Market Overview:

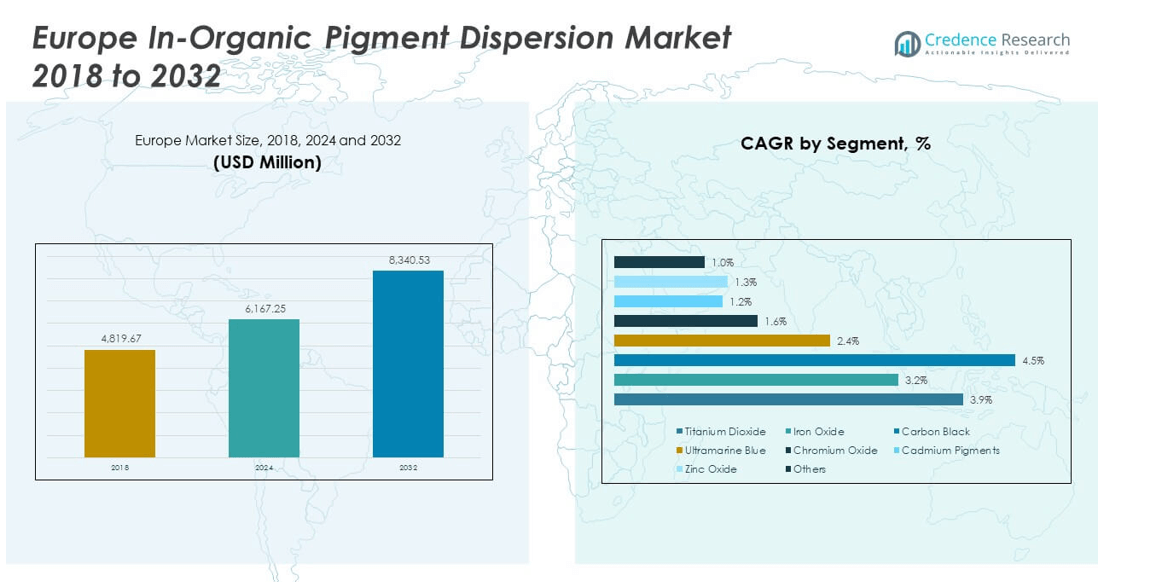

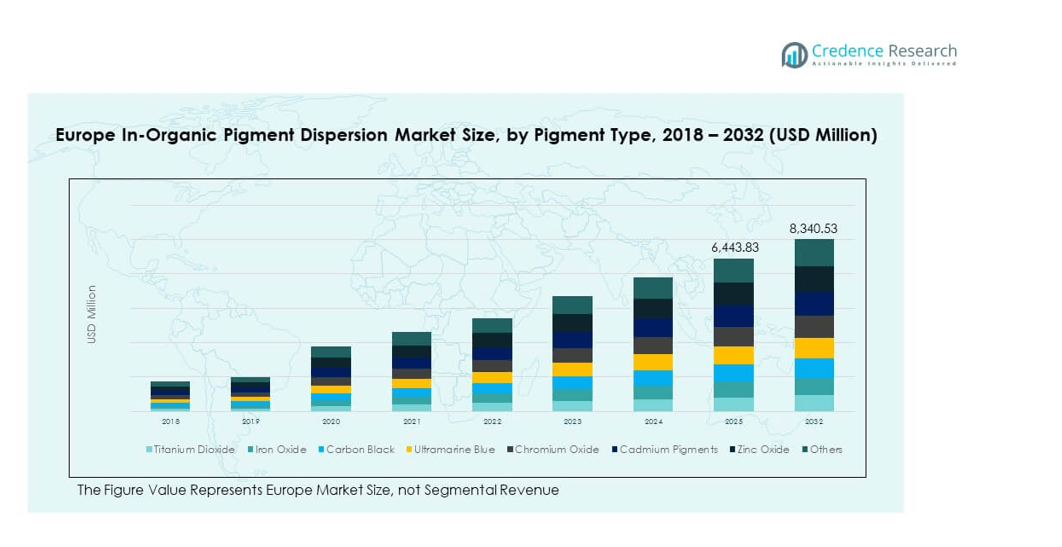

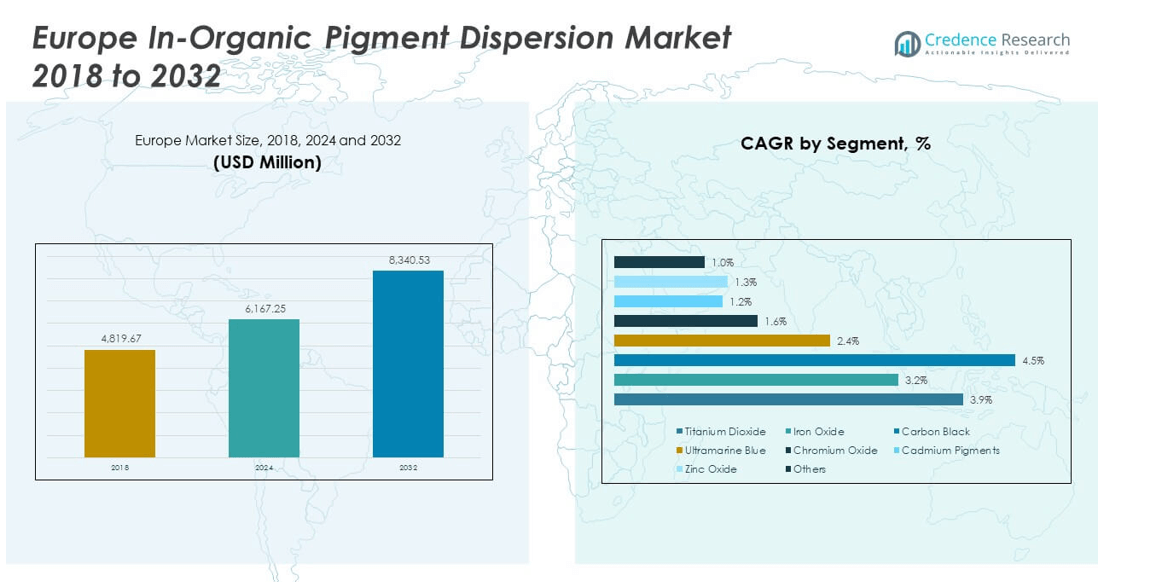

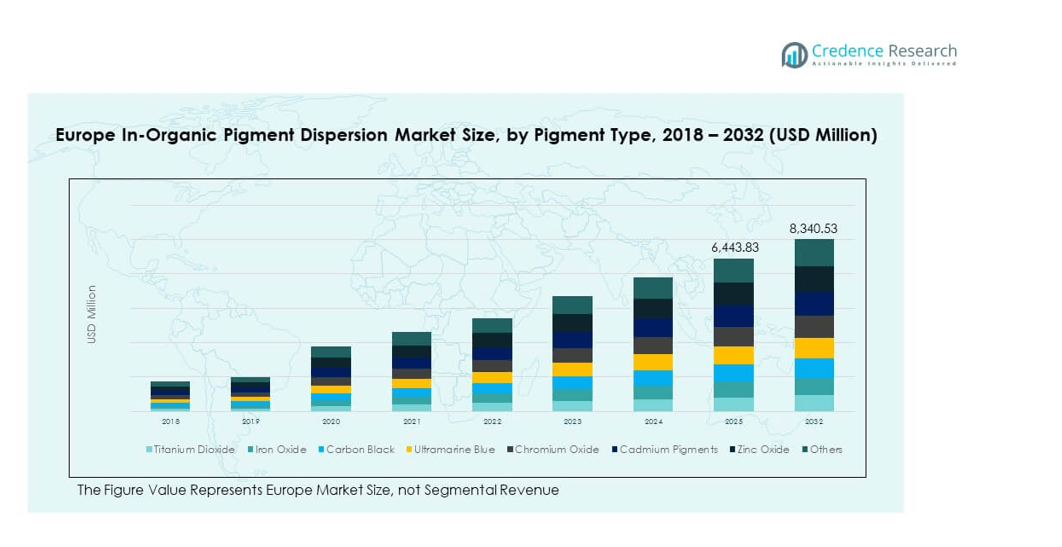

The Europe In-Organic Pigment Dispersion Market size was valued at USD 4,819.67 million in 2018 to USD 6,167.25 million in 2024 and is anticipated to reach USD 8,340.53 million by 2032, at a CAGR of 3.80% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe In-Organic Pigment Dispersion Market Size 2024 |

USD 6,167.25 million |

| Europe In-Organic Pigment Dispersion Market, CAGR |

3.80% |

| Europe In-Organic Pigment Dispersion Market Size 2032 |

USD 8,340.53 million |

The market growth is driven by rising demand from end-use industries such as construction, automotive, and packaging. Inorganic pigment dispersions are preferred for their durability, strong opacity, and weather resistance, making them critical for coatings, plastics, and printing inks. Increasing investments in infrastructure projects across Europe, coupled with stringent environmental regulations promoting safer formulations, support consistent adoption. Additionally, the shift toward high-performance pigments with improved thermal and chemical stability fuels innovation and strengthens market expansion.

Geographically, Western Europe dominates the market due to its established industrial base, advanced manufacturing, and high-quality standards, with Germany, France, and the UK leading consumption. Eastern Europe is emerging as a growth hub, supported by expanding construction activities and increasing foreign investments in industrial sectors. Southern Europe demonstrates steady demand from automotive refinishing and architectural coatings, while Northern Europe benefits from environmentally driven innovations. Together, these diverse dynamics position Europe as a robust and evolving market for inorganic pigment dispersions.

Market Insights

- The Europe In-Organic Pigment Dispersion Market was valued at USD 4,819.67 million in 2018, reached USD 6,167.25 million in 2024, and is projected to attain USD 8,340.53 million by 2032, expanding at a CAGR of 3.80%.

- Western Europe led with 47% share, supported by strong industrial bases and advanced infrastructure, followed by Eastern Europe at 28% with manufacturing growth, and Southern & Northern Europe together accounted for 25%, benefiting from sustainability-driven adoption.

- Eastern Europe is the fastest-growing region with 28% share, driven by infrastructure development, foreign investment, and expanding construction activities across Poland, Hungary, and Czech Republic.

- Titanium dioxide accounted for 34% share, supported by its opacity and widespread use in coatings, while iron oxide held the second-largest position with strong demand in plastics and construction.

- Carbon black contributed a 16% share, primarily driven by printing inks and automotive applications, while ultramarine blue, chromium oxide, cadmium pigments, zinc oxide, and others served smaller but diverse industrial needs.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Growing Demand from Construction and Automotive Industries Enhancing Market Expansion

The construction and automotive industries strongly influence the Europe In-Organic Pigment Dispersion Market by driving steady consumption. Coatings and paints used in both sectors rely on pigment dispersions for durability and color consistency. Infrastructure projects across Western and Eastern Europe require advanced pigments to meet quality standards. The automotive sector values high opacity and weather resistance to maintain long-term performance. Expanding renovation activity in urban centers also supports market demand. Strong construction activity in Germany and Poland stimulates steady adoption. The segment remains critical due to strict requirements for safety and performance. It sustains strong growth through innovation aligned with industry needs.

- For example, in 2024, BASF introduced its EFFLORESCENCE automotive coating concept, featuring a monocoat technology that streamlines the paint process with a single-layer application cured at 80 °C. The coating reflects over 65% of light, lowering car body heating and enhancing energy efficiency in production, while also delivering distinctive visual effects without relying on traditional effect pigments.

Regulatory Support Driving Safe and Sustainable Pigment Formulations

Environmental regulations in Europe push companies to adopt safer pigment dispersions with reduced harmful content. The focus on low-VOC coatings increases opportunities for inorganic pigments. Manufacturers align product portfolios with REACH and EU directives to sustain compliance. Adoption of eco-friendly dispersions enhances market credibility with end-use industries. Regulatory shifts encourage product innovation while supporting broader sustainability targets. Countries with strict policies, such as Germany and France, drive adoption faster. This creates a competitive environment where companies strengthen standards. The Europe In-Organic Pigment Dispersion Market reflects the strong influence of these regulations.

Technological Advancements Supporting High-Performance Pigment Solutions

Companies invest in research to deliver dispersions with improved chemical stability and weather resistance. High-performance pigments gain traction in industries requiring long-lasting quality, such as packaging and automotive refinishing. The need for pigments resistant to chemicals and extreme environments shapes innovation. Research facilities in Western Europe focus on next-generation dispersion solutions. Technology drives better product compatibility across varied applications. Adoption expands in markets requiring strict quality consistency. Customers increasingly prefer products offering enhanced strength and colorfastness. It helps the market create long-term value for critical industries.

Industrial Growth and Urbanization Encouraging Consistent Market Adoption

Urbanization across Europe increases demand for coatings, plastics, and construction materials. Expanding housing and infrastructure projects require durable pigments for surface finishes. Industrial expansion in Eastern Europe drives steady consumption of dispersions. Growth in consumer goods packaging contributes to additional demand for consistent color quality. The market benefits from rising industrial investment in Poland, Hungary, and Czech Republic. Urban centers across Germany and France contribute steady demand for innovative coatings. The Europe In-Organic Pigment Dispersion Market sustains its growth through this structural shift. It gains strong momentum with both urban and industrial expansion reinforcing adoption.

- For example, in January 2024, Grupa Azoty recorded a rise in specialty fertilizer output to approximately 25,000 tonnes, up from 17,000 tonnes in December 2023. While this increase applies specifically to fertilizers, their Chemicals and Plastics segments did not experience a similar uplift. The Chemicals segment showed only a modest sign of recovery in demand, without a significant boost in sales volume, and plastics remained under pressure from macroeconomic conditions.

Market Trends

Shift Toward Digital Printing Applications Supporting Pigment Innovation

Digital printing technologies increasingly rely on pigment dispersions for high-quality results. Inorganic dispersions deliver consistent color strength across packaging, textiles, and advertising materials. The packaging industry uses digital printing for shorter runs and customization. Pigments supporting quick drying and resistance to fading remain in demand. Producers invest in products compatible with advanced digital processes. High-resolution requirements strengthen innovation in dispersion quality. The Europe In-Organic Pigment Dispersion Market adapts to digital trends for diverse applications. It fosters growth through adoption in emerging and established printing segments.

Adoption of Nanotechnology Creating Next-Generation Pigment Solutions

Nanotechnology opens opportunities to improve pigment dispersion properties significantly. Pigments designed at the nanoscale provide stronger opacity and better distribution. These innovations enable coatings and plastics to achieve enhanced durability. Nanoparticles ensure more uniform color stability under varying conditions. Research centers in Europe invest in scaling nanotechnology applications. End users adopt such products to improve performance in automotive and construction sectors. The market benefits from ongoing advancements in precision engineering. It helps the Europe In-Organic Pigment Dispersion Market align with future innovation pathways.

- For example, the NANOMICEX project evaluated the safety of nanotechnology in inks and pigments. It demonstrated that modifying ZnO nanoparticles with silica coated using bovine serum albumin (BSA) and coating quantum dots with glucose significantly lowered their toxicity while preserving dispersion and pigment performance.

Integration of Pigments into Smart and Functional Coating Applications

Functional coatings use inorganic pigments to deliver enhanced performance beyond appearance. Antimicrobial coatings for healthcare facilities employ advanced dispersions. The demand for heat-reflective pigments in construction highlights new applications. Functional coatings also gain adoption in electronics and aerospace sectors. This expands opportunities for pigment dispersions across high-value industries. Investments in R&D strengthen this trend in Western Europe. The Europe In-Organic Pigment Dispersion Market positions itself as a supplier to innovation-driven applications. It supports industries requiring functional features aligned with sustainability.

- For example, Eagle Specialty Products develops custom pigment dispersions for coatings, inks, and adhesives, offering both organic and inorganic options across water-based, solvent-based, and solvent-free systems. The company delivers consistent color strength and quality under ISO 9001:2015 certification, supporting tailored solutions for diverse industrial applications.

Rising Customization in Packaging Driving Pigment Formulation Advances

Consumer goods companies seek pigments supporting bright, unique packaging. Inorganic dispersions enhance durability of printed materials while ensuring safe use. Customization in food and beverage packaging raises demand for color stability. High competition among brands accelerates the need for advanced pigment formulations. Producers deliver dispersions suited for short-run and flexible packaging. Growth in e-commerce creates more demand for quality packaging pigments. The Europe In-Organic Pigment Dispersion Market aligns closely with the evolution of this segment. It drives steady development of products matching dynamic consumer needs.

Market Challenges Analysis

Raw Material Price Volatility Affecting Profitability and Supply Stability

The cost of raw materials creates uncertainty for producers across the Europe In-Organic Pigment Dispersion Market. Fluctuations in mineral and chemical feedstock prices disrupt planning and production efficiency. Producers face difficulties maintaining stable pricing structures for customers. Dependency on imports of raw materials adds to cost volatility. Disruption in logistics and supply chains increases pressure on operating margins. Small and mid-sized companies struggle to absorb rapid cost shifts. This challenge restricts steady investment in innovation. It highlights the risk linked with unstable raw material pricing.

Intense Competition and Pressure from Substitute Pigment Technologies

Strong competition among global and regional players creates significant market pressure. Companies face challenges in differentiating products within similar dispersion categories. Substitute technologies such as organic pigments and dyes offer viable alternatives in select applications. Rising demand for bio-based solutions adds complexity to competition. Maintaining innovation pipelines requires higher investment commitments. This limits smaller companies from scaling effectively in competitive regions. The Europe In-Organic Pigment Dispersion Market experiences pressure from both internal and external substitutes. It demands continuous focus on quality and innovation to remain competitive.

Market Opportunities

Expanding Demand for Eco-Friendly Pigments in Packaging and Coatings

Sustainability drives opportunities for dispersions tailored to low-toxicity and recyclable materials. Eco-conscious customers demand safer pigments for food and beverage packaging. Governments encourage adoption of environmentally compliant products across industries. Producers offering high-performance yet safe formulations stand to gain market share. Packaging and construction sectors prioritize pigments aligning with circular economy models. The Europe In-Organic Pigment Dispersion Market benefits from such strong sustainability shifts. It creates scope for firms innovating with safe, reliable pigment solutions.

Growth Potential Across Emerging Eastern European Industrial Sectors

Eastern Europe emerges as a promising region with growing construction and manufacturing bases. Infrastructure investments in Poland, Hungary, and Czech Republic strengthen demand. Expansion of automotive and consumer goods industries adds steady opportunities for pigment dispersions. Regional governments support industrialization, fueling greater consumption of coating solutions. International companies expand distribution networks to target new customer bases. The Europe In-Organic Pigment Dispersion Market capitalizes on this rising demand. It positions itself to supply growing regional industries with sustainable products.

Market Segmentation Analysis

By pigment type, titanium dioxide holds a leading share in the Europe In-Organic Pigment Dispersion Market due to its strong opacity, brightness, and widespread use in paints and coatings. Iron oxide follows with steady demand across construction and plastics applications where durability and color stability are vital. Carbon black supports growth in printing inks and automotive components, driven by its strong tinting strength. Ultramarine blue and chromium oxide cater to specialized uses in ceramics, plastics, and coatings. Cadmium pigments maintain a niche role due to their vivid shades but face regulatory limits. Zinc oxide strengthens its presence in coatings and cosmetics for its multifunctional properties. Other pigment types support smaller but diverse industrial requirements.

- For example, Lanxess increased its red and black iron oxide pigment production capacity by approximately 23,000 metric tons per year at its Krefeld-Uerdingen site, which is the world’s largest facility of its kind, with current capacity around 280,000 metric tons. The company also expanded black synthetic iron oxide pigment capacity at this site by more than 5,000 metric tons annually through debottlenecking improvements.

By application, paints and coatings dominate due to extensive usage across construction, automotive, and architectural sectors. Printing inks register strong growth supported by packaging and labeling industries requiring high-quality dispersions. Plastics represent a significant segment driven by demand for durable colorants in consumer goods and industrial products. Construction materials benefit from dispersions offering weather resistance and long-term stability. Ceramics and glass use pigments for both functional and decorative purposes, reinforcing niche demand. Cosmetics highlight increasing interest in safe, high-performance inorganic pigments for personal care. The Europe In-Organic Pigment Dispersion Market gains balance from multiple applications that align with both mass demand and specialized requirements. It sustains long-term relevance across diverse industrial sectors.

- For example, in 2024, Beckers Group achieved sales of SEK 7,098 million, reinforcing its role as a global leader in coil and industrial coatings a business that serves critical applications in construction and manufacturing and is headquartered in Germany.

Segmentation

By Pigment Type

- Titanium Dioxide

- Iron Oxide

- Carbon Black

- Ultramarine Blue

- Chromium Oxide

- Cadmium Pigments

- Zinc Oxide

- Others

By Application

- Paints & Coatings

- Printing Inks

- Plastics

- Construction Materials

- Ceramics and Glass

- Cosmetics

- Others

By Region

Regional Analysis

Western Europe dominates the Europe In-Organic Pigment Dispersion Market with a 47% share. Germany, France, and the UK lead due to strong industrial bases, advanced manufacturing, and strict quality standards. These countries drive adoption in automotive coatings, construction, and high-performance packaging applications. The region benefits from strong research facilities that foster product innovation. Demand in Western Europe remains steady due to infrastructure modernization and premium product requirements. It maintains a clear leadership position across multiple end-use industries.

Eastern Europe accounts for 28% of the market, supported by industrial expansion and growing construction activity. Poland, Hungary, and the Czech Republic serve as key hubs for manufacturing growth. Rising foreign investments fuel demand for cost-effective pigment dispersions in coatings and plastics. Infrastructure development projects across urban centers stimulate steady consumption. Emerging demand from local automotive and consumer goods sectors boosts adoption further. The region creates opportunities for companies expanding distribution networks. It strengthens its position through favorable economic policies supporting industrialization.

Southern and Northern Europe together hold 25% of the market share. Italy and Spain show stable demand, driven by architectural coatings and consumer packaging. Northern Europe, including Scandinavian countries, adopts dispersions through strong environmental policies and innovation-focused industries. Sustainable coatings and specialized applications support product adoption in these regions. The combined contribution strengthens the overall European market balance. The Europe In-Organic Pigment Dispersion Market gains resilience from their steady participation. It reflects diverse industrial structures contributing to long-term regional growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- BASF SE

- Clariant AG

- Heubach GmbH

- Lanxess AG

- Venator Materials PLC

- Cabot Corporation

- Ferro Corporation

- DIC Corporation

- Sudarshan Chemical Industries

- Huntsman Corporation

- Chromaflo

Competitive Analysis

The Europe In-Organic Pigment Dispersion Market remains highly competitive with global and regional players shaping its structure. BASF SE, Clariant AG, and Heubach GmbH dominate through extensive product portfolios and advanced R&D. Lanxess AG and Venator Materials PLC strengthen their position with strong pigment supply networks and technical expertise. Cabot Corporation and Ferro Corporation emphasize specialty dispersions for high-performance coatings and plastics. DIC Corporation and Sudarshan Chemical Industries expand their reach with diversified solutions across packaging and construction applications. Huntsman Corporation and Chromaflo support the competitive landscape through innovation and customer-specific formulations. The market emphasizes sustainable production, compliance with EU regulations, and technological upgrades to maintain leadership. It drives continuous product development and strategic partnerships, ensuring players stay relevant in a dynamic industrial environment.

Recent Developments

- In May 2025, BASF introduced Pluriol® A 2400 I, a new reactive polyethylene glycol product, to its portfolio for use in the European construction industry. The product serves as a raw material for advanced polycarboxylate ethers (PCE), which are used to produce high-quality dispersants for inorganic pigments. This move supports local sourcing and sustainability initiatives within BASF’s European distribution network.

- In March 2025, Venator launched the TMP- and TME-free TIOXIDE® TR81 pigment in Europe, an innovative titanium dioxide (TiO₂) product designed for coatings, plastics, and inks, notable for eliminating hazardous substances to meet stricter regulatory demands while maintaining high opacity, brightness, and dispersibility.

- In March 2025, Lanxess AG showcased its expanded line of Levanyl (organic) and Levanox (inorganic) pigment dispersions at the European Coatings Show in Nuremberg, Germany. The company also promoted new sustainable iron oxide yellow pigments with a reduced product carbon footprint (PCF) tailored for European paints, varnishes, and coatings.

Report Coverage

The research report offers an in-depth analysis based on Pigment Type and Application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Europe In-Organic Pigment Dispersion Market will expand with steady demand from construction and automotive coatings.

- Innovation in high-performance pigments will support adoption in packaging, plastics, and specialty coatings.

- Regulatory alignment with EU sustainability policies will drive investment in safer dispersion technologies.

- Rising industrial growth in Eastern Europe will create new opportunities for pigment suppliers.

- Western Europe will maintain leadership due to advanced infrastructure and strict quality standards.

- Customized pigment solutions for digital printing and flexible packaging will gain stronger market traction.

- Functional applications such as antimicrobial and heat-reflective coatings will broaden product use.

- Companies will focus on nanotechnology and precision formulations to improve performance outcomes.

- Strategic collaborations and regional expansions will shape long-term competitiveness among leading players.

- The Europe In-Organic Pigment Dispersion Market will sustain growth by balancing innovation with compliance.