Market Overview

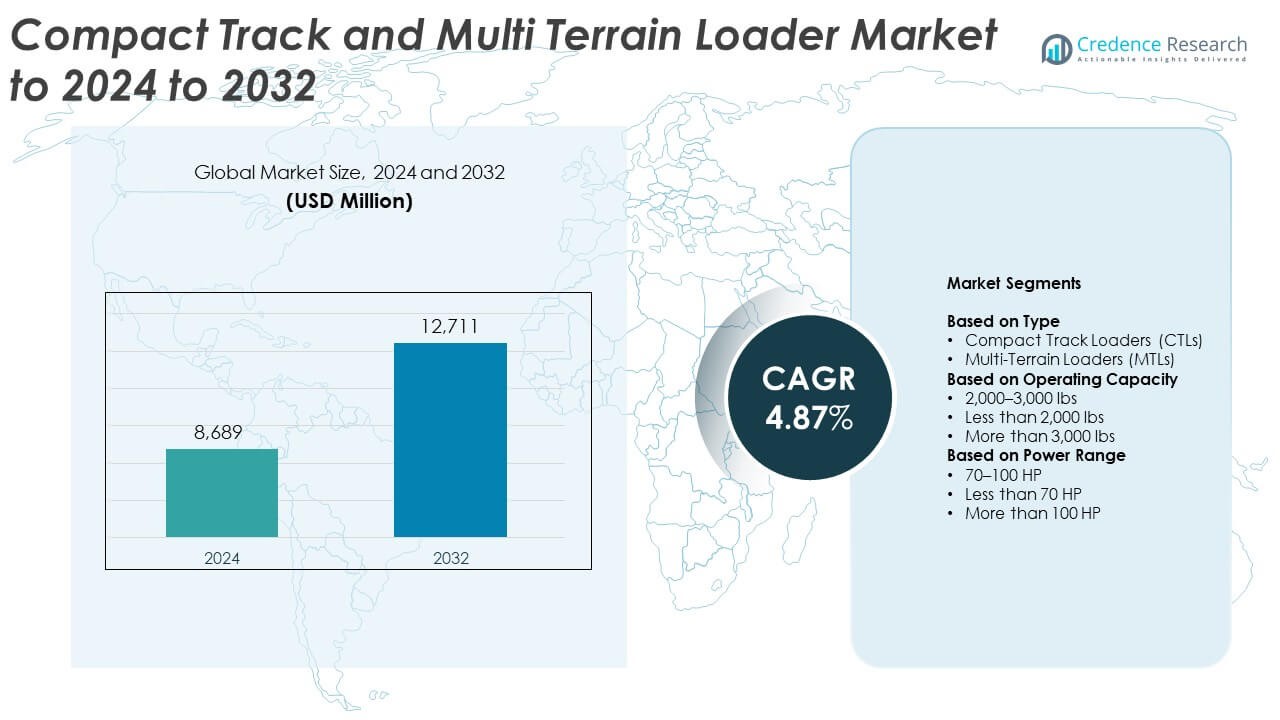

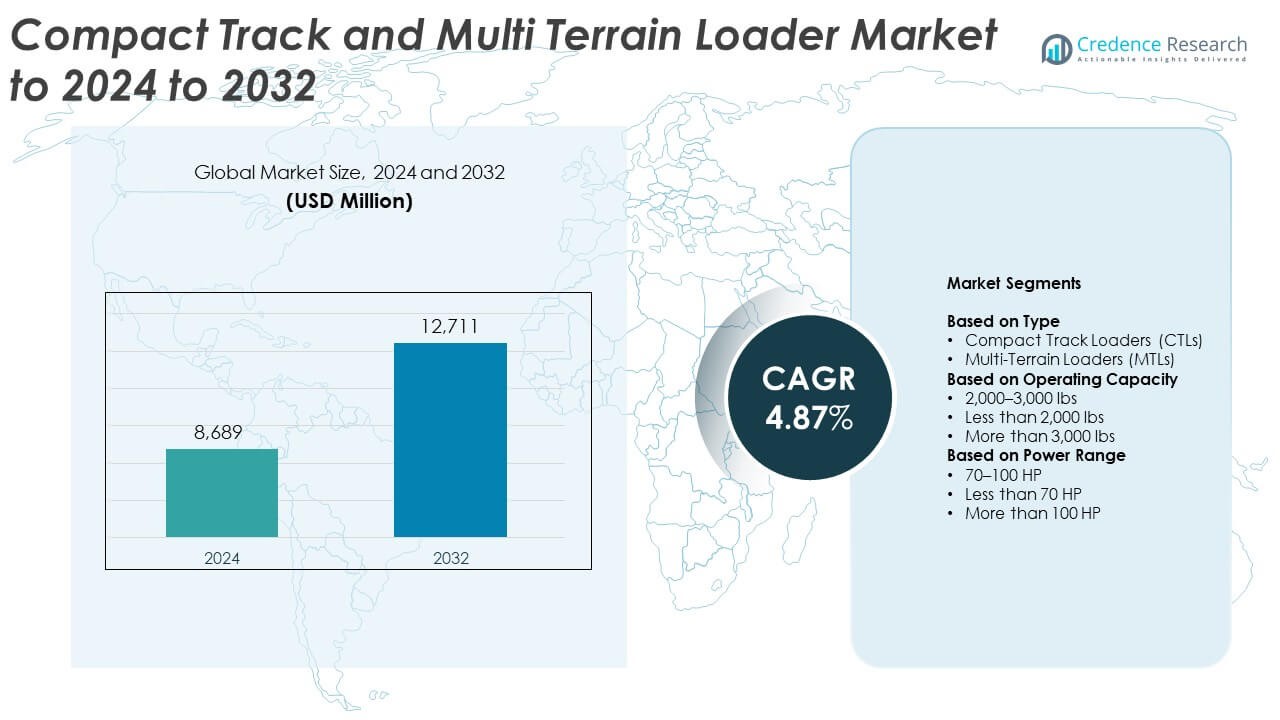

The Compact Track and Multi Terrain Loader Market size was valued at USD 8,689 million in 2024 and is anticipated to reach USD 12,711 million by 2032, at a CAGR of 4.87% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Compact Track and Multi Terrain Loader Market Size 2024 |

USD 8,689 Million |

| Compact Track and Multi Terrain Loader Market, CAGR |

4.87% |

| Compact Track and Multi Terrain Loader Market Size 2032 |

USD 12,711 Million |

The Compact Track and Multi Terrain Loader Market is led by major players including Komatsu Ltd., Bobcat Company, CNH Industrial N.V., J.C. Bamford Excavators Ltd., Deere & Company, Caterpillar Inc., and Kubota Corporation. These companies dominate through strong product portfolios, extensive distribution networks, and continuous technological advancements in hydraulic systems, telematics, and fuel-efficient designs. North America held the largest regional share of 41.2% in 2024, supported by advanced construction infrastructure and strong equipment rental penetration. Europe followed with a 26.7% share, driven by sustainable construction trends, while Asia Pacific accounted for 22.5%, fueled by rapid urbanization and industrial development.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Compact Track and Multi Terrain Loader Market was valued at USD 8,689 million in 2024 and is projected to reach USD 12,711 million by 2032, growing at a CAGR of 4.87%.

• Market growth is driven by expanding construction and infrastructure projects, along with rising adoption of compact and fuel-efficient equipment in urban areas.

• Key trends include the shift toward electric and hybrid loaders, increased use of telematics, and growing demand for rental equipment across industries.

• The market remains competitive with continuous product innovation and digital integration by leading manufacturers to enhance performance, durability, and operator safety.

• North America led the market with a 41.2% share in 2024, followed by Europe at 26.7% and Asia Pacific at 22.5%, while compact track loaders accounted for 74.6% of total product demand due to their superior traction and versatility across diverse terrain conditions.

Market Segmentation Analysis:

By Type

The compact track loaders (CTLs) segment dominated the Compact Track and Multi Terrain Loader Market with a 74.6% share in 2024. CTLs are favored for their superior traction, stability, and ability to operate in challenging terrains such as mud, snow, and uneven surfaces. Their versatility in construction, landscaping, and agriculture applications continues to strengthen demand. The integration of advanced hydraulic systems and telematics by manufacturers enhances equipment efficiency and operator control. For instance, Caterpillar introduced its Smart Attachment Recognition system that automatically adjusts machine settings to match connected tools.

- For instance, Takeuchi’s TL12R2 lists a rated operating capacity of 2,975 lb and a net power of 111.3 hp.

By Operating Capacity

The 2,000–3,000 lbs segment held the largest share of 56.8% in 2024, driven by its balanced performance across compact job sites and heavy-duty operations. These loaders offer optimal lift capacity and maneuverability for urban construction, agriculture, and material handling. The segment benefits from growing adoption in residential infrastructure projects requiring medium-load lifting capabilities. Manufacturers are focusing on developing compact models with enhanced stability and fuel efficiency. For instance, Bobcat launched its T66 loader featuring a vertical lift path and 2,450 lbs rated operating capacity for improved performance in confined spaces.

- For instance, the original ASV’s RT-75 compact track loader has a rated operating capacity of 2,650 lb when measured at 35% of the tipping load, and a total tipping load of 7,571 lb for the HD (Heavy Duty) model, or 2,750 lb capacity at 35% of tipping load and a 7,857 lb tipping load for the standard version.

By Power Range

The 70–100 HP segment led the market with a 61.3% share in 2024, owing to its suitability for diverse applications requiring higher productivity and fuel efficiency. These loaders deliver strong breakout forces and better hydraulic performance, making them ideal for grading, excavation, and snow removal. Increasing demand for mid-range power models in rental and fleet operations supports segment growth. Equipment manufacturers are integrating Tier 4-compliant engines and advanced cooling systems to improve durability. For instance, Deere & Company’s 333G compact track loader delivers 100 HP and enhanced cooling capacity for extended work cycles in demanding environments.

Key Growth Drivers

Rising Infrastructure and Construction Activities

Expanding construction and infrastructure projects across urban and rural areas are driving demand for compact track and multi-terrain loaders. Their ability to perform earthmoving, grading, and material handling efficiently in confined spaces makes them ideal for modern job sites. Government investments in residential and commercial infrastructure, particularly in emerging economies, are accelerating equipment adoption. The increased emphasis on mechanized operations in small and medium-scale construction further strengthens market expansion.

- For instance, Wacker Neuson’s ST31 offers a 125 in lift height and a 74 hp engine for compact jobsites.

Adoption of Advanced Hydraulic and Telematic Systems

Manufacturers are integrating advanced hydraulic systems and telematics to enhance productivity and reduce downtime. Smart controls, real-time diagnostics, and remote monitoring capabilities improve operator efficiency and machine life. These technologies allow fleet managers to track performance, fuel usage, and maintenance needs. Growing interest in connected equipment supports operational visibility and predictive maintenance, aligning with the industry’s shift toward digital transformation in construction machinery.

- For instance, CASE’s TV620B includes SiteWatch telematics hardware with a one-year data subscription and 114 hp.

Growing Preference for Compact and Versatile Equipment

Demand for compact machinery with high versatility is rising due to space constraints and multi-functional requirements in urban projects. Compact track and multi-terrain loaders can handle diverse tasks like excavation, leveling, and landscaping while maintaining stability and low ground pressure. Their quick attachment capabilities and adaptability across industries such as agriculture, waste management, and utilities make them highly cost-effective assets for contractors seeking performance with reduced operating costs.

Key Trends & Opportunities

Shift Toward Electrification and Low-Emission Equipment

The market is witnessing a shift toward electric and hybrid loaders as sustainability regulations tighten globally. Manufacturers are developing zero-emission machines that reduce fuel costs and noise pollution. Electrification presents significant opportunities in urban construction and indoor operations where air quality and sound limits are strict. This trend supports environmental compliance while lowering total lifecycle costs for end users.

- For instance, Bobcat’s T7X is all-electric, with the initial version, unveiled at CES 2022, powered by a 62-kilowatt hour (62 kWh) lithium-ion battery.

Expansion of Rental Equipment Services

The growing popularity of equipment rental models is opening new opportunities for market participants. Contractors prefer renting compact loaders to reduce capital investment and maintenance burdens. Rental firms are expanding fleets with technologically advanced models that meet diverse performance needs. This trend enables greater accessibility to high-end equipment, particularly in emerging economies, driving consistent demand in the rental sector.

- For instance, United Rentals operates an integrated network of 1,639 rental locations in North America (and 41 in Europe, 40 in Australia, and 19 in New Zealand) and has approximately 27,900 employees globally as of reports from Q3 2025.

Key Challenges

High Ownership and Maintenance Costs

The high upfront cost of compact track and multi-terrain loaders, coupled with maintenance expenses, limits adoption among small contractors. Advanced hydraulic and electronic systems increase repair complexity, raising operational costs. Additionally, fluctuating raw material prices affect manufacturing economics. These factors collectively slow down purchases in cost-sensitive markets, pushing buyers toward used or rented equipment instead of ownership.

Operational Limitations in Extreme Conditions

Despite their versatility, compact loaders face challenges in extreme conditions such as heavy snow or wet clay environments. Continuous operation in such terrains can accelerate undercarriage wear and reduce machine efficiency. Inadequate maintenance practices further increase downtime, impacting productivity. These limitations underscore the need for advanced design improvements and durable component materials to ensure consistent performance across diverse operating conditions.

Regional Analysis

North America

North America dominated the compact track and multi-terrain loader market with a 41.2% share in 2024. The region’s leadership stems from extensive construction activity, infrastructure modernization, and strong demand from landscaping and agricultural sectors. The presence of major manufacturers and advanced rental networks supports equipment accessibility. Increasing investments in smart infrastructure and housing projects in the United States and Canada further strengthen market growth. Rising adoption of telematics-based loaders and Tier 4-compliant engines enhances productivity and sustainability, positioning North America as a key hub for innovation and technology integration.

Europe

Europe held a 26.7% share in 2024, supported by high adoption of compact and eco-efficient construction equipment. Stringent emission regulations from the European Union encourage the use of low-emission and hybrid models. Growth in urban redevelopment projects and renewable energy installations fuels steady demand for compact loaders across Germany, France, and the United Kingdom. Manufacturers are emphasizing automation, precision controls, and noise reduction features to align with green building standards. The expanding rental equipment market also aids cost-effective access, sustaining long-term demand across both residential and commercial applications.

Asia Pacific

Asia Pacific accounted for a 22.5% share in 2024, driven by rapid industrialization and large-scale infrastructure expansion. China, India, and Japan lead the market with robust construction and agricultural activities. Government-backed initiatives for smart cities and transport infrastructure boost the deployment of compact track loaders for earthmoving and material handling. Increasing mechanization in agriculture and the rise of small contractors strengthen market penetration. Local manufacturers are focusing on developing cost-efficient and fuel-optimized models, while international players expand production bases to meet growing regional demand efficiently.

Latin America

Latin America captured a 6.1% share in 2024, supported by gradual recovery in the construction and mining sectors. Brazil and Mexico are leading contributors due to expanding urban development and public infrastructure programs. The market is benefiting from increasing adoption of compact loaders for terrain leveling and roadwork in remote areas. Equipment rental companies are expanding their fleets to address the growing preference for flexible leasing options. Economic diversification efforts and increased mechanization in agriculture further support moderate but consistent growth across the region.

Middle East & Africa

The Middle East and Africa held a 3.5% share in 2024, fueled by infrastructure investments and mining development projects. Countries such as Saudi Arabia, the UAE, and South Africa are adopting compact loaders for urban construction, oilfield operations, and industrial site maintenance. Regional governments’ focus on urban expansion and smart city frameworks boosts demand for compact, fuel-efficient machinery. However, high import costs and limited local manufacturing capacity restrict broader market growth. Increasing partnerships with global equipment suppliers are helping address accessibility and aftersales service gaps in emerging markets.

Market Segmentations:

By Type

- Compact Track Loaders (CTLs)

- Multi-Terrain Loaders (MTLs)

By Operating Capacity

- 2,000–3,000 lbs

- Less than 2,000 lbs

- More than 3,000 lbs

By Power Range

- 70–100 HP

- Less than 70 HP

- More than 100 HP

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Compact Track and Multi Terrain Loader Market features leading manufacturers such as Komatsu Ltd., Bobcat Company, CNH Industrial N.V., J.C. Bamford Excavators Ltd., Deere & Company, Caterpillar Inc., and Kubota Corporation. The market is characterized by strong competition centered on innovation, performance efficiency, and advanced technology integration. Companies are investing heavily in product development, emphasizing features like improved hydraulic systems, enhanced operator comfort, and telematics for real-time monitoring. The growing focus on sustainability and low-emission models is driving new product launches and partnerships. Firms are also expanding their global presence through dealer networks and rental channels to increase market accessibility. Continuous improvement in engine efficiency, automation, and compact design remains vital for differentiation, as end users demand reliable and versatile machines capable of operating in diverse construction, agriculture, and landscaping environments.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In 2025, Caterpillar introduced five next-generation skid steer loader (SSL) and compact track loader (CTL) models (250, 260, 270 SSLs and 275, 285 CTLs) to the Latin American market

- In 2024, John Deere launched five new P-Tier Skid Steer and Compact Track Loader models, including the 331, 333, and 335 P-Tier CTLs, which offer more power and advanced features.

- In 2024, Kubota unveiled its smallest compact track loader, the SVL50x, at the Equip Exposition tradeshow.

Report Coverage

The research report offers an in-depth analysis based on Type, Operating Capacity, Power Range and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue expanding due to growing construction and infrastructure development worldwide.

- Demand for compact and fuel-efficient loaders will rise in urban and confined project sites.

- Manufacturers will increasingly adopt electric and hybrid technologies to meet emission norms.

- Integration of IoT and telematics will enhance machine performance and predictive maintenance.

- Rental equipment services will gain traction among small and medium-scale contractors.

- Asia Pacific will emerge as the fastest-growing regional market driven by industrial expansion.

- Loader designs will focus on operator comfort, automation, and advanced hydraulic systems.

- Rising mechanization in agriculture and landscaping will create new growth avenues.

- Ongoing replacement of traditional loaders with advanced models will support long-term adoption.

- Strategic partnerships between manufacturers and rental firms will strengthen market reach and competitiveness.