Market Overview

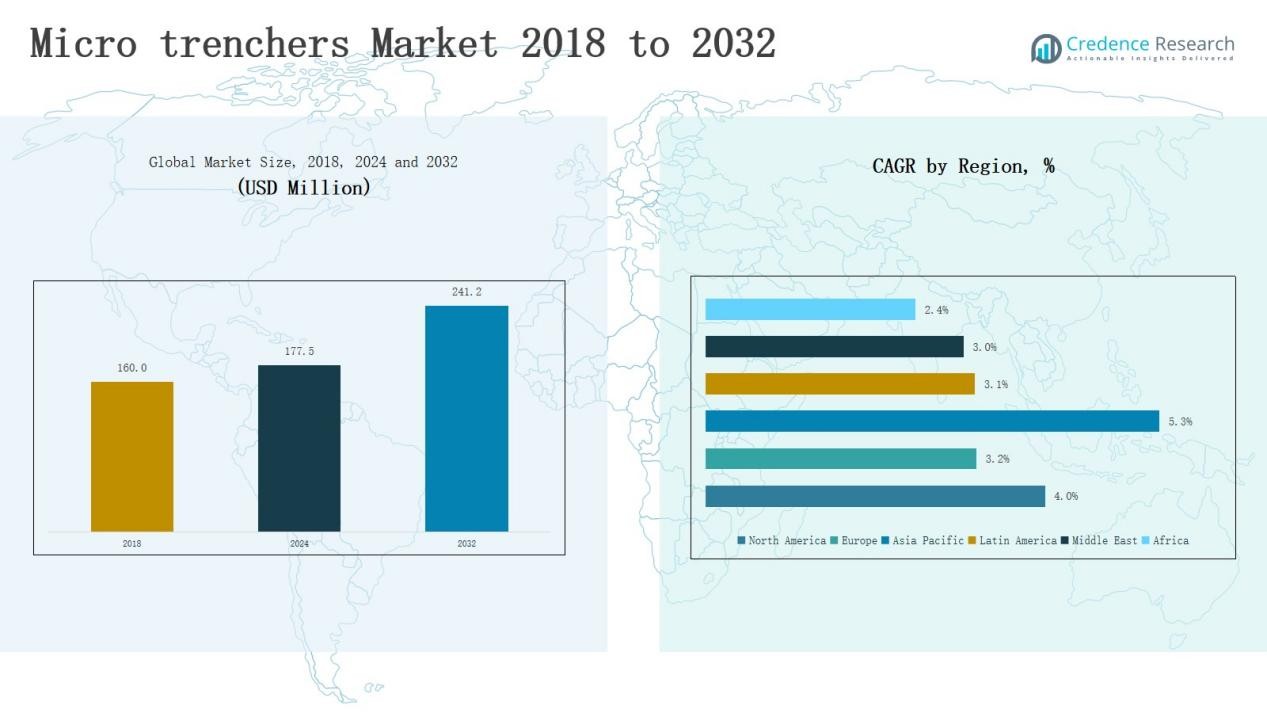

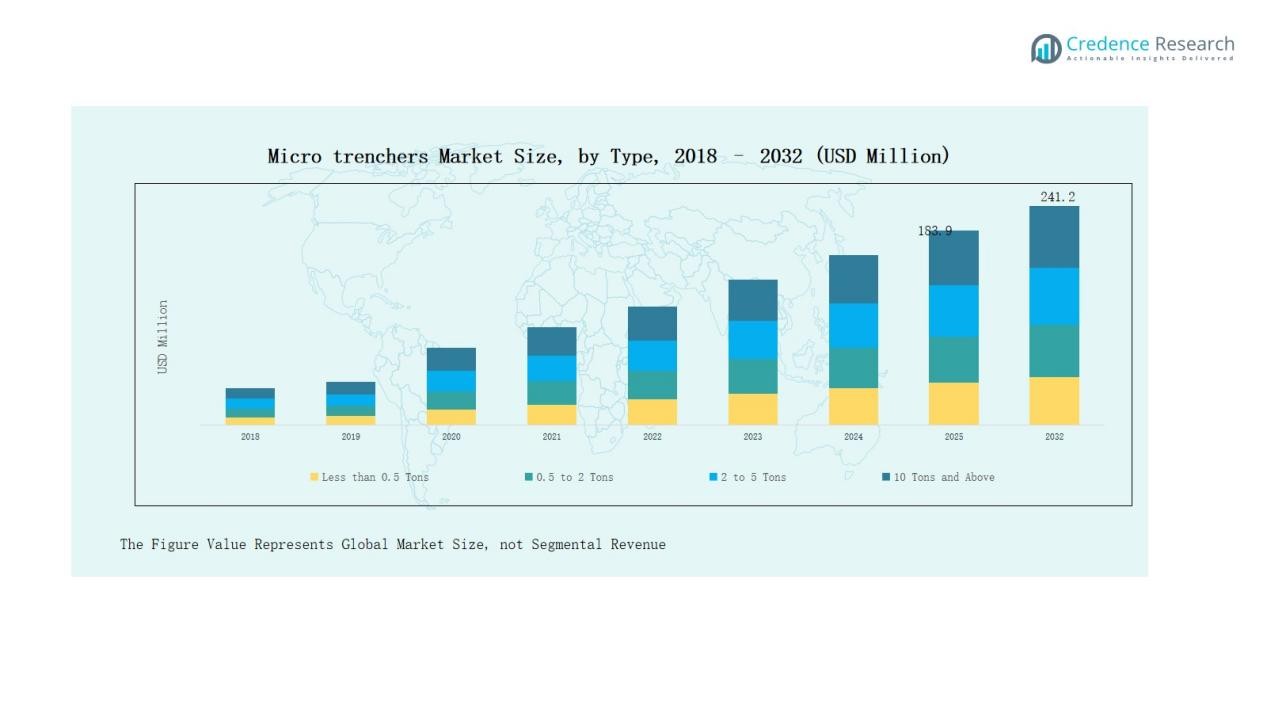

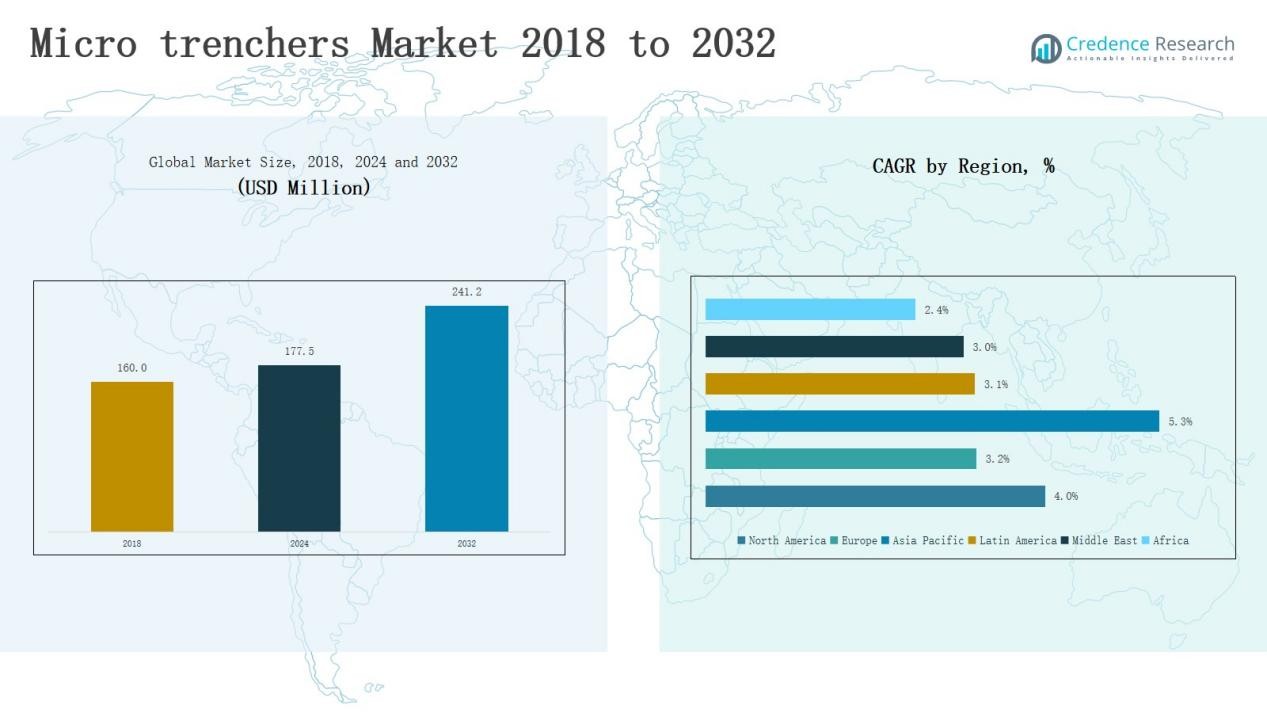

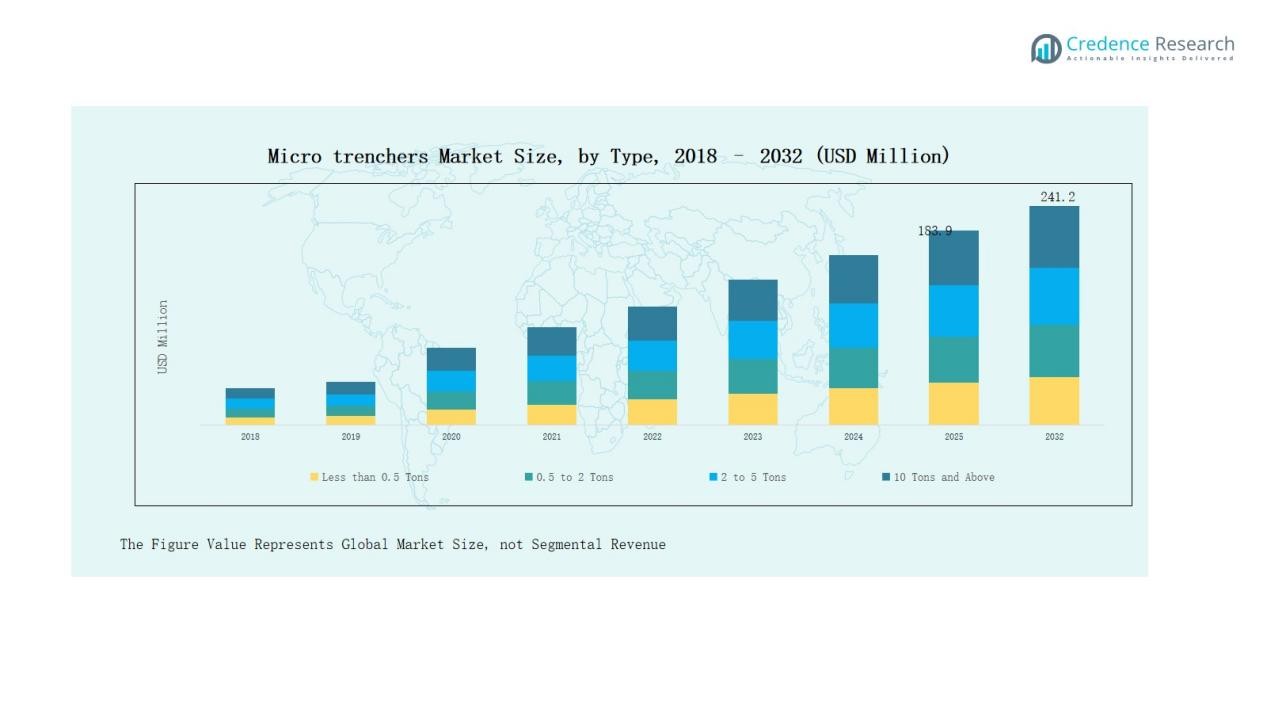

Microtrenchers Market size was valued at USD 160.0 million in 2018 to USD 177.5 million in 2024 and is anticipated to reach USD 241.2 million by 2032, at a CAGR of 4.0 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Microtrenchers Market Size 2024 |

USD 177.5 Million |

| Microtrenchers Market, CAGR |

4.0 % |

| Microtrenchers Market Size 2032 |

USD 241.2 Million |

The Micro Trenchers Market features a competitive landscape shaped by global and regional players focused on innovation, cost efficiency, and customer support. Leading companies such as Ditch Witch, Vermeer Corporation, Tesmec, Barreto, Toro, Simex Engineering SRL, E-Z Trench, Soni Agrotech, Changzhou Jiehe Machinery, Ground Hog, Mastenbroek, Marais, and Crary dominate through advanced product portfolios, strategic partnerships, and expanding distribution networks. These firms emphasize compact designs, automation, and eco-friendly features to address the rising demand for fiber optic and utility projects. North America emerged as the leading region in 2024 with a 34% market share, driven by large-scale fiber optic deployments, urban infrastructure upgrades, and the strong presence of key manufacturers.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Microtrenchers Market grew from USD 160.0 million in 2018 to USD 177.5 million in 2024 and will reach USD 241.2 million by 2032.

- The 5 to 2 Tons segment dominates by type with 38% share in 2024, driven by fiber optic and utility projects requiring compact, maneuverable trenching solutions.

- By application, fiber optic trenchers lead with 41% share in 2024, supported by global FTTH expansion and 5G rollouts across urban and semi-urban areas.

- The direct sales channel accounts for 56% share in 2024, favored for aftersales support, tailored configurations, and long-term service contracts with contractors and utilities.

- North America leads with 34% share in 2024, followed by Europe at 21% and Asia Pacific at 26%, highlighting strong regional demand for fiber and utility upgrades.

Market Segment Insights

By Type

The 0.5 to 2 Tons segment dominates the micro trenchers market, accounting for 38% share in 2024. Its balance of maneuverability and cutting power makes it ideal for urban fiber optic and utility projects. Growing demand for compact machines suited for narrow streets and residential zones drives this segment’s leadership. Meanwhile, the 2 to 5 Tons category follows with 27% share, supported by wider adoption in medium-scale infrastructure and roadside trenching. Lighter models under 0.5 Tons remain niche at 12%, while heavy-duty 10 Tons and above hold 23% share, used in specialized industrial trenching applications.

- For instance, Ditch Witch’s MT26 micro trencher, launched in 2022, can cut up to 26 inches deep, making it a preferred choice for utility companies upgrading 5G backhaul networks along roadways.

By Application

Fiber Optic micro trenchers lead the market with 41% share in 2024, reflecting the global surge in fiber-to-the-home (FTTH) deployments and 5G network expansion. Telecom operators prefer these machines for their precision, minimal disruption, and cost efficiency in dense urban areas. Utility trenchers follow with 28% share, driven by underground utility cabling and water pipeline installations. Cable installation applications hold 16%, while roadside infrastructure projects contribute 10% as smart city developments progress. The others category, including defense and small municipal projects, accounts for 5% share.

- For instance, Tesmec S.p.A., a prominent trencher manufacturer, supplies high-efficiency trenching machines integrated with advanced telematics and 3D-GPS automatic guidance (TrenchIntel) to support utility duct installations, including those for smart city fiber optic and electric networks, globally.

By Sales Channel

The direct channel remains the leading sales model, holding 56% share in 2024, as manufacturers and contractors prefer direct purchases for tailored machine configurations, aftersales support, and long-term service agreements. Direct relationships also help buyers secure training and maintenance, critical for operational uptime. The distribution channel follows with 44% share, favored by small and mid-sized construction firms seeking faster availability, localized support, and flexible procurement. Distributors play a key role in reaching emerging markets and smaller infrastructure players, particularly in Asia Pacific and Latin America.

Key Growth Drivers

Expansion of Fiber Optic Networks

The rapid expansion of fiber optic networks remains the strongest driver for the micro trenchers market. With rising demand for high-speed internet and 5G rollouts, telecom providers are deploying micro trenchers to install fiber-to-the-home (FTTH) connections quickly and efficiently. These machines enable narrow and shallow trenching, minimizing surface disruption and reducing restoration costs. Governments and private telecom operators are investing heavily in digital infrastructure, further boosting demand. This trend positions fiber optic trenching as the leading growth contributor across developed and emerging economies.

- For instance, Google Fiber expanded into Mesa, Arizona, starting in 2022, using micro-trenching techniques that allowed installations at a significantly deeper average depth than two inches, reducing build-time

Urban Infrastructure Modernization

Growing urbanization and modernization of utility networks create significant demand for micro trenchers. Cities worldwide are upgrading power lines, water pipelines, and underground cables to support smart city initiatives and sustainable infrastructure. Micro trenchers are increasingly preferred for these upgrades, as they minimize traffic disruption and reduce labor costs compared to traditional trenching methods. Their compact design and ability to operate in tight spaces make them essential for dense urban environments. This urban infrastructure push directly supports market expansion in both developed and fast-growing regions.

- For instance, Verizon deployed micro trenching for its 5G fiber backhaul in Sacramento, California, demonstrating the method’s efficiency in enhancing next-generation urban connectivity.

Cost Efficiency and Operational Productivity

The need for cost-effective and time-efficient construction solutions drives adoption of micro trenchers. These machines reduce project timelines by delivering faster trenching with less manual intervention. Operators benefit from lower labor costs, minimal surface damage, and quicker restoration of roads, which improves public acceptance of construction works. Contractors also gain higher return on investment due to reduced downtime and efficient fuel consumption. The focus on operational productivity and sustainable trenching practices underpins steady growth in demand from both large infrastructure projects and smaller-scale municipal applications.

Key Trends & Opportunities

Integration of Advanced Technologies

Technological integration is shaping the next phase of growth for the micro trenchers market. Manufacturers are incorporating GPS tracking, automation, and smart controls to enhance precision and operator efficiency. Advanced cutting tools designed for varied soil conditions expand machine versatility. The integration of telematics for real-time performance monitoring is also gaining traction. These innovations align with the construction industry’s move toward digitalization and smart equipment, creating opportunities for players to differentiate through technology-driven solutions while meeting evolving customer needs.

- For instance, Vermeer Corporation offers its RTX550 ride-on tractor with interchangeable micro trencher attachments and the Vermeer Telematics system, enabling remote performance tracking and maintenance scheduling.

Rising Adoption in Emerging Markets

Emerging economies present untapped opportunities for the micro trenchers market. Countries in Asia Pacific, Latin America, and Africa are investing in broadband expansion, power distribution, and water management projects. With governments prioritizing digital connectivity and smart city development, micro trenchers are becoming essential for cost-efficient underground infrastructure deployment. Increasing construction activities and the entry of regional equipment manufacturers are expected to drive adoption. This rising demand from emerging markets not only expands the global customer base but also accelerates competition and innovation across the industry.

- For instance, India’s BharatNet project aims to connect 250,000 village councils with high-speed broadband, where various technologies including compact trenching are being used to install fiber with minimal land disruption.

Key Challenges

High Initial Investment Costs

Despite operational advantages, the high initial cost of micro trenchers poses a barrier to adoption. Small and medium-sized contractors often face budget constraints that limit direct purchases of advanced equipment. Leasing options and distributor-based sales help ease this challenge, but many buyers remain hesitant to invest due to uncertain project pipelines. This capital-intensive nature slows penetration in cost-sensitive markets. Manufacturers must develop flexible financing models and affordable entry-level machines to overcome the challenge and tap into broader demand potential.

Limited Awareness and Technical Expertise

Awareness gaps and lack of skilled operators hinder wider adoption of micro trenchers, especially in developing regions. Many contractors remain accustomed to traditional trenching practices and are hesitant to shift to advanced alternatives. Limited technical expertise in handling precision trenchers results in underutilization of machine efficiency. Training programs and demonstration projects are needed to address these barriers. Expanding technical education and providing aftersales support are essential strategies for manufacturers to increase adoption and improve user confidence globally.

Regulatory and Environmental Constraints

Strict regulatory frameworks and environmental concerns create operational challenges for the micro trenchers market. Projects in urban and ecologically sensitive areas often face restrictions on noise, vibration, and dust emissions. Obtaining permits for trenching activities can delay deployments, particularly for large-scale telecom or utility upgrades. Compliance with evolving environmental standards also increases costs for manufacturers who must redesign machines to reduce emissions and enhance sustainability. Addressing these regulatory hurdles requires continuous innovation and collaboration with policymakers to ensure smoother project execution.

Regional Analysis

North America

North America leads the micro trenchers market with a 34% share in 2024, supported by strong demand from the U.S. and Canada. Market value increased from USD 61.6 million in 2018 to USD 67.6 million in 2024, projected to reach USD 91.7 million by 2032 at a CAGR of 4.0%. Expansion of fiber optic networks, smart city initiatives, and rapid adoption of trenchless technologies underpin growth. Contractors in this region prefer advanced models with high efficiency, and the presence of key players further strengthens North America’s leadership.

Europe

Europe accounts for 21% market share in 2024, making it the second-largest region. Market value rose from USD 38.6 million in 2018 to USD 41.0 million in 2024, with projections of USD 52.3 million by 2032 at a CAGR of 3.2%. Demand is driven by utility upgrades, energy-efficient infrastructure projects, and regulatory compliance for underground installations. Countries like Germany, France, and the UK remain major contributors due to investments in broadband and power distribution networks. Growing preference for low-disruption construction methods sustains steady adoption across the region.

Asia Pacific

Asia Pacific holds a 26% market share in 2024 and is the fastest-growing region. The market expanded from USD 35.7 million in 2018 to USD 41.5 million in 2024, projected to reach USD 62.6 million by 2032 at a CAGR of 5.3%. Rapid urbanization, large-scale fiber optic deployments, and infrastructure modernization across China, India, and Southeast Asia drive growth. Governments are prioritizing broadband connectivity and smart city initiatives, creating strong demand for compact and cost-effective micro trenchers. Local manufacturers and rising investments further enhance regional competitiveness.

Latin America

Latin America contributes 7% share in 2024, with the market rising from USD 11.7 million in 2018 to USD 12.9 million in 2024. It is projected to reach USD 16.4 million by 2032 at a CAGR of 3.1%. Countries like Brazil and Argentina lead adoption, supported by investments in digital connectivity and energy infrastructure. However, budget constraints and limited technical expertise slow wider uptake. Distributor networks play a crucial role in supplying affordable models, making micro trenchers increasingly accessible to mid-sized contractors and municipal projects.

Middle East

The Middle East holds a 6% market share in 2024, with values growing from USD 8.2 million in 2018 to USD 8.6 million in 2024, projected at USD 10.9 million by 2032 at a CAGR of 3.0%. Demand is driven by investments in telecom infrastructure, utility expansion, and smart city projects in GCC countries, Israel, and Turkey. Government-backed initiatives to enhance broadband penetration create opportunities. Still, adoption remains moderate due to high costs and reliance on imports, though demand for compact trenching solutions is expected to strengthen.

Africa

Africa represents 6% market share in 2024, reflecting steady but limited adoption. The market grew from USD 4.3 million in 2018 to USD 6.0 million in 2024, expected to reach USD 7.4 million by 2032 at a CAGR of 2.4%. Growth is supported by infrastructure projects in South Africa, Egypt, and Nigeria, particularly in fiber optic connectivity and power distribution. However, market expansion is constrained by financial limitations, lack of skilled operators, and limited awareness of advanced trenching methods. Distributor-led sales channels remain vital to regional growth.

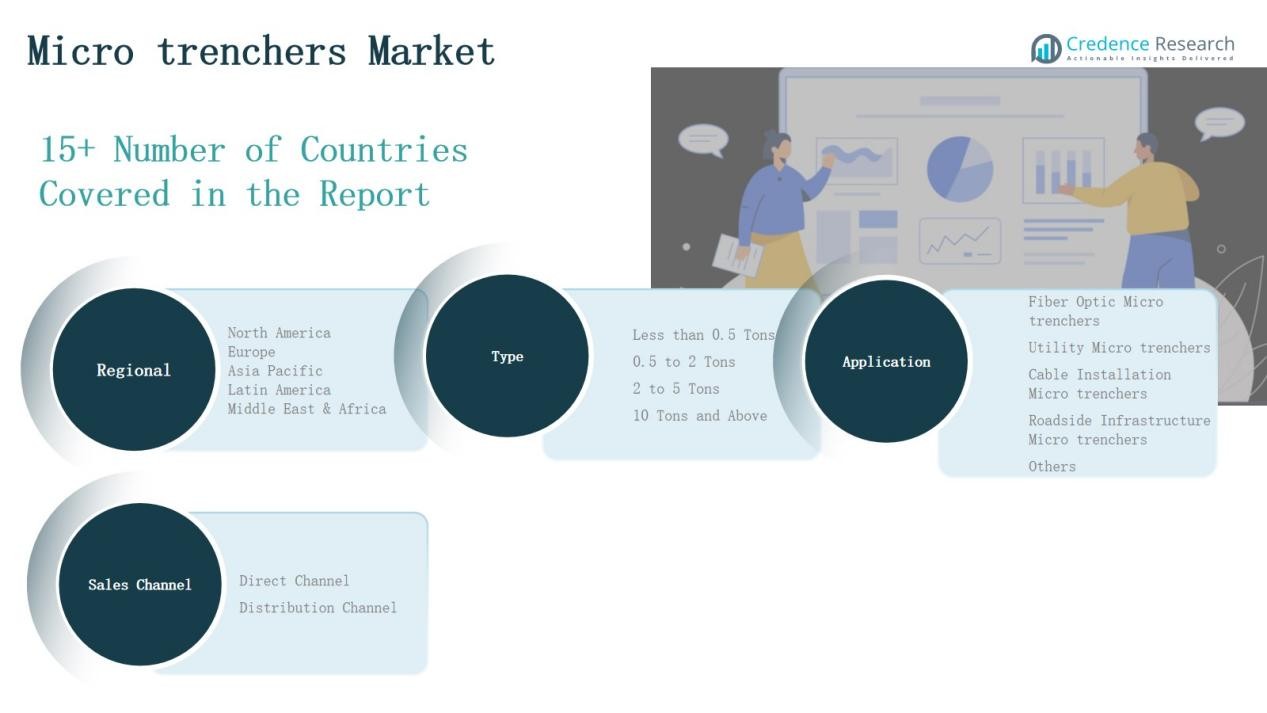

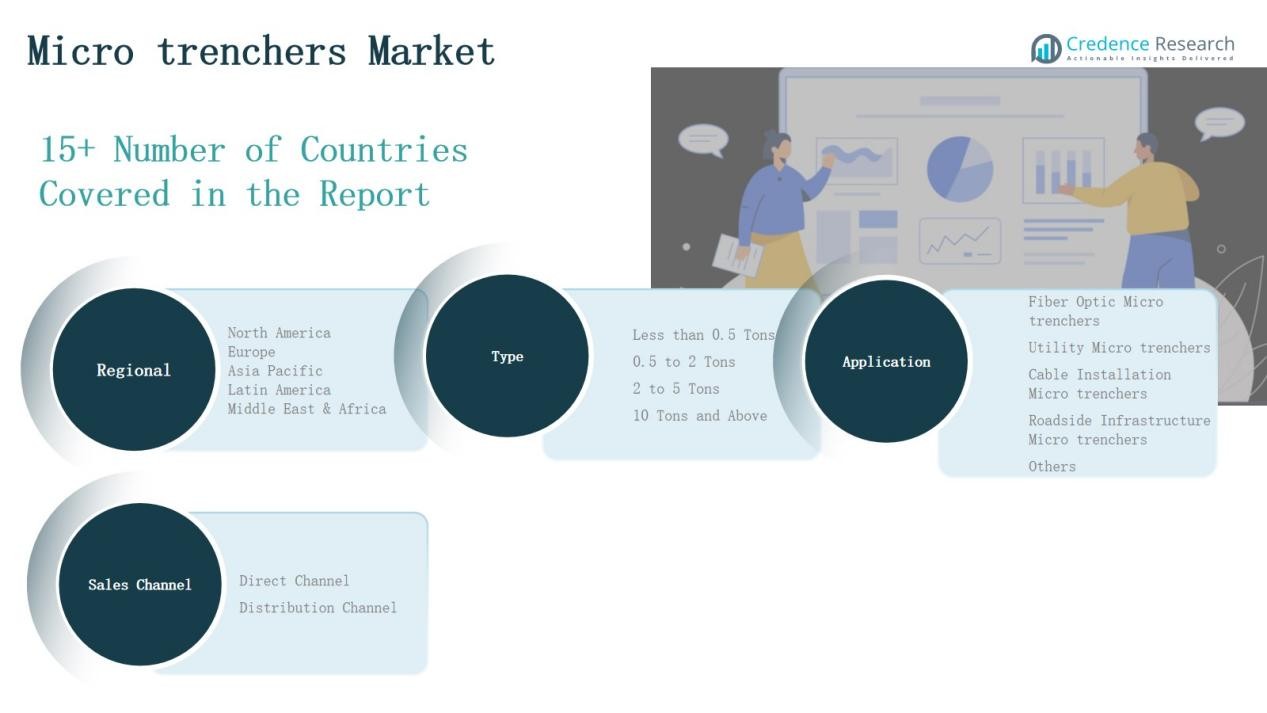

Market Segmentations:

By Type

- Less than 0.5 Tons

- 5 to 2 Tons

- 2 to 5 Tons

- 10 Tons and Above

By Application

- Fiber Optic Micro Trenchers

- Utility Micro Trenchers

- Cable Installation Micro Trenchers

- Roadside Infrastructure Micro Trenchers

- Others

By Sales Channel

- Direct Channel

- Distribution Channel

By Region

North America

Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

Latin America

- Brazil

- Argentina

- Rest of Latin America

Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

Africa

- South Africa

- Egypt

- Rest of Africa

Competitive Landscape

The micro trenchers market is moderately consolidated, with leading players competing on innovation, product reliability, and service support. Companies such as Ditch Witch, Vermeer Corporation, Tesmec, Barreto, Toro, and Simex Engineering SRL hold strong market positions through extensive product portfolios and global distribution networks. These players focus on developing compact, fuel-efficient, and technologically advanced trenchers tailored for fiber optic installations and urban infrastructure projects. Mid-sized firms like E-Z Trench, Soni Agrotech, and Ground Hog strengthen regional presence by offering cost-effective machines and flexible sales models. Strategic partnerships with telecom operators and construction firms enhance market penetration, while aftersales services and operator training programs remain crucial competitive differentiators. New entrants from Asia are introducing lower-priced alternatives, intensifying price competition. The industry’s growth trajectory is increasingly shaped by innovation in automation, telematics, and eco-friendly designs, positioning established companies to maintain dominance while creating opportunities for emerging players in cost-sensitive regions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Ditch Witch

- Vermeer Corporation

- Tesmec

- Barreto

- Soni Agrotech

- E-Z Trench

- Changzhou Jiehe Machinery Co., Ltd.

- Ground Hog

- Toro

- Mastenbroek

- Marais

- Crary

- Simex Engineering SRL

Recent Developments

- In February 2025, Barreto Manufacturing revealed four new products, including the 30RTK Track Trencher. This compact, track-driven machine offers enhanced traction, stability, and hydraulically adjustable trench depth—fitting tough terrains and confined job sites.

- In June 2025, Vermeer Corporation launched the MTR516 microtrencher attachment. It cuts up to 17 inches deep and 1–2 inches wide. The design features a shrouded cutting wheel with vacuum suction and easy servicing—ideal for clean, precise fiber installations.

- In January 2025, Vermeer Corporation formed an exclusive partnership with Tecniwell, an Italian pump maker. This alliance allows Vermeer to distribute Tecniwell’s high-pressure pump packages through its EMEA (Europe, Middle East, Africa) dealer network.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Sales Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for fiber optic trenchers will continue to grow with global 5G expansion.

- Urban infrastructure upgrades will drive adoption of compact and efficient trenching solutions.

- Automation and smart controls will increasingly enhance machine precision and usability.

- Manufacturers will focus on eco-friendly designs to meet stricter environmental standards.

- Emerging markets in Asia, Africa, and Latin America will provide new growth opportunities.

- Direct sales channels will remain dominant, but distributors will expand reach in smaller markets.

- Partnerships with telecom and utility providers will strengthen competitive positioning.

- Training and aftersales support will play a larger role in customer retention.

- Localized manufacturing in cost-sensitive regions will intensify price competition.

- Integration of telematics and remote monitoring will redefine efficiency and fleet management.