Market Overview

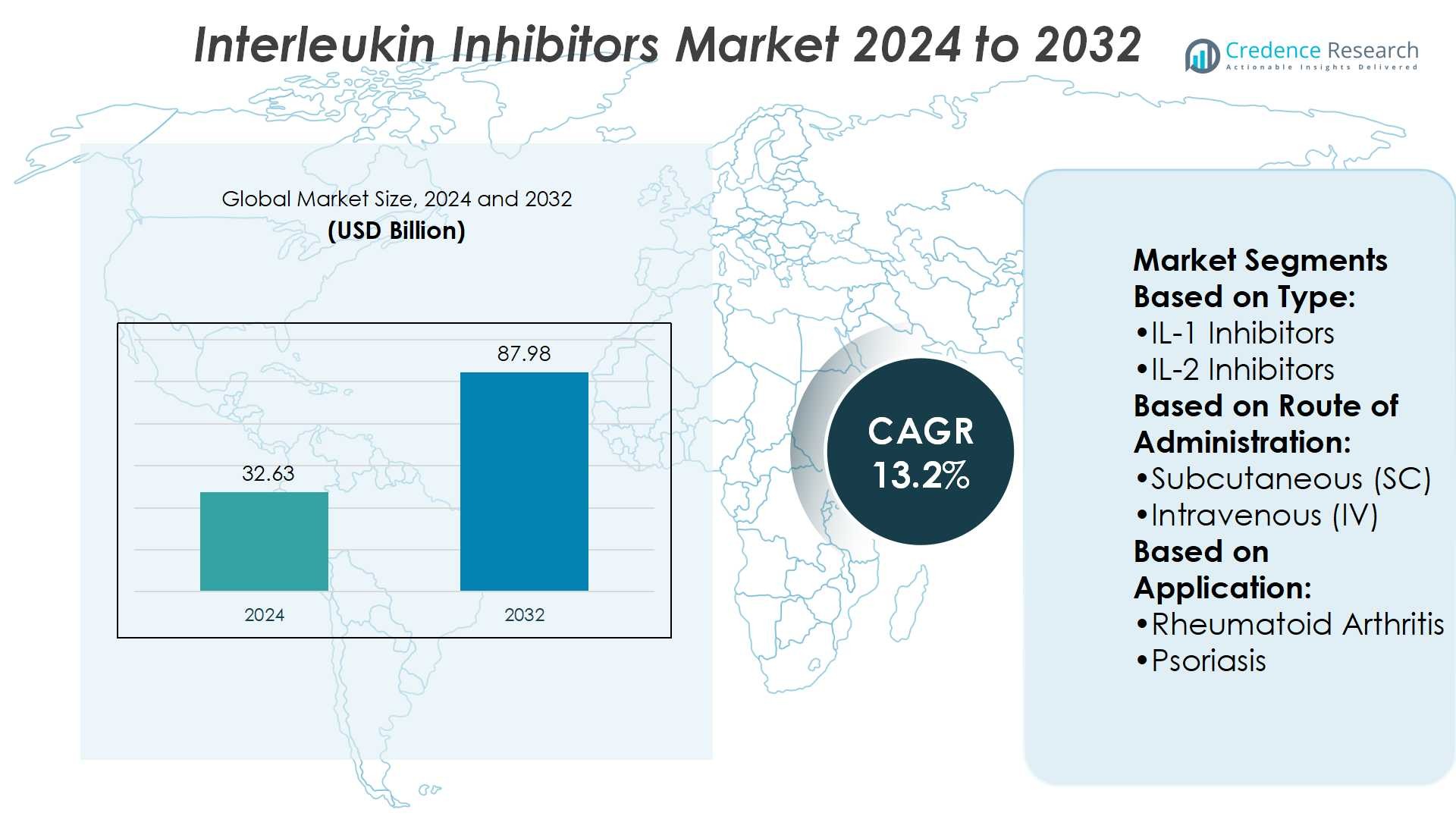

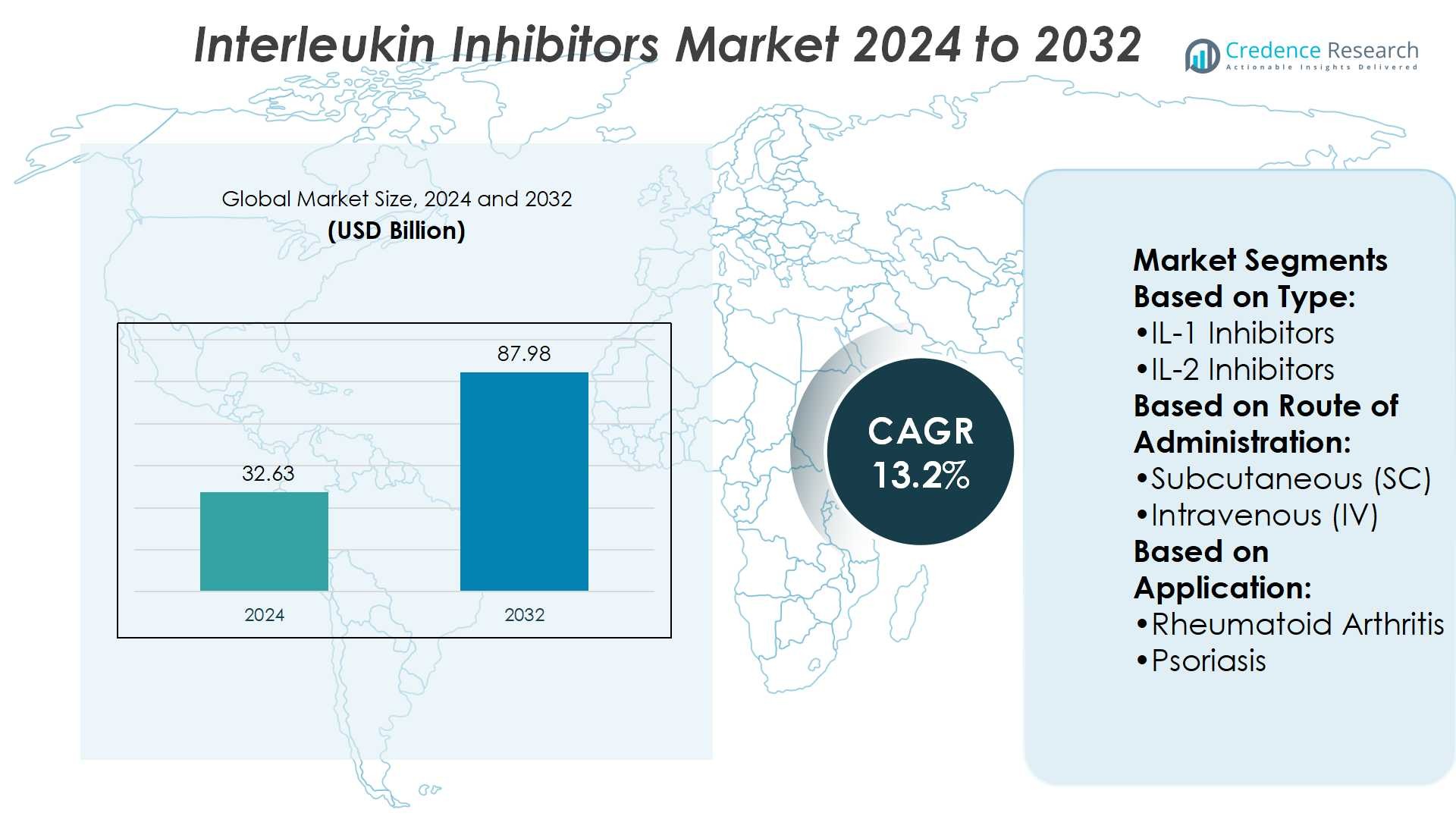

Interleukin Inhibitors Market size was valued at USD 32.63 billion in 2024 and is anticipated to reach USD 87.98 billion by 2032, at a CAGR of 13.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Interleukin Inhibitors Market Size 2024 |

USD 32.63 Billion |

| Interleukin Inhibitors Market, CAGR |

13.2% |

| Interleukin Inhibitors Market Size 2032 |

USD 87.98 Billion |

The Interleukin Inhibitors Market grows through rising prevalence of autoimmune and inflammatory diseases, increasing demand for targeted therapies, and expanding adoption of biologics. Advancements in molecular research enable development of novel inhibitors with improved efficacy and safety profiles. Healthcare infrastructure expansion in emerging regions enhances patient access, while growing awareness of personalized medicine drives therapy adoption. Strategic collaborations and clinical trials accelerate drug approvals, supporting market penetration. Trends include innovative drug delivery systems, combination therapies, and focus on rare disease indications. Continuous technological and clinical advancements position the market for sustained growth globally.

North America leads the Interleukin Inhibitors Market, driven by advanced healthcare infrastructure and high biologics adoption, followed by Europe with strong clinical research and favorable regulatory support. Asia-Pacific shows rapid growth due to increasing disease prevalence and expanding healthcare access. Key players shaping the market include Johnson & Johnson Services, Inc., Novartis AG, AbbVie Inc., Eli Lilly and Company, Regeneron Pharmaceuticals, Inc., AstraZeneca, Bausch Health, F. Hoffmann-La Roche Ltd, GlaxoSmithKline plc., and Teva Pharmaceuticals Industries, Ltd., focusing on innovative therapies, strategic collaborations, and expanded global reach.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Interleukin Inhibitors Market was valued at USD 32.63 billion in 2024 and is projected to reach USD 87.98 billion by 2032, growing at a CAGR of 13.2%.

- Rising prevalence of autoimmune and inflammatory diseases drives strong market demand globally.

- Increased adoption of targeted biologic therapies enhances treatment efficacy and patient outcomes.

- Advancements in molecular research and drug delivery systems support innovation and safety improvements.

- North America dominates due to advanced healthcare infrastructure, high biologics use, and regulatory support, followed by Europe and rapidly growing Asia-Pacific.

- Key players, including Johnson & Johnson, Novartis, AbbVie, Eli Lilly, Regeneron, AstraZeneca, Bausch Health, Roche, GSK, and Teva, focus on collaborations and clinical trials to expand market share.

- Market challenges include high treatment costs and stringent regulatory approvals, while trends such as personalized medicine and combination therapies create growth opportunities across regions.

Market Drivers

Rising Prevalence of Chronic and Autoimmune Diseases Driving Strong Demand

The Interleukin Inhibitors Market is fueled by the increasing prevalence of chronic and autoimmune diseases worldwide. Conditions such as psoriasis, rheumatoid arthritis, Crohn’s disease, and ulcerative colitis continue to show rising incidence across both developed and emerging regions. Healthcare providers seek advanced biologic treatments that deliver targeted immune modulation and improved patient outcomes. Interleukin inhibitors demonstrate high efficacy by blocking specific cytokines that contribute to inflammation. This mechanism drives widespread adoption among clinicians treating severe immune-mediated disorders. It reinforces the role of interleukin inhibitors as critical therapies in modern immunology.

- For instance, Fasenra achieved near-complete depletion of circulating eosinophils within 24 hours of administration, a rapid and measurable response confirmed in controlled clinical trials.

Expanding Clinical Approvals and Pipeline Strengthening Market Growth

Continuous expansion of approved indications supports broader patient access in the Interleukin Inhibitors Market. Regulatory agencies in North America, Europe, and Asia-Pacific grant approvals for newer therapies addressing multiple autoimmune conditions. A strong pipeline of interleukin-targeted drugs further ensures ongoing innovation and therapeutic diversity. Companies invest heavily in clinical research to differentiate product safety and efficacy profiles. This dynamic fosters competitive development and raises adoption rates in specialized treatment areas. It creates momentum for sustained revenue growth across both established and emerging players.

- For instance, in a Phase 2 trial enrolling 153 adults who had failed anti-TNF therapy, 59.5% of patients dosed 300 mg every other week, and 48.7% dosed weekly, achieved HS Clinical Response (HiSCR 50) by week 16—both outperforming 35.0% in the placebo group.

Increasing Focus on Personalized Medicine and Targeted Therapies

The Interleukin Inhibitors Market benefits from a growing emphasis on precision medicine. Physicians prefer biologics tailored to block specific interleukin pathways that correlate with individual disease profiles. This targeted approach improves treatment success while minimizing systemic side effects. Integration of biomarkers and companion diagnostics enhances patient selection, improving therapy outcomes. Healthcare systems value this focus on efficiency and reduced long-term treatment costs. It strengthens the position of interleukin inhibitors in advanced therapeutic strategies.

Rising Healthcare Spending and Infrastructure Supporting Wider Adoption

Expanding healthcare spending and infrastructure in developing economies supports broader penetration of the Interleukin Inhibitors Market. Governments and private insurers increase investment in biologics, improving access for patients with autoimmune disorders. Hospitals and specialty clinics integrate advanced biologics into treatment protocols more frequently. Favorable reimbursement policies in major markets further encourage prescription of interleukin inhibitors. Increased awareness among physicians and patients drives confidence in these therapies. It ensures steady expansion of interleukin inhibitors across global healthcare landscapes.

Market Trends

Growing Adoption of Biologics and Targeted Therapies in Immune-Mediated Conditions

The Interleukin Inhibitors Market reflects a strong shift toward biologics that offer targeted immune modulation. Physicians prefer these therapies for autoimmune diseases because they provide precise action on inflammatory pathways. Patients experience improved outcomes and lower relapse rates compared to conventional treatments. The trend highlights the replacement of broad-spectrum immunosuppressants with more refined approaches. It demonstrates how targeted biologics are shaping treatment standards in multiple therapeutic areas. This adoption strengthens the position of interleukin inhibitors in long-term care strategies.

- For instance, the FDA granted Fast Track designation to TEV-53408, an anti-IL-15 antibody entering a Phase 2a trial for celiac disease—highlighting a focused approach to immune-mediated conditions.

Expansion of Indications Across Multiple Therapeutic Areas Supporting Market Growth

The Interleukin Inhibitors Market shows significant growth due to expanding drug indications across diverse conditions. Regulatory bodies approve these therapies for psoriasis, atopic dermatitis, rheumatoid arthritis, and other chronic immune disorders. Each new approval broadens the patient base and strengthens clinical confidence in the drugs. Companies strategically pursue label expansions to maximize product life cycles and revenue streams. It ensures continuous evolution of therapy portfolios across the competitive landscape. This expansion highlights interleukin inhibitors as versatile options within immunology.

- For instance, The U.S. Food and Drug Administration (FDA) is reviewing GSK’s depemokimab as an add-on maintenance therapy for adults and adolescents (12 years and older) with inadequately controlled asthma with type 2 inflammation, and also for adults with inadequately controlled chronic rhinosinusitis with nasal polyps.

Integration of Biomarkers and Personalized Medicine Driving Treatment Precision

The Interleukin Inhibitors Market trends emphasize the growing role of biomarkers in therapy selection. Biomarker-driven strategies allow physicians to identify patients most likely to respond to specific drugs. This precision reduces unnecessary exposure to ineffective treatments and enhances clinical outcomes. Companies develop companion diagnostics to align therapies with genetic and molecular profiles. It positions interleukin inhibitors within the broader framework of personalized medicine. The integration improves both patient satisfaction and healthcare efficiency worldwide.

Rising R&D Investments and Collaborations Strengthening Innovation Pipelines

The Interleukin Inhibitors Market demonstrates strong investment momentum through research and collaborations. Pharmaceutical companies allocate substantial budgets toward next-generation inhibitors targeting novel interleukin pathways. Partnerships between global firms and biotech companies accelerate innovation and clinical development. Emerging technologies such as monoclonal antibody engineering enhance drug effectiveness and durability. It supports the launch of differentiated products that address unmet medical needs. These developments sustain innovation and reinforce market competitiveness over the forecast period.

Market Challenges Analysis

High Treatment Costs and Limited Accessibility Restricting Broader Market Adoption

The Interleukin Inhibitors Market faces significant barriers due to the high cost of biologic therapies. Many patients in developing regions lack access to advanced treatments because of limited healthcare funding. Even in developed markets, reimbursement challenges restrict availability for certain populations. Hospitals and clinics often prioritize cost-effective alternatives, reducing adoption rates. It limits the reach of interleukin inhibitors despite their proven clinical effectiveness. Affordability issues remain one of the most pressing obstacles for sustainable growth.

Safety Concerns, Regulatory Hurdles, and Competition Impacting Long-Term Market Growth

The Interleukin Inhibitors Market also encounters challenges linked to safety profiles and regulatory requirements. Long-term use raises concerns regarding infection risks and potential adverse effects. Regulatory agencies maintain strict approval standards, which delay product launches and increase development costs. Intense competition among biologics and biosimilars places further pressure on pricing strategies. It creates uncertainty for companies trying to balance innovation with profitability. These challenges highlight the complexity of sustaining growth in a highly regulated and competitive market.

Market Opportunities

Expanding Therapeutic Applications and Emerging Market Penetration Creating Growth Potential

The Interleukin Inhibitors Market holds strong opportunities through the expansion of therapeutic applications. New research explores their role in oncology, respiratory diseases, and rare immune disorders. Broader indications increase patient pools and strengthen the market outlook across regions. Emerging economies show rising demand as healthcare systems invest in biologics and improve treatment access. It creates a pathway for pharmaceutical companies to expand presence in high-growth markets. These developments offer significant potential to extend the impact of interleukin inhibitors beyond traditional uses.

Technological Advancements and Strategic Collaborations Supporting Innovation in Drug Development

The Interleukin Inhibitors Market benefits from advanced technologies such as antibody engineering and novel delivery platforms. These innovations improve drug safety, durability, and patient convenience, enhancing competitive advantages. Strategic collaborations between pharmaceutical leaders and biotech firms accelerate research and speed regulatory approvals. It encourages the introduction of differentiated therapies that address unmet clinical needs. Companies leverage digital health tools to optimize monitoring and improve patient outcomes. Such opportunities strengthen innovation pipelines and open avenues for long-term market expansion.

Market Segmentation Analysis:

By Type Outlook

The Interleukin Inhibitors Market demonstrates strong diversification across type segments, with IL-6 and IL-17 inhibitors leading adoption. IL-6 inhibitors dominate in rheumatoid arthritis treatment due to their proven ability to reduce inflammation and joint damage. IL-17 inhibitors maintain strong uptake in psoriasis, driven by targeted action on skin-specific immune pathways. IL-23 inhibitors gain momentum in inflammatory bowel disease, supported by clinical validation of their long-term effectiveness. IL-1 and IL-5 inhibitors continue to play vital roles in rare inflammatory disorders and asthma care. Others in the category cover niche conditions where interleukin pathways influence immune dysfunction. It reflects the importance of multiple interleukin targets in shaping therapeutic progress.

- For instance, In Phase III long-term extension studies for moderate-to-severe plaque psoriasis, high PASI 90 and PASI 100 response rates were achieved and largely maintained through five years, demonstrating durable skin clearance.

By Route of Administration Outlook

Subcutaneous (SC) delivery dominates the market due to convenience and patient-friendly use. Self-administration reduces the burden of hospital visits and encourages higher adherence rates. Intravenous (IV) drugs remain essential in clinical settings for patients requiring controlled dosing. Hospitals value IV administration for rapid drug action and severe disease management. Both routes complement each other, addressing diverse patient profiles and treatment needs. It ensures flexible administration strategies that enhance access and therapy effectiveness across healthcare systems.

- For instance, in psoriatic arthritis, the APEX Phase 3b trial showed that TREMFYA® significantly reduced joint symptoms (ACR20) at 24 weeks and inhibited structural damage per the modified van der Heijde-Sharp score, compared to placebo.

By Application Outlook

Rheumatoid arthritis holds a leading share, supported by the high prevalence of the disease and the success of IL-6 inhibitors. Psoriasis remains a major application area where IL-17 and IL-23 inhibitors deliver strong clinical outcomes. Inflammatory bowel disease grows steadily, with IL-23 therapies providing durable remission benefits. Asthma care leverages IL-5 inhibitors to manage eosinophilic inflammation and improve respiratory control. These applications underline the ability of interleukin inhibitors to meet distinct therapeutic needs. It highlights a dynamic landscape where biologics advance disease management across multiple immune-mediated conditions.

Segments:

Based on Type:

- IL-1 Inhibitors

- IL-2 Inhibitors

Based on Route of Administration:

- Subcutaneous (SC)

- Intravenous (IV)

Based on Application:

- Rheumatoid Arthritis

- Psoriasis

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America holds the largest share of the Interleukin Inhibitors Market at 38%, supported by advanced healthcare infrastructure and strong adoption of biologic therapies. The region benefits from high prevalence of autoimmune diseases such as rheumatoid arthritis, psoriasis, and inflammatory bowel disease, which drives consistent demand for targeted treatments. Favorable reimbursement policies from private insurers and government programs enhance patient access to costly biologics, further strengthening the market. Pharmaceutical companies also prioritize the U.S. and Canada for clinical trials and regulatory approvals due to efficient frameworks provided by the FDA and Health Canada. Strong investments in research and development, coupled with the presence of leading pharmaceutical players, keep innovation pipelines active. It ensures North America remains a leading hub for interleukin inhibitor therapies, with future growth supported by increased awareness and expanding patient access.

Europe

Europe accounts for 28% of the Interleukin Inhibitors Market, backed by its structured healthcare systems and strong regulatory standards. Countries such as Germany, the United Kingdom, and France lead in biologic adoption, driven by government support for advanced therapies. Widespread prevalence of autoimmune conditions and rising demand for personalized medicine sustain regional momentum. The European Medicines Agency (EMA) plays a central role in harmonizing drug approvals across the continent, which accelerates market penetration. Biosimilars are also gaining traction in Europe, offering cost-effective alternatives that increase patient access to interleukin inhibitors. It reflects a balance between innovation and affordability, positioning Europe as a critical region for both originator biologics and biosimilars. Continuous funding for healthcare modernization across Eastern Europe adds further growth opportunities.

Asia-Pacific

The Asia-Pacific region captures 20% of the Interleukin Inhibitors Market, emerging as the fastest-growing market due to rapid expansion of healthcare infrastructure and rising patient awareness. Countries such as China, Japan, South Korea, and India demonstrate increasing adoption of biologics as chronic disease burdens escalate. Governments in these nations are allocating larger healthcare budgets to improve access to advanced treatments. Local pharmaceutical firms are also entering partnerships with global players to co-develop and distribute interleukin inhibitors. The region experiences growing clinical trial activity, which accelerates approvals and fosters local innovation. It underscores Asia-Pacific’s potential as both a consumption and production hub for biologic therapies. Rising middle-class populations and increased insurance coverage ensure the long-term demand trajectory remains strong.

Latin America

Latin America represents 8% of the Interleukin Inhibitors Market, shaped by gradual adoption of biologics and improving healthcare systems. Brazil and Mexico lead the region in terms of market penetration, supported by expanding access to specialty care and growing pharmaceutical investments. However, challenges such as limited reimbursement policies and cost constraints restrict widespread adoption. Local distributors play a crucial role in ensuring availability across urban and semi-urban centers. International pharmaceutical firms are targeting the region through strategic collaborations and distribution partnerships. It reflects a developing but promising environment where interleukin inhibitors continue to expand steadily despite structural limitations.

Middle East and Africa

The Middle East and Africa account for 6% of the Interleukin Inhibitors Market, with growth concentrated in Gulf Cooperation Council (GCC) countries and South Africa. Wealthier nations such as Saudi Arabia and the United Arab Emirates invest heavily in healthcare infrastructure, enabling access to advanced biologics. However, much of the African continent experiences restricted access due to affordability issues and weaker healthcare systems. International aid programs and government initiatives are gradually improving availability, particularly for chronic disease management. Pharmaceutical companies increasingly recognize the region’s long-term potential, especially with rising urbanization and lifestyle-driven autoimmune conditions. It represents an emerging market segment where gradual improvements in healthcare access drive steady growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Bausch Health

- AstraZeneca

- AbbVie Inc.

- Teva Pharmaceuticals Industries, Ltd.

- GlaxoSmithKline plc.

- Regeneron Pharmaceuticals, Inc.

- Novartis AG

- Johnson & Johnson Services, Inc

- Hoffmann-La Roche Ltd

- Eli Lilly and Company

Competitive Analysis

The Interleukin Inhibitors Market players such as Johnson & Johnson Services, Inc., Novartis AG, AbbVie Inc., Eli Lilly and Company, Regeneron Pharmaceuticals, Inc., AstraZeneca, Bausch Health, F. Hoffmann-La Roche Ltd, GlaxoSmithKline plc, and Teva Pharmaceuticals Industries, Ltd. The Interleukin Inhibitors Market is characterized by strong competition, driven by innovation, expanding pipelines, and strategic partnerships. Companies focus on developing therapies with improved safety, efficacy, and durability to strengthen their position across autoimmune and inflammatory disease segments. Extensive investments in research and development fuel the introduction of next-generation biologics targeting specific interleukin pathways. Strategic collaborations with biotechnology firms accelerate clinical trials and support faster regulatory approvals in key regions. The competitive landscape also reflects rising emphasis on biosimilars, which increase affordability and widen patient access. Market players continuously refine their strategies to balance innovation, pricing, and global expansion, ensuring sustained competitiveness in a rapidly evolving therapeutic space.

Recent Developments

- In July 2025, Johnson & Johnson reported Phase 3 oral icotrokinra results showing 64.7% IGA 0/1 and 49.6% PASI 90 in plaque psoriasis, heralding the first oral IL-23 inhibitor with high efficacy.

- In September 2024, Eli Lilly’s lebrikizumab-based drug, EBGLYSS, received FDA approval for adults and children aged 12 and older with moderate-to-severe atopic dermatitis inadequately controlled by topical treatments. This drug offers significant symptom relief.

- In August 2024, Regeneron Pharmaceuticals Inc. presented 20 abstracts on Dupixent and itepekimab at the ERS Congress, highlighting significant advancements in treating respiratory diseases such as COPD, asthma, and chronic rhinosinusitis with nasal polyps.

- In April 2024, ImmunityBio, Inc. announced that the U.S. Food and Drug Administration (FDA) had approved ANKTIVA. ANKTIVA is an interleukin inhibitor therapy that is found effective for the treatment of BCG-unresponsive non-muscle invasive bladder cancer (NMIBC).

Report Coverage

The research report offers an in-depth analysis based on Type, Route of Administration, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand due to increasing prevalence of autoimmune and inflammatory diseases.

- Rising adoption of biologics will drive stronger demand for interleukin inhibitors.

- Advancements in targeted therapies will enhance treatment efficacy and patient outcomes.

- Expansion of healthcare infrastructure in emerging regions will support market growth.

- Continuous R&D will lead to new interleukin inhibitor formulations and indications.

- Strategic collaborations among pharmaceutical companies will accelerate drug development.

- Increasing awareness about personalized medicine will boost interleukin therapy adoption.

- Regulatory approvals for novel therapies will open new growth avenues.

- Technological innovations in drug delivery will improve patient compliance and adherence.

- Market competition will intensify, fostering innovation and diversified treatment options.