Market Overview

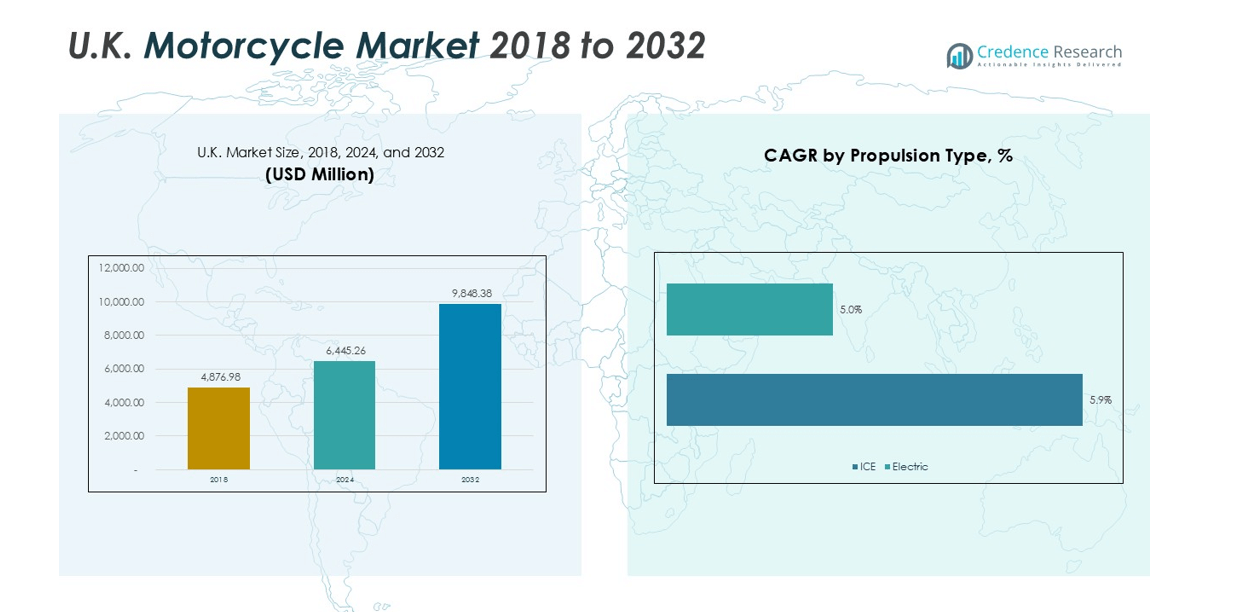

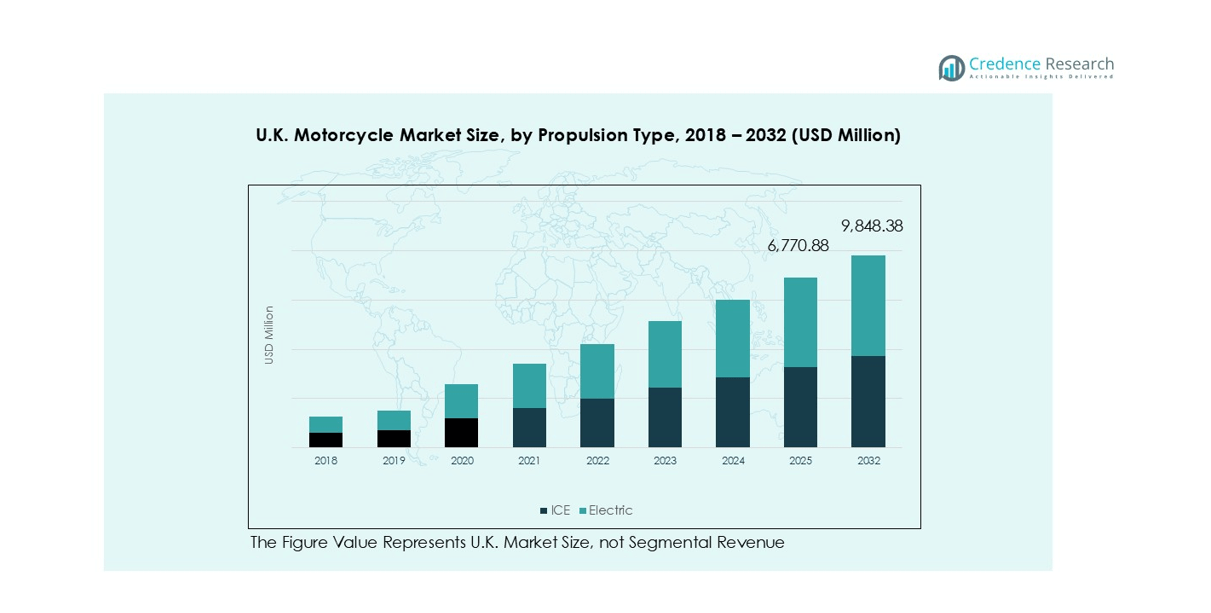

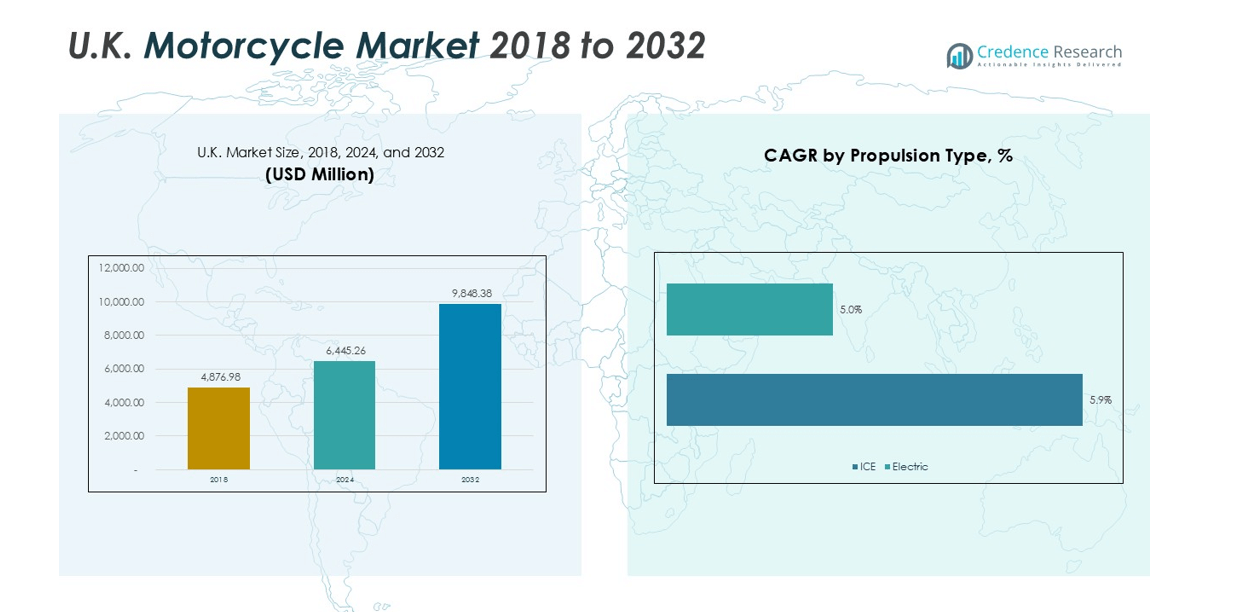

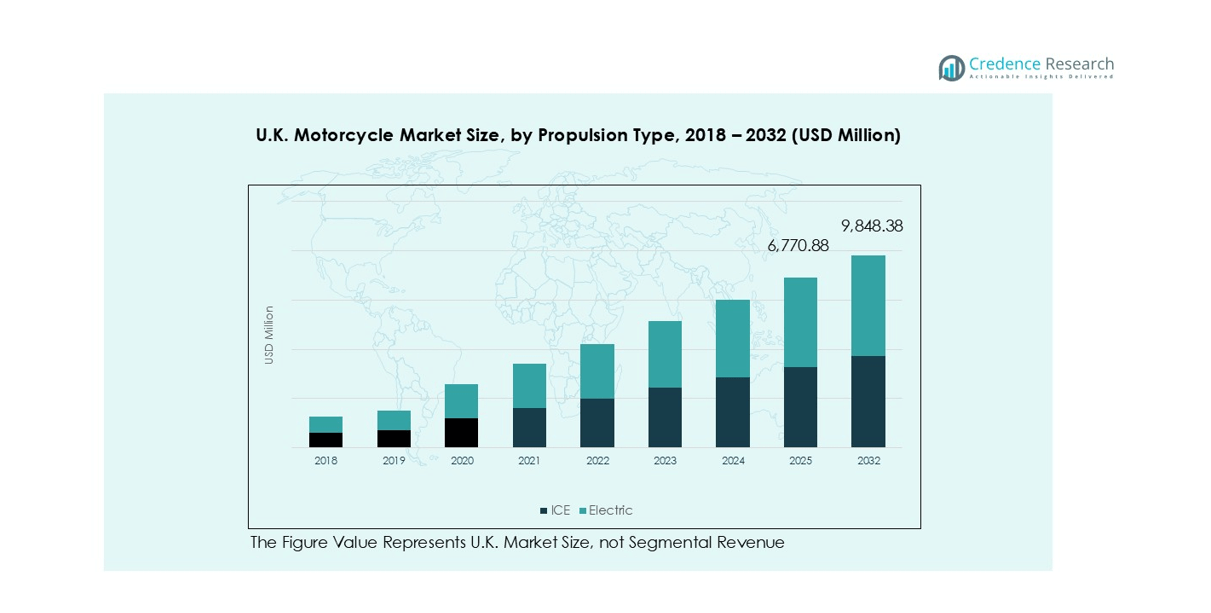

The U.K. Motorcycle Market size was valued at USD 4,876.98 million in 2018, increased to USD 6,445.26 million in 2024, and is anticipated to reach USD 9,848.38 million by 2032, growing at a CAGR of 5.34% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.K. Motorcycle Market Size 2024 |

USD 6,445.26 million |

| U.K. Motorcycle Market, CAGR |

5.34% |

| U.K. Motorcycle Market Size 2032 |

USD 9,848.38 million |

The U.K. Motorcycle Market is led by prominent manufacturers such as Triumph Motorcycles Ltd., BMW AG, Ducati Motor Holding S.p.A., Harley-Davidson Inc., KTM AG, Piaggio Group, Peugeot Motorcycles, Polaris Inc., Ariel Motor Company, and BSA Motorcycles. These companies compete through innovation, advanced safety technologies, and strong brand positioning across various motorcycle categories. Triumph and BMW dominate the premium and touring segments, while Piaggio and Peugeot maintain a solid presence in commuter and urban mobility models. Regionally, England holds the leading position with a 72% market share, driven by high urban population density, robust dealership networks, and strong consumer demand for both standard and electric motorcycles.

Market Insights

- The U.K. Motorcycle Market was valued at USD 6,445.26 million in 2024 and is projected to reach USD 9,848.38 million by 2032, growing at a CAGR of 5.34% during 2025–2032.

- Market growth is driven by rising urban mobility needs, affordability, and increasing demand for fuel-efficient commuting solutions, especially among younger and mid-income consumers.

- Emerging trends include the adoption of electric motorcycles, technological advancements such as IoT connectivity, and the growing popularity of premium and adventure models for leisure riding.

- The market is moderately consolidated, with key players like Triumph, BMW, Ducati, Harley-Davidson, KTM, and Piaggio competing through innovation, product range, and heritage branding.

- England dominates with 72% of the market share, followed by Scotland (12%), Wales (9%), and Northern Ireland (7%), while the Standard motorcycle segment leads with 41%, driven by practicality and cost-efficiency across major urban regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Motorcycle Type

The Standard motorcycle segment dominates the U.K. market, accounting for nearly 41% of total revenue. Its popularity stems from affordability, practicality, and suitability for daily commuting and leisure use. Riders prefer standard bikes for their balanced ergonomics, moderate power, and easy handling. Sports bikes follow with a 20% share, driven by performance-seeking enthusiasts and young riders, while Cruiser and Touring models together contribute about 25%, supported by demand for comfort and long-distance travel. The “Others” category, including adventure and off-road bikes, continues to gain traction due to growing interest in multi-terrain riding.

- For instance, Google through partnerships with firms like Accenture, is actively expanding its cloud architecture teams, focusing on secure cloud solutions deployment for public sector clients.

By Propulsion Type

The Internal Combustion Engine (ICE) segment remains the clear leader with around 96% market share, supported by established fuel infrastructure, wide model variety, and strong consumer familiarity. ICE motorcycles are preferred for their power, range, and lower upfront costs compared to electric variants. Meanwhile, the Electric motorcycle segment, though holding just 4%, is expanding rapidly. Government incentives, tightening emission norms, and improvements in battery performance are encouraging adoption, especially in urban commuting and eco-friendly transportation solutions.

- For instance, Stark Future reached its first profitable quarter in 2025, driven by strong demand for its electric motocross and enduro models like the Stark VARG.

By Engine Capacity

Motorcycles with up to 200cc engines dominate the U.K. market with an estimated 50% share, owing to affordability, fuel efficiency, and suitability for entry-level and commuter riders. The 200cc to 400cc category follows with about 25%, attracting riders seeking balanced performance and manageable power for both city and highway use. Mid-range models between 400cc and 800cc hold nearly 12%, favored by leisure riders, while the above 800cc segment (around 8%) represents the premium niche, driven by touring and performance-focused consumers seeking advanced features and superior engineering.

Key Growth Drivers

Rising Urban Commuting and Fuel Efficiency Demand

The growing need for affordable and fuel-efficient transportation in congested urban areas is a major driver of the U.K. motorcycle market. With rising fuel prices and parking limitations, motorcycles offer a cost-effective and time-saving mobility option. Consumers increasingly prefer two-wheelers for short commutes, supported by the expansion of low-emission zones in major cities. Manufacturers are introducing compact, lightweight models with better mileage and performance, further strengthening the role of motorcycles as practical urban mobility solutions in the U.K.

- For instance, Yamaha launched the XSR 125 in the U.K. with a Euro 5+ engine, combining 14.8 bhp with modern emissions standards, tailored for city commuting and fuel efficiency.

Technological Advancements and Product Innovation

Continuous innovation in motorcycle design and technology is driving market expansion. British and European manufacturers are focusing on advanced safety features such as ABS, traction control, and connectivity tools, enhancing rider safety and convenience. Integration of smart systems like GPS navigation, Bluetooth-enabled dashboards, and AI-based diagnostics is improving user experience. Additionally, electric motorcycle development and battery efficiency advancements are transforming the product landscape, enabling manufacturers to attract environmentally conscious consumers while meeting evolving emission standards.

- For instance, Harley-Davidson’s Pan America 1250 Special includes cornering ABS, traction control, electronically linked braking, and drag torque slip control, offering enhanced braking stability and control on slippery surfaces.

Growing Popularity of Recreational and Premium Motorcycles

An increasing preference for leisure riding and long-distance touring is boosting demand for premium and adventure motorcycles. The rise in disposable income, coupled with a growing motorcycle culture across the U.K., is fueling interest in cruiser, touring, and sport bikes. Motorcycle clubs, weekend touring events, and lifestyle branding by leading manufacturers are encouraging enthusiasts to upgrade to high-performance models. This recreational shift is significantly contributing to overall revenue growth, especially in the mid- to high-capacity engine segments.

Key Trends and Opportunities

Expansion of Electric Motorcycle Segment

The electric motorcycle segment presents a promising growth opportunity, supported by strong government incentives for zero-emission vehicles and the U.K.’s 2035 ban on new ICE vehicle sales. Improved battery technology, reduced charging times, and lower operating costs are attracting environmentally conscious buyers. Manufacturers are investing in R&D to develop affordable, high-performance e-bikes for urban mobility. Partnerships between automakers and energy providers for charging infrastructure expansion are also accelerating adoption and shaping a more sustainable future for the market.

- For instance, PURE EV partnered with Arva Electric to supply up to 50,000 electric motorcycles over two years for Middle Eastern and African markets, supporting expansion of sustainable mobility in emerging regions.

Emergence of Connected and Smart Motorcycles

The integration of digital technologies is redefining the motorcycle experience in the U.K. market. Connected motorcycles equipped with IoT sensors, telematics, and advanced infotainment systems enhance safety, navigation, and real-time diagnostics. Riders benefit from smartphone connectivity, over-the-air updates, and predictive maintenance features. These advancements not only improve user satisfaction but also open new revenue streams through software and subscription services. As consumers increasingly seek convenience and connectivity, smart motorcycles are emerging as a key growth frontier.

- For instance, RGNT Electric Motorcycles uses Telenor IoT to deliver global connectivity, enabling over-the-air (OTA) software updates, GPS tracking, keyless operation, and real-time battery analytics, enhancing rider convenience and vehicle maintenance.

Key Challenges

High Initial Costs and Affordability Concerns

Despite growing interest, high purchase prices of motorcycles—especially electric and premium models—remain a significant barrier. The initial cost of advanced technology, safety features, and battery systems limits accessibility for budget-conscious buyers. Moreover, inflationary pressures and rising interest rates further constrain consumer purchasing power. Manufacturers face the challenge of balancing innovation with affordability to appeal to a broader audience while maintaining profit margins and competitive pricing in a cost-sensitive market.

Regulatory Uncertainty and Emission Compliance

The U.K.’s evolving regulatory environment poses challenges for motorcycle manufacturers. Stricter emission standards, upcoming bans on ICE vehicles, and complex certification requirements increase compliance costs and production timelines. Smaller manufacturers struggle to adapt to frequent policy changes, while electric infrastructure gaps hinder rapid adoption of e-bikes. Balancing sustainability goals with operational feasibility remains difficult, compelling companies to rethink strategies, invest in cleaner technologies, and manage transitions without disrupting existing market stability.

Regional Analysis

England

England dominates the U.K. motorcycle market, capturing around 72% of total market share. The region’s dominance is attributed to its dense urban population, strong commuting demand, and a well-established dealer network. Major cities such as London, Birmingham, and Manchester exhibit high motorcycle adoption for daily travel, supported by fuel efficiency and flexible parking options. The growing interest in electric and premium motorcycles further strengthens England’s position. Additionally, government initiatives promoting low-emission mobility and the presence of key manufacturers contribute significantly to sustained market growth across both commuter and leisure segments.

Scotland

Scotland accounts for 12% of the U.K. motorcycle market, driven by increasing recreational riding and tourism activities. The country’s scenic routes, such as the North Coast 500, attract touring and adventure motorcyclists, boosting demand for mid- and high-capacity bikes. Rising environmental awareness and improving electric charging infrastructure are encouraging gradual adoption of e-motorcycles. Urban centres like Glasgow and Edinburgh support commuter demand, while rural regions prefer touring and adventure models. Growing consumer interest in sustainable transportation and the appeal of long-distance riding continue to support market expansion in Scotland.

Wales

Wales holds 9% of the U.K. motorcycle market, supported by a growing leisure riding culture and expanding infrastructure. The region’s mountainous terrains and scenic landscapes make it a popular destination for sport and touring motorcycles. Rising tourism and motorcycling events also contribute to higher sales in the cruiser and adventure segments. Urban demand remains moderate but steady, as motorcycles provide a practical commuting alternative. Government-backed emission reduction programmes and consumer awareness of electric vehicles are expected to further enhance motorcycle adoption, particularly in the lightweight and electric categories.

Northern Ireland

Northern Ireland represents 7% of the U.K. motorcycle market, characterized by steady growth in commuter and recreational segments. The market benefits from expanding motorcycle ownership among younger riders and the growing influence of European brands. Cities like Belfast witness rising demand for affordable and fuel-efficient motorcycles suited for urban mobility. Additionally, the popularity of weekend touring and cross-border riding experiences supports sales of premium and mid-capacity motorcycles. Although smaller in size, Northern Ireland shows increasing potential through infrastructure development and gradual interest in electric mobility solutions.

Market Segmentations:

By Motorcycle Type:

- Standard

- Sports

- Cruiser

- Touring

- Others

By Propulsion Type:

- Internal Combustion Engine (ICE)

- Electric

By Engine Capacity:

- Up to 200cc

- 200cc to 400cc

- 400cc to 800cc

- More than 800cc

By Region

- England

- Scotland

- Wales

- Northern Ireland

Competitive Landscape

The competitive landscape of the U.K. Motorcycle Market is defined by the presence of major players such as Triumph Motorcycles Ltd., BMW AG, Ducati Motor Holding S.p.A., Harley-Davidson Inc., KTM AG, Piaggio Group, Polaris Inc., Peugeot Motorcycles, Ariel Motor Company, and BSA Motorcycles. The market remains moderately consolidated, with established brands competing through innovation, design differentiation, and brand loyalty. Triumph and BMW lead the premium segment, emphasizing advanced technology and rider safety features, while Piaggio and Peugeot dominate the commuter category with cost-efficient models. Increasing focus on electric mobility has encouraged brands like BMW and Harley-Davidson to expand their electric portfolios. Domestic manufacturing strength, strong distribution networks, and heritage branding contribute to sustained competitiveness. Companies are also adopting digital engagement strategies, dealer partnerships, and product diversification to strengthen market presence. Continuous R&D investments, strategic alliances, and launches of hybrid and electric motorcycles are reshaping competition and aligning with the U.K.’s transition toward sustainable mobility.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Polaris Inc.

- Peugeot

- Ariel Motor Company Limited

- Triumph Motorcycles Ltd

- Ducati Motor Holding S.p.A.

- KTM AG

- Bayerische Motoren Werke (BMW) AG

- Harley-Davidson, Inc.

- Piaggio Group

- BSA Motorcycles

- Other Key Players

Recent Developments

- In October 2025, Hero MotoCorp entered the U.K. market through a partnership with MotoGB Ltd., introducing its Euro 5+ motorcycle lineup led by the Hunk 440 model.

- In April 2025, Ultraviolette Automotive collaborated with MotoMondo to expand into the U.K. and Benelux regions, launching the F77 MACH 2 RECON electric motorcycle.

- In September 2025, Royal Enfield’s UK division formed a partnership with the British Army to supply four Himalayan 450 motorcycles for its Motorised Adventure unit.

- In September 2025, UK e-motorbike startup Maeving secured £8 million in investment to expand production, international sales, and develop new models

Report Coverage

The research report offers an in-depth analysis based on Motorcycle Type, Propulsion Type, Engine Capacity and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The U.K. motorcycle market is expected to witness steady growth driven by rising urban mobility needs and lifestyle riding trends.

- Electric motorcycles will gain significant traction as battery technology improves and charging infrastructure expands.

- Government initiatives supporting zero-emission transport will accelerate the shift toward electric and hybrid motorcycles.

- Premium and adventure bike segments will continue to grow, fueled by increasing recreational and touring activities.

- Technological integration such as IoT connectivity, smart dashboards, and safety assist systems will enhance user experience.

- Domestic manufacturers will strengthen their positions through innovation and heritage branding.

- Younger consumers will drive demand for affordable, fuel-efficient, and lightweight motorcycles for daily commuting.

- Partnerships between OEMs and tech firms will shape future product development and digital retail strategies.

- Aftermarket services, customization, and accessories will emerge as key revenue contributors.

- Overall market dynamics will favor sustainable, connected, and performance-oriented motorcycles across all segments.