Market Overview

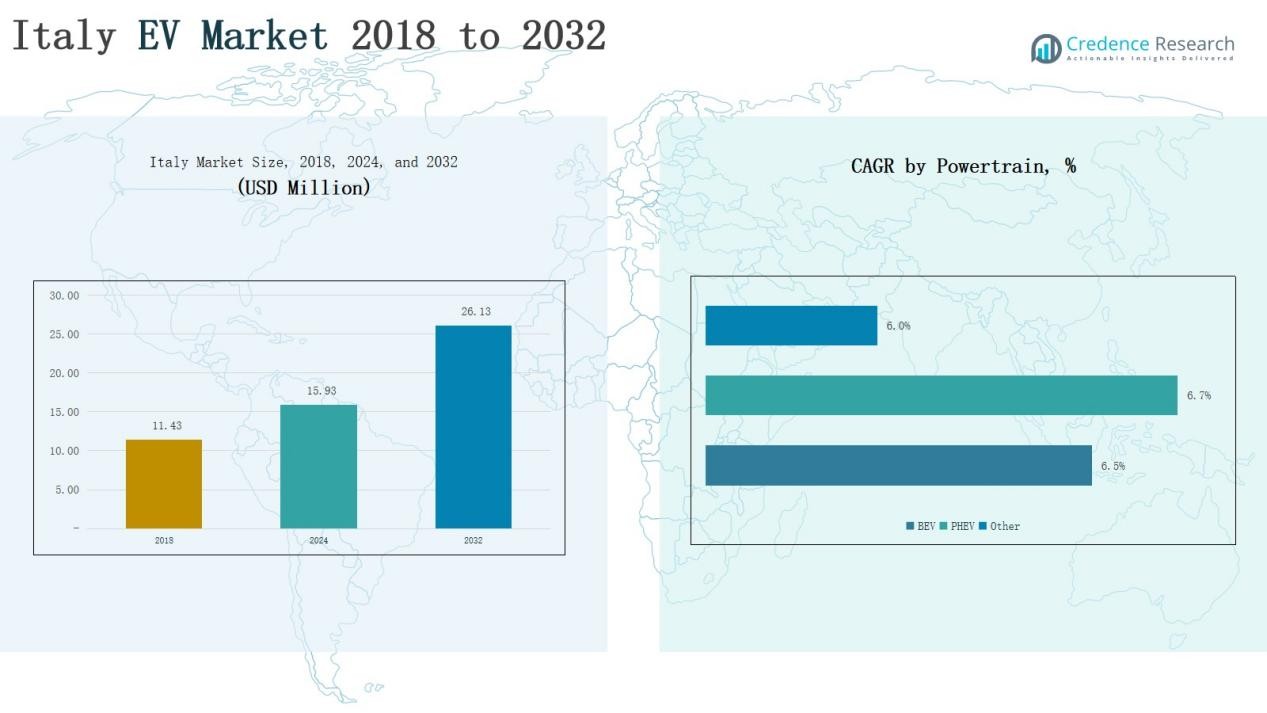

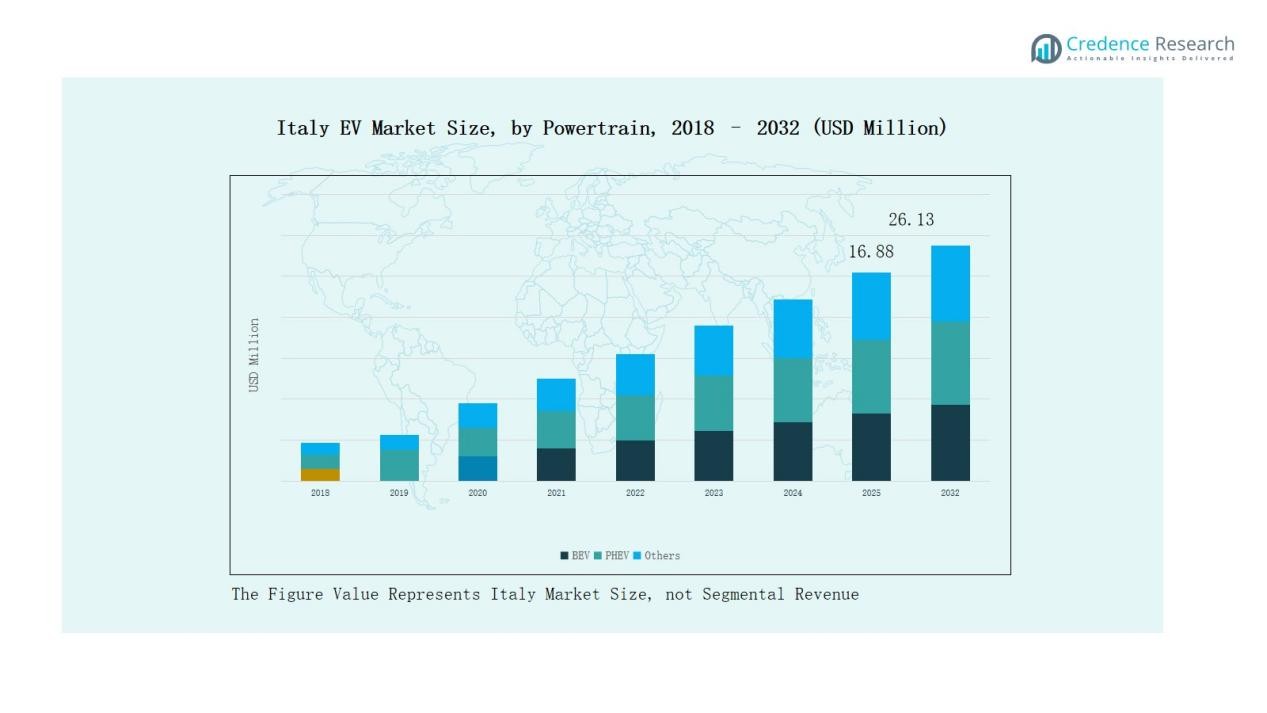

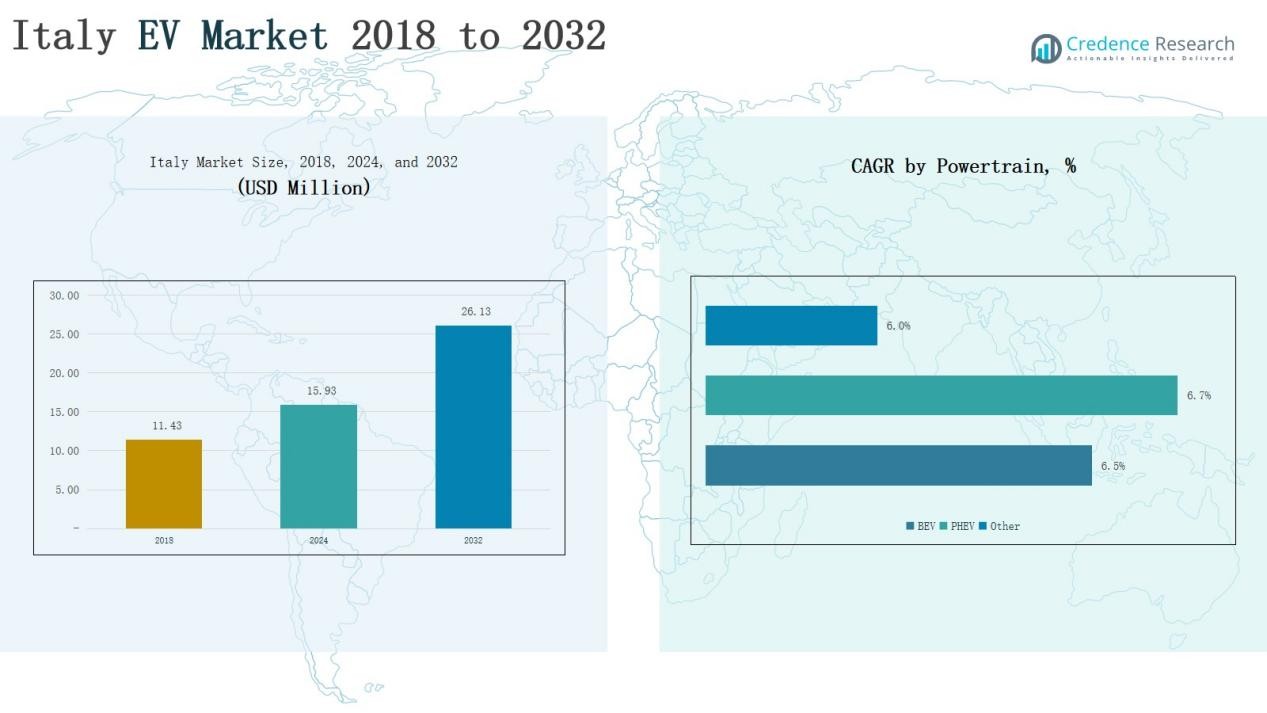

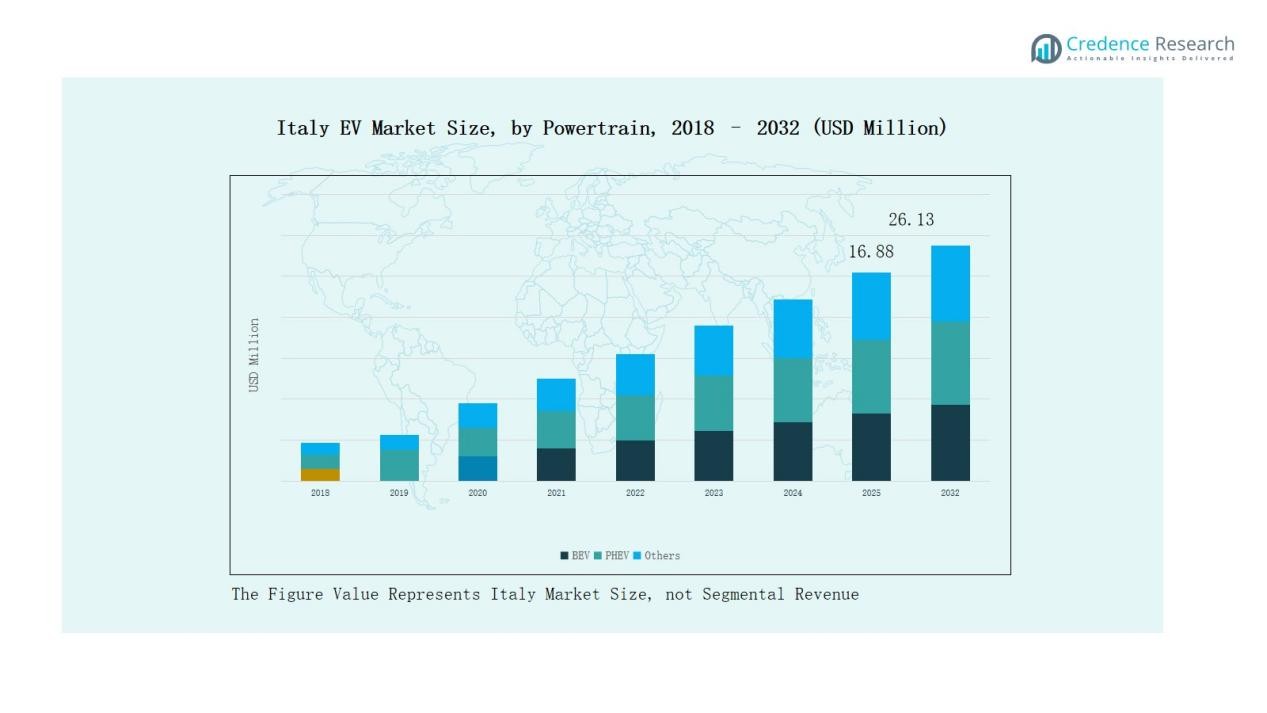

Italy Electric Vehicle (EV) Market size was valued at USD 11.43 million in 2018 to USD 15.93 million in 2024 and is anticipated to reach USD 26.13 million by 2032, at a CAGR of 6.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Italy EV Market Size 2024 |

USD 15.93 Million |

| Italy EV Market, CAGR |

6.1% |

| Italy EV Market Size 2032 |

USD 26.13 Million |

The Italy EV Market is shaped by strong competition among leading automakers, with Volkswagen, Tesla, BMW, Mercedes-Benz, Volvo, and Audi holding prominent positions through advanced technology, diverse product portfolios, and extensive charging partnerships. Skoda, Renault, and Kia expand accessibility with cost-effective models appealing to price-sensitive buyers, while Hyundai and Geely strengthen market dynamics with innovative offerings from Asia. These players focus on expanding electric lineups, fleet solutions, and sustainability-driven strategies to capture a growing customer base. Regionally, Northern Italy led the market with 42% share in 2024, supported by robust infrastructure, high consumer purchasing power, and government-backed electrification programs.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Italy EV Market grew from USD 11.43 million in 2018 to USD 15.93 million in 2024 and is projected to reach USD 26.13 million by 2032.

- Battery Electric Vehicles dominated with 62% share in 2024, supported by government incentives, charging infrastructure expansion, and rising consumer preference for zero-emission mobility solutions.

- Private buyers led demand with 71% share in 2024, driven by affordable EV options, urban adoption programs, and household preference for cost-efficient and sustainable transport solutions.

- Northern Italy held the largest regional share of 42% in 2024, supported by high disposable incomes, robust charging infrastructure, and strong policy-driven adoption.

- Key players include Volkswagen, Tesla, BMW, Mercedes-Benz, Volvo, Audi, Skoda, Renault, Kia, Hyundai, and Geely, each focusing on expanding lineups, affordability, and sustainability strategies.

Market Segment Insights

By Powertrain Segment

Battery Electric Vehicles (BEVs) held the dominant share of 62% in 2024, reflecting Italy’s strong push toward zero-emission mobility and government-backed incentives such as purchase subsidies and tax exemptions. The growth of BEVs is further supported by expanding charging infrastructure and increasing consumer preference for long-term cost savings. Plug-in Hybrid Electric Vehicles (PHEVs) captured 28% share, catering to buyers seeking flexibility for both short urban commutes and extended travel. The remaining 10% share came from other powertrains, including fuel cell EVs and mild hybrids, which remain niche but attract interest for technological diversity.

- For instance, Stellantis launched the Fiat 600e in Italy, a fully electric compact SUV. The 600e is designed to strengthen Fiat’s BEV lineup. Fiat claims it offers a range of over 400 km in the WLTP combined cycle, and buyers in Italy can benefit from government EV incentives.

By End User Segment

Private buyers accounted for a dominant 71% share in 2024, driven by rising consumer awareness, availability of affordable EV models, and strong regional adoption programs. Demand is particularly strong among urban households seeking sustainable and cost-efficient transportation options. Corporate buyers represented 29% share, with demand fueled by fleet electrification programs, sustainability commitments, and incentives for businesses adopting low-emission vehicles. Increasing adoption of EVs by logistics operators, ride-hailing firms, and company fleets is expected to further strengthen this segment’s contribution over the forecast period.

- For instance, Amazon announced the deployment of more than 6,000 Rivian electric delivery vans across over 1,000 U.S. cities as part of its commitment to decarbonize its logistics fleet.

Key Growth Drivers

Government Incentives and Policy Support

The Italy EV Market benefits from robust government incentives, including purchase subsidies, tax exemptions, and reduced registration fees for electric vehicles. These policies lower the upfront cost barrier and encourage adoption among price-sensitive buyers. Additionally, low-emission zones in major cities push consumers toward cleaner mobility. Public charging infrastructure projects, co-financed by EU funds, further strengthen the shift toward electrification. Together, these measures enhance market attractiveness, accelerate demand, and align Italy with the European Union’s broader decarbonization and climate-neutral mobility objectives.

- For instance, Italy approved nearly 600 million euros in subsidies offering up to 11,000 euros to individuals with low incomes and up to 20,000 euros for micro-enterprises, covering up to 30% of an electric vehicle’s purchase price

Expanding Charging Infrastructure

A rapid increase in the number of public and private charging stations is a vital driver of EV adoption in Italy. National and regional programs are supporting infrastructure expansion across highways, urban centers, and residential areas. Fast-charging hubs are improving accessibility, addressing range anxiety, and making EVs more practical for long-distance travel. Partnerships between automakers, utility providers, and tech companies are streamlining charging access through apps and integrated payment solutions. This robust infrastructure development enhances consumer confidence and sustains long-term growth in the Italian EV market.

- For instance, Free To X (Autostrade per l’Italia) specializes in highway fast and ultra-fast charging stations across 50+ rest areas, enhancing long-distance travel practicality.

Consumer Shift Toward Sustainable Mobility

Changing consumer behavior is playing a key role in driving EV sales in Italy. Urban households are increasingly prioritizing sustainable transportation due to rising environmental awareness and stricter pollution standards. The younger population demonstrates higher acceptance of EVs, driven by cost efficiency, digital connectivity, and lifestyle preferences. Growth in shared mobility services also supports EV penetration, as companies integrate electric fleets for eco-friendly urban mobility. This cultural and behavioral shift, combined with broader societal pressure to reduce carbon emissions, continues to fuel strong demand for electric vehicles in Italy.

Key Trends & Opportunities

Integration of Smart and Connected EVs

The adoption of smart and connected EVs is a growing trend in Italy. Automakers are equipping vehicles with advanced driver-assistance systems, real-time navigation, and connected infotainment features, enhancing the driving experience. Opportunities arise for digital mobility services, including predictive maintenance, telematics, and over-the-air software updates. As consumer demand for smart technologies grows, Italian EV manufacturers and suppliers can differentiate through innovation. This trend strengthens the value proposition of EVs, creating long-term opportunities for partnerships between automakers, technology firms, and infrastructure providers.

- For instance, Maserati continued to drive innovation by launching new EV models equipped with advanced driver-assistance systems, strengthening their connected vehicle portfolio.

Corporate Fleet Electrification

Fleet electrification represents a major opportunity in the Italy EV Market. Corporate buyers, including logistics firms, ride-hailing operators, and delivery companies, are transitioning to electric fleets to reduce operating costs and meet sustainability goals. The government supports this shift through tax deductions and co-financing for businesses investing in EV fleets. Electrification not only lowers fuel and maintenance costs but also enhances corporate environmental branding. This trend is expected to accelerate demand in the corporate buyer segment, creating growth opportunities for automakers offering tailored EV fleet solutions.

- For instance, Italy had installed over 64,000 public charging points by December 2024, helping to support fleet electrification and enhance infrastructure accessibility for commercial EV users.

Key Challenges

High Upfront Vehicle Costs

Despite incentives, the high upfront cost of EVs remains a major barrier in Italy. Many consumers still perceive EVs as expensive compared to conventional vehicles, especially in the mass-market segment. Affordability challenges limit penetration in lower-income groups and rural areas where government subsidies may not fully bridge the gap. Automakers must address this challenge by scaling local production, reducing battery costs, and introducing more affordable EV models to expand adoption across diverse consumer segments.

Limited Battery Supply and Dependence on Imports

Italy faces supply chain risks due to limited domestic battery production and reliance on imports from Asia. Battery availability affects both EV production costs and delivery timelines, creating market uncertainty. The absence of strong local manufacturing infrastructure raises vulnerability to global price fluctuations and trade disruptions. Building a sustainable battery ecosystem, through investments in local gigafactories and recycling initiatives, is essential to reducing dependence and ensuring long-term growth of the Italian EV industry.

Charging Infrastructure Gaps in Rural Areas

While major cities and highways benefit from expanding charging networks, rural and less-developed regions face limited infrastructure availability. This disparity reduces adoption potential outside metropolitan areas, where consumers remain concerned about range and charging convenience. Lack of investment in rural electrification projects slows nationwide EV penetration and risks widening the urban-rural adoption gap. Addressing this challenge requires targeted government funding, partnerships with energy providers, and incentives to deploy charging stations in underserved regions of Italy.

Regional Analysis

Northern Italy

Northern Italy commanded the largest share of 42% in 2024, driven by strong urbanization, high disposable income, and advanced infrastructure. The region benefits from concentrated investments in charging networks, particularly in cities like Milan and Turin. Strong policy incentives encourage both private and corporate adoption of EVs. Local demand is reinforced by awareness campaigns and sustainability commitments from businesses. The Italy EV Market gains momentum in this region due to a mature automotive ecosystem and proximity to European supply chains. It remains the leading hub for early adoption and innovation.

Central Italy

Central Italy accounted for 31% share in 2024, supported by government-backed programs and growing demand in metropolitan areas such as Rome and Florence. It benefits from expanding public charging infrastructure and supportive municipal initiatives promoting low-emission mobility. Consumer adoption is rising steadily, driven by tax benefits and growing availability of mid-range EV models. Tourism-driven cities are adopting EVs for sustainable transportation, enhancing their appeal for both residents and visitors. The Italy EV Market in this region is marked by steady growth and favorable conditions for private buyers. It is positioned as a strong contributor to national adoption rates.

Southern Italy

Southern Italy captured 18% share in 2024, reflecting gradual adoption compared to the north and central regions. Limited infrastructure and lower purchasing power restrict penetration, but targeted policies are supporting growth. Coastal cities are beginning to introduce EV-friendly initiatives to cut emissions. Demand is also rising among logistics firms seeking fleet electrification in regional hubs. The Italy EV Market in the south continues to evolve, with future growth tied to infrastructure expansion. It holds significant potential as government programs reduce regional disparities.

Islands (Sicily and Sardinia)

The islands of Sicily and Sardinia held 9% share in 2024, reflecting early-stage adoption. Geographic constraints and limited charging networks remain key challenges for widespread penetration. Tourism-driven demand is encouraging municipalities to introduce EV-friendly transport initiatives. Regional governments are investing in charging stations to improve accessibility for residents and visitors. The Italy EV Market on the islands is gaining traction with the availability of compact and affordable EV models. It is expected to grow steadily with ongoing public and private investment in green mobility infrastructure.

Market Segmentations:

By Powertrain

- Battery Electric Vehicles (BEV)

- Plug-in Hybrid Electric Vehicles (PHEV)

- Other Powertrains

By End User

- Private Buyers

- Corporate Buyers

By Region

- Northern Italy

- Central Italy

- Southern Italy

- Islands

Competitive Landscape

The Italy EV Market is defined by intense competition among global automakers and regional players seeking to strengthen their foothold in a growing industry. Volkswagen, Tesla, BMW, Mercedes-Benz, Volvo, and Audi dominate the market with strong product portfolios, advanced technologies, and established brand equity. These companies focus on expanding electric lineups, integrating connected features, and investing in fast-charging infrastructure to enhance consumer adoption. Local presence is reinforced through partnerships with energy providers and mobility operators. Skoda, Renault, and Kia contribute by offering cost-effective models that appeal to price-sensitive buyers, widening accessibility across customer segments. The market also witnesses emerging participation from Asian automakers such as Hyundai and Geely, further intensifying competition. It is characterized by continuous innovation, frequent product launches, and sustainability-driven strategies. Growing interest in corporate fleet electrification and regional policy support ensures that competitive pressure remains high, driving ongoing advancements in product design, affordability, and performance.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Volkswagen

- BMW AG

- Mercedes-Benz

- Tesla

- Volvo

- Audi

- Skoda

- Renault S.A.

- Kia

- Other Key Players

Recent Developments

- In July 2025, Geely Auto partnered with Jameel Motors to distribute the EX5 electric SUV and a plug-in hybrid SUV in Italy.

- In March 2025, Stellantis reached an agreement to supply Iveco with two fully electric van models, scheduled for launch in Europe from mid-2026.

- In June 2025, Enel and ADR launched ‘Pioneer’, a 10 MWh energy‐storage system at Rome’s Fiumicino airport using 762 used EV battery packs.

- In June 2025, BMW Italia and Eni signed a Letter of Intent to launch joint initiatives that support energy transition for road mobility.

Report Coverage

The research report offers an in-depth analysis based on Powertrain, End User and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Government policies will continue to drive adoption through subsidies and tax incentives.

- Expansion of fast-charging networks will reduce range anxiety and support long-distance travel.

- Battery technology improvements will enhance vehicle performance and lower ownership costs.

- Automakers will launch more affordable EV models targeting mass-market buyers.

- Corporate fleet electrification will accelerate with logistics and mobility firms adopting EVs.

- Consumer demand will rise as awareness of sustainable mobility strengthens across regions.

- Urban centers will see faster adoption due to stricter emission zones and incentives.

- Collaboration between automakers and energy providers will improve charging accessibility.

- Regional disparities will narrow as infrastructure investments expand to southern areas and islands.

- Innovation in connected and smart EVs will increase consumer engagement and market competitiveness.