Market Overview

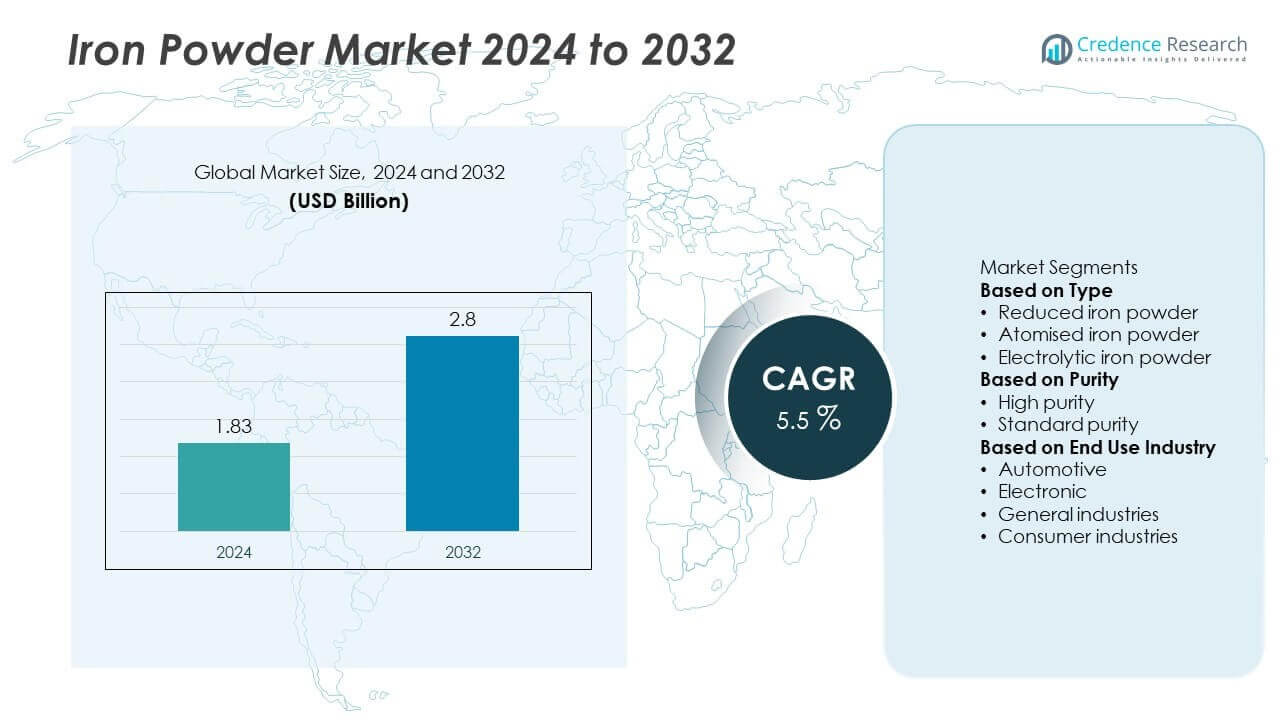

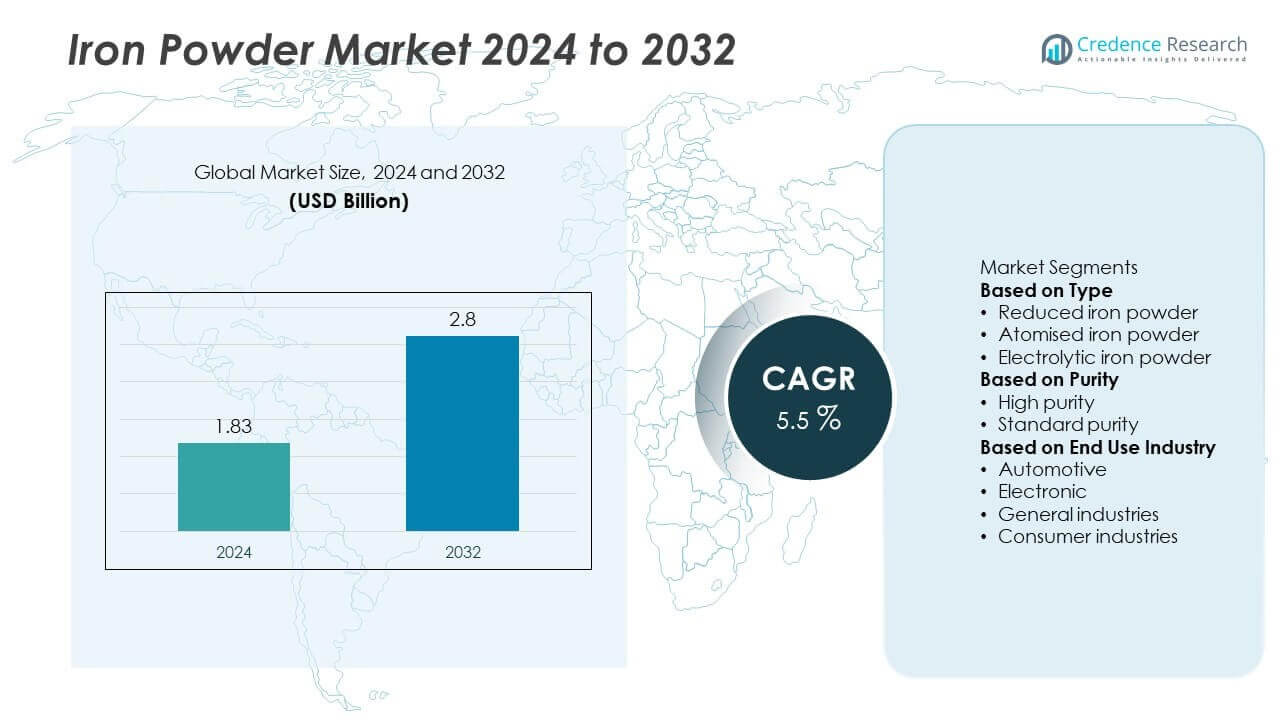

Iron Powder Market size was valued at USD 1.83 billion in 2024 and is anticipated to reach USD 2.8 billion by 2032, growing at a CAGR of 5.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Iron Powder Market Size 2024 |

USD 1.83 Billion |

| Iron Powder Market, CAGR |

5.5% |

| Iron Powder Market Size 2032 |

USD 2.8 Billion |

The Iron Powder Market grows with rising demand from automotive, construction, and chemical industries that rely on powder metallurgy, welding, and catalytic applications. Automotive manufacturers use iron powder for gears, bearings, and lightweight components that improve efficiency.

Asia Pacific leads the Iron Powder Market with strong demand from automotive, electronics, and construction sectors across China, India, Japan, and South Korea. The region benefits from large-scale manufacturing, expanding infrastructure, and growing research in additive manufacturing. North America follows with advanced applications in aerospace, healthcare, and 3D printing, supported by high R&D investments and strong adoption of powder metallurgy. Europe maintains stable demand from automotive, electronics, and renewable energy projects, emphasizing high-purity powders and sustainable production processes. Latin America and the Middle East & Africa show steady growth driven by construction, welding, and mining applications, supported by industrialization and infrastructure development. Global players tailor strategies to regional strengths, focusing on product quality, performance, and cost efficiency. Key companies in this market include Hoganas, BASF SE, Rio Tinto Metal Powder, and Industrial Metal Powders (India) Pvt. Ltd., each contributing advanced solutions across industries that depend on iron powder.

Market Insights

- Iron Powder Market was valued at USD 1.83 billion in 2024 and is projected to reach USD 2.8 billion by 2032, growing at a CAGR of 5.5%.

- Rising demand from automotive and machinery industries drives the use of iron powder in powder metallurgy for gears, bearings, and structural components.

- Growing adoption of additive manufacturing and 3D printing expands opportunities for iron powder in lightweight, customized, and complex part production.

- Key players such as Hoganas, BASF SE, Rio Tinto Metal Powder, and Industrial Metal Powders (India) Pvt. Ltd. compete by offering high-purity powders, advanced particle designs, and global distribution networks.

- The market faces restraints from raw material price volatility, energy-intensive production, and competition from alternative materials in advanced applications.

- Asia Pacific leads demand due to strong industrialization, automotive growth, and infrastructure expansion, while North America shows strength in aerospace, healthcare, and additive manufacturing.

- Europe focuses on high-purity powders and sustainability, while Latin America and Middle East & Africa present growing opportunities in construction, mining, and food fortification.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Expanding Use in Automotive and Industrial Components Strengthens Market Demand

Automotive and machinery industries use iron powder extensively for manufacturing parts through powder metallurgy. The Iron Powder Market benefits from demand for gears, bearings, and structural components requiring precision and strength. It enables cost-efficient production while reducing material waste compared to traditional casting methods. Lightweight components made with iron powder support fuel efficiency and performance goals in vehicles. Industrial equipment manufacturers also adopt powder metallurgy parts for durability under continuous stress. Growing global vehicle production and industrial activity sustain this demand trend.

- For instance, Höganäs AB produces about 500,000 tonnes of metal powder annually, supplying automotive, electrical motor, and additive manufacturing sectors.

Rising Demand for Iron-Based Materials in Chemical and Food Industries

Iron powder plays a critical role in chemical processes such as catalysis, magnetic materials, and water treatment. The Iron Powder Market also gains traction in the food industry, where it is used for nutritional fortification. It supports the production of dietary supplements and enriched foods in regions tackling iron deficiency. Chemical companies employ iron powder in pollutant removal and hydrogen sulfide treatment. Its role in magnetic alloys and soft magnetic composites further expands industrial applications. This multi-sector utility strengthens long-term growth opportunities.

- For instance, Industrial Metal Powders (India) Pvt. Ltd. (IMP) manufactures high-purity electrolytic iron powder used for fortifying wheat flour and rice. The company is a key supplier for food fortification in India and export markets.

Increasing Application in Welding and Flame Cutting Technologies

Welding electrodes and flame cutting processes require iron powder to improve deposition rates and arc stability. The Iron Powder Market expands with rising construction, pipeline projects, and infrastructure development worldwide. It ensures stronger weld quality and higher efficiency for large-scale fabrication. Manufacturers prefer iron-powder-filled electrodes for better productivity and reduced energy costs. It also enhances the quality of welds in demanding industries such as shipbuilding and heavy engineering. Growth in global construction activity directly boosts demand for this application segment.

Adoption in Additive Manufacturing and Emerging Technologies

Iron powder is gaining importance in 3D printing and additive manufacturing due to its compatibility with advanced processes. The Iron Powder Market benefits from industries exploring cost-effective alternatives for prototyping and complex part production. It allows designers to create lightweight, durable, and customized components with reduced material use. Research institutions and manufacturers focus on improving powder characteristics for high-performance printing. It also supports the production of renewable energy components, medical implants, and aerospace parts. This innovation-driven use adds significant growth momentum across modern industries.

Market Trends

Growing Shift Toward Powder Metallurgy for Lightweight and Efficient Components

Industries adopt powder metallurgy to reduce waste and improve cost efficiency in part production. The Iron Powder Market reflects this trend with rising use in automotive gears, bearings, and precision machinery. It supports manufacturing of components with consistent mechanical properties and tight tolerances. Companies value powder metallurgy for its ability to produce complex geometries without extensive machining. Demand grows in vehicles requiring lighter components to improve fuel efficiency. This trend strengthens the role of iron powder as a core raw material in modern engineering.

Expansion of Iron Powder Applications in Energy Storage and Renewable Systems

Iron powder is being explored as a potential material for large-scale energy storage technologies. The Iron Powder Market benefits from research into recyclable and low-cost iron-based fuels for renewable integration. It plays a role in hydrogen generation, clean fuel systems, and magnetic components for wind and solar equipment. Companies develop iron-air batteries using iron powder for extended storage capacity. It creates opportunities for sustainable energy solutions that reduce reliance on rare or expensive materials. This broadens the scope of applications beyond traditional metallurgical use.

- For instance, Pometon S.p.A. partnered in the IRON+ initiative to commercialize iron-based fuel systems, demonstrating pilot plants capable of cycling 1,000 kilograms of reduced iron powder per day as a renewable energy storage medium.

Rising Demand for High-Purity Iron Powder in Electronics and Magnetics

Electronics and electrical industries require high-purity iron powder for magnetic materials and components. The Iron Powder Market grows with its use in inductors, transformers, and electromagnetic shielding systems. It supports the development of soft magnetic composites that enhance device efficiency. Manufacturers refine powder quality to meet stringent requirements of miniaturized and high-performance electronics. Demand intensifies as consumer electronics and smart devices expand globally. It positions iron powder as a strategic material in next-generation electronic applications.

- For instance, JFE Steel Corporation announced on January 16, 2024, that it had used its Denjiro™ insulated pure-iron powder to develop and test a prototype axial-gap motor. This motor was 48% thinner and 40% lighter than existing axial-gap units while maintaining the same or higher performance. JFE Steel developed the motor in collaboration with JFE Techno-Research Corporation and Armis Corporation. The original announcement for the Denjiro™ material itself was made earlier, on January 27, 2022.

Adoption of Iron Powder in Additive Manufacturing and 3D Printing Technologies

Additive manufacturing is driving new demand for iron powder in customized part production. The Iron Powder Market aligns with this shift through its compatibility with sintering and metal printing processes. It supports low-cost prototyping and production of lightweight yet strong components. Automotive, aerospace, and healthcare industries increasingly adopt iron powder for complex structures. Manufacturers optimize particle size distribution and flowability to enhance printing efficiency. It ensures better performance for high-precision and high-strength printed components in emerging industries.

Market Challenges Analysis

Volatility in Raw Material Prices and Supply Chain Disruptions Limit Market Stability

The iron and steel industry experiences frequent fluctuations in raw material prices due to global demand and supply imbalances. The Iron Powder Market faces challenges when these cost shifts directly impact production expenses and profitability. It struggles to maintain competitive pricing in regions heavily dependent on imports. Supply chain disruptions, including transportation delays and geopolitical tensions, further restrict consistent material flow. Smaller manufacturers find it difficult to absorb these risks, affecting availability in key markets. Such volatility discourages long-term investment in capacity expansion and technology upgrades.

Technical Limitations and Environmental Concerns Restrict Wider Adoption

Production of iron powder requires energy-intensive processes that raise environmental concerns regarding carbon emissions. The Iron Powder Market is under pressure to adopt greener technologies while meeting strict regulations. It encounters difficulty balancing high-quality output with sustainable production methods. Technical challenges in achieving uniform particle size and high purity also affect performance in advanced applications. Variations in powder characteristics limit its suitability for demanding sectors like aerospace and electronics. Growing competition from alternative materials in additive manufacturing and advanced alloys further challenges its market penetration.

Market Opportunities

Expansion in Additive Manufacturing and Advanced Engineering Applications Creates Growth Potential

The adoption of 3D printing and additive manufacturing in automotive, aerospace, and healthcare industries creates strong opportunities for iron powder suppliers. The Iron Powder Market benefits from demand for cost-effective materials that deliver durability and complex design flexibility. It supports the production of lightweight yet strong structures with reduced material waste. Research initiatives are expanding the use of iron powder in prototyping and customized manufacturing. Improved powder refinement technologies enable consistent particle size and flowability, enhancing performance in high-precision printing. This application shift positions iron powder as a critical material in next-generation engineering solutions.

Rising Opportunities in Energy Storage and Environmental Technologies Expand Market Scope

Iron powder shows potential in innovative energy storage solutions such as iron-air batteries and recyclable iron-based fuels. The Iron Powder Market gains traction from growing renewable energy projects and demand for sustainable power systems. It also plays a role in water treatment, pollution control, and chemical catalysis, where environmental concerns drive adoption. Governments and industries are investing in research to commercialize these new applications. The growing interest in low-cost, scalable, and eco-friendly materials places iron powder at the center of future energy and environmental strategies. It offers strong potential for long-term market diversification and growth.

Market Segmentation Analysis:

By Type:

The Iron Powder Market is segmented into reduced iron powder, atomized iron powder, and electrolytic iron powder. Reduced iron powder holds a significant share due to its cost-effectiveness and wide application in welding, chemical reactions, and powder metallurgy. Atomized iron powder is valued for its spherical particle structure, which improves flowability and density in manufacturing processes. It is widely used in automotive components and additive manufacturing applications. Electrolytic iron powder, though more expensive, is preferred in industries requiring high purity and fine particle sizes, such as electronics and magnetic materials. The balance among these types reflects the diverse industrial needs that iron powder fulfills.

- For instance, CNPC Powder produces a wide range of metal powders, including water-atomized and gas-atomized powders, with particle sizes tailored for applications like additive manufacturing. With production facilities in China, the company’s annual output surpasses 3,500 tons and it supplies materials to over 40 countries. Its products, which include various iron, copper, nickel, titanium, and aluminum alloys, are used in numerous industries, including additive manufacturing, powder metallurgy, electronics, and automotive.

By Purity:

Purity plays a critical role in determining performance in various applications. The Iron Powder Market includes segments of high-purity iron powder and standard-grade iron powder. High-purity iron powder is in strong demand from electronics, chemical, and magnetic materials industries where performance consistency is essential. It supports applications in inductors, transformers, and advanced catalysts. Standard-grade iron powder remains dominant in metallurgy, automotive, and welding industries where cost-effectiveness and mechanical properties take priority. It ensures durable output for mass production without compromising essential characteristics.

- For instance, Industrial Metal Powders (India) Pvt. Ltd. (IMP) manufactures high-purity electrolytic iron powder with grades exceeding 99.5% purity. This iron powder is used in various applications, including pharmaceuticals, food fortification, and precision electronics.

By End Use Industry:

End use industries adopting iron powder include automotive, chemical, food, electronics, and construction. The Iron Powder Market sees major consumption in automotive manufacturing through powder metallurgy, producing gears, bearings, and precision components. Chemical industries utilize it for water treatment, pollution control, and as a reducing agent. The food industry applies iron powder for nutritional fortification in supplements and enriched foods. Electronics rely on high-purity powders for magnetic applications, while construction uses it in welding electrodes and flame cutting. It continues to expand across industries seeking efficiency, durability, and performance in large-scale production and specialized applications.

Segments:

Based on Type

- Reduced iron powder

- Atomised iron powder

- Electrolytic iron powder

Based on Purity

- High purity

- Standard purity

Based on End Use Industry

- Automotive

- Electronic

- General industries

- Consumer industries

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

Asia Pacific

Asia Pacific holds the largest share of the Iron Powder Market, accounting for nearly 38%. The region’s dominance is driven by rapid industrialization, strong automotive production, and large-scale manufacturing activity in China, India, Japan, and South Korea. Powder metallurgy parts made from iron powder find strong demand in gears, bearings, and structural components for the automotive sector. Expanding construction and infrastructure activity further boosts the use of iron powder in welding electrodes and flame cutting processes. Rising investments in electronics and magnetic materials also add to regional consumption. It remains the most dynamic market, supported by cost-efficient production and growing domestic demand.

North America

North America represents about 27% of the Iron Powder Market, supported by advanced industrial infrastructure and high adoption of powder metallurgy. The United States leads with strong demand from automotive, aerospace, and healthcare sectors. Iron powder is widely used in additive manufacturing and 3D printing, where U.S.-based research institutions and manufacturers focus on developing high-purity powders for precision applications. Canada contributes with strong adoption in mining, chemical, and environmental industries, including water treatment. Welding applications across oil and gas pipelines and construction also sustain regional demand. It remains a key hub for innovation and advanced applications of iron powder.

Europe

Europe holds nearly 22% of the Iron Powder Market, with major contributions from Germany, France, and the UK. The region has a well-established automotive and machinery industry, which drives consistent demand for powder metallurgy components. High-purity iron powder also sees strong use in electronics, magnetic materials, and chemical catalysis across European markets. Strict environmental regulations push manufacturers to develop cleaner and more sustainable powder production processes. Demand from renewable energy projects, including iron-air battery research, supports future growth. It continues to play a vital role in driving advanced applications through innovation and regulatory compliance.

Latin America

Latin America accounts for about 7% of the Iron Powder Market, led by Brazil and Mexico. The region shows steady demand from construction, welding, and mining-related applications. Automotive industries in Brazil and Mexico also contribute to the use of powder metallurgy components. Limited but growing adoption in nutritional fortification of foods and supplements adds to demand in the healthcare and food sectors. Infrastructure development projects increase the requirement for welding electrodes and flame cutting materials. It presents gradual growth opportunities as industrialization expands across emerging economies.

Middle East & Africa

Middle East & Africa represent around 6% of the Iron Powder Market. Demand is concentrated in construction, oil and gas, and mining activities across Saudi Arabia, UAE, South Africa, and Nigeria. Welding and flame cutting applications account for a significant portion of regional usage, supported by large infrastructure and energy projects. Iron powder also finds application in water treatment and pollution control, addressing rising environmental challenges. While industrial adoption is at an early stage, governments in the region are investing in manufacturing and healthcare, creating future growth avenues. It offers long-term potential supported by industrial diversification and infrastructure expansion.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Pometon

- Rio Tinto Metal Powder

- Belmont Metals

- Reade

- BASF SE

- Hoganas

- Industrial Metal Powders (India) Pvt. Ltd.

- American Element

- CNPC Powder

- JFE Steel Corporation

Competitive Analysis

The competitive landscape of the Iron Powder Market includes leading players such as Hoganas, BASF SE, Rio Tinto Metal Powder, Industrial Metal Powders (India) Pvt. Ltd., American Element, CNPC Powder, Belmont Metals, JFE Steel Corporation, Pometon, and Reade. These companies compete by offering a diverse portfolio of iron powder products tailored for automotive, construction, chemical, and additive manufacturing applications. They focus on particle quality, purity levels, and flowability to meet the needs of powder metallurgy, welding electrodes, and 3D printing industries. Innovation centers on developing high-purity grades, energy-efficient production processes, and customized powders for advanced technologies such as soft magnetic composites and iron-air batteries. Strategic initiatives include partnerships with automotive OEMs, expansion of global distribution networks, and investment in R&D to strengthen product performance. Competition also extends to ensuring reliable supply chains and cost control amid volatile raw material prices. Market leadership depends on technological advancement, sustainable practices, and the ability to serve diverse regional demands effectively.

Recent Developments

- In April 2025, Rio Tinto will supply 70 % of iron ore for a hydrogen-based zero-carbon steel plant in Austria—helping drive low-carbon iron usage.

- In March 2025, Höganäs entered a strategic partnership with Porite to supply its newly developed “near-zero” emitted sponge iron powder.

- In 2025, Rio Tinto announced a US $1.8 billion investment to develop the Brockman Syncline 1 iron ore project in Pilbara. This supports future iron supply for powder production value chains.

- In January 2024, JFE Steel Corporation has taken the lead in demonstration eco-friendly innovations in the development of Denjiro, an insulation-coated pure-iron powder.

Report Coverage

The research report offers an in-depth analysis based on Type, Purity, End Use Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for iron powder will grow with expanding automotive and industrial component production.

- Powder metallurgy will remain a major driver due to efficiency and material savings.

- High-purity iron powder will gain traction in electronics, magnetic materials, and energy storage.

- Additive manufacturing and 3D printing will create new opportunities for customized applications.

- Renewable energy projects will support iron powder use in batteries and sustainable fuels.

- Food and pharmaceutical industries will increase adoption for nutritional fortification.

- Asia Pacific will continue leading growth through industrialization and large-scale manufacturing.

- North America and Europe will drive innovation in advanced and eco-friendly powder technologies.

- Latin America and Middle East & Africa will expand demand in construction and welding.

- Sustainability initiatives will encourage energy-efficient production and recycling in iron powder manufacturing.