Market Overview

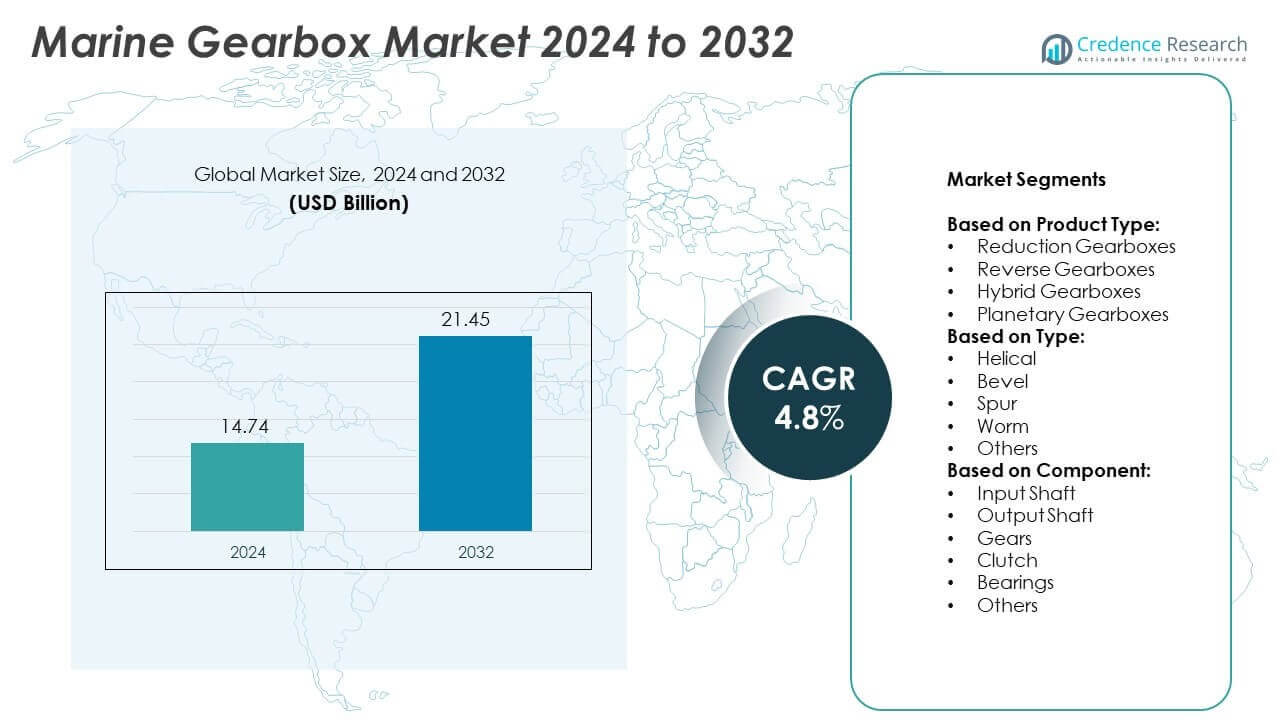

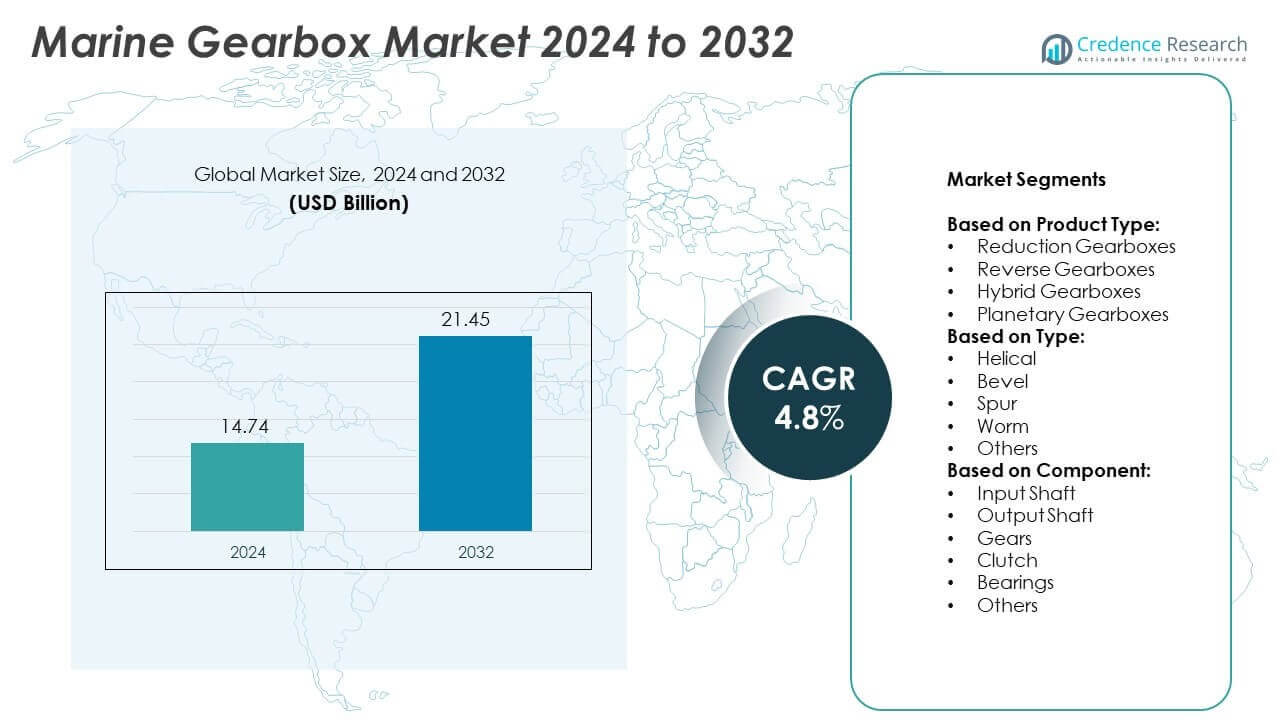

Marine Gearbox Market size was valued at USD 14.74 billion in 2024 and is anticipated to reach USD 21.45 billion by 2032, at a CAGR of 4.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Low Powered Electric Motorcycle and Scooter Market Size 2024 |

USD 14.74 Billion |

| Low Powered Electric Motorcycle and Scooter Market, CAGR |

4.8% |

| Low Powered Electric Motorcycle and Scooter Market Size 2032 |

USD 21.45 Billion |

The Marine Gearbox market grows with rising demand for fuel-efficient propulsion, hybrid systems, and fleet modernization. Shipbuilders and operators seek advanced gear solutions that reduce emissions and improve operational efficiency. Offshore wind, oil exploration, and naval upgrades further support gearbox deployment. Smart gear technologies with real-time diagnostics and modular designs gain traction. The market trends align with global decarbonization goals, pushing manufacturers to develop lightweight, low-noise, and digitally integrated gear units suited for diverse vessel applications.

Asia Pacific leads the Marine Gearbox market due to strong shipbuilding activity in China, South Korea, and Japan. North America and Europe follow with steady demand from naval modernization, offshore operations, and emission-compliant propulsion systems. Latin America and the Middle East show rising adoption driven by coastal trade and fleet replacement. Manufacturers expand local support and service centers to meet regional needs. Key players include Wärtsilä, MAN Energy Solutions, Caterpillar, and Kongsberg Gruppen, all offering advanced, region-specific gearbox solutions.

Market Insights

- The Marine Gearbox market was valued at USD 14.74 billion in 2024 and is projected to reach USD 21.45 billion by 2032, growing at a CAGR of 4.8%.

- Growth is driven by demand for hybrid propulsion systems, naval fleet upgrades, and offshore energy expansion.

- Trends include the integration of smart gearboxes with predictive maintenance, noise-reducing designs, and compatibility with electric and dual-fuel engines.

- Leading players focus on modular designs, global servicing networks, and emission-compliant gearbox technologies to maintain competitiveness.

- High cost of advanced gearbox systems and complex integration with hybrid propulsion setups limit faster adoption in cost-sensitive regions.

- Asia Pacific dominates the market due to strong commercial shipbuilding, followed by North America and Europe with steady defense and retrofit activities.

- Manufacturers expand service networks in Latin America and Africa to support rising vessel operations, coastal trade, and gearbox replacement demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Expansion of Global Commercial and Naval Shipping Drives Gearbox Demand

Rising global trade volumes and naval modernization initiatives fuel demand for reliable propulsion systems. Commercial shipping companies invest in new vessels to meet freight capacity and energy efficiency standards. Governments allocate defense budgets to upgrade naval fleets with high-performance transmission solutions. This trend creates consistent demand in the Marine Gearbox market. It supports advanced gearbox technologies that meet maritime safety and durability standards. OEMs prioritize lightweight and compact gear systems to increase vessel efficiency and reduce emissions. Marine gearbox suppliers benefit from long-term contracts and retrofit programs.

- For instance, In September 2023, Wärtsilä was contracted to supply an integrated hybrid propulsion system, including gearboxes, engines, and batteries, for two 147-meter-long, methanol-fuelled hybrid Ro-Ro vessels for the Swedish shipping company Stena RoRo. The vessels have a capacity of 2,800 lane meters and are scheduled for delivery in June and November 2025

Growth in Offshore Exploration and Marine Renewable Energy Supports Adoption

The offshore oil and gas sector continues to invest in exploration and production activities. Floating production systems and support vessels rely on robust marine gearboxes for harsh ocean conditions. The growing marine renewable energy sector, including offshore wind farms, uses gear-driven vessels for installation and maintenance. This expansion boosts gearbox adoption across various marine applications. The Marine Gearbox market benefits from diversified end-user demand across energy and utility sectors. It creates opportunities for suppliers offering corrosion-resistant and heavy-duty transmission systems. Manufacturers develop gear units that meet both offshore reliability and regulatory compliance.

- For instance, Transfluid is a manufacturer of hybrid propulsion systems, including parallel hybrid gearboxes, that are suitable for inland waterway vessels. Transfluid offers various hybrid system models, such as the HTM700, which has a maximum input power of 145 kW and is suitable for retrofit or new applications on passenger and freight boats

Stricter Maritime Emission Regulations Push Technological Innovation

New environmental rules by the IMO and regional authorities limit vessel emissions and fuel use. These rules accelerate the shift to hybrid propulsion and electric drive systems. Marine gearboxes must adapt to work with dual-fuel engines, battery packs, and electric motors. The Marine Gearbox market sees rising demand for quiet, efficient, and low-vibration gear solutions. It leads manufacturers to invest in noise-dampening and smart gearbox technologies. The trend supports innovation in automated, sensor-enabled gear systems that optimize energy consumption. These systems help meet emission targets without compromising power delivery.

Rising Demand for Passenger and Recreational Marine Vessels Increases Production

Growth in marine tourism and leisure boating expands the need for smaller, high-efficiency propulsion systems. OEMs in the yacht and ferry sectors seek lightweight and compact gearboxes with minimal maintenance. The Marine Gearbox market gains from rising demand for smooth, quiet, and responsive gear transitions. It reflects in customized gear ratios and digitally controlled transmission units. Recreational boat users value durability and fuel efficiency over long service intervals. This demand influences manufacturers to offer modular gearboxes compatible with different engine types and vessel sizes.

Market Trends

Integration of Hybrid and Electric Propulsion Systems Shapes Product Development

Shipbuilders adopt hybrid propulsion to meet efficiency and environmental standards. These systems require gearboxes that support both mechanical and electric drive modes. The Marine Gearbox market sees growing innovation in dual-input, split-path, and coaxial gear designs. It enables seamless power transmission from multiple propulsion sources. Manufacturers develop gear units that reduce fuel use and improve vessel maneuverability. Digital integration supports real-time monitoring and predictive maintenance for hybrid drive systems. Demand grows for gearboxes optimized for low-noise, low-emission operation.

- For instance, ZF Marine offers a range of hybrid-ready gearboxes, such as the ZF 3200 A/V PTI, which was announced in late 2024 and is intended for high-speed craft like yachts and patrol boats. In June 2025, ZF introduced the ENC (Electric Non-Clutchable) series, which is optimized for electric drives and can be combined with ZF gearboxes from the 2000 to 9000 series.

Adoption of Smart Gearbox Technologies Improves Performance and Diagnostics

Marine vessels use sensor-based gearboxes to monitor vibration, temperature, and torque in real time. Smart gearboxes detect wear or failure early, reducing downtime and extending service life. The Marine Gearbox market moves toward embedded control systems that adjust gear ratios dynamically. It allows vessels to operate efficiently under varying sea conditions and load profiles. OEMs integrate condition-based maintenance features for fleet operators. Remote diagnostics reduce the need for manual inspections in offshore operations. These systems improve asset lifecycle management and reduce operational costs.

- For instance, Twin Disc’s QuickShift MGX-5136RV gearbox, which features quick-shift technology, supports engine outputs of up to 895 kW (1200 hp) for recreational boats. The gearbox has been available for many years. It provides smooth clutch engagement, precise slow-speed maneuvering, and fast shifts in approximately 0.05 seconds, contributing to the demand for quiet, efficient, and responsive gear solutions in the marine market.

Growth in High-Speed Craft Drives Demand for Lightweight and Compact Gear Systems

The rise in patrol boats, fast ferries, and recreational vessels increases the need for compact gear solutions. These vessels prioritize weight reduction and speed without compromising reliability. The Marine Gearbox market offers aluminum and composite gear housings to meet these needs. It supports faster acceleration and better fuel efficiency in lightweight vessels. Gearbox makers tailor designs for quick shifting and low backlash. Compact, modular units help optimize onboard space in small engine rooms. These trends encourage innovation in flexible gear configurations.

Focus on Noise and Vibration Control Enhances Passenger and Crew Comfort

Marine gearboxes now feature noise-dampening designs for passenger ships, yachts, and research vessels. Reducing vibration improves comfort and prevents structural fatigue over long voyages. The Marine Gearbox market supports precision gear meshing, soft engagement clutches, and elastomeric couplings. It results in quieter operations across propulsion and auxiliary systems. Naval and survey vessels also demand stealth performance with minimal acoustic signature. Manufacturers respond with low-decibel gear solutions for underwater noise compliance. This trend continues to shape gearbox design and material selection.

Market Challenges Analysis

High Costs of Advanced Gearbox Systems Limit Adoption in Price-Sensitive Segments

Advanced marine gearboxes with smart sensors, hybrid compatibility, and high-efficiency designs carry high development and installation costs. Small and mid-sized vessel operators often delay upgrades due to limited budgets. The Marine Gearbox market faces resistance in regions with cost-focused procurement, particularly in fishing, inland cargo, and older fleets. It creates a gap between available innovations and real-world implementation across vessel categories. Maintenance costs and skilled labor requirements further raise total ownership expenses. These factors challenge OEMs to balance performance with affordability. Price sensitivity remains a barrier to faster penetration of advanced gear systems.

Complex Integration with Hybrid and Next-Gen Propulsion Systems Slows Deployment

Gearboxes must now support variable-speed engines, electric drives, and dual-fuel systems, increasing technical complexity. Ensuring compatibility across propulsion types requires custom engineering and rigorous testing. The Marine Gearbox market deals with extended design cycles and qualification delays due to evolving propulsion standards. It affects time-to-market and limits standardization across ship classes. System integration challenges also raise risks of malfunction or inefficiency under mixed load conditions. Limited global expertise in hybrid gearbox configuration further constrains adoption. Overcoming these integration hurdles is critical to future scalability.

Market Opportunities

Rising Investments in Green Shipping Open Avenues for Hybrid and Electric Gear Systems

Global shipping companies and governments commit to decarbonization through alternative propulsion technologies. Hybrid and electric vessels require specialized gearboxes that offer silent operation, high torque efficiency, and seamless mode transition. The Marine Gearbox market can capitalize on this shift by supplying compact, energy-optimized transmission systems. It creates demand for gearboxes compatible with battery-electric drives, fuel cells, and dual-fuel engines. Manufacturers that offer integration support and digital diagnostics will gain early traction. Green shipping corridors and zero-emission port initiatives support this opportunity. Regulatory incentives also push fleet operators toward low-emission retrofits.

Growth in Emerging Maritime Economies Expands Gearbox Replacement and Retrofit Scope

Countries in Southeast Asia, Africa, and Latin America expand inland waterways, fisheries, and coastal trade fleets. These markets need gearbox replacements for aging vessels and transmission upgrades for new builds. The Marine Gearbox market finds strong opportunities in offering durable, low-maintenance solutions suited for regional demands. It benefits from localized production, modular designs, and simplified maintenance kits. Training services and aftersales support also add value in these expanding regions. Gearbox vendors can form partnerships with local shipyards and service providers to scale reach. Rising vessel count in these economies supports recurring gearbox demand.

Market Segmentation Analysis:

By Product Type:

Reduction gearboxes lead the market due to their role in reducing engine speed while increasing torque output. They serve high-power applications in commercial shipping and offshore vessels. Reverse gearboxes follow in demand, especially in fishing boats and tugboats where directional control is critical. Hybrid gearboxes gain momentum from the rise of dual propulsion systems in ferries and patrol vessels. The Marine Gearbox market also sees strong uptake in planetary gearboxes used in compact, high-torque applications such as naval crafts and offshore service vessels. Each product type addresses specific vessel dynamics and propulsion requirements.

- For instance, D-I Industrial Co., a major South Korean manufacturer of marine transmissions since 1990, uses aluminum housing in many gearboxes to reduce weight. The company’s products include transmissions, steering systems, and power take-offs. These products cover a power range from approximately 70 to 1,800 horsepower (52 to 1,342 kW) and support torque loads up to 3,500 kgf-m. Some models are suitable for vessels up to 22 meters in length.

By Type:

Helical gearboxes dominate due to smooth power transmission and high load-bearing capacity. These are preferred in mid- to large-sized vessels operating under continuous load. Bevel gear systems support angled shaft configurations and are used in vessels requiring flexibility in drivetrain layout. Spur gear systems offer cost-effective solutions for low-speed or auxiliary systems. Worm gear units serve specific use cases where high gear reduction is necessary within limited space. Others include specialty gear systems customized for military or scientific vessels. These types reflect diverse mechanical and operational priorities across ship categories.

- For instance, Marine gearbox manufacturer Katsa Oy, based in Finland, offers gearboxes compatible with hybrid propulsion systems, its L490 hybrid gearbox series, designed for marine applications, covers a power range of 1,000 to 2,500 kW.

By Component:

Gears represent the most critical element in transmission systems due to their role in torque transfer and durability. Input and output shafts follow, essential for connecting propulsion systems and distributing mechanical energy. Bearings support load balance and reduce friction under variable sea conditions. Clutches enable smooth gear engagement and disengagement, especially in hybrid and electric vessels. The Marine Gearbox market includes other key components like seals and housings that ensure operational stability. Component selection and design play a direct role in vessel performance and lifecycle.

Segments:

Based on Product Type:

- Reduction Gearboxes

- Reverse Gearboxes

- Hybrid Gearboxes

- Planetary Gearboxes

Based on Type:

- Helical

- Bevel

- Spur

- Worm

- Others

Based on Component:

- Input Shaft

- Output Shaft

- Gears

- Clutch

- Bearings

- Others

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds a market share of 28.4% in the global Marine Gearbox market, driven by advanced naval infrastructure and the presence of established shipbuilding industries in the U.S. and Canada. The U.S. Navy and Coast Guard continue to invest in fleet modernization, fueling consistent demand for high-performance marine transmission systems. Commercial shipping and inland waterway transport across the Great Lakes and Mississippi River also create stable gearbox replacement cycles. Offshore oil and gas operations in the Gulf of Mexico add to regional demand for heavy-duty gearboxes used in supply and service vessels. It also supports demand for hybrid gearboxes integrated into emission-reducing propulsion systems. OEMs in the region focus on integrating IoT-enabled gearbox systems with remote diagnostics and automated monitoring to meet evolving maritime regulations and maintenance standards. Gearbox manufacturers benefit from long-term military contracts, robust retrofitting activities, and proximity to digital technology suppliers.

Europe

Europe accounts for 24.6% of the global Marine Gearbox market, supported by its strong shipbuilding nations including Germany, Italy, France, and the Netherlands. The region benefits from demand across defense, commercial shipping, and passenger transport segments, especially in the Baltic and Mediterranean Sea zones. European countries enforce strict maritime emission regulations, which accelerates adoption of hybrid and electric propulsion systems. This trend boosts demand for specialized gearboxes compatible with variable-speed and dual-fuel engines. It influences local gearbox suppliers to develop energy-efficient, lightweight, and noise-reducing transmission systems. The presence of major OEMs and gearbox producers in Western Europe enhances regional supply capabilities. Offshore wind farm service vessels operating in the North Sea also create niche demand for compact and durable marine gearboxes.

Asia Pacific

Asia Pacific holds the largest market share at 31.7%, led by China, Japan, South Korea, and India. China dominates regional demand with its expansive commercial shipbuilding activity and growing naval fleet. South Korea and Japan focus on advanced LNG carriers, container vessels, and hybrid ferries that require precision marine transmission systems. India expands its shipbuilding infrastructure under maritime development programs and naval modernization schemes. The Marine Gearbox market in Asia Pacific grows rapidly due to the need for cost-efficient, high-durability gear units across both commercial and defense segments. It sees strong demand for compact and modular gearboxes for ferries, fishing boats, and small coastal vessels. Regional suppliers increasingly adopt advanced manufacturing and quality control standards to meet international certification. Integration of digital monitoring features gains traction, especially among high-speed craft manufacturers.

Latin America

Latin America contributes 7.2% to the global Marine Gearbox market, with demand concentrated in Brazil, Argentina, and Chile. The region relies on marine transport for trade, fishing, and offshore energy operations. Brazil, with its offshore oil reserves, maintains steady demand for marine propulsion systems in supply vessels and support fleets. Coastal and inland waterway navigation across the Amazon and Paraná rivers supports demand for low-maintenance gearbox systems. It reflects growing adoption of lightweight gear units suitable for ferries and workboats. Regional governments also invest in modernization of naval and patrol vessels, generating need for advanced gearbox systems with high torque and durability. Local gearbox suppliers benefit from increased investments in dockyard maintenance and fleet servicing programs.

Middle East and Africa

The Middle East and Africa together hold a 5.1% share in the Marine Gearbox market. The Middle East sees stable demand due to offshore oil extraction and defense modernization programs, particularly in Saudi Arabia and the UAE. Port operations and inter-coastal shipping in the Persian Gulf and Red Sea regions create consistent gearbox requirements for tugboats and cargo vessels. Africa shows growing demand from coastal security, fishing, and regional shipping routes, especially in South Africa, Nigeria, and Kenya. It drives interest in affordable, rugged marine gear systems that require minimal maintenance. The market faces challenges related to service infrastructure and skilled labor availability. However, it holds long-term potential with rising interest in green maritime projects and small-scale shipbuilding across coastal economies.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- GEARTEC

- Wärtsilä

- Caterpillar

- ABB

- Parker Hannifin

- Kongsberg Gruppen

- Schneider Electric

- MAN Energy Solutions

- Bruntons Propellers

- Burckhardt Compression

- Rolls-Royce

- Siemens

- Danfoss

- Dana Incorporated

- GE

- SODEXO

Competitive Analysis

The Marine Gearbox market features strong competition among major players such as GEARTEC, Wärtsilä, Caterpillar, MAN Energy Solutions, Rolls-Royce, ABB, Siemens, Schneider Electric, Kongsberg Gruppen, and Parker Hannifin, Bruntons Propellers, Burckhardt Compression, GE, SODEXO. These companies focus on technological innovation, product customization, and global servicing capabilities to maintain competitive advantage. They cater to a wide range of vessel types, including naval, commercial, offshore, and recreational craft. Leading players invest heavily in hybrid-ready and smart gearbox systems that support fuel efficiency, emission reduction, and digital monitoring. Integration with electric and dual-fuel propulsion systems is a key area of focus across portfolios. Global aftersales support, modular gearbox designs, and compliance with IMO standards further strengthen their market positions. Companies expand presence in Asia Pacific and Latin America to tap into rising vessel production and retrofitting demand. Local partnerships and service center expansions help enhance delivery times and technical support. Pricing competitiveness, lifecycle service contracts, and retrofit solutions also play a major role in customer retention. The market dynamics favor manufacturers that offer durability, performance efficiency, and adaptability to evolving propulsion technologies. As the marine industry moves toward decarbonization and automation, players that align with regulatory and performance trends will sustain leadership in the marine gearbox landscape.

Recent Developments

- In June 2025, Wärtsilä announced it would deliver an integrated hybrid propulsion solution with PTO/PTI/PTH capability for four new tween-decker vessels built for Vertom Group

- In 2024, Horsburgh & Scott launched an “Industrial Marine Gearing Solutions” division to serve the commercial and military maritime markets.

- In September 2022, Caterpillar Marine launched two new solutions, the Cat MPC100 and MPC300, featuring reliable and precise control of engines and transmissions with extensive integration capabilities. While this is late 2022, it is close to the requested timeframe

Report Coverage

The research report offers an in-depth analysis based on Product Type, Type, Component and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily with rising global demand for fuel-efficient marine propulsion systems.

- Hybrid and electric propulsion vessels will drive demand for advanced gearbox configurations.

- Governments will invest in naval fleet upgrades, supporting long-term gearbox replacement cycles.

- Offshore wind energy and oil exploration will create new use cases for high-performance gear systems.

- Compact, lightweight gearboxes will gain preference in fast ferries and recreational vessels.

- Smart gearboxes with predictive maintenance and remote diagnostics will become industry standard.

- Manufacturers will adopt modular designs to support multiple propulsion platforms.

- Regional production hubs in Asia and Latin America will expand to meet rising local demand.

- Strict maritime emission rules will influence the development of low-noise and low-vibration gear units.

- Collaboration between OEMs and digital solution providers will shape next-generation gearbox offerings.