Market Overview:

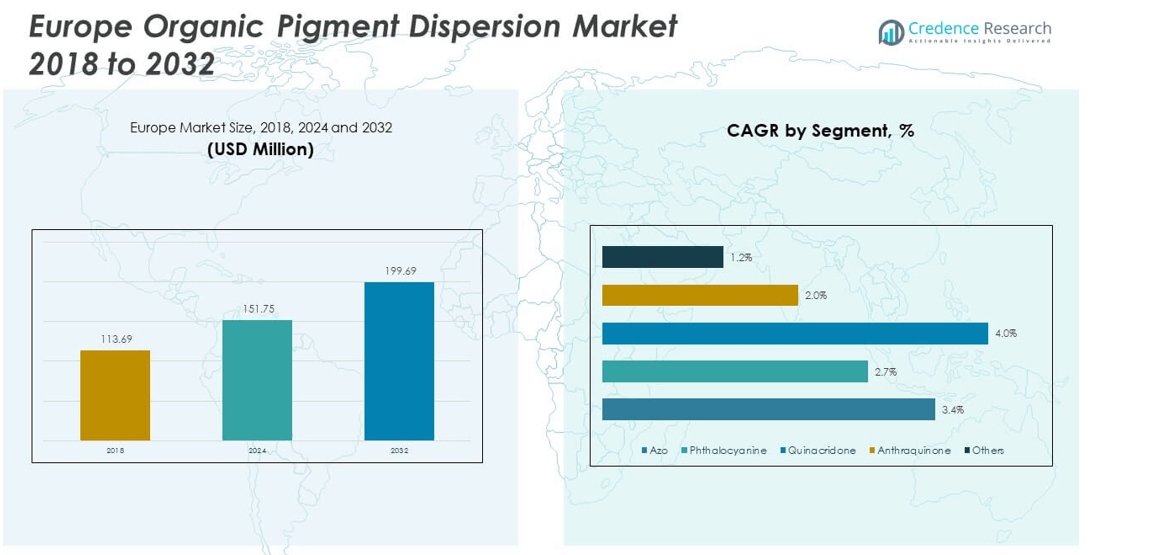

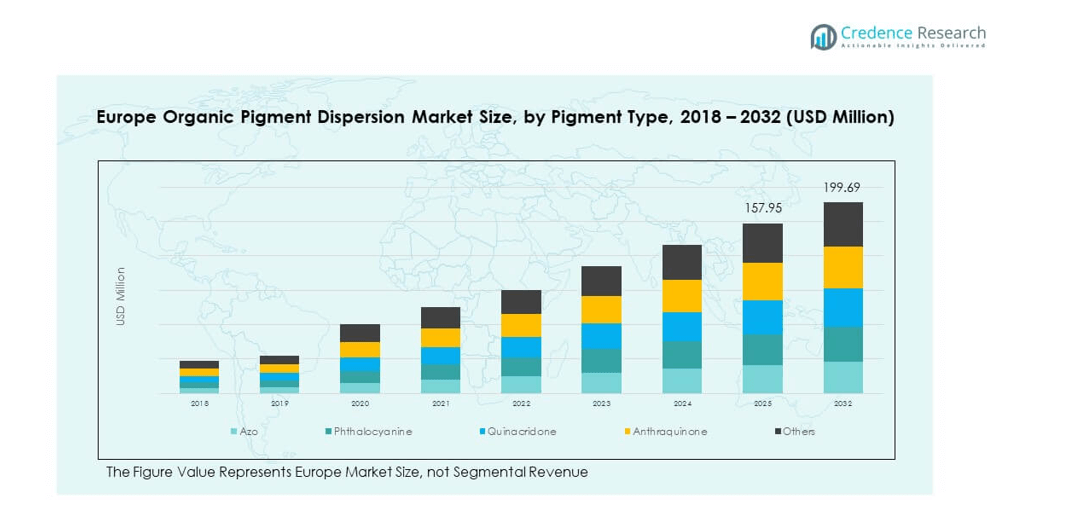

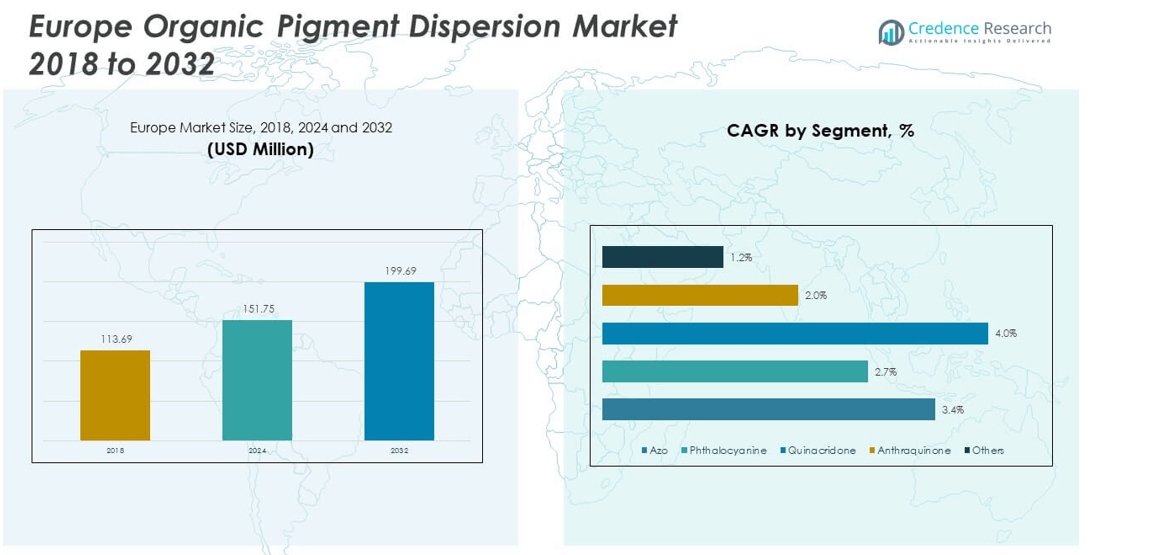

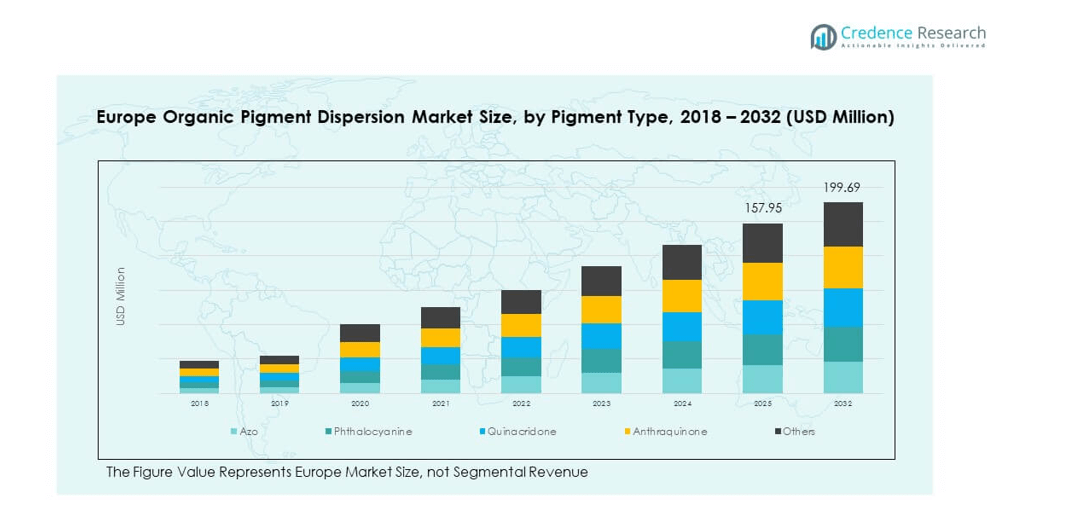

The Europe Organic Pigment Dispersion Market size was valued at USD 113.69 million in 2018 to USD 151.75 million in 2024 and is anticipated to reach USD 199.69 million by 2032, at a CAGR of 3.40% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Organic Pigment Dispersion Market Size 2024 |

USD 151.75 million |

| Europe Organic Pigment Dispersion Market, CAGR |

3.40% |

| Europe Organic Pigment Dispersion Market Size 2032 |

USD 199.69 million |

Market growth is fueled by increasing demand for eco-friendly pigments across industries such as packaging, coatings, textiles, and plastics. Companies focus on sustainable alternatives due to strict European environmental regulations that restrict hazardous materials. Rising consumer preference for recyclable and safe products further supports the shift from synthetic pigments to organic dispersions. It also benefits from technological advancements that enhance stability, performance, and application flexibility, driving adoption in both mainstream and specialty uses.

Western Europe leads the Europe Organic Pigment Dispersion Market due to strong industrial bases in automotive, packaging, and construction sectors. Germany, France, and the UK dominate with advanced manufacturing capacity and high regulatory compliance. Southern Europe shows steady adoption in textiles and decorative paints, while Eastern Europe emerges as a growth hub with expanding industrial output. Northern Europe emphasizes circular economy models and sustainable manufacturing, strengthening long-term market opportunities. Together, these subregions create a balanced landscape of mature demand and rising adoption across Europe.

Market Insights

- The Europe Organic Pigment Dispersion Market size was USD 113.69 million in 2018, reached USD 151.75 million in 2024, and is projected to attain USD 199.69 million by 2032, growing at a CAGR of 3.40%.

- The Global Organic Pigment Dispersion Market size was valued at USD 397.20 million in 2018 to USD 549.81 million in 2024 and is anticipated to reach USD 768.02 million by 2032, at a CAGR of 4.18% during the forecast period.

- Western Europe held the largest share at 46% in 2024, supported by strong automotive, packaging, and coatings industries; Southern Europe followed with 24%, driven by construction and textiles; Eastern and Northern Europe together captured 30%, supported by rising industrial activities and sustainability initiatives.

- Eastern Europe is the fastest-growing region with 18% share, supported by manufacturing expansion and regulatory alignment encouraging the use of eco-friendly pigments.

- By pigment type, azo pigments accounted for 38% share in 2024, leading demand across packaging and printing inks due to cost-effectiveness and strong color strength.

- Phthalocyanine pigments secured 27% share, driven by coatings and plastics demand, while quinacridone, anthraquinone, and other pigments collectively captured 35%, supporting high-performance and specialty applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Growing Demand for Eco-Friendly Pigments Across Packaging and Printing Industries

The packaging industry strongly supports the growth of the Europe Organic Pigment Dispersion Market, with brands prioritizing non-toxic and recyclable solutions. Printing inks benefit from strict sustainability goals that encourage adoption of organic pigments over synthetic substitutes. Demand increases from food and beverage packaging where safety and compliance standards are critical. Regulatory frameworks in Europe push companies to adapt to greener alternatives quickly. It fosters strong competition among pigment suppliers to innovate sustainable formulations. Packaging converters value the dispersions for their superior stability and vivid coloration. The shift toward environmentally responsible inks creates consistent volume growth. Strategic collaborations between packaging firms and pigment producers expand the industry reach.

Expansion of Paints and Coatings Sector with Sustainable Material Preferences

The paints and coatings industry drives significant demand for organic pigment dispersions across Europe. Rising construction activities and architectural projects require durable and eco-compliant colorants. Automotive coatings also embrace organic pigments to meet stringent emission and safety guidelines. It benefits from advancements in dispersions that improve weather resistance and gloss retention. End-users increasingly prefer organic pigments due to reduced toxicity concerns. Government initiatives promoting low-VOC materials reinforce the shift. Coating manufacturers integrate organic pigments into waterborne systems to enhance sustainability credentials. This trend strengthens the alignment of environmental policies with market growth.

- For instance, in January 2023, Heubach Group introduced Ultrazur, a new series of environment-friendly Ultramarine Blue pigments, which underwent testing to demonstrate heat resistance up to 350°C and exceptional lightfastness. The pigments are formulated for coatings and paints, meeting European environmental and performance standards.

Innovation in Formulation Technologies Enhancing Application Performance and Efficiency

The Europe Organic Pigment Dispersion Market expands with innovation in formulation technologies. Advances in dispersions deliver improved particle stability, dispersion uniformity, and color consistency. These innovations create opportunities across plastics, textiles, and specialty chemicals. End-users value high-performance attributes that reduce maintenance and improve longevity. It leads to higher adoption in premium applications demanding advanced quality. Companies invest in research to balance cost efficiency with performance enhancements. Collaborations with research institutions accelerate breakthroughs in nano-dispersion technology. These advancements support a wide portfolio of industries adopting sustainable color solutions.

Stringent Environmental Regulations Driving Substitution of Synthetic Pigments

Environmental legislation in Europe significantly influences the market landscape. Regulations restrict harmful chemicals, forcing industries to replace synthetic pigments. It increases demand for organic alternatives that comply with strict safety norms. Producers benefit from favorable policies encouraging safer material usage. The regulatory push accelerates innovation and standardization of pigment dispersions. Manufacturers align their operations with EU directives on waste reduction and emission control. Compliance builds trust among end-users seeking safe and certified solutions. Long-term adoption of organic pigments gains momentum under this regulated framework. Companies focused on sustainable pigments gain strong competitive advantage.

- For example, BASF has aligned its European operations with the EU’s REACH regulation, ensuring its pigments and chemical products meet strict safety and compliance requirements. The company integrates environmental management systems at production sites to minimize emissions and improve sustainability performance.

Market Trends

Adoption of Organic Pigments in High-Performance Textile Applications

The textile sector sees expanding adoption of organic pigment dispersions for high-performance fabrics. Producers prefer them for superior lightfastness and resistance to harsh washing cycles. The Europe Organic Pigment Dispersion Market supports applications in sportswear, uniforms, and industrial textiles. It provides consistent coloration without compromising safety standards. Textile companies highlight eco-friendly dyeing processes using pigment dispersions. Rising consumer awareness about sustainable clothing increases adoption in fashion lines. Technological improvements enable finer dispersion suited for complex textile designs. The integration into circular textile practices reinforces growth momentum.

- For instance, Alchemie Technology’s Endeavour™ digital dyeing system eliminates wastewater emissions entirely and reduces the carbon footprint of textile dyeing by over 85%, while also lowering operational costs by more than 50% compared to traditional dyeing processes; the system achieves colour fastness above 4/5 on multiple fabrics and can process over 1,500 m² of fabric per hour with run-to-run colour consistency less than deltaE 0.5—all validated by Alchemie’s official 2021 technical datasheet.

Rising Integration of Organic Pigments into Plastics and Polymers Industry

Plastics and polymers industry increasingly relies on organic pigment dispersions for coloration. Producers prefer them in consumer goods, packaging films, and engineering plastics. It offers superior heat stability and chemical resistance compared to traditional alternatives. The Europe Organic Pigment Dispersion Market gains traction through innovation in plastic compounding. Strict compliance requirements in consumer plastics encourage this transition. Companies adopt organic dispersions to differentiate products with vibrant, stable colors. End-users seek pigments compatible with recyclable plastics, aligning with circular economy goals. Broader use in construction plastics adds new market depth.

- For instance, Venator launched its TMP- and TME-free TIOXIDE® TR81 titanium dioxide pigment in March 2025, engineered for plastics manufacturers to eliminate trimethylolpropane (TMP) and trimethylolethane (TME), helping clients meet stringent European chemical regulations without compromising on opacity, brightness, dispersibility, or durability, as officially confirmed in Venator’s product news release.

Digital Printing Growth Driving Demand for Advanced Pigment Dispersions

Digital printing adoption accelerates pigment demand across commercial and industrial uses. The Europe Organic Pigment Dispersion Market benefits from high-resolution printing needs. It enhances color intensity and image durability in digital formats. Expanding e-commerce drives label and packaging printing volumes. Pigment dispersions support flexibility across substrates, including paper, films, and textiles. Inkjet technologies require dispersions with stable particle sizes for performance. Companies expand product lines tailored for digital ink systems. The rise of customized printing strengthens long-term opportunities.

Increasing Focus on Circular Economy and Closed-Loop Manufacturing

The European market reflects a strong shift toward circular economy practices. The Europe Organic Pigment Dispersion Market aligns with recycling initiatives and sustainable manufacturing. It drives producers to offer pigments compatible with biodegradable substrates. Industrial customers emphasize closed-loop systems to minimize waste. Pigments engineered for recyclability gain preference in packaging and automotive industries. Companies adopt certifications to showcase eco-compliance to customers. Demand for traceability in supply chains further shapes pigment adoption. This reinforces sustainable practices as a central trend.

Market Challenges Analysis

High Cost of Organic Pigments Compared to Synthetic Alternatives

The Europe Organic Pigment Dispersion Market faces challenges due to higher production costs. Organic pigments require complex manufacturing processes and specialized raw materials. It creates pricing gaps compared to widely available synthetic pigments. Small manufacturers struggle to absorb these additional costs. Customers in cost-sensitive sectors hesitate to switch from cheaper alternatives. The competitive pressure limits adoption in developing regions of Europe. High R&D investment further adds to the overall expense. Suppliers focus on cost optimization strategies to reduce these barriers.

Limited Availability of Raw Materials and Volatility in Supply Chains

Supply chain disruptions impact pigment availability across Europe. Organic pigment production depends on specific intermediates that face supply volatility. It creates risks for consistent manufacturing schedules in end-use industries. Shortages increase procurement costs for buyers, adding financial strain. Volatility in global raw material markets affects long-term contracts. Regional dependence on imports complicates supply reliability. Companies invest in local sourcing to reduce vulnerability. These challenges limit smooth expansion of pigment dispersion adoption.

Market Opportunities

Expanding Role of Organic Pigments in Sustainable Packaging Innovation

Sustainable packaging solutions create major opportunities for pigment dispersions. The Europe Organic Pigment Dispersion Market benefits from strict EU recycling policies. It provides safe and durable pigments for food, cosmetics, and pharmaceutical packaging. Demand rises from eco-conscious consumers seeking recyclable and biodegradable products. Packaging converters value high-performing dispersions compatible with advanced substrates. It enhances compliance with sustainability targets across industries. Opportunities grow as companies shift to premium packaging formats. Collaboration with packaging leaders opens new supply chain growth.

Emergence of New Applications in Specialty Chemicals and Electronics

Specialty chemical and electronics sectors offer new opportunities for pigment dispersions. The Europe Organic Pigment Dispersion Market adapts to high-performance demands in these fields. It enables coloration in coatings for electronic components requiring durability. Specialty chemicals integrate pigments for innovative material applications. Growth arises from advanced design requirements in automotive electronics. Companies explore nano-dispersions for high-precision industrial processes. Expanding collaborations with specialty manufacturers foster long-term growth. The push for high-value applications increases adoption beyond traditional uses.

Market Segmentation Analysis

By pigment type, the Europe Organic Pigment Dispersion Market is dominated by azo pigments, valued for their strong color strength and wide cost-effective use. Phthalocyanine pigments follow with high demand due to excellent stability in coatings and plastics. Quinacridone and anthraquinone pigments secure niche adoption in high-performance applications such as automotive and decorative coatings. It also includes other specialty pigments tailored for cosmetics and textiles, where unique shades and compliance with safety standards remain critical. Diverse pigment portfolios allow manufacturers to address both mass-market and premium requirements.

- For example, Clariant’s Hostaperm® quinacridone series stands out for use in automotive and coil coatings, offering weathering resistance for over five years in exposed applications according to 2025 company and industry reports.

By application, paints and coatings hold the largest share of the Europe Organic Pigment Dispersion Market, driven by construction and automotive industries seeking durable and eco-compliant pigments. Printing inks continue to expand through packaging and digital printing demand. Plastics and polymers applications rise as producers integrate organic dispersions into recyclable and high-performance materials. Textiles show consistent uptake with sustainable coloration in apparel and industrial fabrics. Cosmetics utilize organic pigments for non-toxic, skin-safe formulations. It also finds use across other industries such as specialty chemicals, where customization and performance remain key drivers. Together, these segments highlight the market’s adaptability across diverse end-use sectors.

- For instance, in 2025, AkzoNobel launched its new Sikkens Autowave Optima waterborne automotive basecoat in Europe, confirmed to deliver up to 50% faster process time versus traditional basecoats and achieve up to 60% energy and carbon emissions savings, as officially described in industry and company press releases.

Segmentation

By Pigment Type

- Azo

- Phthalocyanine

- Quinacridone

- Anthraquinone

- Others

By Application

- Printing Inks

- Paints & Coatings

- Plastics & Polymers

- Textiles

- Cosmetics

- Others

Regional Analysis

Western Europe

Western Europe dominates the Europe Organic Pigment Dispersion Market with a 46% share in 2024. Germany, France, and the UK drive growth due to strong demand in automotive coatings, packaging, and industrial applications. These countries maintain advanced production facilities and invest in eco-friendly technologies that align with strict EU environmental regulations. It benefits from strong R&D investments that enhance the quality and sustainability of pigment dispersions. The presence of leading manufacturers ensures reliable supply chains and consistent product innovation. Western Europe remains the hub for high-value applications, with steady demand from construction and consumer goods sectors.

Southern Europe

Southern Europe accounts for 24% of the market share, led by Italy and Spain. Both countries have well-developed manufacturing sectors that rely heavily on organic pigments for textiles, paints, and plastics. Demand is supported by expanding architectural coatings and decorative paints in residential and commercial projects. It also benefits from growing packaging exports that integrate sustainable pigment solutions. Southern Europe’s industries adapt to EU climate policies by integrating low-VOC and recyclable pigment technologies. The shift to advanced dispersion technologies continues to expand opportunities in specialty chemicals and design-focused industries.

Eastern and Northern Europe

Eastern and Northern Europe together represent a 30% market share in 2024. Eastern Europe, including Poland, Czech Republic, and Russia, demonstrates rising demand supported by industrial expansion and increasing regulatory compliance. Northern Europe, with countries such as Sweden and Denmark, emphasizes sustainable manufacturing and circular economy models that create long-term growth. It reflects higher demand for eco-compliant pigments across packaging and construction applications. Supply chain investments strengthen adoption in both regions, addressing growing demand from local and export markets. Both subregions are gaining traction as secondary hubs for pigment dispersions, adding depth to the European market landscape.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- BASF SE

- Clariant AG

- Heubach GmbH

- Lanxess AG

- Venator Materials PLC

- Cabot Corporation

- Ferro Corporation

- DIC Corporation

- Sudarshan Chemical Industries

- Heubach Group

Competitive Analysis

The Europe Organic Pigment Dispersion Market is highly competitive with a mix of global and regional players. BASF SE, Clariant AG, and Lanxess AG dominate through strong R&D investments, broad product portfolios, and advanced distribution networks. It benefits from established players introducing high-performance dispersions for coatings, packaging, and plastics. Companies like DIC Corporation, Cabot Corporation, and Sudarshan Chemical Industries expand their European presence with new product launches and local partnerships. Heubach Group and Venator Materials PLC strengthen competitiveness through acquisitions and capacity expansions. Smaller firms target niche applications such as cosmetics and specialty textiles to build differentiated positions. The competition centers on sustainability, cost efficiency, and innovation, shaping the growth trajectory of the regional pigment dispersion industry.

Recent Developments

- In June 2025, BASF Coatings signed a strategic partnership agreement with Toyota Motor Europe to develop the Toyota Body&Paint program for Europe. This collaboration will leverage BASF’s premium refinish solutions under the Glasurit and R-M brands, bringing sustainable and high-performance coatings to Toyota and Lexus vehicles across Europe.

- In July 2025, Sun Chemical, a wholly owned subsidiary of DIC Corporation, launched a new effect pigment called Chione Electric Amber SB90D, expanding its Chione Electric product line with a shimmering amber hue. This pigment is designed for vegan beauty products in cosmetics, skin, and sun care, offering enhanced chroma, UV stability, and non-staining properties.

- In November 2023, Heubach GmbH expanded its cooperation with TER Chemicals to include inorganic colored pigments, anti-corrosion pigments, and pigment preparations in Germany and Austria. This partnership aims to enhance product availability for coatings and related applications.

Report Coverage

The research report offers an in-depth analysis based on Pigment Type and Application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Sustainability regulations will continue to drive adoption of organic pigment dispersions in multiple industries.

- Packaging manufacturers will integrate eco-friendly pigments to strengthen compliance with circular economy targets.

- Automotive coatings will create steady demand for dispersions offering durability and reduced toxicity.

- Textile industries will adopt advanced dispersions to meet performance standards in sportswear and technical fabrics.

- Innovation in nano-dispersion technology will improve particle stability and enhance application performance.

- Regional producers will expand local supply chains to reduce dependence on volatile imports.

- Digital printing will emerge as a major consumer of high-quality dispersions with precise particle sizes.

- Investment in R&D will accelerate product development focused on recyclability and long-term efficiency.

- Eastern Europe will experience stronger growth as industries modernize and adopt eco-compliant pigments.

- Strategic collaborations between pigment producers and end-use industries will shape competitive positioning.