Market Overview

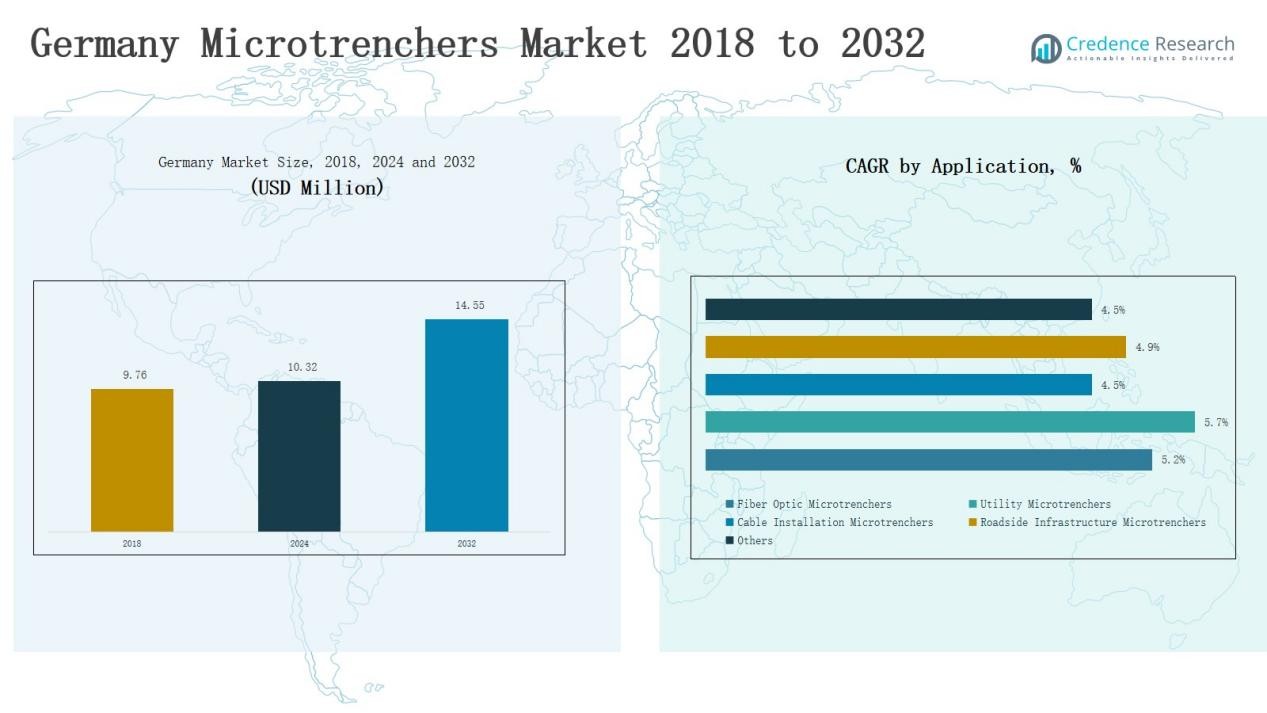

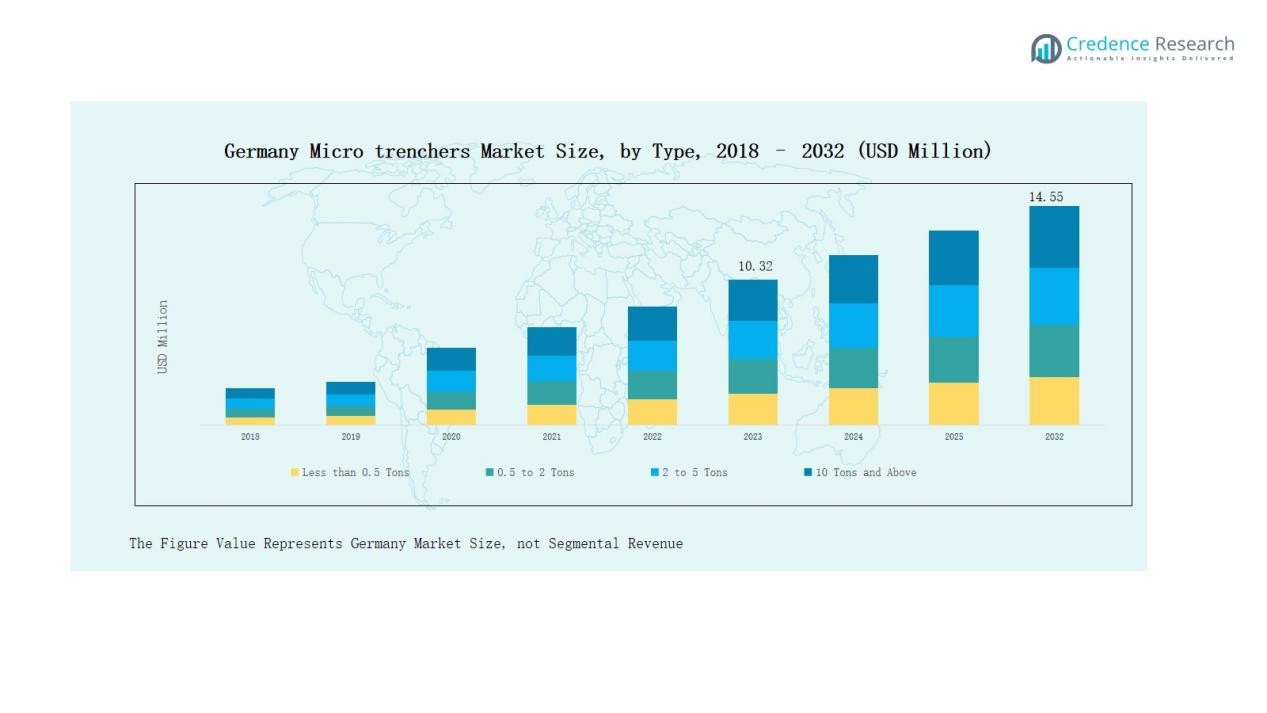

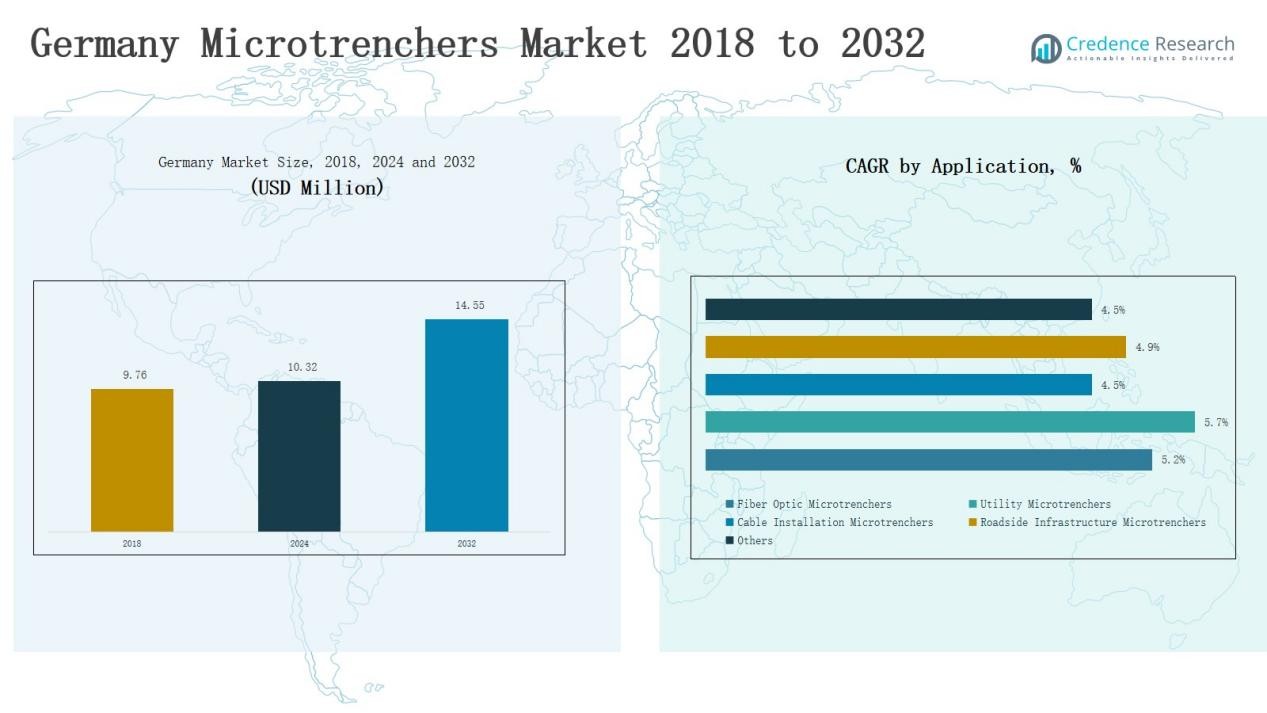

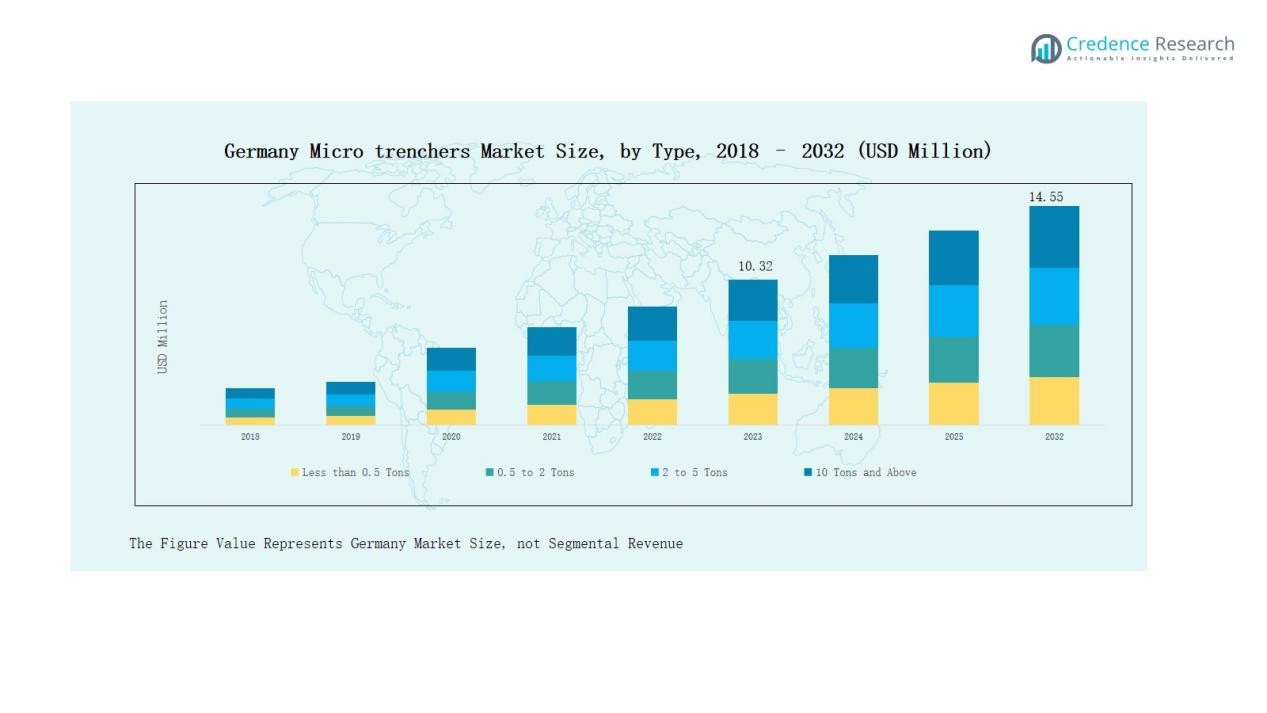

Germany Microtrenchers Market size was valued at USD 9.76 million in 2018 to USD 10.32 million in 2024 and is anticipated to reach USD 14.55 million by 2032, at a CAGR of 4.39% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Germany Microtrenchers Market Size 2024 |

USD 10.32 Million |

| Germany Microtrenchers Market, CAGR |

4.39% |

| Germany Microtrenchers Market Size 2032 |

USD 14.55 Million |

The Germany Microtrenchers Market is shaped by the presence of established players such as Vermeer, Essexcare Midlands Ltd, AFT Trenchers Ltd, BETEK GmbH & Co. KG, Webster Technologies Ltd, and Rotech Subsea. These companies strengthen competitiveness through advanced product portfolios, strong dealer networks, and a focus on eco-friendly, efficient trenching solutions. Strategic partnerships with telecom operators and utility contractors further enhance their market penetration. Regionally, Southern Germany leads the market with a 32% share in 2024, driven by robust industrial bases, broadband expansion, and significant investments in smart city and infrastructure modernization projects.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Germany Microtrenchers Market grew from USD 9.76 million in 2018 to USD 10.32 million in 2024 and is forecasted to reach USD 14.55 million by 2032.

- The 0.5 to 2 Tons segment leads with 44% share in 2024, supported by compact size, cost efficiency, and suitability for urban fiber optic trenching projects.

- Fiber Optic Micro Trenchers hold 39% share in 2024, driven by broadband expansion, 5G rollout, and rising digital infrastructure investments across both urban and semi-urban regions.

- Direct Channel accounts for 58% share in 2024, backed by strong manufacturer-contractor partnerships, customization options, after-sales services, and widespread adoption in telecom and utility sectors.

- Southern Germany dominates with 32% share in 2024, benefiting from industrial strength, smart city programs, 5G expansion, and major public and private infrastructure modernization investments.

Market Segment Insights

By Type

In the Germany Microtrenchers Market, the 0.5 to 2 Tons segment dominates with a 44% market share in 2024. Its leadership stems from compact size, cost efficiency, and suitability for urban fiber optic projects. Growing demand for precision trenching in crowded city infrastructure further supports adoption. The 2 to 5 Tons segment follows, supported by use in utility expansion and medium-scale roadworks. Increasing investments in smart city projects and road connectivity upgrades are expected to reinforce the growth of lighter machines, especially in urban deployment zones.

By Application

The Fiber Optic Micro Trenchers segment accounts for 39% of market share in 2024, making it the leading application in Germany. Expanding fiber-to-the-home (FTTH) deployment and nationwide broadband projects are key drivers. Rising investment in digital infrastructure and 5G rollout continues to fuel demand. Utility trenchers remain a strong secondary segment with steady adoption across energy distribution. Roadside infrastructure trenchers and cable installation equipment also show notable traction, supported by public sector investments and increasing modernization of transport and communication corridors across Germany’s urban regions.

- For instance, in 2024, Vodafone Germany installed 1,000 km of new fiber optic links and expanded its overall fiber network. This expansion contributes to supporting its 5G network, which also uses discreet installations like converting advertising columns into cell sites in dense urban areas to minimize disruption.

By Sales Channel

The Direct Channel holds a 58% share in 2024, reflecting strong engagement between manufacturers and large contractors. This dominance is supported by project-specific customization, after-sales services, and long-term supplier agreements. The Distribution Channel serves smaller contractors and regional buyers, contributing to broader accessibility and aftermarket growth. Both channels benefit from rising demand in telecom and utility installations. Expanding dealer networks and tailored financing schemes are boosting market penetration, with direct partnerships increasingly preferred for large-scale government-backed broadband expansion initiatives across the country.

- For instance, TiniFiber, known for its patented Micro Armor Fiber® optical cabling, partnered with OmniCable in 2024 to extend its distribution across North America, making over 40 SKUs available in 18 locations, enhancing accessibility for distributors serving regional buyers.

Key Growth Drivers

Expansion of Fiber Optic Networks

Germany’s ongoing digital transformation is fueling demand for fiber optic deployment. Nationwide broadband initiatives, alongside strong investments in 5G infrastructure, create sustained demand for efficient trenching solutions. Micro trenchers are favored for their ability to deliver narrow, precise cuts with minimal disruption to urban environments. Municipal governments and telecom operators are prioritizing quick installation to meet rising data consumption. This has positioned micro trenchers as essential equipment for contractors, ensuring steady adoption across both public and private sector connectivity projects.

- For instance, Deutsche Telekom made more than 2.5 million new fiber optic connections possible in 2023 alone, expanding its network to cover eight million households and connecting 3,000 commercial areas nationwide.

Rising Urban Infrastructure Projects

Germany’s dense urban centers require compact and efficient construction solutions. Micro trenchers meet this need by enabling work in confined areas without excessive road closures or environmental impact. Increasing modernization of transportation corridors, underground utility upgrades, and smart city projects support demand for small and medium-sized trenching equipment. Contractors benefit from reduced operating costs and faster project timelines when using these machines. As Germany accelerates infrastructure renewal efforts, micro trenchers will continue to capture investment from both municipal authorities and private sector developers.\

- For instance, in 2021, Deutsche Telekom used micro trenching to roll out 1 Gbps fiber-optic lines in over 30 additional German towns, accelerating 5G and digital infrastructure projects by reducing traditional trenching times and disruption to public spaces.

Growing Focus on Cost and Time Efficiency

Construction firms and utility providers are under pressure to complete projects faster while minimizing costs. Micro trenchers offer strong advantages over conventional methods, reducing excavation expenses and restoration needs. Their compact designs help shorten project timelines while ensuring minimal disruption to surrounding infrastructure. This efficiency is especially valuable in urban and residential zones, where downtime can create public inconvenience. With increasing emphasis on sustainable construction practices and reduced environmental impact, the cost and time-saving benefits of micro trenchers make them a preferred choice.

- For instance, in Australia, NBN Co reported that using micro trenching for fiber deployment in suburban neighborhoods enabled faster last-mile connections with reduced disruption to residents.

Key Trends & Opportunities

Adoption of Eco-Friendly and Automated Equipment

German contractors are increasingly shifting toward eco-friendly construction equipment to align with strict environmental regulations. Manufacturers are developing trenchers with lower emissions, energy efficiency, and automation features to meet these requirements. Semi-automated guidance systems and advanced cutting tools reduce labor needs while enhancing safety and accuracy. These innovations present opportunities for companies to expand their product offerings and differentiate in a competitive market. With rising focus on sustainable construction practices, eco-friendly and automated trenchers will see stronger demand in both public and private projects.

- For instance, Caterpillar’s D5 dozer integrates automated grade control technology that reduces fuel use and rework, supporting both efficiency and sustainability goals in construction projects.

Expansion into Secondary Cities and Rural Areas

While major cities drive initial adoption, rural and secondary regions in Germany offer untapped opportunities for micro trencher deployment. Broadband penetration remains uneven, prompting government initiatives to expand high-speed internet to underserved communities. Micro trenchers provide an efficient method for laying fiber optics and utilities in less accessible areas where traditional machinery is costly or disruptive. Contractors and suppliers targeting these regions can unlock new revenue streams. Growing investments in regional connectivity and rural development will further strengthen demand for cost-effective trenching equipment.

- For instance, Vodafone Germany has been deploying fiber-to-the-home in secondary cities such as Augsburg and Wolfsburg, demonstrating that operators see business potential beyond metropolitan hubs.

Key Challenges

High Initial Investment Costs

Despite efficiency advantages, micro trenchers carry significant upfront costs that deter small contractors. Machines require specialized tooling and maintenance, adding to ownership expenses. Many regional operators prefer leasing or conventional methods to avoid capital burden. Limited access to affordable financing also constrains adoption, particularly for smaller businesses. Unless manufacturers or financial institutions develop flexible rental and purchase schemes, high investment requirements will remain a barrier. This challenge slows widespread penetration, particularly in rural regions where smaller contractors dominate infrastructure projects.

Competition from Conventional Methods

Traditional trenching and manual excavation methods continue to dominate many German projects. Contractors familiar with existing techniques often resist adopting new equipment due to perceived risks. Conventional methods are also supported by a skilled workforce and established supply chains. While micro trenchers offer long-term benefits, initial resistance and reliance on legacy equipment limit market penetration. Overcoming this challenge requires stronger awareness campaigns, training programs, and demonstration projects to showcase clear advantages. Without wider acceptance, competition from established practices will restrain rapid growth.

Regulatory and Safety Compliance Requirements

Germany enforces strict regulations for construction activities, particularly in urban environments. Micro trencher operators must comply with safety, noise, and environmental standards, which often increase operating complexity. Delays in obtaining permits and approvals can slow project execution, discouraging contractors from investing in specialized machinery. Regulatory hurdles also raise costs for manufacturers adapting products to local standards. Unless streamlined policies and clearer guidelines emerge, compliance burdens may continue to limit adoption. This challenge particularly affects smaller contractors lacking resources to navigate complex approval processes.

Regional Analysis

Southern Germany

Southern Germany accounts for 32% share of the Germany Microtrenchers Market in 2024. The region benefits from strong industrial bases in Bavaria and Baden-Württemberg, where demand for advanced communication networks and utility infrastructure is expanding rapidly. It is also supported by heavy investments in smart city programs and transportation modernization projects. Contractors in Southern Germany favor micro trenchers for their efficiency in urban areas with dense underground systems. The growing rollout of 5G networks is expected to further accelerate adoption. Rising investment from both public and private operators strengthens the region’s leading position.

Western Germany

Western Germany holds 28% share of the Germany Microtrenchers Market in 2024. The presence of key metropolitan areas such as North Rhine-Westphalia drives high demand for fiber optic trenching. Strong construction activity and utility upgrades across transport corridors are critical factors supporting growth. It benefits from a large base of contractors with direct access to international suppliers and distributors. The market in this region shows consistent adoption of compact trenchers for roadside and cable-laying projects. Growing demand from both telecom and infrastructure operators continues to reinforce its regional importance.

Northern Germany

Northern Germany represents 21% share of the Germany Microtrenchers Market in 2024. The expansion of renewable energy projects and grid connectivity in coastal states drives demand for trenching solutions. Fiber optic penetration also supports steady growth, especially across urban hubs such as Hamburg and Bremen. The region focuses on compact trenchers for utility and broadband installations, supported by public sector infrastructure programs. Contractors rely on these machines to deliver faster and cost-effective deployment. Market players are expanding presence to meet rising demand, particularly from energy and communication sectors.

Eastern Germany

Eastern Germany contributes 19% share of the Germany Microtrenchers Market in 2024. Ongoing infrastructure modernization and rural broadband rollout initiatives support market activity in this region. It shows growing adoption of trenchers for both utility and fiber optic projects across states such as Saxony and Brandenburg. The region remains highly focused on bridging connectivity gaps in rural and semi-urban areas. Demand is also supported by European Union-backed funding for digital infrastructure. Contractors view micro trenchers as cost-effective solutions for projects in diverse terrain conditions, boosting steady market expansion.

Market Segmentations:

By Type

- Less than 0.5 Tons

- 5 to 2 Tons

- 2 to 5 Tons

- 10 Tons and Above

By Application

- Fiber Optic Micro Trenchers

- Utility Micro Trenchers

- Cable Installation Micro Trenchers

- Roadside Infrastructure Micro Trenchers

- Others

By Sales Channel

- Direct Channel

- Distribution Channel

By Region

- Southern Germany

- Western Germany

- Northern Germany

- Eastern Germany

Competitive Landscape

The competitive landscape of the Germany Microtrenchers Market is characterized by the presence of both global manufacturers and domestic suppliers focused on product innovation, distribution expansion, and service integration. Companies compete by offering trenchers with compact designs, precision cutting tools, and eco-friendly features that address Germany’s strict regulatory standards. Established players maintain an edge through advanced technology, wide dealer networks, and strategic partnerships with telecom operators and utility contractors. Domestic firms enhance competition by providing localized solutions and cost-effective equipment tailored to regional needs. The market is also shaped by growing emphasis on after-sales services, rental offerings, and financing options that attract small and medium-sized contractors. Competitive intensity remains high as both international and regional companies strive to capture opportunities from nationwide fiber optic deployment and smart infrastructure programs. Continuous investment in automation, sustainable equipment, and customer-centric strategies defines the evolving market landscape and supports long-term growth in Germany.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

Recent Developments

- In July 2025, Vermeer introduced the MTR516 microtrencher attachment, designed to simplify fiber-optic sscable installations and minimize restoration work. This launch marked the most recent product development connected to the Germany microtrencher market.

- On July 20, 2023, Vermeer formed a distribution partnership with PioneerBore GmbH (Switzerland). This expands access in Europe—including Germany—to trenchless tools like the Mini Twinny and E‑Z‑Jet systems.

- On October 10, 2023, Rotech Subsea deployed its TRS2 jet trencher in the German sector of the North Sea, performing cable de‑burial, cutting, and recovery—reaching depths over 5 m in one pass.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Sales Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise with continued expansion of fiber optic and 5G networks across Germany.

- Urban infrastructure modernization will drive adoption of compact trenchers in dense city environments.

- Rural broadband rollout will create steady opportunities for deployment in underserved regions.

- Contractors will favor trenchers that reduce project costs and minimize disruption to public spaces.

- Automation and eco-friendly features will become key differentiators among competing equipment.

- Direct sales channels will remain dominant due to customization and strong after-sales services.

- Distribution networks will expand to support small and mid-sized contractors in regional markets.

- Regulatory alignment with environmental standards will shape product innovation and design.

- Strategic collaborations between manufacturers and telecom operators will strengthen long-term market presence.

- Rising investments in smart city projects will further accelerate adoption of micro trenchers.