Market Overview:

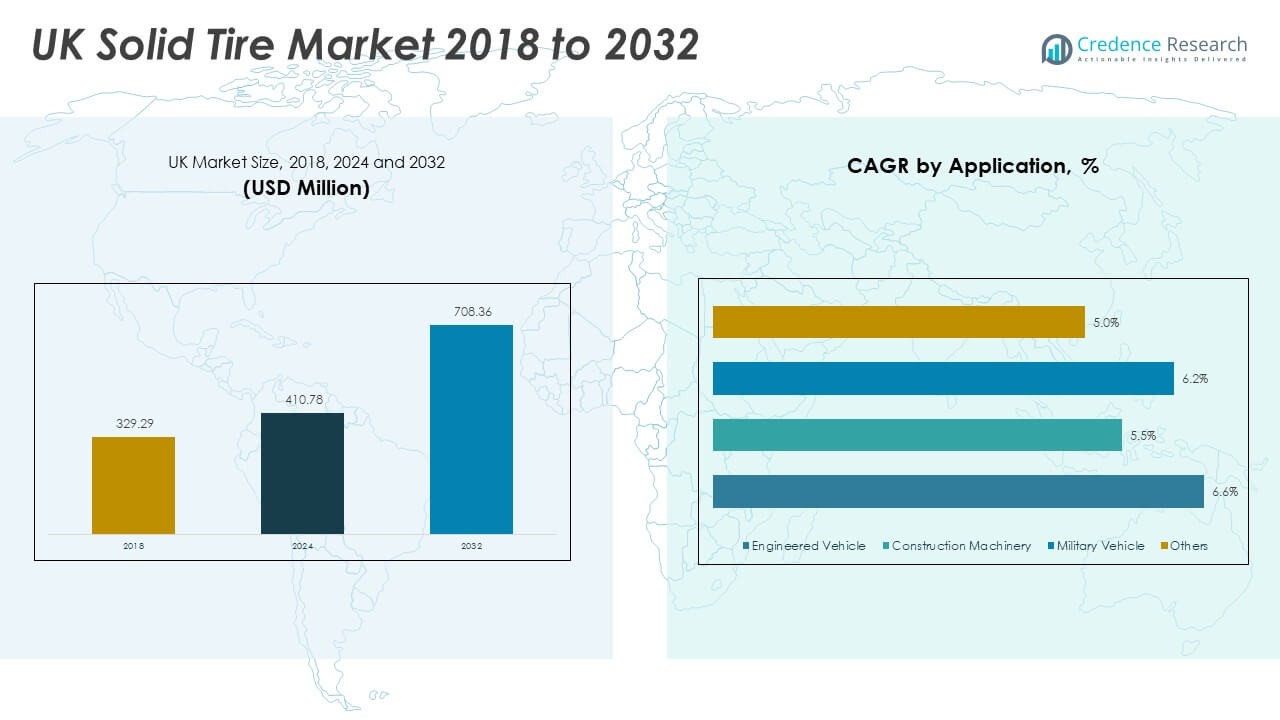

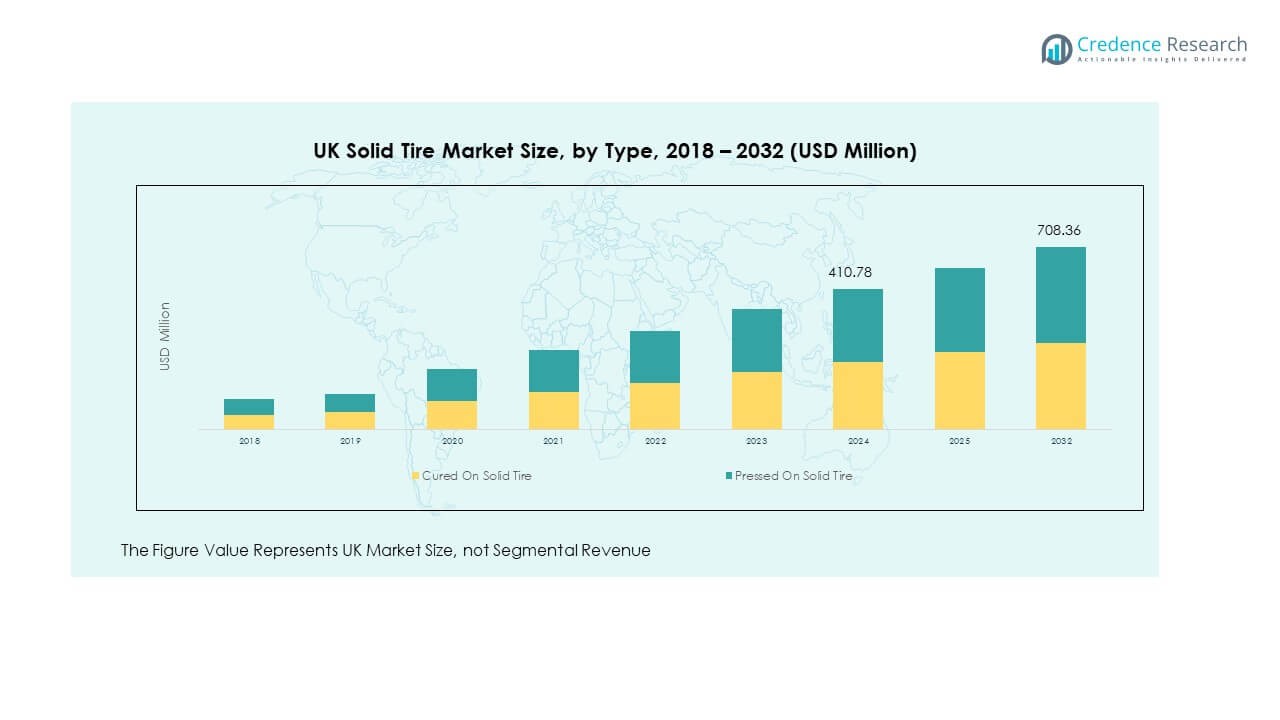

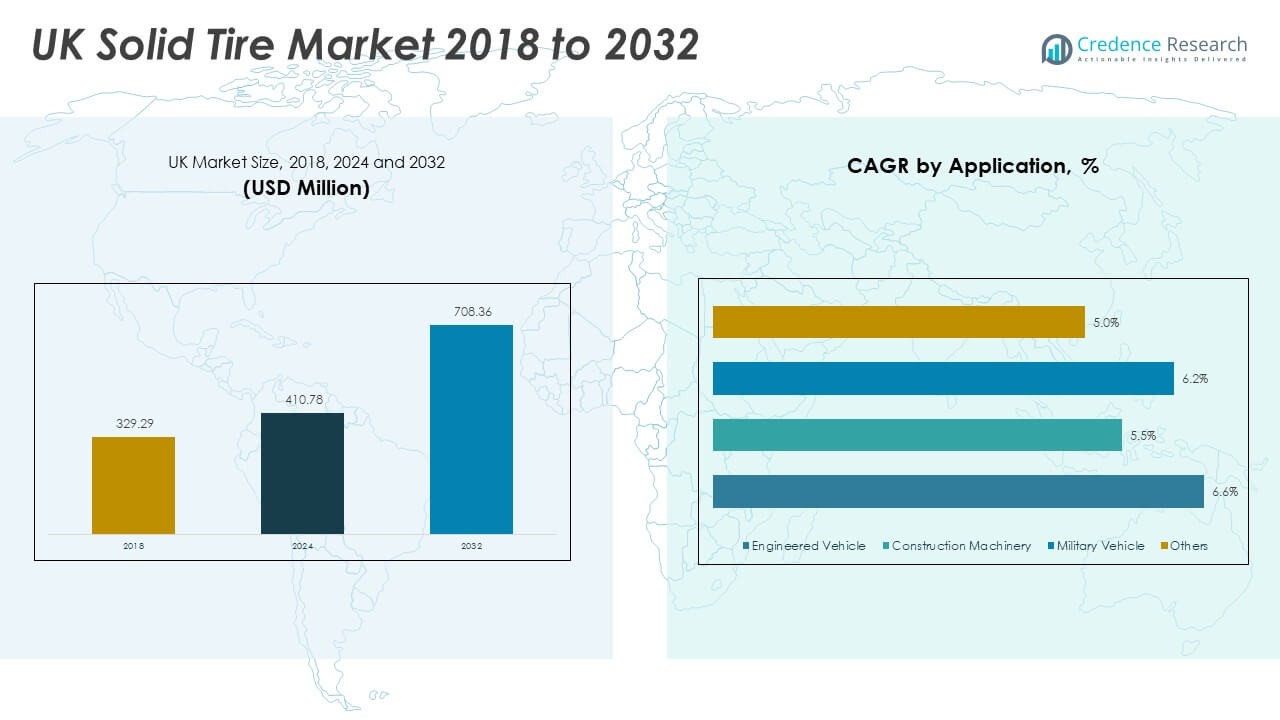

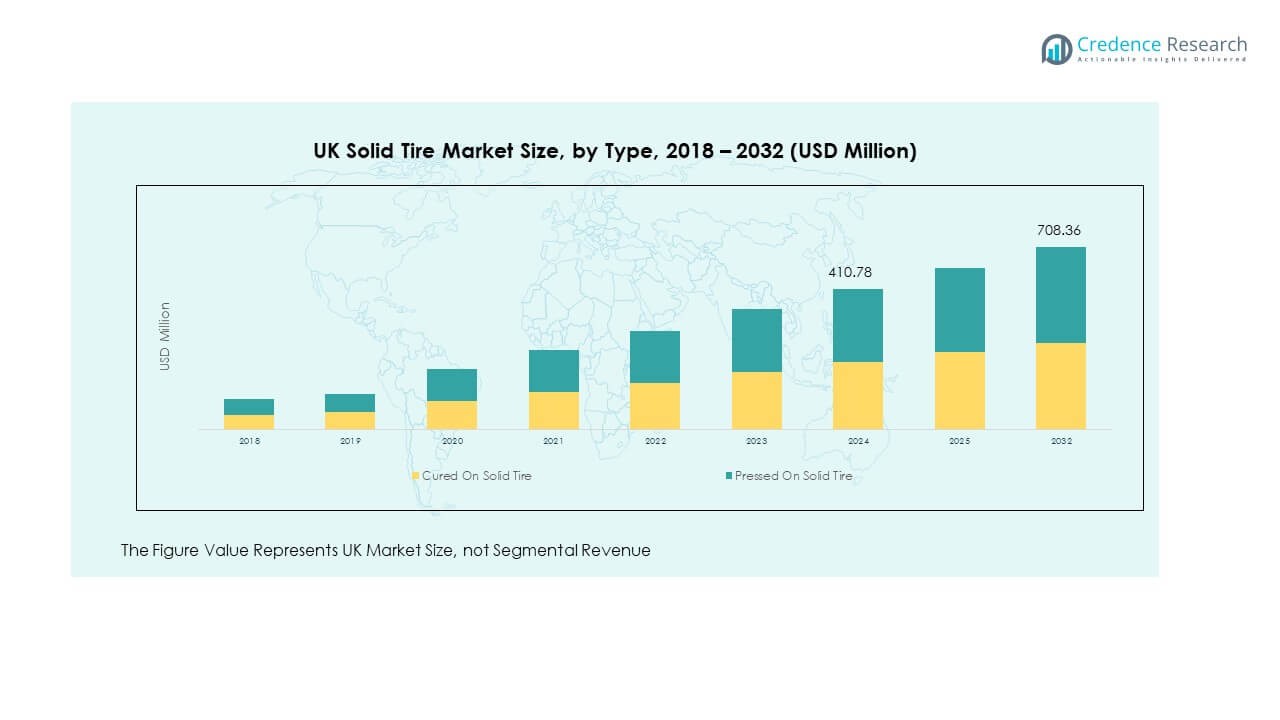

The UK Solid Tire Market size was valued at USD 329.29 million in 2018 to USD 410.78 million in 2024 and is anticipated to reach USD 708.36 million by 2032, at a CAGR of 7.05% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| UK Solid Tire Market Size 2024 |

USD 410.78 Million |

| UK Solid Tire Market, CAGR |

7.05% |

| UK Solid Tire Market Size 2032 |

USD 708.36 Million |

Market expansion is driven by the rise in warehouse automation, growth in construction activities, and the increasing adoption of material-handling equipment. Strong demand for resilient and puncture-proof tires in forklifts, port equipment, and military vehicles continues to push growth. The market also benefits from the steady rise of e-commerce and logistics sectors in the UK, which require dependable equipment for seamless operations.

Geographically, the UK market is highly developed, with strong adoption across industrial hubs such as the Midlands and Southeast England. These areas drive demand due to concentration of manufacturing and warehousing facilities. Emerging opportunities are observed in northern regions, where infrastructure development and logistics modernization are gaining momentum. The strong presence of global tire manufacturers in the UK further strengthens its market growth prospects.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The UK Solid Tire Market was valued at USD 329.29 million in 2018, USD 410.78 million in 2024, and is projected to reach USD 708.36 million by 2032, registering a CAGR of 7.05% during 2024–2032.

- Europe holds the largest share at 38%, driven by strong construction and logistics infrastructure, followed by North America at 29% due to robust warehousing demand, and Asia Pacific at 22% with rising industrialization and manufacturing.

- Asia Pacific is the fastest-growing region with 22% share, fueled by rapid urbanization, expanding e-commerce, and large-scale infrastructure projects in China and India.

- Cured-on solid tires accounted for nearly 57% of the UK market in 2024, favored for their durability in heavy-duty applications.

- Pressed-on solid tires held about 43% share in 2024, driven by forklifts and warehousing applications where easy replacement and compact use are critical.

Market Drivers:

Rising Demand for Durable and Low-Maintenance Tires:

The UK Solid Tire Market benefits from demand for tires that deliver durability and low maintenance. Industries such as construction and warehousing depend on tires that can handle heavy-duty usage without frequent replacement. Solid tires, known for puncture resistance, offer cost-effectiveness by reducing downtime. Growth in the e-commerce industry boosts material-handling equipment usage, further fueling tire demand. With companies aiming for operational efficiency, the adoption of long-lasting solid tires becomes essential. It supports overall productivity by minimizing disruptions in industrial workflows.

- For instance, the increased adoption of electric forklifts fitted with solid rubber tires significantly reduces maintenance and downtime in industrial logistics environments. Toyota Material Handling’s deployment of Automated Guided Vehicles (AGVs) often uses similar puncture-proof tires, eliminating common tire-related interruptions.

Expansion of Construction and Infrastructure Projects:

Infrastructure growth in the UK is fueling higher adoption of solid tires in construction machinery. Heavy-duty vehicles such as loaders, cranes, and compact construction equipment rely on solid tires for better stability and performance on uneven terrain. Government investments in housing, transport networks, and renewable energy projects contribute to consistent demand. The resilience of these tires makes them suitable for long-term projects. Their reliability ensures safe operation under challenging site conditions. The construction sector’s ongoing expansion positions solid tires as an indispensable component in UK projects.

- For example, Trelleborg’s Brawler HPS Soft Ride solid tire provides 40% greater deflection compared to standard solid tires, improving operator comfort and tire life on waste management and recycling sites, which are part of the broader infrastructural network.

Growth in Warehousing and Logistics Sector:

The warehousing and logistics sector plays a pivotal role in driving tire demand. Rapid growth of e-commerce has increased the use of forklifts, yard chassis, and tow tractors in distribution centers. Solid tires are preferred due to their ability to endure continuous operation without frequent replacements. The UK’s shift toward automation in warehouses further increases reliance on these tires. Companies are adopting advanced handling systems where durability and uptime are critical. The logistics sector’s rapid modernization continues to ensure strong market prospects for solid tires.

Rising Adoption in Military and Specialized Vehicles:

The UK Solid Tire Market also sees traction in military and defense vehicles that require enhanced reliability. Solid tires offer safety in combat zones by resisting punctures from debris or sharp objects. They are also deployed in specialized vehicles used in mining and ports. The government’s focus on strengthening defense infrastructure supports steady demand. Military modernization programs encourage wider usage of solid tires in specialized fleets. Their safety features, low maintenance, and ruggedness align with the operational demands of these industries.

Market Trends:

Increasing Focus on Sustainable Tire Manufacturing:

Manufacturers in the UK Solid Tire Market are moving toward sustainable practices. Eco-friendly production methods, including recycled rubber and energy-efficient processes, are gaining traction. With rising environmental concerns, the demand for green products is rising. Companies are promoting sustainable tire innovations to align with government regulations. This trend supports brand reputation while appealing to eco-conscious buyers. Growing awareness of carbon footprints in the logistics sector enhances adoption of such solutions. It reflects a broader global trend in sustainable industrial goods.

- For instance, Nokian Tyres is pioneering in this field, constructing the world’s first net-zero carbon tire factory in Romania, powered by 100% CO2-free energy sources and holding the ISCC PLUS certification for sustainable raw materials use.

Advancements in Tire Technology and Design:

Technological innovation is reshaping the market. Manufacturers are introducing solid tires with improved tread patterns and advanced rubber compounds. These designs enhance grip, stability, and heat resistance. With digitalization, tire monitoring solutions are being integrated for predictive maintenance. Advanced tire compounds also reduce rolling resistance, improving energy efficiency in handling equipment. Enhanced designs ensure longer product lifespans and improved comfort for operators. Such technological advances are expanding adoption across industries that prioritize efficiency and safety.

- For instance, Swedish-based NIRA Dynamics developed the Tread Wear Indicator (TWI), which offers continuous real-time tread depth tracking and predictive analytics to reduce unplanned downtime by alerting fleet managers before maintenance is necessary. This digital integration improves safety, reduces costs, and extends tire life in logistics and industrial vehicle fleets, supporting efficiency and safety priorities across the markets it serves.

Customization for Industry-Specific Applications:

The UK Solid Tire Market is witnessing rising customization trends. Companies are developing specialized solid tires tailored for industries like ports, mining, and defense. This approach ensures performance optimization under specific operating conditions. For example, ports demand heavy-duty tires capable of handling extreme loads, while warehouses prefer smooth rolling for quiet operations. Customization helps manufacturers capture niche segments with precise solutions. It also increases customer loyalty and positions suppliers as key partners in industry-specific applications.

Growing Popularity of OEM Collaborations:

Collaboration between tire manufacturers and original equipment manufacturers (OEMs) is expanding. OEMs integrate solid tires into new forklifts, tractors, and other vehicles. Partnerships ensure compatibility and performance optimization, increasing adoption among end-users. These collaborations also help tire companies secure long-term contracts and steady revenue. Growing emphasis on ready-to-use solutions strengthens this trend. Such partnerships are particularly strong in the logistics and construction industries. The strategy enhances overall customer confidence in product quality and reliability.

Market Challenges Analysis:

High Upfront Costs and Replacement Limitations:

The UK Solid Tire Market faces challenges due to the higher upfront cost of solid tires compared to pneumatic alternatives. Many small-scale businesses prefer cheaper solutions despite long-term benefits of solid tires. Another concern is their limited replacement flexibility since solid tires require specialized fitting equipment. This makes tire replacement more complex and costlier, reducing attractiveness for budget-sensitive buyers. These factors may restrain adoption among smaller logistics firms and contractors, slowing overall market penetration.

Competition from Pneumatic and Advanced Alternatives:

Solid tires also face strong competition from pneumatic and hybrid tires that offer flexibility and comfort. Pneumatic tires remain widely used in sectors prioritizing operator comfort and speed. New airless tire technologies are emerging, further intensifying competition. While solid tires excel in durability, their ride comfort and adaptability remain concerns. Industries seeking versatile performance sometimes favor alternatives. Addressing these competitive pressures requires manufacturers to invest in innovation, balancing durability with enhanced operator experience.

Market Opportunities:

Rising Demand for Automation and E-Commerce Support:

Automation in warehouses and e-commerce expansion creates new opportunities for solid tires. Forklifts and automated guided vehicles require durable tires to ensure uninterrupted operation. Companies expanding fulfillment centers across the UK increase reliance on solid tire technology. Demand is expected to rise further with ongoing digitalization of logistics. This creates space for suppliers to introduce advanced designs supporting automation. The trend represents a strong opportunity for manufacturers to establish dominance in logistics-focused applications.

Expansion into Niche Applications and Export Markets:

The UK Solid Tire Market holds opportunities in niche sectors such as defense, ports, and mining. Export potential also grows, with manufacturers supplying neighboring European markets. Companies focusing on specialized applications can secure premium contracts. Innovation in tire design supports entry into high-demand industries. Leveraging the UK’s industrial base enables companies to build strong export strategies. Niche opportunities remain critical to long-term expansion. Tire manufacturers aligning with these markets can achieve sustainable revenue streams.

Market Segmentation Analysis:

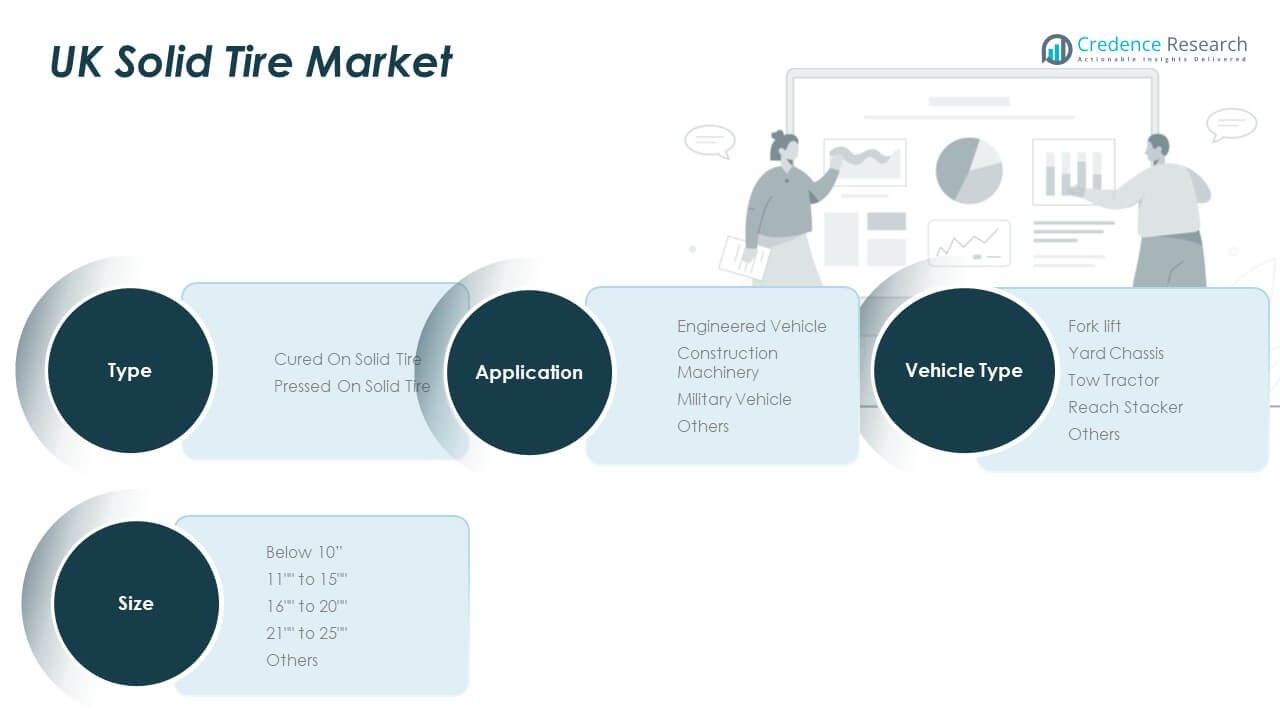

Type

The UK Solid Tire Market is classified into cured-on and pressed-on solid tires. Cured-on tires hold a larger share due to their extended durability and ability to perform in high-intensity industrial environments. They are widely used in heavy construction machinery and port equipment, where safety and reliability are critical. Pressed-on tires, however, dominate warehouse and logistics applications. Their compact design and ease of replacement make them popular for forklifts and yard chassis. Manufacturers are enhancing both types with improved rubber compounds and tread patterns to maximize service life.

- For instance, Pressed-on tires dominate in warehouse applications where their compact design facilitates quick installation and replacement, supported by manufacturers continuously improving tread compounds and designs to maximize efficiency in high-turnover logistics environments.

Application

Applications include engineered vehicles, construction machinery, military vehicles, and others. Construction machinery leads the segment because of strong demand from infrastructure and building projects across the UK. Engineered vehicles, such as specialized port and mining equipment, also generate significant demand. Military vehicles rely on solid tires for their durability and puncture resistance in rough conditions. The “others” category covers smaller industrial and municipal vehicles. Growing diversity in applications highlights the adaptability of solid tires across both heavy-duty and niche sectors.

Size

The market is segmented by size into below 10”, 11–15”, 16–20”, 21–25”, and others. Tires in the 11–20” range dominate demand, primarily used in forklifts and loaders that operate intensively in warehouses and industrial facilities. Larger sizes, such as 21–25”, are applied in heavy-duty construction and mining equipment. Smaller sizes below 10” are used in compact industrial machinery, carts, and specialized handling equipment. Demand across different size ranges reflects the versatility of solid tires in meeting varied operational requirements.

Vehicle Type

Vehicle types include forklifts, yard chassis, tow tractors, reach stackers, and others. Forklifts account for the largest share, supported by rapid warehouse automation and rising e-commerce logistics activities. Yard chassis and tow tractors follow, particularly in ports and logistics yards where continuous operation is vital. Reach stackers are prominent in shipping and container handling, requiring highly durable solid tires. The “others” segment includes industrial tractors and municipal service vehicles. Broad usage across these categories ensures consistent demand across both urban and industrial landscapes.

Segmentation:

By Type

- Cured On Solid Tire

- Pressed On Solid Tire

By Application

- Engineered Vehicle

- Construction Machinery

- Military Vehicle

- Others

By Size

- Below 10”

- 11”–15”

- 16”–20”

- 21”–25”

- Others

By Vehicle Type

- Forklift

- Yard Chassis

- Tow Tractor

- Reach Stacker

- Others

Regional Analysis:

England – 65% Share

England holds the dominant 65% share of the UK Solid Tire Market, driven by its strong logistics, warehousing, and e-commerce sectors. The Midlands and Southeast act as industrial hubs, with high forklift and material-handling equipment usage. London’s continuous construction projects also strengthen demand for solid tires in heavy-duty machinery. The presence of global tire manufacturers such as Michelin and Continental further enhances accessibility and adoption. England’s industrial diversity and advanced infrastructure ensure it remains the largest contributor to market growth.

Scotland – 20% Share

Scotland accounts for around 20% of the UK Solid Tire Market, with demand supported by energy, infrastructure, and construction projects. Aberdeen’s oil and gas industry contributes significantly, requiring durable solid tires for specialized vehicles. Construction activities in cities such as Glasgow and Edinburgh also add to regional adoption. Logistics modernization is progressing, though at a smaller scale compared to England. Scotland’s strategic role in energy and heavy industries positions it as a consistent contributor to overall market demand.

Wales and Northern Ireland – 15% Combined Share

Wales and Northern Ireland together represent about 15% of the UK Solid Tire Market. Wales benefits from industrial estates and construction activity requiring forklifts and compact equipment. Northern Ireland shows strong adoption through port operations and logistics services, especially around Belfast. Infrastructure projects in both regions continue to support growth in construction machinery applications. Though smaller in share, both markets are witnessing steady modernization. Their combined role strengthens balanced nationwide demand, ensuring the overall resilience of the UK solid tire industry.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- CAMSO (Michelin)

- Continental AG

- Trelleborg AB

- Maxam Tire Europe Ltd. (UK)

- Global Rubber Industries (GRI)

- TY Cushion Tire

- Tube & Solid Tire

- Yantai Balsanse Rubber Co., Ltd.

- Superior Tire & Rubber Corp.

Competitive Analysis:

The UK Solid Tire Market is moderately concentrated, with several global and regional players competing for share. Companies like CAMSO, Continental AG, and Trelleborg AB maintain strong presence through extensive product portfolios and innovation. Local players such as Maxam Tire Europe Ltd. strengthen competition by catering to domestic demand. Partnerships with OEMs help leading firms secure stable contracts. Smaller manufacturers focus on niche markets such as defense and mining to stay competitive. Intense price competition and innovation in design remain key differentiators.

Recent Developments:

- CEAT acquired Michelin’s Camso brand off-highway tires in September 2025, enhancing its product portfolio and manufacturing capabilities. This integration provides CEAT with access to a global customer base and two manufacturing plants in Sri Lanka, strengthening its position in high-margin off-highway tire segments.

- In the first half of 2025, Continental AG reported strong tire sales performance with a 3.7% increase in revenue to $3.69 billion in the U.S. and Europe. The company emphasized improving profitability with an EBIT margin rising to 13.4%. Continental continues investing in sustainable materials, aiming to raise the share of renewable and recycled materials in tire production by several percentage points in 2025, advancing product innovation and environmental goals.

- Trelleborg AB showcased advanced tire technologies at the ScotPlant Show in Scotland in mid-2024, introducing the Brawler Soft Ride compound designed for construction and recycling applications. This tire technology offers enhanced cut resistance, improved stability, reduced vibration, and better fuel efficiency, responding to the rigorous demands of UK construction sites.

Report Coverage:

The research report offers an in-depth analysis based on type, application, size, and vehicle type. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising demand from logistics and e-commerce sectors.

- Expansion of construction projects across the UK.

- Growing automation in warehousing operations.

- Increased focus on sustainability in tire production.

- Wider adoption in defense and specialized vehicles.

- Stronger collaboration between OEMs and tire manufacturers.

- Customization for industry-specific needs driving growth.

- Export potential across Europe and Asia.

- Rising competition from hybrid and pneumatic alternatives.

- Continued innovation in design and durability.