Market Overview:

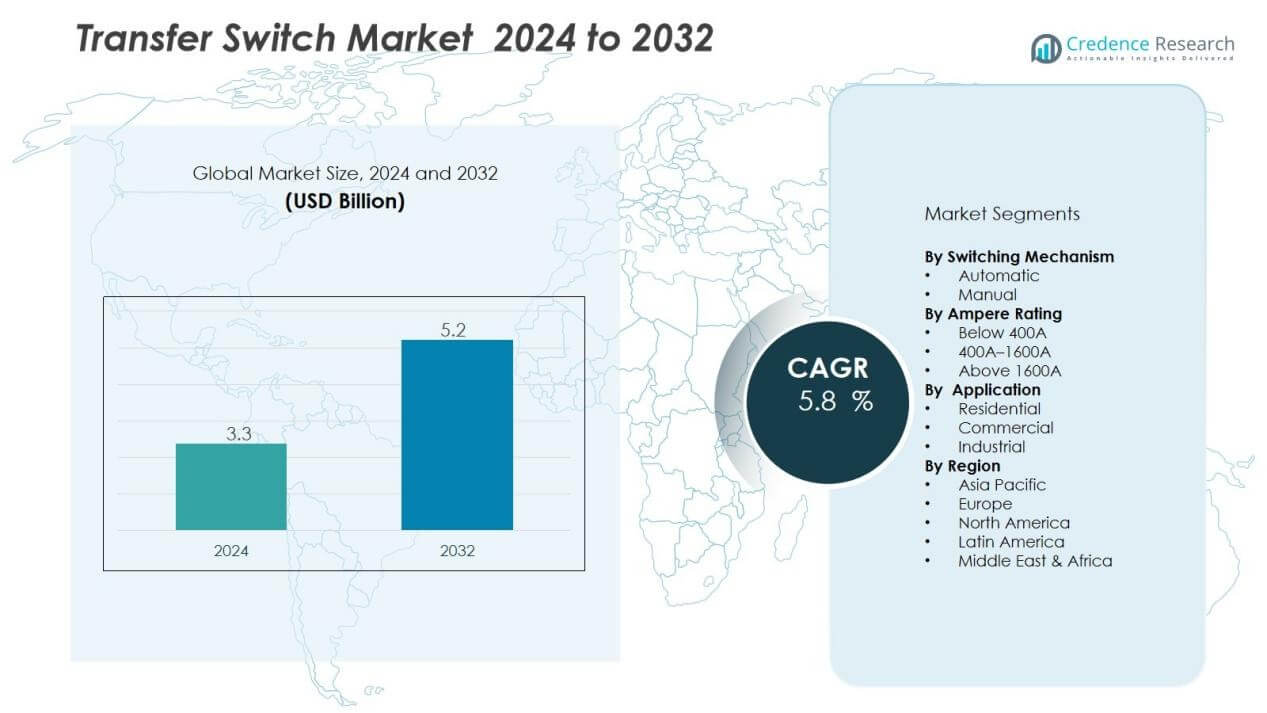

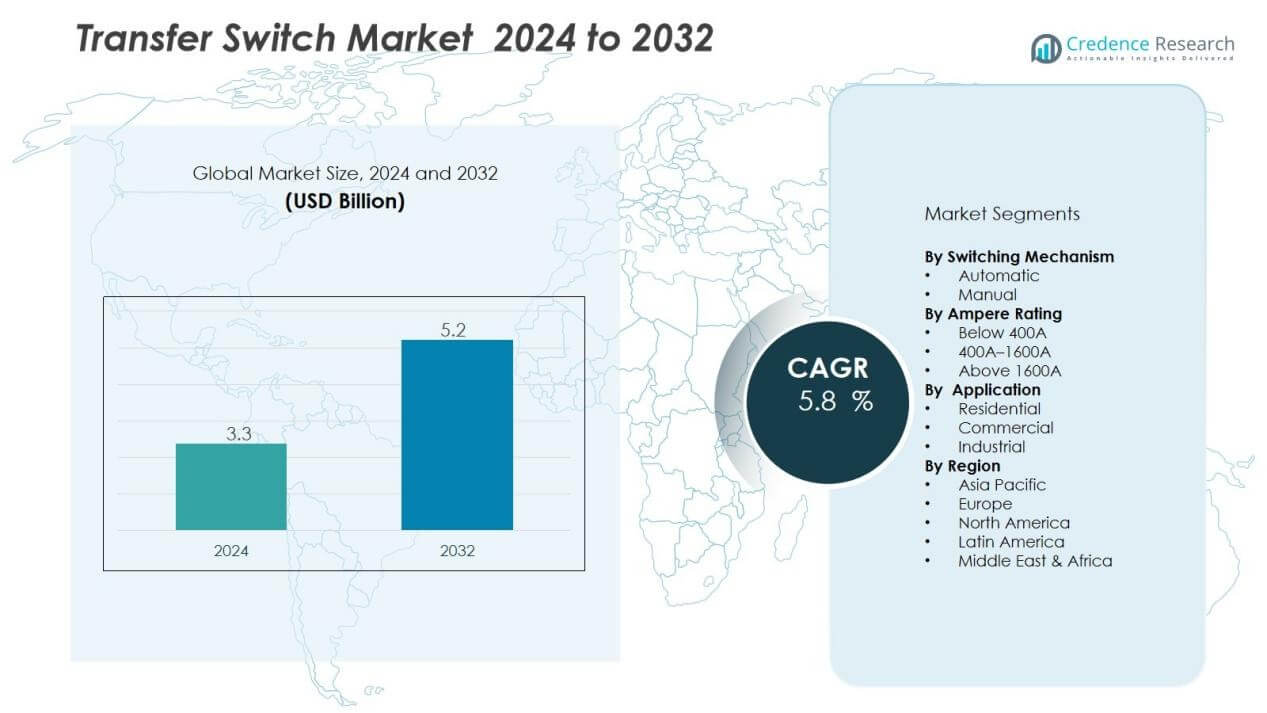

The transfer switch market size was valued at USD 3.3 billion in 2024 and is anticipated to reach USD 5.2 billion by 2032, at a CAGR of 5.8 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Transfer Switch Market Size 2024 |

USD 3.3 Billion |

| Transfer Switch Market, CAGR |

5.8% |

| Transfer Switch Market Size 2032 |

USD 5.2 Billion |

Growth in this market is primarily driven by increasing power outages, rising demand for reliable energy solutions, and rapid urbanization. The growing penetration of renewable energy and distributed power generation further fuels the demand for advanced transfer switch systems. In addition, technological advancements such as smart switches with automated controls and remote monitoring capabilities enhance operational efficiency, making them more attractive to end users.

Regionally, North America leads the transfer switch market, supported by a strong base of backup power installations and frequent grid instability. Europe follows closely, driven by stringent regulations for power reliability and growing industrial demand. Asia-Pacific is emerging as the fastest-growing region, with rapid infrastructure development, increasing industrialization, and rising adoption of smart grid technologies. Latin America and the Middle East & Africa also show growth potential, supported by investments in energy infrastructure and urban development projects.

Market Insights:

- The transfer switch market was valued at USD 3.3 billion in 2024 and is expected to reach USD 5.2 billion by 2032, growing at a CAGR of 5.8%.

- Growing demand for reliable backup power solutions in healthcare, data centers, and manufacturing drives adoption.

- Integration of renewable and distributed energy systems like solar and wind accelerates the need for advanced transfer switches.

- Smart and automated switches with IoT, predictive maintenance, and remote monitoring enhance efficiency and safety.

- High installation costs and maintenance complexity remain key barriers, limiting adoption in cost-sensitive regions.

- North America leads with 38% share, supported by grid instability, smart grid investments, and strong infrastructure.

- Europe holds 27% share, driven by strict regulations, industrial reliance, and rapid renewable energy integration.

- Asia-Pacific accounts for 24% share, expanding rapidly with industrialization, smart city development, and rising electricity demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Growing Demand for Reliable Backup Power Solutions:

The transfer switch market is strongly driven by the rising need for continuous power supply. Power outages disrupt industrial operations, commercial activities, and residential comfort, making reliable backup systems essential. Transfer switches ensure seamless transition between primary and backup sources, reducing downtime and protecting critical equipment. It supports industries like healthcare, data centers, and manufacturing, where uninterrupted power is non-negotiable.

- For instance, Eaton’s automatic transfer switches designed for healthcare facilities support compliance with NFPA 99 standards by enabling power transfer within 8 seconds to avoid critical equipment downtime, ensuring 24/7 patient care continuity.

Increasing Integration of Renewable and Distributed Energy Resources:

The global shift toward renewable energy significantly boosts demand for advanced transfer switches. Solar and wind systems require efficient switching mechanisms to balance supply from multiple sources. It helps integrate renewable systems with traditional grids and backup generators, ensuring stability. Rising government incentives and investment in clean energy projects further stimulate adoption.

- For instance, Russelectric, a Siemens Business, provides paralleling systems with dual, redundant programmable logic controllers (PLCs) that perform soft loading transfer and phase lock synchronizing for renewable energy facilities, enabling seamless utility paralleling with zero load interruption as verified in field installations with up to 30-cycle UL-tested transfer switches.

Advancements in Smart and Automated Switch Technologies:

Technological innovation is a key driver in the transfer switch market, with automation leading growth. Modern switches offer features like remote monitoring, predictive maintenance, and intelligent load management. These innovations improve operational efficiency and reduce manual intervention during outages. It enhances safety, reliability, and cost-effectiveness, encouraging wider adoption across sectors.

Expanding Industrialization and Infrastructure Development:

Rapid industrialization in emerging economies creates robust demand for reliable power solutions. New factories, commercial complexes, and infrastructure projects rely on transfer switches to maintain operational continuity. It plays a vital role in reducing downtime during unstable grid conditions in developing regions. The growing focus on modernizing infrastructure further strengthens market demand worldwide.

Market Trends:

Adoption of Smart and Automated Transfer Switches with Advanced Features:

The transfer switch market is witnessing a clear trend toward smart and automated solutions. Modern transfer switches now include digital monitoring, IoT connectivity, and cloud-based control platforms. These systems allow remote access, real-time performance tracking, and predictive maintenance alerts, which enhance reliability and reduce operational costs. Automation minimizes manual intervention and improves safety during power transfers, making them ideal for critical industries. It also enables intelligent load management, ensuring optimal energy usage and greater efficiency. Growing investment in smart grid infrastructure supports the integration of these advanced technologies.

- For instance, Schneider Electric’s automatic transfer switches incorporate IoT connectivity and QR code access for rating and wiring details, enabling users to interact with a switch position remotely, contributing to operational uptime across over 2 million installed units worldwide.

Rising Deployment Across Renewable Energy and Critical Infrastructure Sectors:

Renewable integration is shaping the future demand for transfer switches globally. Solar, wind, and hybrid energy systems require efficient transfer mechanisms to balance multiple power sources. It ensures stability in distributed energy generation, making transfer switches vital for grid resilience. At the same time, industries like healthcare, data centers, and telecommunications prioritize advanced systems for uninterrupted operations. Expanding renewable projects and increasing reliance on digital infrastructure accelerate adoption across both developed and emerging markets. The transfer switch market reflects this dual trend of renewable integration and critical sector demand, positioning it for long-term growth.

- For instance, Nature’s Generator launched a 12-circuit 120V/240V 30 Amp manual transfer switch specifically designed for solar power integration, capable of running up to 12 single-pole or 6 double-pole circuits with full code compliance including UL 1008 certification.

Market Challenges Analysis:

High Installation Costs and Maintenance Complexity Restrict Widespread Adoption:

The transfer switch market faces challenges due to high initial costs and complex installation requirements. Transfer switches require skilled professionals for setup, calibration, and integration with backup systems. It increases project costs for residential and small-scale users, limiting adoption. Regular maintenance is also critical to ensure reliability, especially in industries with strict uptime requirements. High-quality switches with advanced features demand significant investment, creating barriers in cost-sensitive markets. This cost-related restraint slows penetration in emerging economies.

Regulatory Compliance and Supply Chain Disruptions Affect Market Growth:

Strict safety and performance regulations create hurdles for manufacturers in the transfer switch market. Meeting compliance standards requires extensive testing and certification, which adds cost and time to product development. It also limits smaller manufacturers from competing with established players. Global supply chain disruptions further affect the availability of raw materials and components. Delays in procurement increase lead times and hinder timely project completion. These challenges reduce operational efficiency for manufacturers and slow overall market expansion.

Market Opportunities:

Expanding Renewable Energy Integration Creates Strong Growth Prospects :

The transfer switch market is set to benefit from the rapid growth of renewable energy projects. Solar and wind installations require reliable switching mechanisms to balance fluctuating power supply. It ensures seamless operation between renewable sources, traditional grids, and backup generators. Governments worldwide are increasing investments in clean energy, creating significant demand for advanced transfer switches. Smart technologies with remote monitoring further enhance compatibility with renewable systems. Rising focus on energy efficiency and sustainability strengthens the market’s growth potential.

Growing Demand in Critical Infrastructure and Emerging Economies :

Critical sectors such as healthcare, data centers, and telecommunications present strong opportunities for advanced transfer switch adoption. These industries require continuous power supply to avoid costly disruptions, making high-performance switches essential. It supports reliable operations in high-demand environments where downtime is not acceptable. Emerging economies in Asia-Pacific, Latin America, and Africa are also investing heavily in industrialization and urban infrastructure. Rising electricity demand in these regions increases the need for backup power solutions. This trend opens new revenue opportunities for manufacturers offering cost-effective and scalable solutions.

Market Segmentation Analysis:

By Switching Mechanism:

The transfer switch market is segmented into automatic and manual mechanisms, with automatic switches leading adoption. Automatic systems ensure seamless power transfer without human intervention, making them suitable for critical facilities such as hospitals, data centers, and commercial complexes. It improves safety, reduces downtime, and enhances operational efficiency during outages. Manual switches, while cost-effective, find demand in smaller applications where budget and simplicity are priorities. Growing demand for reliability continues to strengthen the automatic segment’s dominance.

- For Instance, Eaton manufactures industrial-grade manual transfer switches, such as the Magnum series, that support high-amperage operation (from 1,600 up to 5,000 A) with UL compliance. These are typically used in critical power facilities, not residential or smaller commercial buildings.

By Ampere Rating:

Segmentation by ampere rating includes switches below 400A, between 400A–1600A, and above 1600A. Switches below 400A dominate residential and small commercial applications due to their cost-effectiveness and ease of installation. It provides reliable power transfer in households, offices, and small facilities. The 400A–1600A range supports medium-scale industries, institutional buildings, and large commercial establishments. Above 1600A switches serve heavy industries, large data centers, and critical infrastructure where high loads require robust solutions. Demand across all categories reflects varied application requirements.

- For instance, the Trystar TMTS-04 SER Manual Transfer Switch is a 400A, single-phase switch designed specifically for these markets, featuring UL1008 listing and a solid neutral rotary mechanism for robust performance in small-scale applications.

By Application:

The transfer switch market by application includes residential, commercial, and industrial sectors, with industrial leading adoption. Industries such as manufacturing, oil and gas, and healthcare rely heavily on uninterrupted power for operations. It ensures minimal downtime and safeguards sensitive equipment in critical facilities. The commercial sector, including offices, telecom, and retail, shows rising adoption due to increased reliance on backup power systems. Residential demand is expanding with urbanization and growing awareness of energy security. This diverse application base sustains steady market growth.

Segmentations:

By Switching Mechanism:

By Ampere Rating:

- Below 400A

- 400A–1600A

- Above 1600A

By Application:

- Residential

- Commercial

- Industrial

By Region:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis:

North America:

North America holds 38% market share in the global transfer switch market, reflecting its dominance. The region benefits from frequent grid instability, growing demand for reliable backup power, and strong adoption in commercial and residential sectors. It is further supported by widespread use of data centers, healthcare facilities, and manufacturing units requiring uninterrupted electricity. Investments in smart grid technologies and renewable energy integration accelerate demand for advanced transfer switches. Strict regulations for power reliability also encourage adoption of high-performance systems. Continuous modernization of power infrastructure strengthens regional leadership.

Europe:

Europe accounts for 27% market share in the transfer switch market, driven by strict energy reliability requirements. Industrial hubs across Germany, France, and the U.K. prioritize seamless power transfer to maintain productivity. It is reinforced by rapid growth in renewable energy installations requiring efficient switching systems. Government policies promoting sustainable energy transition further stimulate market expansion. The region also benefits from adoption in commercial buildings, transportation, and telecommunication sectors. Rising focus on energy security underpins the strong regional demand.

Asia-Pacific:

Asia-Pacific holds 24% market share in the transfer switch market, highlighting its rapid expansion. The region is fueled by industrialization, urbanization, and rising electricity demand across China, India, and Southeast Asia. It is strongly driven by investments in large-scale infrastructure, smart cities, and renewable energy projects. Data centers and healthcare facilities expand their reliance on backup systems, increasing transfer switch adoption. Growing government initiatives to modernize power distribution further enhance opportunities. Manufacturers view the region as a critical growth center due to its scale and demand dynamics.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- ABB

- Briggs & Stratton

- AEG Power Solutions

- Caterpillar

- Eaton

- Generac Power Systems

- Cummins

- General Electric

- Kohler

- Global Power Supply

- One Two Three Electric

Competitive Analysis:

The transfer switch market is highly competitive, shaped by established global players and strong regional presence. Key companies include ABB, Briggs & Stratton, AEG Power Solutions, Caterpillar, Eaton, Generac Power Systems, Cummins, and General Electric. It is characterized by continuous innovation, with leading firms focusing on advanced automatic switches, IoT integration, and smart monitoring capabilities. Manufacturers invest heavily in R&D to improve safety, reliability, and energy efficiency, meeting the demands of critical industries such as healthcare, data centers, and manufacturing. Strategic alliances, product launches, and expansion into emerging markets strengthen competitive positions. Companies also emphasize after-sales services and customized solutions to build long-term customer relationships. This competitive environment drives continuous technological progress and ensures sustained growth across diverse applications.

Recent Developments:

- In May 2025, ABB announced it would acquire BrightLoop, a French advanced power electronics company, to expand electrification capabilities in off-highway and marine vehicles, with the transaction expected to close in Q3 2025.

- In June 2025, Briggs & Stratton added HAINZL Motion & Drives to its Vanguard battery technology network to boost electrification in mobile machinery in Central Europe.

Report Coverage:

The research report offers an in-depth analysis based on Switching Mechanism, Ampere Rating, Application and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- The transfer switch market will see strong adoption of smart and automated systems with remote monitoring features.

- Demand from renewable energy projects will expand as solar and wind integration accelerates globally.

- Manufacturers will focus on cost-effective designs to increase adoption in residential and small-scale applications.

- Healthcare, data centers, and telecommunications will remain critical sectors driving demand for high-reliability switches.

- The market will benefit from increasing investments in smart grid and modern power infrastructure.

- IoT-enabled transfer switches with predictive maintenance capabilities will gain wider preference among end users.

- Emerging economies in Asia-Pacific, Latin America, and Africa will create significant new revenue opportunities.

- Regulatory support for energy reliability and sustainability will encourage faster adoption of advanced systems.

- Supply chain optimization and local production strategies will help manufacturers reduce cost pressures.

- The transfer switch market will continue evolving toward intelligent, flexible, and energy-efficient solutions meeting diverse sector needs.