Market Overview

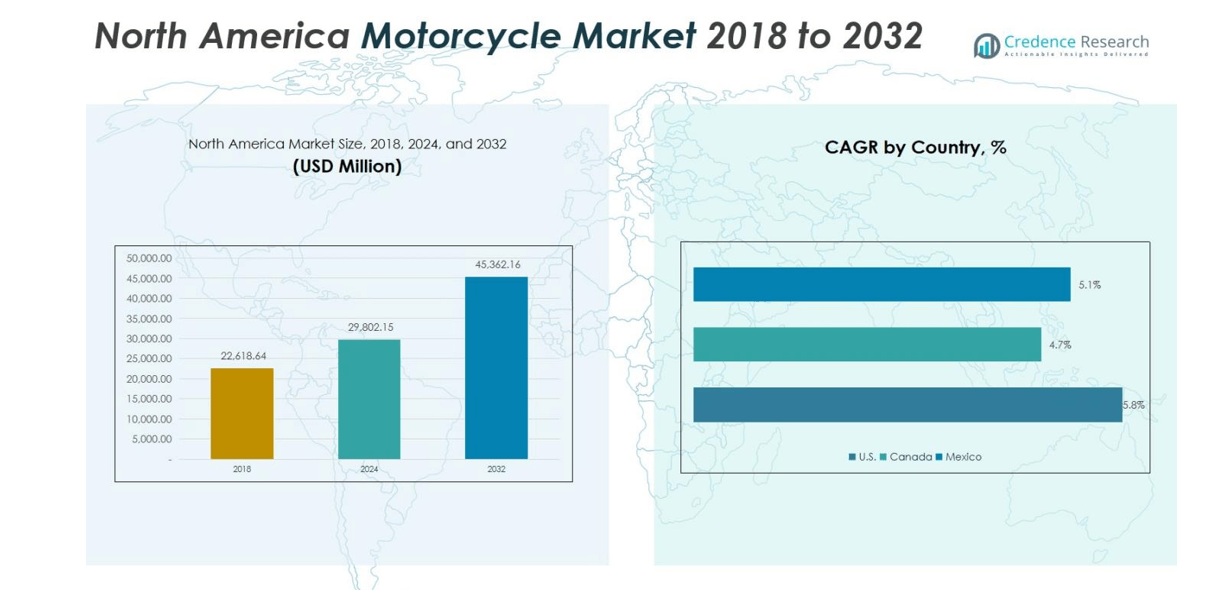

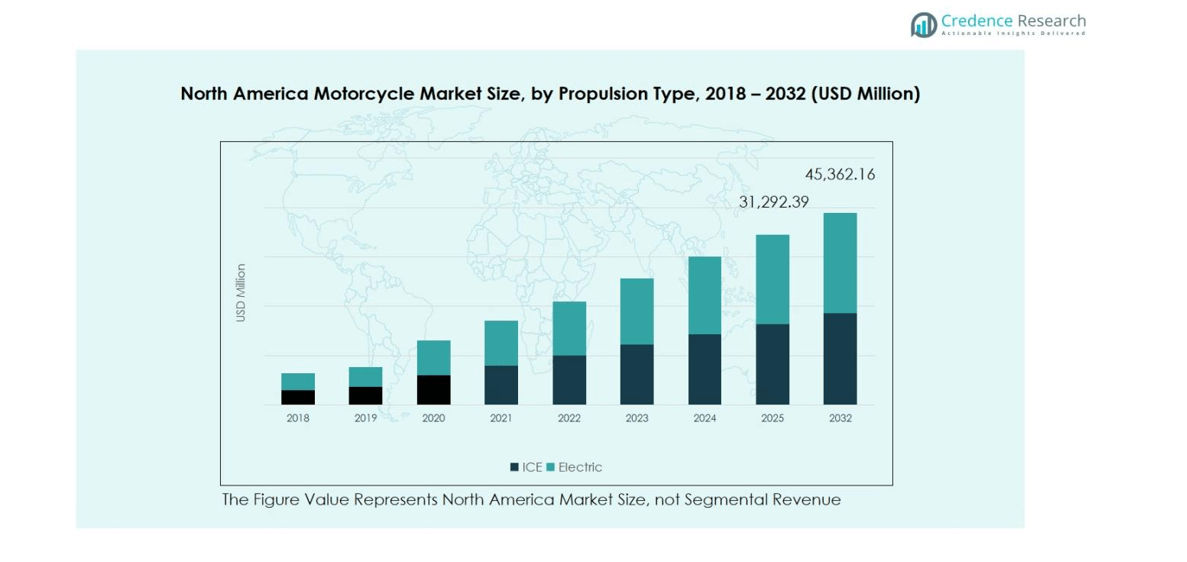

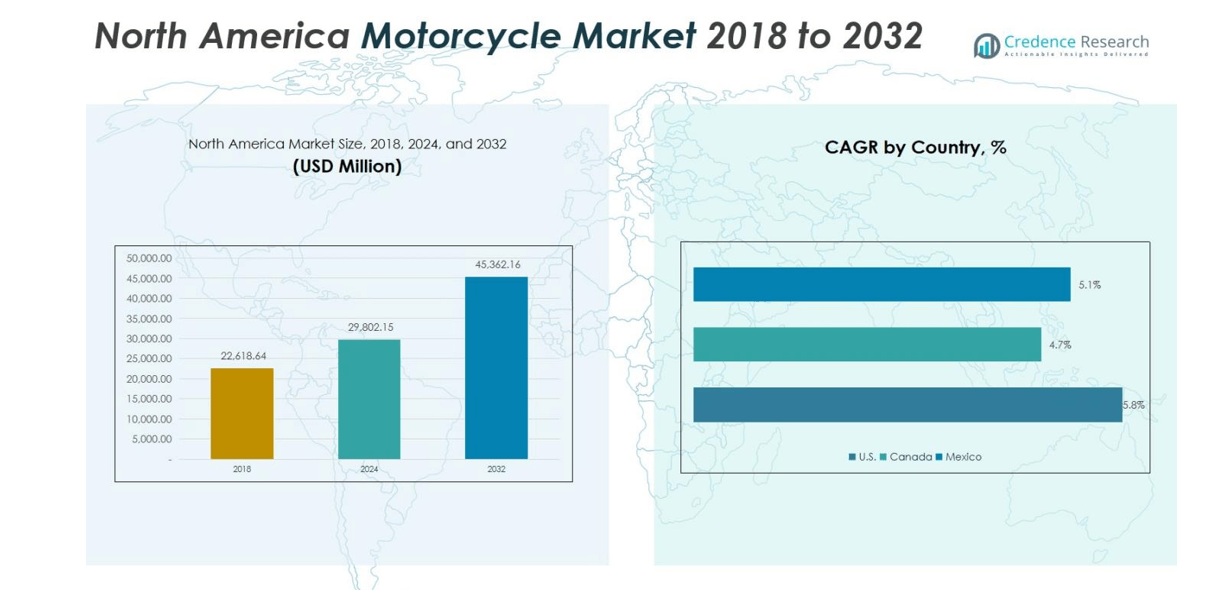

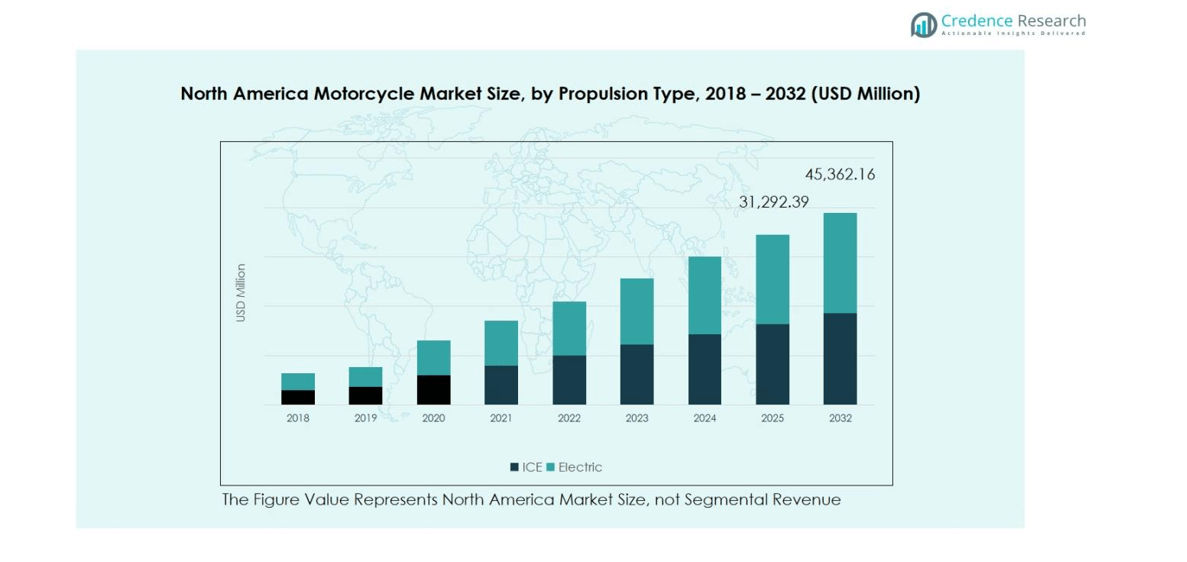

The North America Motorcycle Market size was valued at USD 22,618.64 million in 2018, increased to USD 29,802.15 million in 2024, and is anticipated to reach USD 45,362.16 million by 2032, growing at a CAGR of 5.34% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| North America Motorcycle Market Size 2024 |

USD 29,802.15 million |

| North America Motorcycle Market, CAGR |

5.34% |

| North America Motorcycle Market Size 2032 |

USD 45,362.16 Million |

The North America Motorcycle Market is highly competitive, with key players including Harley-Davidson, Polaris Inc., Yamaha Motor Co., Suzuki Motor Corporation, BMW AG, Kawasaki Motors Corp., Piaggio Group, Bajaj Auto Ltd., TVS Motor Company Ltd., and Zero Motorcycles Inc. These companies dominate through strong brand recognition, innovative product portfolios, and expansive dealer networks. Harley-Davidson continues to lead the cruiser and touring segments, while Yamaha and Suzuki excel in sports and standard categories. Zero Motorcycles drives growth in the electric segment with advanced battery and performance innovations. The United States leads the regional market with a 72% share in 2024, supported by deep-rooted riding culture, robust infrastructure, and the presence of major manufacturers.

Market Insights

- The North America Motorcycle Market was valued at USD 29,802.15 million in 2024 and is projected to reach USD 45,362.16 million by 2032, growing at a CAGR of 5.34% during the forecast period.

- Market growth is driven by rising demand for recreational and touring motorcycles, supported by increasing disposable incomes and strong brand engagement across the U.S. and Canada.

- Technological trends such as electric mobility adoption, connected features, and advanced safety systems are transforming the riding experience and attracting new customer segments.

- The market is moderately competitive, with key players including Harley-Davidson, Polaris Inc., Yamaha, Suzuki, BMW, and Zero Motorcycles focusing on innovation, performance, and expanding electric lineups.

- Regionally, the United States holds 72% share, followed by Canada at 17% and Mexico at 11%; by type, Standard motorcycles lead with 40% share, while ICE propulsion remains dominant with about 90% market contribution.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Segmentation Analysis:

By Motorcycle Type

The Standard motorcycles lead the North America market with around 40% share, driven by their affordability, comfort, and versatility for daily commuting and leisure riding. Their balanced performance and practicality make them highly popular among both entry-level and seasoned riders. The Sports segment follows with nearly 25% share, fueled by rising demand for performance-oriented bikes and technological advancements such as advanced traction control and lightweight frames. Cruisers hold about 20% share, supported by strong brand loyalty and cultural appeal, particularly in the U.S., where touring and lifestyle biking remain integral to the motorcycle community.

- For instance, Honda’s CB500F, known for its balanced performance and user-friendly design, remains a top choice among entry-level riders in the U.S., contributing significantly to the Standard segment’s popularity.

By Propulsion Type

The Internal Combustion Engine (ICE) segment dominates the North America motorcycle market with nearly 90% revenue share, supported by established OEM networks, wide product availability, and rider preference for proven engine technology. However, the Electric segment, currently accounting for around 10%, is expanding rapidly. This growth is driven by environmental regulations, government incentives, and improvements in battery technology, including enhanced range and reduced charging times. The electric segment is especially gaining traction in urban centers where sustainability and lower maintenance costs appeal to new-generation riders.

- For instance, in cities like New York and Los Angeles, electric two-wheelers are increasingly used in shared mobility and delivery services, supported by government incentives and expanding charging infrastructure.

By Engine Capacity

The 400cc to 800cc category leads the market with approximately 35% share, driven by riders seeking a balance between power, comfort, and affordability for both city commuting and long-distance travel. The More than 800cc segment follows with about 25% share, supported by the popularity of high-end touring and cruiser models among experienced riders. Meanwhile, the 200cc to 400cc range holds around 25% share, appealing to mid-level users upgrading from entry bikes. The Up to 200cc class accounts for roughly 15%, primarily attracting budget-conscious urban commuters and first-time buyers.

Key Growth Drivers

Rising Demand for Recreational and Touring Motorcycles

The North America motorcycle market is driven by increasing demand for recreational and long-distance touring bikes. Consumers with higher disposable incomes are investing in premium motorcycles that offer advanced comfort, connectivity, and performance features. The growing popularity of motorcycle tourism, group rides, and adventure events is encouraging manufacturers to introduce innovative touring and cruiser models. Additionally, favorable financing options and motorcycle clubs across the U.S. and Canada continue to expand the customer base, fueling consistent market growth in the premium segment.

- For instance, Indian Motorcycle introduced the 2025 Scout lineup comprising five distinct cruiser models designed with a focus on rider-centric technology and classic American design, enhancing their appeal for long-distance cruising and touring enthusiasts.

Technological Advancements and Electric Mobility Expansion

Rapid technological innovations, including advanced braking systems, rider-assist technologies, and enhanced connectivity, are transforming the motorcycle landscape in North America. The adoption of electric motorcycles is accelerating due to supportive government policies, sustainability goals, and reduced operating costs. Manufacturers are investing in extended battery range, fast-charging solutions, and improved powertrains, making e-motorcycles more viable for daily commuting. This technological shift not only diversifies product portfolios but also attracts environmentally conscious riders, positioning electric mobility as a key growth driver for the future.

- For instance, Indian Motorcycle’s new Rider Assist technologies include electronic combined braking and blind spot warnings, boosting rider safety and convenience.

Growing Urbanization and Shift Toward Affordable Personal Mobility

Increasing urban congestion and the need for cost-efficient, flexible transport solutions are boosting motorcycle adoption across North American cities. Standard and mid-capacity motorcycles are gaining traction as practical alternatives to cars due to lower maintenance and fuel costs. Younger riders and working professionals are embracing two-wheelers for short-distance commuting and leisure rides. The rising acceptance of motorcycles for last-mile deliveries and ride-sharing services further supports market expansion, highlighting affordability and versatility as core growth enablers across both developed and emerging urban centers.

Key Trends and Opportunities

Integration of Smart Features and Connected Technologies

Motorcycle manufacturers in North America are increasingly focusing on integrating smart and connected technologies to enhance safety and performance. Features such as Bluetooth-enabled dashboards, GPS navigation, real-time diagnostics, and adaptive cruise control are becoming standard in mid-to-premium models. This digital integration not only improves rider experience but also creates opportunities for aftermarket upgrades and subscription-based services. As consumer demand for safety and convenience grows, connected motorcycles represent a key innovation frontier and a major opportunity for manufacturers to differentiate their offerings.

- For instance, KTM has developed an adaptive cruise control system using radar sensors that automatically adjusts cruising speed by detecting the vehicle ahead and maintains a safe following distance, enhancing rider safety on highways.

Expansion of Electric Motorcycle Infrastructure

The rapid development of electric vehicle infrastructure across the U.S. and Canada presents significant growth potential for the motorcycle market. Government-backed initiatives promoting EV adoption, tax incentives, and expanding charging networks are encouraging consumers to transition from traditional ICE models to electric alternatives. Companies are collaborating with energy providers and tech firms to establish dedicated charging hubs and battery-swapping systems. These developments are expected to reduce range anxiety and operational barriers, positioning the electric motorcycle segment for accelerated long-term growth.

- For instance, Harley-Davidson’s launch of the LiveWire in 2019 marked a significant step in electric motorcycle development, featuring a 105 horsepower motor, a 146-mile city range, and 40-minute fast-charging capabilities.

Key Challenges

High Initial Costs and Limited Financing Options for Premium Models

Despite growing consumer interest, the high upfront cost of premium and electric motorcycles remains a significant barrier to widespread adoption. Many potential buyers find advanced models financially out of reach, especially with limited financing and leasing options compared to the automotive sector. Additionally, the high cost of maintenance and spare parts further limits market penetration in price-sensitive segments. Manufacturers need to introduce flexible financing schemes and localized production strategies to make motorcycles more affordable for broader demographics.

Safety Concerns and Regulatory Constraints

Rider safety remains a major concern in the North America motorcycle market, as accident rates continue to influence consumer perception and regulatory frameworks. Stricter safety standards, emissions regulations, and licensing requirements can slow market expansion, particularly for entry-level riders. Moreover, adverse weather conditions in several regions limit year-round usability, affecting sales consistency. Addressing safety through advanced rider-assist systems, awareness programs, and improved road infrastructure will be crucial for manufacturers and policymakers to sustain long-term growth and consumer confidence.

Regional Analysis

United States

The United States dominates the North America motorcycle market, holding a market share of 72% in 2024. The strong presence of major manufacturers such as Harley-Davidson, Polaris, and Zero Motorcycles, combined with a well-established rider culture, sustains its leadership position. Demand is concentrated in touring, cruiser, and sports segments, supported by a robust aftermarket and dealer network. Rising interest in electric motorcycles and technological innovations are reshaping the premium segment. Additionally, favorable financing options, motorcycle clubs, and extensive road networks continue to boost the market’s long-term growth and consumer engagement across diverse rider demographics.

Canada

Canada accounts for a 17% share of the North America motorcycle market, driven by a growing preference for standard and touring motorcycles. The country’s scenic routes and seasonal tourism encourage motorcycle ownership, particularly for leisure and adventure riding. Increasing adoption of mid-capacity models and electric motorcycles reflects shifting consumer priorities toward efficiency and sustainability. Government incentives for electric vehicle adoption and expanding charging infrastructure further enhance growth prospects. However, the shorter riding season and weather limitations moderately affect year-round demand, keeping market expansion steady but regionally concentrated in urban and southern provinces.

Mexico

Mexico holds an 11% share of the North America motorcycle market, supported by rising urbanization, affordability, and increasing demand for commuter motorcycles. Two-wheelers are widely used for daily transportation, delivery services, and micro-mobility, making the standard and low-capacity ICE segments dominant. Local manufacturing presence and favorable import regulations strengthen availability across economic tiers. Growing interest in electric motorcycles and supportive government measures are gradually transforming market dynamics. Although economic disparities and limited financing options pose challenges, Mexico remains a key growth frontier due to its expanding youth population and evolving mobility ecosystem.

Market Segmentations:

By Motorcycle Type

- Standard

- Sports

- Cruiser

- Touring

- Others

By Propulsion Type

- Internal Combustion Engine (ICE)

- Electric

By Engine Capacity

- Up to 200cc

- 200cc to 400cc

- 400cc to 800cc

- More than 800cc

By Region

- United States

- Canada

- Mexico

Competitive Landscape

The competitive landscape of the North America Motorcycle Market is characterized by the strong presence of leading manufacturers such as Harley-Davidson, Polaris Inc., Yamaha Motor Co., Suzuki Motor Corporation, BMW AG, Kawasaki Motors Corp., Piaggio Group, Bajaj Auto Ltd., TVS Motor Company Ltd., and Zero Motorcycles Inc. These companies compete through extensive product portfolios, brand reputation, technological innovation, and distribution strength. Harley-Davidson continues to dominate the cruiser and touring segments, while Japanese brands such as Yamaha, Suzuki, and Kawasaki maintain a firm foothold in sports and standard categories. The electric motorcycle segment is witnessing growing competition, with Zero Motorcycles leading advancements in battery efficiency and performance. Strategic collaborations, product launches, and investments in sustainable mobility solutions are shaping market dynamics. Companies are also emphasizing connected technology, rider safety features, and customer experience to strengthen brand loyalty. Overall, the market remains highly competitive, driven by innovation, premiumization, and electrification trends.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Key Player Analysis

- Polaris Inc.

- TVS Motor Company Ltd.

- Bajaj Auto Ltd.

- Yamaha Motor Co., Ltd.

- Suzuki Motor Corporation

- Zero Motorcycles Inc.

- Bayerische Motoren Werke (BMW) AG

- Harley-Davidson, Inc.

- Piaggio Group

- Kawasaki Motors Corp.

- Other Key Players

Recent Developments

- In January 2025, Harley‑Davidson, Inc. announced a multi-year title partnership with Dynojet Research Inc. for its Factory Race Team’s 2025 MotoAmerica Mission King of the Baggers season.

- In October 2025, Polaris Inc. announced it will separate its Indian Motorcycle business into a standalone company by selling a majority stake to Carolwood LP, signaling strategic refocusing in the motorcycles market.

- In June 2025, KTM Group (North America) announced a partnership with Synchrony Financial to sponsor the “Babes in the Dirt 2025” off-road adventure series, focusing on female riders and off-road engagement.

- In July 2025, Yamaha was named the motocross paddock sponsor of the 2025 AMA Vintage Motorcycle Days, reinforcing its engagement with the vintage segment and North American motorcycle community

Report Coverage

The research report offers an in-depth analysis based on Motorcycle Type, Propulsion Type, Engine Capacity and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The North America motorcycle market is expected to witness steady growth driven by increasing demand for recreational and touring motorcycles.

- Electric motorcycles will experience significant adoption as infrastructure and battery technology continue to advance.

- Premium motorcycle manufacturers will focus on innovation, customization, and rider-assist technologies to enhance user experience.

- The rise in urban congestion will encourage greater adoption of motorcycles for personal and last-mile mobility.

- Government incentives and emission regulations will accelerate the shift toward electric and hybrid propulsion models.

- Connected and smart motorcycle technologies will become a key differentiator for major brands.

- Mid-capacity motorcycles will gain traction due to their balance of affordability, comfort, and performance.

- Expansion of financing options and subscription-based ownership models will attract new riders.

- The aftermarket segment will grow as consumers invest in accessories, performance parts, and digital upgrades.

- Manufacturers will prioritize sustainability and localization strategies to meet evolving consumer preferences.