Market Overview

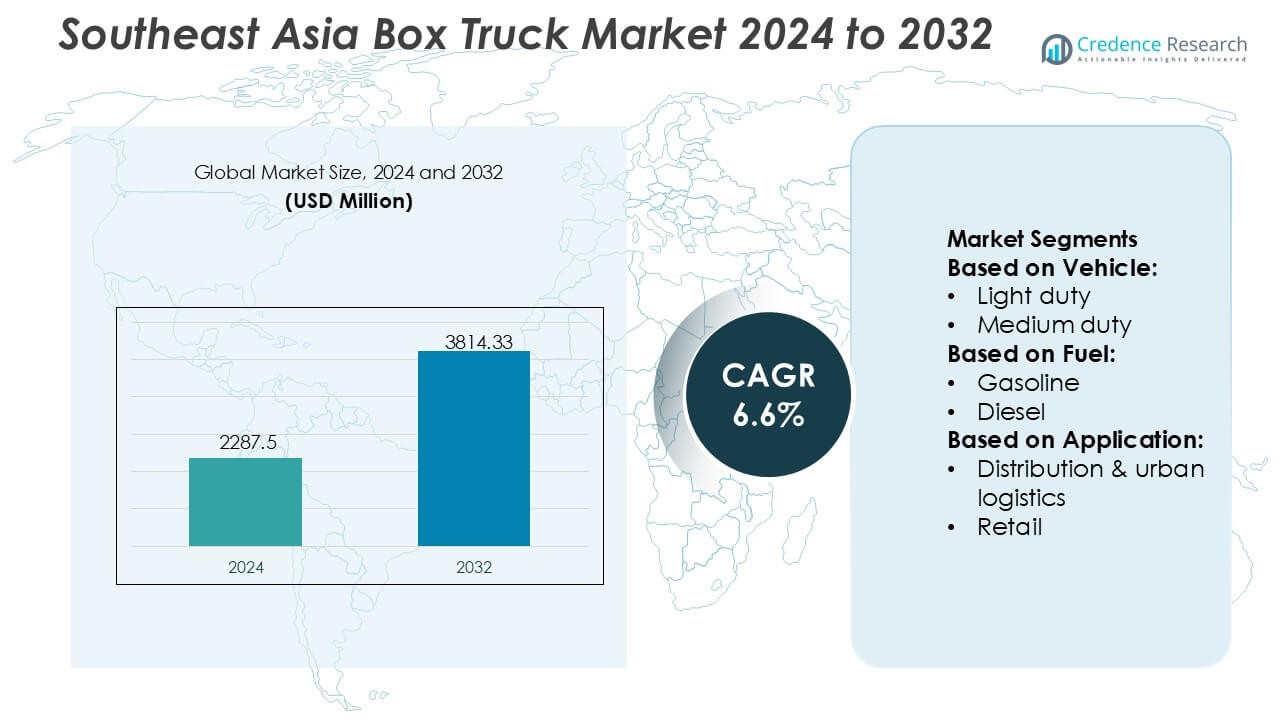

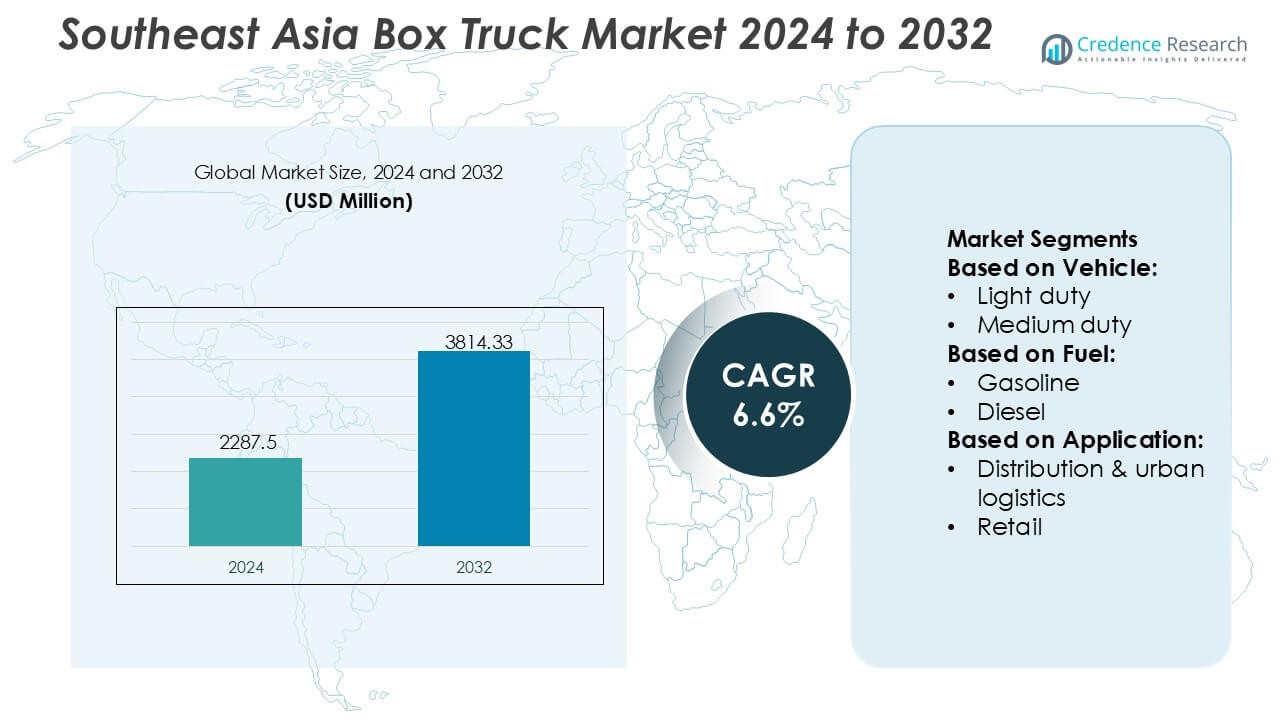

Southeast Asia Box Truck Market size was valued USD 2287.5 million in 2024 and is anticipated to reach USD 3814.33 million by 2032, at a CAGR of 6.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Southeast Asia Box Truck Market Size 2024 |

USD 2287.5 Million |

| Southeast Asia Box Truck Market, CAGR |

6.6% |

| Southeast Asia Box Truck Market Size 2032 |

USD 3814.33 Million |

The Southeast Asia Box Truck Market is shaped by a mix of global OEMs, regional manufacturers, and emerging electric mobility firms that collectively drive technological advancement and fleet modernization across the region. Competition intensifies as companies focus on improving payload efficiency, durability, and low-emission performance to meet the growing needs of e-commerce, retail distribution, and cold-chain logistics. Strategic investments in localized assembly, aftersales support, and telematics integration further strengthen market positioning. Asia-Pacific stands as the leading region with an exact 42% market share, supported by strong manufacturing capacity, expanding logistics networks, and rapid adoption of light- and medium-duty box trucks across fast-growing urban centers.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The market reached USD 2287.5 million in 2024 and is projected to achieve USD 3814.33 million by 2032 at a 6.6% CAGR, supported by strong logistics and distribution expansion.

- Market drivers include rising e-commerce penetration, accelerating fleet upgrades, and increasing adoption of light-duty box trucks, which account for the dominant segment share due to their suitability for dense urban delivery routes.

- Trends highlight growing interest in electric and hybrid box trucks, enhanced telematics integration, and wider use of insulated bodies for cold-chain applications.

- Competitive intensity increases as OEMs strengthen regional assembly, diversify product portfolios, and optimize aftersales networks to retain fleet operators.

- Regional analysis shows Asia-Pacific leading with a 42% share, driven by manufacturing scale and logistics infrastructure, while other regions contribute through import demand and cross-border trade linkages that support medium- and heavy-duty truck deployments.

Market Segmentation Analysis:

By Vehicle

Light-duty box trucks dominate the Southeast Asia market with an estimated 54% share, driven by their maneuverability, lower operating costs, and suitability for dense urban environments where last-mile delivery demand continues to rise. Medium-duty models gain steady adoption in intercity logistics and regional distribution networks that require higher payload capacity without compromising fuel efficiency. Heavy-duty box trucks remain a smaller yet essential segment, primarily serving construction material transport and large-scale retail distribution, supported by expanding infrastructure development and cross-border freight activity across ASEAN corridors.

- For instance, Navistar, Inc. enhanced performance through its S13 Integrated Powertrain, which reduces the overall weight of the powertrain by approximately 24 kilograms (52 pounds) compared to the previous generation, enabling fleets to operate more efficiently in high-load regional applications.

By Fuel

Diesel-powered box trucks hold the leading position with an estimated 62% share, supported by widespread fueling infrastructure, higher torque output, and strong fleet operator preference for long-haul reliability. Gasoline vehicles maintain a moderate presence in lighter applications requiring lower upfront investment. Electric and hybrid variants witness fast growth as governments incentivize fleet electrification; BEVs see the highest traction among emerging alternatives due to lower maintenance costs. CNG and LPG gain adoption in select urban fleets, while biodiesel aligns with regional sustainability policies and mandates promoting low-emission commercial vehicles.

- For instance, BYD Motors Inc. introduced its latest eTruck platform featuring the Blade Battery, which delivers a tested energy density of 150 Wh/kg and supports rapid charging from 20% to 80% in 45 minutes, enabling significantly higher fleet uptime and operational efficiency.

By Application

Distribution and urban logistics represent the dominant application segment with an estimated 48% share, driven by booming e-commerce activity, rapid fulfillment expectations, and the expansion of micro-warehousing networks across major Southeast Asian cities. Retail distribution follows closely as modern trade, convenience stores, and quick-commerce platforms scale regionally. Food & beverage logistics expand with rising cold-chain investments, while construction applications gain momentum from large infrastructure programs. Other segments, including services and rental fleets, benefit from diversified mobility needs across SMEs and last-mile delivery operators.

Key Growth Drivers

- Expansion of E-Commerce and Last-Mile Delivery Networks

Rising online retail penetration across Southeast Asia strengthens demand for box trucks as companies scale last-mile delivery fleets to manage high shipment volumes, frequent dispatch cycles, and rapid fulfillment requirements. Urban densification and the proliferation of micro-warehouses further accelerate fleet modernization toward compact, efficient models suitable for narrow roads and high-traffic corridors. Retailers, logistics aggregators, and third-party delivery platforms increasingly deploy light- and medium-duty box trucks to enhance route optimization, reduce turnaround time, and meet the growing expectations for same-day and next-day delivery services in major metros.

- For instance, Tevva Motors Limited demonstrated its capability for high-frequency urban delivery cycles through its 7.5-tonne electric truck equipped with a 105 kWh LFP battery, enabling up to 227 km of real-world range and rapid DC charging from 20% to 80% in approximately 1 hour, supporting continuous multi-trip operations in dense e-commerce environments.

- Infrastructure Development and Industrial Expansion

Large-scale investments in logistics hubs, industrial parks, cross-border trade routes, and cold-chain networks bolster the adoption of box trucks across manufacturing, FMCG, and distribution sectors. Governments prioritize transport infrastructure enhancements that improve freight mobility and lower operating barriers for fleet operators. Rising construction activity, supported by commercial real estate development and economic zone expansion, increases the movement of materials and equipment, driving higher utilization of medium- and heavy-duty box trucks. This momentum reinforces demand for robust, high-capacity vehicles capable of supporting frequent, long-distance, and multi-stop logistics operations.

- For instance, EV heavy truck variant typically integrates a 282 kWh battery system (from CATL), with an operational range generally suited for short-haul or battery-swapping operations rather than “exceeding 300 km” on a single charge in high-load scenarios.

- Fleet Modernization and Transition Toward Low-Emission Mobility

Growing regulatory emphasis on emissions reduction, combined with corporate sustainability commitments, accelerates the shift toward cleaner, more efficient box truck fleets. Operators increasingly adopt hybrid, electric, and alternative-fuel models to reduce fuel costs, enhance operational predictability, and comply with tightening urban emission norms. Advancements in battery technology, charging ecosystems, and telematics integration enable improved range, route planning, and vehicle performance. Fleet replacement cycles shorten as companies pursue operational efficiency, digital fleet management, and long-term cost optimization, reinforcing the commercial viability of next-generation box trucks.

Key Trends & Opportunities

- Rising Adoption of Electric and Alternative-Fuel Box Trucks

Governments across Southeast Asia introduce incentive programs, pilot zones, and low-emission urban freight corridors that promote electric and alternative-fuel vehicles. Fleet owners increasingly evaluate total cost of ownership benefits as charging infrastructure and renewable energy integration advance across major cities. Manufacturers invest in diversified powertrain offerings BEV, HEV, PHEV, and CNG platforms tailored to logistics intensity and route profiles. This shift enables significant opportunities for OEMs, battery suppliers, and charging-infrastructure partners seeking to capitalize on the region’s long-term decarbonization trajectory.

- For instance, Daimler Truck AG advanced zero-emission logistics with the Mercedes-Benz eActros 300, equipped with a 336 kWh battery pack delivering up to 330 km of real-world range, and the eActros 400 featuring a 448 kWh battery enabling up to 400 km per charge both designed for intensive distribution cycles and rapid-charge capability at 160 kW.

- Digitalization Through Telematics, IoT, and Fleet Analytics

Rapid deployment of telematics systems, sensor-based monitoring, and cloud-integrated fleet platforms enhances visibility, fuel optimization, driver performance tracking, predictive maintenance, and route efficiency. Logistics companies increasingly invest in digital platforms to minimize downtime and reduce operating expenses. The combination of real-time location tracking, loading-pattern analysis, and automated maintenance scheduling unlocks new revenue opportunities for technology vendors. As digital freight ecosystems expand, integrated data-driven operations become a critical differentiator for fleet operators seeking efficiency and competitive advantage.

- For instance, Kenworth Truck Company integrated its TruckTech+ Remote Diagnostics system across new models, enabling real-time fault-code monitoring and reducing diagnostic time by up to 30%, while its Smart Diagnostics platform supports over 1,000 monitored engine and vehicle parameters, significantly improving maintenance accuracy and uptime for digitally enabled fleets.

- Growth of Cold-Chain and Temperature-Controlled Logistics

Demand for temperature-controlled box trucks surges with the expansion of pharmaceutical distribution, food delivery platforms, and fresh produce supply chains. Retailers and 3PLs upgrade fleets with multi-compartment refrigerated units to meet stringent food safety, vaccine transport, and perishable-goods handling standards. Regional trade of processed foods and seafood further drives adoption of advanced insulated truck bodies and energy-efficient cooling systems. This trend creates strong opportunities for specialized body builders, refrigeration-technology providers, and OEMs offering customizable cold-chain-ready box truck configurations.

Key Challenges

- High Acquisition Costs and Limited Operating Margins

Fleet operators face significant financial pressure due to high vehicle acquisition costs—especially for electric and hybrid box trucks—as well as fluctuating fuel prices and operational expenses. Small and mid-sized logistics companies experience tightened margins, limiting their ability to upgrade fleets or adopt advanced technologies. Limited access to financing, lower resale value in emerging EV markets, and slow subsidy approval cycles further delay modernization efforts. These constraints pose barriers to fleet scaling, efficiency improvements, and rapid adoption of next-generation vehicles.

- Infrastructure Gaps and Operational Constraints in Urban Areas

Despite rapid development, several Southeast Asian markets continue to face infrastructure limitations, including inadequate charging infrastructure, limited parking zones, and road congestion that reduces delivery efficiency. Narrow roads, inconsistent roadway quality, and regulatory restrictions on delivery window timings complicate route planning for fleet operators. Cross-border logistics face additional delays due to varying national standards and regulatory frameworks within ASEAN. These structural challenges hinder operational reliability, increase delivery costs, and slow adoption of larger or more advanced box truck configurations.

Regional Analysis

North America

North America holds 22% of the Southeast Asia box truck market’s external demand, supported by strong trade linkages, multinational logistics operators, and rising procurement of medium-duty fleet units for cross-border distribution within integrated supply chains. Companies in the U.S. and Canada increasingly source box trucks from Southeast Asia due to competitive manufacturing costs and flexible customization standards. Fleet modernization programs by logistics, parcel delivery, and retail distributors further strengthen procurement volumes. Regulatory emphasis on fuel-efficient and low-emission commercial vehicles also drives interest in Southeast Asian suppliers that offer cost-efficient diesel, electric, and alternative-fuel models aligned with North American compliance needs.

Europe

Europe accounts for 18% of the Southeast Asia box truck market’s demand footprint, driven by active sourcing of specialized fleet variants suitable for cold-chain, food distribution, and urban logistics applications. European logistics companies increasingly engage with Southeast Asian OEMs for competitively priced, lightweight box truck bodies that support payload efficiency and lower operating costs. The region’s growing focus on electrification and sustainable fleet solutions encourages partnerships for electric and hybrid truck platforms manufactured in Southeast Asia. Stringent environmental regulations and strong e-commerce penetration accelerate procurement of compact, maneuverable box trucks that improve last-mile delivery performance in dense European cities.

Asia-Pacific

Asia-Pacific dominates with a 42% market share, driven by the strong manufacturing base, expanding intra-regional trade, and large-scale adoption of box trucks across distribution, retail, FMCG, and construction sectors. High urbanization rates in Southeast Asia, coupled with rapid growth of e-commerce and cold-chain logistics, boost regional demand for light- and medium-duty trucks. OEMs in Thailand, Indonesia, and Vietnam benefit from favorable industrial policies, export-oriented production, and increasing investment in EV commercial fleets. The region’s diverse logistics needs—from last-mile delivery to heavy-duty haulage—position Southeast Asia as both a core producer and high-growth consumer market for box trucks.

Latin America

Latin America captures 10% of the Southeast Asia box truck market’s export-linked demand, supported by rising fleet replacement in Brazil, Chile, Mexico, and Colombia. Logistics firms seek cost-effective imports from Southeast Asian manufacturers to offset regional production gaps and volatile domestic pricing. Growing retail, food distribution, and agricultural supply chains expand the need for durable box trucks capable of operating in mixed terrains. Trade agreements and improving port connectivity facilitate smoother procurement flows. As Latin American fleet operators adopt modern telematics and emission-compliant engines, Southeast Asian suppliers benefit from supplying affordable, adaptable gasoline, diesel, and alternative-fuel models.

Middle East & Africa

The Middle East & Africa region holds 8% of demand for Southeast Asian box trucks, driven by expanding construction, FMCG distribution, and infrastructure-led logistics requirements across the Gulf states and key African economies. Regional buyers prefer Southeast Asian trucks for their durability in high-temperature environments and lower maintenance costs compared with Western imports. Demand grows further with the rise of urban distribution networks and cold-chain expansion in the UAE, Saudi Arabia, and South Africa. Strategic government investment in transport corridors and industrial zones enhances procurement volume, positioning Southeast Asian OEMs as reliable, cost-efficient partners in fleet expansion programs.

Market Segmentations:

By Vehicle:

By Fuel:

By Application:

- Distribution & urban logistics

- Retail

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

Competitive Landscape

The Southeast Asia Box Truck Market features a competitive ecosystem shaped by global commercial vehicle manufacturers and emerging electric truck innovators, including Navistar, Inc., BYD Motors Inc., Tevva Motors Limited, SAIC HONGYAN Automotive Co., Ltd., Daimler Truck AG, Kenworth Truck Company, Nikola Corporation, DAF Trucks, Scania, and AB Volvo. the Southeast Asia Box Truck Market is defined by a mix of global OEMs, regional assemblers, and fast-growing electric mobility innovators that collectively shape fleet modernization, technological upgrades, and supply-chain efficiency. Manufacturers focus on expanding production capacity, strengthening distribution networks, and offering customizable box body configurations suited for e-commerce, cold-chain logistics, and urban delivery. The shift toward low-emission mobility intensifies competition as companies accelerate investments in BEV, HEV, and alternative-fuel platforms optimized for Southeast Asia’s regulatory and operational requirements. Strong aftersales service networks, improved telematics integration, and enhanced durability standards further differentiate competitors, enabling them to secure long-term contracts with logistics, retail, FMCG, and construction operators.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Navistar, Inc.

- BYD Motors Inc.

- Tevva Motors Limited

- SAIC HONGYAN Automotive Co., Ltd.

- Daimler Truck AG

- Kenworth Truck Company

- Nikola Corporation

- DAF Trucks

- Scania

- AB Volvo

Report Coverage

The research report offers an in-depth analysis based on Vehicle, Fuel, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand as e-commerce logistics networks scale across major Southeast Asian economies.

- Fleet operators will increasingly adopt electric and hybrid box trucks to meet tightening emission standards.

- Urban delivery demand will grow, driving higher preference for compact, maneuverable light-duty box trucks.

- Cold-chain expansion will accelerate procurement of insulated and refrigerated box truck variants.

- OEMs will invest in localized assembly to reduce lead times and enhance regional competitiveness.

- Telematics and fleet management systems will become standard for optimizing route efficiency and uptime.

- Digital freight platforms will strengthen demand for standardized, versatile box truck configurations.

- Infrastructure development in secondary cities will boost medium-duty truck deployments.

- Public–private partnerships will support renewal of aging fleets with cleaner and more efficient models.

- Rising cross-border trade within ASEAN will increase demand for durable, long-haul box trucks.