Market Overview

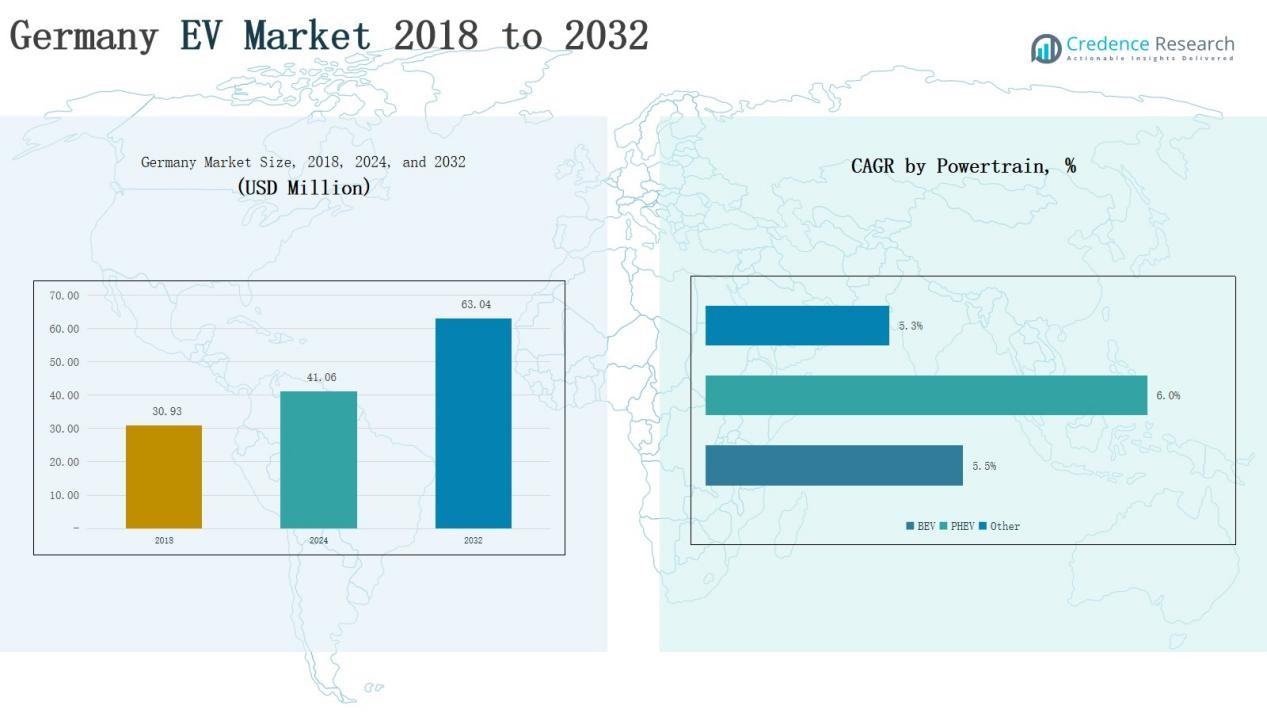

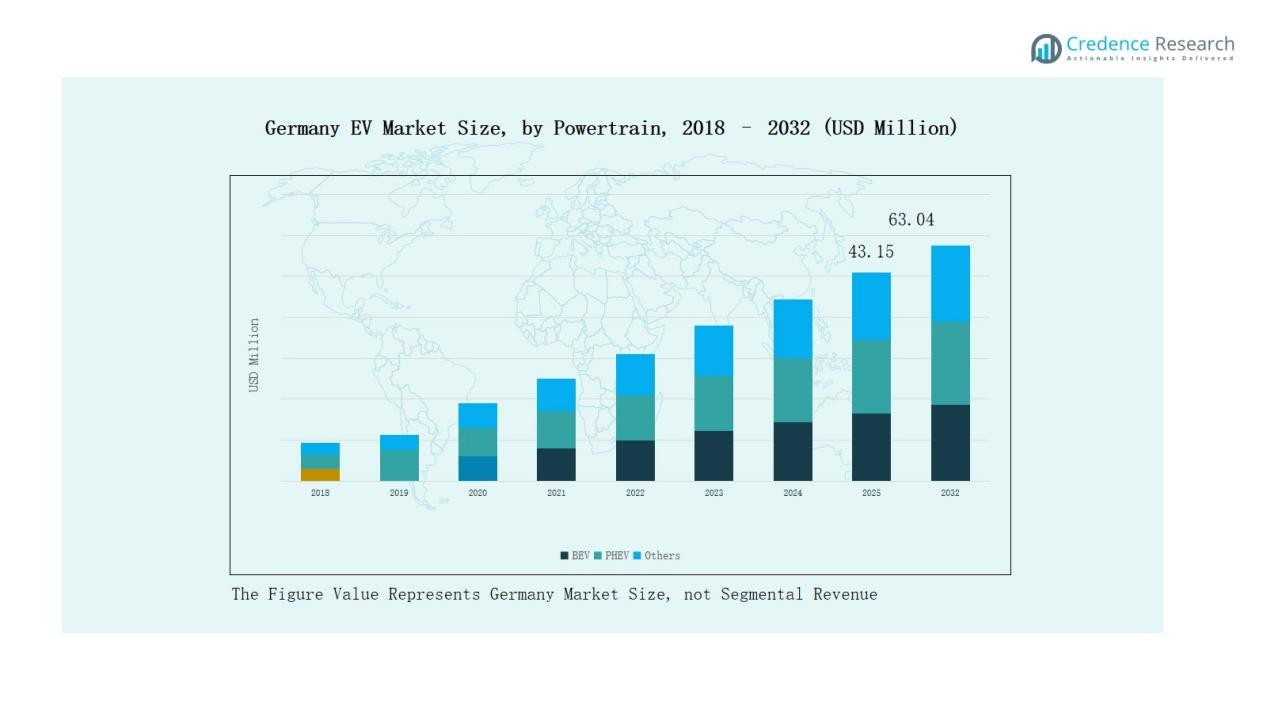

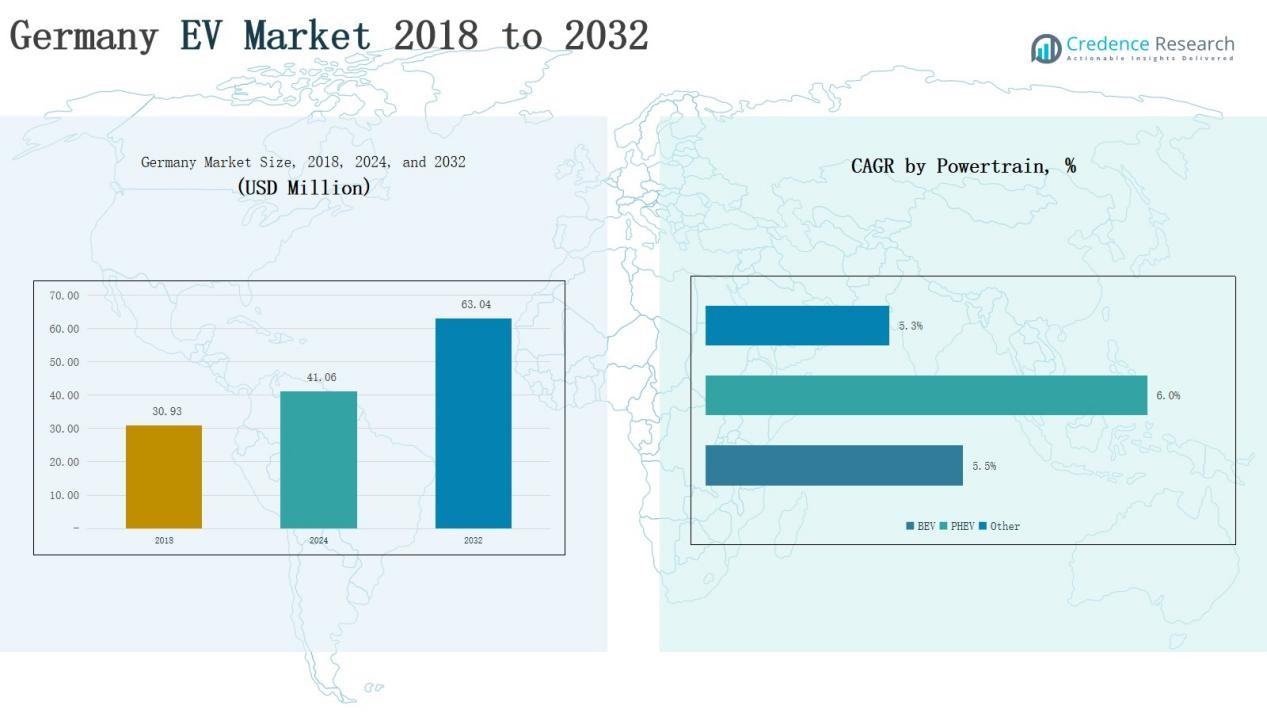

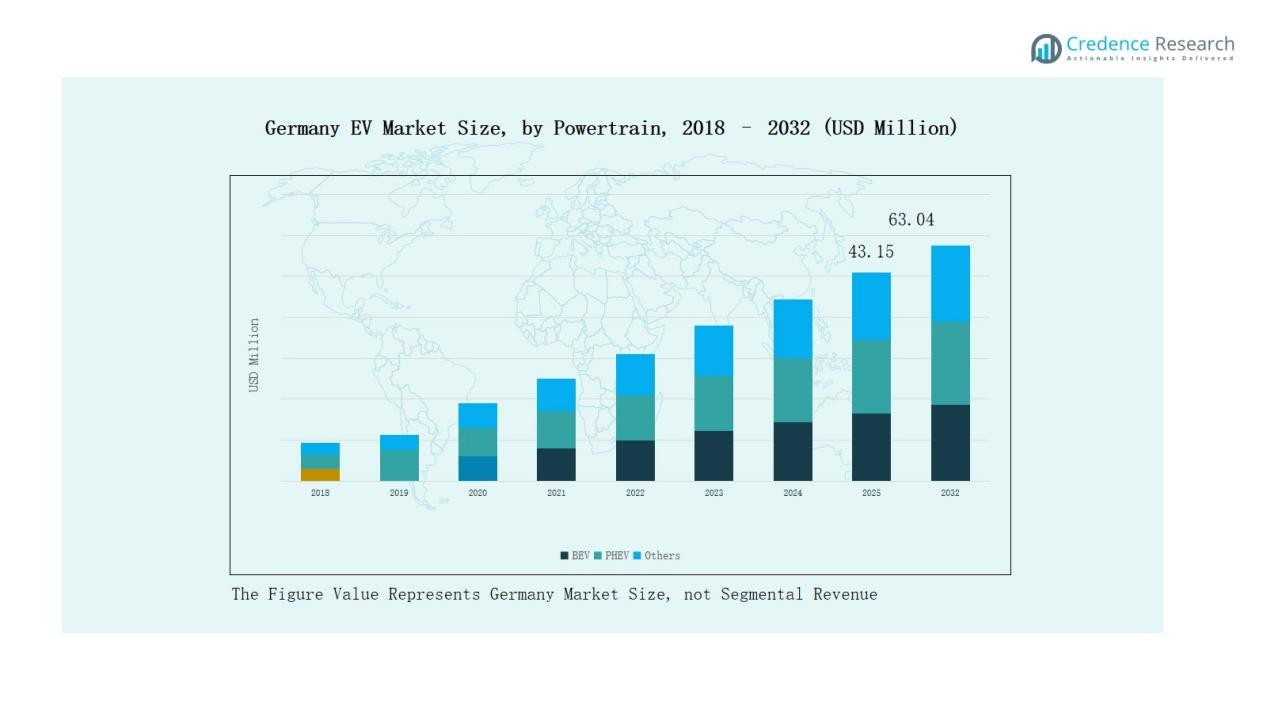

Germany Electric Vehicle (EV) Market size was valued at USD 30.93 million in 2018 to USD 41.06 million in 2024 and is anticipated to reach USD 63.04 million by 2032, at a CAGR of 5.51% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Germany EV Market Size 2024 |

USD 41.06 Million |

| Germany EV Market, CAGR |

5.51% |

| Germany EV Market Size 2032 |

USD 63.04 Million |

The Germany EV Market is highly competitive, driven by both domestic and international automakers. Volkswagen, BMW AG, Mercedes-Benz, and Audi leverage strong R&D capabilities and advanced production networks to secure leadership across BEV and PHEV segments. Tesla strengthens its premium positioning through advanced technology and a dedicated supercharger network, while Volvo, Renault S.A., Skoda, and Geely Holding expand accessibility with cost-efficient models tailored to diverse customer groups. Competitive strategies focus on charging partnerships, innovative battery technologies, and broad product portfolios. Regionally, Southern Germany led the market in 2024 with a 35% share, supported by major automaker headquarters, advanced infrastructure, and strong consumer purchasing power, making it the central hub for EV innovation and adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Germany EV Market was USD 30.93 million in 2018, USD 41.06 million in 2024, and is projected to reach USD 63.04 million by 2032, growing at 5.51%.

- Battery Electric Vehicles led with 68% share in 2024, supported by incentives, emission regulations, and fast-charging expansion, while PHEVs held 27% and other powertrains 5%.

- Private buyers dominated with 72% share in 2024, driven by subsidies, tax benefits, and affordable BEV models, while corporate buyers held 28% supported by fleet electrification and leasing demand.

- Southern Germany led regionally with 35% share in 2024 due to automaker presence, strong infrastructure, and high consumer purchasing power, followed by Northern and Western regions at 25% each, and Eastern at 15%.

- Volkswagen, BMW AG, Mercedes-Benz, and Audi drive leadership in BEV and PHEV segments, while Tesla, Volvo, Renault, Skoda, and Geely expand affordability through broader product portfolios and strategic innovations.

Market Segment Insights

By Powertrain

Battery Electric Vehicles (BEVs) dominate the Germany EV Market, accounting for 68% share in 2024. Their leadership is driven by government incentives, stringent CO₂ emission targets, and the rapid expansion of charging infrastructure across urban and highway networks. Plug-in Hybrid Electric Vehicles (PHEVs) hold a 27% share, appealing to buyers who prioritize flexibility between electric driving and long-distance fuel reliability. Other powertrains, including fuel-cell EVs, represent the remaining 5% share, supported by early-stage investments and pilot projects in hydrogen mobility.

- For instance, PHEVs accounted for 10% of new registrations in Germany in April 2025 – 24,317 units – a jump of +60.7% year-on-year.

By End User

Private buyers lead the market with a 72% share in 2024, supported by strong subsidies, tax exemptions, and growing consumer preference for eco-friendly personal mobility. Affordable BEV models from domestic brands like Volkswagen and Renault further strengthen adoption in households. Corporate buyers hold a 28% share, with demand fueled by fleet electrification, sustainability commitments, and tax benefits for company-owned EVs. Logistics operators, mobility service providers, and employee leasing programs are expanding this segment steadily.

- For instance, Volkswagen introduced the ID. EVERY1, a compact battery electric vehicle priced around €20,000 ($21,000), aimed at offering affordable personal mobility with a range of over 155 miles.

Key Growth Drivers

Government Incentives and Regulatory Push

Government policies remain the backbone of EV adoption in Germany. Purchase subsidies, tax exemptions, and low-emission vehicle benefits significantly reduce the total cost of ownership. The German government also enforces strict CO₂ emission limits, compelling automakers to accelerate EV rollouts. Expansion of clean mobility zones in major cities further supports demand. These initiatives, combined with long-term commitments to phase out internal combustion engines, ensure steady growth momentum for the EV market.

- For instance, Volkswagen announced an €180 billion investment plan through 2027, with two-thirds allocated to electrification and digitalization, in line with the German government’s emission reduction targets.

Expansion of Charging Infrastructure

The rapid buildout of charging networks strongly boosts consumer confidence in EV adoption. Germany has invested in public fast-charging corridors across highways and dense urban regions, enabling long-distance travel convenience. Partnerships between energy providers, automakers, and government programs expand both public and private charging solutions. Home-charging subsidies encourage residential adoption, particularly in multi-family housing projects. By ensuring accessibility and reliability, charging infrastructure reduces range anxiety and promotes higher BEV penetration.

- For instance, in November 2023, Mercedes-Benz partnered with energy expert E.ON to develop and operate the Mercedes-Benz Charging Network in Europe, which is openly accessible to all vehicles. The partnership supports Mercedes-Benz’s wider goal of having over 10,000 high-power charging points worldwide by the end of the decade.

Domestic Automotive Leadership and Innovation

Germany’s strong automotive industry provides a major advantage for EV growth. Leading brands such as Volkswagen, BMW, and Mercedes-Benz invest heavily in electrification, with extensive BEV and PHEV product portfolios. Advanced manufacturing facilities, R&D hubs, and dedicated EV production lines enhance supply capabilities. Continuous innovation in battery performance, connected vehicle features, and autonomous driving integration strengthens the value proposition. The presence of strong domestic players ensures competitiveness while meeting both local and global EV demand.

Key Trends & Opportunities

Rising Consumer Shift Toward BEVs

A clear transition is underway from PHEVs to BEVs, reflecting consumer preference for fully electric mobility. Falling battery prices and longer driving ranges make BEVs more appealing than ever. Domestic automakers are also scaling affordable entry-level EV models, broadening adoption among households. Government-supported leasing programs and attractive financing options further expand consumer accessibility. This trend positions BEVs to hold an increasing market share over the forecast period.

- For instance, BYD’s Dolphin hatchback offers 340 km WLTP range using a 44.9 kWh “blade” battery pack in its entry-level trim.

Integration of Smart and Connected Mobility

Opportunities are emerging from the integration of smart, connected features in EVs. Automakers in Germany are embedding advanced telematics, AI-driven energy optimization, and over-the-air software updates. These innovations improve performance, enhance user convenience, and unlock new revenue streams through subscription-based services. Coupled with the rise of vehicle-to-grid (V2G) solutions, connected EVs offer added value to consumers and grid operators alike. This trend drives technological leadership in Germany’s EV ecosystem.

- For instance, BMW announced that over 12 million vehicles are now connected to its My BMW app, enabling features like remote software upgrades and real-time vehicle data access.

Key Challenges

High Vehicle Costs and Affordability Gap

Despite subsidies, upfront EV prices remain higher compared to traditional vehicles. Battery costs, advanced technology integration, and supply chain complexities contribute to this premium. Many middle-income consumers delay EV purchases, limiting adoption beyond early adopters. While operational savings offset long-term expenses, affordability remains a major challenge. Achieving cost parity with internal combustion vehicles is crucial for wider market penetration.

Supply Chain Constraints and Battery Dependence

The EV industry faces supply chain risks, particularly for critical battery materials such as lithium, cobalt, and nickel. Global shortages and geopolitical dependencies create pricing volatility. Germany’s reliance on imports increases vulnerability, raising concerns over production scalability. Automakers are investing in local gigafactories and alternative chemistries, but short-term bottlenecks remain a barrier. Stable raw material access is essential to meet growing demand.

Uneven Charging Access Across Regions

Although infrastructure is expanding, disparities persist between urban and rural areas. Metropolitan regions enjoy dense charging availability, while remote areas lag behind, discouraging adoption outside cities. Limited high-speed charging capacity further slows BEV growth in long-distance travel use cases. Addressing these regional gaps requires coordinated government policies, public-private investment, and grid modernization. Ensuring equitable access to charging remains critical for nationwide adoption.

Regional Analysis

Northern Germany

Northern Germany holds 25% share of the Germany EV Market. The region benefits from strong wind energy generation, which supports sustainable EV charging. Hamburg and Bremen lead adoption with robust urban infrastructure and supportive municipal policies. Public transport electrification and large logistics hubs also strengthen demand. Manufacturers and suppliers collaborate with renewable projects to align EV use with clean energy. It remains a key growth area for sustainable urban mobility solutions.

Southern Germany

Southern Germany accounts for the largest share at 35%. The region is home to major automakers such as BMW, Audi, and Mercedes-Benz, which drive EV innovation and adoption. Dense urban centers like Munich and Stuttgart provide strong consumer demand supported by advanced charging networks. High purchasing power further fuels private EV ownership. Corporate fleets also expand steadily in industrial hubs. It plays a pivotal role in shaping product development and consumer adoption trends nationwide.

Eastern Germany

Eastern Germany represents 15% share of the market. The region has seen steady adoption due to government-backed investments in renewable energy and mobility infrastructure. Cities like Leipzig and Dresden act as focal points for EV pilot programs and charging rollouts. Lower population density slows adoption compared to western regions, but incentives are encouraging uptake. Emerging industrial sites contribute to growing fleet demand. It is gradually expanding its role within the national EV ecosystem.

Western Germany

Western Germany holds 25% share. Strong industrial bases and urban centers such as Cologne, Düsseldorf, and Frankfurt foster demand for EVs across both private and corporate segments. Extensive highway networks in the region make fast-charging infrastructure essential, which has been expanding rapidly. Consumers benefit from strong subsidy schemes and brand access through leading dealerships. Corporate electrification also gains traction in logistics and leasing services. It remains a balanced market with both consumer and industrial growth drivers.

Market Segmentations:

By Powertrain

- Battery Electric Vehicles (BEV)

- Plug-in Hybrid Electric Vehicles (PHEV)

- Other Powertrains

By End User

- Private Buyers

- Corporate Buyers

By Region

- Northern

- Southern

- Eastern

- Western

Competitive Landscape

The Germany EV Market is shaped by strong competition among domestic and international automakers. Leading companies such as Volkswagen, BMW, Mercedes-Benz, and Audi leverage advanced R&D capabilities, manufacturing strength, and established distribution networks to dominate both BEV and PHEV segments. Tesla holds a strong position in the premium EV category, supported by its dedicated supercharger network and technology-driven appeal. Volvo, Renault, Skoda, and Geely enhance accessibility by offering cost-effective models for mass-market adoption. Competitive strategies focus on expanding charging partnerships, improving battery efficiency, and launching models across various price points. Financial strength and innovation pipelines enable key players to maintain resilience against supply chain challenges and regulatory shifts. The market also witnesses growing fleet electrification demand from corporate buyers, encouraging automakers to develop tailored leasing and fleet solutions. Intense competition drives continuous innovation, ensuring rapid evolution of Germany’s EV ecosystem.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Volkswagen

- BMW AG

- Mercedes-Benz

- Tesla

- Volvo

- Audi

- Skoda

- Renault S.A.

- Geely Holding

- Other Key Players

Recent Developments

- In September 2025, BMW Group and E.ON introduced Germany’s first commercial Vehicle-to-Grid (V2G) solution, enabling bidirectional charging for BMW iX3 customers with a dedicated energy tariff.

- In September 2025, Volkswagen Group subsidiary Elli also launched a pilot project for bidirectional charging in private households, starting participant recruitment with an 11 kW charger solution.

- In February 2025, Tesla acquired parts of insolvent German parts maker Manz AG, including movable assets, property in Reutlingen, and more than 300 employees.

Report Coverage

The research report offers an in-depth analysis based on Powertrain, End User and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Automakers will expand BEV portfolios across premium and mass-market segments.

- Charging infrastructure will grow rapidly, with more fast-charging corridors nationwide.

- Private buyers will continue leading adoption, supported by stronger subsidy schemes.

- Corporate fleet electrification will increase as businesses pursue sustainability goals.

- Domestic automakers will strengthen battery manufacturing and local gigafactory capacity.

- Connected and smart mobility features will become standard in most EV models.

- Partnerships between energy providers and automakers will accelerate grid integration.

- Hydrogen mobility pilots will gain traction in heavy-duty transport and logistics.

- Regional adoption gaps will narrow as rural charging investments expand.

- Competitive intensity will rise as foreign brands challenge domestic leaders with affordable models.