Market Overview:

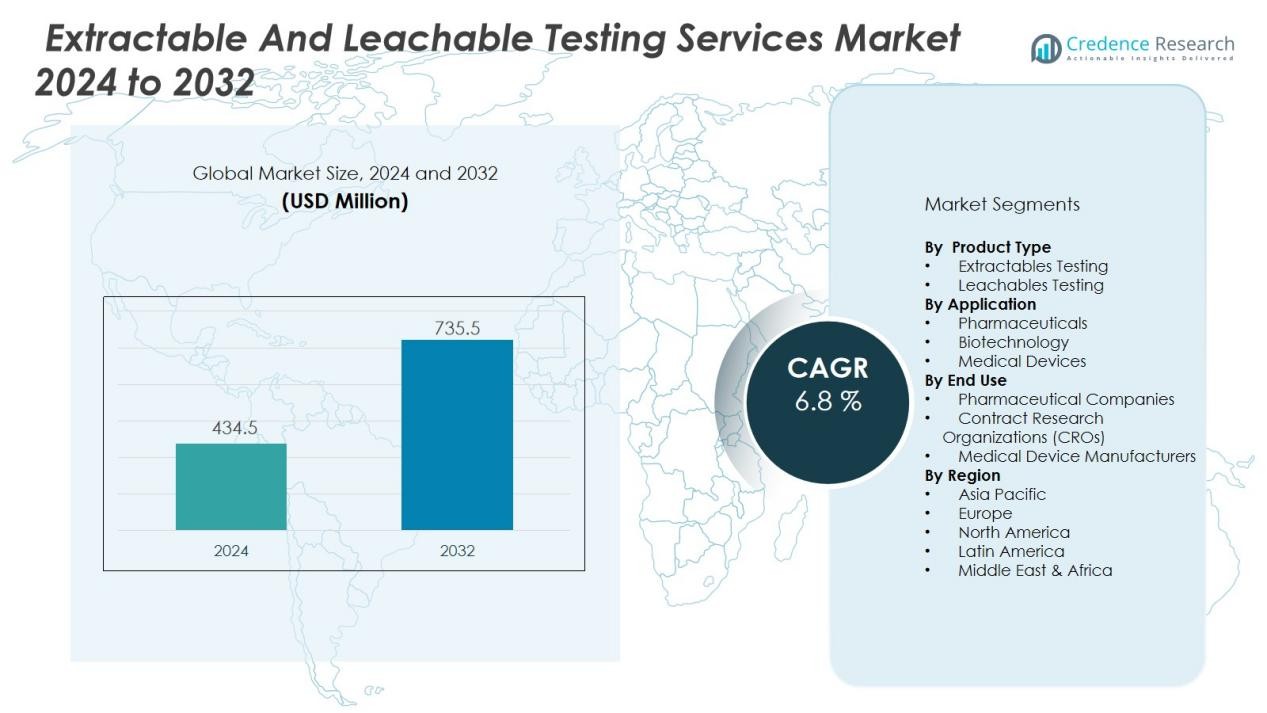

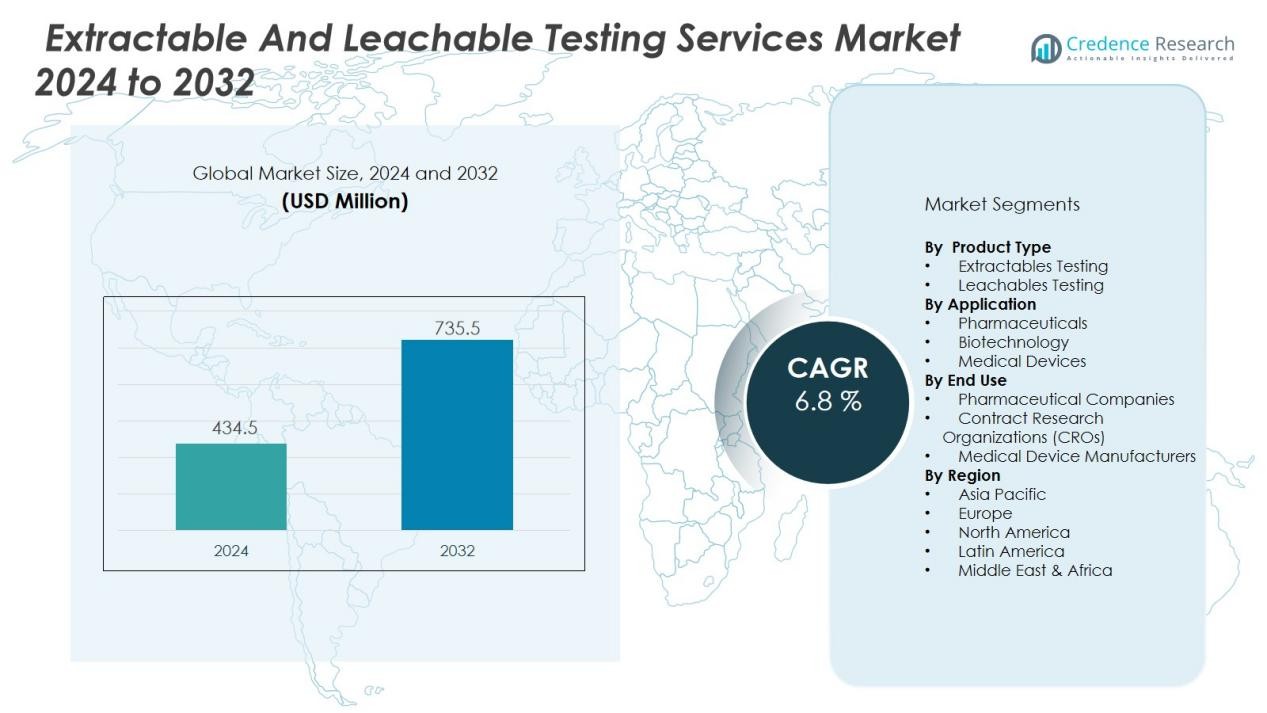

The extractable and leachable testing services market size was valued at USD 434.5 million in 2024 and is anticipated to reach USD 735.5 million by 2032, at a CAGR of 6.8 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Extractable and Leachable Testing Services Market Size 2024 |

USD 434.5 Million |

| Extractable and Leachable Testing Services Market, CAGR |

6.8 % |

| Extractable and Leachable Testing Services Market Size 2032 |

USD 735.5 Million |

Growth is driven by stricter regulations from agencies like the FDA and EMA, which mandate comprehensive testing to ensure packaging materials and delivery systems do not compromise drug safety. Expanding biologics, injectable therapies, and combination products further increase demand for robust extractable and leachable analysis. Rising awareness among manufacturers about potential contamination risks, along with the adoption of advanced analytical technologies, continues to strengthen the market outlook.

Regionally, North America dominates due to stringent regulatory frameworks and a strong presence of leading pharmaceutical manufacturers. Europe follows, benefiting from harmonized safety standards and strong R&D investments. Asia-Pacific is the fastest-growing region, fueled by expanding pharmaceutical manufacturing, growing clinical trials, and increasing compliance with international safety standards. Collectively, these regions shape a competitive and innovation-driven global landscape for extractable and leachable testing services.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The extractable and leachable testing services market was valued at USD 434.5 million in 2024 and is projected to reach USD 735.5 million by 2032, growing at a CAGR of 6.8%.

- Stricter regulations from the FDA, EMA, and other global authorities continue to drive mandatory compliance testing for packaging, delivery systems, and medical devices.

- Expanding biologics, biosimilars, and injectable therapies create greater demand for advanced extractables and leachables testing to safeguard drug safety and efficacy.

- Adoption of technologies such as LC-MS, GC-MS, and ICP-MS enhances precision, enabling early detection of contaminants and better decision-making.

- North America holds the dominant regional position, supported by strong regulatory frameworks and major pharmaceutical players, while Europe benefits from harmonized safety standards.

- Asia-Pacific emerges as the fastest-growing region, fueled by large-scale pharmaceutical manufacturing, clinical trials, and stronger regulatory enforcement.

- High testing costs, shortage of skilled professionals, and lack of global standardization remain key restraints, creating challenges for smaller companies and delaying drug approvals.

Market Drivers:

Rising Regulatory Pressure Driving Compliance-Oriented Testing Demand:

Regulatory authorities such as the FDA, EMA, and other global agencies impose strict guidelines to ensure the safety of pharmaceutical and medical products. These requirements mandate extensive extractables and leachables testing for packaging materials, drug delivery systems, and medical devices. The extractable and leachable testing services market benefits from this environment, as compliance is non-negotiable for product approvals. It creates consistent demand from both established pharmaceutical firms and emerging biotech companies.

- For instance, Elexes supported 50+ medical device companies in 2024 for successful MDR/CE marking, delivering evidence-backed regulatory compliance through robust extractables and leachables risk assessments as required by the new EU MDR and IVDR guidelines.

Expansion of Biologics and Injectable Therapies Accelerating Testing Needs:

The growth of biologics, biosimilars, and injectable therapies significantly increases the complexity of packaging safety requirements. Biologics are highly sensitive to external contaminants, which heightens the risk of harmful interactions with packaging components. Companies rely on testing services to safeguard product integrity and meet regulatory expectations. It drives higher adoption of extractables and leachables analysis across the biopharma industry.

For instance, Pfizer made a partnership with the American Cancer Society through the ‘Change the Odds’ initiative in February 2024, which is a 3-year initiative driven by $15 million funding support to fill gaps in cancer care disparities.

Advancements in Analytical Technologies Supporting Precision Testing:

The adoption of advanced technologies such as LC-MS, GC-MS, and ICP-MS strengthens the precision of extractables and leachables testing. These tools enable detection of trace impurities and potential contaminants with greater accuracy. The extractable and leachable testing services market leverages these advancements to provide detailed insights that improve decision-making. It allows manufacturers to predict risks earlier and maintain product quality standards.

Growth of Outsourcing and Global Clinical Trials Expanding Market Scope :

Pharmaceutical and biotech companies increasingly outsource testing services to reduce costs and focus on core R&D activities. The rise in global clinical trials, particularly in Asia-Pacific, fuels demand for third-party testing providers with international compliance expertise. The extractable and leachable testing services market gains from this trend, with specialized laboratories expanding service capacity. It ensures faster time-to-market while meeting global regulatory benchmarks.

Market Trends:

Increasing Focus on Biopharmaceutical Packaging and Complex Drug Delivery Systems:

The rise of biologics and advanced therapies highlights the need for packaging that ensures safety and stability. Biopharmaceuticals are highly sensitive to impurities, driving expanded use of extractables and leachables testing for vials, syringes, and infusion systems. The extractable and leachable testing services market adapts by developing more specialized methods tailored to complex drug formulations. It reflects a shift from general testing to customized solutions for high-risk products. Growing collaborations between drug developers and testing providers support early-stage packaging evaluations. This trend strengthens compliance while reducing risks during clinical development and commercial launch.

- For Instance, Eurofins BioPharma Product Testing offers advanced GC-MS and LC-MS-based extractables and leachables (E&L) testing for biologic packaging, as part of their comprehensive range of services for mitigating risks of adverse drug reactions and regulatory non-compliance in injectable therapies

Integration of Digital Tools and Expansion of Global Outsourcing Networks:

Adoption of digital technologies, including automated data management and cloud-based platforms, improves testing efficiency and transparency. Laboratories integrate advanced informatics to track, analyze, and report extractables and leachables data for faster decision-making. The extractable and leachable testing services market expands globally, with more outsourcing to specialized labs in Asia-Pacific and Latin America. It ensures cost-effective solutions while meeting international regulatory standards. Growing demand from multinational pharmaceutical firms encourages cross-border service collaborations and partnerships. This trend supports a more interconnected testing ecosystem aligned with global drug supply chains.

- For Instance, WuXi AppTec conducts extractables and leachables (E&L) studies for clients, including at its Suzhou facility, which underwent a successful audit by Japan’s PMDA in 2024. Throughout 2024, the company served approximately 6,000 customers across over 30 countries and met its financial guidance, demonstrating its wide-ranging capacity and global partnerships

Market Challenges Analysis:

High Testing Costs and Limited Standardization Creating Barriers for Adoption:

The cost of extractables and leachables testing remains a significant challenge, particularly for small and mid-sized pharmaceutical firms. Complex analytical methods such as LC-MS and GC-MS demand advanced equipment, skilled personnel, and lengthy testing cycles. The extractable and leachable testing services market faces hurdles because cost-sensitive companies may delay or limit testing. It restricts widespread adoption and slows early-stage drug development programs. Limited global standardization in testing protocols further complicates compliance, creating uncertainty for companies operating across multiple regions. This lack of harmonization increases regulatory risk and forces firms to invest more in region-specific testing.

Shortage of Skilled Expertise and Extended Timelines Affecting Market Efficiency:

Testing requires highly trained scientists capable of handling sophisticated analytical instruments and interpreting complex results. A shortage of skilled professionals impacts service capacity and contributes to backlogs in testing laboratories. The extractable and leachable testing services market struggles with extended timelines, especially when demand surges with new product launches or regulatory changes. It creates bottlenecks that can delay approvals and market entry for pharmaceutical products. Maintaining consistent quality across outsourced testing networks also poses challenges, as variations in capabilities exist among providers. Addressing these gaps is critical to improving efficiency and strengthening industry confidence.

Market Opportunities:

Expansion of Biologics and Combination Products Creating Long-Term Growth Opportunities:

The growing pipeline of biologics, biosimilars, and advanced therapies drives strong demand for specialized safety testing. These complex drugs require packaging solutions that eliminate risks of leachable impurities, opening new revenue streams for testing providers. The extractable and leachable testing services market gains traction by offering tailored solutions for injectable devices, pre-filled syringes, and infusion systems. It allows pharmaceutical companies to accelerate regulatory approvals while ensuring patient safety. The surge in drug-device combination products further expands opportunities, as regulators increase scrutiny on packaging materials. Service providers that innovate in this space position themselves for long-term competitive advantage.

Emerging Markets and Outsourcing Demand Supporting Service Expansion:

Pharmaceutical manufacturing growth in Asia-Pacific and Latin America creates attractive opportunities for global testing companies. Rising investments in clinical trials and stricter regulatory enforcement drive higher demand for extractables and leachables analysis. The extractable and leachable testing services market benefits by expanding outsourcing networks to meet regional compliance needs. It enables cost-efficient solutions for companies seeking international approvals. Digital platforms and remote data access enhance collaboration between global pharma firms and regional labs. This trend fosters broader adoption of testing services across new geographies and strengthens the overall market potential.

Market Segmentation Analysis:

By Product Type:

The extractable and leachable testing services market by product type is divided into extractables testing and leachables testing. Extractables testing leads due to its role in identifying potential risks in packaging materials before product launch. Leachables testing follows closely, supported by its critical role during stability studies and post-approval monitoring. It ensures patient safety by detecting harmful substances that migrate into drug formulations during storage or use. Growth in biologics and combination devices drives higher demand for both service categories.

- For Instance, Eurofins Scientific provides comprehensive leachables testing for the biopharmaceutical industry. The company uses advanced analytical techniques like LC-MS/MS and has a proven track record of helping clients detect and quantify impurities at very low levels to ensure product safety and regulatory compliance

By Application:

By application, the market covers pharmaceuticals, biotechnology, and medical devices. Pharmaceuticals dominate, fueled by the expanding pipeline of injectables and oral solid dosage forms that require rigorous safety testing. Biotechnology contributes strongly due to the complexity of biologics, biosimilars, and gene therapies. It creates significant demand for precise analytical testing to meet global compliance standards. Medical devices, including infusion systems and pre-filled syringes, further expand service adoption.

- For instance, Pfizer conducts comprehensive analytical testing for its COVID-19 vaccine manufacturing, submitting Certificates of Analysis for each drug product lot at least 48 hours prior to vaccine distribution, with their injectable products undergoing 100% visual inspection testing to meet USP <1> Injections standards.

By End Use:

End use segmentation highlights pharmaceutical companies, contract research organizations (CROs), and medical device manufacturers. Pharmaceutical companies represent the largest end-use segment, driven by regulatory mandates and safety requirements. CROs gain traction as outsourcing accelerates across global drug development pipelines. It offers cost efficiency and expertise, making CROs a vital growth channel. Medical device manufacturers also increasingly rely on extractables and leachables testing to ensure compliance with stringent quality benchmarks.

Segmentations:

By Product Type:

- Extractables Testing

- Leachables Testing

By Application:

- Pharmaceuticals

- Biotechnology

- Medical Devices

By End Use:

- Pharmaceutical Companies

- Contract Research Organizations (CROs)

- Medical Device Manufacturers

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America:

North America holds 41% market share in the extractable and leachable testing services market in 2024. The region leads due to stringent FDA requirements and the presence of major pharmaceutical manufacturers. It benefits from strong infrastructure, advanced analytical capabilities, and a skilled workforce. Growth is supported by the expansion of biologics and combination therapies that demand higher testing standards. The presence of global contract research organizations further strengthens service capacity. Increasing investments in R&D pipelines and early compliance testing continue to sustain regional dominance.

Europe:

Europe accounts for 29% market share in the extractable and leachable testing services market in 2024. The region thrives under EMA-led harmonized safety guidelines and expanding pharmaceutical innovation hubs. It is supported by the rapid adoption of biosimilars and high investments in biologics manufacturing. Strong collaborations between drug developers and specialized testing laboratories enhance compliance outcomes. Growth in outsourcing further boosts service demand across leading countries such as Germany, the UK, and Switzerland. The presence of advanced healthcare systems continues to support regulatory-driven market expansion.

Asia-Pacific:

Asia-Pacific captures 21% market share in the extractable and leachable testing services market in 2024. The region is the fastest-growing, driven by expanding pharmaceutical production in China and India. It benefits from increasing clinical trials and rising regulatory alignment with global safety standards. Outsourcing opportunities strengthen as multinational firms seek cost-efficient and compliant testing partners. The availability of skilled talent pools and growing healthcare infrastructure accelerate adoption. Strong government support for local manufacturing and exports fuels long-term industry growth. It positions Asia-Pacific as a critical hub for the future expansion of testing services.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Eurofins Scientific

- SGS Société Générale de Surveillance SA

- WuXi AppTec

- Merck KGaA

- West Pharmaceutical Services, Inc.

- Wickham Micro Limited (Medical Engineering Technologies Ltd.)

- Pacific Biolabs

- Boston Analytical

- Sotera Health (Nelson Laboratories, LLC)

Competitive Analysis:

The extractable and leachable testing services market is highly competitive, driven by global demand for regulatory compliance and product safety. Key players include Eurofins Scientific, SGS Société Générale de Surveillance SA, WuXi AppTec, Merck KGaA, and West Pharmaceutical Services, Inc. These companies strengthen their positions through advanced analytical capabilities, global presence, and comprehensive service portfolios. It focuses on meeting complex requirements from pharmaceutical, biotechnology, and medical device sectors. Strategic partnerships, acquisitions, and regional expansions are common strategies to extend market reach and service capacity. Continuous investment in modern technologies such as LC-MS and ICP-MS enhances accuracy and efficiency in testing. It ensures stronger customer confidence, while differentiation often comes through specialized expertise, faster turnaround times, and tailored solutions for high-risk biologics and combination products.

Recent Developments:

- In September 2025, Eurofins Scientific announced the completion of its purchase financed by senior unsecured Euro-denominated bonds.

- In September 2025, SGS Société Générale de Surveillance SA partnered with 44west, with leadership updates from CEO Géraldine Picaud.

- In Dec 2025, WuXi AppTec announced the sale of its US and UK-based Advanced Therapies operations to Altaris LLC, with closing expected in the first half of 2025.

Report Coverage:

The research report offers an in-depth analysis based on Product Type, Application, End Use and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- The extractable and leachable testing services market will expand with growing demand for biologics and injectable therapies.

- It will witness stronger adoption of advanced analytical technologies such as LC-MS and GC-MS to improve accuracy.

- Service providers will focus on offering customized testing solutions for complex drug-device combination products.

- Outsourcing of testing services will rise as pharmaceutical firms aim to reduce costs and streamline operations.

- Global harmonization of regulatory guidelines will create opportunities for consistent testing standards across regions.

- The market will benefit from rising investments in Asia-Pacific, driven by expanding clinical trials and pharma manufacturing.

- Digital platforms and automated data management tools will enhance reporting speed and transparency.

- Collaborations between pharmaceutical companies and specialized laboratories will increase to ensure early compliance.

- The extractable and leachable testing services market will see demand growth from emerging biosimilars and advanced therapies.

- It will remain competitive, with companies differentiating through technology, global presence, and regulatory expertise.