Market Overview

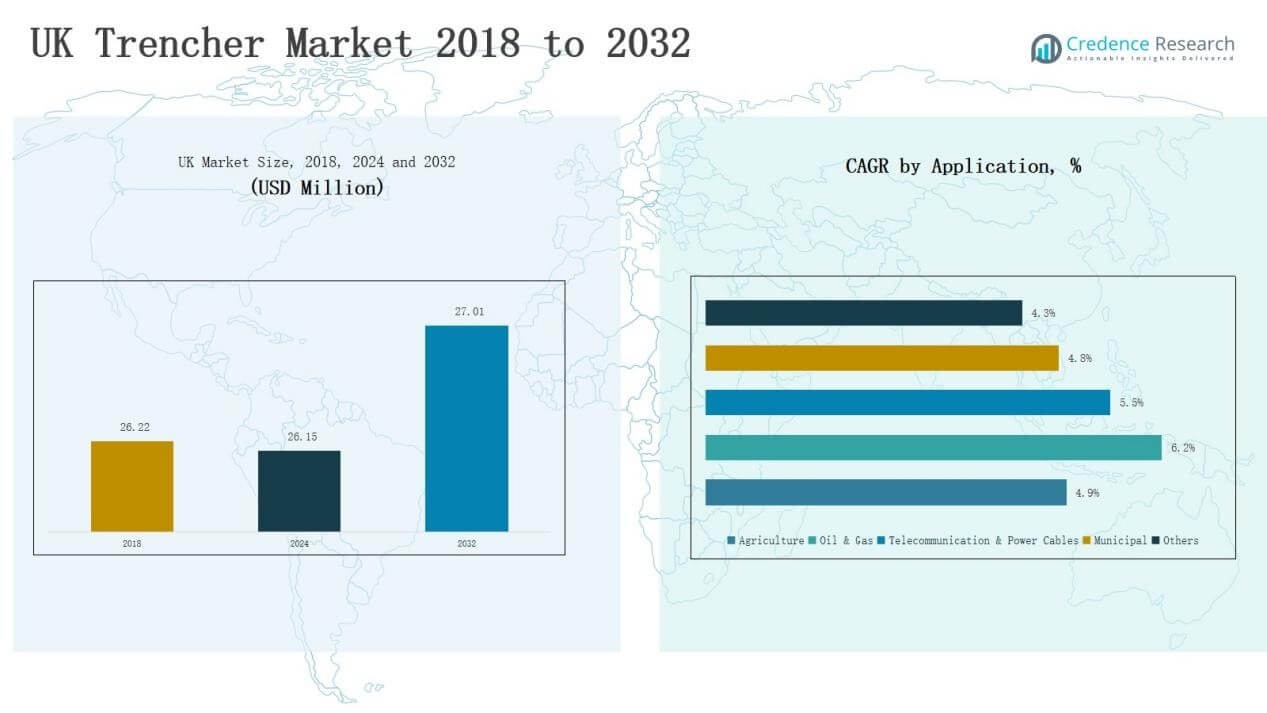

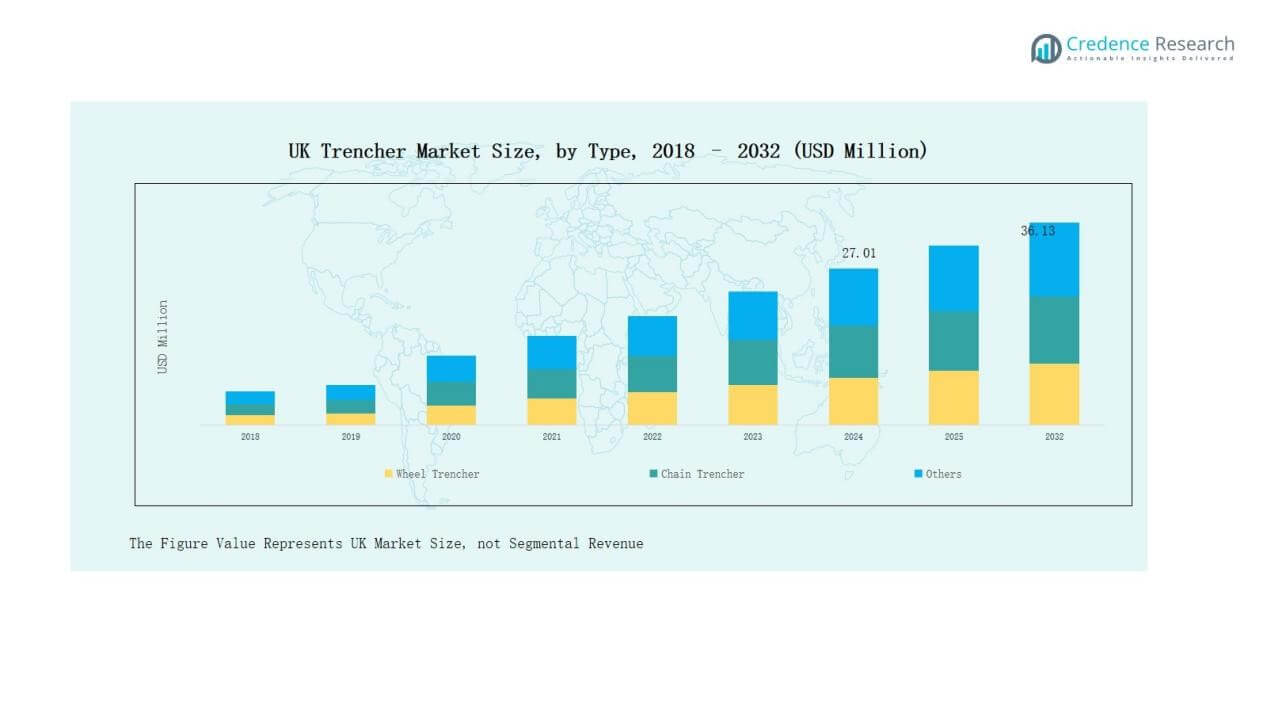

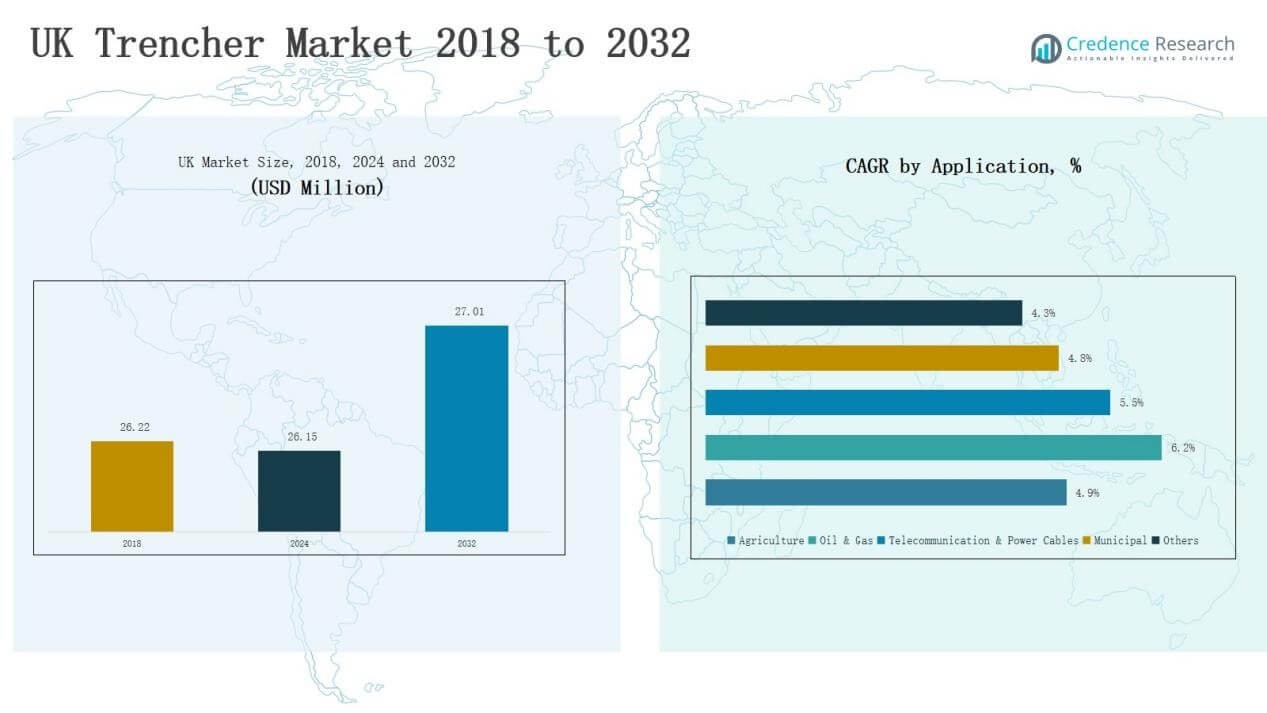

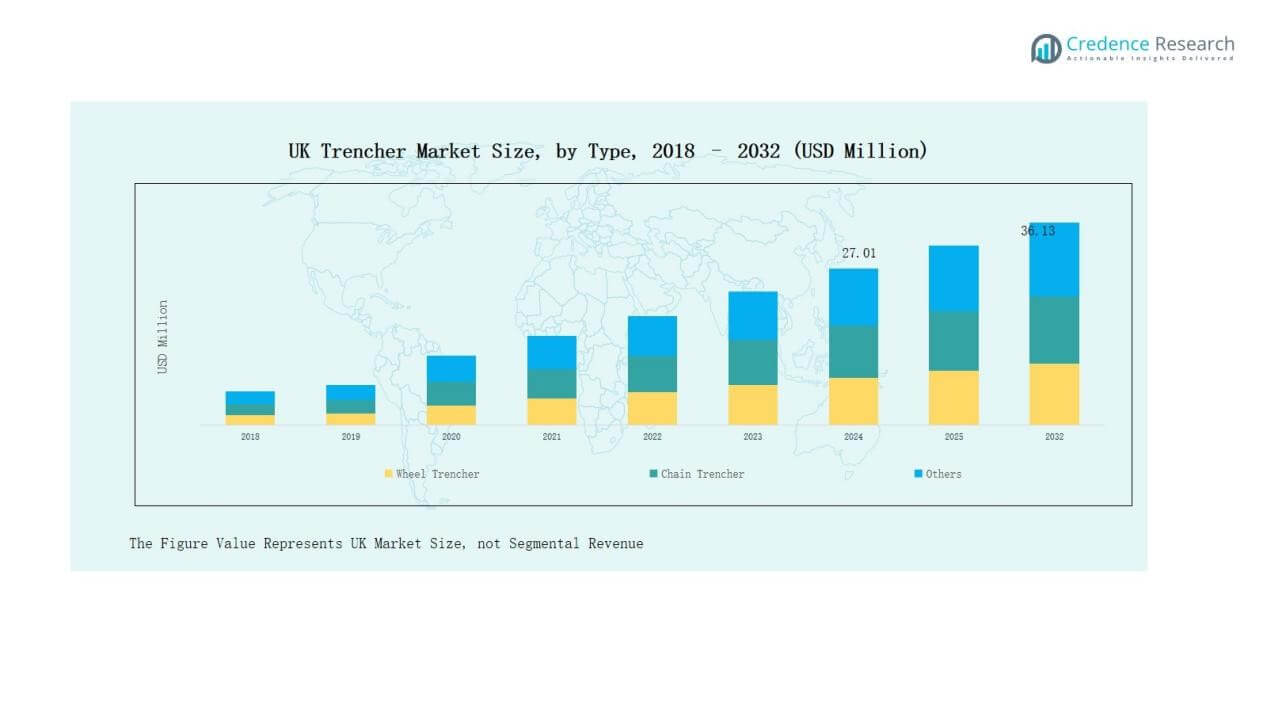

UK Trencher Market size was valued at USD 26.22 million in 2018 to USD 27.01 million in 2024 and is anticipated to reach USD 36.13 million by 2032, at a CAGR of 3.70 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| UK Trencher Market Size 2024 |

USD 27.01 Million |

| UK Trencher Market, CAGR |

3.70 % |

| UK Trencher Market Size 2032 |

USD 36.13 Million |

The UK Trencher Market is shaped by established players such as Aardvark Equipment Ltd., AFT Trenchers Ltd., Mastenbroek Limited, Osbit Ltd., Soil Machine Dynamics, Global Marine Systems, Modus Subsea Services Ltd., DeepOcean, and DOF Subsea. These companies compete through advanced product portfolios, automation, and eco-friendly trenching solutions tailored for agriculture, telecom, municipal, and energy applications. Strong dealer networks, rental services, and long-term partnerships with utility providers further enhance their competitiveness. Regionally, England leads the market with a 48% share in 2024, driven by broadband expansion, smart city projects, and extensive agricultural mechanization, making it the dominant hub for trencher demand across the UK.

Market Insights

- The UK Trencher Market grew from USD 26.22 million in 2018 to USD 27.01 million in 2024 and is expected to reach USD 36.13 million by 2032 at a CAGR of 3.70%.

- Wheel trenchers led with a 47% share in 2024, followed by chain trenchers at 36% and other types at 17%.

- Agriculture held the largest application share at 34% in 2024, while telecom and power cables accounted for 28% and municipal projects secured 22%.

- Distribution channels dominated sales with a 62% share in 2024, supported by strong dealer networks and aftermarket services, while direct channels held 38%.

- England led regionally with a 48% share in 2024, followed by Scotland at 22%, Wales at 16%, and Northern Ireland at 14%.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segment Insights

By Type

In the UK Trencher Market, wheel trenchers hold the dominant position with around 47% share in 2024. Their popularity stems from high efficiency in cutting through hard and rocky surfaces, making them ideal for utility and municipal projects. Chain trenchers follow with a 36% share, widely used in agriculture and fiber optic cable installation due to their precision in narrow trenching. Other types account for the remaining 17% share, serving niche applications that require customized trenching solutions.

- For instance, Tesmec’s surface miners have been adapted for specialized UK projects such as laying high-voltage underground cables where controlled trench depths are critical.

By Application

Agriculture leads the application segment with a 34% share in 2024, driven by mechanization in drainage systems and irrigation projects. The telecommunication and power cables segment holds a 28% share, supported by expanding fiber optic networks and 5G rollouts. Municipal applications secure a 22% share, reflecting strong investments in water pipelines and urban infrastructure. Oil and gas follows with a 10% share, while other applications make up 6%, mostly covering construction and landscaping needs.

By Sales Channel

The distribution channel dominates the UK Trencher Market with a 62% share in 2024, reflecting customer preference for established dealer networks and aftermarket service availability. Direct channels represent 38% share, supported by larger buyers such as utilities and contractors who prefer direct procurement for cost control and technical customization. Strong dealer partnerships, financing options, and local support services drive the distribution channel’s continued leadership in the market.

- For instance, Vermeer’s UK dealers provide on-site service trucks and parts supply, ensuring reduced equipment downtime for trenching contractors.

Market Overview

Key Growth Drivers

Infrastructure Expansion

The UK Trencher Market benefits from significant investments in infrastructure modernization. Government-backed projects for water pipelines, sewage systems, and urban utility upgrades continue to accelerate demand for trenching equipment. The growing focus on smart cities further adds pressure to expand underground networks for gas, water, and electricity. Wheel and chain trenchers are particularly favored for large-scale projects due to efficiency and reliability. This steady push for infrastructure expansion positions trenchers as essential machinery across both urban and semi-urban developments.

- For instance, National Grid has been working on its London Power Tunnels project (2020–2026), a £1 billion scheme involving over 32 km of underground electricity cables, where trenching equipment plays a vital role in access and utility connections.

Agriculture Mechanization

Agriculture drives trencher adoption as farms increasingly modernize to improve productivity. The demand for drainage and irrigation systems, particularly in areas with high rainfall or poor soil drainage, supports steady sales of trenchers. Compact chain trenchers are widely preferred for their accuracy in laying pipes and cables with minimal soil disruption. Farmers and agribusinesses view mechanized trenching as a long-term investment that reduces labor costs and project timelines. This shift toward agricultural mechanization ensures a strong foundation for trencher market growth in rural regions.

Telecom and Energy Network Expansion

Telecommunication and energy projects remain a critical growth driver. Fiber optic rollouts for broadband and 5G networks require extensive trenching for underground cables across cities and towns. Similarly, the expansion of renewable energy projects, including solar and wind farms, creates demand for trenchers to install power lines and underground connections. Contractors increasingly rely on trenchers for precision and speed in such high-volume projects. This dual push from telecom and energy infrastructure ensures continuous demand for advanced and versatile trenching solutions across the UK.

- For instance, National Grid’s London Power Tunnels project involves the installation of 32 km of underground electricity cables, relying on trenching and tunneling equipment to modernize aging infrastructure.

Key Trends & Opportunities

Eco-Friendly and Automated Trenchers

A major trend in the UK Trencher Market is the adoption of eco-friendly and automated equipment. Manufacturers are introducing electric and hybrid trenchers that reduce emissions and noise, aligning with sustainability goals. Automation technologies, including GPS-based guidance and operator-assist systems, improve accuracy and reduce manual labor requirements. These innovations not only enhance productivity but also meet regulatory requirements on emissions and safety. Companies that offer advanced eco-friendly trenchers are expected to gain a competitive edge, especially in urban and environmentally sensitive projects.

- For instance, Bobcat launched its all-electric T7X compact track loader in 2022, eliminating hydraulic fluids and achieving near-zero emissions, a move aligned with the broader electrification shift in attachment-driven equipment such as trenchers.

Rental and Aftermarket Services Expansion

The growing preference for rental and aftermarket services presents a strong opportunity for market players. Contractors and municipalities increasingly opt for renting trenchers to avoid high upfront costs and maintenance responsibilities. This shift expands opportunities for equipment rental companies and dealers offering financing, repair, and spare parts support. Service-based models ensure recurring revenue streams for manufacturers and distributors. The trend also allows smaller contractors to access advanced trenching equipment without heavy investments, driving wider adoption and boosting market penetration across diverse applications.

- For instance, United Rentals reported that its specialty rentals segment, including trench safety equipment, grew year-over-year in 2023, reflecting strong demand from utility and infrastructure projects.

Key Challenges

High Initial Investment Costs

The high upfront cost of purchasing trenchers remains a major challenge for small and medium contractors. Wheel and chain trenchers require significant capital investment, which can discourage adoption in cost-sensitive projects. Many firms turn to rental options, which, while useful, limit long-term growth for direct sales. Financing constraints and budget restrictions across small municipalities further add pressure. Market players must address this barrier through flexible financing, leasing programs, and affordable models to expand adoption beyond large-scale contractors and utility providers.

Skilled Operator Shortage

The UK faces a shortage of skilled operators capable of handling advanced trenching machinery. Modern trenchers with automation features still require trained personnel for safe and efficient operation. The lack of specialized training programs in vocational institutes contributes to this gap. Contractors often struggle with delays and higher labor costs due to limited skilled workers. Without focused training initiatives, the adoption of next-generation trenchers may face slowdowns, affecting productivity in telecom, municipal, and energy projects that depend on timely execution.

Regulatory and Environmental Constraints

Strict regulations related to noise, emissions, and land disruption pose challenges in the UK Trencher Market. Urban projects often face restrictions on working hours and machine usage due to environmental and community concerns. Compliance with evolving sustainability standards requires manufacturers to invest heavily in R&D for cleaner technologies. Smaller contractors also face difficulties adapting to regulatory demands, especially in urban centers. These constraints can increase project costs, slow down timelines, and restrict market penetration, particularly in areas with high regulatory oversight.

Regional Analysis

England

England dominates the UK Trencher Market with a 48% share in 2024. Strong investments in fiber optic networks, water pipelines, and urban utility upgrades support steady demand. Municipalities drive adoption through smart city projects and modernized infrastructure plans. Telecom operators also rely on trenchers for rapid broadband and 5G rollout. Agricultural mechanization in rural counties adds further traction. The concentration of large contractors and service providers strengthens market growth. It remains the primary hub for both equipment demand and supplier presence.

Scotland

Scotland accounts for a 22% share in 2024, driven by energy and utility projects. Renewable energy installations, particularly wind farms, create high demand for trenchers to connect underground power lines. Oil and gas operations in the North Sea support further adoption for pipeline construction. Municipal authorities focus on water and sewage upgrades in growing urban centers. Agricultural applications also contribute to steady use of compact trenchers. The combination of energy expansion and utility modernization sustains strong growth across Scotland. It continues to be a vital region for specialized trenching equipment.

Wales

Wales holds a 16% share in 2024, led by municipal and telecommunication projects. Investments in fiber optic infrastructure and regional connectivity programs encourage adoption of trenchers. Water and sewage system modernization in urban and semi-urban areas further boosts demand. Agricultural use supports adoption in rural counties, particularly for irrigation and drainage. Local contractors increasingly prefer renting trenchers due to cost benefits. Distribution channels and dealer networks play a central role in market penetration. It remains an emerging region where municipal and telecom demand drives consistent growth.

Northern Ireland

Northern Ireland represents a 14% share in 2024, supported by infrastructure upgrades and energy projects. Investments in broadband expansion and electricity distribution create stable demand for trenchers. Municipal authorities emphasize modernizing water pipelines and drainage networks across towns and cities. Agricultural applications remain important in rural areas with strong dependence on trenchers for irrigation systems. Contractors focus on compact trenchers for cable and utility installations in narrow spaces. The presence of regional distributors supports steady equipment supply. It continues to grow as infrastructure and telecom investments gain momentum.

Market Segmentations:

Market Segmentations:

By Type

- Wheel Trencher

- Chain Trencher

- Other Types

By Application

- Agriculture

- Oil & Gas

- Telecommunication & Power Cables

- Municipal

- Others

By Sales Channel

- Direct Channel

- Distribution Channel

By Region

- England

- Scotland

- Wales

- Northern Ireland

Competitive Landscape

The UK Trencher Market features a mix of global leaders and strong domestic manufacturers competing through technology, product range, and service support. Key players include Aardvark Equipment Ltd., AFT Trenchers Ltd., Mastenbroek Limited, Osbit Ltd., Soil Machine Dynamics, Global Marine Systems, Modus Subsea Services Ltd., DeepOcean, and DOF Subsea. These companies focus on offering advanced wheel and chain trenchers tailored for agriculture, telecom, municipal, and energy applications. Product innovation, automation, and eco-friendly models remain central strategies to strengthen market position. Local firms maintain an edge with cost-effective solutions and established dealer networks, while larger players emphasize R&D investments, partnerships, and long-term contracts with utility providers. The competitive environment is characterized by strong aftermarket services, rental options, and regional distribution channels, which enhance accessibility for contractors and municipalities. It remains a moderately consolidated market where technological leadership and strategic collaborations define growth opportunities for both established players and new entrants.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Aardvark Equipment Ltd.

- AFT Trenchers Ltd.

- Mastenbroek Limited

- Osbit Ltd.

- Soil Machine Dynamics

- Global Marine Systems

- Modus Subsea Services Ltd.

- DeepOcean

- DOF Subsea

Recent Developments

- In July 2025, NKT partnered with Helix Robotics Solutions to operate its new T3600 subsea trencher under a long-term frame agreement covering installation, offshore operations, and maintenance.

- In March 2025, Helix Robotics Solutions secured a contract with cable systems giant Prysmian for deployment of its T1400‑2 subsea trencher.

- In February 2025, Barreto Manufacturing revealed four new products in their product lineup, including the 30RTK Track Trencher, highlighting new product launches in the market.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Sales Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise with continued investments in broadband and 5G expansion projects.

- Agriculture will remain a major growth driver with focus on irrigation and drainage systems.

- Municipal projects will expand as cities upgrade water, sewage, and utility networks.

- Eco-friendly and hybrid trenchers will gain traction under stricter environmental regulations.

- Automation and GPS-guided systems will improve efficiency and reduce reliance on manual labor.

- Rental services will grow as contractors seek cost-effective access to advanced equipment.

- Energy projects, including renewables, will create consistent demand for trenchers in rural regions.

- Local manufacturers will strengthen competitiveness with cost-effective and specialized models.

- Distribution channels will expand, offering financing, service support, and aftermarket parts.

- Collaboration with telecom and utility providers will remain a key strategy for market growth.

Market Segmentations:

Market Segmentations: