Market Overview:

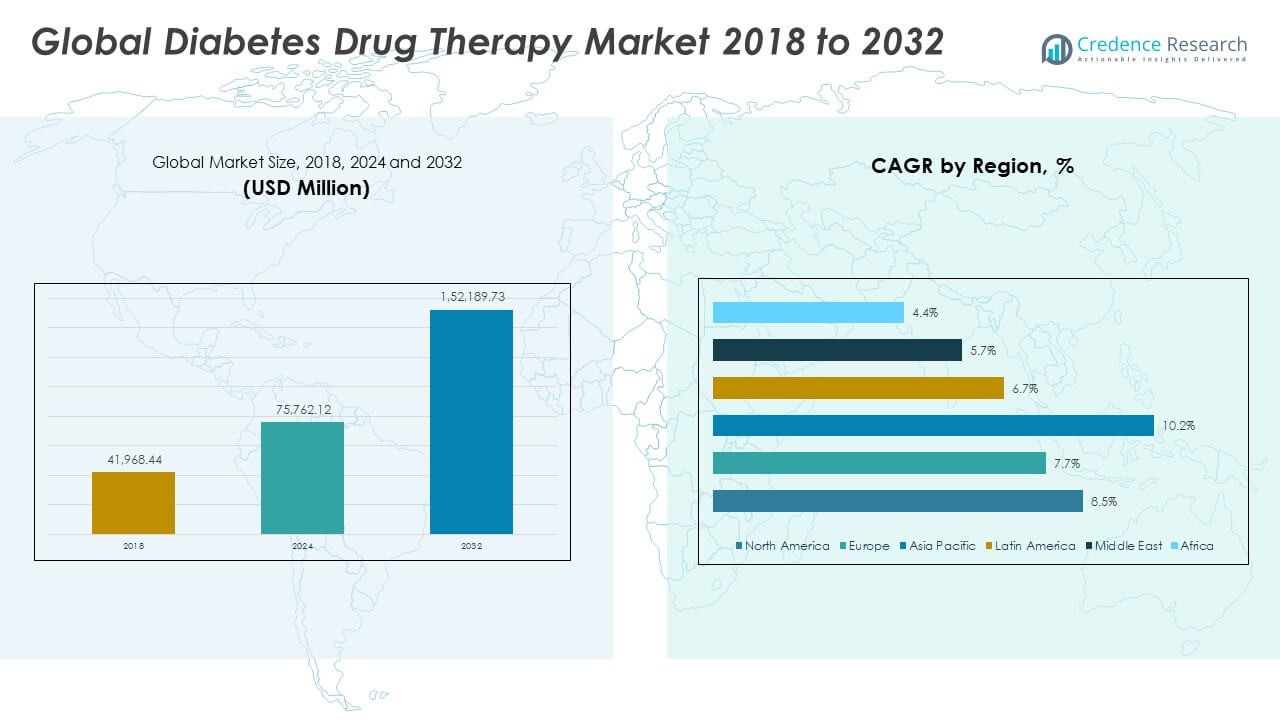

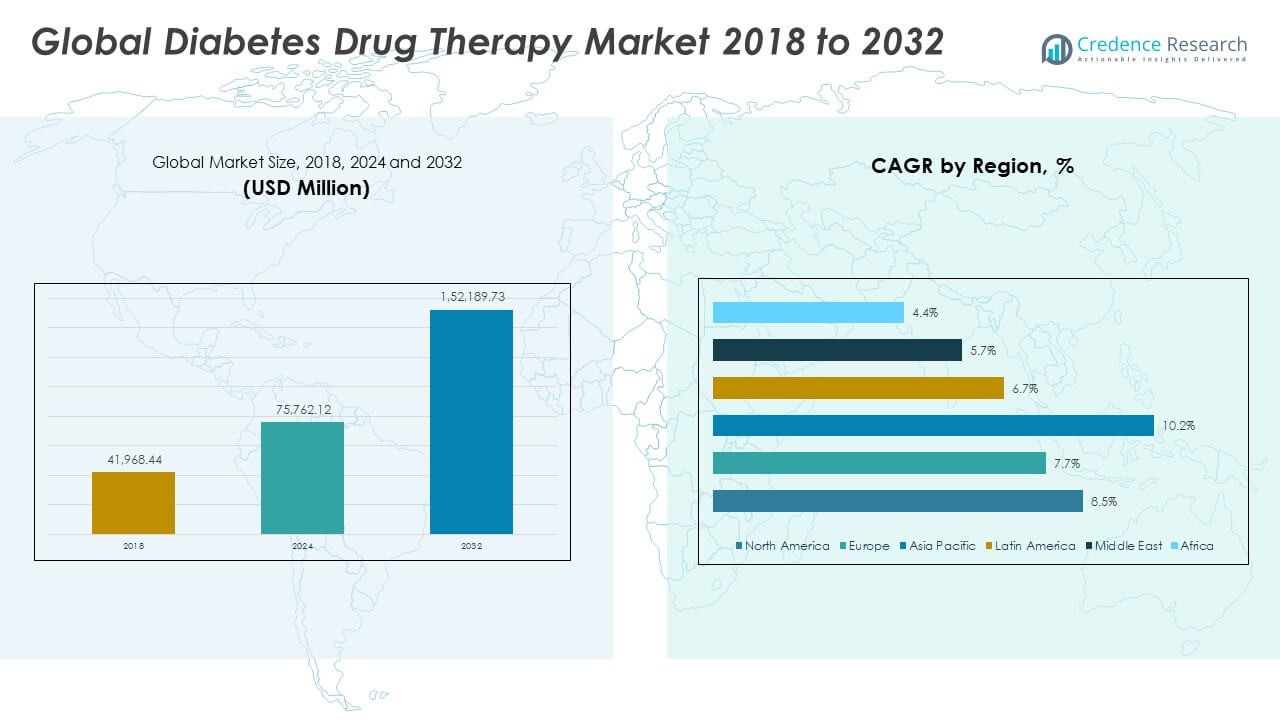

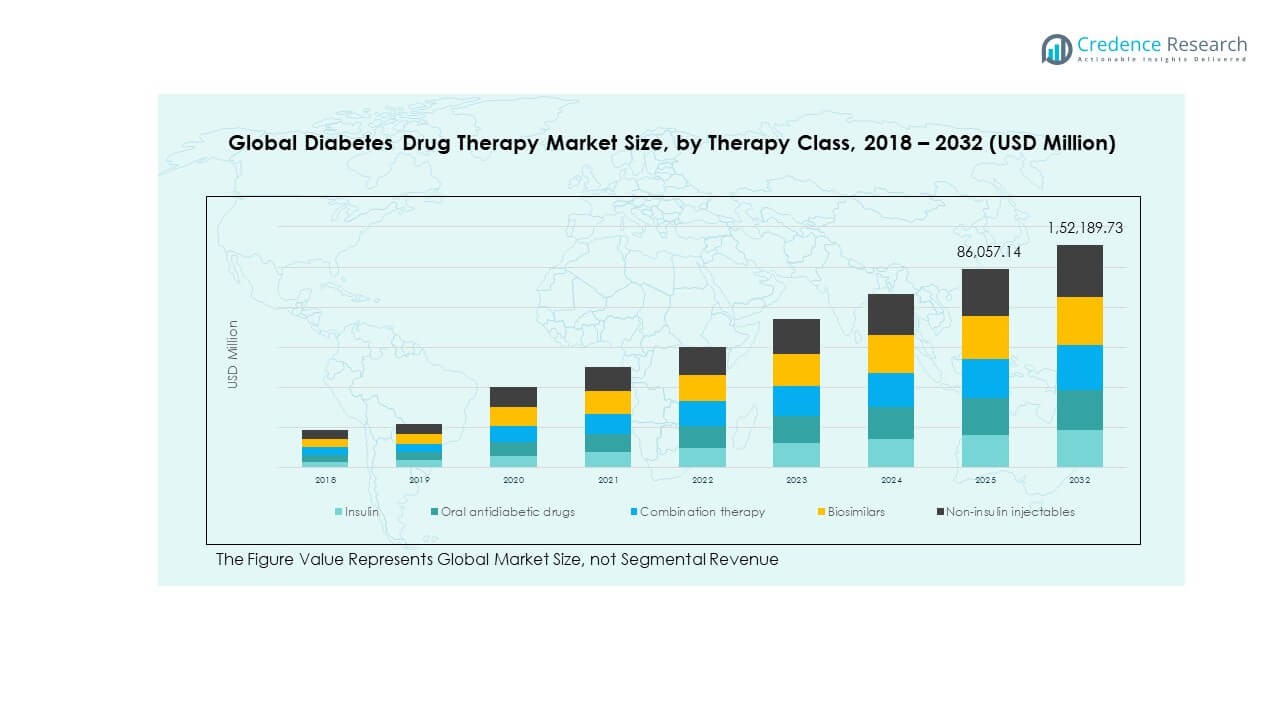

The Global Diabetes Drug Therapy Market size was valued at USD 41,968.44 million in 2018 to USD 75,762.12 million in 2024 and is anticipated to reach USD 152,189.73 million by 2032, at a CAGR of 8.49% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Diabetes Drug Therapy Market Size 2024 |

USD 75,762.12 Million |

| Diabetes Drug Therapy Market, CAGR |

8.49% |

| Diabetes Drug Therapy Market Size 2032 |

USD 152,189.73 Million |

The market is growing due to rising diabetes prevalence, an aging population, and lifestyle-related health concerns. Demand is supported by innovative drug classes such as GLP-1 receptor agonists, SGLT-2 inhibitors, and insulin analogs. Increasing awareness about early diagnosis and management is boosting prescription volumes. Strong investment in R&D and improved access to healthcare facilities in both developed and emerging economies are further driving adoption. Government initiatives for diabetes control programs also contribute to market momentum.

North America leads the Global Diabetes Drug Therapy Market due to high healthcare expenditure and strong adoption of advanced therapies. Europe follows closely with supportive reimbursement policies and increasing awareness programs. Asia Pacific is an emerging growth hub, supported by large diabetic populations in China and India, expanding healthcare access, and rising economic development. Latin America and the Middle East & Africa are witnessing steady growth, driven by improving healthcare infrastructure and government support for chronic disease management.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Global Diabetes Drug Therapy Market size was USD 41,968.44 million in 2018, rising to USD 75,762.12 million in 2024 and projected to reach USD 152,189.73 million by 2032, at a CAGR of 8.49%.

- North America holds 38% share, supported by high healthcare spending and strong adoption of advanced therapies; Europe follows with 28% due to favorable reimbursement policies; Asia Pacific holds 22%, driven by a large patient pool and expanding healthcare infrastructure.

- Asia Pacific is the fastest-growing region with 22% share, fueled by rising diabetes prevalence, urbanization, and expanding access to modern drug therapies in China and India.

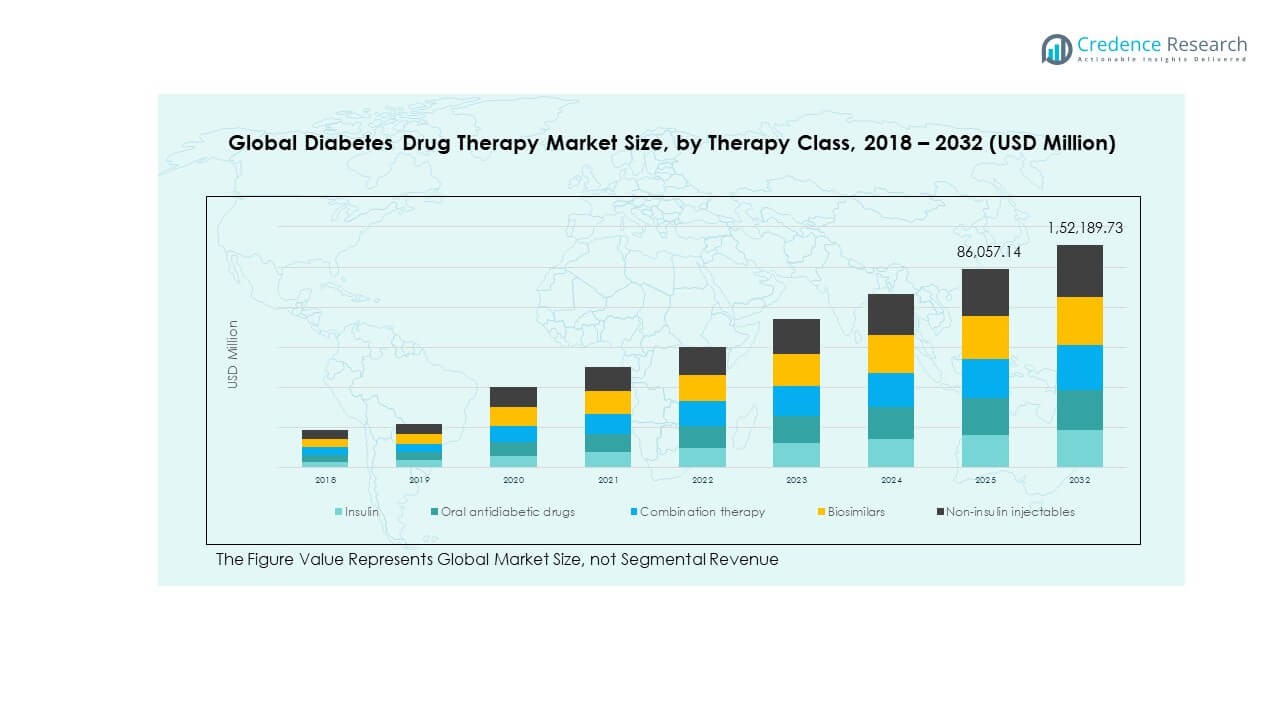

- Insulin and oral antidiabetic drugs together account for over 55% of the market share, reflecting their status as core treatment classes for diabetes management.

- Combination therapies and non-insulin injectables collectively represent around 35% of the market, indicating rising demand for more effective, multi-action treatment approaches.

Market Drivers:

Rising Prevalence of Diabetes and Lifestyle Disorders:

The Global Diabetes Drug Therapy Market is driven by a sharp rise in diabetes prevalence worldwide. Increasing obesity rates, sedentary lifestyles, and unhealthy diets fuel the demand for effective treatments. The aging population also contributes significantly to higher patient numbers requiring long-term therapy. Governments and health agencies emphasize early detection programs, creating more opportunities for timely interventions. Stronger focus on preventive healthcare accelerates prescription adoption in both developed and emerging nations. Pharmaceutical companies are investing in advanced therapies to address diverse patient needs. It benefits from technological integration in drug delivery systems that improve patient compliance. Expansion of health coverage and rising healthcare spending further strengthen the market base.

- For instance, Novo Nordisk reported that their oral semaglutide pill, developed for obesity and diabetes, has demonstrated improved patient adherence and resulted in a reduction in cardiovascular events in diabetic patients with pre-existing heart disease during clinical trials, highlighting advances in drug delivery that enhance outcomes. Expansion of health coverage and rising healthcare spending further strengthen the market base.

Innovation Pipeline Driving Growth in Advanced Therapies:

The market is supported by rapid advancements in drug development and insulin analog formulations. GLP-1 receptor agonists and SGLT-2 inhibitors deliver superior clinical outcomes, making them highly favored. Insulin analogs with improved pharmacokinetics address challenges of traditional insulin use. Biopharmaceutical research focuses on dual or triple combination therapies that improve efficacy. Continuous R&D efforts strengthen intellectual property portfolios and enhance competitive advantages. It reflects higher demand for personalized treatment regimens tailored to patient-specific responses. Strategic collaborations between pharma and biotech players expand innovation pipelines. Growing preference for biologics creates opportunities for premium-priced drugs and higher revenue streams.

- For instance, AstraZeneca’s Farxiga (dapagliflozin) was approved by the FDA for use in pediatric type 2 diabetes, based on clinical data showing significant glycemic improvements in children aged 10 and above, emphasizing the innovation in drug efficacy and safety profiles. Strategic collaborations between pharma and biotech players expand innovation pipelines.

Expanding Healthcare Access and Insurance Support:

The Global Diabetes Drug Therapy Market benefits from broadening healthcare access across emerging economies. Governments launch programs to expand diagnosis and therapy availability in rural and semi-urban areas. Insurance coverage and reimbursement policies reduce out-of-pocket costs, encouraging treatment adherence. Public health initiatives target reduction of diabetes-related complications, strengthening long-term adoption. It grows further with digital health platforms enabling prescription tracking and patient monitoring. Rising investments in healthcare infrastructure increase drug penetration in underserved regions. Partnerships between governments and private players accelerate access to affordable generics. Increasing disposable incomes also enable patients to afford premium therapies.

Patient Awareness and Shift Toward Disease Management Models:

Rising awareness about diabetes management supports stronger patient engagement and adherence to therapies. Educational campaigns highlight the importance of lifestyle changes alongside drug treatment. Patient-centric care models integrate personalized drug regimens with digital health tools. It drives uptake of therapy innovations that improve quality of life. Multidisciplinary approaches involving dieticians, endocrinologists, and general physicians strengthen treatment outcomes. Employers and insurers also invest in wellness programs to minimize workforce health risks. Broader engagement from patient advocacy groups spreads knowledge about new drug options. This expanding awareness ecosystem fosters greater market penetration across all age groups.

Market Trends:

Integration of Digital Health into Drug Therapy:

The Global Diabetes Drug Therapy Market is influenced by digital health adoption in treatment pathways. Mobile apps and wearable devices support therapy adherence and real-time monitoring. Artificial intelligence enhances prediction of glucose fluctuations and personalized dosing schedules. Remote patient management programs reduce hospital visits and increase accessibility. It strengthens doctor-patient communication through data-driven feedback loops. Pharmaceutical firms increasingly integrate digital solutions with drug offerings. Digital therapeutics expand the role of virtual healthcare platforms. Growing patient comfort with digital tools accelerates demand for integrated drug-digital ecosystems.

- For instance, Eli Lilly integrates their oral GLP-1 receptor agonist development programs with digital health tools to optimize patient monitoring and adherence, leveraging AI-driven algorithms to predict glucose variability, which assists in personalizing diabetes management. Pharmaceutical firms increasingly integrate digital solutions with drug offerings. Digital therapeutics expand the role of virtual healthcare platforms.

Advancements in Genomics and Precision-Based Treatments:

The market witness’s stronger adoption of precision medicine strategies tailored to genetic profiles. Advances in genomics enable identification of drug response markers for diabetic patients. It promotes targeted therapies that minimize adverse effects and optimize efficacy. Pharmaceutical pipelines now include drugs specifically designed for distinct patient subgroups. Personalized formulations reduce trial-and-error approaches in prescribing. Genetic testing becomes more accessible, strengthening adoption in clinical settings. Biotech startups collaborate with pharma companies to develop novel therapies based on molecular insights. These precision strategies create new revenue streams while improving patient satisfaction.

- For instance, Sanofi’s TZIELD (teplizumab) for Stage 2 Type 1 Diabetes received FDA approval, supported by clinical trial data showing delayed onset of Stage 3 diabetes in genetically identified at-risk patients, reflecting the impact of precision medicine. Genetic testing becomes more accessible, strengthening adoption in clinical settings.

Development of Longer-Acting and Convenient Formulations:

The Global Diabetes Drug Therapy Market is shaped by demand for longer-acting formulations. Once-weekly injectables and oral therapies reduce dosing burden on patients. It improves compliance rates by simplifying treatment schedules. Drug developers highlight improved safety and effectiveness of extended-release products. Longer-acting therapies are increasingly supported by clinical trial evidence. Patients show preference for convenience-driven regimens that fit daily routines. Physicians adopt such options to minimize treatment dropouts. The trend reshapes therapy adoption across both primary and specialty care settings.

Growing Preference for Combination and Multifunctional Therapies:

The market reflects growing reliance on combination therapies to address complex diabetes management. Dual or triple action drug formulations enhance outcomes by targeting multiple pathways. It reduces polypharmacy issues while improving overall treatment efficacy. Physicians increasingly prescribe multifunctional drugs to optimize patient care. Combination therapies reduce the risk of comorbidities linked with diabetes. Pharmaceutical firms invest in research to develop next-generation multifunctional drug classes. These therapies hold strong appeal in both developed and emerging markets. They contribute to expanding product differentiation and competitive advantage.

Market Challenges Analysis:

High Cost of Advanced Drugs and Limited Reimbursement:

The Global Diabetes Drug Therapy Market faces persistent challenges linked to affordability and reimbursement issues. High costs of innovative therapies limit adoption in low- and middle-income countries. Insurance coverage gaps and restrictive reimbursement frameworks burden patients financially. Generic alternatives exist but often lack advanced efficacy compared to premium drugs. It limits equal access to modern therapies across different regions. Pharmaceutical companies face pressure to balance profitability with affordability. Health systems struggle with long-term budget allocations for chronic disease management. These financial barriers slow down market penetration despite high patient need.

Regulatory Complexities and Low Patient Adherence:

The market also faces regulatory and compliance-related hurdles that delay drug approvals. Stringent clinical trial requirements increase costs and extend development timelines. Safety and efficacy demands create uncertainty for smaller biotech entrants. It restricts the pace of innovation and limits product diversification. Patient adherence challenges also remain significant, despite digital health support tools. Lifestyle-linked noncompliance with prescribed regimens affects therapy outcomes. Resistance toward injectables and side effects of certain drug classes discourage consistent use. These factors collectively restrict the pace of growth despite strong demand drivers.

Market Opportunities:

Growth Potential in Emerging Economies:

The Global Diabetes Drug Therapy Market holds significant opportunity in emerging economies with large undiagnosed populations. Rising healthcare investments in Asia Pacific, Latin America, and Africa create stronger demand potential. Governments focus on widening healthcare infrastructure and expanding diagnostic facilities. It benefits from international partnerships that introduce advanced drugs in new regions. Increasing disposable incomes support higher spending on premium therapies. Multinational companies can strengthen presence by launching patient support programs. Emerging countries provide long-term growth avenues with favorable demographics and disease prevalence.

Technological Innovations and Next-Generation Drug Models:

The market has opportunities through deeper integration of digital technologies with drug therapy. AI-driven platforms can personalize drug regimens for optimal efficacy. Smart insulin delivery devices enhance convenience and compliance. It supports adoption of next-generation therapies that reduce patient burden. Opportunities exist in development of oral insulin and gene-editing approaches. Pharmaceutical firms collaborating with digital health providers create differentiated product ecosystems. Expansion of precision medicine creates revenue growth avenues for advanced biotech players.

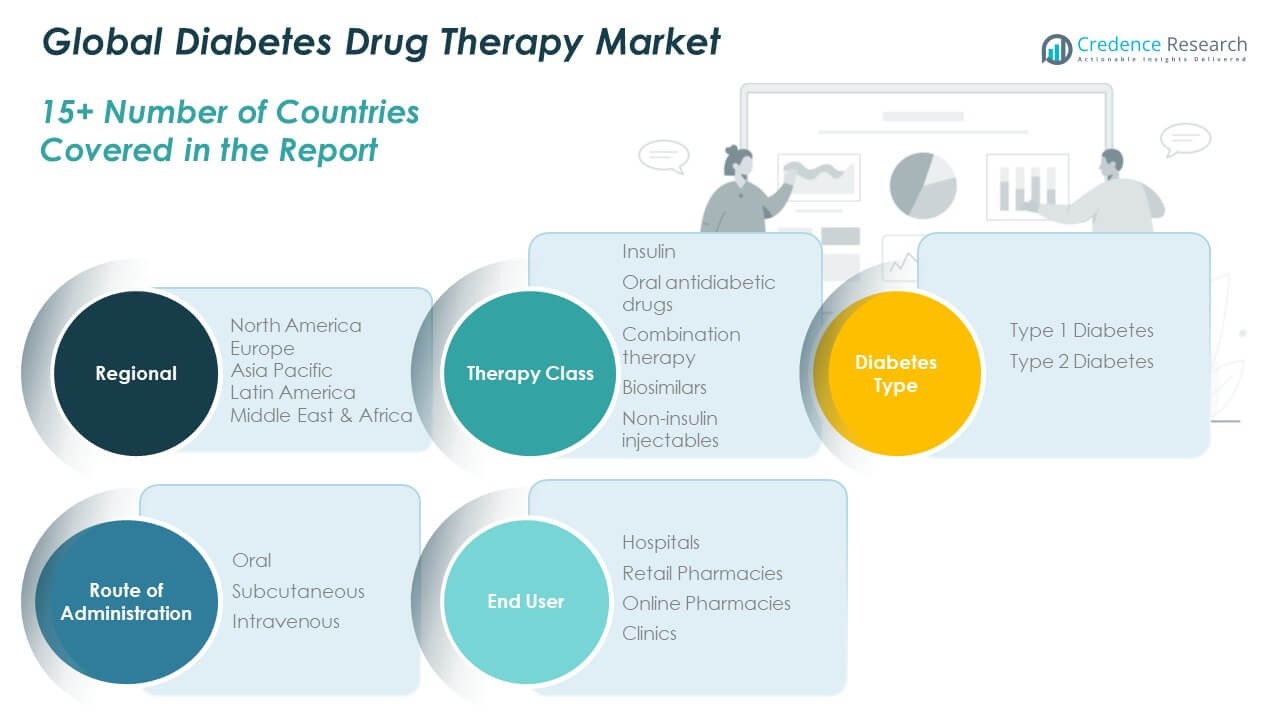

Market Segmentation Analysis:

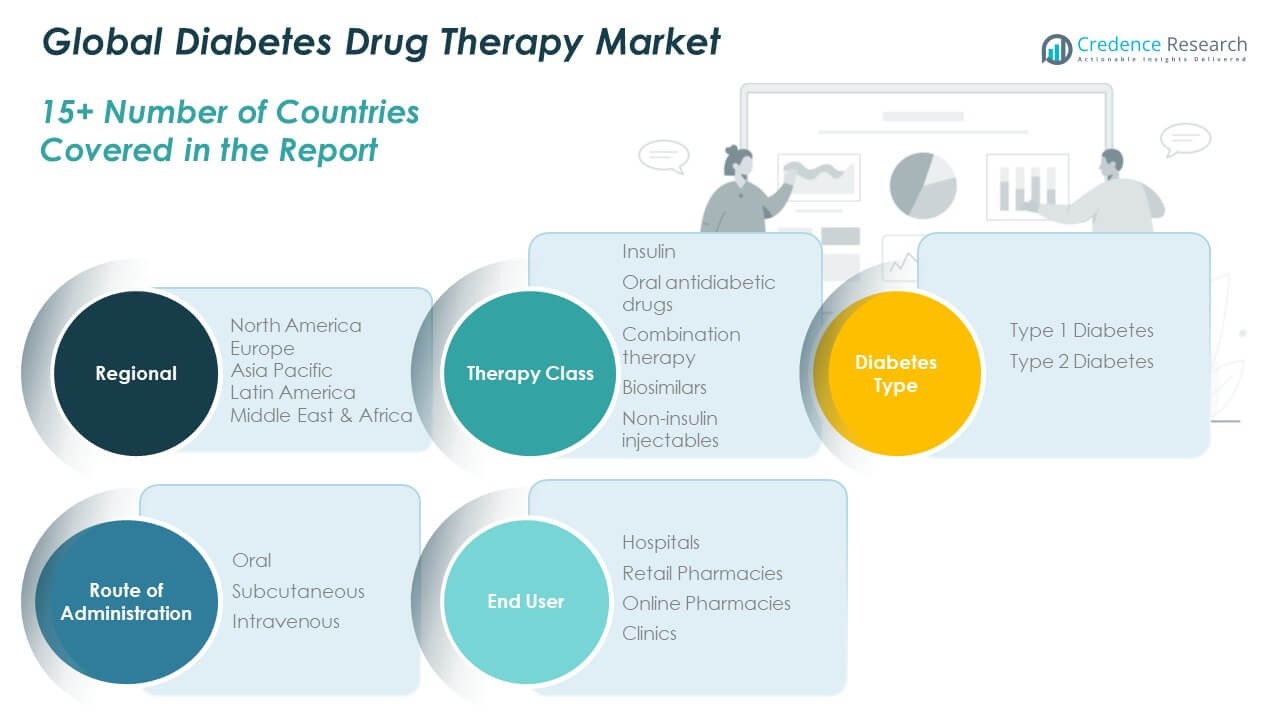

By Therapy Class

The Global Diabetes Drug Therapy Market shows strong variation across therapy classes. Insulin dominates due to its critical role in Type 1 Diabetes and increasing adoption for advanced Type 2 Diabetes. Oral antidiabetic drugs remain highly prescribed because of affordability and ease of use. Combination therapy is gaining momentum as it addresses multiple pathways to enhance outcomes. Biosimilars expand steadily in cost-driven markets, offering affordable alternatives. Non-insulin injectables, particularly GLP-1 receptor agonists, witness rapid uptake for their superior efficacy and weight management benefits.

- For instance, while Merck’s once-weekly DPP-4 inhibitor, omarigliptin, demonstrated A1C reductions similar to Januvia in clinical trials, the company ultimately decided not to seek regulatory approval for it in the U.S. and Europe for business reasons. Meanwhile, non-insulin injectables, particularly GLP-1 receptor agonists, have experienced rapid uptake for their superior efficacy in glycemic control and significant weight management benefits.

By Diabetes Type

Type 2 Diabetes leads the market with the largest share, supported by lifestyle-related risk factors and a growing elderly population. Type 1 Diabetes maintains stable demand due to the lifelong need for insulin-based therapies.

- For example, Johnson & Johnson’s INVOKANA (canagliflozin) received FDA approval showing its efficacy in reducing cardiovascular risk in adults with Type 2 Diabetes, reinforcing its wide usage in managing the disease and associated comorbidities.

By Route of Administration

Oral therapies dominate due to convenience and patient preference. Subcutaneous delivery plays a critical role, driven by insulin and GLP-1 injectables. Intravenous administration remains niche, largely confined to hospital and acute care settings.

By End User

Hospitals hold the largest share, supported by diagnosis, critical care, and therapy initiation. Retail pharmacies serve as vital distribution hubs for continued prescription supply. Online pharmacies show the fastest growth, fueled by e-commerce adoption and convenience-driven patient behavior. Clinics contribute steadily, offering local support for diabetes management and follow-up treatments.

Segmentation:

By Therapy Class

- Insulin

- Oral antidiabetic drugs

- Combination therapy

- Biosimilars

- Non-insulin injectables

By Diabetes Type

- Type 1 Diabetes

- Type 2 Diabetes

By Route of Administration

- Oral

- Subcutaneous

- Intravenous

By End User

- Hospitals

- Retail Pharmacies

- Online Pharmacies

- Clinics

By Region

- North America (U.S., Canada, Mexico)

- Europe (UK, France, Germany, Italy, Spain, Russia, Rest of Europe)

- Asia Pacific (China, Japan, South Korea, India, Australia, Southeast Asia, Rest of Asia Pacific)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East (GCC Countries, Israel, Turkey, Rest of Middle East)

- Africa (South Africa, Egypt, Rest of Africa)

Regional Analysis:

North America

The North America Diabetes Drug Therapy Market size was valued at USD 18,522.35 million in 2018 to USD 33,093.27 million in 2024 and is anticipated to reach USD 66,659.86 million by 2032, at a CAGR of 8.5% during the forecast period. North America accounts for 38% of the global share, making it the largest regional market. The Global Diabetes Drug Therapy Market in this region benefits from strong healthcare infrastructure, high expenditure, and access to advanced therapies. Demand is driven by a rising prevalence of Type 2 Diabetes linked with obesity and lifestyle factors. Robust insurance coverage and favorable reimbursement policies encourage adoption of premium drug classes. Pharmaceutical giants have a strong presence in the U.S., ensuring steady innovation and clinical trial activities. It also benefits from digital integration in diabetes management. Expanding use of GLP-1 receptor agonists and once-weekly injectables reflects growing preference for convenience-driven therapies.

Europe

The Europe Diabetes Drug Therapy Market size was valued at USD 12,059.42 million in 2018 to USD 20,995.02 million in 2024 and is anticipated to reach USD 39,739.43 million by 2032, at a CAGR of 7.7% during the forecast period. Europe represents 28% of the global share, supported by favorable regulatory policies and healthcare programs. The Global Diabetes Drug Therapy Market in this region thrives on reimbursement frameworks that ease patient access to innovative therapies. Rising aging populations and high awareness levels sustain long-term demand. Germany, the UK, and France lead adoption due to advanced healthcare systems. Biosimilars gain strong traction as cost pressures drive interest in affordable alternatives. It benefits from government-backed screening programs that enhance early detection. Pharmaceutical firms actively pursue R&D and collaborations within the region. Growth is steady, supported by structured health policies and patient education.

Asia Pacific

The Asia Pacific Diabetes Drug Therapy Market size was valued at USD 8,025.79 million in 2018 to USD 15,710.72 million in 2024 and is anticipated to reach USD 35,765.96 million by 2032, at a CAGR of 10.2% during the forecast period. Asia Pacific holds 22% of the global share and is the fastest-growing region. The Global Diabetes Drug Therapy Market here expands due to large populations in China and India facing rising diabetes prevalence. Increasing urbanization, lifestyle changes, and dietary shifts contribute to higher incidence rates. Governments invest heavily in healthcare infrastructure and public health programs. Rising disposable incomes improve access to premium therapies. It benefits from partnerships introducing advanced drugs across emerging economies. Japan and South Korea lead in adopting novel drug classes due to advanced R&D ecosystems. Growth prospects remain strong with ongoing policy support and expanding healthcare coverage.

Latin America

The Latin America Diabetes Drug Therapy Market size was valued at USD 1,851.77 million in 2018 to USD 3,298.36 million in 2024 and is anticipated to reach USD 5,809.96 million by 2032, at a CAGR of 6.7% during the forecast period. Latin America contributes about 6% of the global share. The Global Diabetes Drug Therapy Market in this region benefits from a growing diabetic population and improving healthcare systems. Brazil and Mexico remain key markets due to larger patient bases. Public health initiatives focus on early detection and long-term management programs. It faces challenges with affordability and uneven healthcare access across rural areas. The adoption of biosimilars and generics helps address cost concerns. Rising e-pharmacy platforms are improving therapy availability. Multinational companies expand distribution networks to strengthen presence in urban centers.

Middle East

The Middle East Diabetes Drug Therapy Market size was valued at USD 1,017.06 million in 2018 to USD 1,653.70 million in 2024 and is anticipated to reach USD 2,713.16 million by 2032, at a CAGR of 5.7% during the forecast period. The region holds nearly 3% of the global share. The Global Diabetes Drug Therapy Market here is supported by high prevalence rates in GCC countries driven by sedentary lifestyles and dietary habits. Governments invest in diabetes awareness and screening campaigns. Wealthier nations such as Saudi Arabia and UAE lead adoption of advanced therapies. It benefits from private healthcare investment and increasing insurance penetration. However, cost sensitivity remains a concern in low- and middle-income countries. Digital platforms and hospital expansions are improving patient access. Pharmaceutical firms see the region as a gateway for expansion across surrounding geographies.

Africa

The Africa Diabetes Drug Therapy Market size was valued at USD 492.04 million in 2018 to USD 1,011.05 million in 2024 and is anticipated to reach USD 1,501.36 million by 2032, at a CAGR of 4.4% during the forecast period. Africa contributes around 2% of the global share, making it the smallest regional market. The Global Diabetes Drug Therapy Market in Africa faces challenges of limited healthcare infrastructure and low affordability. South Africa and Egypt lead adoption due to relatively better systems. Rising urbanization and dietary changes are increasing diabetes prevalence. It depends significantly on generic drugs and international aid programs. Access to innovative therapies is restricted, with affordability acting as the primary barrier. Governments and NGOs promote education campaigns to improve awareness. Evolving e-health platforms are gradually increasing patient outreach. Growth remains steady but modest compared to other regions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Novo Nordisk A/S

- Eli Lilly & Company

- Sanofi S.A.

- Merck & Co.

- AstraZeneca

- Boehringer Ingelheim

- Johnson & Johnson

- Takeda Pharmaceuticals

- Pfizer

- Novartis

- Bristol-Myers Squibb

Competitive Analysis:

The Global Diabetes Drug Therapy Market is highly competitive with strong participation from multinational pharmaceutical companies and emerging biotech firms. It is led by Novo Nordisk, Eli Lilly, and Sanofi, which dominate insulin and non-insulin injectable portfolios. Merck, AstraZeneca, and Boehringer Ingelheim strengthen competition through oral drug classes and innovative therapies. Companies focus on strategic partnerships, R&D investments, and global distribution to expand their presence. It reflects growing emphasis on biologics, biosimilars, and digital integration to improve patient adherence. Competitive intensity is marked by frequent product launches and regional expansion. Firms also invest in affordability strategies to capture cost-sensitive markets.

Recent Developments:

- Eli Lilly’s oral GLP-1 receptor agonist orforglipron is an investigational drug that has not yet received FDA approval as of August 2025. Lilly plans to.file for approval by late 2025 after positive Phase 3 trial results showing significant weight loss and blood sugar control.

- In 2025, Novo Nordisk applied to the FDA for approval of an oral pill version of its weight loss medication Wegovy (semaglutide). This pill is expected to receive FDA approval by late 2025 and represents a significant advance in obesity care by offering a more convenient, potentially less costly alternative to injections.

- AstraZeneca received FDA approval in June 2024 for Farxiga (dapagliflozin) to treat pediatric type 2 diabetes patients aged 10 and older. This extends the drug’s benefits from adult to pediatric populations based on the positive T2NOW Phase III clinical trial results.

Report Coverage:

The research report offers an in-depth analysis based on therapy class, diabetes type, route of administration, and end user. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising adoption of GLP-1 receptor agonists for improved outcomes.

- Expansion of biosimilars in emerging economies.

- Growing role of digital platforms in therapy adherence.

- Increased investment in precision medicine and genomic therapies.

- Expansion of once-weekly insulin formulations.

- Rising collaborations between pharma and tech firms.

- Broader penetration of online pharmacies worldwide.

- Increased government funding for diabetes prevention programs.

- Stronger focus on affordability in cost-sensitive markets.

- Continuous innovation in combination therapies for complex cases.