Market Overview:

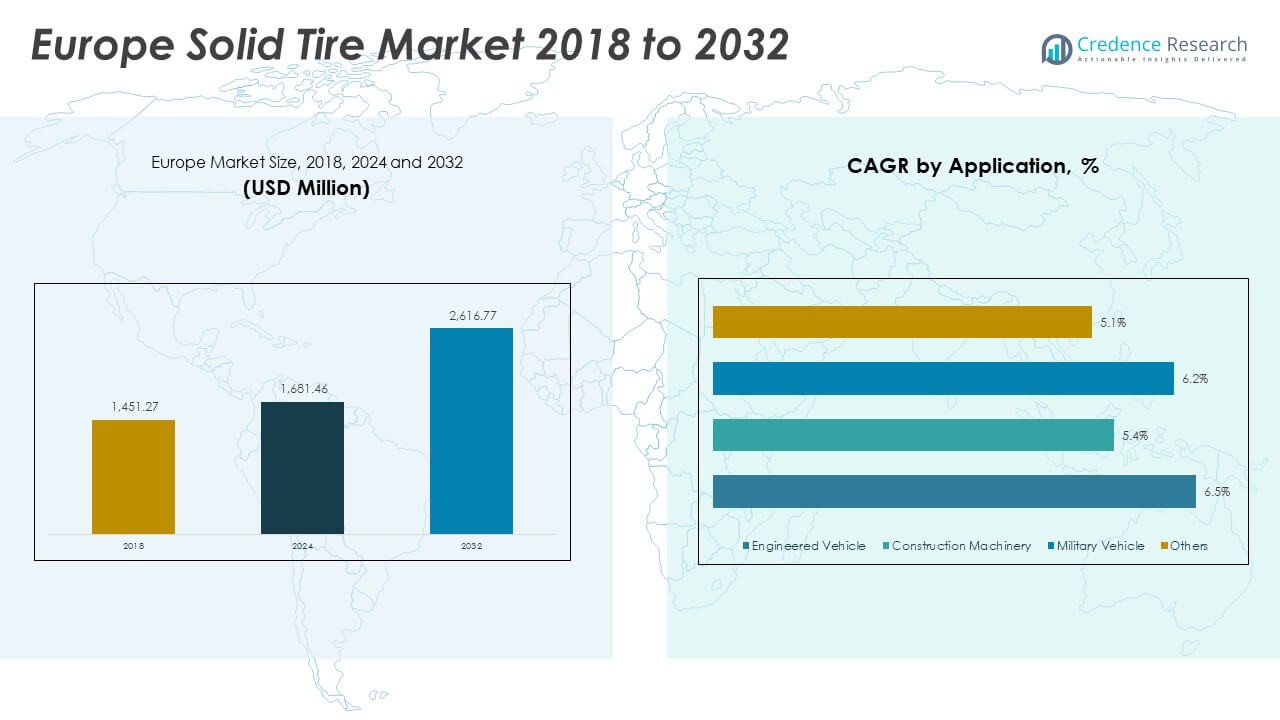

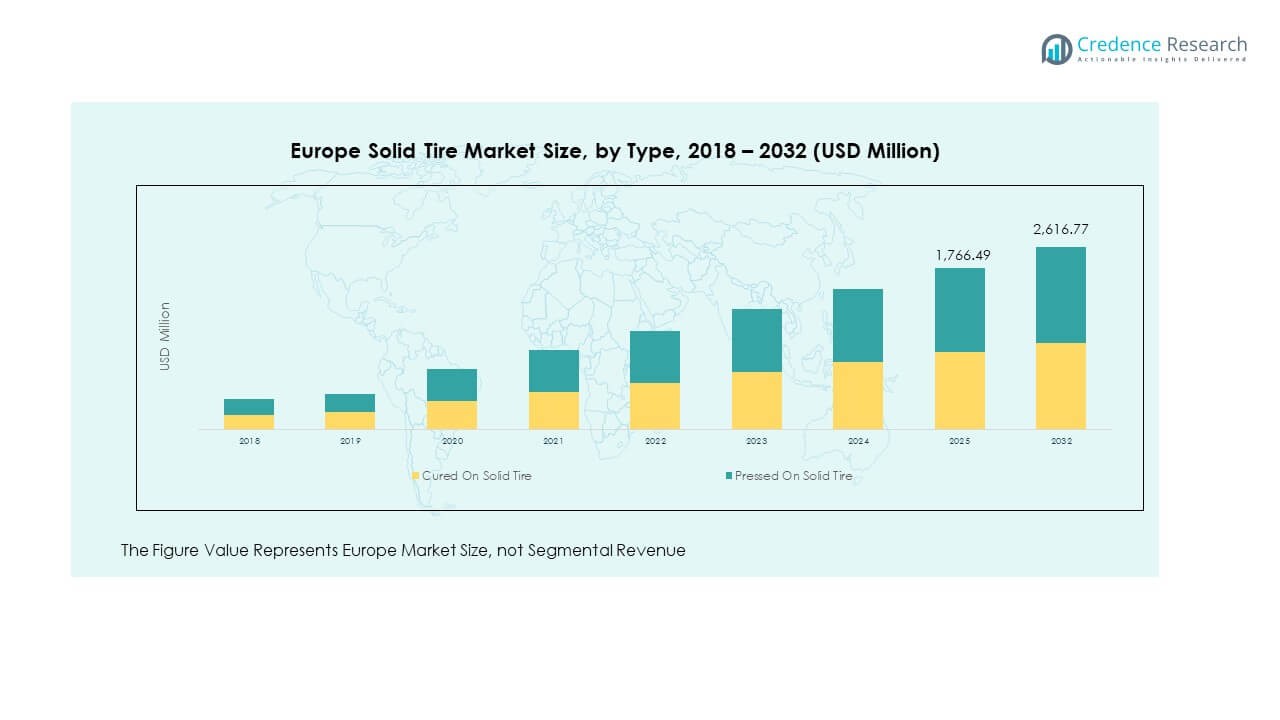

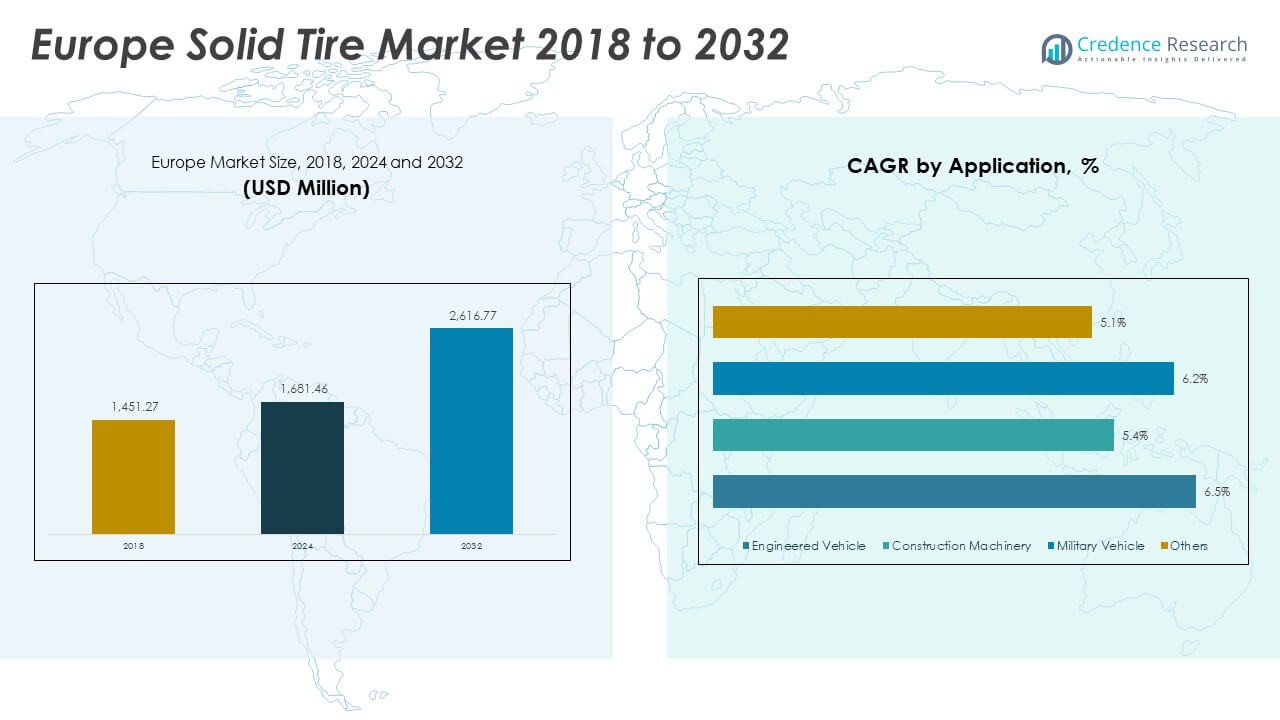

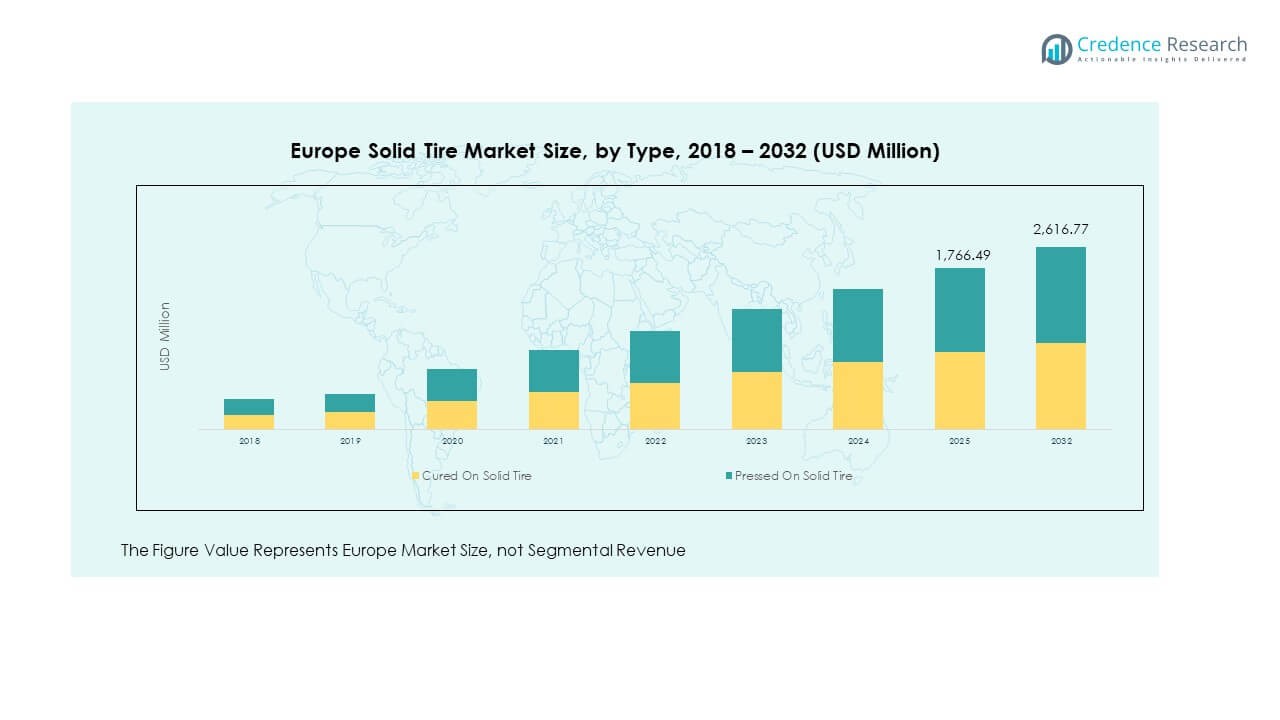

The Europe Solid Tire Market size was valued at USD 1,451.27 million in 2018 to USD 1,681.46 million in 2024 and is anticipated to reach USD 2,616.77 million by 2032, at a CAGR of 5.80% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Solid Tire Market Size 2024 |

USD 1,681.46 Million |

| Europe Solid Tire Market, CAGR |

5.80% |

| Europe Solid Tire Market Size 2032 |

USD 2,616.77 Million |

The market is driven by the rising need for solid tires in construction, logistics, and material handling. Solid tires offer puncture resistance, stability, and longer lifespan, making them essential for forklifts, yard tractors, and other heavy vehicles. Companies are prioritizing operational efficiency and cost optimization, which enhances demand for durable and low-maintenance tire solutions. Growing urbanization and infrastructure development projects across Europe also create steady opportunities for adoption.

Regionally, Western Europe leads the market due to advanced industrial sectors, strong construction activity, and high logistics demand in countries like Germany, France, and the UK. Eastern Europe shows emerging potential as investments in infrastructure and manufacturing rise. Southern Europe contributes with moderate growth, while Northern Europe emphasizes adoption through advanced technology integration. Together, these regions shape a competitive and evolving market landscape.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Europe Solid Tire Market was valued at USD 1,451.27 million in 2018, reached USD 1,681.46 million in 2024, and is expected to hit USD 2,616.77 million by 2032, growing at a CAGR of 5.80%.

- Western Europe held the largest share at around 40%, driven by industrial strength in Germany, France, and the UK.

- Southern Europe contributed nearly 22%, supported by infrastructure and construction growth, while Eastern Europe accounted for 18% due to rising industrialization.

- Asia Pacific is the fastest-growing region with about 25% share, fueled by manufacturing expansion, logistics growth, and large-scale construction projects.

- Cured On Solid Tires captured approximately 57% of the market in 2024, while Pressed On Solid Tires held 43%, reflecting steady adoption in cost-sensitive and mid-scale applications.

Market Drivers:

Rising Industrial Automation and Logistics Infrastructure Expansion:

The Europe Solid Tire Market benefits from the growing demand for robust tire solutions in industrial automation and logistics infrastructure. Warehouses, ports, and distribution centers prefer solid tires due to their ability to withstand heavy loads and frequent use. Forklifts, tow tractors, and reach stackers require durability and puncture resistance, making solid tires an attractive choice. Increasing investment in e-commerce and trade expansion supports this demand. It is evident that industries are shifting toward efficiency and cost reduction. This trend continues to expand tire demand across manufacturing and logistics.

- For instance, Bridgestone has developed an air-free tire technology, known as the “Air Free Concept,” featuring a proprietary design with high-strength, flexible thermoplastic resin spokes and reinforced tread. This technology eliminates the risk of punctures and the need for air pressure maintenance, making it suitable for high-volume automated vehicle applications, such as ultra-compact electric vehicles used for short-distance transport.

Growing Use in Construction and Infrastructure Development Projects:

Construction activities across Europe drive solid tire adoption due to high resistance to damage. The market thrives on demand from equipment like loaders, construction machinery, and compact vehicles. Solid tires provide long service life in harsh conditions, making them more suitable than pneumatic alternatives. Large-scale urbanization projects create a continuous cycle of demand for such equipment. Governments investing in road and building projects increase the requirement for durable tires. It helps reduce downtime and maintenance costs. This advantage enhances market penetration across the construction ecosystem.

- For instance, Michelin’s Carbion technology uses an innovative liquid blending process to create a more uniform compound for increased tire longevity, while its Forcion technology incorporates a reinforcing agent to enhance mileage and abrasion resistance, particularly for heavy-duty commercial applications.

Rising Adoption in Military and Defense Applications:

Military vehicles and specialized defense equipment prefer solid tires for operational reliability in challenging terrains. The Europe Solid Tire Market gains traction as armies prioritize readiness and durability over speed. Defense agencies are investing in vehicles fitted with tires that resist punctures and harsh impact. Solid tires deliver steady performance under extreme conditions, enhancing mobility for military fleets. Modernization of defense vehicles adds further opportunity for market expansion. It is clear that defense budgets across Europe are reinforcing demand for reliable solid tire applications.

Growing Sustainability Focus and Reduction in Maintenance Costs:

The focus on sustainability encourages adoption of solid tires due to their long life and recyclability. Companies seek options that reduce replacement frequency and waste generation. The Europe Solid Tire Market aligns with sustainability targets set by industries. Solid tires also provide cost advantages by reducing downtime and maintenance efforts. Fleet operators view them as a long-term cost-saving measure. This shift supports adoption across diverse applications, from logistics to agriculture. It becomes clear that efficiency and sustainability are shaping industry-wide tire procurement strategies.

Market Trends:

Increasing Shift Toward Non-Marking Solid Tires in Warehouses:

A key trend in the Europe Solid Tire Market is the growing adoption of non-marking solid tires in warehouses. These tires prevent floor damage and stains, which is crucial for food, pharmaceuticals, and sensitive industries. Operators prefer them for maintaining hygiene and safety standards. This trend aligns with the expansion of clean logistics operations. It helps ensure compliance with strict safety requirements in regulated sectors. Manufacturers are responding by offering a broader range of non-marking tire variants. It is a clear indication of shifting demand dynamics in specialized applications.

- For instance, non-marking solid tires are a significant segment of the forklift tire market in Europe, highlighting their critical role in clean logistics operations. The market is experiencing strong growth, driven by manufacturers expanding product ranges to meet increasingly stringent safety and cleanliness regulations.

Technological Advancements in Tire Design and Material Innovation:

Innovation in materials and design enhances tire durability, comfort, and efficiency. The Europe Solid Tire Market benefits from improvements in rubber compounds and structure. Advanced engineering reduces vibration and increases vehicle stability. Smart tire designs focus on balancing performance with reduced rolling resistance. Companies are investing in R&D to deliver premium tire solutions. It provides competitive advantage while addressing industry-specific needs. This continuous evolution reinforces adoption across varied sectors, from logistics to military. It signals long-term market maturity supported by technological innovation.

- For instance, emerging smart tire systems with real-time monitoring capabilities have cut unplanned downtime by up to 15% in automated warehouse fleets through predictive maintenance. Smart monitoring platforms enable early detection of wear and pressure issues, optimizing tire life and fleet uptime.

Growing Customization for Industry-Specific Applications:

Customization is emerging as a strong trend, with tires designed for specific industrial uses. The Europe Solid Tire Market reflects this shift as customers demand tailored features. Construction, logistics, and mining require different load capacities and resilience. Manufacturers are offering segmented product lines that match operational demands. It creates differentiation in a competitive landscape. Customers are more inclined toward specialized solutions for their equipment. It is expected that customization will define future product development. The trend ensures long-term relevance for solid tire suppliers in Europe.

Integration of Smart Monitoring and IoT-Enabled Tires:

Smart monitoring technologies are influencing the tire industry globally. The Europe Solid Tire Market witness’s early adoption of IoT-enabled solid tires. These solutions provide real-time insights on wear, load distribution, and maintenance needs. It enhances operational efficiency and safety across fleets. Companies investing in predictive maintenance benefit from these advancements. It helps reduce costs while extending tire lifespan. Manufacturers are partnering with tech providers to deliver integrated solutions. This trend aligns with Europe’s broader push toward smart and digitalized industrial operations.

Market Challenges Analysis:

High Initial Cost of Solid Tires Limits Wider Adoption:

The Europe Solid Tire Market faces challenges due to the higher upfront cost of solid tires compared to pneumatic alternatives. Many small operators hesitate to adopt them despite long-term savings. It creates barriers in price-sensitive industries and small-scale businesses. Budget constraints in SMEs reduce willingness to invest in premium tire solutions. This limits the penetration rate across emerging sectors. The cost gap between conventional and solid tires continues to shape buyer decisions. It is a key restraint that companies must address through financing or flexible models.

Limited Comfort and Ride Quality Restrict Certain Applications:

Ride quality and comfort present another restraint in the Europe Solid Tire Market. Vehicles fitted with solid tires experience more vibration and stiffness. It reduces suitability for certain applications requiring smoother rides. Operators often prioritize comfort in environments with long operating hours. This limits adoption in passenger-related or sensitive transport uses. Companies are investing in design innovation to mitigate these issues. It demonstrates that product refinement remains essential for broader acceptance. The challenge persists, influencing how industries perceive the suitability of solid tires.

Market Opportunities:

Expanding Demand in Emerging Eastern European Economies:

The Europe Solid Tire Market has significant opportunity in Eastern Europe. Infrastructure development and industrialization are gaining pace in countries like Poland and Romania. Manufacturing hubs and construction projects create demand for heavy-duty vehicles. These vehicles rely heavily on solid tires for durability. It is evident that emerging economies can reshape the demand landscape. This opportunity positions suppliers to expand networks and capture long-term growth. Strategic partnerships in these regions provide competitive advantages to key players.

Integration of Advanced Materials and Eco-Friendly Designs:

Another opportunity comes from eco-friendly materials and sustainable tire designs. The Europe Solid Tire Market aligns with Europe’s strict environmental policies. Companies can focus on recyclable compounds and low-carbon manufacturing. It enhances brand value while meeting regulations. Eco-friendly designs provide cost benefits for customers over time. Innovation in materials creates differentiation for tire manufacturers. It is a forward-looking strategy that ensures competitive advantage in the regional market. This opportunity is expected to attract higher investments in R&D initiatives.

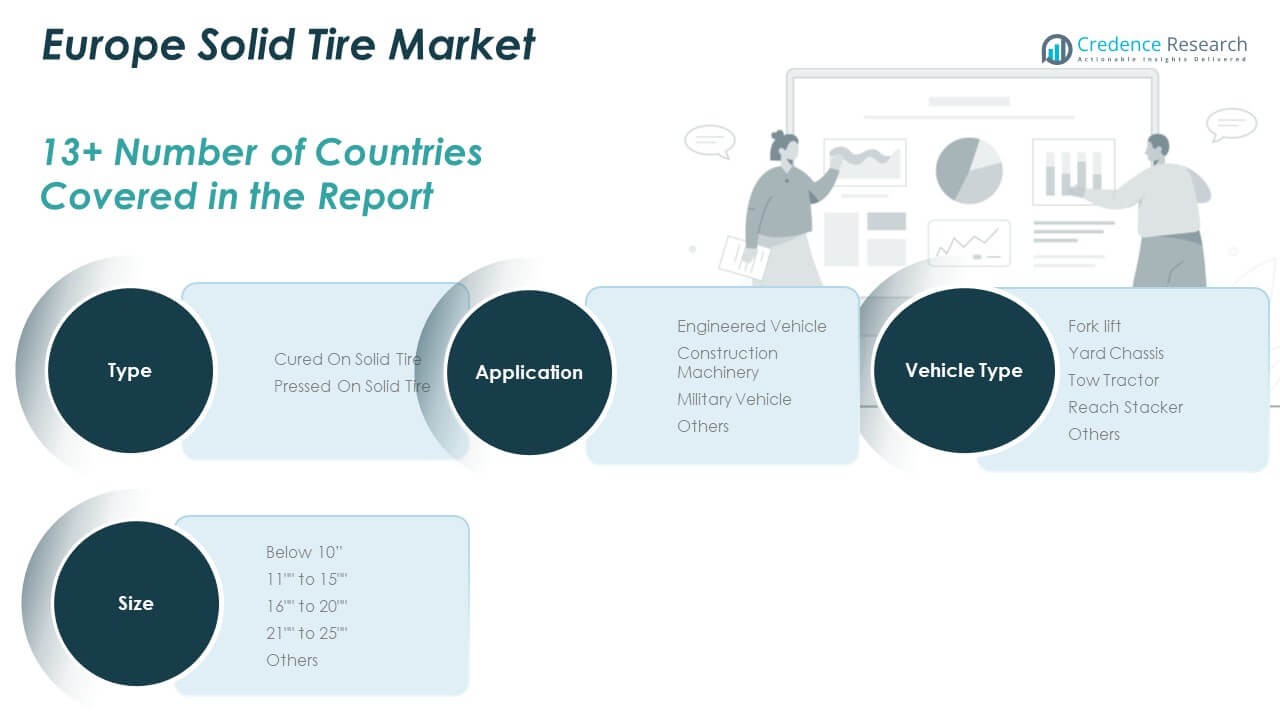

Market Segmentation Analysis:

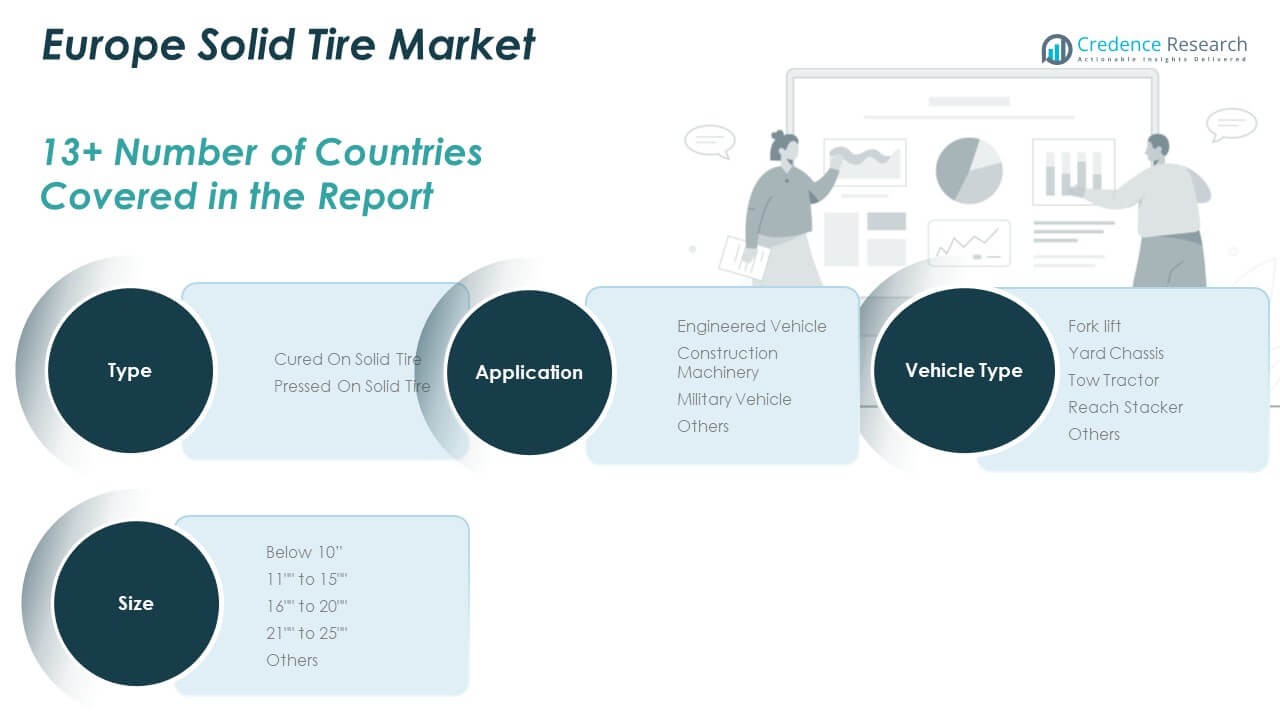

By Type

The Europe Solid Tire Market is divided into cured-on and pressed-on solid tires. Cured-on tires dominate due to their superior durability and strong use in industrial machinery. Pressed-on variants gain traction in cost-sensitive applications, particularly in mid-sized warehouses and smaller fleets.

- For example, Continental’s Super Elastic solid tires, manufactured with sustainable materials like recovered carbon black, offer enhanced abrasion resistance and a long service life while reducing the use of fossil raw materials. A 2023 report did indicate that the “cured-on” segment, a type of solid tire, held a significant market share within a specific industrial tire market, aligning with the industry’s focus on low-maintenance and robust tire solutions.

By Application

Construction machinery and engineered vehicles lead application demand, supported by infrastructure development and industrial growth. Military vehicles form a growing niche, with solid tires chosen for durability under extreme conditions. The “others” category includes smaller applications across agriculture and compact industrial equipment.

By Size

Mid-sized categories, particularly 11” to 15” and 16” to 20”, hold the largest market share, driven by their use in forklifts and yard vehicles. Below 10” serves smaller machinery, while larger sizes above 21” dominate in heavy construction and military vehicles.

By Vehicle Type

Forklifts remain the leading vehicle type segment, reflecting their widespread use in logistics and warehousing. Yard chassis and tow tractors also support demand in ports and industrial sites. Reach stackers contribute significantly in shipping and logistics hubs, expanding the specialized application base.

Segmentation:

- By Type

- Cured On Solid Tire

- Pressed On Solid Tire

- By Application

- Engineered Vehicle

- Construction Machinery

- Military Vehicle

- Others

- By Size

- Below 10”

- 11” to 15”

- 16” to 20”

- 21” to 25”

- Others

- By Vehicle Type

- Forklift

- Yard Chassis

- Tow Tractor

- Reach Stacker

- Others

- By Country

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

Regional Analysis:

Europe Solid Tire Market Regional Analysis

Western and Northern Europe: Mature Markets with High Industrial Demand

Germany, the United Kingdom, and France dominate the Western Europe solid tire sector due to strong industrial bases and advanced manufacturing. Germany holds a significant market share, driven by its robust logistics, construction, and material handling industries. It relies on solid tires for superior durability and minimal maintenance downtime in industrial applications. The UK and France also represent mature markets with high demand for solid tires, particularly for forklifts and other equipment in material handling and construction. The Nordic countries demonstrate strong demand for green and digital technologies, influencing the solid elastic tire segment. These markets align with strict environmental and safety regulations, pushing innovation towards sustainable and high-efficiency products.

Eastern and Southern Europe: Growing Markets with Infrastructure Investment

Central and Eastern European countries are gaining traction in the solid tire market due to cost-effective production and rising investment in infrastructure and logistics. This region, including Russia, presents a growing niche for durable tire solutions. Southern Europe, including Italy and Spain, shows potential with robust construction and material handling activity, although market maturity differs from their western counterparts. Italy’s strong automotive industry and Spain’s construction sector contribute to a steady demand for high-performance industrial tires. The demand for solid elastic tires is a key driver across this region, linked to expanding e-commerce and warehousing sectors.

Factors Shaping the Regional Landscape

The Europe Solid Tire Market reflects varying regional drivers and market conditions. Western Europe’s stability rests on technological advancements and a well-established industrial infrastructure. Central and Eastern Europe present opportunities linked to infrastructure development and improving supply chains. Southern European markets continue to develop, with demand influenced by specific industrial sectors and increasing investment. Overall, regulatory frameworks focused on sustainability and safety influence market dynamics across the entire continent, encouraging the adoption of durable and environmentally friendly solid tire solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- CAMSO (Michelin)

- Continental AG

- Trelleborg AB (Sweden)

- Global Rubber Industries

- Maxam Tire

- Tube & Solid Tire

- Yantai Balsanse Rubber Co., Ltd

Competitive Analysis:

The Europe Solid Tire Market is highly competitive with established global and regional players. Companies like Michelin (CAMSO), Continental, and Trelleborg dominate through extensive product portfolios and strong distribution networks. Local and specialized manufacturers enhance competition by serving niche demands. The market reflects strategies such as acquisitions, partnerships, and technology-driven product innovation. It is observed that sustainability, durability, and efficiency remain key differentiation factors. Continuous investments in R&D secure long-term positioning for leading companies.

Recent Developments:

- In September 2025, Michelin completed the sale of its Camso brand and Sri Lanka manufacturing plants to India-based CEAT, marking a strategic shift. The acquisition allows CEAT to expand its product lines, including wheel loader tires, strengthening its position in the European solid tire market with enhanced capabilities in material handling and construction sectors.

Report Coverage:

The research report offers an in-depth analysis based on type, size, application, and vehicle type. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Strong growth expected from e-commerce logistics and warehouse automation.

- Cured-on solid tires will maintain dominance in heavy-duty applications.

- Eastern Europe will present attractive opportunities through infrastructure expansion.

- Military modernization programs will continue to boost defense demand.

- Eco-friendly material innovation will influence product development.

- Forklifts will remain the leading vehicle segment.

- Pressed-on solid tires will grow in cost-sensitive applications.

- Western Europe will sustain leadership due to industrial base strength.

- Asia Pacific competition will challenge European suppliers in exports.

- Digital and IoT-enabled tires will transform fleet operations.