Market Overview

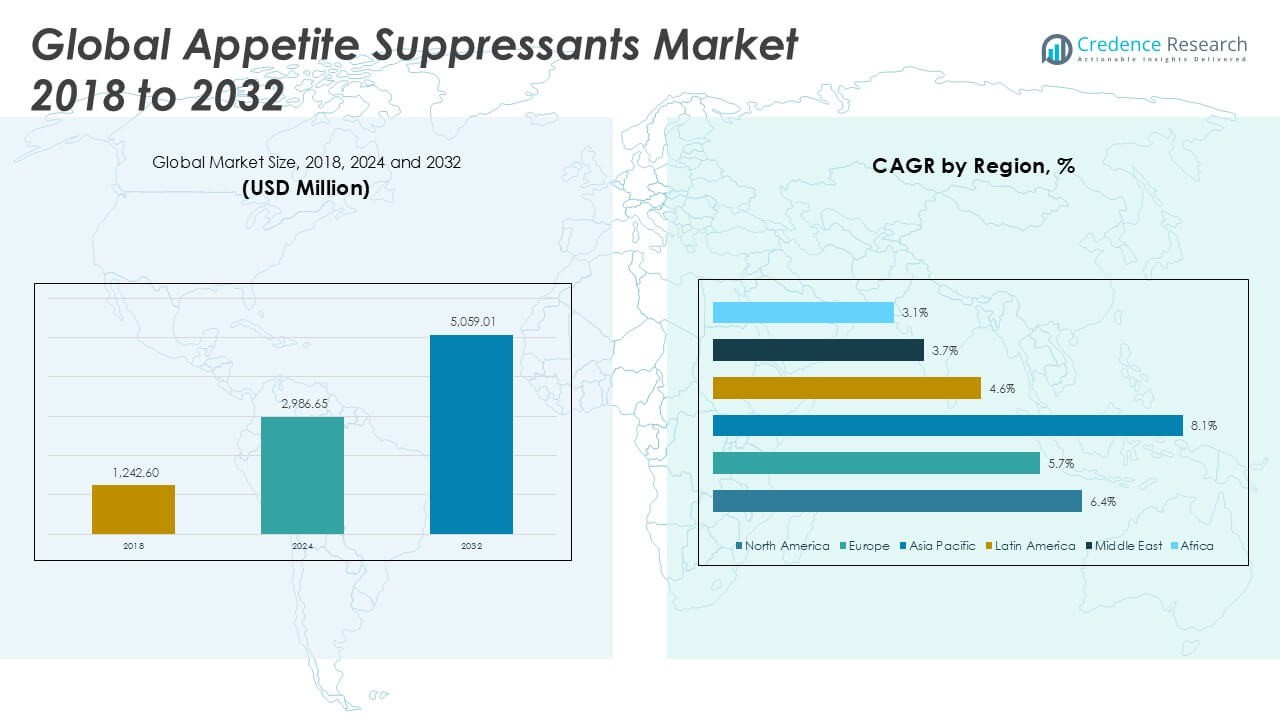

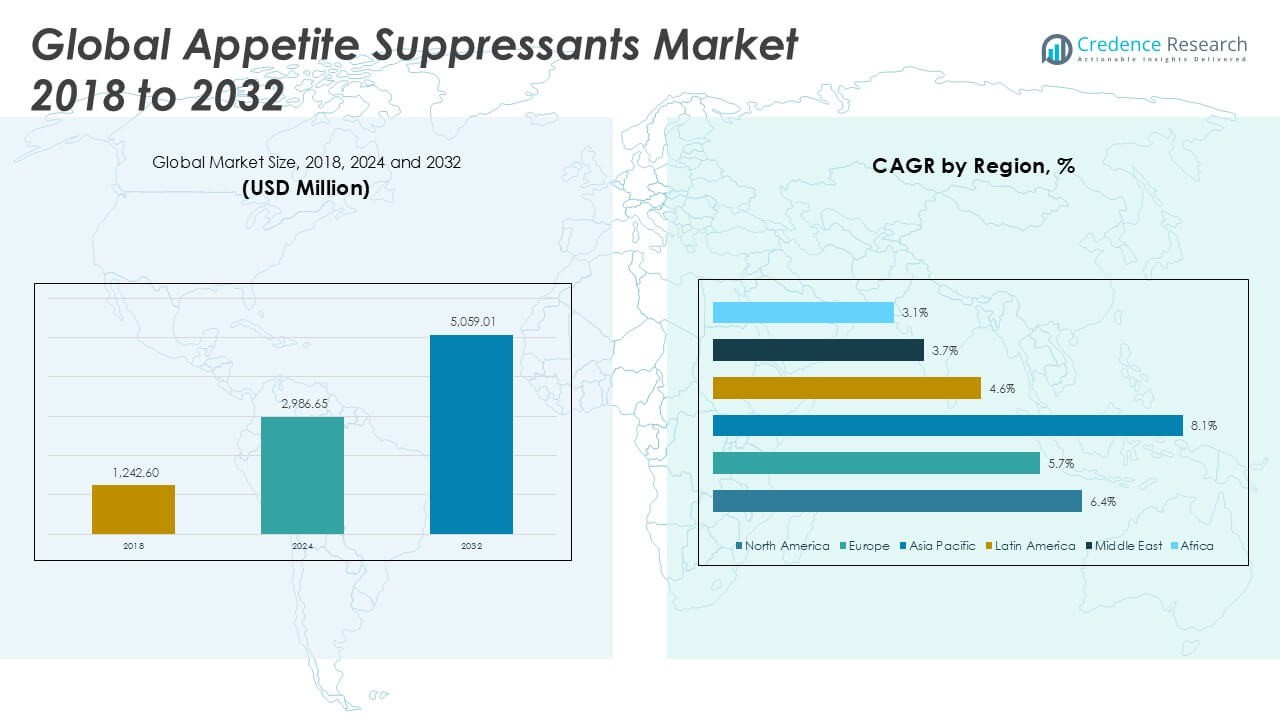

The Appetite Suppressants market size was valued at USD 2,001.40 million in 2018, increased to USD 2,986.65 million in 2024, and is anticipated to reach USD 5,059.01 million by 2032, growing at a CAGR of 6.34% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Appetite Suppressants Market Size 2024 |

USD 2,986.65 Million |

| Appetite Suppressants Market, CAGR |

6.34% |

| Appetite Suppressants Market Size 2032 |

USD 5,059.01 Million |

The appetite suppressants market is led by prominent players such as Novo Nordisk, Eli Lilly, VIVUS, Currax Pharmaceuticals, and Rhythm Pharmaceuticals, which dominate the prescription drug segment with clinically approved and effective therapies for obesity management. Companies like GlaxoSmithKline, Wolfson Brands, and Nutrex Research play a significant role in the over-the-counter and nutraceutical categories, leveraging consumer demand for natural and accessible solutions. North America emerged as the leading region in 2024, accounting for 40.8% of the global market share, driven by high obesity prevalence, strong healthcare infrastructure, and widespread product availability.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The global appetite suppressants market was valued at USD 2,986.65 million in 2024 and is projected to reach USD 5,059.01 million by 2032, growing at a CAGR of 6.34% during the forecast period.

- Rising global obesity rates, increased awareness of weight-related health risks, and growing demand for non-invasive weight management solutions are driving market growth.

- A key trend is the growing preference for natural and herbal suppressants, along with rising adoption of digital wellness platforms offering personalized supplement plans.

- The market is moderately consolidated with key players such as Novo Nordisk, Eli Lilly, and GlaxoSmithKline, while niche brands like Nutrex Research and Wolfson Brands compete through e-commerce and innovation.

- North America held the largest market share at 40.8% in 2024, followed by Europe (31.7%) and Asia Pacific (19.2%); by segment, prescription appetite suppressants accounted for the highest revenue share.

Market Segmentation Analysis:

By Product Type:

The Prescription Appetite Suppressants segment held the largest market share in 2024, accounting for over 40% of the total market. This dominance is primarily driven by the increasing prevalence of obesity and the clinical efficacy of prescription drugs in managing weight-related conditions under medical supervision. These suppressants are often recommended in cases of morbid obesity and associated comorbidities, where lifestyle changes alone prove insufficient. Additionally, the growing awareness among patients and rising approvals from health authorities have contributed to their widespread adoption across developed markets.

- For instance, Novo Nordisk’s Wegovy (semaglutide 2.4 mg) was approved by the FDA in June 2021 for chronic weight management, with patients achieving an average 15.3 kg weight loss over 68 weeks, according to its Phase 3 clinical trial (STEP 1), involving 1,961 adults with obesity or overweight conditions.

By Mechanism of Action

Among the mechanism types, Stimulants emerged as the dominant sub-segment, capturing more than 35% of the market in 2024. These agents act on the central nervous system to suppress appetite, offering rapid results that appeal to consumers seeking fast weight loss solutions. Their efficacy, particularly in prescription medications like phentermine-based products, supports their strong position. Rising obesity rates, sedentary lifestyles, and an increase in short-term weight loss goals among adults have further accelerated demand for stimulant-based appetite suppressants, especially in North America and Europe.

- For instance, Currax Pharmaceuticals’ Contrave (bupropion/naltrexone) demonstrated an average 8.1% total body weight reduction over 56 weeks in the COR-I clinical trial, involving 1,742 participants, reinforcing the effectiveness of central nervous system stimulants in weight loss treatment.

Key Growth Drivers

Rising Global Obesity and Overweight Prevalence

The surge in obesity and overweight cases worldwide significantly drives demand for appetite suppressants. According to the World Health Organization, over 1.9 billion adults were overweight in 2022, with more than 650 million classified as obese. This growing health crisis has led to increased awareness about weight management, prompting both consumers and healthcare providers to adopt pharmacological interventions. Appetite suppressants offer a practical solution when combined with lifestyle changes, especially for individuals struggling with weight-related comorbidities such as diabetes, hypertension, and cardiovascular diseases.

- For instance, Eli Lilly’s tirzepatide (Mounjaro), primarily a type 2 diabetes drug, demonstrated significant weight loss benefits, with patients losing up to 23.6 kg in the SURMOUNT-1 trial across 2,539 participants, prompting expanded use in obesity management.

Increasing Consumer Focus on Health and Aesthetic Wellness

Rising consumer consciousness around physical appearance, wellness, and preventive healthcare is accelerating the appetite suppressant market. Individuals, particularly in urban areas, are seeking quick and effective methods to manage body weight and improve body image. This trend is further amplified by the influence of social media, celebrity endorsements, and fitness-centric content promoting slim body ideals. The growing interest in non-invasive weight loss solutions has led consumers to prefer appetite suppressants over surgical procedures or intense fitness regimes, fostering market expansion.

- For instance, Wolfson Brands’ PhenQ, a popular OTC appetite suppressant, has surpassed 190,000 global users since launch and consistently ranks among top-rated natural weight-loss pills online, supported by aggressive influencer-led marketing campaigns and user testimonials.

Product Innovations and Growing Availability via E-commerce

Innovation in appetite suppressant formulations, such as herbal supplements, gummies, and combination therapies, is broadening consumer appeal and usage. Manufacturers are focusing on clean-label, plant-based, and scientifically backed ingredients to tap into the wellness and nutraceutical space. Additionally, the proliferation of online retail platforms has improved accessibility and product visibility, enabling consumers to purchase both prescription and over-the-counter appetite suppressants conveniently. This digital shift allows companies to reach a broader audience, offer targeted marketing, and build brand loyalty through subscription models and bundled wellness packages.

Key Trends & Opportunities

Shift Toward Herbal and Natural Formulations

Consumers are increasingly favoring herbal and natural appetite suppressants due to perceived safety, fewer side effects, and alignment with holistic health trends. Products containing ingredients like green tea extract, garcinia cambogia, and glucomannan are gaining traction, especially among younger and health-conscious demographics. This trend offers significant opportunities for supplement manufacturers to diversify offerings and develop scientifically validated plant-based formulations. With growing regulatory scrutiny on synthetic drugs, the demand for natural alternatives is expected to rise, opening avenues for innovation and brand differentiation.

- For instance, BioThrive Sciences, a U.S.-based nutraceutical manufacturer, developed a proprietary glucomannan blend used in over 75 private label formulations, distributed across 350+ online retail platforms, reflecting the demand surge for natural appetite suppressants.

Growing Demand from Emerging Economies

Emerging economies in Asia-Pacific and Latin America are witnessing rapid urbanization, rising disposable incomes, and increased adoption of Western dietary habits, contributing to higher obesity rates. As awareness of weight-related health risks spreads, the appetite suppressant market is expanding in these regions. Government initiatives on preventive healthcare and rising healthcare infrastructure are facilitating access to weight management solutions. This shift presents a strategic opportunity for market players to penetrate untapped markets through affordable pricing, localized product variants, and regional distribution partnerships.

- For instance, GSK’s Alli (orlistat 60mg) gained approval from several Latin American health authorities, with its retail footprint extended to over 5,000 pharmacies in Brazil and Mexico by 2023, marking one of the most widespread OTC anti-obesity product distributions in the region.

Integration with Digital Health and Personalized Wellness

The convergence of digital health tools and personalized wellness plans is transforming the appetite suppressant market. Mobile health apps, wearable devices, and AI-driven dietary tracking are being integrated with supplement regimes for improved weight loss outcomes. Consumers increasingly prefer personalized approaches that combine data analytics with appetite control products tailored to individual metabolic profiles. This creates opportunities for companies to offer tech-enabled solutions, such as subscription-based wellness kits or mobile-guided supplement plans, enhancing user engagement and product effectiveness.

Key Challenges

Regulatory Hurdles and Safety Concerns

The appetite suppressants market faces stringent regulatory oversight due to safety concerns associated with certain active ingredients. Past withdrawals of popular suppressants, such as sibutramine, have heightened scrutiny from regulatory bodies like the FDA and EMA. Compliance with evolving guidelines on labeling, dosage, and ingredient claims is essential to ensure product approval and consumer trust. Moreover, adverse effects or misuse of stimulants can lead to health risks, potentially resulting in legal challenges and product recalls, which hinder market growth and brand credibility.

High Dependency on Consumer Perception and Compliance

The effectiveness of appetite suppressants often depends on user compliance and lifestyle modifications, which can vary significantly. Many consumers expect rapid results and discontinue use prematurely when expectations are unmet, affecting product credibility. Additionally, skepticism around supplement efficacy, especially in OTC and herbal categories, may reduce repeat purchases. Negative reviews or misinformation spread via social media can influence public perception and deter new users, presenting a marketing and retention challenge for manufacturers and retailers alike.

Regional Analysis

North America

North America dominated the appetite suppressants market in 2024, accounting for approximately 40.8% of global revenue. The market grew from USD 825.04 million in 2018 to USD 1,217.64 million in 2024 and is projected to reach USD 2,068.60 million by 2032, registering a CAGR of 6.4%. This growth is driven by the high prevalence of obesity, widespread awareness of weight management, and strong healthcare infrastructure. The region benefits from extensive adoption of both prescription and OTC appetite suppressants, supported by favorable reimbursement frameworks and advanced retail distribution channels, including digital platforms and wellness clinics.

Europe

Europe held the second-largest share in the appetite suppressants market in 2024, capturing about 31.7% of the global revenue. The market size expanded from USD 655.15 million in 2018 to USD 947.12 million in 2024, with projections reaching USD 1,523.36 million by 2032 at a CAGR of 5.7%. The region’s growth is fueled by increasing health awareness, rising cases of obesity and metabolic disorders, and growing demand for natural and prescription weight loss solutions. Regulatory clarity and rising wellness culture in countries like Germany, the UK, and France are also propelling product adoption across various consumer segments.

Asia Pacific

Asia Pacific represents the fastest-growing regional market for appetite suppressants, with a CAGR of 8.1%, and held an estimated 19.2% share of the global market in 2024. The market surged from USD 352.94 million in 2018 to USD 574.87 million in 2024, and is expected to reach USD 1,113.59 million by 2032. Growth is driven by rising obesity rates, urbanization, and increased disposable income in countries such as China, India, and Japan. Moreover, growing awareness of health and wellness, coupled with a booming e-commerce sector and demand for herbal products, is accelerating the regional market expansion.

Latin America

Latin America’s appetite suppressants market is expanding steadily, with a CAGR of 4.6% and a market share of around 4.5% in 2024. The market grew from USD 90.52 million in 2018 to USD 133.33 million in 2024, and is forecasted to reach USD 198.73 million by 2032. Economic growth, urban lifestyle adoption, and increasing awareness regarding obesity-related health risks are supporting market development in countries like Brazil and Mexico. While the market remains smaller compared to developed regions, growing access to OTC products and online pharmacies is gradually improving product penetration across urban and semi-urban areas.

Middle East

The appetite suppressants market in the Middle East recorded moderate growth, reaching USD 65.18 million in 2024 from USD 48.49 million in 2018, with projections of USD 90.17 million by 2032 at a CAGR of 3.7%. The region accounted for roughly 2.2% of global market share in 2024. Growth is influenced by a rising obesity burden, particularly in Gulf countries, and increasing adoption of Western diets. However, regulatory complexities, cultural sensitivities regarding weight loss products, and limited access to personalized health solutions have slightly constrained faster adoption. Nonetheless, urbanization and medical tourism offer long-term growth opportunities.

Africa

Africa held the smallest share in the global appetite suppressants market in 2024, contributing approximately 1.6%. The market grew from USD 29.26 million in 2018 to USD 48.51 million in 2024, and is expected to reach USD 64.56 million by 2032, at a CAGR of 3.1%. Despite relatively low market size, the rising incidence of obesity in urban centers and growing health awareness are gradually increasing demand for appetite suppressants. Limited healthcare access, affordability concerns, and lower product availability remain key challenges, though improving digital infrastructure and international investments in healthcare may facilitate future growth.

Market Segmentations:

By Product Type

- Prescription Appetite Suppressants

- Over-the-Counter (OTC) Appetite Suppressants

- Herbal & Natural Appetite Suppressants

By Mechanism of Action

- Stimulants

- Satiation Promoters

- Inhibitors of Nutrient Absorption

- Cannabinoids

By Formulation Type

- Tablets and Capsules

- Powders

- Liquid Formulations

- Gummies

By Distribution Channel

- Online Retail

- Pharmacies

- Supermarkets and Hypermarkets

- Health and Wellness Stores

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The appetite suppressants market is characterized by a mix of pharmaceutical giants and nutraceutical companies competing across prescription, over-the-counter (OTC), and natural product segments. Leading players such as Novo Nordisk and Eli Lilly dominate the prescription drug space with clinically approved, innovative weight management solutions supported by strong R&D capabilities and global distribution networks. Companies like VIVUS, Currax Pharmaceuticals, and Rhythm Pharmaceuticals focus on specialized therapies targeting obesity-related metabolic disorders. Meanwhile, firms such as GlaxoSmithKline and Wolfson Brands serve the OTC and herbal supplement market, catering to a broad consumer base seeking non-prescription options. Startups and niche players like BioThrive Sciences, Nutrex Research, and Activated Synergy are gaining traction through digital marketing and e-commerce channels, emphasizing natural ingredients and personalized wellness. Strategic collaborations, product innovation, and geographic expansion are key competitive strategies. The market remains dynamic, with increasing M&A activity and investment in novel delivery formats and personalized health solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In June 2025, Novo Nordisk announced plans to start late-stage (Phase 3) trials of its experimental obesity drug amycretin in both injectable and oral forms, targeting overweight and obese adults. These trials are scheduled to begin in the first quarter of 2026. Amycretin works via a dual mechanism, mimicking both GLP-1 and amylin hormones to suppress appetite.

- In June 2025, Eli Lilly maintains a strong position in the weight loss drug market, actively pursuing research and data releases to solidify its presence and expand its influence. Key strategies include increasing manufacturing capacity for incretin-based drugs and advancing its pipeline of oral and injectable treatments. The company is also focusing on meeting the growing demand for its drugs, particularly in emerging markets like India.

- In June 2025, Novo Nordisk released comprehensive Phase 3 data for CagriSema, a combination of semaglutide (GLP-1 agonist) and cagrilintide (amylin analog). In the REDEFINE 1 trial, participants lost an average of 20.4% of body weight over 68 weeks, outperforming semaglutide alone.

Market Concentration & Characteristics

The Appetite Suppressants Market demonstrates a moderately concentrated structure, with a mix of established pharmaceutical companies and emerging nutraceutical brands competing for share. It is driven by rising demand for weight management solutions, particularly in regions with high obesity rates such as North America and Europe. Leading players like Novo Nordisk and Eli Lilly dominate the prescription drug segment through robust R&D pipelines and strong regulatory backing. Meanwhile, smaller firms and startups actively target the over-the-counter and herbal supplement space through e-commerce and social media-driven strategies. It features product differentiation across formulations, including tablets, capsules, and natural supplements, catering to a broad consumer base. The market benefits from high consumer awareness and growing interest in wellness, but it remains sensitive to regulatory scrutiny, ingredient safety, and clinical efficacy. Entry barriers are moderate, influenced by the complexity of drug approvals and the need for transparent labeling in nutraceuticals. Competitive dynamics revolve around innovation, strategic partnerships, and direct-to-consumer marketing.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Mechanism of Action, Formulation Type, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The appetite suppressants market is expected to witness steady growth driven by increasing obesity rates and rising awareness about weight management.

- Demand for both prescription and over-the-counter appetite suppressants will grow due to consumer preference for non-invasive weight loss solutions.

- Herbal and natural formulations are likely to gain more market share as consumers seek safer and clean-label products.

- Digital health integration, including apps and wearable devices, will enhance personalized weight loss programs combined with supplement use.

- Emerging markets in Asia-Pacific and Latin America will offer new growth opportunities due to rising urbanization and lifestyle-related health issues.

- E-commerce will continue to expand product accessibility and allow companies to directly engage consumers with tailored marketing.

- Strategic collaborations between pharmaceutical firms and tech platforms may drive innovation in personalized dosing and wellness tracking.

- Regulatory developments will play a key role in shaping product approvals, labeling requirements, and market entry strategies.

- Brand differentiation through clinically supported claims and transparent ingredient sourcing will become increasingly important.

- Market competition will intensify, with established players investing in R&D and new entrants leveraging digital marketing and niche product positioning.