Market Overview:

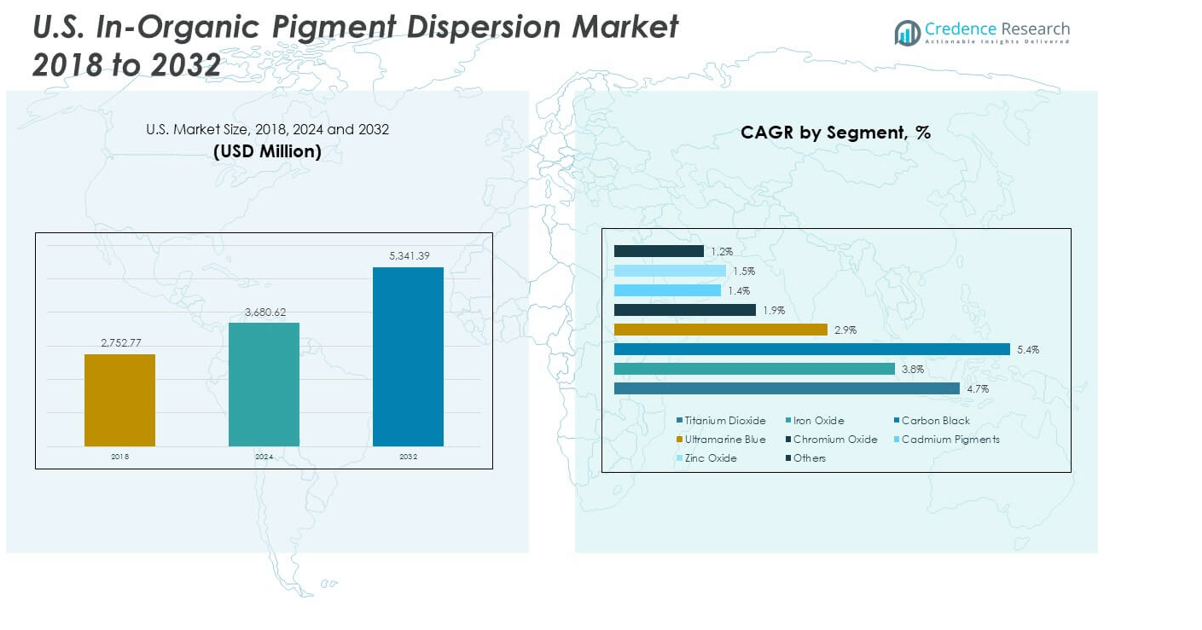

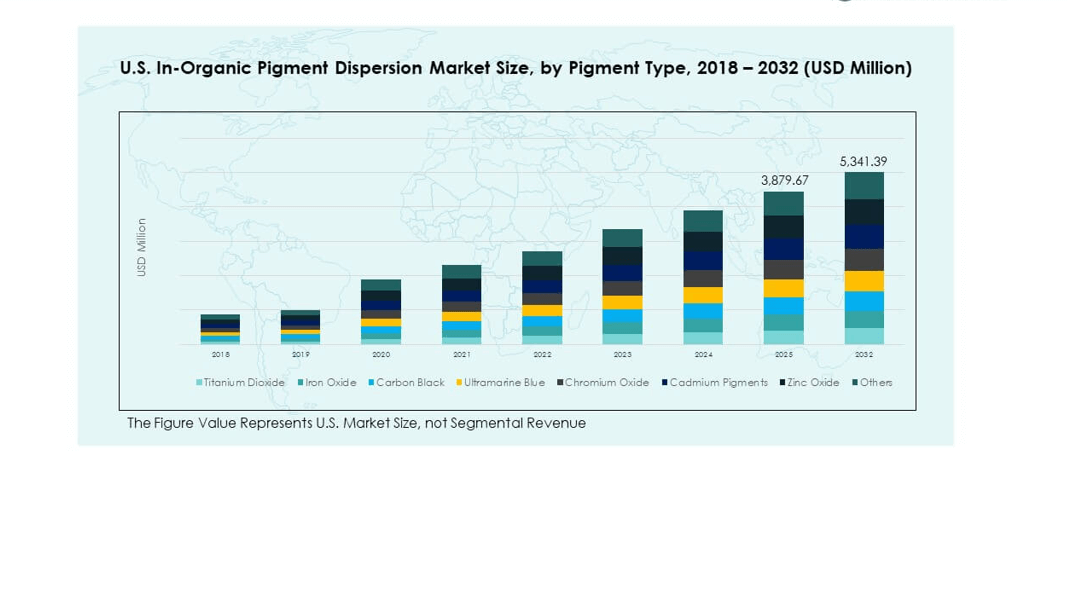

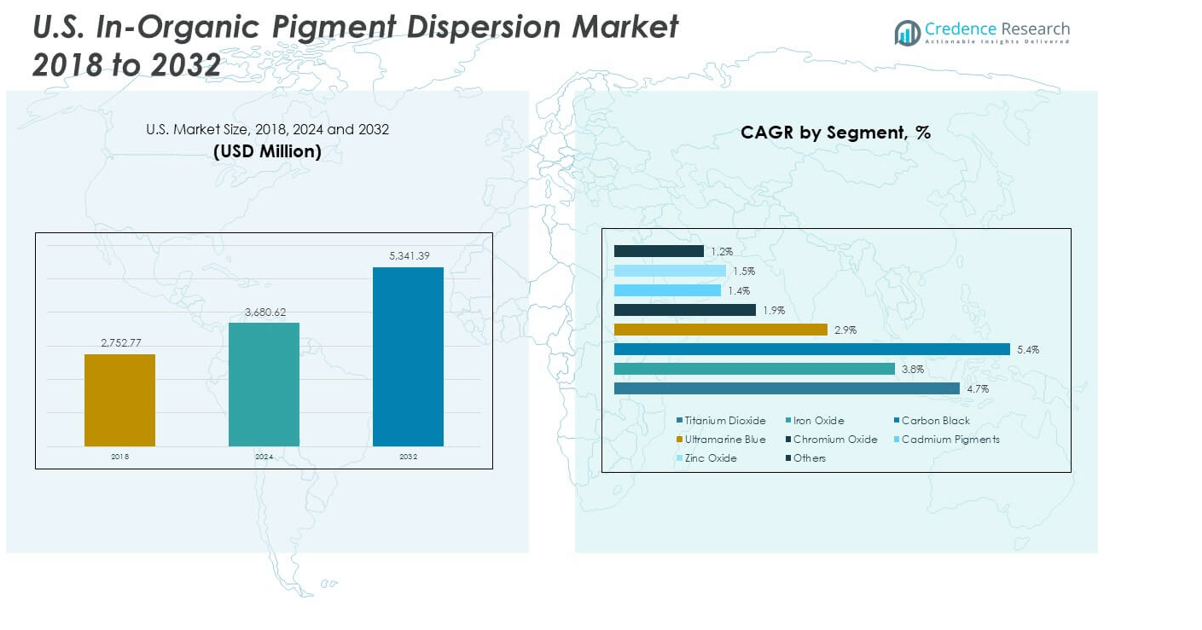

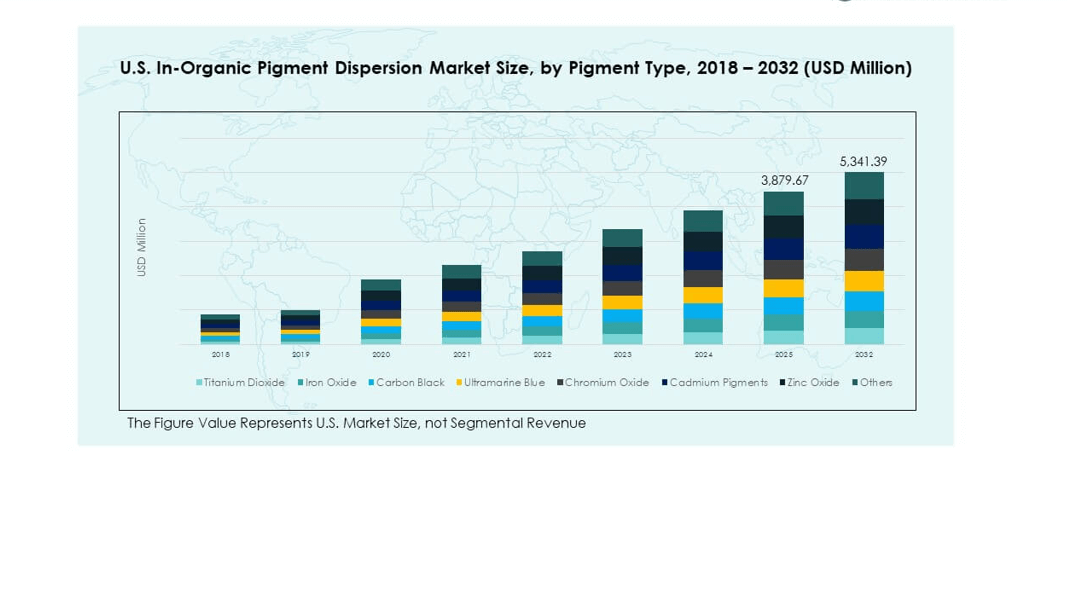

The U.S. In-Organic Pigment Dispersion Market size was valued at USD 2,752.77 million in 2018 to USD 3,680.62 million in 2024 and is anticipated to reach USD 5,341.39 million by 2032, at a CAGR of 4.67% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.S. In-Organic Pigment Dispersion Market Size 2024 |

USD 3,680.62 million |

| U.S. In-Organic Pigment Dispersion Market, CAGR |

4.67% |

| U.S. In-Organic Pigment Dispersion Market Size 2032 |

USD 5,341.39 million |

The market is driven by increasing demand from industries such as construction, automotive, packaging, and consumer goods, where pigments enhance product aesthetics, durability, and performance. Regulations promoting eco-friendly coatings and sustainable materials push manufacturers to adopt advanced inorganic dispersions with higher efficiency and lower environmental impact. The growing need for high-performance pigments in industrial applications, such as paints, coatings, and plastics, also supports steady expansion. Rising innovation in dispersion technologies and formulations ensures that end-users gain benefits such as improved opacity, color stability, and resistance to harsh conditions, further fueling adoption across diverse sectors.

The U.S. In-Organic Pigment Dispersion Market demonstrates strong regional leadership, shaped by advanced manufacturing and regulatory standards. The South held the largest share at 32%, supported by urbanization, infrastructure growth, and packaging demand. The Northeast followed with 28%, driven by construction projects and printing activities. The Midwest accounted for 25%, anchored by its automotive and industrial base. The West contributed 15%, fueled by innovation and advanced packaging industries. Together, these subregions reflect balanced growth, sustained by industrial expansion, sustainability efforts, and investments across diverse applications.

Market Insights

- The U.S. In-Organic Pigment Dispersion Market was valued at USD 2,752.77 million in 2018, reached USD 3,680.62 million in 2024, and is projected to attain USD 5,341.39 million by 2032, expanding at a CAGR of 4.67%.

- The South led with 32% share in 2024, driven by rapid urbanization and industrial growth, while the Northeast followed with 28% due to construction and packaging demand, and the Midwest held 25% supported by its strong automotive base.

- Eastern U.S. emerged as the fastest-growing region with 28% share, supported by infrastructure expansion, foreign investment, and rising demand for coatings in construction.

- Titanium dioxide accounted for the 36% share in 2024, supported by its opacity and wide use in coatings and plastics.

- Iron oxide represented the 24% share in 2024, driven by strong demand in construction materials and durable finishes across multiple industries.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand from Construction and Infrastructure Sectors

The U.S. In-Organic Pigment Dispersion Market gains strong momentum from growing construction and infrastructure projects. Pigments play a key role in coatings, paints, and concrete products used in residential and commercial developments. Contractors and manufacturers demand high-performance pigments that deliver durability and weather resistance. Expanding urbanization and government-backed projects increase product adoption across multiple states. The market benefits from continuous demand in coatings that enhance surface protection. Builders prefer inorganic pigments for their opacity, consistency, and color strength. It remains an essential material for architectural applications. The sector continues to expand due to investments in modern infrastructure.

- For example, in 2025, independent laboratory testing confirmed that PPG Coraflon Platinum powder coating exhibited only a 6% color loss over five years, delivering 20 times the color retention compared to similar competitor coatings under identical conditions.

Growing Adoption in Automotive Coatings and Finishes

The automotive industry strongly drives pigment dispersion consumption, reflecting the need for superior coatings. Vehicle manufacturers focus on aesthetics, durability, and resistance to heat and chemicals. Inorganic pigments help achieve long-lasting finishes and ensure consistent quality across models. Automakers value pigments for their color stability and strong performance under extreme conditions. The U.S. In-Organic Pigment Dispersion Market benefits from rising consumer demand for customized vehicle finishes. Coatings with pigment dispersions extend the lifespan of vehicles and improve their appeal. It supports both mass production and premium segments. The automotive industry provides continuous volume and revenue streams.

- For instance, BASF’s automotive coating innovation, EFFLORESCENCE, recognized with a Red Dot Award in 2024, integrates a monocoat technology that reflects over 65% of light to reduce car body heating, simplifying paint lines and lowering energy consumption during manufacturing.

Increasing Use in Packaging for Consumer and Industrial Goods

Packaging applications contribute significantly to pigment demand across various sectors. Manufacturers of consumer goods and industrial products adopt pigment dispersions to enhance shelf appeal. Pigments provide durability, color vibrancy, and resistance to fading during transportation and storage. The U.S. In-Organic Pigment Dispersion Market benefits from packaging expansion across food, beverages, and e-commerce shipments. Regulatory pressure for sustainable materials encourages the use of eco-friendly pigment solutions. Packaging firms integrate pigments into films, laminates, and rigid plastics. It ensures consistent branding, safety compliance, and product visibility. The packaging sector remains a vital growth contributor for pigment producers.

Growing Role of Regulatory Standards in Driving Innovation

Government regulations in the U.S. enforce strict environmental and safety requirements for coatings and pigments. Manufacturers invest in research to meet compliance while maintaining product performance. Pigment producers develop solutions with lower toxicity and reduced ecological impact. The U.S. In-Organic Pigment Dispersion Market shows resilience due to adherence to these standards. Compliance builds trust among industrial buyers and enhances supplier credibility. It drives innovation toward advanced pigment chemistries that balance efficiency and safety. Producers that align with evolving standards strengthen their competitive position. Regulatory frameworks continue shaping the direction of pigment technologies.

Market Trends

Advancing Digital Printing Technologies Expanding Pigment Applications

The U.S. In-Organic Pigment Dispersion Market experiences rising opportunities from digital printing advancements. Printers for textiles, packaging, and labels integrate pigment dispersions for sharp images. Consumers and industries demand vibrant, durable prints that resist fading. It supports adoption across commercial printing services and personalized products. Manufacturers refine pigment formulations to ensure compatibility with new printing machinery. Ink producers benefit from enhanced dispersion stability and consistency. The growth of e-commerce further increases demand for printed packaging. Printing applications remain a key avenue for pigment innovation.

Shift Toward Sustainable and Eco-Friendly Coating Solutions

Sustainability emerges as a defining trend across industrial coatings and pigments. Producers focus on reducing volatile organic compounds and harmful substances. The U.S. In-Organic Pigment Dispersion Market sees new product launches with eco-friendly properties. Industries adopt greener pigment solutions to align with corporate sustainability goals. It strengthens collaboration between raw material suppliers and manufacturers. Coatings companies actively promote eco-compliant solutions to expand market share. Rising consumer awareness accelerates adoption of safer and durable coatings. The trend shapes the development strategies of major producers.

- For example, in November 2022, P2 Science launched the Citrosperse™ range—10 biobased pigment dispersions for cosmetics and personal care. Developed with American Colors, the range uses P2’s proprietary Citropol® platform, which relies on upcycled forestry by-products sourced from Forest Stewardship Council–certified pine trees.

Technological Integration Driving High-Performance Pigments

Pigment producers introduce advanced dispersion technologies for better opacity and stability. The U.S. In-Organic Pigment Dispersion Market evolves with innovations in nanotechnology and surface treatments. High-performance pigments gain relevance in demanding industries such as aerospace and electronics. It ensures better heat resistance and consistent quality under stress. Manufacturers focus on tailored solutions for high-value applications. Research pipelines emphasize durable pigments that meet modern performance benchmarks. End-users benefit from products offering superior efficiency and longer lifespan. The industry continues shifting toward technologically advanced pigment categories.

Rising Customization in Consumer-Oriented Applications

Customization plays a critical role in shaping pigment demand across consumer sectors. The U.S. In-Organic Pigment Dispersion Market benefits from lifestyle-driven preferences for unique colors. Personalization in packaging, textiles, and automotive segments drives product variety. It enables companies to target niche consumer bases with tailored solutions. Pigments allow brands to differentiate themselves through distinctive visual appeal. Manufacturers design dispersions supporting flexibility in applications and consistent outcomes. Digital channels amplify demand for customized product designs. Customization ensures pigment use expands into creative and consumer-focused industries.

- For example, Pan Technology operates a flexible production facility capable of handling batch sizes from 15 gallons up to 2,000 gallons, with quick changeovers between products. The company specializes in dispersing difficult-to-process pigments such as transparent iron oxides and high-jet carbon blacks, supporting diverse applications across coatings, inks, and industrial uses.

Market Challenges Analysis

Compliance Pressures and Rising Production Costs in Pigment Manufacturing

Producers in the U.S. In-Organic Pigment Dispersion Market face significant challenges with stringent compliance rules. Meeting safety and environmental regulations requires high investment in R&D and process upgrades. Smaller manufacturers struggle to sustain margins under these conditions. Raw material prices fluctuate frequently, raising input costs for pigment producers. It pressures companies to balance affordability with quality standards. Competitive intensity further limits flexibility in pricing strategies. Sustaining profitability requires efficiency improvements and long-term supplier partnerships. The industry continues to adjust under complex cost and compliance conditions.

Market Competition and Substitution Threat from Alternative Materials

The market faces risks from substitutes such as organic pigments and advanced polymers. Buyers in industries like packaging and consumer goods explore alternatives for sustainability. The U.S. In-Organic Pigment Dispersion Market sees strong competition among global and regional players. It forces producers to differentiate through innovation and technical support. Overcapacity in some regions intensifies pricing pressure. Entry of low-cost suppliers into the U.S. market increases challenges for established brands. End-users demand higher performance at lower cost, raising expectations for suppliers. Competitive rivalry and substitution risks shape long-term market dynamics.

Market Opportunities

Emergence of Smart Coatings and High-Value Applications

Smart coatings create opportunities by integrating pigments that enhance performance beyond color. The U.S. In-Organic Pigment Dispersion Market benefits from advanced applications in aerospace, defense, and electronics. Pigments in these areas contribute to heat management, UV resistance, and conductivity. It positions dispersions as multifunctional materials rather than traditional colorants. Industries seek pigments with added value in safety and durability. Producers that develop specialized dispersions gain access to premium markets. Demand for functional coatings ensures a profitable path for technological innovation.

Expansion Potential in Renewable Energy and Green Infrastructure Projects

Renewable energy projects drive pigment usage in solar panels, wind turbines, and energy-efficient coatings. The U.S. In-Organic Pigment Dispersion Market aligns with government-backed sustainability initiatives. Pigments provide protection against UV radiation and environmental stress, extending component life. It supports adoption in both residential and industrial energy applications. Growing investment in green infrastructure creates fresh revenue streams for pigment producers. Industries seek dispersions that combine aesthetics with technical performance. Opportunities continue expanding as the energy transition accelerates across the U.S. economy.

Market Segmentation Analysis

By pigment type, titanium dioxide leads the U.S. In-Organic Pigment Dispersion Market, driven by its high opacity, brightness, and versatile use in coatings and plastics. Iron oxide follows as a major contributor, supported by demand in construction materials and durable finishes. Carbon black maintains a strong position due to its role in printing inks and automotive applications. Ultramarine blue and chromium oxide serve niche markets, delivering vibrant color and stability in ceramics and specialty coatings. Cadmium pigments continue to face regulatory pressure, yet remain present in select high-performance uses. Zinc oxide contributes to cosmetics and protective coatings. Other pigments support tailored solutions in smaller-scale applications. It demonstrates a diversified pigment base aligned with both mass demand and specialized needs.

- For example, Chemours’ Ti-Pure™ R-960 titanium dioxide pigment has offered over 50 years of proven exterior durability, retaining chalk resistance, gloss, and color under harsh weather conditions. It remains a top choice for critical applications like automotive OEM topcoats, aerospace coatings, and durable industrial finishes.

By application, paints and coatings dominate the U.S. In-Organic Pigment Dispersion Market, supported by construction, infrastructure, and automotive sectors. Printing inks represent another significant segment, reflecting ongoing demand in packaging and commercial printing. Plastics adopt pigment dispersions for durability and aesthetics across consumer and industrial goods. Construction materials show steady growth due to urban projects and architectural finishes. Ceramics and glass benefit from pigments that provide color stability under high heat. Cosmetics integrate dispersions for safe and durable formulations. Other applications, including niche manufacturing, contribute to the market’s breadth. It highlights broad end-user reliance on pigment dispersions to enhance product quality, performance, and value.

- For instance, PPG Industries leverages titanium dioxide pigments in automotive coatings to enhance gloss retention and durability against environmental stressors, sustaining vehicle exterior quality.

Segmentation

By Pigment Type

- Titanium Dioxide

- Iron Oxide

- Carbon Black

- Ultramarine Blue

- Chromium Oxide

- Cadmium Pigments

- Zinc Oxide

- Others

By Application

- Paints & Coatings

- Printing Inks

- Plastics

- Construction Materials

- Ceramics and Glass

- Cosmetics

- Others

Regional Analysis

Northeast United States

The Northeast holds a 28% share of the U.S. In-Organic Pigment Dispersion Market, driven by its strong presence in construction, automotive, and printing sectors. The region benefits from advanced infrastructure projects and the steady demand for coatings in urban housing. Printing inks and packaging applications remain important contributors due to concentrated publishing and commercial printing activities. Strict environmental policies in states like New York and Massachusetts push manufacturers toward eco-friendly pigment solutions. It gains momentum through innovation-focused buyers demanding sustainable alternatives. The regional market is defined by high-quality standards and regulatory compliance.

Midwest United States

The Midwest accounts for 25% share, supported by its industrial base and widespread manufacturing activities. The automotive industry in Michigan and Ohio creates significant demand for pigment dispersions in coatings and plastics. Agricultural equipment and machinery production also drive pigment adoption for durability and corrosion resistance. The construction sector expands steadily across growing cities, sustaining paint and coating consumption. It is reinforced by cost-effective supply chains and established pigment producers. Local demand emphasizes performance, affordability, and efficiency. The Midwest continues to represent a balanced market for industrial and consumer applications.

South and West United States

The South leads with a 32% share, while the West contributes 15%, together shaping more than half of the national demand. The South benefits from rapid urbanization, expanding infrastructure, and thriving automotive and packaging sectors in states like Texas and Georgia. The West, with hubs in California, supports pigment demand through technological innovation and advanced packaging solutions. Both subregions attract global pigment suppliers due to large industrial bases and growing consumer demand. The U.S. In-Organic Pigment Dispersion Market gains further traction here from investments in sustainable construction and green manufacturing. It demonstrates robust opportunities supported by long-term economic growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- DCL Corporation

- Van Horn, Metz & Co., Inc.

- Barentz

- Palmer Holland, Inc.

- Hapco, Inc.

- Chromaflo: A Vibrantz Technologies

- Alluvius

- ChromaScape

- Valtris Specialty Chemicals

- Gibraltar Chemical Works, Inc.

- Ravago Chemicals U.S.

Competitive Analysis

The U.S. In-Organic Pigment Dispersion Market shows a competitive landscape shaped by established suppliers, distributors, and specialty chemical companies. Key players such as DCL Corporation, Barentz, Palmer Holland, and Chromaflo: A Vibrantz Technologies focus on expanding portfolios and strengthening distribution networks. It emphasizes innovation in pigment chemistries to meet regulatory standards and customer-specific requirements. Market leaders invest in eco-friendly formulations and advanced dispersion technologies, which provide differentiation in industrial and consumer applications. Strategic mergers and acquisitions strengthen global positioning, while regional players compete through pricing and niche market focus. Companies align with sustainability goals to maintain relevance across coatings, plastics, and packaging industries. Competitive intensity remains high, driving continuous product development and customer-centric strategies.

Recent Developments

- In June 2025, Clariant AG launched HOSTAPHAT OPS 100, a dispersing agent specifically developed for metal-containing pigments and their dispersions, supporting advanced pigment preparations in industrial coatings and related markets.

- In April 2025, Barentz entered exclusive discussions to acquire 100% equity of Fengli Group, a move aimed at enhancing Barentz’s pharmaceutical presence in Asia-Pacific. The acquisition is expected to be completed in the second half of 2025 and will bolster Barentz’s ingredient solutions capabilities globally, including in the U.S. specialty chemicals sector.

- In April 2024, Van Horn, Metz announced a new distribution partnership with StanChem Resins, effective April 1, 2024, expanding Van Horn, Metz’s offerings in acrylic latex binders and related products across the eastern U.S., serving coatings and adhesives markets.

Report Coverage

The research report offers an in-depth analysis based on Pigment Type and Application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand from construction and infrastructure projects will remain a central growth driver, supported by urban development.

- Automotive coatings will strengthen pigment usage, as manufacturers focus on durability and enhanced finishes.

- Packaging applications will expand due to rising e-commerce and consumer demand for shelf appeal.

- Sustainable and eco-friendly pigment solutions will gain prominence, shaped by strict regulatory policies.

- Digital printing growth will open new opportunities in textiles, labels, and specialty applications.

- Nanotechnology and advanced dispersion methods will drive product innovation and performance.

- Customization trends in automotive and consumer goods will encourage tailored pigment solutions.

- Market competition will intensify as global suppliers expand portfolios and local firms seek niche advantages.

- Regional growth in the South and West will accelerate due to rapid industrialization and innovation hubs.

- The U.S. In-Organic Pigment Dispersion Market will benefit from long-term investment in green infrastructure and renewable energy.