Market Overview

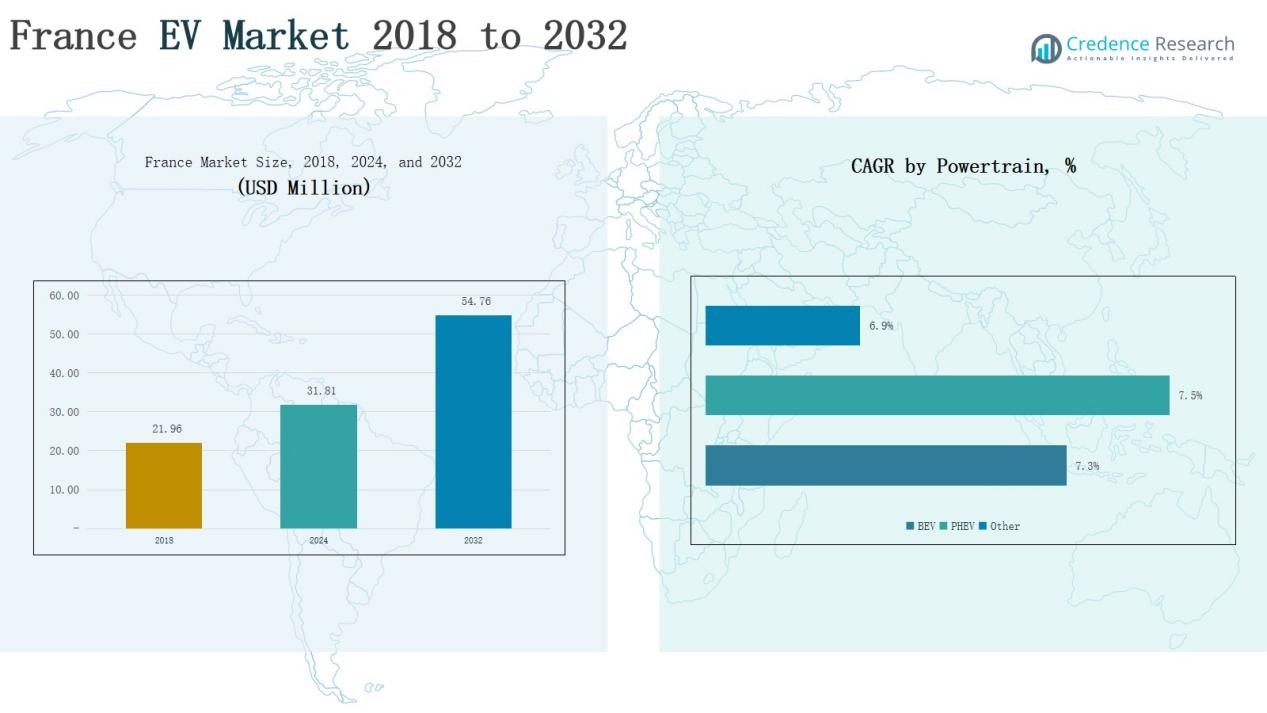

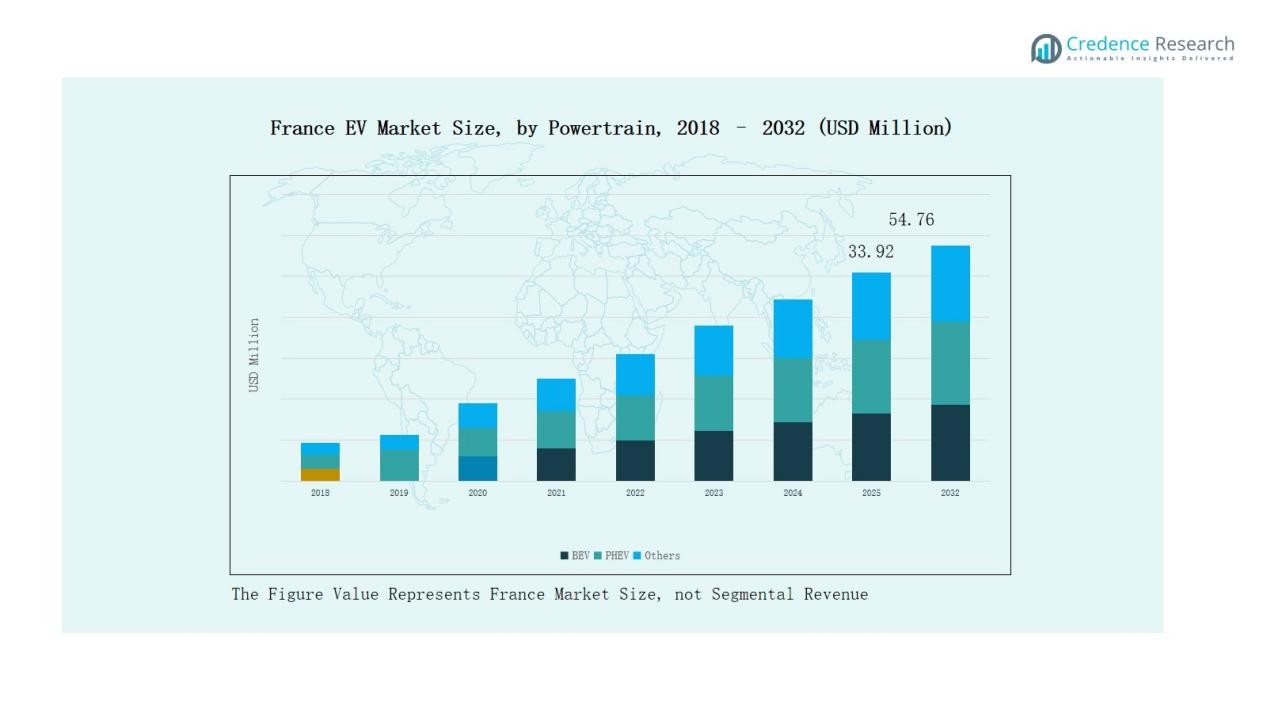

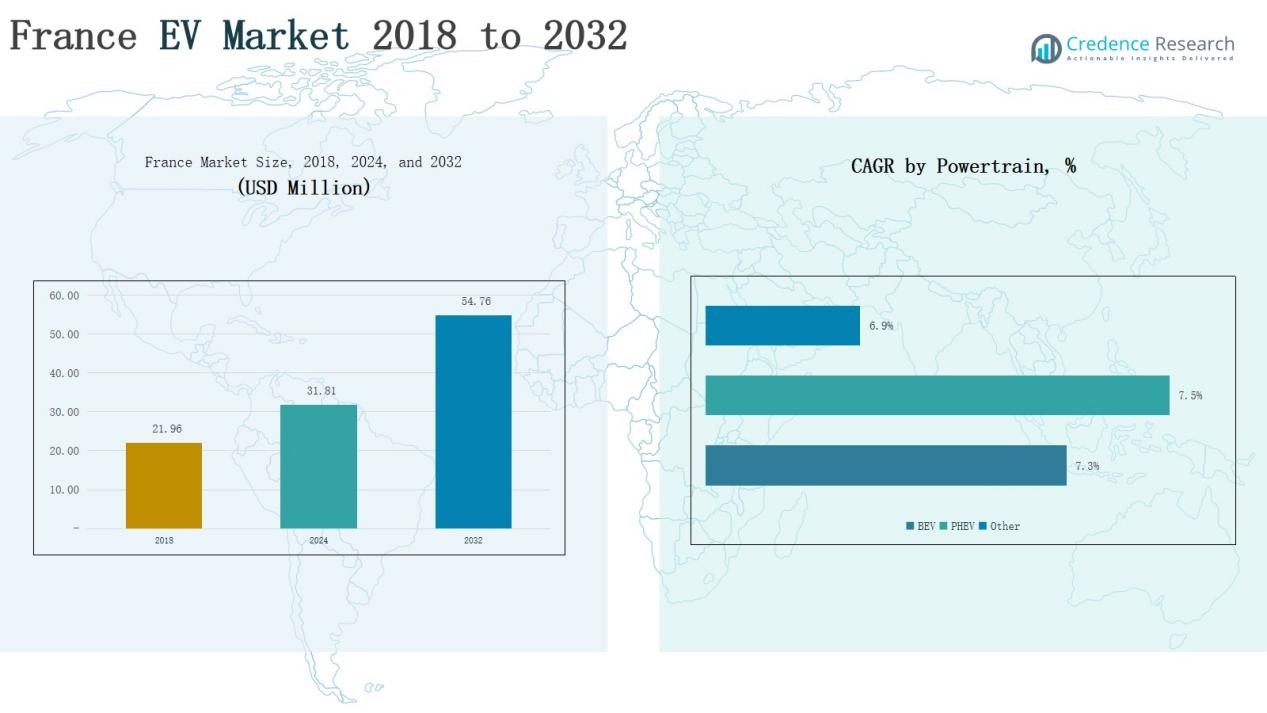

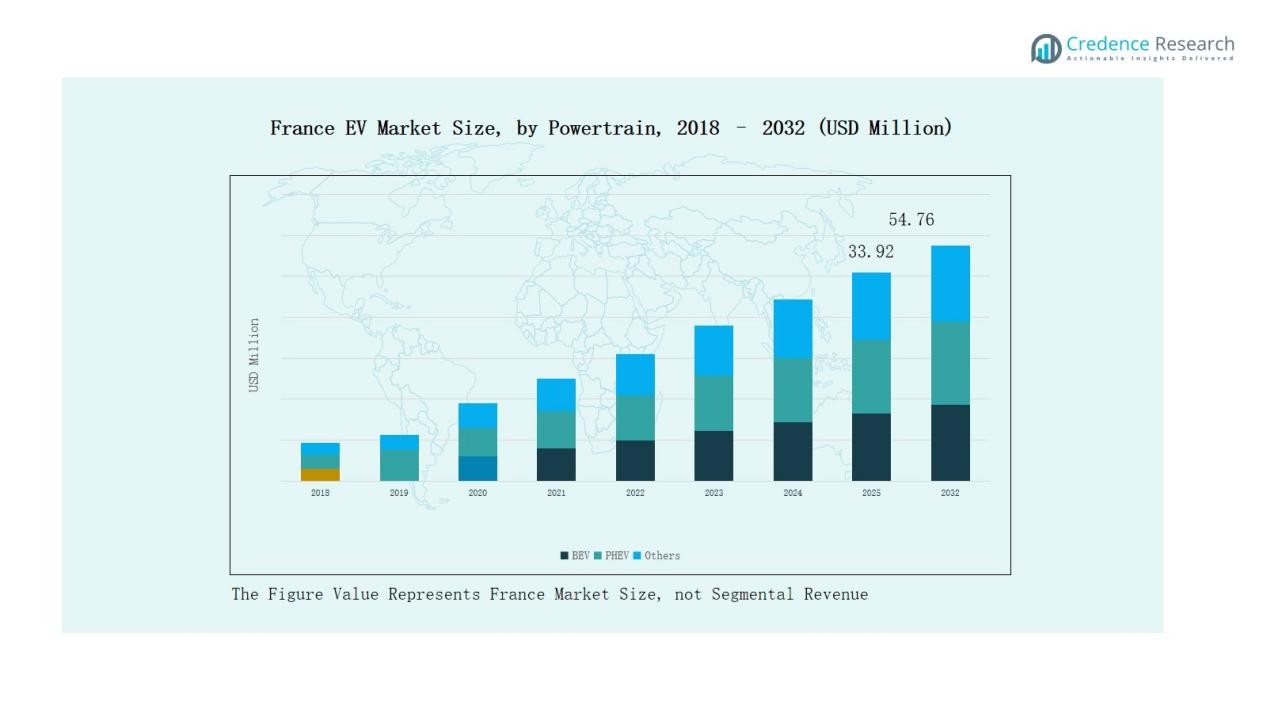

France Electric Vehicle (EV) Market size was valued at USD 21.96 million in 2018 to USD 31.81 million in 2024 and is anticipated to reach USD 54.76 million by 2032, at a CAGR of 6.47% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| France EV Market Size 2024 |

USD 31.81 Million |

| France EV Market, CAGR |

6.47% |

| France EV Market Size 2032 |

USD 54.76 Million |

The France EV Market is shaped by leading players including Volkswagen, Tesla, BMW, Mercedes-Benz, Renault, Peugeot, Audi, Volvo, Skoda, and Geely Holding, each leveraging diverse product portfolios and strong distribution networks to strengthen their positions. Tesla leads the premium segment with advanced technology and dedicated supercharging infrastructure, while Renault and Peugeot dominate the mass-market through affordable and locally manufactured EV models. German brands such as BMW, Mercedes-Benz, and Audi enhance competitiveness with performance-focused electric vehicles, while Volvo and Skoda target environmentally conscious consumers with mid-range offerings. Geely Holding continues to expand accessibility through strategic investments and product diversification. Regionally, Île-de-France commanded the largest market share at 42% in 2024, supported by dense urbanization, favorable government policies, and extensive charging infrastructure, making it the central hub for EV adoption in the country.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- France EV Market grew from USD 21.96 million in 2018 to USD 31.81 million in 2024 and is projected to reach USD 54.76 million by 2032, growing at 6.47%.

- Leading players include Volkswagen, Tesla, BMW, Mercedes-Benz, Renault, Peugeot, Audi, Volvo, Skoda, and Geely Holding, competing through diverse portfolios and innovation.

- BEVs dominate the powertrain segment with 62% share in 2024, followed by PHEVs at 28% and other powertrains at 10%.

- Private buyers lead the end-user segment with 70% share in 2024, while corporate buyers hold 30% driven by fleet electrification goals.

- Île-de-France commanded the largest regional share at 42% in 2024, supported by dense urbanization, incentives, and advanced charging infrastructure, with Auvergne-Rhône-Alpes (21%) and Provence-Alpes-Côte d’Azur (15%) following.

Market Segment Insights

By Powertrain

In the France EV Market, the powertrain segment is led by Battery Electric Vehicles (BEVs), holding a dominant 62% share in 2024. Strong government incentives, expanding charging infrastructure, and consumer preference for zero-emission solutions drive BEV adoption. Plug-in Hybrid Electric Vehicles (PHEVs) account for 28% share, appealing to buyers seeking range flexibility, while other powertrains collectively represent 10% share, supported mainly by niche demand.

- For instance, Stellantis announced the launch of the Citroën ë-C3 in France at a starting price of €23,300, positioning it as one of the most affordable BEVs on the market.

By End User

Private buyers dominate the end-user segment with a 70% share in 2024, driven by rising environmental awareness, favorable subsidies, and availability of affordable EV models. Corporate buyers hold the remaining 30% share, supported by fleet electrification initiatives, company sustainability targets, and lower long-term operating costs, making EVs attractive for businesses seeking efficiency and regulatory compliance.

- For instance, in 2024, Tesla delivered 1,789,226 electric vehicles globally, maintaining its position as a leading EV manufacturer.

Key Growth Drivers

Government Incentives and Policy Support

The France EV Market benefits greatly from robust government incentives and policy frameworks. Subsidies, purchase rebates, and tax exemptions significantly lower upfront costs for consumers, making electric vehicles more accessible. Strict emission reduction targets aligned with European Union climate goals further accelerate adoption. The government’s investment in expanding charging infrastructure also supports consumer confidence in EV ownership. Together, these measures create a favorable environment for both manufacturers and buyers, driving sustained growth and positioning France as a leading EV hub in Europe.

- For instance, the Social Leasing program was relaunched in September 2025, enabling low-income households to lease EVs for at least three years with monthly payments capped at €150 and government contributions of up to €6,000, making EVs financially accessible to a broader population.

Expansion of Charging Infrastructure

Rapid growth in France’s charging network is a key enabler for EV adoption. Public and private investments have increased the number of fast-charging stations across cities and highways, addressing range anxiety among consumers. Retailers, energy companies, and transport operators are also integrating EV charging points into their services, improving convenience. As infrastructure coverage expands, it encourages private and corporate buyers to transition toward electric mobility. This strong ecosystem supports long-term demand growth, ensuring both urban and regional markets benefit from accessible charging options.

Technological Advancements in EV Models

Automakers are introducing advanced EV models with higher ranges, faster charging, and improved performance in the French market. Innovations in battery technology, including energy density improvements and cost reductions, make EVs more competitive with traditional vehicles. Enhanced features such as smart connectivity, autonomous driving support, and energy-efficient designs appeal to tech-savvy buyers. These advancements expand EV adoption beyond early adopters, attracting mainstream consumers and businesses. Continuous R&D investment by global and domestic automakers positions France as a dynamic market for cutting-edge EV technologies.

- For instance, Renault launched the Mégane E-Tech in France, featuring a 60 kWh battery that delivers a range of 470 km and supports fast charging from 0 to 80% in 40 minutes.

Key Trends & Opportunities

Rise of Corporate Fleet Electrification

Fleet operators and corporations in France are increasingly adopting EVs to meet sustainability targets and reduce operating costs. Government-backed incentives for businesses and urban emission restrictions make EV fleets an attractive choice. Logistics, ride-hailing, and delivery companies are rapidly integrating EVs into their operations. This trend creates opportunities for automakers to offer tailored fleet solutions and partnerships. As more companies prioritize ESG goals, fleet electrification is expected to grow, reinforcing EV demand and expanding market share in the corporate buyer segment.

- For instance, Electra has installed over 500 ultra-fast charging stations across multiple European countries (including hundreds in France), with chargers offering up to 400 kW of charging capacity that enables EV fleets to recharge a significant portion of their battery in under 30 minutes, supporting logistics and delivery operations with reduced downtime.

Integration with Renewable Energy Ecosystem

The integration of EVs with renewable energy and smart grid systems presents a major growth opportunity in France. Solar and wind energy projects are increasingly paired with EV charging stations, enabling cleaner energy use. Vehicle-to-grid (V2G) technology also offers consumers the ability to supply excess energy back to the grid, supporting energy efficiency. This synergy enhances sustainability while reducing carbon emissions. With government focus on renewable energy expansion, EVs are positioned at the center of a broader transition toward a green mobility and energy ecosystem.

- For instance, Mobilize (a Renault Group brand) partnered with NW, a leading French energy storage company, to form a joint venture focused on integrating EV charging with electricity storage, aiming to reduce charging costs while maximizing the use of decarbonized electricity across France.

Key Challenges

High Initial Purchase Cost

Despite incentives, the upfront cost of EVs in France remains higher than internal combustion engine vehicles. Premium battery prices and advanced features increase overall pricing, limiting affordability for middle-income buyers. While total cost of ownership may be lower in the long run, initial expenses discourage some consumers from adopting EVs. This cost barrier continues to challenge broader market penetration, particularly in rural regions where financial support mechanisms are less impactful. Manufacturers face pressure to reduce costs through economies of scale and innovation.

Charging Infrastructure Gaps in Rural Areas

While urban regions in France enjoy expanding charging networks, rural areas still face significant coverage gaps. Limited fast-charging options outside major cities create range anxiety for long-distance travelers and residents in remote areas. This disparity restricts nationwide adoption and highlights infrastructure inequality. Investment is required to ensure equitable charging access across all regions. Without addressing these gaps, EV adoption will remain concentrated in urban centers, slowing the overall pace of market growth and limiting the government’s national electrification objectives.

Battery Supply Chain Dependence

The France EV Market faces challenges from heavy dependence on imported battery components and raw materials. Supply chain disruptions, geopolitical risks, and fluctuating commodity prices can affect production costs and availability. Europe’s reliance on Asia for lithium-ion cells exposes the market to volatility. This dependence poses risks for automakers operating in France, limiting their ability to scale production sustainably. Efforts to develop domestic gigafactories and secure raw material supply chains are underway, but overcoming this challenge requires long-term strategic planning and investment.

Regional Analysis

Île-de-France

Île-de-France holds the largest share in the France EV Market, accounting for 42% in 2024. The region benefits from dense urbanization, advanced infrastructure, and strong government incentives promoting green mobility. High adoption rates in Paris and surrounding areas are driven by low-emission zones and restrictions on traditional vehicles. Charging infrastructure expansion across highways and city centers supports consumer confidence. Corporate fleet operators are also accelerating demand with sustainability targets. It continues to set the pace for national EV adoption through strong policy and infrastructure alignment.

Auvergne-Rhône-Alpes

Auvergne-Rhône-Alpes commands a 21% share in 2024, making it the second-largest regional market. The presence of major industrial hubs and strong automotive manufacturing activities support growth. Government-backed initiatives to reduce emissions in urban centers like Lyon drive higher adoption. The region benefits from well-developed charging networks and growing corporate investment in EV fleets. Rising consumer awareness and access to incentives contribute to steady demand. It plays a key role in supporting France’s transition to sustainable mobility.

Provence-Alpes-Côte d’Azur

Provence-Alpes-Côte d’Azur holds a 15% share in 2024, supported by tourism, urban growth, and sustainable energy initiatives. Coastal cities like Marseille and Nice encourage EV adoption through local policies and infrastructure development. The region attracts buyers seeking eco-friendly mobility solutions to comply with emission regulations. Expanding renewable energy integration enhances the appeal of EVs among consumers. Corporate fleets in transport and logistics sectors add to demand. It continues to emerge as a significant contributor to the market’s growth trajectory.

Hauts-de-France

Hauts-de-France accounts for 12% share in 2024, with demand supported by its proximity to key European transport corridors. Strong cross-border logistics activities promote EV fleet adoption in commercial applications. The region benefits from infrastructure investments and incentives targeting lower emissions. Consumers in Lille and surrounding areas are increasingly adopting EVs due to environmental awareness. Local government policies reinforce adoption momentum. It serves as a growing market with strategic importance for cross-European mobility.

Other Regions

Other regions collectively represent 10% share in 2024, driven by gradual adoption in smaller cities and rural areas. Market expansion is supported by government incentives and regional infrastructure projects. Lower urban density slows adoption compared to leading regions. However, rising consumer awareness and expanding charging networks are closing the gap. Regional governments are investing in mobility solutions aligned with national policies. It is expected to provide incremental growth to strengthen nationwide EV penetration.

Market Segmentations:

By Powertrain

- BEV (Battery Electric Vehicles)

- PHEV (Plug-in Hybrid Electric Vehicles)

- Other

By End User

- Private Buyers

- Corporate Buyers

Competitive Landscape

The France EV Market is highly competitive, shaped by global and domestic automakers striving for leadership in one of Europe’s fastest-growing mobility sectors. Volkswagen, Tesla, BMW, Mercedes-Benz, Renault, and Peugeot hold strong positions through diverse portfolios, extensive distribution networks, and strategic investments in charging infrastructure. Tesla leads the premium segment with its advanced technology and expanding supercharger network, while Renault and Peugeot drive mass-market adoption through affordable, locally manufactured EV models. German brands such as BMW, Mercedes-Benz, and Audi strengthen their presence by offering performance-driven electric models with strong brand appeal. Volvo and Skoda contribute by targeting environmentally conscious buyers with reliable mid-range offerings. Partnerships with energy companies and fleet operators further reinforce market penetration. Intense competition pushes continuous innovation in battery performance, vehicle range, and connected features. It remains characterized by strong brand rivalry, price competition, and strategic collaborations, ensuring dynamic growth and technological advancement across all segments.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Volkswagen

- BMW AG

- Mercedes-Benz

- Tesla

- Volvo

- Audi

- Skoda

- Renault S.A.

- Geely Holding

- Other Key Players

Recent Developments

- In June 2025, Polestar started taking orders in France for its Polestar 2, 3, and 4 models, with deliveries expected from October and a new showroom in Le Mans.

- In September 2025, Volkswagen renamed its “ID.2all” concept to ID. Polo, reviving its Polo badge for the EV era; the production model is set for launch in 2026.

- In January 2025, Renault introduced its FlexEVan electric light commercial vehicle line under the Flexis joint venture, with production scheduled to begin in 2026 at Sandouville.

- In late 2024, Renault launched the Renault 5 E-Tech, which quickly gained strong demand and emerged among France’s best-selling EVs in 2025.

Report Coverage

The research report offers an in-depth analysis based on Powertrain, End User and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Government incentives will continue to drive strong adoption across consumer and corporate segments.

- Expansion of charging infrastructure will reduce range anxiety and support nationwide penetration.

- Battery technology improvements will enhance vehicle range, performance, and affordability.

- Domestic production capacity will strengthen to reduce dependence on imported batteries.

- Automakers will introduce broader model portfolios to target mass-market and premium buyers.

- Corporate fleet electrification will accelerate, supported by sustainability and cost-efficiency goals.

- Integration with renewable energy will create new synergies for clean mobility solutions.

- Regional adoption will expand beyond urban hubs into rural and semi-urban areas.

- Competitive intensity will increase, driving innovation and strategic partnerships.

- Consumer awareness and preference for eco-friendly transport will solidify long-term demand.