Market Overview

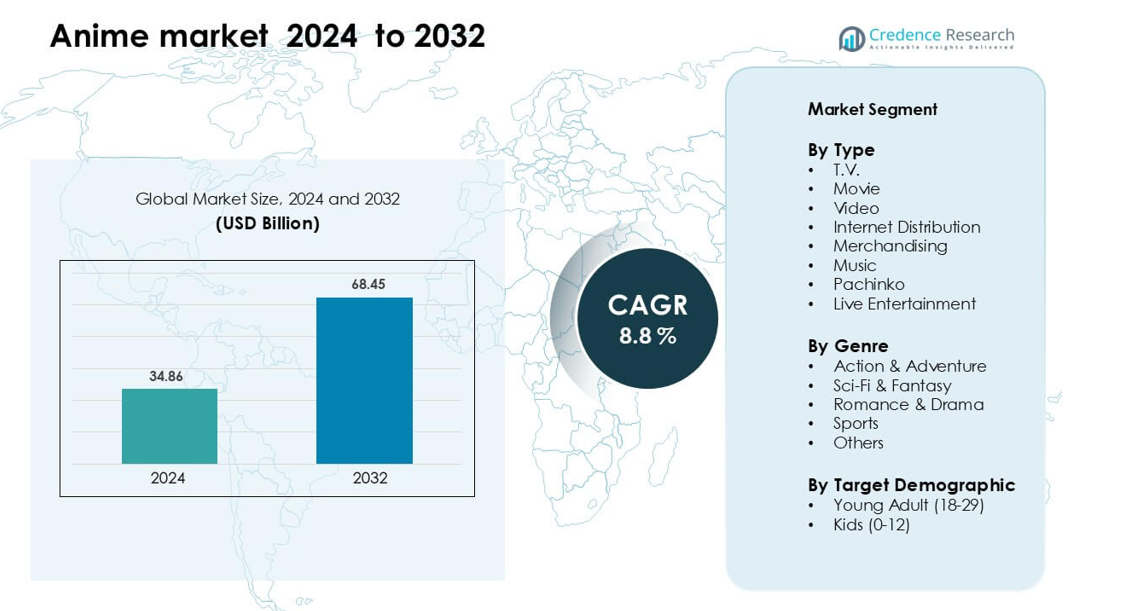

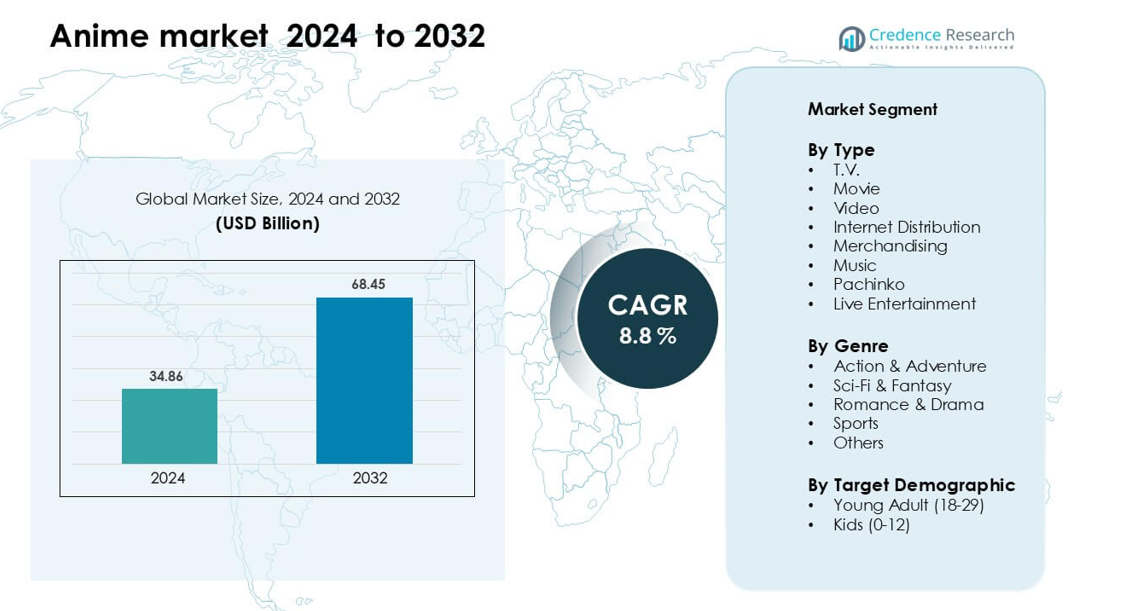

Anime market was valued at USD 34.86 billion in 2024 and is anticipated to reach USD 68.45billion by 2032, growing at a CAGR of 8.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Anime Market Size 2024 |

USD 34.86 billion |

| Anime Market, CAGR |

8.8% |

| Anime Market Size 2032 |

USD 68.45billion |

The anime market is dominated by key players including Studio Ghibli, Toei Animation, Sunrise (Bandai Namco Filmworks), Production I.G, Bones, Pierrot, MADHOUSE, Kyoto Animation, Bioworld Merchandising, and Crunchyroll (Sony Pictures Entertainment Inc.), which collectively drive content production, distribution, and merchandising revenue. These companies leverage strong intellectual property portfolios, cross-media franchises, and global streaming partnerships to maintain competitive advantage. Asia-Pacific emerges as the leading region, accounting for approximately 40% of the global market share, with Japan at the core of production and domestic consumption. The region’s dominance is supported by high adoption of TV broadcasts, digital platforms, theatrical releases, and complementary revenue streams such as merchandise, music, and live entertainment. Rising international demand further solidifies Asia-Pacific’s position as the primary growth engine in the anime industry.

Market Insights

- The global anime market was valued at USD 34.86 billion in 2024 and is projected to grow at a CAGR of 8.8 % through 2030, driven by rising international demand and digital distribution.

- Market growth is fueled by the expansion of streaming platforms, cross-media franchise development, and increasing merchandise and live entertainment revenues, especially among young adult audiences.

- Key trends include rising internet-based distribution, investment in high-quality original content, and growth in global fan engagement through conventions, social media, and e-commerce merchandise. Action & adventure, fantasy, and romance genres dominate, with TV and internet streaming as leading segments.

- The competitive landscape is highly concentrated with major players like Studio Ghibli, Toei Animation, Sunrise, Production I.G, Crunchyroll, and Bioworld Merchandising driving content creation, licensing, and international partnerships, while smaller studios focus on niche genres.

- Asia-Pacific leads the market with a 40% share, followed by North America (25%), Europe (18%), Latin America (8%), and the Middle East & Africa (5%), supported by strong domestic consumption and growing international adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The anime market is diversified across multiple distribution and revenue channels, with TV anime emerging as the dominant sub-segment, accounting for over 35% of the total market share. TV anime benefits from widespread accessibility and scheduled programming, creating consistent viewership and advertising revenue. Streaming via Internet Distribution is rapidly growing, driven by global platforms offering simulcast releases, while Merchandising and Music provide complementary revenue streams. Drivers include technological advancements, expanding international demand, and cross-media promotions that leverage popular franchises to boost engagement across multiple formats.

- For instance, Toei Animation’s “One Piece” TV anime has over 1,138 episodes in broadcast as of 2025.

By Genre

In terms of genre, Action & Adventure leads the anime market with an estimated 40% market share, driven by its global appeal and adaptability across TV, movies, and gaming tie-ins. Sci-Fi & Fantasy follows closely, attracting audiences through immersive storytelling and visually sophisticated animation. Romance & Drama, while more niche, drives engagement through serialized content and character-driven narratives. Market growth is fueled by the rising demand for binge-worthy content, international streaming accessibility, and cross-promotional strategies involving merchandise, music, and gaming, which reinforce fan loyalty and franchise longevity.

- For instance, the Sword Art Online: Progressive Aria of a Starless Night film (produced by A-1 Pictures / Aniplex) grossed US$ 14.03 million in its theatrical run.

By Target Demographic

Within demographics, Young Adults (18–29) dominate the market with approximately 55% share, attracted to complex storylines, high-quality animation, and franchise-based merchandise. Kids (0–12) remain an important segment through educational and entertainment content distributed via TV and Internet platforms. Drivers for young adult engagement include global streaming platforms, social media communities, and immersive experiences such as live events and games. Merchandising, music, and collectibles further enhance consumer interaction, creating a full-cycle revenue ecosystem that sustains franchise growth across both domestic and international markets.

Key Growth Drivers

Expansion of Global Streaming Platforms

The rapid proliferation of global streaming services such as Netflix, Crunchyroll, and Amazon Prime Video has significantly boosted anime consumption worldwide. These platforms enable simulcast releases, multilingual subtitles, and targeted recommendations, making anime accessible to audiences beyond Japan. The convenience of on-demand viewing and binge-watching fosters consistent engagement, while subscription-based models provide stable revenue streams for studios and distributors. Additionally, streaming platforms actively invest in original anime content, driving higher production budgets, improved animation quality, and innovative storytelling. This digital accessibility accelerates international adoption, expands fan bases, and encourages cross-media collaborations, including merchandise, music, and gaming, further amplifying market growth.

- For instance, Netflix announced that over 150 million households (≈ 300 million viewers) worldwide now watch anime, representing more than 50% of its global subscriber base.

Cross-Media Franchise Development

Anime franchises increasingly leverage a multi-channel approach, integrating TV series, movies, manga, games, merchandise, and music to maximize audience engagement and revenue. Popular franchises such as “Demon Slayer” and “One Piece” exemplify this strategy, creating interconnected ecosystems where fans participate across formats. This cross-media synergy drives both brand loyalty and recurring consumption, as successful content spurs merchandise sales, live events, and collaborations with other media industries. Studios benefit from diversified income streams while mitigating risks associated with reliance on a single channel. The approach also enables international localization, partnerships with streaming platforms, and co-productions, further enhancing the global reach and longevity of anime franchises.

- For instance, the Demon Slayer manga has sold over 220 million copies globally.

Rising International Demand and Fan Communities

Growing global interest in Japanese culture, including anime, cosplay, and gaming, has expanded the anime market beyond its domestic audience. International fan communities actively engage through conventions, social media, and fan translations, creating organic marketing and sustained demand. Licensing agreements and localized adaptations allow studios to tap into diverse regions while fostering strong brand recognition. The internationalization of anime also drives collaborations with global brands, streaming platforms, and merchandise manufacturers, contributing to higher revenues. Moreover, increased accessibility via digital platforms enables creators to respond to viewer preferences quickly, ensuring content relevance and fostering loyalty, making international adoption a key growth driver for the anime market.

Key Trends & Opportunities

Rise of Internet Distribution and On-Demand Viewing

Internet distribution is transforming the anime market, shifting consumption from traditional TV to digital platforms. Audiences now prefer on-demand viewing, binge releases, and simulcast streaming, allowing immediate access to new episodes. This trend encourages studios to adopt flexible production schedules and experiment with diverse genres and formats. Opportunities also arise for targeted advertising, subscription models, and regional content localization. With growing mobile device penetration and high-speed internet adoption, digital distribution enables studios to reach younger demographics and international markets efficiently. Additionally, partnerships with global platforms allow co-productions and investments in high-quality animation, expanding revenue potential and establishing a scalable model for long-term growth.

- For instance, in the first half of 2025, Netflix users streamed over 4.4 billion hours of anime, an 11.3% increase from the previous six months.

Expansion of Merchandising and Live Entertainment

Merchandise sales, including figures, apparel, and collectibles, represent a major revenue stream for anime franchises. Coupled with live entertainment events, such as stage adaptations, concerts, and exhibitions, these extensions enhance fan engagement and brand loyalty. Growth in e-commerce and international shipping facilitates access to merchandise worldwide, while experiential events strengthen emotional connections with audiences. Opportunities exist in themed cafes, pop-up stores, and interactive exhibitions, leveraging the popularity of hit series. This trend not only diversifies income but also reinforces franchise visibility across media platforms, creating a holistic ecosystem where content consumption, merchandise, and live experiences mutually drive each other’s growth.

- For instance, the Gundam franchise (Bandai Namco) has shipped over 800 million Gunpla model kits to date.

Increasing Investment in Original Content and High-Quality Animation

Studios are increasingly focusing on producing original content with sophisticated storytelling, superior animation quality, and cinematic production standards. This trend caters to both domestic and international audiences seeking immersive experiences. Investment in original IP reduces reliance on existing franchises and opens opportunities for new hits to emerge. Collaborations with international platforms and co-productions further enhance the budget, technology access, and market reach. High-quality animation attracts wider viewership, increases licensing potential, and stimulates merchandise and music sales. Studios leveraging this approach gain competitive advantage, strengthen brand value, and ensure sustainable growth in an increasingly crowded and globalized anime market.

Key Challenges

Rising Production Costs and Talent Shortages

The anime industry faces significant challenges from escalating production costs and a shortage of skilled animators, directors, and technical staff. High-quality animation requires advanced technology, extended timelines, and specialized talent, leading to budget pressures, especially for smaller studios. Talent shortages can delay releases, reduce output quality, and limit the number of simultaneous projects. These factors create a bottleneck that hinders scalability and affects profitability. Studios must invest in training, automation tools, and international collaborations to mitigate labor constraints. Failure to address these challenges risks declining content quality and competitiveness, impacting both domestic and global market growth prospects.

Piracy and Intellectual Property (IP) Concerns

Piracy remains a persistent issue, undermining revenue streams from streaming, DVD sales, and merchandising. Unauthorized distribution on illegal platforms not only reduces earnings but also affects licensing and international market expansion. IP protection is challenging in global markets with differing enforcement standards. Studios must invest in anti-piracy measures, legal action, and digital rights management technologies. Additionally, global demand for anime often drives fan-sub groups that, while increasing exposure, may reduce monetized viewership. Addressing piracy and strengthening IP management are critical to ensuring sustainable profitability, safeguarding investments, and maintaining incentives for continued high-quality content production.

Regional Analysis

North America

North America holds approximately 25% of the global anime market, driven by strong digital adoption and growing popularity of streaming platforms like Crunchyroll and Netflix. U.S. and Canadian audiences favor action, adventure, and fantasy genres, contributing to high content engagement. Licensing agreements, merchandise, and live events further support revenue growth. Increasing interest in Japanese culture, conventions, and cosplay communities reinforces market penetration. The region benefits from localized content, English dubbing, and marketing campaigns tailored for young adults. Expansion opportunities exist through partnerships with e-commerce platforms and digital distribution channels, strengthening both domestic consumption and cross-border content licensing.

Europe

Europe accounts for around 18% of the anime market, with Germany, France, and the U.K. leading consumption. The market growth is fueled by a combination of streaming platforms, TV broadcasts, and localized merchandising. Anime conventions, cosplay events, and fan communities drive engagement, while subtitled and dubbed content increases accessibility. Action, sci-fi, and fantasy genres remain dominant. Digital distribution is a key growth driver, supported by high internet penetration and mobile device usage. European licensing agreements and cross-media franchises further expand revenue streams. Opportunities lie in expanding localized content, merchandising, and partnerships with regional streaming services for enhanced market reach.

Asia-Pacific

Asia-Pacific is the largest market, contributing approximately 40% of global revenue, led by Japan as the origin of anime. Strong domestic consumption is complemented by rising demand in China, South Korea, and Southeast Asia. TV, internet streaming, and theatrical releases drive wide-scale viewership, while merchandising, pachinko, and music segments significantly boost revenue. High adoption of mobile and digital platforms facilitates international distribution. Popular genres include action, adventure, romance, and fantasy. Cross-media franchises and live entertainment events enhance engagement. The region presents continuous growth opportunities through expansion into emerging markets, regional partnerships, and digital content innovations to capture younger audiences.

Latin America

Latin America contributes around 8% of the global anime market, with Brazil and Mexico as leading countries. Market growth is fueled by streaming services, localized dubbing, and growing fan communities. Action, adventure, and fantasy genres dominate, attracting young adult and teen audiences. Conventions, cosplay events, and merchandising create additional engagement and revenue streams. Internet penetration and mobile device usage enable broad access to digital content, while collaborations with international platforms increase content availability. Rising interest in Japanese pop culture and anime-inspired local productions present growth opportunities. Challenges include limited local production and piracy concerns, which necessitate stronger licensing and enforcement strategies.

Middle East & Africa

The Middle East & Africa region holds approximately 5% of the global anime market, with increasing popularity in the UAE, Saudi Arabia, and South Africa. Streaming platforms and satellite TV channels have expanded access to anime content, while merchandising and music sales remain smaller but emerging revenue sources. Young adult audiences drive demand for action, adventure, and fantasy genres. Language localization and cultural adaptation are key factors for regional adoption. Opportunities exist in expanding digital distribution, licensing agreements, and live events targeting urban populations. Market growth is moderated by regulatory restrictions, limited local production, and piracy, which require strategic partnerships to unlock further potential.

Market Segmentations:

By Type

- V.

- Movie

- Video

- Internet Distribution

- Merchandising

- Music

- Pachinko

- Live Entertainment

By Genre

- Action & Adventure

- Sci-Fi & Fantasy

- Romance & Drama

- Sports

- Others

By Target Demographic

- Young Adult (18-29)

- Kids (0-12)

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The global anime market is highly competitive, characterized by the presence of leading studios, streaming platforms, and merchandise companies that leverage strong intellectual property portfolios. Major players such as Studio Ghibli, Toei Animation, Sunrise (Bandai Namco Filmworks), Production I.G, and Crunchyroll (Sony Pictures Entertainment Inc.) dominate content production, distribution, and international licensing. Companies differentiate through high-quality animation, cross-media franchises, merchandising, and global partnerships. Strategic collaborations, co-productions, and digital platform expansions intensify competition, while smaller studios focus on niche genres and innovative storytelling to capture market share. Merchandising companies like Bioworld enhance revenue streams through licensed products. Market competitiveness is further fueled by rapid technological adoption, streaming accessibility, and international audience growth. Studios increasingly invest in original IP, live events, and international partnerships to strengthen brand recognition and sustain long-term growth amid rising global demand.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Studio Ghibli, Inc.

- Crunchyroll (Sony Pictures Entertainment Inc.)

- Production I.G, Inc.

- Toei Animation Co., Ltd.

- Bones Inc.

- Pierrot Co., Ltd.

- MADHOUSE, Inc.

- Bioworld Merchandising, Inc.

- Sunrise, Inc. (Bandai Namco Filmworks)

- Kyoto Animation Co., Ltd.

Recent Developments

- In July 2025, at San Diego Comic-Con, Crunchyroll officially announced a new monthly theatrical program titled ‘Crunchyroll Anime Nights,’ designed to bring a specially curated list of anime movies and sneak peeks to theaters nationwide.

- In May 2025, Toei Animation outlined plans to integrate artificial intelligence tools into parts of its animation workflow in its forward-looking financial guidance, signaling a shift toward tech-enabled production that has sparked debate among anime fans and creators.

- In May 2024, Studio Ghibli received the honorary Palme d’Or at the 77th Cannes Film Festival, becoming the first film studio ever to receive this distinction and strengthening Studio Ghibli’s global brand value in the anime market.

Report Coverage

The research report offers an in-depth analysis based on Type, Genre, Target Demographic, and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Digital streaming platforms will continue to expand, increasing global accessibility and viewership.

- Original content production will rise, focusing on high-quality animation and innovative storytelling.

- Cross-media franchise development will strengthen, integrating TV, movies, games, merchandise, and music.

- International demand will grow, particularly in emerging markets across Asia, Europe, and Latin America.

- Merchandising and licensing opportunities will expand alongside popular anime franchises.

- Live entertainment events, such as concerts, stage shows, and exhibitions, will drive fan engagement.

- Mobile and on-demand consumption will accelerate, encouraging flexible and short-form content creation.

- Collaborations between studios and global streaming platforms will increase co-productions and budget investments.

- Niche genres and experimental storytelling will attract specialized audiences and create new market segments.

- Industry focus on intellectual property protection and anti-piracy measures will enhance revenue sustainability.