Market Overview

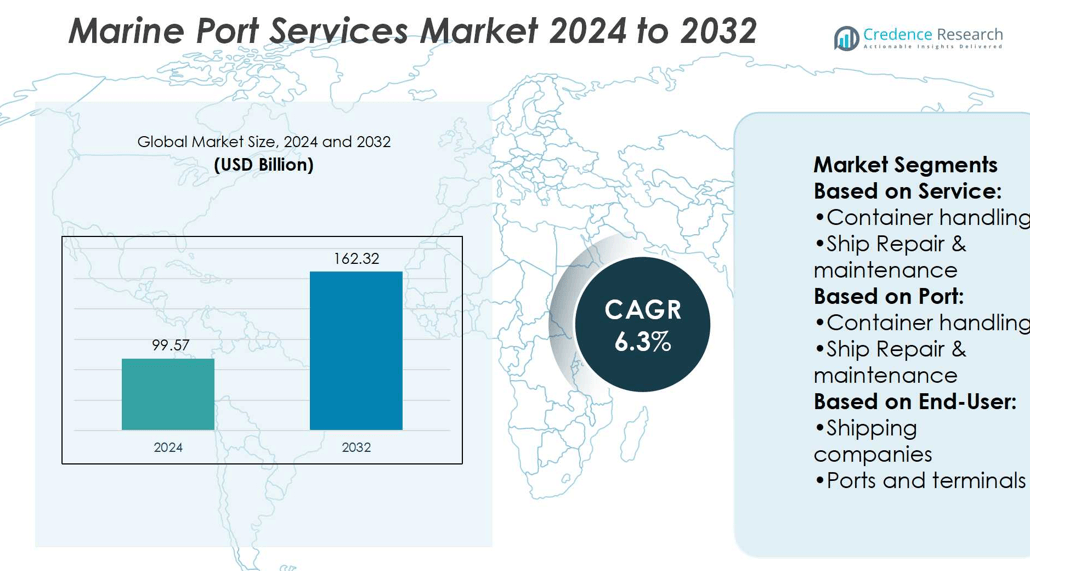

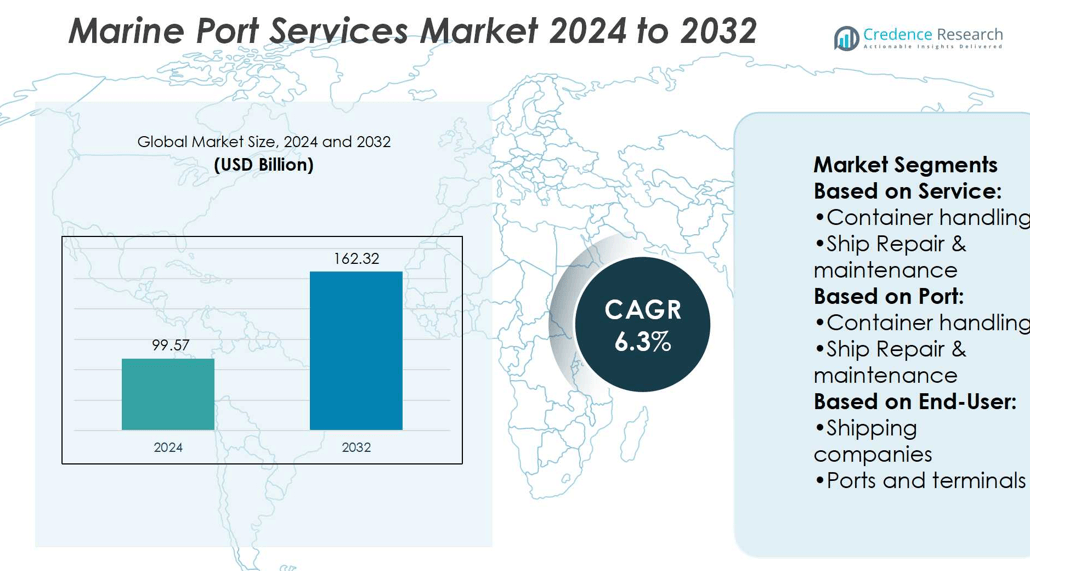

Marine Port Services Market size was valued at USD 99.57 billion in 2024 and is anticipated to reach USD 162.32 billion by 2032, at a CAGR of 6.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Marine Port Services Market Size 2024 |

USD 99.57 billion |

| Marine Port Services Market, CAGR |

6.3% |

| Marine Port Services Market Size 2032 |

USD 162.32 billion |

The Marine Port Services Market grows through rising global trade, expanding containerization, and strong demand for modern infrastructure. Governments and private operators invest in deep-water terminals, logistics corridors, and smart port facilities to handle increasing cargo volumes and larger vessels. Digital transformation with IoT, blockchain, and AI platforms enhances efficiency, transparency, and cargo visibility across supply chains. Sustainability trends drive adoption of LNG bunkering, shore power, and electrified cargo equipment to meet stricter emission norms. Multi-modal connectivity further supports seamless cargo transfer, positioning ports as critical hubs in global trade networks while advancing resilience and competitiveness in evolving markets.

The Marine Port Services Market shows strong regional variation, with Asia-Pacific holding the largest share due to rapid trade growth and advanced port infrastructure, followed by Europe with sustainable operations and North America with ongoing modernization. Latin America and the Middle East & Africa record steady expansion through energy exports and strategic trade routes. Key players such as PSA International, DP World Limited, AP Moller Maersk, Hutchison Ports, and China Merchants Port focus on digitalization, capacity expansion, and green port initiatives.

Market Insights

- Marine Port Services Market size was valued at USD 99.57 billion in 2024 and is projected to reach USD 162.32 billion by 2032 at a CAGR of 6.3%.

- Rising global trade, expanding containerization, and demand for advanced infrastructure drive market growth.

- Ports adopt IoT, blockchain, and AI platforms to improve cargo visibility and operational efficiency.

- Stricter emission norms encourage adoption of LNG bunkering, shore power, and electrified handling equipment.

- Competition remains high with players focusing on digitalization, sustainability, and global capacity expansion.

- High infrastructure costs and regulatory complexity create restraints for modernization projects in some regions.

- Asia-Pacific leads with largest share, followed by Europe and North America, while Latin America and the Middle East & Africa show steady growth supported by trade routes and energy exports.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Global Trade and Expanding Containerization

The Marine Port Services Market gains momentum from sustained growth in international trade volumes. Containerization supports efficient cargo handling, reducing transit times and ensuring secure shipments. Major ports invest in larger container terminals to meet demand from mega-vessels. It strengthens port competitiveness in global supply chains. The adoption of automated cranes and smart yard systems enhances operational efficiency. Rising container traffic across Asia-Pacific and Europe further accelerates port modernization efforts.

- For instance, DP World’s London Gateway currently operates four deep-water berths, with a quay length of over 1,600 m. While it is designed to handle the world’s largest container vessels, its current annual throughput is below the eventual 3.5 million TEU capacity.

Infrastructure Development and Investment in Port Expansion Projects

Governments and private operators drive investment in deep-water berths, logistics parks, and smart facilities. The Marine Port Services Market benefits from rising capital inflows for large-scale port infrastructure. It enables ports to handle increasing cargo throughput and vessel sizes. Expansion projects in Asia, the Middle East, and Africa improve connectivity to trade hubs. Integration of multi-modal transport networks ensures seamless cargo transfer between sea, rail, and road. Upgraded facilities also attract global shipping alliances, strengthening long-term growth prospects.

- For instance, Tianjin Port’s Second Container Terminal, the world’s first “smart zero-carbon” terminal, has an annual designed capacity of 2.5 million TEUs. The facility features the world’s largest driverless fleet, comprised of 76 autonomous electric container trucks, which work with other automated equipment to improve efficiency.

Technological Integration for Port Automation and Digital Transformation

Automation technologies, IoT systems, and AI-based solutions transform traditional port operations. The Marine Port Services Market adopts smart gates, digital twins, and predictive analytics to streamline workflows. It reduces vessel turnaround times and minimizes manual errors. Ports in Europe and North America lead in deploying blockchain-enabled trade platforms. Real-time cargo visibility boosts transparency for logistics partners and shippers. Advancements in digital systems enhance resilience against supply chain disruptions.

Rising Demand for Sustainability and Green Port Initiatives

Environmental regulations encourage ports to adopt cleaner fuels, electrified equipment, and renewable energy. The Marine Port Services Market gains from initiatives like shore power and LNG bunkering stations. It reduces emissions during vessel berthing and supports compliance with IMO targets. Ports across Scandinavia and East Asia implement large-scale renewable integration programs. Deployment of hybrid cargo-handling equipment improves energy efficiency. Sustainable infrastructure development positions ports as leaders in green logistics and trade facilitation.

Market Trends

Adoption of Smart Port Technologies and Digital Platforms

The Marine Port Services Market advances through rapid integration of digital tools and automation. Ports deploy IoT sensors, AI-driven monitoring, and automated gates to enhance efficiency. It reduces vessel waiting times and improves cargo visibility for stakeholders. Blockchain-based trade platforms gain traction, ensuring secure documentation and streamlined transactions. Predictive analytics assist operators in optimizing berth allocation and resource management. Global ports prioritize digitalization to strengthen resilience against future supply chain disruptions.

- For instance, COSCO-HIT’s Remote Operations Centre saw the use of 17 remote-controlled quay cranes. While the company aims to enhance productivity, the number of moves per hour depends on various factors and does not apply uniformly to every crane.

Expansion of Multi-Modal Connectivity and Integrated Logistics

Growing demand for seamless logistics fosters investment in rail, road, and inland waterways. The Marine Port Services Market emphasizes multi-modal integration to support higher cargo volumes. It ensures smooth cargo transfer from ports to regional and inland hubs. Development of logistics corridors and dry ports strengthens hinterland connectivity. Major economies invest heavily in infrastructure to reduce bottlenecks and improve supply chain agility. Integration of smart tracking systems enhances real-time cargo coordination across transport modes.

- For instance, PSA Singapore handled a record 40.9 million TEUs across its container terminals, solidifying its position as the world’s largest container transhipment hub. The port, which operates as an integrated facility with 55 berths at its City, Pasir Panjang, and Tuas Port terminals, is continually investing in advanced technology to improve efficiency.

Shift Toward Sustainable and Eco-Friendly Port Operations

Sustainability commitments drive ports to adopt renewable energy, electrified cranes, and hybrid cargo equipment. The Marine Port Services Market evolves with the adoption of LNG bunkering, shore power systems, and emission control areas. It aligns with global IMO regulations to cut carbon footprints. Ports in Northern Europe and East Asia lead green initiatives through renewable integration projects. Deployment of energy-efficient technologies strengthens competitiveness for eco-conscious shipping lines. Sustainability trends reshape long-term strategies in port development worldwide.

Rising Focus on Mega-Vessel Handling and Terminal Capacity Expansion

The growing size of container vessels increases demand for larger berths and advanced terminals. The Marine Port Services Market adapts by expanding deep-water facilities and strengthening handling capacity. It enables ports to serve global alliances deploying ultra-large container ships. Investment in automated cranes and smart yard equipment improves cargo throughput. Ports across Asia and the Middle East lead expansion projects to meet global trade needs. Rising vessel sizes push operators to redesign port layouts for higher efficiency.

Market Challenges Analysis

High Infrastructure Costs and Complexity of Port Modernization

The Marine Port Services Market faces significant challenges from the high costs of expanding and modernizing port infrastructure. Building deep-water berths, automated terminals, and digital platforms demands extensive capital investment. It often strains government budgets and delays project timelines, especially in emerging economies. Ports also face difficulties in aligning funding with long-term trade forecasts, which creates uncertainty in investment returns. Regulatory approvals and land acquisition add further complexity to expansion projects. Limited private sector participation in certain regions restricts modernization progress and slows efficiency gains.

Environmental Regulations and Rising Operational Constraints

Stringent emission norms and sustainability targets increase compliance costs for port operators. The Marine Port Services Market must adapt to stricter rules on vessel emissions, cargo-handling equipment, and fuel use. It requires investments in shore power facilities, LNG bunkering, and electrified cranes, which are often costly and time-consuming. Rising fuel prices and labor shortages compound operational challenges in maintaining smooth port services. Global supply chain disruptions highlight the vulnerability of ports to geopolitical tensions and trade conflicts. Limited adoption of uniform international standards further complicates global coordination across maritime hubs.

Market Opportunities

Growth Potential through Digital Transformation and Smart Port Development

The Marine Port Services Market offers strong opportunities through digitalization and automation. Ports that integrate IoT, blockchain, and AI solutions improve operational efficiency and attract global shipping alliances. It creates faster clearance processes, reduced vessel turnaround times, and enhanced cargo visibility. Investment in digital twins and predictive analytics supports better resource allocation and risk management. Smart port initiatives funded by governments and private investors expand the scope of innovation. Ports that embrace digital platforms gain a competitive edge in global trade networks.

Expansion Opportunities in Green Infrastructure and Emerging Trade Corridors

Sustainability and new trade routes open fresh prospects for global ports. The Marine Port Services Market benefits from investments in LNG bunkering stations, shore power facilities, and renewable integration projects. It positions ports to meet stricter emission norms while attracting eco-conscious shipping lines. Growth in Belt and Road corridors and Africa’s coastal trade hubs creates demand for advanced port services. Rising interest in offshore energy, including wind projects, drives new port infrastructure requirements. Ports that align with green strategies and emerging trade flows capture long-term business growth.

Market Segmentation Analysis:

By Service

The Marine Port Services Market demonstrates strong growth in container handling, driven by rising global trade volumes. It supports efficient cargo movement and remains the backbone of modern port operations. Advanced terminal automation and digital yard systems strengthen throughput capacity and minimize delays. Ship repair and maintenance services also hold a critical position, ensuring operational safety and compliance with global standards. Ports equipped with dry docks and specialized repair facilities attract higher vessel traffic. Increasing demand for preventive maintenance and retrofitting services expands opportunities for service providers.

- For instance, DP World’s official publications, the port has over 100 berths across its various terminals, with a total quay length of 25 kilometers (25,000 meters).

By Port

Container ports lead the market due to their essential role in handling large-scale global shipments. The Marine Port Services Market benefits from the growing deployment of deep-water container terminals designed for mega-vessels. It enables smoother trade flows and supports supply chain reliability across regions. Ports offering container handling services gain a competitive edge with advanced cranes and automated tracking systems. Ship repair and maintenance ports also maintain steady growth through their ability to extend vessel lifecycles. Strategic investments in multipurpose port facilities improve overall operational efficiency.

- For instance, HHLA’s Container Terminal Burchardkai (CTB) in Hamburg operates over 30 container gantry cranes, 18 of which are mega-ship cranes capable of servicing vessels carrying up to 24,000 TEUs or more.

By End User

Shipping companies dominate the end-user segment, relying on ports for container handling, vessel repairs, and logistics support. The Marine Port Services Market evolves with the growing requirements of shipping lines for faster turnaround and sustainable solutions. It ensures reduced downtime and improved coordination between sea and land transport. Ports and terminals represent another major end-user group, focusing on digital upgrades and infrastructure modernization. Investments in smart port technologies and eco-friendly operations strengthen their global position. The combination of shipping company demands and terminal upgrades drives long-term growth across the sector.

Segments:

Based on Service:

- Container handling

- Ship Repair & maintenance

Based on Port:

- Container handling

- Ship Repair & maintenance

Based on End-User:

- Shipping companies

- Ports and terminals

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds 28% share of the Marine Port Services Market, driven by advanced infrastructure and strong trade activity. The region benefits from major ports such as Los Angeles, Long Beach, and New York, which handle large container volumes and maintain modern facilities. It leverages advanced automation systems, predictive maintenance platforms, and digitalized cargo tracking to strengthen efficiency. The United States leads investments in green port initiatives, including shore power systems that reduce emissions from berthed vessels. Canada supports growth with expanded container handling capacity at ports like Vancouver and Halifax, which serve as vital gateways to Asia-Pacific and Europe. Mexico plays an increasing role through Gulf of Mexico ports that boost energy exports and imports. It is positioned strongly in global trade networks through advanced services and reliable port operations.

Europe

Europe accounts for 25% share of the Marine Port Services Market, supported by its dense network of container ports and extensive maritime trade. Major hubs such as Rotterdam, Antwerp, and Hamburg dominate regional cargo handling and transshipment. The region leads in sustainable port operations, with large-scale integration of renewable energy and electrified cargo equipment. It also advances adoption of blockchain platforms to streamline documentation and enhance supply chain transparency. Ports across the Mediterranean, including Valencia and Piraeus, expand their role in connecting Europe with Asia and Africa. Ship repair and maintenance services remain strong in regions like Northern Europe, where advanced dry docks and specialized facilities attract global fleets. Europe maintains its competitive position by balancing technological innovation with sustainability commitments.

Asia-Pacific

Asia-Pacific commands the largest share at 32%, reflecting its position as the global hub for container handling and trade growth. China dominates with leading ports such as Shanghai, Ningbo-Zhoushan, and Shenzhen, which together handle billions of tons of cargo annually. Japan, South Korea, and Singapore strengthen the region through advanced terminal automation, LNG bunkering services, and integrated logistics hubs. It benefits from strong government-led infrastructure investments and regional trade corridors, including the Belt and Road Initiative. Rapid growth in India’s container ports, particularly Mundra and Jawaharlal Nehru, enhances connectivity with global markets. Southeast Asian nations, including Malaysia and Indonesia, expand container capacity and repair facilities to serve regional demand. Asia-Pacific leads in innovation and scale, setting global benchmarks in port efficiency and digital transformation.

Latin America

Latin America holds 8% share of the Marine Port Services Market, with Brazil, Mexico, and Panama leading regional activity. Ports in Brazil, including Santos, invest in container terminal modernization and expanded ship repair services. Mexico’s Pacific coast ports strengthen trade with Asia, while Atlantic ports boost connections with the United States and Europe. The Panama Canal remains a pivotal hub for global shipping, supporting regional demand for advanced port services. It improves competitiveness through expanded terminals and upgraded cargo-handling equipment. Chile and Colombia also grow their presence with investments in logistics corridors and container ports. Latin America shows gradual improvement, with rising opportunities tied to energy exports and diversified trade.

Middle East & Africa

The Middle East & Africa represent 7% share of the Marine Port Services Market, fueled by strategic trade routes and energy exports. The UAE, with Jebel Ali Port, dominates regional shipping services and logistics operations. Saudi Arabia invests heavily in port expansion under Vision 2030, creating advanced container and logistics hubs. Africa strengthens its role through expanding coastal trade, with Nigeria, South Africa, and Kenya upgrading ports to meet growing demand. Ship repair and maintenance facilities expand in Gulf countries to support oil and gas fleets. It benefits from growing trade with Asia and Europe, supported by investments in free trade zones and special economic areas. The region continues to emerge as a critical link in global maritime trade.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The Marine Port Services Market players include Shipping Solutions and Services Ltd., Tianjin Port Development Holdings Ltd., Hutchison Ports, CarboShield Inc., PSA International, DP World Limited, AP Moller Maersk, International Container Terminal Services, China Merchants Port, and Hamburger. The Marine Port Services Market remains highly competitive, with companies prioritizing infrastructure expansion, digital transformation, and sustainable operations. Operators invest heavily in smart port technologies, including IoT-enabled monitoring, blockchain trade platforms, and automated cargo-handling systems to strengthen efficiency and reliability. Green initiatives, such as shore power facilities and LNG bunkering stations, also gain momentum to meet stricter environmental regulations. Firms expand their global presence by targeting high-growth regions in Asia-Pacific, the Middle East, and Africa, where rising trade volumes drive demand for modern port services. Strategic collaborations with logistics providers and government bodies further enhance competitiveness. The market continues to evolve around innovation, efficiency, and environmental stewardship, ensuring long-term growth across interconnected trade networks.

Recent Developments

- In May 2024, Caterpillar Marine partnered up with Damen Shipyards Group to unveil the first set of marine 3500E cat engines, and this is succeeding their signing of the memorandum of understanding. Lastly, the field test will be conducted in the year 2026.

- In February 2024, Boluda Towage & Salvage SL has acquired the towage company Resolve Salvage and Fire (Gibraltar), which operates on both sides of the Strait of Gibraltar. This acquisition will enable Boluda Towage to further expand its international footprint, enhancing its presence in the strategically important Strait of Gibraltar, a key gateway between the Atlantic Ocean and the Mediterranean Sea, as well as in the Indian Ocean, facilitated by the Suez Canal and Red Sea.

- In January 2024, Yamaha Motor has declared that they will be acquiring all the stocks of Torqeedo, the German leader in Marine Electric Propulsion Systems, after purchasing the stock that was held by DEUTZ AG. This purchase, however, still needs to be approved due to not having the proper governance for electric marine propulsion as it has a mechanical range that consists of electric outboard, inboard, motors, batteries, and accessories.

- In November 2023, ONE launched its new West India North America (WIN) service, which connects India’s West Coast and the U.S. East Coast. The new WIN service offers a weekly route from Hazira, Nhava Sheva, Mundra to New York, Norfolk, Savannah, Charleston.

Report Coverage

The research report offers an in-depth analysis based on Service, Port, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Marine Port Services Market will expand through rising container volumes and global trade flows.

- Ports will adopt automation and digital platforms to improve efficiency and cargo visibility.

- Green port initiatives will grow with wider use of shore power and LNG bunkering facilities.

- Demand for ship repair and maintenance services will rise with larger and aging fleets.

- Asia-Pacific will maintain leadership with continuous investment in mega-port and logistics projects.

- Europe will strengthen its position through sustainable operations and advanced digital integration.

- North America will focus on port modernization and expansion of trade infrastructure.

- Latin America will gain growth from energy exports and upgraded container terminals.

- Middle East & Africa will emerge as strategic hubs with rising investments in port capacity.

- Collaboration between governments and private operators will drive innovation and long-term competitiveness.