approach relies on expert travel advisors and journey designers.

Expanding Middle-Class Wealth and Affluent Populations

The rapid increase in global wealth and the expanding middle-class contribute strongly to demand growth. It broadens the customer base for high-end travel experiences beyond traditional elite groups. Rising disposable incomes across Asia-Pacific and Latin America encourage long-distance and international trips. The Global Luxury Travel Market sees rising participation from new-age travelers prioritizing status and comfort. Growing access to luxury cruises, boutique hotels, and premium tours supports industry diversification. Improved air connectivity and visa flexibility make international travel easier. It helps more consumers indulge in premium vacations. The expanding luxury demographic sustains long-term market growth.

- For instance, Marriott International’s 2025 luxury travel report for Asia Pacific revealed 72% of affluent travelers planned to increase luxury travel spending in the region, with trusted global brands such as Ritz-Carlton and St. Regis driving bookings—especially among travelers aged 31–50.

Technological Advancements Enhancing Booking and Travel Experience

Digital transformation is redefining the way luxury travel operates. Smart apps, virtual tours, and AI-powered concierge services improve trip customization. The Global Luxury Travel Market benefits from digital tools that personalize choices based on traveler preferences. It allows real-time assistance and itinerary management, boosting convenience. Online platforms connect users directly with exclusive resorts and service providers. Augmented reality previews help travelers make confident premium bookings. Technology-driven upgrades enhance safety and transparency during trips. The adoption of blockchain for secure payments also builds greater consumer trust in luxury travel brands.

Growing Demand for Sustainable and Eco-Conscious Tourism

Affluent travelers are increasingly aware of their environmental impact. They prefer destinations and hotels that follow sustainable practices. The Global Luxury Travel Market adapts by promoting eco-resorts, conservation programs, and carbon-neutral tours. It encourages businesses to adopt renewable energy and waste reduction strategies. Luxury brands use sustainability as a new form of prestige and loyalty appeal. Green certifications and transparent sustainability reports attract responsible consumers. Tour operators now integrate wildlife protection and local community engagement into premium packages. Environmentally conscious luxury travel is evolving into a key long-term market pillar.

Market Trends:

Rise of Wellness and Health-Oriented Luxury Retreats

Wellness tourism is gaining momentum within the premium travel segment. High-net-worth individuals are investing in rejuvenation experiences that blend comfort with physical and mental well-being. The Global Luxury Travel Market benefits from the growing popularity of spa resorts, yoga retreats, and detox vacations. It caters to travelers seeking personalized health programs and holistic therapies. Premium resorts integrate nutrition, fitness, and mindfulness into curated packages. This focus on self-care and mental balance elevates travel from leisure to lifestyle improvement. It strengthens partnerships between luxury hotels and wellness brands. The wellness trend continues to redefine what luxury travel represents.

- For instance, Six Senses introduced high-tech personalized longevity clinics at its Ibiza and Turkey locations in 2025, including data-driven diagnostics and bespoke wellness therapies that combine biomarker tracking and individualized nutrition programs, validated by onsite medical specialists and global experts.

Expansion of Experiential and Cultural Travel Offerings

Travelers now prioritize cultural immersion and authentic experiences over traditional luxury. The Global Luxury Travel Market embraces this change by offering exclusive access to heritage sites, culinary tours, and local artistry. It allows travelers to connect with communities while maintaining high-end comfort. Curated experiences such as private vineyard tastings and guided art expeditions enhance engagement. Social media influence drives interest in visually appealing, story-rich destinations. Brands invest in experiences that deliver emotional satisfaction rather than material indulgence. It promotes destination diversity and supports local economies. Experiential travel has become a key differentiator in the evolving luxury segment.

Integration of Smart Technologies and Artificial Intelligence in Services

The integration of artificial intelligence, automation, and predictive analytics is transforming luxury travel operations. It enables service providers to anticipate traveler preferences and deliver proactive assistance. The Global Luxury Travel Market utilizes AI-driven personalization for flight bookings, hotel check-ins, and activity suggestions. It enhances convenience through chatbots, digital concierges, and real-time itinerary updates. Luxury hotels employ smart room technologies that adjust lighting, temperature, and entertainment automatically. This digital sophistication elevates the overall customer experience. It reduces manual errors while improving efficiency in hospitality management. AI-backed innovation ensures a seamless and intelligent luxury journey for travelers.

Growing Influence of Social Media and Celebrity Endorsements

Social media platforms now shape travel aspirations and booking behavior. Luxury travelers rely on influencers and celebrities for destination inspiration and brand trust. The Global Luxury Travel Market leverages digital storytelling and influencer marketing to attract affluent audiences. It emphasizes curated visuals, immersive videos, and authentic narratives that spark desire. Hotels and travel brands collaborate with high-profile personalities to enhance visibility. User-generated content drives engagement and brand loyalty across online channels. It transforms luxury tourism into a digital-first industry. The blending of social media influence and aspirational marketing continues to expand market reach globally.

Market Challenges Analysis:

High Operational Costs and Limited Scalability of Luxury Services

Premium travel experiences involve significant investment in infrastructure, staffing, and service quality. The Global Luxury Travel Market faces constant pressure to maintain exclusivity while ensuring profitability. It struggles with fluctuating fuel prices, labor shortages, and inflation affecting travel costs. Luxury accommodations and private transport providers must balance service excellence with operational efficiency. Economic uncertainty can reduce discretionary spending among affluent travelers. The seasonal nature of high-end tourism limits scalability for smaller operators. It forces companies to adopt innovative pricing and membership models. Maintaining high standards while managing costs remains a core challenge for this sector.

Geopolitical Instability and Changing Consumer Behavior Patterns

Geopolitical tensions, visa restrictions, and safety concerns directly influence travel preferences. The Global Luxury Travel Market experiences sudden disruptions in destination demand due to regional conflicts or health crises. It requires flexibility to shift focus to safer or emerging luxury destinations. Changing consumer behavior, with younger travelers preferring sustainability over extravagance, reshapes spending patterns. Economic slowdowns and currency volatility also affect outbound travel demand. It challenges companies to adapt marketing and product strategies quickly. Growing cyber risks in online bookings further strain digital trust. The market must invest in resilience and security to sustain long-term confidence.

Market Opportunities:

Rising Demand in Emerging Economies and Untapped Destinations

Emerging economies present major growth potential due to expanding wealth and improving infrastructure. The Global Luxury Travel Market can benefit from untapped destinations in Asia-Pacific, Africa, and the Middle East. It enables operators to offer unique, less-explored luxury experiences with cultural depth. Governments investing in tourism promotion further support market growth. Remote islands and eco-resorts appeal to travelers seeking exclusivity. It allows brands to diversify portfolios while reducing dependency on traditional hubs. Increasing air routes and private jet availability make these destinations more accessible. Expanding into new regions can significantly boost global market penetration.

Integration of Advanced Technologies and Sustainable Models

Luxury travel companies are embracing innovation to stay competitive and eco-conscious. The Global Luxury Travel Market benefits from integrating blockchain, AI, and digital twins for transparent and personalized operations. It promotes smart travel solutions that optimize itineraries and reduce waste. Investments in carbon-neutral transport and renewable-powered resorts attract responsible travelers. Enhanced data analytics help brands predict preferences and refine offers. It strengthens traveler trust through improved transparency and efficiency. Sustainable luxury continues to redefine premium experiences globally. The fusion of technology and responsibility creates a strong foundation for long-term growth.

Market Segmentation Analysis:

By Tour Segment

The Global Luxury Travel Market is divided into customized and private vacations, safari and adventure, cruises, yachting and small ship expeditions, celebration journeys, culinary travel and shopping, luxury trains, and others. Customized and private vacations hold the dominant share due to strong demand for exclusive, personalized experiences. It reflects travelers’ growing desire for privacy and control over itineraries. Safari and adventure tours attract affluent consumers seeking outdoor excitement and cultural depth. Cruises and yachting maintain steady growth, supported by high-end ocean liners and private charters. Celebration journeys and culinary tours continue to expand through destination weddings and gourmet-focused experiences. Luxury trains capture niche interest through heritage and scenic travel. Each segment adds diversity to the market and strengthens global tourism value.

- For instance, Seabourn’s ultra-luxury ship Venture began new expedition itineraries in May 2025, operating 21 voyages from eight to 28 days across Arctic and Antarctic destinations, featuring advanced PC6 Polar Class technology and a 24-person team of scientists and naturalists for immersive exploration.

By Age Group

The market by age group includes 21–30 years, 31–40 years, 41–60 years, and 60 and above. Travelers aged 41–60 years lead the market, driven by higher disposable income and preference for comfort. It remains the most frequent segment engaging in international premium travel. The 31–40-year group follows closely, focusing on adventure, wellness, and family-oriented luxury experiences. Younger travelers between 21–30 years are emerging as a growth segment due to rising spending on experiential and social media-driven travel. The 60 and above group represents a stable category with interest in cruises, scenic tours, and wellness retreats. This balanced distribution ensures steady growth across diverse consumer segments.

- For instance, The Virtuoso 2025 Luxe Report indicates that solo female travelers, many over 65, constitute 68% of solo bookings, embracing independent travel and redefining the segment. The report also highlights a growing preference among high-end travelers for meaningful, sustainable, and experiential trips, often booked during off-peak times.

Segmentation:

- By Tour Segment:

- Customized & Private Vacations

- Safari & Adventure

- Cruises, Yachting & Small Ship Expeditions

- Celebration Journeys

- Culinary Travel & Shopping

- Luxury Trains

- Others

- By Age Group:

- 21–30 Years

- 31–40 Years

- 41–60 Years

- 60 and Above

- By Region:

- North America

- Europe

- Germany

- France

- Italy

- U.K.

- Russia

- Rest of Europe

- Asia-Pacific

- India

- China

- Japan

- Rest of Asia-Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Regional Analysis:

North America

The North America Global Luxury Travel Market size was valued at USD 374,993.60 million in 2018 to USD 491,858.09 million in 2024 and is anticipated to reach USD 910,642.01 million by 2032, at a CAGR of 8.1% during the forecast period. North America holds an estimated 27.9% market share, supported by its mature tourism infrastructure and strong purchasing power. The United States drives the region with growing interest in high-end leisure and adventure trips. It benefits from a strong presence of luxury hospitality chains, private jet operators, and exclusive tour providers. Canada and Mexico complement growth with nature-based and cultural experiences. The rise in wellness travel and sustainable resorts appeals to affluent consumers seeking health-oriented escapes. It remains a top region for bespoke vacations, luxury cruises, and celebration journeys.

Europe

The Europe Global Luxury Travel Market size was valued at USD 472,703.20 million in 2018 to USD 611,797.09 million in 2024 and is anticipated to reach USD 1,088,954.62 million by 2032, at a CAGR of 7.5% during the forecast period. Europe contributes nearly 33.4% of the total market share, led by France, Italy, the UK, and Germany. The region’s cultural richness and historical landmarks attract high-spending travelers from across the globe. It benefits from extensive luxury accommodation networks, premium cruise routes, and culinary tourism. The Global Luxury Travel Market in Europe thrives on heritage tours, art-based journeys, and boutique hotel experiences. Sustainable tourism initiatives and eco-retreats are expanding across Mediterranean destinations. It continues to strengthen through cross-border travel convenience within the Schengen zone.

Asia Pacific

The Asia Pacific Global Luxury Travel Market size was valued at USD 308,973.60 million in 2018 to USD 430,729.51 million in 2024 and is anticipated to reach USD 885,189.23 million by 2032, at a CAGR of 9.5% during the forecast period. Asia Pacific accounts for approximately 27.2% of the global market, driven by rising affluence and a growing middle-class population. China, Japan, India, and Australia dominate luxury travel spending. It benefits from emerging destinations offering personalized cultural and nature-based experiences. The region shows strong growth in luxury cruises, wellness retreats, and adventure tours. Expanding air connectivity and digital platforms enhance accessibility for premium travelers. Regional brands are investing in boutique resorts and experiential tourism to attract younger luxury consumers.

Latin America

The Latin America Global Luxury Travel Market size was valued at USD 93,748.40 million in 2018 to USD 123,829.15 million in 2024 and is anticipated to reach USD 214,917.93 million by 2032, at a CAGR of 7.2% during the forecast period. Latin America holds an estimated 6.6% market share, with Brazil and Argentina leading growth. It benefits from diverse natural attractions, including rainforests, beaches, and heritage cities. The Global Luxury Travel Market in this region gains momentum through adventure and eco-tourism demand. Affluent travelers favor customized experiences such as cultural immersion and culinary tours. Investments in high-end resorts and private aviation services are expanding. It continues to evolve with improved tourism infrastructure and regional connectivity.

Middle East

The Middle East Global Luxury Travel Market size was valued at USD 39,347.92 million in 2018 to USD 48,190.29 million in 2024 and is anticipated to reach USD 77,997.89 million by 2032, at a CAGR of 6.3% during the forecast period. The region captures about 2.4% of the global share, fueled by rapid tourism development in the UAE, Saudi Arabia, and Qatar. It benefits from government initiatives to diversify economies through luxury tourism. The Global Luxury Travel Market here is supported by world-class resorts, desert safaris, and mega event attractions. Growing air connectivity via premium airlines enhances accessibility. It appeals to affluent travelers seeking architectural marvels and exclusive hospitality experiences. Continued investment in cultural and entertainment hubs strengthens regional competitiveness.

Africa

The Africa Global Luxury Travel Market size was valued at USD 30,633.28 million in 2018 to USD 52,782.73 million in 2024 and is anticipated to reach USD 85,057.69 million by 2032, at a CAGR of 5.8% during the forecast period. Africa holds around 2.5% of the total market share, with South Africa and Egypt being key contributors. It thrives on safari and adventure-based luxury travel, attracting tourists seeking exclusive wildlife encounters. The Global Luxury Travel Market in Africa is gaining traction through sustainable eco-lodges and heritage tourism. It faces challenges in infrastructure and accessibility but benefits from strong global interest in nature-driven experiences. Investments in boutique resorts and conservation-focused tourism enhance market prospects. The continent continues to grow as a premium travel destination for experiential and luxury-seeking tourists.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- TUI Group

- Butterfield & Robinson Inc.

- Cox & Kings Ltd.

- Scott Dunn Ltd.

- Abercrombie & Kent USA, LLC

- Lindblad Expeditions

- Geographic Expeditions, Inc.

- Micato Safaris

- Exodus Travels Limited

- Travel Edge (Canada) Inc.

Competitive Analysis:

The Global Luxury Travel Market is highly competitive, characterized by the presence of global and regional players offering exclusive, experience-based travel services. It includes major companies such as TUI Group, Abercrombie & Kent USA, Cox & Kings Ltd., and Scott Dunn Ltd. These firms compete on service quality, customization, destination diversity, and brand reputation. The market favors operators that deliver high-value, personalized experiences supported by strong partnerships with hotels, airlines, and cruise lines. It emphasizes customer loyalty through premium memberships and digital engagement. Mergers, acquisitions, and technology adoption remain core strategies to expand global reach.

Recent Developments:

- In September2025, TUI Group announced a major strategic alliance with the Oman Tourism Development Company (OMRAN Group), marking the launch of a joint venture to develop a cluster of five new luxury hotels in Oman. This partnership includes land and capital contributions from Oman, and TUI’s expertise in hotel management and travel operations. Simultaneously, OMRAN Group became a 1.4% shareholder in TUI, acquiring newly issued shares. These developments aim to position Oman as a year-round premium travel destination, driving sustainable growth and employment.

- In September 2025, Butterfield & Robinson, a key player in luxury active travel, ushered in a new era by expanding its executive team across marketing, trip design, and traveller experience. The leadership refresh coincided with the launch of its redesigned website and a new “Around the World in 60 Days” trip collection, demonstrating the company’s intent to drive innovation and global brand presence. Alexander Green joined as Chief Marketing Officer, and Kristi Elborne was appointed Chief Experience Officer, each bringing deep strategic and creative direction to the brand’s luxury travel vision.

- In February 2025, Cox & Kings, under the new ownership of Wilson & Hughes Limited (acquired in 2024 via insolvency proceedings), announced the expansion of its franchise network across India. Ten new franchises launched in key cities, with plans for 300 more globally, reflecting the firm’s renewed focus on outbound, domestic, and inbound luxury travel. The ambitious growth plan is powered by AI-driven itinerary planning and customer-centric service, furthering the brand’s status in the global luxury travel arena.

Report Coverage:

The research report offers an in-depth analysis based on tour and age group segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for personalized and experiential travel will continue to shape global luxury tourism.

- Digital platforms and AI-based travel customization will dominate service innovation.

- Sustainable and eco-friendly tourism models will gain stronger adoption among affluent travelers.

- Emerging economies in Asia-Pacific will drive rapid market expansion.

- Wellness, adventure, and cultural tourism will remain leading luxury travel themes.

- Strategic alliances between hospitality, aviation, and tour operators will increase competitiveness.

- Luxury cruises and small ship expeditions will see consistent long-term demand.

- The use of blockchain and secure digital payments will enhance traveler confidence.

- Mature markets like Europe and North America will sustain high revenue through premium offerings.

- Green-certified resorts and carbon-neutral experiences will define future brand positioning.