Market Overview

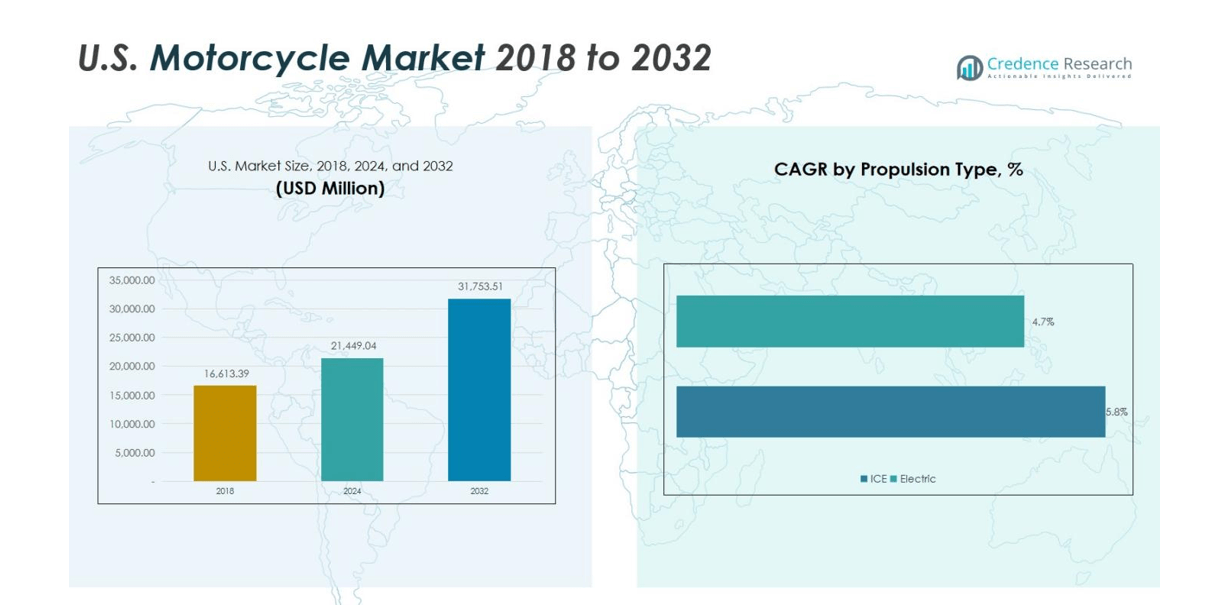

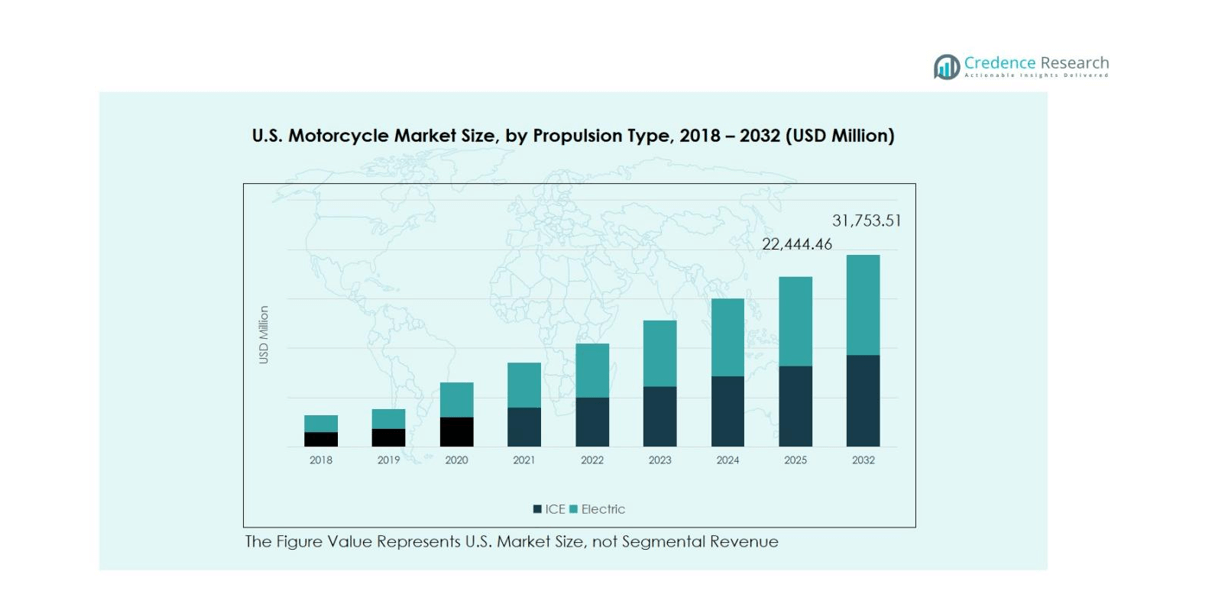

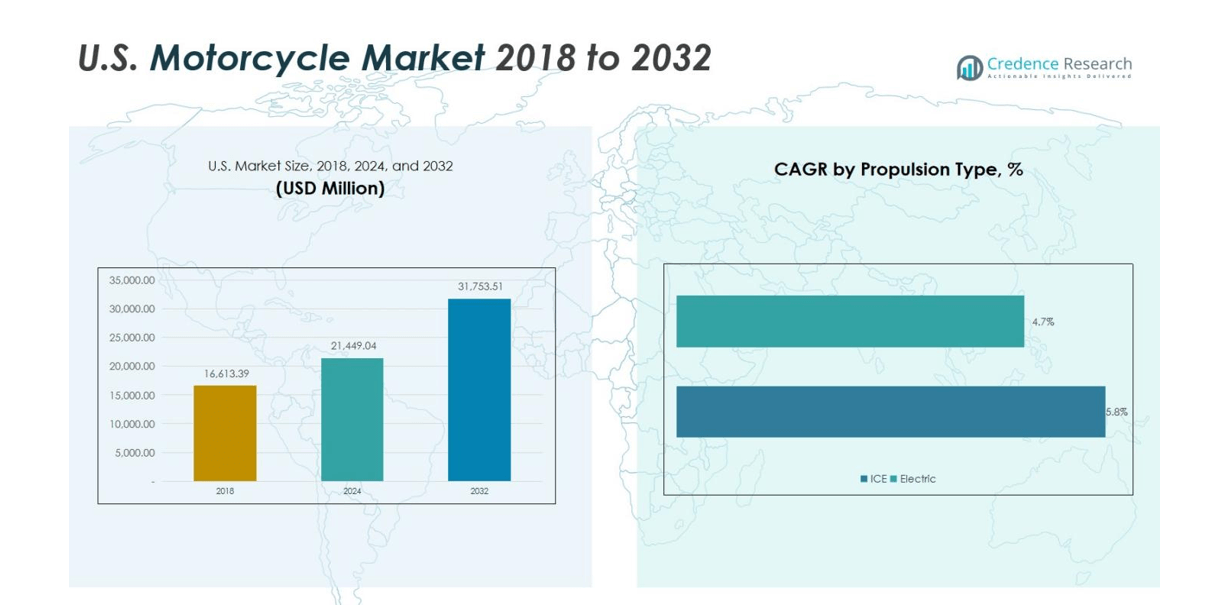

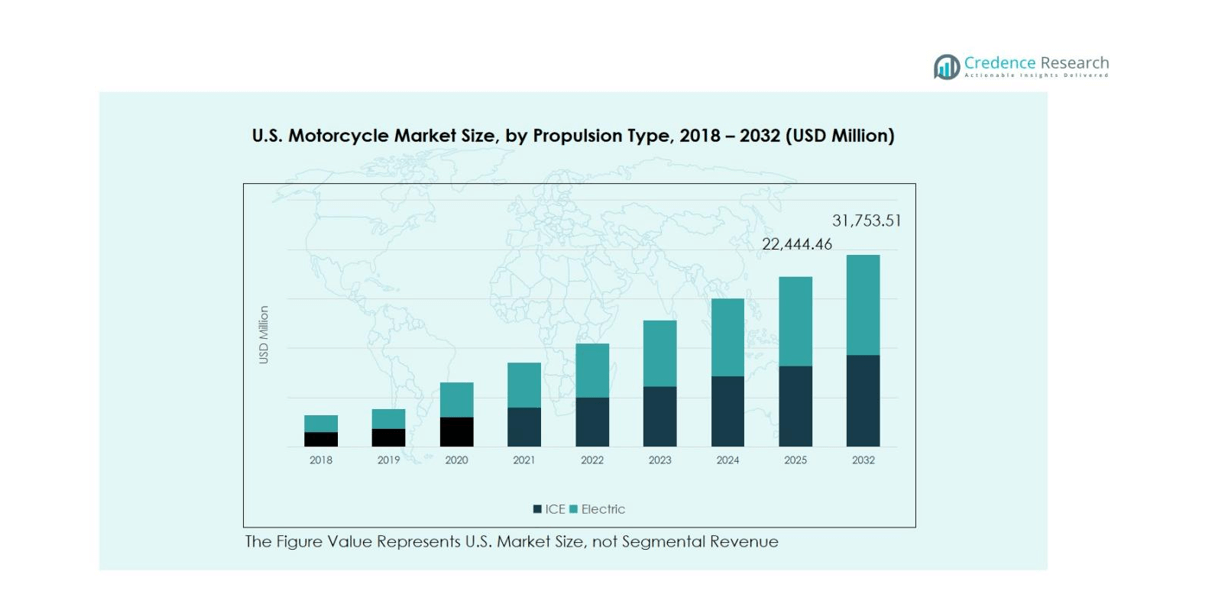

The U.S. Motorcycle Market size was valued at USD 16,613.39 million in 2018, growing to USD 21,449.04 million in 2024, and is anticipated to reach USD 31,753.51 million by 2032, at a CAGR of 5.01% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.S. Motorcycle Market Size 2024 |

USD 21,449.04 million |

| U.S. Motorcycle Market, CAGR |

5.01% |

| U.S. Motorcycle Market Size 2032 |

USD 31,753.51 million |

The U.S. Motorcycle Market is dominated by key players such as Harley-Davidson, Polaris Inc., Yamaha Motor Co., Suzuki Motor Corporation, BMW AG, Honda Motor Co., Kawasaki Motors Corp., and Zero Motorcycles Inc. These companies lead through extensive product portfolios, innovation, and strong brand recognition across diverse segments. Harley-Davidson continues to hold a commanding position in the cruiser and touring categories, while Japanese manufacturers such as Yamaha, Honda, and Suzuki maintain dominance in sports and standard motorcycles. Zero Motorcycles is expanding rapidly within the electric segment through continuous advancements in battery efficiency. Regionally, the Western United States leads the market with a 36% share, driven by favorable weather conditions, scenic riding routes, and a strong culture of motorcycle tourism.

Market Insights

- The U.S. Motorcycle Market was valued at USD 21,449.04 million in 2024 and is expected to reach USD 31,753.51 million by 2032, growing at a CAGR of 5.01% during the forecast period.

- Market growth is primarily driven by rising consumer interest in recreational and touring activities, technological advancements, and the increasing availability of electric motorcycles supported by sustainability initiatives.

- A key trend shaping the market is the growing adoption of connected and smart motorcycles equipped with advanced safety and infotainment systems, appealing to younger and tech-oriented riders.

- The competitive landscape features leading players such as Harley-Davidson, Polaris Inc., Yamaha Motor Co., Suzuki Motor Corporation, and Zero Motorcycles Inc., focusing on product innovation and electrification.

- Regionally, the Western United States holds the largest share at 36%, while the standard motorcycle segment dominates the market with a 41.5% revenue share, supported by affordability and versatility.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

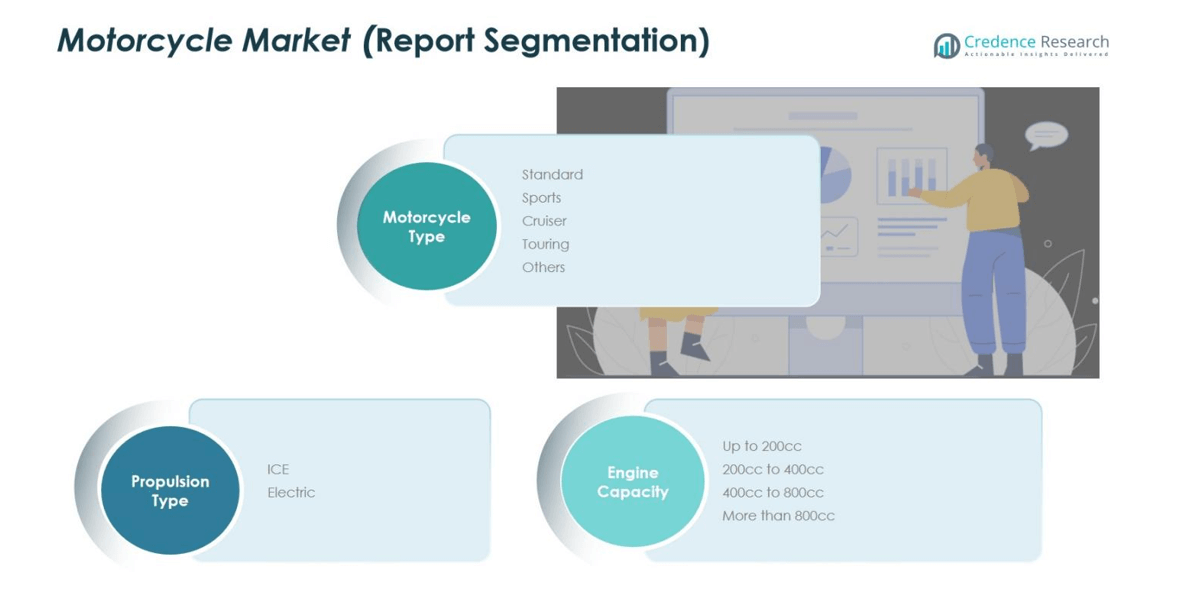

By Motorcycle Type

The U.S. motorcycle market is segmented into Standard, Sports, Cruiser, Touring, and Others, with the Standard segment dominating at nearly 41.5% market share in 2024. Standard motorcycles lead due to their versatility, affordability, and comfort for both daily commuting and recreational use. The Cruiser segment follows closely, supported by strong demand for long-distance and classic-styled bikes from brands like Harley-Davidson. Meanwhile, Sports motorcycles are witnessing rising popularity among younger riders drawn to performance, speed, and advanced technology integration. Touring and Adventure models are also gaining traction due to the growing trend of leisure and cross-country riding.

- For instance, Harley-Davidson reported that its new Street Glide and Road Glide touring motorcycles contributed to a nearly 5% growth in the U.S. Touring segment and helped the brand achieve a 74.5% market share in that segment for 2024.

By Propulsion Type

Based on propulsion, the Internal Combustion Engine (ICE) segment holds a dominant 89% market share, driven by widespread fuel infrastructure, cost efficiency, and mature technology. However, the Electric motorcycle segment is the fastest-growing, fueled by advancements in battery range, government incentives, and sustainability goals. U.S. manufacturers such as Zero Motorcycles are expanding their electric portfolios to attract eco-conscious consumers. The ongoing transition toward electrification highlights growing awareness of green mobility and the government’s support for emission-free transportation.

- For instance, the collaboration between Hero MotoCorp and Zero Motorcycles to co-develop premium electric motorcycles, targeting the midweight performance segment with launches planned by FY2026.

By Engine Capacity

The U.S. market is divided into Up to 200cc, 200cc–400cc, 400cc–800cc, and Above 800cc categories. The 400cc–800cc segment dominates, accounting for a significant 38–40% share, as it offers a balance of performance, comfort, and affordability. This range is preferred by mid-level riders for both urban and highway use. The Above 800cc category contributes notably to revenue through premium touring and cruiser motorcycles, while lower-capacity models (below 400cc) cater to beginners and commuters seeking fuel-efficient options. The demand across all capacity ranges is reinforced by rising motorcycle ownership and lifestyle-driven purchases in the U.S.

Key Growth Drivers

Rising Demand for Recreational and Lifestyle Motorcycles

The increasing popularity of motorcycling as a leisure activity is a major driver in the U.S. market. Consumers are investing in high-performance and touring motorcycles for weekend rides and long-distance travel. Established brands such as Harley-Davidson and BMW Motorrad benefit from this lifestyle shift, introducing feature-rich models tailored for comfort and adventure. Growing interest in road trips, motorcycle rallies, and club culture continues to expand demand, particularly among middle-aged and affluent consumers seeking both style and recreational value.

- For instance, BMW Motorrad’s R 1300 RT model comes equipped with integral ABS Pro, dynamic electronic suspension adjustment, and adaptive cruise control for safer, more comfortable touring experiences.

Technological Advancements and Product Innovation

Continuous innovation in motorcycle design, safety, and performance is fueling market expansion. Manufacturers are integrating advanced rider-assist technologies, digital connectivity, ABS, and traction control systems to enhance safety and experience. Electric motorcycles are also gaining traction due to improved battery efficiency and lower maintenance costs. These innovations attract tech-savvy and sustainability-conscious riders, while premium features such as adaptive cruise control and infotainment systems elevate consumer expectations, boosting the overall market appeal across multiple motorcycle categories.

- For instance, Bosch has developed radar-based rider assistance systems that monitor a motorcycle’s surroundings, providing blind spot detection and adaptive cruise control to automatically maintain a safe distance from vehicles ahead.

Expansion of Electric Motorcycle Segment

The rapid evolution of electric mobility represents a pivotal growth driver in the U.S. motorcycle market. Companies like Zero Motorcycles and Harley-Davidson’s LiveWire are leading this transformation with advanced electric models offering extended range and fast-charging capabilities. Government incentives, emission regulations, and expanding charging infrastructure are further accelerating adoption. As consumers increasingly prioritize environmental responsibility and operating cost savings, the electric motorcycle segment is poised to register substantial growth over the forecast period, reshaping the nation’s two-wheeler landscape.

Key Trends & Opportunities

Integration of Smart Connectivity and IoT Features

The adoption of smart connectivity and IoT technologies is emerging as a key trend in the U.S. motorcycle market. Manufacturers are integrating features such as GPS navigation, vehicle diagnostics, and smartphone connectivity to enhance rider convenience and safety. Real-time monitoring systems and app-based interfaces provide riders with data-driven insights into performance and maintenance. This digital transformation creates opportunities for manufacturers to differentiate their products, attract tech-oriented customers, and establish new revenue streams through connected services and subscription models.

- For instance, Harley-Davidson launched its LiveWire electric motorcycle with smart features including real-time performance tracking, customizable ride modes, and remote diagnostics appealing to tech-savvy riders.

Growing Market for Premium and Customized Motorcycles

An expanding segment of U.S. consumers is showing strong interest in premium and customized motorcycles. Riders are seeking exclusivity, performance, and personalization—driving demand for luxury cruisers, sport bikes, and custom builds. Brands like Indian Motorcycle and Ducati are capitalizing on this trend by offering bespoke options, performance upgrades, and limited-edition models. The shift toward high-value motorcycles not only boosts profitability but also encourages aftermarket growth, creating opportunities for accessory manufacturers and service providers in the customization ecosystem.

- For instance, Indian Motorcycle offers the 2025 Roadmaster Elite, a touring model limited to just 350 units worldwide, featuring exclusive paint schemes and luxury finishes.

Key Challenges

High Ownership and Maintenance Costs

One of the major challenges in the U.S. motorcycle market is the high cost of ownership and maintenance, particularly for premium and large-displacement models. Expenses related to insurance, spare parts, and servicing often deter potential buyers, especially younger demographics. Additionally, rising component and labor costs have led to higher retail prices. These factors restrict market penetration in the mid- to low-income segments, compelling manufacturers to explore cost-effective production techniques and flexible financing options to sustain demand.

Safety Concerns and Regulatory Barriers

Safety risks associated with motorcycle riding remain a critical concern influencing market growth. Increasing accident rates and limited protective infrastructure discourage potential riders. Furthermore, stringent emission norms and noise regulations challenge manufacturers to continually adapt engine technologies, adding to development costs. The lack of widespread training programs and inconsistent licensing standards across states exacerbate safety challenges. Addressing these issues through enhanced safety awareness, rider education, and technological advancements will be essential for long-term market sustainability.

Regional Analysis

Western United States

The Western region holds the largest market share of 36% in the U.S. motorcycle market, driven by favorable weather conditions, scenic routes, and a strong leisure-riding culture. States such as California and Arizona contribute significantly due to their year-round riding climate and high concentration of motorcycle enthusiasts. The region also leads in electric motorcycle adoption, supported by progressive emission policies and robust charging infrastructure. Major manufacturers and dealerships are expanding their presence here, capitalizing on strong consumer demand for both premium touring and eco-friendly electric motorcycles.

Southern United States

The Southern region accounts for 29% of the U.S. motorcycle market, fueled by the popularity of cruisers and touring motorcycles suited for long highway rides. States like Texas, Florida, and Georgia are key contributors due to extensive road networks, strong motorcycling communities, and numerous biking events. Favorable registration costs and relatively mild winters support consistent year-round usage. The region also shows rising interest in mid-range motorcycles, supported by a growing youth population and increasing affordability. These factors collectively sustain the South’s robust position in the national motorcycle landscape.

Midwestern United States

The Midwest captures a market share of 21%, characterized by steady demand for heavy and cruiser motorcycles. States such as Illinois, Ohio, and Michigan have strong motorcycle ownership bases and a growing aftermarket ecosystem. While the riding season is shorter due to climatic conditions, the region benefits from a dense network of dealerships and manufacturer operations. Local consumers display loyalty to iconic brands like Harley-Davidson, which originated in this region. Expanding availability of mid-size and adventure bikes further supports gradual market growth across both urban and semi-rural communities.

Northeastern United States

The Northeastern region represents 14% of the U.S. motorcycle market, with concentrated demand in states such as New York, Pennsylvania, and Massachusetts. Despite limited riding months, the region maintains a steady market through strong urban commuter interest and premium motorcycle sales. Rising adoption of electric and low-emission models aligns with the region’s environmental policies. The high-income consumer base supports the growth of luxury and performance motorcycles, while increasing urban congestion continues to drive interest in two-wheel mobility solutions, including compact and electric models for daily transportation.

Market Segmentations:

By Motorcycle Type

- Standard

- Sports

- Cruiser

- Touring

- Others

By Propulsion Type

- Internal Combustion Engine (ICE)

- Electric

By Engine Capacity

- Up to 200cc

- 200cc to 400cc

- 400cc to 800cc

- More than 800cc

By Region

- Western United States

- Southern United States

- Midwestern United State

- Northeastern United States

Competitive Landscape

The competitive landscape of the U.S. motorcycle market is defined by the presence of major players such as Harley-Davidson, Polaris Inc., Yamaha Motor Co., Suzuki Motor Corporation, BMW AG, Honda Motor Co., Kawasaki Motors Corp., and Zero Motorcycles Inc. These companies collectively shape market dynamics through product innovation, brand loyalty, and extensive dealership networks. Harley-Davidson continues to dominate the premium cruiser and touring segments, while Polaris, through its Indian Motorcycle brand, focuses on heritage and performance models. Japanese manufacturers such as Yamaha, Suzuki, and Kawasaki maintain strong positions in sports and standard categories, emphasizing affordability and reliability. Meanwhile, BMW and Honda drive technological advancement with luxury and adventure motorcycles. The growing electric segment is led by Zero Motorcycles and Harley-Davidson’s LiveWire division, both investing heavily in battery technology and range improvement. Competitive intensity remains high, with brands pursuing electrification, connectivity, and premiumization to strengthen market presence and customer engagement.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Polaris Inc.

- TVS Motor Company Ltd.

- Bajaj Auto Ltd.

- Yamaha Motor Co.

- Suzuki Motor Corporation

- Zero Motorcycles Inc.

- Bayerische Motoren Werke (BMW) AG

- Harley-Davidson, Inc.

- Piaggio Group

- Kawasaki Motors Corp.

- Other Key Players

Recent Developments

- In August 2025, Harley-Davidson, Inc. achieved a major milestone by completing its strategic partnership with KKR and PIMCO, finalizing the sale of over USD 230 million in residual interests in securitized consumer loan receivables to strengthen its financial services operations.

- In October 2025, Polaris Inc. announced its plan to separate the Indian Motorcycle brand into an independent company by selling a majority stake to Carolwood LP, aiming to enhance profitability and focus on core business segments.

- In October 2025, Siemens Digital Industries Software extended its long-term partnership with Ducati Motor Holding S.p.A., focusing on advancing digital innovation, simulation technology, and sustainable manufacturing practices within the motorcycle industry.

- In October 2025, LiveWire Group Inc. showcased its upcoming S2 Alpinista Corsa and Patrol electric models production begins spring 2026 underscoring its expansion in the U.S. electric motorcycle segment.

Report Coverage

The research report offers an in-depth analysis based on Motorcycle Type, Propulsion Type, Engine Capacity and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The U.S. motorcycle market is expected to witness steady growth driven by rising recreational and touring activities.

- Electric motorcycles will gain strong traction due to stricter emission norms and government incentives.

- Premium and customized motorcycles will continue to attract affluent consumers seeking personalized experiences.

- Advancements in battery technology will enhance range and reduce charging time for electric models.

- Integration of smart connectivity and safety features will become standard across new motorcycle models.

- Manufacturers will expand mid-capacity motorcycle offerings to attract younger and urban riders.

- Expanding dealership networks and online sales channels will improve market accessibility.

- The growing popularity of motorcycle clubs and road tourism will support long-distance bike sales.

- Sustainability and eco-conscious consumer behavior will shape future product development strategies.

- Strategic collaborations and product diversification will remain key for companies to maintain competitiveness.