Market Overview

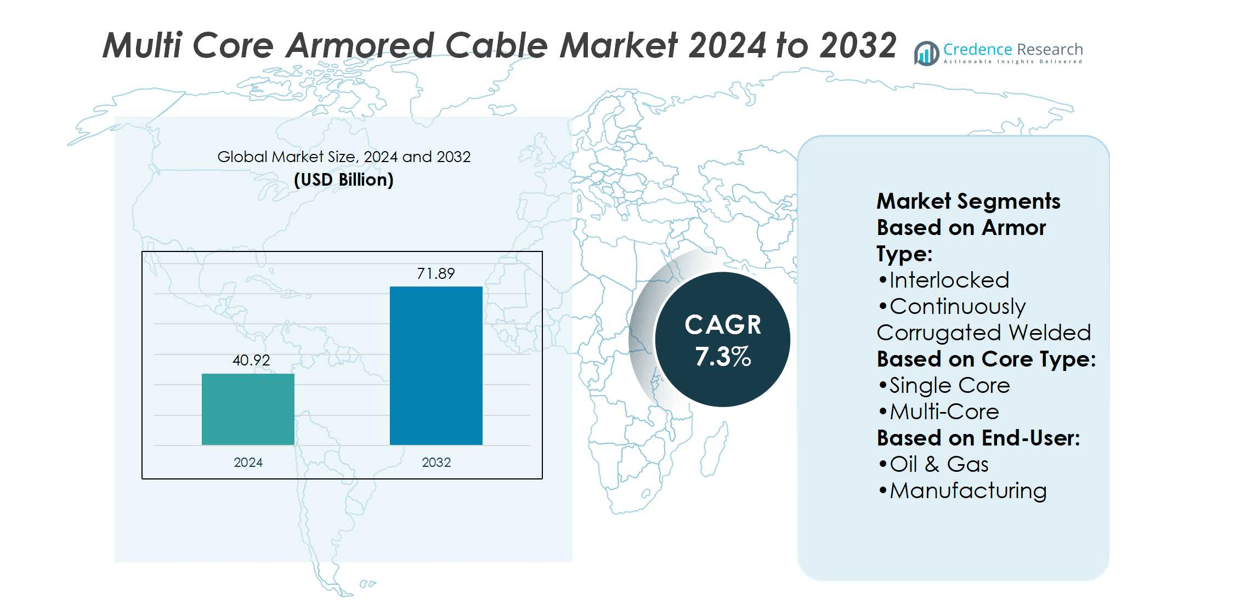

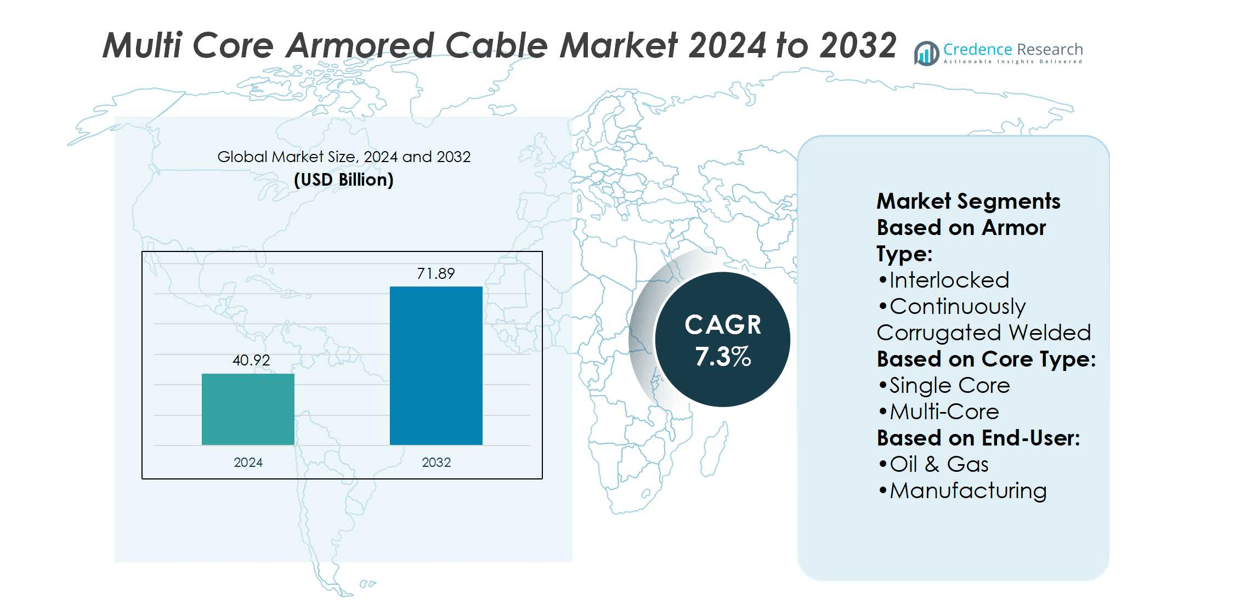

Multi Core Armored Cable Market size was valued at USD 40.92 billion in 2024 and is anticipated to reach USD 71.89 billion by 2032, at a CAGR of 7.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Multi Core Armored Cable Market Size 2024 |

USD 40.92 billion |

| Multi Core Armored Cable Market CAGR |

7.3% |

| Multi Core Armored Cable Market Size 2032 |

USD 71.89 billion |

The Multi Core Armored Cable Market grows through rising demand for reliable power distribution across industrial, construction, and energy sectors. Drivers include rapid urbanization, infrastructure expansion, and strong requirements from oil, gas, and mining projects. It benefits from regulatory emphasis on safety, fire resistance, and durable cabling solutions. Trends highlight increasing adoption in renewable energy installations, smart grids, and underground utility networks. Advancements in insulation materials and eco-friendly designs strengthen market competitiveness. Expanding applications in data centers and smart city projects further support growth. The market continues to evolve with technology-driven solutions that balance efficiency, safety, and sustainability.

The Multi Core Armored Cable Market shows strong geographical presence across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. Asia-Pacific leads growth with rapid industrialization and infrastructure projects, while North America and Europe maintain steady demand through energy, construction, and regulatory compliance. Latin America and Middle East & Africa display opportunities in oil, gas, and mining. Key players shaping the market include Anixter, AT&T, Atkore, Belden, Finolex, Furukawa Electric, Havells, Helukabel, KEI Industries, and Leoni Cables.

Market Insights

- The Multi Core Armored Cable Market size was valued at USD 40.92 billion in 2024 and is expected to reach USD 71.89 billion by 2032, growing at a CAGR of 7.3%.

- The market grows with rising demand for reliable power distribution in industrial, construction, and energy sectors.

- Trends highlight adoption in renewable energy projects, smart grids, and underground cabling networks.

- Competitive intensity increases with players focusing on innovation, eco-friendly materials, and customized solutions.

- High installation costs and raw material price fluctuations act as key restraints for growth.

- Asia-Pacific leads global demand, while North America and Europe sustain growth through modernization and compliance.

- Latin America and the Middle East & Africa create opportunities driven by oil, gas, and mining projects.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Growing Need for Reliable Power Distribution in Industrial and Commercial Sectors

The Multi Core Armored Cable Market benefits from rising demand for secure power distribution in industries and commercial facilities. Heavy machinery, automation systems, and large buildings rely on armored cables for consistent performance. It supports resistance against physical damage, moisture, and harsh environments. Strong growth in industrialization across Asia-Pacific and Africa drives higher adoption. Energy-intensive sectors such as oil, gas, and mining prioritize armored cables for operational safety. This demand strengthens the role of multi-core variants that simplify complex wiring systems.

- For instance, Habia Cable is a known manufacturer of customized, high-performance cables. The company produces cables that are fire-resistant, halogen-free, and designed to meet demanding industry standards like IEC 60331 for fire survival.

Advancing Infrastructure Development and Urban Expansion Projects

The market grows with increasing infrastructure investments in transportation, utilities, and smart cities. Multi Core Armored Cable Market participants supply cables for airports, metros, and large construction sites. It ensures safe underground and overhead power transmission. Rising urbanization in developing economies fuels large-scale housing and commercial projects. Governments fund smart grid modernization, which boosts armored cable requirements. The ability of multi-core designs to handle high voltage and multiple circuits adds long-term value. Expansion of public infrastructure accelerates steady demand worldwide.

- For instance, AFC Cable Systems introduced its patented MC Luminary® MultiZone armored cable, integrating power and control conductors within a single armor, which is designed to reduce installation time and supports 277/480 V circuits.

Stringent Safety Standards and Regulatory Compliance Requirements

Regulatory bodies enforce strict safety standards in construction, power, and telecom sectors. Multi Core Armored Cable Market adoption grows as manufacturers align with these compliance needs. It offers high fire resistance, anti-rodent properties, and improved insulation. Rising awareness of workplace safety strengthens the preference for armored solutions. Certification from global standards such as IEC and UL drives buyer confidence. Industrial operators and contractors prefer cables with proven durability in hazardous settings. Compliance-focused procurement directly fuels the market’s growth trajectory.

Technological Innovation in Cable Design and Performance

Innovation in materials and design enhances the efficiency of armored cables. Multi Core Armored Cable Market players develop lightweight yet durable products to reduce installation costs. It improves conductivity while maintaining flexibility for complex wiring. Integration of halogen-free insulation meets sustainability requirements in modern projects. Smart monitoring technologies embedded within cables support predictive maintenance. Advanced manufacturing methods allow higher customization for varied voltage ratings and applications. These innovations create a strong growth path for cable manufacturers across global markets.

Market Trends

Rising Adoption of Armored Cables in Renewable Energy and Power Projects

The Multi Core Armored Cable Market expands with the global shift toward renewable energy. Solar farms, wind installations, and hydroelectric projects require reliable power transmission systems. It ensures stable connectivity in outdoor and high-stress conditions. Demand grows as utilities integrate renewable plants into national grids. Multi-core designs simplify installation across large project sites. Armored cables gain traction in clean energy due to durability and safety benefits.

- For instance, Prysmian Group leads innovation in cable technologies with record-setting projects. The company engineered a ±525 kV high-voltage direct current (HVDC) armored cable, designed to deliver highly efficient and reliable power transmission across ultra-long distances.

Integration of Advanced Materials for Improved Durability and Safety

Manufacturers focus on advanced insulation and sheath materials that enhance performance. The Multi Core Armored Cable Market adopts halogen-free compounds and flame-retardant coatings. It aligns with sustainability goals and strict safety regulations. These innovations improve fire resistance, reduce toxic emissions, and extend cable lifespan. Industrial operators prefer solutions that deliver resilience against moisture, chemicals, and rodents. Continuous material improvements strengthen the competitive edge of leading suppliers.

- For instance, General Cable developed the 17 FREE™ line of halogen-free cables, which are based on removing halogens from Group 17 of the periodic table.

Growing Use of Armored Cables in Smart Cities and Infrastructure Modernization

Urban infrastructure projects increase demand for armored cables in communication, utilities, and transport. The Multi Core Armored Cable Market supports underground cabling networks required for smart city development. It ensures secure data and power transmission in dense urban environments. Governments invest in metro rail, airports, and digital infrastructure, boosting adoption. Contractors value multi-core cables for handling multiple circuits in limited spaces. Rising infrastructure budgets create long-term opportunities across global regions.

Shift Toward Customization and High-Performance Solutions in End-User Industries

End-user sectors demand tailored solutions to meet specific power and operational needs. The Multi Core Armored Cable Market responds with products designed for oil, gas, telecom, and defense. It enables higher voltage capacity, flexibility, and efficient routing in complex setups. Customization extends to insulation type, conductor material, and sheath thickness. Clients prioritize cables that balance safety with cost efficiency. This trend pushes manufacturers to invest in specialized product portfolios and advanced production lines.

Market Challenges Analysis

High Installation Costs and Complexity of Deployment Across Applications

The Multi Core Armored Cable Market faces challenges linked to high installation costs and labor-intensive deployment. It requires skilled technicians to manage bending, cutting, and terminating processes during setup. Heavy weight and rigid structures increase handling difficulties in large projects. Contractors in cost-sensitive markets hesitate to adopt premium armored solutions. Rising material costs for steel armor and copper conductors further pressure pricing strategies. Budget constraints in small-scale infrastructure projects limit adoption despite long-term reliability benefits. Manufacturers must address cost efficiency to widen market reach.

Supply Chain Disruptions and Compliance with Evolving Standards

Global supply chains expose the market to fluctuations in raw material availability and prices. The Multi Core Armored Cable Market often struggles when disruptions impact copper, aluminum, or specialty polymers. It slows production schedules and raises costs for end users. Compliance with evolving international safety and environmental standards adds further challenges. Regional variations in certification create delays for cross-border suppliers. Smaller players face higher costs to meet these regulatory demands. Sustaining competitiveness requires continuous investment in testing, certification, and quality assurance systems.

Market Opportunities

Expanding Role of Armored Cables in Renewable Energy and Utility Networks

The Multi Core Armored Cable Market holds strong opportunities in renewable energy and modern utility projects. It supports large-scale solar farms, offshore wind turbines, and hydropower plants where reliability is critical. Governments worldwide invest heavily in clean energy, driving demand for durable cabling solutions. Multi-core armored designs meet the need for secure underground and underwater transmission. Utility operators prefer these cables for handling high voltage and resisting environmental stress. Growing adoption of smart grids further boosts demand for advanced armored cable infrastructure. These factors create long-term growth prospects for suppliers.

Rising Demand for Customization in Industrial and Infrastructure Applications

Industries require tailored armored cable solutions to meet diverse operational needs. The Multi Core Armored Cable Market benefits from this trend by offering specialized products for oil, gas, telecom, and defense sectors. It provides flexibility in conductor type, insulation material, and sheath strength. Manufacturers that invest in customization secure contracts in niche, high-value projects. Rapid urbanization and smart city development create further opportunities in underground cabling networks. Demand for high-performance solutions drives innovation in fire-resistant and eco-friendly materials. The shift toward customized, sustainable designs opens new avenues for competitive differentiation.

Market Segmentation Analysis:

By Armor Type

The Multi Core Armored Cable Market is segmented into interlocked and continuously corrugated welded types. Interlocked cables dominate demand due to their flexibility, cost-effectiveness, and ease of installation in commercial and residential projects. It provides strong resistance to crushing forces, making it suitable for building wiring and light industrial applications. Continuously corrugated welded cables offer superior protection in extreme environments where moisture, chemicals, and mechanical stress are common. These cables see high adoption in heavy industries and underground utility networks. Their seamless aluminum or steel sheath ensures better durability, strengthening long-term operational reliability. The preference between the two types depends on application scale, budget, and environmental demands.

- For instance, Sumitomo Electric achieved a world-record in optical fiber capacity and distance. They transmitted 1.02 petabits per second over 1,808 km using a 19-core optical fiber with a standard 0.125 mm cladding, reaching 1.86 exabits per second-km capacity-distance product.

By Core Type

The market is further segmented into single-core and multi-core armored cables. Single-core variants find applications in high-power transmission where minimal interference and flexibility are required. It is widely used in power plants and large-scale industrial facilities. Multi-core armored cables dominate in commercial, residential, and infrastructure projects where multiple circuits must run in compact spaces. These cables save installation costs and reduce space requirements while improving safety. Their versatility supports adoption in control systems, renewable energy networks, and manufacturing plants. The growing need for efficient multi-circuit wiring strengthens demand for multi-core options.

- For instance, Mitsui Chemicals’ EPT™ (Ethylene-Propylene-Terpolymer) demonstrates a volume resistivity ranging from \(10^{13}\) to \(10^{16}\) Ω·cm and a dielectric constant of 3 to 4, offering superior electrical insulation compared to many standard rubbers.

By End User

End users span oil and gas, manufacturing, mining, and construction sectors. The Multi Core Armored Cable Market plays a critical role in oil and gas where cables must withstand harsh offshore and onshore conditions. It ensures reliable power and signal transmission in refineries, rigs, and pipelines. Manufacturing facilities adopt armored cables for machinery, automation systems, and plant safety. Mining operations depend on these cables to endure abrasion, moisture, and heavy loads in underground environments. The construction sector records rising adoption for residential towers, commercial complexes, and public infrastructure projects. Each end user sector drives unique specifications, fueling ongoing product innovation and tailored solutions from manufacturers.

Segments:

Based on Armor Type:

- Interlocked

- Continuously Corrugated Welded

Based on Core Type:

Based on End-User:

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America accounts for 28% of the global market share in the Multi Core Armored Cable Market. Strong demand arises from the oil and gas industry in the U.S. and Canada, where cables support offshore drilling and refining activities. It also gains momentum from the modernization of aging power infrastructure and rising renewable energy projects. The construction sector contributes significantly, with armored cables integrated into commercial buildings, data centers, and residential projects. Increasing investment in smart grids and utility upgrades further boosts adoption. The region’s emphasis on strict safety standards and compliance with UL certifications strengthens preference for armored cables. Growth in manufacturing and defense also supports long-term market opportunities.

Europe

Europe holds 24% of the global market share, supported by its advanced industrial base and strong regulatory environment. The region’s oil and gas sector in the North Sea continues to use armored cables for offshore platforms and pipelines. It also sees high demand in renewable energy, especially wind projects in Germany, the UK, and Denmark. Manufacturing hubs in Central and Eastern Europe contribute steadily through automation and industrial equipment needs. The construction sector drives further adoption, particularly in commercial and public infrastructure projects. EU directives emphasizing fire safety and eco-friendly materials shape product development across the region. Sustainable infrastructure projects under the European Green Deal present growing opportunities for suppliers.

Asia-Pacific

Asia-Pacific leads with 32% of the global market share, making it the largest regional contributor. Rapid industrialization, urbanization, and infrastructure development across China, India, and Southeast Asia drive extensive demand. It finds strong application in large construction projects, metro systems, airports, and energy plants. The oil and gas industry in countries such as China, India, and Australia also relies heavily on armored cables. Expanding renewable energy projects, including solar farms and offshore wind, further fuel growth. Low-cost manufacturing capabilities in the region enhance production scale and supply availability. Rising demand for power distribution in both urban and rural electrification strengthens the region’s dominant position.

Latin America

Latin America represents 8% of the global market share, with growth driven by oil, gas, and mining activities. Brazil, Mexico, and Chile are key contributors, where armored cables support refineries, mining sites, and infrastructure development. It also gains traction from growing construction projects and rising electricity demand in urban areas. Investment in renewable energy, including hydropower and solar plants, adds to adoption. Economic volatility and fluctuating raw material costs limit large-scale expansion, but niche opportunities remain strong. Regional governments’ focus on energy security and industrial modernization supports steady demand. Contractors value armored cables for their resilience in remote and harsh project sites.

Middle East & Africa

The Middle East & Africa account for 8% of the global market share, largely driven by oil and gas dominance. Countries such as Saudi Arabia, UAE, and Qatar use armored cables extensively in refineries, rigs, and petrochemical facilities. It also sees demand growth in mining and construction across South Africa and Nigeria. Rising investments in smart city projects, particularly in the Gulf states, add further opportunities. Renewable energy projects in the region, such as solar parks in the UAE and Morocco, support increasing usage. Harsh desert environments and rugged terrain highlight the importance of armored protection. Strong reliance on infrastructure and energy development ensures steady market demand.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The Multi Core Armored Cable Market features including Anixter, AT&T, Atkore, Belden, Finolex, Furukawa Electric, Havells, Helukabel, KEI Industries, and Leoni Cables. The Multi Core Armored Cable Market is highly competitive, driven by innovation, regulatory compliance, and regional expansion. Companies focus on developing advanced materials, fire-resistant insulation, and eco-friendly designs to meet evolving safety and sustainability standards. It also reflects rising demand from renewable energy projects, smart grids, and large-scale infrastructure development. Strong supply chain capabilities and tailored product offerings support differentiation in a crowded market. Competition intensifies with cost pressures, fluctuating raw material prices, and varying certification requirements across regions. Firms aim to strengthen global presence through partnerships, mergers, and localized manufacturing facilities. The landscape emphasizes a balance between technology advancement and affordability to secure long-term market leadership.

Recent Developments

- In May 2024, in Mexico, BYD introduced the BYD SHARK, its first pickup truck. The newest model in BYD’s lineup, the DMO Super Hybrid Off-road Platform, is a feature of the BYD SHARK, which is positioned as a new energy-intelligent luxury pickup.

- In March 2024, Belden Introduces New Options for Mission-Critical Environments with Improved Connectivity, Quicker Speeds, and More Power. Belden IO Plenum Stadium Cables and Access Control Cables, Lumberg Automation’s LioN-X IO-Link Hub, and improvements to Belden REVConnect Connectivity System, Belden Horizon Console, and Hirschmann Industrial HiVision are among the releases.

- In February 2024, Modern Dispersions, a worldwide producer of thermoplastic compounds and concentrates, has finished and put into service the first stage of a multifaceted production expansion.

- In January 2023, Nexans collaborated with Trimet for a joint development project to develop a material with recycled aluminum for the manufacturing of aluminum rod that is used in electrical cables. Both participants are focusing on reducing the carbon footprint as the product has the capability to fulfil technical requirements on the mechanical properties & conductivity of the alloy.

Report Coverage

The research report offers an in-depth analysis based on Armor Type, Core Type, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily with rising demand from renewable energy projects.

- Infrastructure expansion in emerging economies will increase adoption of armored cables.

- Smart grid modernization will create consistent opportunities for multi-core cable installations.

- Adoption in oil, gas, and mining sectors will remain strong due to safety needs.

- Technological innovation will drive development of fire-resistant and eco-friendly cable materials.

- Urbanization and smart city projects will push higher demand for underground cabling networks.

- Customization for end-user industries will become a key competitive differentiator.

- Regional suppliers will expand presence through cost-effective and localized manufacturing.

- Regulatory compliance and sustainability requirements will influence new product designs.

- Digital monitoring and smart cable technologies will gain traction in advanced markets.