Market Overview

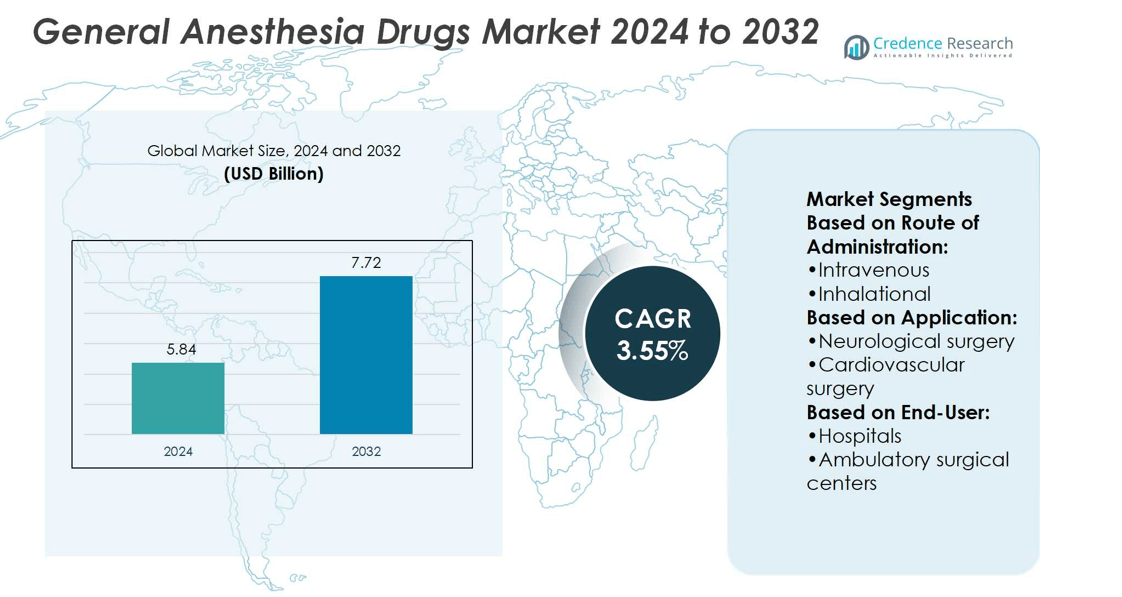

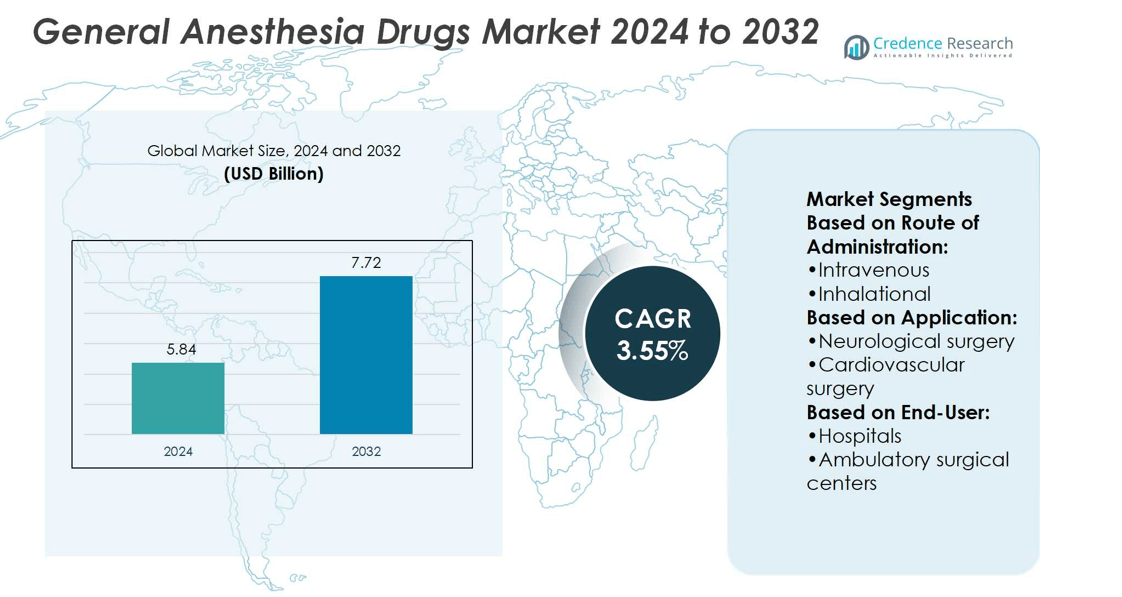

General Anesthesia Drugs Market size was valued at USD 5.84 billion in 2024 and is anticipated to reach USD 7.72 billion by 2032, at a CAGR of 3.55% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| General Anesthesia Drugs Market Size 2024 |

USD 5.84 billion |

| General Anesthesia Drugs Market, CAGR |

3.55% |

| General Anesthesia Drugs Market Size 2032 |

USD 7.72 billion |

The General Anesthesia Drugs Market grows through strong demand driven by the rising number of surgeries, increasing prevalence of chronic illnesses, and advancements in drug formulations that enhance safety and efficacy. Trends highlight a shift toward short-acting agents and combination therapies that improve patient recovery and minimize side effects. Growing use of anesthesia in outpatient and ambulatory settings strengthens adoption, while digital monitoring and precision dosing technologies improve clinical outcomes. The market also sees expansion from aging populations and healthcare infrastructure growth in emerging economies, shaping a steady path of innovation and adoption across global medical practices.

North America dominates the General Anesthesia Drugs Market due to advanced healthcare infrastructure and high surgical volumes, followed by Europe with strong regulatory support and established pharmaceutical networks. Asia Pacific records the fastest growth, driven by expanding healthcare access and rising medical tourism. Latin America and the Middle East & Africa show gradual adoption with increasing investments. Key players shaping the market include Baxter International Inc., Fresenius SE & Co. KGaA, Novartis AG, Hikma Pharmaceuticals, and Abbott Laboratories.

Market Insights

- The General Anesthesia Drugs Market was valued at USD 5.84 billion in 2024 and is projected to reach USD 7.72 billion by 2032, growing at a CAGR of 3.55%.

- Rising surgical volumes and the increasing prevalence of chronic illnesses drive steady market demand.

- Advancements in drug formulations support safer procedures, shorter recovery times, and improved patient outcomes.

- A trend toward short-acting agents and combination therapies enhances efficiency and minimizes side effects.

- Competitive dynamics involve global players like Baxter International, Fresenius SE & Co. KGaA, Novartis AG, Hikma Pharmaceuticals, and Abbott Laboratories.

- Limited access to advanced healthcare facilities in developing regions and regulatory hurdles restrain faster adoption.

- North America leads the market, Europe shows strong regulatory backing, Asia Pacific grows fastest with medical tourism, while Latin America and the Middle East & Africa expand gradually with rising healthcare investments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Surgical Procedures Driving Drug Utilization Across Diverse Specialties

The General Anesthesia Drugs Market experiences strong growth due to the rising number of surgical procedures worldwide. It benefits from expanding volumes of elective surgeries such as orthopedic, cardiovascular, and cosmetic interventions. Demand increases further with advancements in minimally invasive techniques that still require anesthesia support. Hospitals and ambulatory centers continue to expand surgical capacity, ensuring sustained usage of anesthesia agents. The growing prevalence of chronic illnesses also pushes up surgical interventions that need anesthetic drugs. Rising healthcare spending across developed and emerging economies ensures broader access to these services.

- For instance, Teva offers around 500 FDA-approved generic medicines in its portfolio, enabling broad supply of anaesthetic supportive drugs in diverse hospital settings. The growing prevalence of chronic illnesses also pushes up surgical interventions that need anesthetic drugs.

Expanding Geriatric Population Creating Greater Anesthetic Requirements

An aging population contributes significantly to the demand for anesthesia drugs across healthcare systems. It correlates with higher rates of age-related conditions that require surgical care. Procedures such as joint replacements, cardiac surgeries, and cancer interventions are more common among elderly patients. The market benefits from increasing life expectancy and larger senior populations in key regions. It drives consistent growth in both inpatient and outpatient anesthesia use. Hospitals rely on effective anesthesia protocols to ensure safety in complex geriatric cases.

- For instance, Hikma operates sterile injectable manufacturing capacity exceeding 500 million units annually across its FDA- and EMA-approved sites in the US and Europe.Procedures such as joint replacements, cardiac surgeries, and cancer interventions are more common among elderly patients.

Technological Advancements Enhancing Safety and Drug Efficiency

Innovation in anesthetic formulations and delivery systems drives adoption across clinical settings. It improves drug stability, onset time, and recovery profiles, reducing complications during surgery. New drug combinations aim to minimize postoperative side effects such as nausea or cognitive impairment. Continuous monitoring technologies support safer administration and dosage control. Pharmaceutical firms invest heavily in research that develops agents with improved pharmacokinetics and tolerability. These developments strengthen the role of anesthesia drugs in modern surgical care.

Expanding Healthcare Infrastructure and Rising Access in Emerging Economies

Improved healthcare infrastructure in emerging markets supports wider use of anesthesia drugs. It aligns with rising government investment in hospital networks and surgical facilities. Expanding medical tourism industries in regions such as Asia-Pacific boost demand for advanced anesthetic care. Availability of trained anesthesiologists enhances safety, encouraging adoption across secondary and tertiary care centers. Broader health insurance coverage in several economies also enables more patients to undergo surgeries. These dynamics position anesthesia drugs as a critical part of global healthcare delivery.

Market Trends

Growing Shift Toward Short-Acting and Rapid Recovery Anesthetic Agents

The General Anesthesia Drugs Market is witnessing a rising preference for short-acting agents that enable faster patient recovery. It reflects the increasing demand for efficiency in outpatient and day-care surgeries. Hospitals and clinics prefer agents that reduce post-operative complications and shorten recovery room stays. New formulations are designed to improve onset times while ensuring consistent depth of anesthesia. This trend reduces overall hospital costs by optimizing surgical throughput. Patient satisfaction also improves with shorter discharge times and fewer side effects.

- For instance, AbbVie’s ARCH (AbbVie R&D Convergence Hub) aggregates data from more than 200 internal and external sources into a platform with over 2 billion distinct data points. That lets scientists analyze patient-specific biomarkers and physiologic variables more rapidly.

Increasing Integration of Digital Monitoring and Personalized Anesthesia Protocols

Advances in perioperative monitoring drive the development of personalized anesthesia protocols. It supports precise drug dosing based on patient physiology and surgery type. Integration of AI-driven systems allows clinicians to predict drug responses and reduce risks. These technologies improve safety in high-risk patients, including elderly and pediatric groups. The trend aligns with the growing emphasis on individualized healthcare solutions. Hospitals adopting advanced monitoring solutions enhance patient outcomes and increase trust in anesthetic care.

- For instance, AstraZeneca sold its non-U.S. rights of its anesthesia portfolio (Diprivan, EMLA, and five local anesthetics) to Aspen Global Incorporated (AGI). AstraZeneca would also supply manufacturing for 10 years under cost-plus basis.

Rising Focus on Non-Inhalation Anesthesia and Intravenous Alternatives

A clear trend is the growing preference for intravenous anesthesia drugs over inhalation agents. It is supported by benefits such as better control of induction and smoother recovery. Intravenous formulations reduce exposure to environmental pollutants compared to volatile inhalation drugs. Healthcare systems favor these agents for improved patient safety and operating room efficiency. Pharmaceutical companies are actively developing novel intravenous molecules to strengthen product pipelines. This trend positions IV anesthesia as a key growth driver in surgical practices.

Expanding Role of Combination Therapies and Multimodal Approaches

Combination therapies are gaining traction to optimize anesthetic outcomes and minimize side effects. It enables lower doses of individual drugs while maintaining effective anesthesia depth. Multimodal approaches combine anesthetic agents with analgesics or sedatives for better pain control. Hospitals and surgical centers adopt these methods to reduce opioid dependency in post-operative care. Clinical trials increasingly validate such strategies, driving their adoption into practice. The market trend emphasizes safer, more effective, and patient-centered anesthetic management.

Market Challenges Analysis

Stringent Regulatory Frameworks and Rising Concerns Over Adverse Effects

The General Anesthesia Drugs Market faces challenges from stringent regulatory standards governing safety, efficacy, and approval timelines. It requires extensive clinical trials and post-marketing surveillance, delaying the entry of new drugs. Adverse effects such as respiratory depression, cognitive impairment, and allergic reactions remain key concerns for healthcare providers. These risks limit the use of certain formulations in vulnerable populations, including elderly and pediatric patients. Stringent labeling requirements and pharmacovigilance obligations increase compliance costs for manufacturers. Regulatory hurdles reduce innovation speed and restrict faster adoption of novel anesthetic agents.

Shortages, Cost Pressures, and Dependence on Skilled Professionals

Drug shortages and supply chain disruptions create uncertainty in meeting hospital demand. The General Anesthesia Drugs Market also faces cost pressures as hospitals negotiate competitive pricing with suppliers. It becomes more difficult to balance affordability with investments in advanced formulations. A limited pool of skilled anesthesiologists restricts the safe and effective use of certain drugs in critical surgeries. Training requirements and workforce shortages in emerging economies hinder wider adoption. High operational costs and reimbursement limitations further challenge the growth of this market segment.

Market Opportunities

Expanding Demand in Emerging Economies and Growing Medical Tourism

The General Anesthesia Drugs Market has significant opportunities in emerging economies with expanding healthcare infrastructure. It benefits from government investments in modern hospitals and rising access to surgical services. Medical tourism in regions such as Asia-Pacific and the Middle East further boosts demand for advanced anesthetic protocols. Patients seek cost-effective surgeries in these regions, creating consistent opportunities for drug suppliers. Broader health insurance coverage supports higher procedure volumes and adoption of safe anesthesia practices. Local production and distribution partnerships can also reduce supply chain risks and expand market reach.

Innovation in Formulations and Advancements in Patient-Centered Anesthesia Care

Pharmaceutical innovation creates strong prospects through the development of safer, faster-acting formulations. It includes intravenous drugs with improved recovery profiles and inhalation agents designed for better tolerability. The focus on personalized anesthesia care encourages adoption of multimodal and combination therapies. Digital monitoring tools that integrate predictive analytics support wider use of tailored anesthesia protocols. Hospitals adopting these technologies aim to improve patient safety and operational efficiency. Growing collaborations between drug developers and healthcare institutions provide a pathway for new product introductions and enhanced market presence.

Market Segmentation Analysis:

By Route of Administration

The General Anesthesia Drugs Market is segmented into intravenous and inhalational drugs. Intravenous anesthesia leads adoption due to rapid onset, better control, and reduced side effects. It is favored in short-duration and outpatient procedures where quick recovery is essential. Inhalational anesthesia remains vital in pediatric surgeries and long-duration operations. Advances in delivery systems support safer administration of inhalational agents. Hospitals employ both routes depending on surgical type and patient needs. This balance ensures sustained demand across specialties.

- For instance, Fresenius Kabi’s Ivenix Infusion System uses pneumatic pumping technology that delivers medication with accuracy of ±5% over infusion rates from 0.5 to 1000 mL/hr, under ambient-temperature range of 5°C to 35°C, and over durations up to 96 hours.

By Application

The market divides into neurological surgery, cardiovascular surgery, orthopedic surgery, and other applications. Neurological surgery relies on precise anesthetic management to protect brain function and enable recovery. Cardiovascular surgery creates strong demand from procedures such as bypass and valve replacements. Orthopedic surgery contributes significantly with rising cases of joint replacement and trauma repair. Other applications include general surgeries, organ transplants, and gynecological procedures that depend on safe anesthesia protocols. It highlights the broad clinical reliance on anesthesia across multiple therapeutic areas.

- For instance, Abbott Proclaim™ XR Spinal Cord Stimulation System, used in chronic pain (often following surgical injury), has a battery designed to last up to 10 years under low-dose settings without needing recharging.

By End User

The market includes hospitals, ambulatory surgical centers, and specialty clinics. Hospitals dominate due to large procedure volumes, intensive care capabilities, and advanced monitoring systems. They remain central to high-risk and complex surgeries requiring specialized anesthetic support. Ambulatory surgical centers expand rapidly, meeting demand for cost-effective same-day procedures. Specialty clinics provide tailored anesthesia for fields such as cosmetic surgery and dental care. It demonstrates the importance of diverse healthcare settings in sustaining anesthesia drug adoption.

Segments:

Based on Route of Administration:

Based on Application:

- Neurological surgery

- Cardiovascular surgery

Based on End-User:

- Hospitals

- Ambulatory surgical centers

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

Market Share

North America dominates the General Anesthesia Drugs Market with 38% share, driven by high surgical volumes and advanced healthcare systems. Hospitals and ambulatory surgical centers remain primary users of both intravenous and inhalational drugs. Strong presence of global pharmaceutical companies ensures innovation and consistent supply. Widespread use of short-acting agents supports efficiency in outpatient procedures. Insurance coverage allows patients access to advanced anesthesia solutions. Continuous clinical research from major academic centers further strengthens patient safety and outcomes.

Europe

Europe holds 27% share of the market, supported by strong healthcare infrastructure and strict regulatory frameworks. Countries such as Germany, France, and the UK contribute significantly with high surgical volumes. Demand for safe and effective anesthesia drugs is boosted by rising numbers of elective and complex surgeries. Focus on cost-effectiveness and patient safety drives use of modern formulations. Day-care surgery expansion increases reliance on short-acting anesthesia drugs. Regional emphasis on compliance and quality standards enhances adoption across hospitals and specialty clinics.

Asia Pacific

Asia Pacific captures 22% share and represents the fastest-growing region in the General Anesthesia Drugs Market. Rapid urbanization, rising disposable incomes, and growing healthcare infrastructure support expansion. China, India, and Japan lead in surgical volumes and hospital investments. Medical tourism in Thailand, Singapore, and India boosts adoption of advanced anesthesia protocols. Governments invest in expanding hospital networks and training programs to increase access. Local drug manufacturing improves affordability and supply security, reinforcing long-term growth.

Latin America

Latin America accounts for 8% share, showing steady expansion driven by reforms and healthcare investments. Brazil and Mexico dominate regional demand due to growing hospital capacity. Private hospitals increasingly adopt advanced anesthesia protocols to support patient safety. Elective and cosmetic surgeries add to intravenous anesthesia usage. Public procurement policies influence pricing and availability of essential drugs. Professional training programs for anesthesiologists strengthen adoption of modern practices.

Middle East & Africa

The Middle East & Africa region holds 5% share, with growth supported by rising healthcare investments. Gulf countries such as Saudi Arabia and the UAE drive demand through advanced hospitals and medical tourism. Chronic disease prevalence increases the need for surgical care requiring anesthesia. Government-backed initiatives improve access to essential drugs. In Africa, infrastructure gaps and workforce shortages remain challenges, but growth potential exists with ongoing investments. The General Anesthesia Drugs Market continues to expand in this region as modern surgical practices become more widely available.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The General Anesthesia Drugs Market companies include Abbott Laboratories, AbbVie, AstraZeneca plc, B. Braun Melsungen AG, Baxter International Inc., Eisai Co., Fresenius SE & Co. KGaA, Hikma Pharmaceuticals, and Novartis AG. The General Anesthesia Drugs Market remains highly competitive, driven by innovation, safety, and expanding global demand. Companies focus on developing advanced formulations that enable faster recovery, improved tolerability, and reduced side effects. Strong emphasis on regulatory compliance and clinical validation ensures trust among healthcare providers. Global players strengthen their positions through robust distribution networks, strategic partnerships, and investments in manufacturing capacity. Emerging markets provide significant opportunities, with rising surgical volumes and government-backed healthcare expansion fueling adoption. Competition also centers on cost efficiency, as hospitals and surgical centers seek effective yet affordable solutions. Continuous research and integration of modern anesthesia practices sustain the long-term growth and resilience of the market.

Recent Developments

- In April 2025, Johnson & Johnson acquired Intra-Cellular Therapies, Inc. for paying per share in cash. The deal strengthened Johnson & Johnson’s neuroscience portfolio, adding Caplyta for schizophrenia and bipolar depression and pipeline drug ITI-1284.

- In September 2024, Eugia Steriles, a subsidiary of Aurobindo Pharma received USFDA approval for Lidocaine Hydrochloride injection. The injection is used as an anesthetic on the body to help reduce discomfort and pain caused by invasive procedures such as needle punctures, insertion of breathing tube or catheter, and surgery.

- In August 2024, Amneal Pharmaceuticals, Inc. announced FDA approval for its Propofol Injectable Emulsion USP in three single-dose vial concentrations; it is widely used in hospitals to induce and maintain anesthesia and sedation.

- In August 2023, PAION AG, a specialty pharmaceutical company, announced the launch of its lead compound, Byfavo (remimazolam), which became commercially available in the Netherlands for order and delivery for use in general anesthesia. This launch marked a significant milestone for PAION in advancing the commercial distribution of its innovative products across Europe.

Report Coverage

The research report offers an in-depth analysis based on Route of Administartion, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with rising global surgical volumes across specialties.

- Demand for short-acting drugs will grow due to preference for faster recovery.

- Intravenous anesthesia will see stronger adoption compared to inhalational agents.

- Personalized anesthesia protocols will gain importance with advanced monitoring tools.

- Emerging economies will drive growth through expanding hospital infrastructure.

- Medical tourism will increase demand for advanced anesthetic protocols.

- Innovation will focus on safer formulations with fewer postoperative side effects.

- Combination therapies will expand to improve outcomes and reduce opioid use.

- Regulatory approvals will shape timelines for new product introductions.

- Strategic collaborations will strengthen global distribution and research capabilities.