Market Overview:

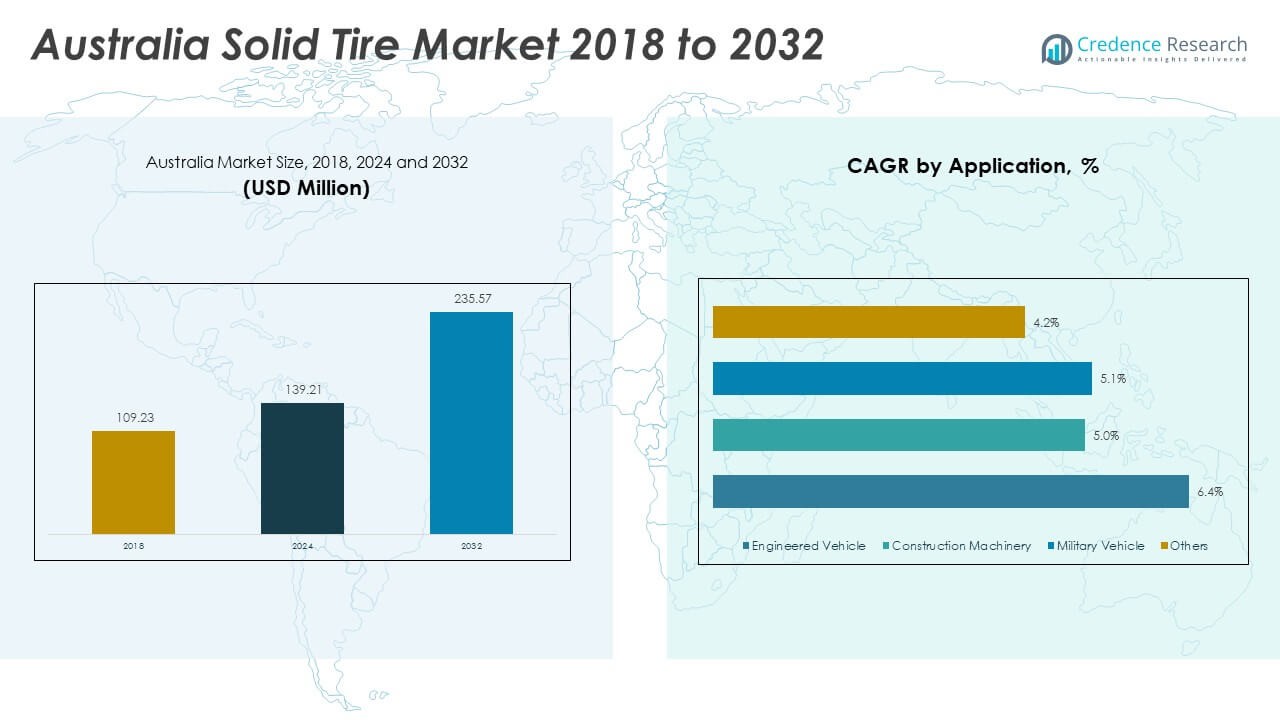

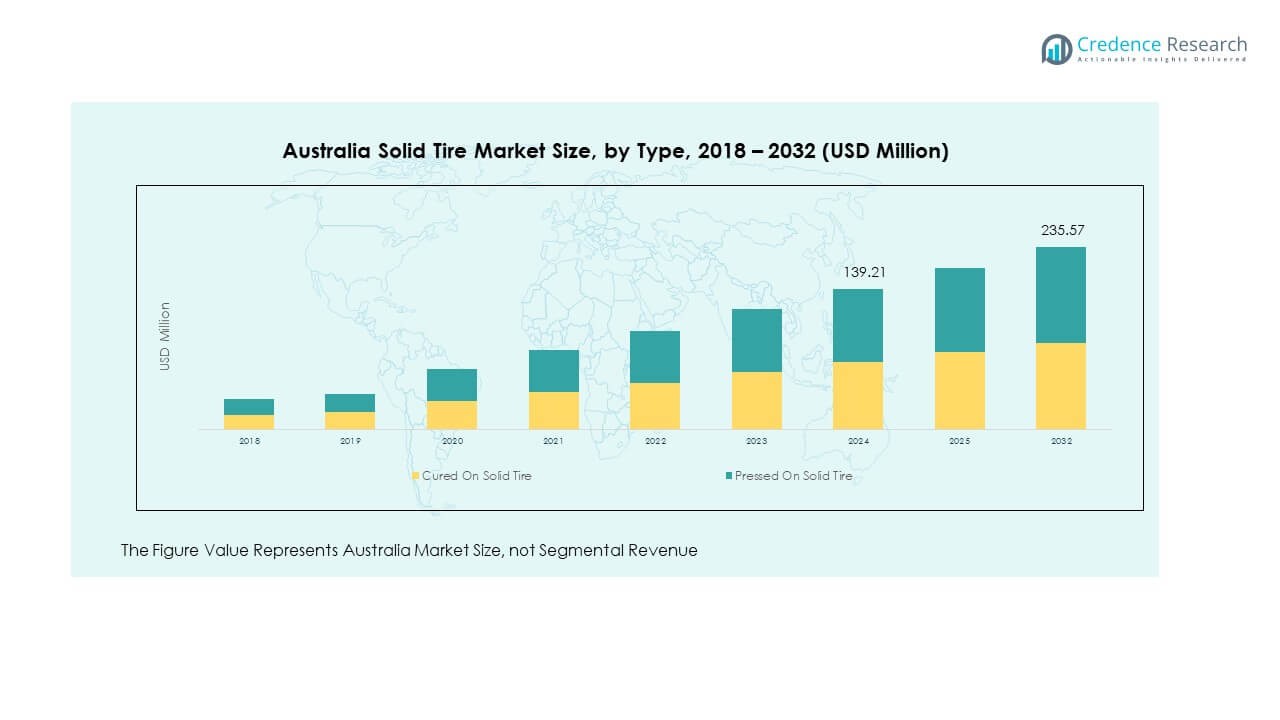

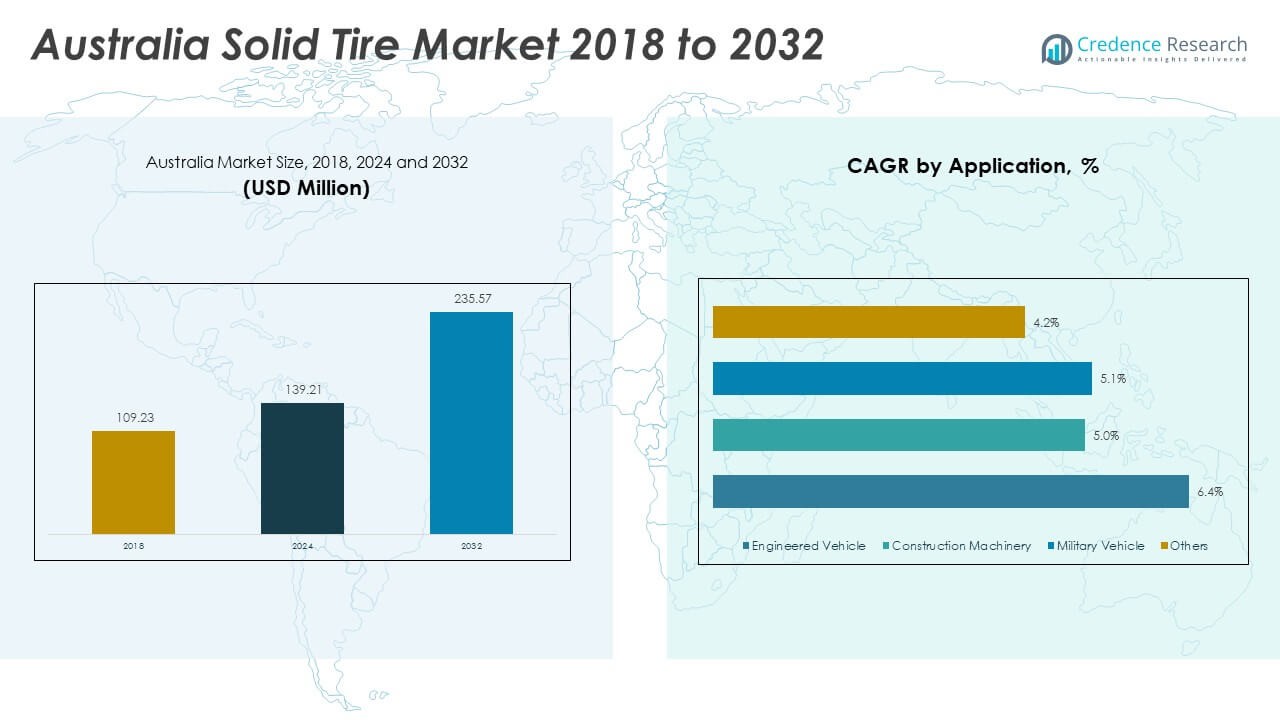

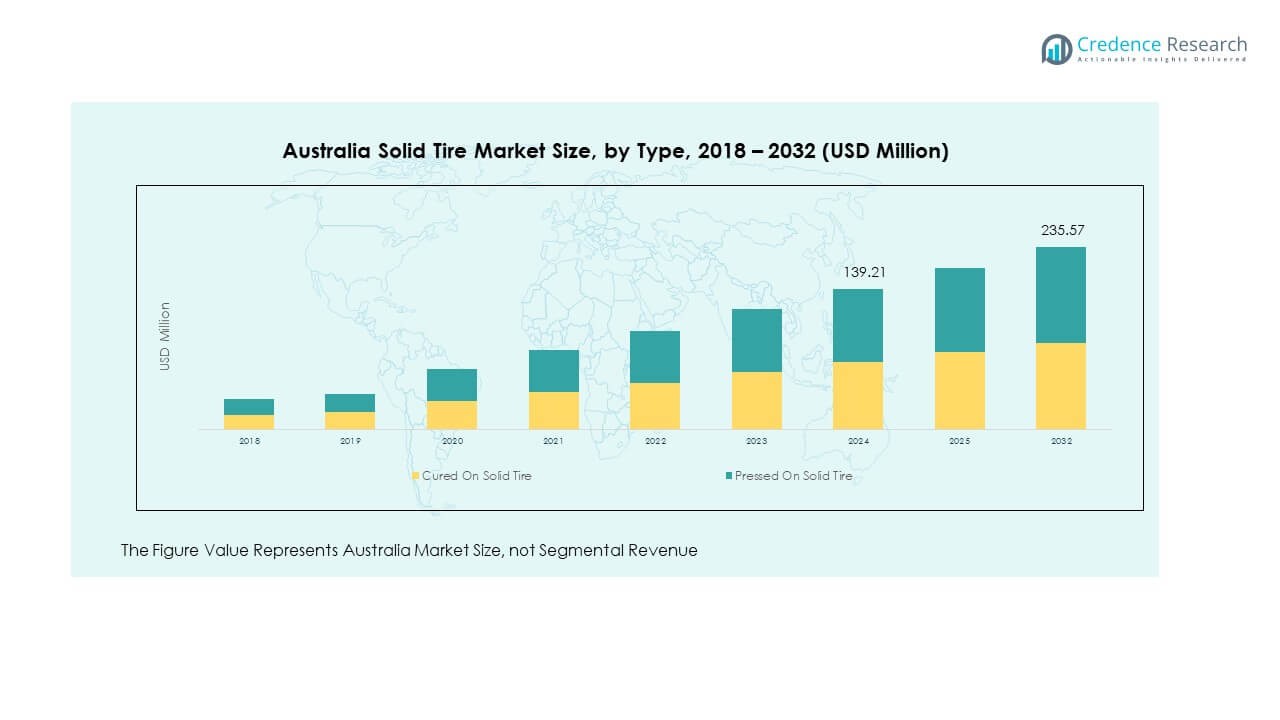

The Australia Solid Tire Market size was valued at USD 109.23 million in 2018 to USD 139.21 million in 2024 and is anticipated to reach USD 235.57 million by 2032, at a CAGR of 6.80% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Australia Solid Tire Market Size 2024 |

USD 139.21 Million |

| Australia Solid Tire Market, CAGR |

6.80% |

| Australia Solid Tire Market Size 2032 |

USD 235.57 Million |

The market growth is driven by expanding industrial applications, particularly in material handling, construction, and warehousing. Companies increasingly prefer solid tires for their durability, resistance to punctures, and reduced downtime. Rising investments in infrastructure projects and automation in logistics further enhance adoption. Growing demand from forklift operations and heavy-duty vehicles supports steady growth. Environmental benefits, such as longer product life and reduced waste, also encourage businesses to switch to solid tire solutions across diverse applications.

Geographically, adoption in Australia is strong due to the nation’s well-developed mining, construction, and industrial sectors. Demand remains concentrated in urban and industrial hubs with high logistics activity. Regional ports and trade centers also contribute to consistent adoption, given their reliance on efficient cargo handling equipment. Emerging areas are witnessing higher demand as infrastructure expansion accelerates, while established cities continue to lead due to advanced warehousing and construction activity.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Australia Solid Tire Market size was valued at USD 109.23 million in 2018, reached USD 139.21 million in 2024, and is projected to hit USD 235.57 million by 2032, expanding at a CAGR of 6.80%.

- North America holds the largest share at 35%, supported by advanced industrial infrastructure and high adoption in logistics. Europe follows with 28%, driven by strong construction activity, while Asia-Pacific accounts for 25%, benefiting from expanding mining and warehousing sectors.

- The fastest-growing region is Asia-Pacific, projected to increase its share beyond 25%, driven by rapid industrialization, rising trade volumes, and government investments in infrastructure and logistics.

- By type, Pressed-On Solid Tires dominate with 60% share, due to higher adoption in forklifts, port handling, and construction equipment.

- Cured-On Solid Tires account for 40% share, preferred for heavy-duty applications requiring enhanced durability in mining and large-scale industrial operations.

Market Drivers:

Rising Dependence on Material Handling Equipment Across Warehouses and Logistics Operations:

The Australia Solid Tire Market is strongly driven by the expanding warehousing and logistics industry. Companies increasingly rely on forklifts, pallet trucks, and port handling vehicles to ensure seamless cargo movement. Solid tires provide unmatched durability and puncture resistance, reducing downtime and operational risks in these environments. Their long service life lowers replacement frequency, creating cost savings for operators. The sector’s growth is supported by rising e-commerce and supply chain expansion across major Australian cities. Increased trade volumes also fuel higher utilization of material handling fleets. It ensures that demand for solid tires will remain consistent across industries.

- For instance, Bridgestone’s W920 commercial trucking tire with next-generation ENLITEN technology delivers 6% longer wear life, projected to enable 17,000 kilometers (10,000 miles) more mileage compared to competitive models, specifically reducing fleet maintenance needs in challenging environments.

Growth in Mining and Construction Sectors Driving Heavy Equipment Utilization:

The mining and construction sectors create significant demand for heavy-duty equipment fitted with solid tires. The Australia Solid Tire Market benefits from ongoing investments in large-scale infrastructure and mining projects across the country. Solid tires withstand harsh terrains, abrasive conditions, and continuous heavy loads, making them ideal for these industries. Government-backed infrastructure expansion, including road, bridge, and port development, sustains the need for reliable equipment performance. Operators value solid tires for their ability to minimize disruptions caused by punctures in remote sites. Higher focus on safety standards further supports their adoption in industrial vehicles. Strong mining exports also increase equipment deployment, reinforcing tire demand.

- For instance, Michelin’s “Performance made to last” philosophy ensures high levels of safety and grip even as a tire wears. Technologies like EverGrip for passenger vehicles and specialized compounds for industrial tires are designed to optimize wet braking performance throughout the tire’s life cycle.

Rising Industrial Automation and Demand for Cost-Efficient Operations:

Industrial automation is another major driver influencing adoption in the Australia Solid Tire Market. Automated warehouses and robotic systems rely on vehicles that demand consistent tire performance with minimal downtime. Solid tires deliver operational stability by offering longer wear life and reducing maintenance. Businesses also prioritize cost efficiency, pushing them to invest in durable tire solutions. Energy efficiency in automated systems benefits from solid tires due to reduced rolling resistance and better stability. Growth in food processing, retail logistics, and pharmaceuticals enhances industrial demand for high-performing tire solutions. Operators value the predictable lifecycle costs, which align with long-term budgeting. It supports a continuous shift toward reliable solid tire installations.

Sustainability Focus and Preference for Environmentally Responsible Solutions:

Sustainability trends strongly influence adoption within the Australia Solid Tire Market. Companies are adopting longer-lasting products that reduce waste and support circular economy initiatives. Solid tires minimize disposal requirements compared to pneumatic alternatives due to extended lifespans. Environmental regulations encourage industries to adopt durable equipment that lowers carbon footprints. Organizations also pursue sustainability certifications, making solid tires an attractive option for compliance. Recycling and retreading technologies are being explored to reduce landfill contributions further. Corporate commitments to sustainable supply chains reinforce their selection of solid tires. It aligns with national strategies promoting green and resource-efficient operations across industries.

Market Trends:

Increasing Adoption of Technologically Enhanced Tire Designs for Industrial Applications:

The Australia Solid Tire Market is witnessing innovation in tire design and material composition. Manufacturers are introducing advanced rubber compounds and reinforced structures to improve performance. These developments enhance load-bearing capacity, wear resistance, and heat dissipation in demanding environments. Smart tire technologies that enable performance monitoring are slowly gaining traction in industrial settings. Customized solutions for specific applications, such as heavy forklifts and construction vehicles, are also becoming popular. Tire makers invest in R&D to balance durability with comfort for operators. It reflects a shift toward premium, technologically advanced products in industrial markets.

- For instance, Michelin’s Primacy 5 tyre incorporates Silent Rib Gen-3 technology to reduce road noise and MaxTouch construction for extended tread life, meeting higher demands of electric and hybrid vehicles with rolling resistance reduced by 13%, reflecting a shift toward premium, technologically advanced products in industrial markets.

Growing Integration of Solid Tires with Electric and Hybrid Industrial Vehicles:

The electrification of industrial vehicles is influencing tire demand in the Australia Solid Tire Market. Electric forklifts and hybrid loaders require stable, durable, and low-maintenance tire options. Solid tires provide enhanced performance by reducing downtime and ensuring efficient energy use. Their compatibility with modern vehicles ensures reliable operation under continuous duty cycles. Businesses are adopting electric fleets to cut emissions, reinforcing the shift toward solid tires. The trend aligns with sustainability targets in logistics and manufacturing sectors. It highlights the role of solid tires in supporting eco-friendly industrial transitions.

- For instance, Michelin manufactures specific industrial and heavy-duty tires for electric industrial vehicles like forklifts, engineered to be highly durable and efficient. The reduction of rolling resistance in these specialized, solid-style tires helps to extend the operational range of electric vehicles in logistics and manufacturing sectors, supporting the trend toward more eco-friendly industrial transitions.

Expanding Popularity of Aftermarket Services and Replacement Models:

The aftermarket segment is growing rapidly in the Australia Solid Tire Market. Customers prefer replacement and servicing solutions that ensure lower costs over time. Tire suppliers are expanding service networks to meet rising demand across remote industrial regions. Fleet operators often rely on aftermarket channels for cost-efficient replacement cycles. The focus on customer service, retreading, and timely replacements strengthens aftermarket presence. Global players are partnering with local distributors to enhance reach and ensure timely delivery. It highlights the growing importance of service models alongside new product sales.

Rising Customization to Meet Application-Specific Requirements in End-Use Industries:

The Australia Solid Tire Market is trending toward customization to serve diverse industries. Different vehicle categories require unique tire properties such as tread design and load capacity. Construction projects demand tires with stronger grip, while ports prioritize heat resistance and longevity. Manufacturers are offering tailored solutions to meet these varied operational needs. Industry clients increasingly request specialized products to maximize efficiency and reduce total costs. Customization also improves operator safety and enhances performance consistency across equipment. It reflects a move toward customer-focused tire development strategies.

Market Challenges Analysis:

Price Sensitivity and Higher Initial Cost Concerns Among End Users:

The Australia Solid Tire Market faces challenges due to the high upfront costs of solid tires. Small and medium businesses often hesitate to adopt them because of capital constraints. Pneumatic tires, despite their shorter life, remain preferred in price-sensitive applications. Operators calculate immediate costs more than long-term savings, creating barriers for adoption. Educating customers about lifecycle value is an ongoing challenge for suppliers. Market penetration among budget-conscious buyers slows down due to limited awareness. It highlights a key restraint in expanding solid tire use across all industry levels.

Limited Product Awareness and Competition from Alternative Tire Solutions:

Awareness regarding the technical benefits of solid tires remains limited in the Australia Solid Tire Market. Many buyers underestimate advantages such as reduced downtime and enhanced safety. Competitive products like foam-filled tires often attract customers due to perceived cost benefits. Resistance to switching from traditional solutions creates adoption barriers in conservative industries. Distribution challenges in remote regions further restrict availability. Global competitors with diversified product portfolios add pressure on local suppliers. It slows overall market growth despite rising demand in major industries.

Market Opportunities:

Expansion of Smart Infrastructure and Advanced Warehousing Facilities:

The rise of smart infrastructure creates strong opportunities in the Australia Solid Tire Market. Expanding warehouses, automated logistics hubs, and industrial parks rely heavily on material handling fleets. Solid tires provide efficiency, low maintenance, and reliability in these settings. Their adoption ensures consistent performance in automated systems requiring uninterrupted operation. Technology-driven logistics growth enhances the demand for premium and durable tire solutions. It positions solid tires as a preferred choice for next-generation industrial infrastructure.

Growth Potential in Export-Oriented and Specialized Industrial Applications:

The Australia Solid Tire Market is well placed to benefit from growth in export-oriented industries. Mining, agriculture, and manufacturing require dependable tire solutions for intensive operations. Solid tires align with these industries by offering durability and safety in extreme conditions. Opportunities also emerge in specialized sectors such as defense logistics and heavy engineering. Growing trade relations amplify equipment movement, supporting higher tire consumption. It highlights solid tires’ importance in advancing national industrial competitiveness.

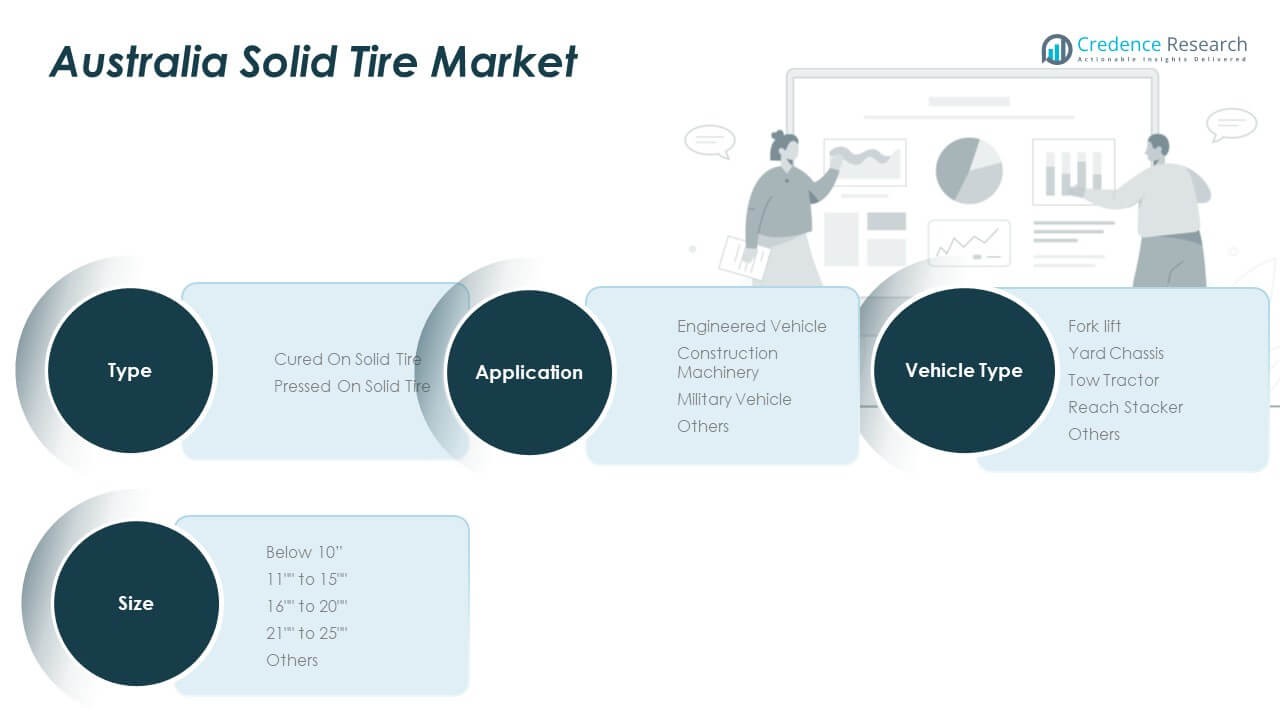

Market Segmentation Analysis:

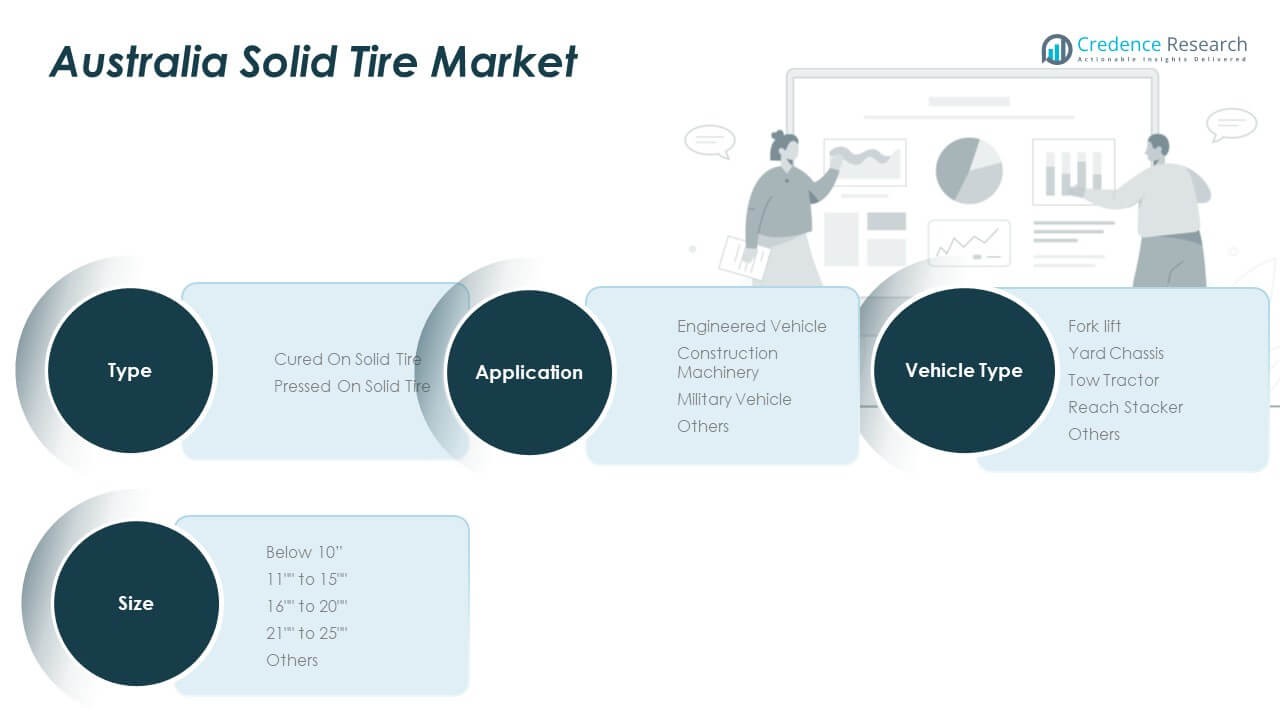

By Type

The Australia Solid Tire Market is segmented into cured on solid tires and pressed on solid tires. Pressed on solid tires dominate due to their widespread use in forklifts, construction equipment, and port handling vehicles. Their durability, ease of installation, and higher load-bearing capacity make them the preferred choice. Cured on solid tires hold a significant share, particularly in heavy-duty operations such as mining, where enhanced traction and resilience are essential.

- For instance, Bridgestone’s new radial drive W920 tire’s 6% longer wear life and outstanding retread capability exemplify advancements in commercial truck tires accommodating heavy-duty applications with extended life cycles and operational cost benefits.

By Application

Engineered vehicles represent a leading segment, with strong adoption in logistics and material handling. Construction machinery also contributes substantially, driven by infrastructure expansion and mining activities. Military vehicles show growing demand, supported by requirements for durability and safety under extreme conditions. Other applications, including industrial carts and utility vehicles, add niche opportunities.

- For instance, Michelin’s Primacy 5 tire, available in 30 dimensions and featuring enhanced wear life and wet grip performance validated by real-world usage, signals increasing preference for technologically superior tires across these application segments in Australia.

By Size

The market spans below 10”, 11” to 15”, 16” to 20”, 21” to 25”, and others. The 11” to 15” category leads usage, especially in forklifts and warehouse equipment. Larger sizes, particularly 16” to 20” and 21” to 25”, are preferred for heavy machinery and construction vehicles requiring stronger load capacities. Smaller sizes serve light-duty industrial applications.

By Vehicle Type

Forklifts dominate demand due to their critical role in warehousing, logistics, and industrial hubs. Yard chassis and tow tractors follow, driven by port operations and intermodal transport. Reach stackers gain traction in container handling, reflecting trade activity. Other vehicles, including specialized industrial machines, create steady demand across diverse sectors.

Segmentation:

By Type

- Cured On Solid Tire

- Pressed On Solid Tire

By Application

- Engineered Vehicle

- Construction Machinery

- Military Vehicle

- Others

By Size

- Below 10”

- 11” to 15”

- 16” to 20”

- 21” to 25”

- Others

By Vehicle Type

- Forklift

- Yard Chassis

- Tow Tractor

- Reach Stacker

- Others

Regional Analysis:

Strong Demand from Eastern Australia

The Australia Solid Tire Market shows strong demand concentration in Eastern states, including New South Wales, Victoria, and Queensland. These regions account for over 55% of the national share, supported by dense urbanization, large-scale logistics networks, and strong industrial hubs. Sydney and Melbourne dominate forklift and warehouse vehicle adoption, reflecting growing e-commerce and port handling activity. Construction projects in Brisbane and surrounding areas also drive demand for heavy-duty solid tires. The presence of mining operations in Queensland further enhances consumption. It highlights Eastern Australia as the largest contributor to market growth.

Expanding Opportunities in Western Australia

Western Australia holds close to 25% share, driven mainly by its extensive mining and resource extraction activities. The region’s demand is supported by iron ore, gold, and lithium mining operations that require durable and puncture-resistant tires for heavy machinery. Perth also serves as a growing hub for logistics and warehousing, strengthening demand for forklift tires. Solid tires are widely used in harsh mining environments where reliability and durability are critical. It is expected to maintain steady growth as mining exports remain strong. The region continues to play a strategic role in supplying global commodities, boosting market expansion.

Emerging Growth in Northern and Southern Australia

Northern and Southern Australia collectively represent about 20% share of the market. South Australia benefits from its industrial base, manufacturing units, and port activities in Adelaide, which support demand for solid tires in warehousing and construction. Northern Australia, including the Northern Territory, relies heavily on mining, agriculture, and defense-related operations, which increasingly deploy engineered vehicles fitted with solid tires. The relatively smaller population and industrial footprint limit overall share but provide opportunities in niche sectors. Both regions are expected to see gradual adoption as infrastructure development and agricultural mechanization expand. It highlights the balanced contribution of secondary regions in sustaining national demand.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Bridgeston

- Michelin

- Pirelli

- Dunlop

- Maxxis

- Global Rubber Industries (GRI)

- TY Cushion Tire

- NEXEN Tire

Competitive Analysis:

The Australia Solid Tire Market is competitive, with global and regional players focusing on durability, safety, and cost-efficiency. Companies like Bridgestone, Michelin, Dunlop, Maxxis, and Global Rubber Industries compete strongly, supported by established distribution networks. Local demand for mining, construction, and logistics applications drives firms to innovate product designs and enhance performance under heavy loads. Players differentiate through aftersales support, customized solutions, and partnerships with equipment manufacturers. Market strategies include expanding size ranges, developing heat-resistant compounds, and targeting sustainability-focused buyers. It continues to attract investment as industries seek reliable and low-maintenance tire solutions.

Recent Developments:

- In August 2025, NEXEN Tire launched the ROADIAN ATX all-terrain tire in Australia, designed for SUVs and pickup trucks to handle diverse terrains from outback trails to coastal highways. The tire features advanced grip technologies, stone ejectors, and side biters for durability and traction, and it is an original equipment fitment on Jeep Wrangler and Gladiator models. NEXEN is also expanding its logistics infrastructure and marketing partnerships in Australia, including sponsorship with Sydney FC, to bolster its market presence.

- In August 2025, Bridgestone launched the W920 trucking tire in Australia, engineered with next-generation ENLITEN technology for enhanced all-weather performance, extended tire life, and sustainability. This tire targets trucking fleets needing reliable traction and durability in diverse weather conditions across regions including Australia. Additionally, Bridgestone supports the 2025 Bridgestone World Solar Challenge in Australia with ENLITEN tires featuring a high percentage of recycled materials, reinforcing their innovation leadership in sustainable mobility.

- In April 2025, Dunlop renewed its partnership as the official tire supplier for MotoAmerica through 2029, continuing its commitment to high-performance tires across all racing classes. Although primarily a North American racing update, this long-term agreement signifies sustained product innovation that may influence Dunlop’s broader markets, including Australia, as part of Sumitomo Rubber Industries’ portfolio.

Report Coverage:

The research report offers an in-depth analysis based on type, application, size, and vehicle type. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The market will benefit from rising demand in logistics and warehousing operations.

- Mining projects will continue to generate strong need for heavy-duty solid tires.

- Construction sector expansion will sustain adoption across equipment categories.

- Increasing automation in industrial hubs will accelerate forklift tire demand.

- Product innovation will focus on heat resistance and extended durability.

- Sustainability commitments will drive adoption of longer-lasting tire solutions.

- Aftermarket services will grow as operators prioritize cost-efficient replacements.

- Regional hubs like Queensland and New South Wales will lead consumption.

- Partnerships with OEMs will strengthen competitive positioning of key players.

- Growing awareness of lifecycle cost savings will widen the customer base.